Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Journal of Economics, Finance and Administrative Science

versión impresa ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.24 no.47 Lima jun. 2019

http://dx.doi.org/https://doi.org/10.1108/JEFAS-12-2017-0125

ARTICLE

Financial development and economic growth: panel evidence from BRICS

Biplab Kumar Guru1,*

Inder Sekhar Yadav1

1 Humanities and Social Sciences, Indian Institute of Technology Kharagpur, Kharagpur, India

Corresponding author:*yadavis@hss.iitkgp.ac.in

Abstract

Purpose: The purpose of this paper is to examine the relationship between financial development and economic growth for five major emerging economies: Brazil, Russia, India, China and South (BRICS) during 1993 to 2014 using banking sector and stock market development indicators.

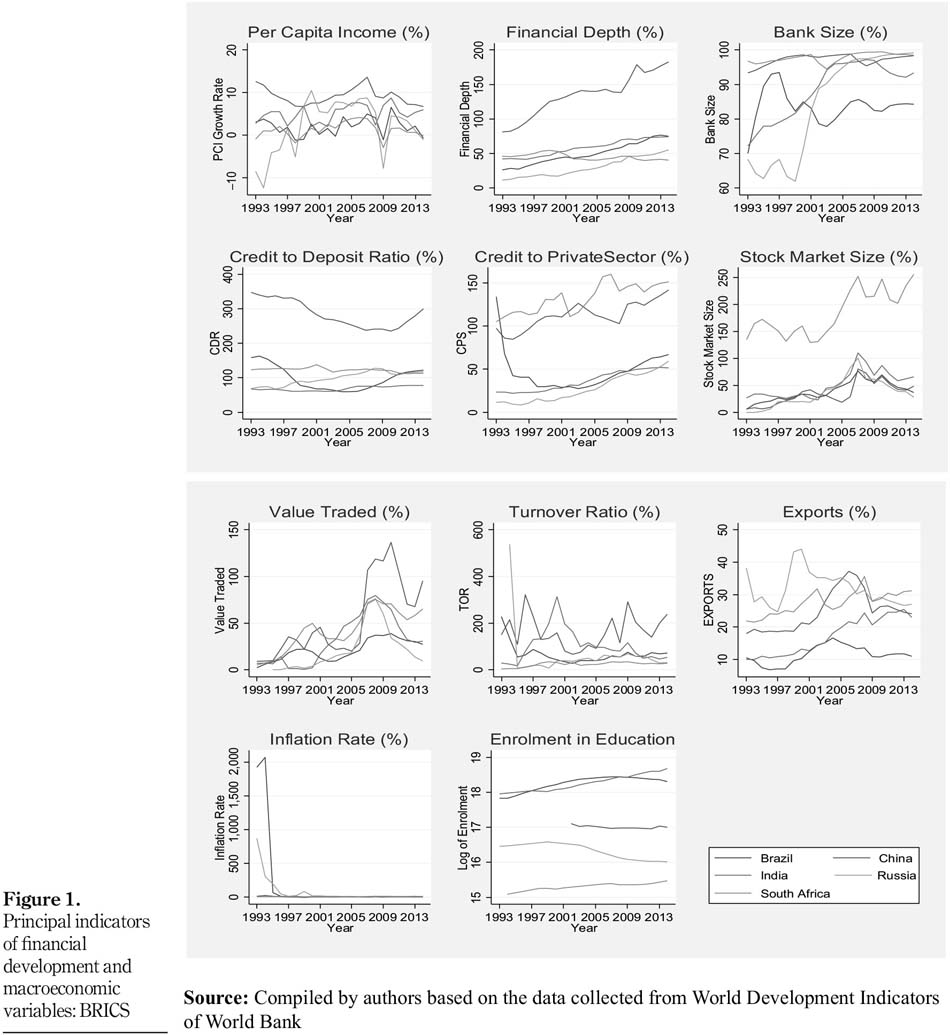

Design/methodology/approach: To begin with, the study first examined some of the principal indicators of financial development and macroeconomic variables of the selected economies. Next, using generalized method of moment system estimation (SYS-GMM), the relationship between financial development and growth is investigated. The banking sector development indicators used in the study include size of the financial intermediaries, credit to deposit ratio (CDR) and domestic credit to private sector (CPS), whereas the stock market development indicators are value of shares traded and turnover ratio. Also, some macroeconomic control variables such as inflation, exports and the enrolment in secondary education were used.

Findings: The examination of the principal indicators of financial development and macroeconomic variables have shown considerable differences between the selected economies. Results from the dynamic one-step SYS-GMM estimates confirm that in presence of turnover ratio, all the selected banking development indicators such as size of financial intermediaries, CDR and CPS are positively significantly determining economic growth. Similarly, in presence of all the selected banking sector development indicators, value of shares traded is found to be positively significantly associated with economic growth. However, the same is not true when turnover ratio is regressed in presence of banking sector variables. Overall, the evidence suggests that banking sector development and stock market development indicators are complementary to each other in stimulating economic growth.

Practical implications: A positive association between financial development and growth indicates that the policymakers should take necessary measures toward simultaneous development of both banking sector as well as stock market for inducing growth.

