1. Introduction

Financial development, one of the most significant economic growth determinants, has been thoroughly explored in existing literature (Pradhan et al., 2018; Samargandi et al., 2019; Sehrawat and Giri, 2016; Verma and Giri, 2020). Financial services reduce transactional costs and enhance resource allocation, leading to economic growth through information accumulation, monitoring investments, risk allocation and savings, and enabling a smooth flow of goods and services (Demirguc-Kunt and Levine, 1996). Recently, there have been tremendous revolutions in the financial and banking sectors under the accelerated advancement of information and communication technologies (ICT). The worldwide financial industry spent more than $197bn on ICT products and services in 2014 and has been the single largest purchaser of ICT products and services since the mid-1990s (Cheng et al., 2021). Since the 1980s, the transmission and operation of digital information have been at the core of the financial sector's evolution.

Consequently, the interdependence between technology and finance impacts the relationship between financial development and economic growth. The significance and relevance of ICTs are such that, in the contemporary world, the comparative advantage of a developing economy in national resources and reserve has diminished compared to the competitive edge generated by technology (Kpodar and Andrianaivo, 2011). Thus, investing in the ICT industry results in enhanced value addition and increases efficiency (Pohjola, 2001). The World Bank (2020) has also collaborated with clients and significantly supported reforms in the ICT industry through technical support and lending activities in recent years. To keep up with this trend, several financial institutions combine ICT with internal operational modernization and provide new services, such as payment processing, remittance and money transfers via smartphones. The impact of ICT dissemination on financial evolution may have various implications on economic activity, depending on the factors above.

The economic theory of Cobb and Douglas (1928) states that the production function consists of three production components: labour, capital and technology, and that shifts in any of these three factors affect economic growth. Financial development is commonly used to represent a capital improvement in the context of production elements, whereas the expansion of ICT represents technological innovation. Additionally, the financial sector can accumulate savings, allocate resources to the most lucrative ventures, minimize information and transaction costs, and enable inter-industry commerce. The consequence is a more efficient use of resources and rapid progress in human capital technology (Greenwood and Smith, 1997; Levine, 1997). However, as the global banking crisis of 2008 showed, weak banking institutions can lead to resource misallocation, waste, reduced savings, increased speculation, fewer investments and fewer returns on those investments. Research on the relationship between finance and economic growth has yielded positive and negative outcomes. Some causes include an increase in the frequency of financial crises or a dearth of publicly traded corporations to spur expansion and non-linear relationships (Samargandi et al., 2019).

Although ICT is one of the fundamental causes for faster economic progress, its impact on economic growth has been the subject of substantial scholarly attention in recent years. Through electronic encoding and virtual mobility, ICT facilitates the dissemination of information, which affects the development and technology of many businesses and modifies economic activity. However, empirical research has produced conflicting findings, despite widespread assumptions in the theoretical literature that more widespread use of ICTs will boost economic growth. While some studies have found favourable impacts (Cheng et al., 2021; Hwang and Shin, 2017; Verma and Giri, 2020), others showed insignificant, ambiguous or negative relationships (Veeramacheneni et al., 2007).

Furthermore, many modern theories of economic growth recognized the significance of ICT. These include Neo-Schumpeterian models predicated on Kondratiev's concept of cyclical growth consisting of economic boom and bust in the long term and Schumpeter's ideas, which emphasize the role of inventors and enterprises in capitalizing on market inefficiencies to lay the basis for future economic expansion (Pyka and Andersen, 2012; Schumpeter and Backhaus, 2003). These ideas typically coincide with technological and economic breakthroughs. To be truly “pervasive”, ICT applications must significantly impact virtually every sector of the economy (Avgerou, 1998).

