INTRODUCTION

In Peru, the interest rate on consumer loans and the Value Added Tax (VAT) plays a crucial role in financial decisions and government revenue. When these rates increase, people have less incentive to borrow and make purchases, resulting in a reduction in consumption and, consequently, VAT revenue. Although the Central Reserve Bank of Peru (BCRP) has the authority to set maximum rates, excessively high limits can affect the effectiveness of this measure and increase people's debt.

For this reason, the study is relevant in comprehensively examining the relationship between the interest rate on consumer loans and VAT revenue in an oligopolistic market, identifying patterns and trends that contribute to theoretical understanding and providing insights for policy formulations. Furthermore, the research is novel as it provides empirical evidence on the relationship between these two variables.

In the Peruvian context, four banks control 81 % of direct loans (Apoyo & Asociados, 2022). This concentration gives them control over interest rates, directly affecting their profits and expanding their pricing margin. In this regard, Méndez-Heras et al. (2021a) argue that central banks should incorporate efficient competition as one of its objectives. According to Estrada González (2016), in an oligopoly, higher rates are applied to consumers with fewer resources, leading to a lower quality of life.

Additionally, Batu Tunay et al. (2020) show that the financial structures of banks need to be supervised and strengthened. Renke and Steennot (2020b) suggest that self-regulation alone, being voluntary, is rarely sufficient. Similarly, Nugroho et al. (2022) point out that regulators should compel banks to reduce their rates, and Goldenberg Serrano (2020) considers implementing regulations to mitigate active overindebtedness. These points highlight the relevance of regulatory intervention to ensure the efficient functioning of the financial system.

According to Havranek et al. (2016), banks with low deposit rates often achieve higher profits by charging higher interest rates on their loans. This practice, intrinsic to the capitalist credit system, reflects the dynamics of speculation, where profit-seeking becomes a central element (de la Oliva de Con & Aguilar Cabezas, 2019). Thus, the pursuit of profits is presented as a central element in the financial operations of banks in the capitalist credit system.

Regarding the macroeconomic situation, retail interest rates are associated to a series of controls, which are factors in the financial and banking sector (Perera & Wickramanayake, 2016), so expansive monetary policies should be applied using the credit channel and focus on the production sphere (Levy Orlik, 2012). This policy encourages households to seek more credit to cover their expenses (Rodríguez Nava & Venegas Martínez, 2015); in other words, expansive monetary policy reduces interest rates, influencing VAT revenue through increased bank credit.

Despite the fact that credit benefits spending, especially in households with fewer resources (Ceballos Mina, 2022), loans are positively associated with sustained economic growth (Cisneros Zepeda, 2022). However, it is crucial to consider that more pronounced credit fluctuations are observed, particularly in poor regions during recession periods (Dow & Rodriguez-Fuentes, 2020). Additionally, high credit card fees affect low-income families, threatening their long-term well-being (Ceballos Mina & Santiago Ayala, 2019). In summary, while credit benefits individuals with lower incomes, fluctuations pose a threat to their well-being.

Regarding credit scoring, it facilitates the granting of loans to customers, aligning with sustainability and investment goals (Vasconcellos de Paula et al., 2019); moreover, it can optimize loan stages and functions (Martínez Sánchez & Pérez Lechuga, 2016). Therefore, the growth of credit scoring emphasizes the importance of distinguishing between good and bad customers to manage credit risk and delinquency (Kritzinger & van Vuuren, 2018). Hence, credit management impacts interest rates, which in turn affect people's behavior in the economy.

Similarly, Saiag (2020) emphasizes that a deficiency in financial knowledge within the informal sector prompts workers to accumulate debts, rendering timely payments challenging and resulting in an upsurge in their expenses. In this context, insufficient financial literacy has a more substantial impact on the utilization of informal loans compared to a poor credit history (Braun Santos et al., 2018). Consequently, the details of credit costs should encompass monthly payments, the number of payments, and interest rates (Renke & Steennot, 2020a).

Furthermore, consumer credit establishes a correlation between finances and individuals in their local environments (Parserisas, 2019). This is related to the positive correlation between credit and the human development index (Méndez-Heras et al., 2021b). Thus, credit facilitates access to financial resources to improve the health, education, and incomes of families.