Originality/value: The present paper attempts to examine the relationship between financial development and growth using both banking sector and stock market development indicators which has not been attempted before for BRICS. Also, most of the existing studies are found in case of developed economies. This paper tries to fill this void by studying five major emerging economies.

Keywords: Growth

1. Background

Development of an economy requires its financial sector to be developed. And the development of financial sector happens in the process of founding and growth of institutions, instruments and markets that sustain the huge investments and growth which help in reducing poverty. Accordingly, financial development gives better information about possible profitable investments and promotes optimum allocation of capital. In other words, the emergence of financial institutions helps in curtailing cost of acquiring information and effectively implements contracts and executes transactions. Also, the expanding financial access inculcates dynamic efficiency in the system by bringing about a structural change through innovation and welfare gain to the entire economy.

Development of financial system may be defined as the development of the size, efficiency and stability of financial markets along with increased access to the financial markets that can have multiple advantages for the economy. For instance, a well-developed financial market channelizes the savings of an economy to profitable investments (Stiglitz and Weiss, 1983; Diamond, 1984), reduce information cost thereby leading to better capital allocation (Greenwood and Jovanovic, 1990) and also reduce the cost of corporate governance (Bencivenga and Smith, 1993). Also, developed financial intermediaries boost the technological innovation through rewards to the entrepreneurs (King and Levine, 1993b). Further, according to Levine (1997), financial systems assist in trading, diversification, hedging and risk amelioration, apart from facilitating transactions of goods and services. Also, according to Levine (1997), capital accumulation and technological innovation are the paraphernalia between financial development and growth. The allocation of credit through financial system works as a channel between financial and real sectors, which can be used to finance working capital requirements and investment in fixed capital; the former is used to raise production whereas the latter enhances productivity in the real sector (Das and Guha- Khasnobis, 2008).

However, contrary to above, some economists also have a different perception toward the association between financial development and economic growth. Leading this school of thought, Robinson (1952) opined, "finance plays a minor role in economic growth; rather it is driven by growth." According to Wijnberg (1983) and Buffie (1984), because of financial development, borrowers from informal sector shift to formal sector which in turn reduces the total supply of credit, thereby stifling economic growth of the concerned economy. Further, Lucas (1988) insisted that financial markets play a lesser role in an economy's development.

Also, recently Shan (2005) opined that Asian economic crisis of 1997 further casts' doubt on financial development as a driver of economic growth, as here the financial markets failed to allocate the large inflow of funds into profitable ventures. Further, the global financial crisis of 2008 indicates the failure of financial markets which was mainly driven by subprime mortgage lending. Thus, the failure of the economies in monitoring and regulating the evolving financial markets and inability to keep pace with the financial innovation warrants the prudent and sound development of financial markets which may have serious implication for an economy as a whole. In this context, it is worth noting that very few studies that have examined the finance and growth relationship in BRICS (Brazil, Russia, India, China and South Africa) have barely studied the impact of banking sector and stock market development on economic growth separately.

Against this backdrop, the present paper endeavors to investigate the relationship between financial development and growth for a panel of five major emerging economies (BRICS) during 1993 to 2014. The rest of the paper is organized as follows: Section II presents some principal indicators of financial development and macroeconomic variables of BRICS. Section III discusses some prominent literature pertaining to financial development and growth. Section IV outlines econometric methodology. Section V discusses empirical findings, and finally summary and conclusion are drawn in Section VI.

2. Principal indicators of financial development and macroeconomic variables: Brazil, Russia, India, China and South Africa

Figure 1 depicts some principal indicators of financial development and macroeconomic variables of the selected economies during 1993 to 2014. The principal indicators of financial development used in the study include variables representing both the development of banking sector as well as stock market of an economy. Banking sector development indicators include:

-

financial depth (FDP), a measure of the size of the financial intermediaries of an economy is measured as the percentage of bank's liquid liabilities to gross domestic product (GDP) (Levine, 1997; Adusei, 2013);

-

bank size (BS), a measure of the depth of a bank is measured as a ratio of commercial bank assets to deposit money bank assets plus central bank assets (Levine, 1997);

-

credit to deposit ratio (CDR), a measure of financial stability within the country and the extent of banking penetration is measured as percentage of bank credit to bank deposits; and

-

domestic CPS, is measured as domestic CPS as percentage of GDP (Levine, 1997; Levine and Zervos, 1998; Saci et al., 2009; Adusei, 2013).

The stock market indicators include:

-

stock market size (SS), a measure of stock market size is measured as total value of all listed shares of stock market as a percentage of GDP;

-

value of shares traded (VT), a measure of liquidity on an economy wide basis is measured as total value of shares traded in a stock market exchange as a percentage of GDP (Levine and Zervos, 1998; Saci et al., 2009); and

-

turnover ratio (TOR), another measure of liquidity measured as the ratio of value of total shares traded to average real market capitalization (Levine and Zervos, 1998; Beck et al., 2000; Saci et al., 2009).

Economic growth, a macroeconomic variable is measured as per capita income (PCI) growth (Levine, 1997). Also, following the existing literature, some macroeconomic control variables used in the study are inflation (INF), exports as percentage of GDP and the log of number of enrolment in secondary education of the selected economies. All the necessary variables were culled from World Development Indicators (WDI) published by World Bank.