The existing studies focus solely on the relationship between ICT diffusion and economic growth without looking into the causal relationships. Thus, one primary purpose of this study is to examine the causal dynamics of ICT infrastructure in greater detail than in the past literature. Using a panel data approach and considering the influence of financial sector development, this study investigates the short-term and long-term link between ICT diffusion and economic growth in developing nations. For this purpose, the study examines the possible causation amongst ICT diffusion, financial sector development and economic growth in 88 developing countries between 2005 and 2019. The methodological framework combines ICT diffusion with the pre-existing finance-growth nexus. It analyses the dynamics of ICT diffusion, financial sector development and economic growth by employing panel vector autoregressive (VAR) models with exogenous variables and the Granger causality approach.

The present study is segregated in this manner: Section 2 covers the literature review; Section 3 presents the data and methodology employed; Section 4 covers the empirical results; Section 5 offers the discussion and section 6 concludes with policy implications.

2. Literature review

2.1 ICT diffusion and economic growth

The first body of research investigates the connection between ICT diffusion and economic growth. Theoretically, ICT diffusion and economic growth appear to be a significant link. ICT is an external and uncontrollable force that develops from government action or corporate initiatives and reveals itself through productivity gains in real economic activity. Economic growth is a widely discussed and ever-evolving subject for economists. In his ground breaking theory of economic development, Smith (1776) recognized that rising labour productivity is a direct result of technological progress in the economy. While the classical theory (Smith (1776) emphasized specialization to increase productivity, the neo-classical theories (Solow, 1956) posited growth via increased workforce and productivity through technological progress. Thus, focussing on human capital formation and investments in health and education programs increases productivity. Romer (1986), in contrast to the then-prevailing neo-classical growth theories, put out the AK model of growth, which integrated technological knowledge as an endogenous factor.

Four hypotheses describe the causal relationship between economic growth and ICT diffusion. First, the ICT diffusion-driven economic growth theory, often known as a supply-leading hypothesis, proposes that ICT diffusion causes economic growth in a unidirectional manner (Alimi and Adediran, 2020; Pradhan et al., 2018, 2021; Sawng et al., 2021). This argument is based on the premise that increased investment in ICT infrastructure and consequent increased use of ICT boosts employment possibilities and the productivity of firms, which positively contributes to economic growth. Growing ICT infrastructure creates more jobs and new digital enterprises, which benefits economic expansion. The second school of thought, the demand-following hypothesis, asserts that economic development granger-causes ICT diffusion. This theory assumes that as a country develops economically, it can invest more in ICT infrastructure, allowing it to serve a broader range of individuals and businesses. According to the data, advanced economies rely increasingly on the digital economy to maintain their global market edge. As a result, they have expedited the development of more advanced ICT infrastructure. Studies exploring these associations include those by Beil et al. (2005), Lee (2011) and Salahuddin and Gow (2016). Additionally, Chakraborty and Nandi (2011), Ramlan and Ahmed (2009) and Shiu and Lam (2008) support the feedback hypothesis by demonstrating the presence of a bidirectional causal relationship among the variables. Finally, some studies indicate that the variables have no causal association (Dutta, 2001; Shiu and Lam (2008; Veeramacheneni et al., 2007).

2.2 Financial development and economic growth

The second strand examines the possible association between financial sector development and economic growth, the theoretical foundation of which lines back to Gurley and Shaw (1955), Schumpeter and Backhaus (2003) and Thornton and Poudyal (1990). They suggested that creating financial institutions such as banks can optimize resource distribution and accelerate technological advancement in production, thereby boosting economic growth. Further, financial development helps minimize transaction costs, decrease monitoring costs, reduce information symmetry and increase financial inclusion (King and Levine, 1993). The initial endogenous theories focused on allocative efficiency and the role of the financial sector in financial inclusion (Goldsmith, 1969). However, King and Levine (1993) and Saint-Paul (1992) endorsed financial development since it creates diversified portfolios, reduces risks, increases liquidity and boosts economic growth by increasing demand.

The link between economic growth and financial development is the subject of competing hypotheses (Franciskovic and Miralles, 2021; Guru and Yadav, 2019; Jalil and Ma, 2008; Salahuddin and Gow, 2016; Saqib, 2015). First, the financial development-driven economic growth theory states that financial development activities granger-cause economic growth. The hypothesis is that economic agents can better optimize social welfare by accessing credit and other financial services. Because of this, industry's competitiveness improves, leading to higher wages overall, particularly for previously underserved populations. As a result, economic growth accelerates. Second, the economic growth-driven financial development hypothesis (Asongu and Odhiambo, 2019; Hsueh et al., 2013; Sehrawat and Giri, 2016) is based on the idea that an expanding economy will need the introduction of new forms of financial services, which will, in turn, be utilized by a larger demographic. Expanding access to financial services due to these factors helps more people become economically active. Increasing wealth in the country should lead to more investment and eventually to the provision of more advanced financial services that boost socio-economic reach and wealth. Therefore, robust economic growth is hypothesized to boost financial development efforts. Notwithstanding, evidence of the feedback hypothesis was observed from another strand of literature (Bangake and Eggoh, 2011; Erlando et al., 2020; Kar et al., 2011).

2.3 ICT diffusion and financial development

Another strand of literature examines the relationship between ICT diffusion and financial sector development. Two schools of thought explain the causal relationship between ICT diffusion and financial development. The first school, the ICT-driven financial development hypothesis, holds that ICT infrastructure is the sole cause of financial development (Abor et al., 2018; Lashitew et al., 2019; Marszk and Lechman, 2019; Pradhan et al., 2018). According to this theory, new financial services and applications will directly result from the exponential growth of ICTs. Two key benefits are the increased accessibility and the potential for individualized service provision by digital financial services. As a result of pursuing economies of scale and scope via digital architecture, financial institutions can keep service fees low while expanding their offerings. These projects should improve access to these essential financial services for excluded and disadvantaged people. Therefore, the expansion of ICTs is crucial to the success of financial development initiatives in many nations.

The second school of thought holds that financial development granger-causes ICT diffusion (Chinoda and Kwenda, 2019; Das et al., 2018; Lenka and Barik, 2018). Through increased use of financial services, marginalized and vulnerable groups get access to the tools and knowledge they need to improve their economic standing in society. The increased purchasing power and expanded worldview have increased the likelihood of increased spending on ICTs such as cell phones and the Internet. Thus, more individuals will want ICT services. Another line of thinking favouring this direction of the causal link suggests that increased infrastructure spending in disadvantaged communities directly results from increased access to innovative financial tools and skills for these groups. Such investments in infrastructure are essential steps towards creating a state-of-the-art, technologically advanced monetary system. Hence, an increase in financial development measures will result in a rise in ICT infrastructure development. The importance of IT diffusion increases the need for duality in the early phases of monetary growth. Consequently, ICT diffusion and financial sector growth may have a bidirectional relationship (Comin and Nanda, 2019; Shamim, 2007).

2.4 ICT diffusion, financial development and economic growth

The literature on the association between ICT diffusion and financial development is extensive. However, few studies have examined the trivariate relationship between ICT diffusion, financial sector development and economic growth. The advancement of ICT and the financial sector, particularly in developing countries, has prompted scholars to investigate the combined effect of ICT diffusion and financial sector development on growth.

According to Sassi and Goaied (2013), an economic growth strategy incorporating ICT and financial development has a favourable impact on Middle East North Africa (MENA) countries. The interaction effect is also taken into account by Das et al. (2018) by constructing an economic growth framework. According to this research conducted between 2000 and 2014 in 43 developing nations using generalized method of moments (GMM), ICT diffusion and financial sector development can help enhance economic growth in low-income economies but not in lower-middle-income economies. Similarly, Verma and Giri (2020) examined the trivariate relationship in developing countries using advanced co-integration techniques in conjunction with Granger causality tests and concluded that the combined effect of ICT diffusion and financial sector expansion is beneficial to growth.