From Figure 1, it is observed that the average growth rate of PCI of the selected economies ranged between 1.18 per cent (South Africa) and 9.14 per cent (China) during the period of analysis (1993-2014). In case of Brazil, Russia and India, the average growth rate of PCI is about 1.92, 2.02 and 5.20 per cent, respectively, during the study period. From Figure 1, it is observed that the FDP has been increasing since 1993 for the selected economies. The average percentage of bank's liquid liabilities to GDP of China is about 134.79 per cent followed by India (58.91 per cent), Brazil (49.70 per cent), South Africa (45.14 per cent) and Russia with a low of 29.94 per cent. Similarly, the ratio of commercial bank assets to deposit money bank assets plus central bank assets has increased over the study period. The average size of the banking sector of South Africa is about 97.77 per cent marginally higher than China (97.23 per cent) followed by India (89.16 per cent), Russia (84.51 per cent) and Brazil (83.56 per cent).

The mean CDR of China (281.67 per cent) which measures the financial stability and banking penetration is found to be the highest among the selected economies which is also about twice that of South Africa (122.61 per cent) during the study period followed by Brazil (98.33 per cent), Russia (98.26 per cent) and India (68.91 per cent). CPS, another measure of banking sector development, shows that the mean value of the variable for South Africa (132.18 per cent) is highest followed by China (112.46 per cent), Brazil (47.22 per cent), India (36.80 per cent) and Russia (27.47 per cent).

Next, the examination of the stock market development indicators of the selected economies shows that the mean SS for South Africa is about 184.53 per cent followed by India (52.47 per cent), Brazil (38.97 per cent), Russia (35.88 per cent) and China (34.94 per cent). Further, value of shares traded, a proxy for the stock market liquidity indicates that the mean value of the variable during the study period is about 52.92 per cent for China followed by South Africa (42.56 per cent), India (33.26 per cent), Russia (21.74 per cent) and Brazil (21.11 per cent). Finally, the mean turnover ratio is found to be highest in China (163.82 per cent) followed by India (106.03 per cent), Brazil (67.63 per cent), Russia (62.97 per cent) and South Africa (23.99 per cent).

Among the selected control variables, inflation was unexpectedly high for Brazil and Russia in early 1990s which smoothed in subsequent years. The mean inflation of China is about 4.50 per cent followed by 6.51 per cent for South Africa and 7.45 per cent for India over the study period 1993-2014.

Next, exports expressed as a ratio of GDP, an indicator of the relative importance of international trade in the economy indicates that the mean value of the variable during the study period is highest in case of Russia (31.97 per cent) followed by South Africa (27.51 per cent), China (24.81 per cent), India (17.08 per cent) and Brazil (11.38 per cent). Finally, the mean growth of number of enrolments in secondary education is found to be promising in case of India, Brazil and South Africa compared to Russia and China.

3. Theoretical and analytical framework

The seminal exertion by Schumpeter (1934), Goldsmith (1969), McKinnon (1973) and Shaw (1973) underscores the relevance of financial development for economic growth for some considerable time. To begin with, Goldsmith (1969) sought to investigate first how economic growth leads to changes in financial structure, which is the assortment of financial instruments, intermediaries and markets. Second, Goldsmith tried to examine the impact of financial development on economic growth. Third, Goldsmith sought to assess whether the structure of a country's financial system influences the rate of economic growth. In other words, does the mixture of financial intermediaries and markets functioning in an economy influence economic development. For the first issue, Goldsmith found that development of economies leads to the evolution of and improvements in the financial system. Particularly, he stated that banks tend to grow bigger relative to national output along with economic development.

For the second issue, Goldsmith was not fully successful in evaluating the nexus between the level of financial development and economic growth. In his work, he took a panel of 35 countries using data prior to 1964 and documented a positive correlation between financial development and the level of economic activity, but he refrained clearly from drawing causal interpretations from his graphical analysis. Thus, Goldsmith always refrained from asserting any causal inference that runs from financial development to economic growth. Finally, for the third issue, because of cross-country data limitations, Goldsmith failed to substantiate much on the association between economic development and the combination of financial intermediaries and markets operating in an economy.

To Goldsmith's (1969) second objective which was to establish the nexus between financial development and economic growth, considerable progress has been made to expand the analysis in subsequent research. For example, to begin with, late 1960s and early 1970s, most of the studies attempted to investigate the association between financial development, economic growth and reduction of poverty. Specifically, subsequent literature has embodied additional findings on the finance""growth relationship and engulfs the wider approach on causal association where cross-country, firm-level and industry-level studies suggest that economic growth is positively driven by a developed financial system.

After Goldsmith's (1969) work, the subsequent studies can be divided mainly into two categories viz., structuralists and repressionists. The main contention of structuralists is the quantity, composition and structure of financial variables that prompt economic growth by mobilization of savings, which in turn increases capital formation leading to economic growth thereby reducing poverty (Guha-Khasnobis and Mavrotas, 2008).

On the other hand, McKinnon (1973), and Shaw (1973) lead the financial repressionists, and their hypothesis is popularly referred to as the "McKinnon-Shaw" hypothesis. They contended that an appropriate rate of return on account of financial liberalization on the real cash balances is a driver of economic growth. The fundamental principle of their hypothesis is that a low or negative real interest rate will dampen savings which will shrink the supply of loanable funds for investment, which will in turn pull back the growth rate. Therefore, the McKinnon""Shaw model states that financial liberalization will amplify competition, induce an increase in savings by raising interest rates and thereby promote investment and consequently promote economic growth.