Research shows a lack of consistency in the relationships between ICT diffusion, financial sector development and economic growth. As a result, additional research is required to understand the interrelationship between these variables to implement appropriate policy-based actions to ensure sustained economic development. Considering the research gaps, this study investigates the causal association between ICT diffusion, financial sector development and economic growth in developing nations, which has not been examined previously in the literature. Ipso facto, the following hypotheses were developed in light of existing research and theories:

H1A, B. ICT diffusion granger-causes economic growth, and vice versa

H2A, B. Economic growth granger-causes financial development, and vice versa

H3A, B. ICT diffusion granger-causes financial development, and vice versa

2.4.1 Relevance and contribution of the study

Since the late 1980s, most developing countries have sought to promote financial development through formal policy decisions, such as minimizing government engagement in financial sectors or privatizing banks. The economy's expansion is the intended result of such policy choices, which may involve measures such as boosting the savings rate or domestic and foreign investment. However, a solid causal link between the financial and real sectors is required for these measures to be effective.

Therefore, this study explores novel evidence to determine the economic impact of the financial sector. The study examines whether economic expansion has impacted economic growth in the sample of selected developing economies and whether the policy effects of financial development are relevant and beneficial for boosting growth and ICT diffusion in these economies. Given that ICT diffusion does not always guarantee economic growth, this study also looks at the effect of financial sector development on ICT diffusion. The present study is the first to analyse the relationship between ICT diffusion, financial sector development and economic growth in a large sample of developing nations.

The distinctive aspects of our study are as follows. First, the study integrates two types of research to examine the correlation between ICT diffusion and economic growth and the correlation between financial sector development and economic growth. Second, it discusses all three variables simultaneously and looks for any association between two variables in the presence of a third one. Finally, the dynamics between the three variables in a diverse sample of emerging countries and for a broad time range are examined using sophisticated econometric techniques.

3. Method

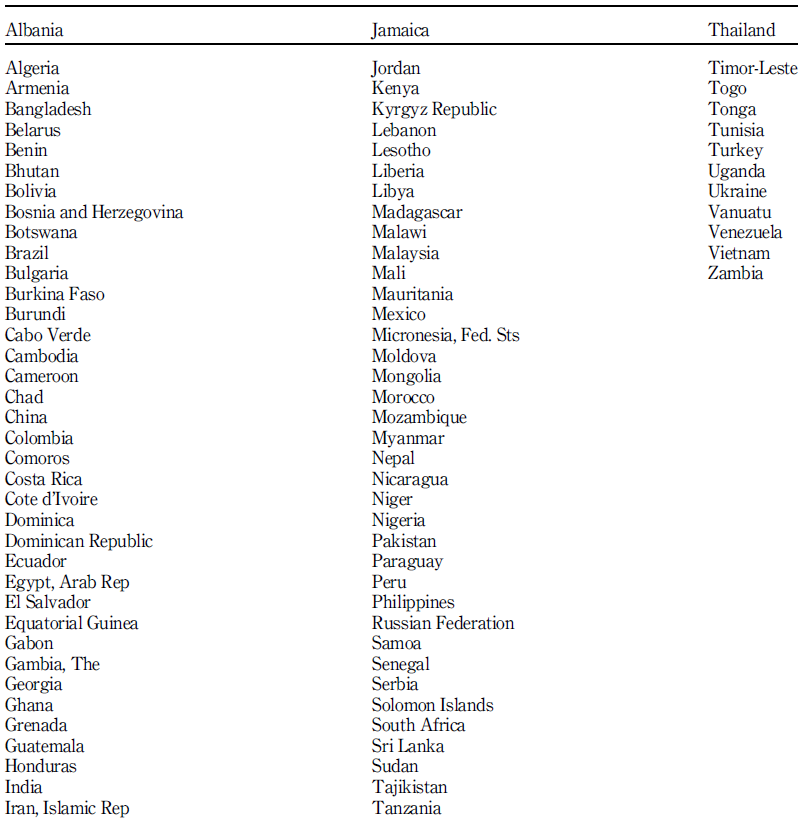

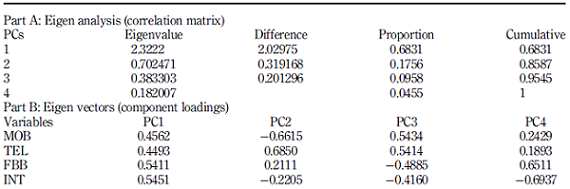

To examine the research hypothesis and enhance methodological transparency, the study follows Aguinis et al. (2018) and adopts a panel data sample covering the annual data of 88 developing countries from 2005 to 2019. The variables include the per capita real gross domestic product (GDP) constant at 2010 United States (US)$ (GDP), which measures economic growth; the financial development index (FD) based on Svirydzenka (2016), which evaluates financial sector development on several dimensions; and ICT diffusion proxied by ICT diffusion index (Pradhan et al., 2020; Verma et al., 2022). In addition, the study employs principal component analysis (PCA) to establish an ICT diffusion index, which includes fixed telephone subscription (per 100 individuals), mobile cellular subscription (per 100 individuals), fixed broadband subscription (per 100 individuals) and percentage of individuals using the Internet. Table A1 in Appendix presents the summary of PCA.

Table A1 Summary of PCA related information of ICT diffusion

Note(s): PCs, principal components; MOB, mobile phone penetration; TEL, telephone line penetration; FBB, fixed broadband penetration; INT, Internet user penetration

Source(s): Own elaboration

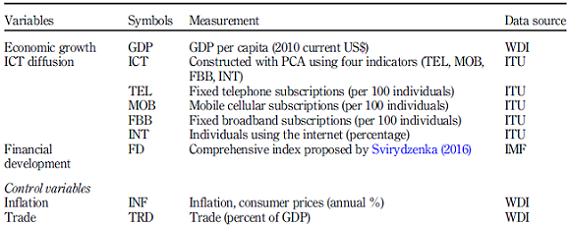

Inflation (INF) and trade openness (TRD) are used as control variables to help ensure the integrity of a study by reducing the potential for bias caused by other factors. Countries that have opened their markets for global trade are known to grow faster, innovate and improve productivity as the market's total size increases, specialization is promoted, and the ease of diffusion of knowledge increases, thus contributing to economic growth. Also, a low and stable INF rate encourages productive investment and financial operations, whereas high INF is associated with instability. Table A2 in Appendix presents the list of these economies. The description and source of data have been displayed in Table 1.

Table 1 Descriptions of the variables

Note(s): WDI, world development indicators; ITU, international telecommunication union; IMF, international monetary fund

Source(s): Own elaboration

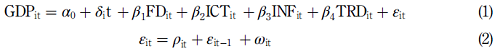

Methodologically, the study uses a panel VAR model, a multi-variable forecasting model that incorporates several exogenous elements and their lags to make predictions about the dependent model. Econometricians favour panel VAR estimate because it considers both static and dynamic dependencies and cross-sectional heterogeneities. The methodological objective is to analyse the dynamics between ICT diffusion, financial development and the growth of the economy. As a result, an economic growth model based on Sassi and Goaied (2013) was developed, which is expressed as

wherein i represents the individual countries and t refers to the periods of the respective countries. αi includes the country-specific fixed effects, δ covers the deterministic time trend, and βi refers to the projected residual indicating the deviance from the long-term association.