After the early debate on the relationship between financial development and economic growth, many subsequent empirical studies (using recent data) have found mixed results with respect to the association of financial development and growth. Also, later some empirical studies attempted to establish a cause and effect relationship between the two and made an attempt to make certain predictions on the basis of the nature of association.

For instance, King and Levine (1993a), using the data for 77 countries over the 30-year period from 1960 to 1989, established the presence of statistically significant positive relationship between FDP with growth in real per capita GDP, real per capita capital stock and total productivity, respectively. Also, Beck and Levine (2004) further using the generalized method of moments (GMM) and averaged non-overlapping five year's data from 1976 to 1998, for 40 countries establish that the development of bank and stock market sector positively influenced economic growth.

However, very recently, Saci et al. (2009) using indicators of development in banking sector and stock market found that stock market development indicators have positive significant effect on growth. However, it was found that in the presence of stock market development indicators, banking sector development negatively influenced economic growth. Recently, Leitao (2010) found a positive correlation of financial development with economic growth for 27 European Union Countries and five BRICS countries between 1980 and 2006. Again, Adusei (2013) using dynamic GMMmodel for 24 selected African countries over the period 1981-2010 found a positive relationship between financial development and economic growth. Further, using pairwise granger causality testing, they supported the evidence of bidirectional causality between financial development and economic growth.

With respect to causality between financial development and growth studies like Jung (1986) found a bidirectional causality between real and financial variables on the basis of data collected for 56 countries in the postwar period, including 19 developed industrial economies. Also, King and Levine (1993a) find that financial development is not the outcome of economic growth, rather finance leads to growth. Further, Wachtel and Rousseau (1995) stated that financial development does Granger-causes growth. Also, Luintel and Khan (1999) found bidirectional causality between financial development and economic growth for a sample of ten economies. Similarly, Wolde-Rufael (2009) found bidirectional causality between economic growth and each of the financial development variables.

However, conversely, Demetriades and Hussein (1996) conducting causality analysis found little evidence on the causality flowing from financial development to economic growth. They note that causality patterns vary across countries. Further, studies like Levine and Zervos (1998) have shown that bank loans to private enterprises as a proportion of GDP, stock market turnover ratio and value of shares traded are robust predictors of economic growth, productivity growth and capital accumulation. Also, Bhanumurthy and Singh (2013) did not find a long-run equilibrium relationship between bank branches and state domestic product for India. Finally, Menyah et al. (2014) found financial development or trade to have no causal association with economic growth.

4. Methodology

As mentioned before, the nexus between financial development and growth is investigated for a panel of five countries, viz., BRICS. The economies selected in the panel are largely heterogeneous with respect to their geographical region, culture, political and financial structures leading to high variation in explanatory variables to perform the panel regressions. The period of analysis is from 1993 to 2014 which covers mainly an era of liberalization, rapid economic growth and volatile world markets. As noted before, all the necessary variables were collected fromWDI published by World Bank.

In the present study, real GDP per capita growth (PCI) is the dependent variable, a proxy which measures the growth of the selected economies. Banking sector indicators such as FDP, CPS, CDR and BS are the selected explanatory variables which measure the banking sector development. Also, the stock market indicators such as SS, turnover ratio (TOR) and value of shares traded (VT) are the selected explanatory variables which measure the stock market development. Further, inflation (INF), exports as percentage of GDP (EXP) and enrolment in secondary education (LNESE) are used as control variables in the model. All the independent variables barring inflation are expected to have a positive impact on the growth rate.

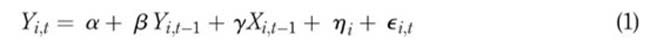

The following is the specified regression model used in the study:

where, Y is dependent variable, X stands for a vector of explanatory variables, η is the time invariant country-specific fixed effect, ε is the disturbance term which follows N (0, σ2) and the subscripts "I" and "t" represent country and time, respectively.

In equation (1), the dependent variable is lagged, and we have time invariant countryspecific fixed effects. If the country fixed effects in the panel data estimation are omitted, it will lead to biased and inconsistent ordinary least squares (OLS) estimators in levels (Hsiao, 1986). Further, several right-hand side explanatory variables can be endogenous. Therefore, to avoid the simultaneity problem, one must control for endogeneity of the explanatory variables in the regression model (Hao, 2006). Levine and Zervos (1998) used initial values of explanatory variables as instruments to get rid of simultaneity problem. However, this results in information loss as well as potential consistency loss rendering the estimation inefficient (Beck and Levine, 2004). Thus, for the model to be efficient and consistent, proper instruments should be used in place of the initial values of the explanatory variables.

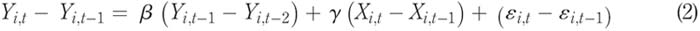

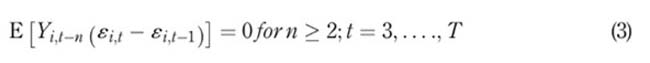

Therefore, for this, Arellano and Bond (1991) propose the first-differenced GMM estimator. Thus, following the methodology of Arellano and Bond (1991), the following model has been specified in the present study:

In equation (2), first-differencing eliminates the intercept as well as the country-specific effects (ηi). However, estimation of equation (2) will be biased and inconsistent, as the lagged dependent variable (Yi,t-1- Yi,t-2) and the error term (εi,t -εi,t-1) will be correlated (Hao, 2006). Further, to aggravate the problem, the selected explanatory variables may be endogenous as noted before. Thus, Arellano and Bond (1991) impose the following moment restrictions which rules out the possibility of endogeneity within the model.

However, the above moment restrictions are applied under the assumptions that:

-

the disturbance term is serially uncorrelated; and

-

the regressors are weakly exogenous which means that the regressors are uncorrelated with the present and future values of the disturbance term but may be correlated with the past realizations of the disturbance term (Hao, 2006).

Therefore, the valid instruments would be lagged values of explanatory variables. Also, as noted before, OLS estimation of equation (2) will be biased and inconsistent, because the dependent variable in the equation can be correlated with the disturbance term.

5. Empirical findings and discussion

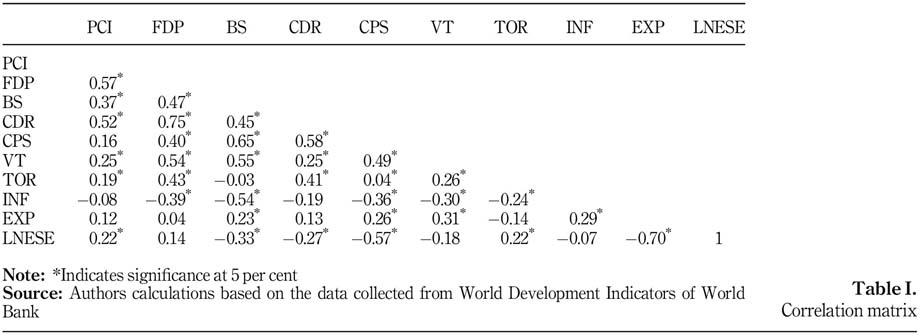

Table I reports the correlation matrix of the selected variables used in the study. The selected explanatory variables, viz., FDP, BS, CDR, VT, TOR and LNESE are positively and significantly correlated with the growth rate of PCI except exports which is positive but insignificant, whereas the correlation between inflation and the growth rate is negative but insignificant. FDP is positively and significantly correlated with bank size, CDR, private credit, value of shares traded and turnover ratio, whereas negatively and significantly correlated with inflation but uncorrelated with other two control variables, namely, exports and educational enrolment. Similarly, BS is positively and significantly correlated with CDR, private credit, value of shares traded and exports. However, BS moves in the opposite direction of turnover ratio, inflation and educational enrolment. Again, CDR has significant and positive correlation with private credit, value of shares traded and turnover ratio, whereas the former does not move in the same direction of inflation and educational enrolment. Though CDR has positive correlation with exports but is found to be insignificant. Private credit and value of shares traded are positively and significantly correlated, and their direction of co-linearity is positive and significant with turnover ratio and exports. Further, private credit and value of shares traded are negatively and significantly correlated with inflation, whereas they move in the opposite direction of educational enrolment, but the correlation is significant only in case of private credit. Inflation negatively and significantly affects turnover ratio, whereas it is positive and significantly affected by education. It is evident from the correlation analysis that the increase in number of enrolments in higher education is associated with higher PCI. Further, except PCI, FDP and turnover ratio, all other variables are negatively impacted by educational enrolment. Higher domestic inflation seems to promote exports exhibiting a positive and significant correlation. In most of the cases, barring BS and turnover ratio, both banking sector development and stock market development are complementary to each other.

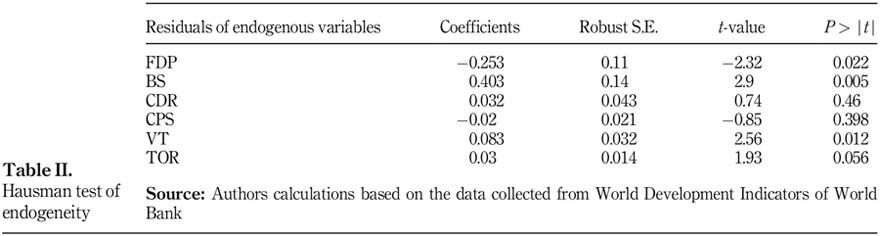

Arellano and Bond (1991) and Blundell and Bond (1998) have stated that Monte Carlo studies reveal that two-step estimators lead to efficiency gain albeit less, but the asymptotic errors associated may be biased downward. However, the precision with the one-step standard errors is high, for which we report the system GMM one-step parameter estimates in Table III. To estimate the GMM one-step system estimator, the endogeneity of the explanatory variables is tested using Hausman test of endogeneity, results of which are reported in Table II. As per Hausman test of endogeneity, the null hypothesis is that the coefficient of the predicted residuals of endogenous variables is zero. From Table II, it is observed that except CDR and CPS, the p-values of all the other selected variables are statistically significant indicating that the variables like FDP, BS, VT and TOR suffer from the problem of endogeneity. Therefore, this warrants for the use of instruments for these set of variables which are endogenous as per the test.