If two series are co-integrated, it is assumed that they have a long-run relationship since the deviations from equilibrium are stationary with finite variances, regardless of the characteristics of the individual series. Thus, the long-run relationship between the variables can be identified using co-integration among the series (Engle and Granger, 1987). Therefore, the present study analyses the long-run relationship using Kao’s (1999) residuals-based cointegration test and Pedroni’s (2004) panel co-integration tests. As for the estimating method, the study uses fully modified least squares (FMOLS) along with dynamic ordinary least squares (DOLS) estimators, which take into account the problem of heteroskedasticity and serial correlation (Kao’s, 1999; Pedroni’s, 2004) and provides consistent standard error estimates and robust statistical inferences, unlike the traditional ordinary least square (OLS).

In addition, the Granger causality approach (Engle and Granger, 1987) was used to estimate the long-run and short-run causality. If two-time series of order I (1) are integrated and demonstrate co-integration, at least one causal relationship occurs in either direction. Furthermore, a vector error correction model (VECM) can achieve this causality among the long run co-integrating vectors. The long-run dynamics among the variables are attained with the help of ECTs, i.e. the error-correction terms, which are extracted from the co-integration equations using a t-test. In contrast, the short-run dynamics are achieved through the statistical significance of the F-statistic and the lagged changes of the explanatory variables.

4. Results

The study offers the empirical findings in three parts: first, observations on the stationarity of time series variables are made; second, the co-integration between them; and third, the causal relationships between the variables.

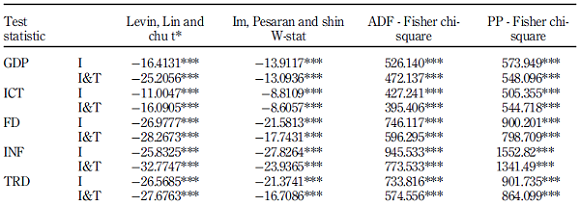

The prerequisite for panel co-integration is that the series cannot be integrated at the order I (2) to avoid erroneous results. As a result, the first-generation panel unit test, namely Levine Lin Chu (LLC) test (Levin et al., 2002), Im Pesaran Shin (IPS) test (Im et al., 2003), Maddala and Wu Fisher Augmented Dickey-Fuller (ADF) test, Maddala and Wu Fisher Phillips and Perron (PP) test (Maddala and Wu, 1999) are used to confirm the absence of unit roots as a null hypothesis. The findings of the stationarity test displayed in Table 2 demonstrate that all the variables are I(1), i.e. integrated of order one.

Table 2 Panel unit root tests

Note(s): LLC, Levin-Lin-Chu; IPS, Im-Pesaran-Shin; ADF, Augmented Dickey-Fuller; PP, Phillips and Perron; I, intercept only; I&T, both intercept and trend. The figures are reported here at the first difference level. *** denotes significance at 1% level

Source(s) Author’s own elaboration

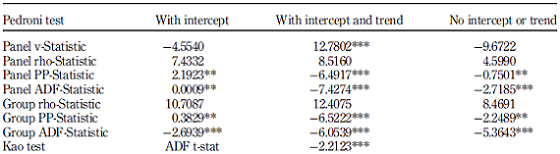

The Pedroni and Kao co-integration test was performed to examine the long-run association between the variables, as detailed in Table 3. The null hypothesis asserts the absence of a co-integration relationship among the variables. The combined outcomes of both tests confirm long-run association within the variables. In other words, the spread of ICT, financial development, economic growth, TRD and INF are all intertwined.

Table 3 Panel cointegration tests

Note(s): NIT, no trend and intercept; IT, both trend and intercept; I, only intercept; CE, co-integrating equation.***, ** denotes significance at 1 and 5% levels, respectively

Source(s): Own elaboration

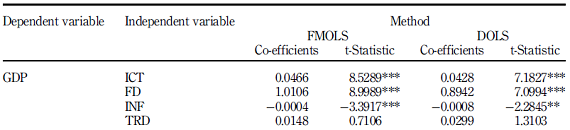

Further, the research estimates the long-run coefficients of the model by employing FMOLS and DOLS methods depicted in Table 4. The findings support theoretical literature suggesting that advancement in the financial sector and ICT diffusion positively influence economic growth (Chatterjee, 2020; Dahmani et al., 2021; Franciskovic and Miralles, 2021; Salahuddin and Gow, 2016; Saqib, 2015). Also, macro-economic indicators, namely TRD and INF, which served as control variables, are in accordance with the literature (Pradhan et al., 2018). While TRD positively affects the growth of an economy, INF has an inverse relationship with economic growth. This proves that TRD enlarges market demand and accelerates economic growth, while high INF impedes market demand, thus hindering growth.