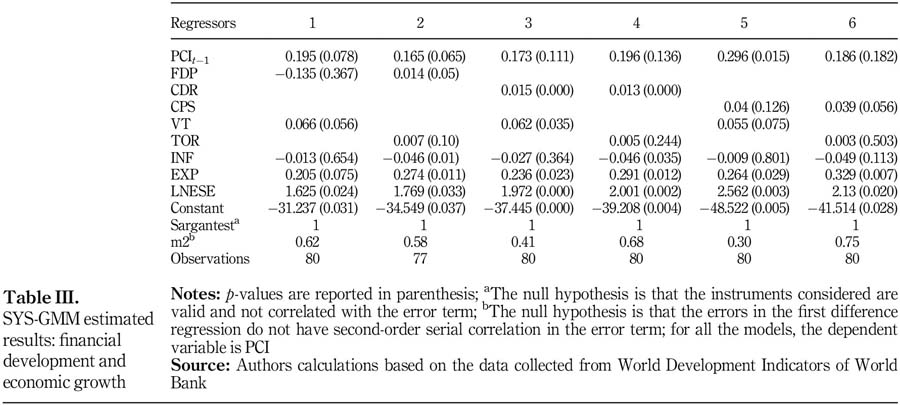

Owing to unavailability of exogenous factors to instrument the financial indicators, the lagged values of the financial variables are used as possible instruments in the system GMM estimation (SYS-GMM). In all, about six one-step SYS-GMM models are estimated, the results of which are reported in Table III. Every single model is estimated by keeping only one development indicator each from banking sector and stock market along with the selected control variables. The variables BS and SS are dropped from the regression analysis, as results are found not to be robust. Various diagnostic tests are also conducted as applicable. Mainly, the validity of instruments is tested by the Sargan test, whereas the presence of second-order serial correlation is determined by m2 test statistic. As can be observed from Table III, the Sargan test statistic clearly indicates that the chosen instruments in all the estimated models are valid, as the null hypothesis is not rejected.

Similarly, m2 test statistic in all the estimated models indicates the absence of second-order serial correlation, as the null hypothesis is not rejected.

In Columns 1 and 2 of Table III, FDP along with other two indicators of stock market development, namely, VT and TOR are introduced separately. For the selected economies, estimated empirical results suggest that unlike the findings of Saci et al. (2009), FDP is found to be negatively insignificant (Column 1) in presence of VT (which is found to be positive and significant). However, FDP is found to be positively significant (Column 2) in presence of TOR (which is found to be positive and significant) consistent with the findings of Levine et al. (2000), Beck and Levine (2004) and Rousseau and Wachtel (2000). The significant positive coefficient of banking sector development indicator (FDP) and stock market development indicators (VT and TOR) along with the presence of control variables indicate that mobilization of savings and/or in presence of liquid and efficient stock market tend to stimulate economic growth for the selected economies. In this case, economic growth is enhanced by a marginal increase in FDP, where the latter is complemented by the liquid and efficient stock markets. This means that, the overall size of financial intermediaries and stock market development of the selected economies is a significant determinant of economic growth.

In Columns 3 and 4 of Table III, CDR is found to be positively significant in presence as well as absence of both VT (found to be positive and statistically significant) and TOR (found to be positive but statistically insignificant), respectively. The positive and significant CDR indicates that an economy having higher banking penetration will be in a better position to inject more stimulus to economic growth as is the case with China which has a mean CDR of 281.67 per cent, and in the past decade or so, the same has also registered better economic growth than its counterparts in BRICS.

Further, in Models 3 and 4, banking sector and stock market development indicators are also found to complement each other to stimulate economic growth as was the case with Models 1 and 2. Further in Columns 5 and 6 of Table III, CPS is found to be positively insignificant in presence of VT (found to be positive and statistically significant), whereas it is found to be positively significant in presence of TOR (found to be positive but statistically insignificant), respectively. The positive significant relationship of CPS with economic growth of BRICS is consistent with the findings of Levine and Zervos (1998), Levine et al.(2000) and Beck and Levine (2004), though TOR is found to be positive but insignificant. In other words, CPS and the stock market variables complement each other to augment economic growth of BRICS countries. In this case for instance, South Africa (132.18 per cent) is comparatively better placed among BRICS in allocating resources to productively efficient private sector and thus can augment its economic growth.

Overall, from the SYS-GMM estimated results, consistently it is found that the stock market development indicator VT is positive and significant in presence of each selected banking sector development variable. This suggests that in a liquid and active stock market, the opportunity for economic growth gets enhanced (Levine and Zervos, 1998). However, TOR is found to be positive but insignificant in presence of CDR and CPS but positive and significant in presence of FDP. This suggests that there may not be any tradeoff between stock market development and banking sector development, as both the financial sectors complement each other and are crucial for economic growth in the selected economies (Beck and Levine, 2004; Saci et al., 2009).

As reported in the Table III, the selected control variables such as inflation, exports and the log of enrolment in secondary education have the expected sign and are found to be statistically significant in all the regression models barring inflation which is insignificant in Columns 1, 3, 5 and 6 of Table II.

6. Summary and conclusion

First to begin, the paper examined some of the principal indicators of financial development and macroeconomic variables for a panel of selected economies (BRICS). Second, the paper investigated the relationship between financial development and economic growth for the panel of BRICS using SYS-GMM by employing financial development indicators both from banking sector and stock market during 1993 to 2014.

The principal indicators of financial development used in the study include variables representing both banking sector as well as stock market development of an economy. Banking sector development indicators used in the study include FDP, CDR and domestic CPS. The stock market development indicators include stock market size, value of shares traded and turnover ratio. The macroeconomic variables used in the study include PCI growth, inflation, exports as percentage of GDP and the log of number of enrolment in secondary education.

The examination of selected variables revealed interesting facts. FDP, one of the selected banking sector development indicators, was observed to be increasing since 1993 for the selected economies. Similarly, it was noted that the ratio of commercial bank assets to deposit money bank assets plus central bank assets has increased over the study period. The mean CDR which measures the financial stability and banking penetration for China was found to be highest among the selected economies followed by South Africa, Brazil, Russia and India. CPS, another measure of banking sector development showed that the mean value of the variable for South Africa was highest followed by China, Brazil, India and Russia.

Next, the examination of the stock market development indicators of the selected economies showed that the mean SS for South Africa was highest followed by India, Brazil, Russia and China. Further, value of shares traded was observed to be highest for China followed by South Africa, India, Russia and Brazil. Finally, the mean turnover ratio was found to be highest for China followed by India, Brazil, Russia and South Africa.

Among the selected control variables, it was observed that the average growth rate of PCI of the selected economies ranged between 1.18 per cent (South Africa) and 9.14 per cent (China) during the period of analysis (1993-2014). It was noted that inflation was unexpectedly high for Brazil and Russia which smoothed in subsequent years. The mean inflation of China was about 4.50 per cent followed by 6.51 per cent for South Africa and 7.45 per cent for India over the study period 1993-2014. Next, exports expressed as a ratio of GDP, an indicator of the relative importance of international trade in the economy indicated that the mean value of the variable during the study period was highest in case of Russia followed by South Africa, China, India and Brazil. Finally, the mean growth of number of enrolments in secondary education was found to be promising in case of India, Brazil and South Africa compared to Russia and China.

The main finding from SYS-GMM estimates was that the FDP, CDR and CPS have significantly positive association with economic growth in the presence of stock market variable turnover ratio. Also, stock market development indicator value of shares traded was found to be positively and significantly influencing economic growth in presence of all the selected banking sector development indicators. However, turnover ratio which measures the stock market efficiency was found to be positively and statistically determining the growth of the selected economics only in the presence of FDP.

The main conclusion from the study is that there is a strong and positive association between financial development and economic growth of selected economies. Simultaneous development of bank and stock market activities are integral to an economy's growth process. Hence, there may not be any tradeoff between the bank development and stock market development. In conclusion, the present study supports the notion of Schumpeter (1934), McKinnon (1973), Shaw (1973), King and Levine (1993a, 1993b) and Levine et al. (2000) that financial development is the engine of economic growth.

References

Adusei, M. (2013), "Finance-growth nexus in Africa: a panel generalized method of moments (GMM) analysis", Asian Economic and Financial Review, Vol. 3 No. 10, pp. 1314-1324. [ Links ]

Arellano, M. and Bond, S. (1991), "Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations", The Review of Economic Studies, Vol. 58 No. 2, pp. 277-297. [ Links ]

Beck, T. and Levine, R. (2004), "Stock markets, banks, and growth: panel evidence", Journal of Banking and Finance, Vol. 28 No. 3, pp. 423-442. [ Links ]

Beck, T., Demirguc-Kunt, A. and Levine, R. (2000), "A new database on financial development and structure", World Bank Economic Review, Vol. 14 No. 3, pp. 597-605. [ Links ]

Bencivenga, V.R. and Smith, B.D. (1993), "Some consequences of credit rationing in an endogenous growth model", Journal of Economic Dynamics and Control, Vol. 17 Nos 1/2, pp. 97-122. [ Links ]

Bhanumurthy, N.R. and Singh, P. (2013), "Financial sector development and economic growth in Indian states", International Journal of Economic Policy in Emerging Economies, Vol. 6 No. 1. [ Links ]

Blundell, R. and Bond, S. (1998), "Initial conditions and moment restrictions in dynamic panel data models", Journal of Econometrics, Vol. 87 No. 1, pp. 115-143. [ Links ]

Buffie, E. (1984), "Financial repression, the new structuralists, and stabilization policy in semiindustrialized economies", Journal of Development Economics, Vol. 14 No. 3, pp. 305-322. [ Links ]

Das, P.K. and Guha-Khasnobis, B. (2008), "Finance and growth an empirical assessment of the Indian economy", in Guha-Khasnobis, B. and Mavrotas, G. (Eds), Financial Development, institutions, growth and Poverty Reduction, Palgrave Macmillan, New York, NY, pp. 120-140. [ Links ]

Demetriades, P.O. and Hussein, K.A. (1996), "Does financial development cause economic growth? Time series evidence from16 countries", Journal of Development Economics, Vol. 51 No. 2, pp. 387-411. [ Links ]