Table 4 Panel FMOLS and DOLS results

Note(s): FMOLS, fully modified least squares; DOLS, dynamic ordinary least squares. ***, ** denotes significance at 1 and 5% levels, respectively

Source(s): Own elaboration

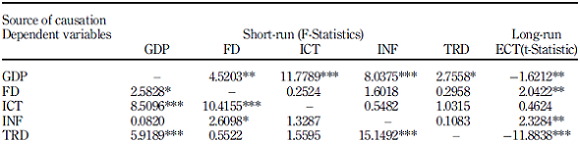

After validating the long-run correlation amongst the variables using panel co-integration tests, a causal relationship is determined using the panel Granger causality based on VECM. The results of the Granger causality test are displayed in Table 5. ECTs are statistically significant at a 5% level in the long run when GDP is taken as the dependent variable. Similarly, when financial sector development and other control variables are the dependent variables, the ECTs are again statistically significant. However, the error terms are statistically insignificant when ICT diffusion is the dependent variable. This is under the research outcomes of Das et al. (2018) and Pradhan et al. (2018). Consequently, it can be inferred that growth acts as a regulator in the long run whenever the system deviates from the equilibrium, as confirmed by the negative sign carried by the error correction term (ECT).

Table 5 Results from granger causality test

Note(s): ***, **, * denotes significance at 1%, 5% and 10% level, respectively

Source(s): Own elaboration

In the short run, outcomes of the test indicate a cause-and-effect link between ICT diffusion and economic growth, corroborating the feedback hypothesis. The visible bidirectionality implies an increase in the economy's wealth and ICT adoption fortify each other. This is supported by Hong (2017), Lam and Shiu (2010) and Veeramacheneni et al. (2007). The use of ICT amplifies the impact of growth; hence ICT infrastructure must be included in the economy for it to expand. Growing disposable income means more people can afford to invest in ICT infrastructure, and more people want to buy high-tech goods. Using ICTs spreads helps make businesses more effective and productive, boosting economic growth.

Similarly, a feedback relationship linking the financial sector expansion and economic growth was observed due to the bidirectional causal nexus between the two. Therefore, the growth of an economy and financial sector development is thus found to complement each other, supporting the results of the studies conducted by Bangake and Eggoh (2011), Calderón and Liu (2003), Erlando et al. (2020), Kar et al. (2011) and Pradhan et al. (2018). The empirical findings also confirm one-way causality from financial sector development to ICT diffusion, which is following the studies of Comin and Nanda (2019) and Marszk and Lechman (2019).

5. Discussion

This research examines the relationship between ICT diffusion, financial development and economic growth in the panel of developing countries for 2005-2019. The study yielded several theoretical and practical benefits, elaborated upon below.

5.1 Theoretical implications

The results of the VECM model demonstrated that ICT diffusion has a direct and significant association with financial development and economic growth in developing countries over the long term. This is demonstrated by the results of empirical estimates, which showed that ICT diffusion and financial development positively and significantly impact economic growth in the long run. In addition, results show that ICTs (fixed landline, mobile phones, the internet, etc.) is essential for financial development and to drive economic growth, especially in the long term for the developing countries that represent the study sample. This finding is critical for researchers and policymakers alike. It fills a void in the existing literature and investigates the relationship between growth and financial sector development via direct and indirect channels. In addition, the rising integration of ICT infrastructures and financial sectors substantially impacts long-term growth in developing economies. Advanced telecommunications services facilitate worldwide transactions and communications between parent firms and their overseas subsidiaries and generate new global business practices. These findings are consistent with theories of economic growth that identify investment in information and communication technology as one of the production elements that enhance the economy's productivity.