Diamond, D.W. (1984), "Financial intermediation and delegated monitoring", The Review of Economic Studies, Vol. 51 No. 3, pp. 393-414. [ Links ]

Goldsmith, R.W. (1969), Financial Structure and Development, Yale University Press, New Haven, CT. [ Links ]

Greenwood, J. and Jovanovic, B. (1990), "Financial development, growth, and the distribution of income", The Journal of Political Economy, Vol. 98 No. 5, Part 1, pp. 1076-1107. [ Links ]

Guha-Khasnobis, B. and Mavrotas, G. (2008), Financial Development, Institutions, Growth and Poverty Reduction, Palgrave Macmillan, New York, NY. [ Links ]

Hao, C. (2006), "Development of financial intermediation and economic growth: the chinese experience", China Economic Review, Vol. 17 No. 4, pp. 347-362. [ Links ]

Hsiao, C. (1986), "Analysis of panel data", No. 11, Econometric Society Monographs, Cambridge University Press. [ Links ]

Jung, W.S. (1986), "Financial development and economic growth", Economic Development and Cultural Change, Vol. 34 No. 2, pp. 333-346. [ Links ]

King, R.G. and Levine, R. (1993a), "Finance and growth: schumpeter might be right", The Quarterly Journal of Economics, Vol. 108 No. 3, pp. 717-737. [ Links ]

King, R.G. and Levine, R. (1993b), "Finance, entrepreneurship, and growth: theory and evidence", Journal of Monetary Economics, Vol. 32 No. 3, pp. 513-542. [ Links ]

Leitao, N.C. (2010), "Financial development and economic growth: a panel data approach", Theoretical and Applied Economics, Vol. 10 No. 551, pp. 15-24. [ Links ]

Levine, R. (1997), "Financial development and economic growth: views and agenda", Journal of Economic Literature, Vol. 35, pp. 688-726. [ Links ]

Levine, R. and Zervos, S. (1998), "Stock markets, banks, and economic growth", The American Economic Review, Vol. 88 No. 3, pp. 537-558. [ Links ]

Levine, R., Loayza, N. and Beck, T. (2000), "Financial intermediation and growth: causality and causes", Journal of Monetary Economics, Vol. 46 No. 1, pp. 31-77. [ Links ]

Lucas, R.E. (1988), "On the mechanics of economic development", Journal of Monetary Economics, Vol. 22 No. 1, pp. 3-42. [ Links ]

Luintel, K.B. and Khan, M. (1999), "A quantitative reassessment of the finance-growth nexus: evidence froma multivariate VAR", Journal of Development Economics, Vol. 60 No. 2, pp. 381-405. [ Links ]

McKinnon, R.I. (1973), Money and Capital in Economic Development, Brookings Institution, Washington, DC. [ Links ]

Menyah, K., Nazlioglu, S. and Wolde-Rufael, Y. (2014), "Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach", Economic Modelling, Vol. 37, pp. 386-394. [ Links ]

Robinson, J. (1952), "The generalization of the general theory", The Rate of Interest and Other Essays, Macmillan, London. [ Links ]

Rousseau, P.L. and Wachtel, P. (2000), "Equity markets and growth: cross-country evidence on timing and outcomes, 1980-1995", Journal of Banking and Finance, Vol. 24 No. 12, pp. 1933-1957. [ Links ]

Saci, K., Giorgioni, G. and Holden, K. (2009), "Does financial development affect growth?", Applied Economics, Vol. 41 No. 13, pp. 1701-1707. [ Links ]

Schumpeter, J.A. (1934), A Theory of Economic Development: An Inquiry into Profits, capital, credit, interest, and the Business Cycle, Harvard University Press, Cambridge, MA. [ Links ]

Shan, J. (2005), "Does financial development "˜lead' economic growth? A vector autoregression appraisal", Applied Economics, Vol. 37 No. 12, pp. 1353-1367.

Shaw, E.S. (1973), Financial Deepening in Economic Development, Oxford University Press, New York, NY. [ Links ]

Stiglitz, J.E. and Weiss, A. (1983), "Incentive effects of terminations: applications to the credit and labor markets", The American Economic Review, Vol. 73 No. 5, pp. 912-927. [ Links ]

Wachtel, P. and Rousseau, P.L. (1995), "Financial intermediation and economic growth: a historical comparison of the United States, the United Kingdom, and Canada", in Bordo, M.D. and Sylla, R. (Eds), Anglo-American Financial Systems: Institutions and Markets in the Twentieth Century, Irwin Professional Publishing, New York, NY, pp. 329-381. [ Links ]

Wijnberg, S.V. (1983), "Interest rate management in LDCs", Journal of Monetary Economics, Vol. 12 No. 3, pp. 433-452. [ Links ]

Wolde-Rufael, Y. (2009), "Re-examining the financial development and economic growth nexus in Kenya", Economic Modelling, Vol. 26 No. 6, pp. 1140-1146. [ Links ]

Citation:

Guru, B. and Yadav, I. (2019), "Financial development and economic growth: panel evidence from BRICS", Journal of Economics, Finance and Administrative Science, Vol. 24 No. 47, pp. 113-126. https://doi.org/10.1108/JEFAS-12-2017-0125

Received: 30 December 2017

Revised: 12 June 2018

Accepted: 13 November 2018