Further, as the financial development and information technology industries grow more linked, financial goods and services will become more sophisticated, user-friendly and value-creating due to this integration. Thus, more of the population can benefit from new financial services, leading to more significant economic growth. Therefore, to maintain long-term economic growth, substantial incentives and investments are needed to establish a viable financial ecosystem that supports increasing ICT diffusion and improves wealth-creation prospects for every economic entity.

5.2 Policy implications

From a practical point of view, this study recommends that the policymakers in these countries keep pace with recent developments in ICT and pay attention to this element because of its role in financial development and economic growth. Furthermore, developing countries should plan to increase investment in ICT capital sectors such as the internet, mobile and broadband infrastructure, e-commerce practices, etc., as well as increase investment in ICT skills such as education. Therefore, developing countries are called upon to restructure strategies and policies related to investment in ICT. The following are some of the most essential policy incentives that can be adopted by developing economies:

1. Adequate investments in developing ICT infrastructures, significantly expanding network coverage for remote and rural regions.

2. Support for low-income communities in the form of tax subsidies to ensure affordable ICT services.

3. Digital literacy and e-training programs will allow the public to use digital services and access online banking services to enhance their social and economic well-being.

4. Preventing market failures like cyber-crimes and other virtual illegal activities which undermine the trust of users by creating an effective regulatory environment.

5.3 Limitations and future research directions

Despite its intriguing and vital findings, the current study has limitations. The study collects data from various databases, so certain measurement mistakes may exist in their computations. The present research studies the linear combination of study variables and uses linear estimate methodologies. However, further studies may investigate the non-linear relationship between ICT, GDP per capita and financial development. In addition, this study uses PCA-constructed ICT diffusion; however, researchers may use observations of a more comprehensive ICT indicator to analyse a similar relationship. In addition, countries with various income levels, such as lower, lower-middle, upper-middle and high, may be compared.

6. Conclusions

Using panel data methodology, the present study extended the already existing finance-growth nexus by analysing the influence of ICT diffusion in this nexus. The study examined the short and long-term dynamics of ICT diffusion, financial sector development and growth of 88 developing nations from 2005 to 2019. Theoretically, the study considers the function of ICTs in supporting financial policies in accomplishing the goal of promoting economic growth. In terms of methodology, the study employs a more robust estimating procedure that provides more accurate short- and long-term estimates. Co-integration tests followed by panel Granger causality are used for this context and objective. After confirming the stationarity using first-generation stationarity tests: LLC, IPS, ADF and PP test, the variables are co-integrated by Kao and Pedroni co-integration test. This brings to light the existence of a long-run association between the three variables. Next, the long-run coefficients were estimated by employing FMOLS and DOLS, confirming the positive influence of financial sector development, ICT diffusion and TRD on growth but a negative influence of INF on economic growth.

Further, the causality was examined using the Granger causality tests, which confirm bidirectional or two-way causality between ICT diffusion and economic growth as well as between financial sector development and economic growth. Empirical analysis demonstrates that financial development also has a one-way causality effect on ICT diffusion. The findings offer cautious optimism in light of the recent progress made by nations like Hong Kong, China, Singapore and Taiwan in ICT diffusion. First, the findings demonstrate that ICTs can provide policymakers engaged in developing countries with realistic ways to assist the region's young population and contribute meaningfully to its development. Secondly, improving financial access with targeted investments in ICT skills, usage and access can be a game-changer for inclusive growth. Finally, considering the low resource mobilization performance of the region, geopolitical volatility and grim socio-economic outlook due to COVID-19, creating shared opportunities may not be about increasing infrastructure investment per se, but rather infrastructural development of options, inclusiveness and gender neutrality.