Delinquency, as asserted by Trejo García et al. (2017), stands out as a crucial factor influencing banking decisions. According to these authors, banks grapple with decisions related to credit limits and their willingness to take on risks in relation to the profitability levels they seek to achieve. Furthermore, Crespi Junior et al. (2017) highlight that the operating margin should be considered to define the cutoff point for granting credit, and thereby, the company's profitability can be enhanced. In this sense, the comprehensive management of interest rates and VAT collection requires regulations and competition. This equilibrium significantly impacts access to credit, economic stability, and social well-being. Notably, elevated rates not only deter consumption but also discourage VAT contributions.

Hence, the research question is as follows: What is the correlation between the interest rate on consumer loans and the collection of VAT in Peru from 2011 to 2022? The study's objective is to ascertain this correlation, with the hypothesis proposing a significant link between the interest rate on consumer loans and the collection of VAT in Peru during the period 2011-2022.

METHODS

The descriptive aspect was conveyed through tables, figures, and the presentation of trends. The study was conducted at a correlational level, enabling the determination of whether a statistically significant correlation exists between the interest rates on consumer loans and the collection of VAT.

The normality test revealed that the variables were not normally distributed. Therefore, to conduct the correlational analysis, the Spearman correlation coefficient was used. This non-parametric test does not require the variables to be normally distributed. That being said, the Spearman's Rho correlation coefficient does not provide information about the causality of the relationship. This measure can vary between [-1, 1], where -1 suggests a total negative correlation, 1 denotes a total positive correlation, and 0 represents a lack of linear correlation.

Now, if the p-value is less than the significance level of 0.05, the null hypothesis of no correlation is rejected. In this scenario, there is a significant correlation between the interest rate on consumer loans and the collection of VAT in the examined period. On the contrary, if the p-value exceeds the significance level of 0,05, the null hypothesis is not rejected, and the alternate hypothesis suggesting a significant correlation between the interest rate on consumer loans and the collection of VAT in the examined period is not accepted.

The study utilized a dataset comprising observations collected over 144 months, spanning from January 2011 to December 2022. The focus of these observations was on two key variables: the interest rate on consumer loans and the collection of VAT. Encompassing a 12-year period, the study aimed to offer a more comprehensive understanding of these variables over time, facilitating the contextualization and comprehension of their dynamics.

The data related to the interest rate and VAT collection were gathered from the online portals of the Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones (Superintendency of Banking, Insurance, and Private Pension Fund Administrators) and the Superintendencia Nacional de Aduanas y de Administración Tributaria (National Superintendence of Customs and Tax Administration), respectively.

As the collected information for each month relied on the annual average interest rate of the financial system, and recognizing the necessity for a monthly metric to facilitate the review and comparison with other variables, the calculation of the average monthly interest rate was carried out. This conversion of rates was undertaken to ensure the necessary temporal coherence for the research and to guarantee the relevance of the findings within the specific desired time scale.

It is important to highlight a limitation of this study, which is related to data availability. Despite conducting a correlational assessment of the interest rate on consumer loans and the collection of VAT from January 2011 to December 2022, certain datasets, such as the comparison of deposits, the amount of consumer loans, and the number of debtors in the Multiple Banking system, are consistently available only from September 2015 onwards.

RESULTS

Public deposits in the local currency within the Multiple Banking system are a key factor in economic dynamics and the perception of the financial system's strength by economic agents. In Peru, these deposits have exhibited a progressive trend in recent years, as illustrated in Table 1.

Table 1 Comparison of public deposits in national currency in Multiple Banking (thousands of soles)

| Bank | 2015 | % | 2022 | % |

|---|---|---|---|---|

| Banco de Crédito del Perú | 30 520 920 | 33 % | 62 089 105 | 34 % |

| BBVA Perú | 19 565 017 | 21 % | 37 046 624 | 20 % |

| Interbank | 11 866 106 | 13 % | 26 971 080 | 15 % |

| Scotiabank Perú | 11 388 633 | 12 % | 24 127 560 | 13 % |

| Other banks | 19 456 963 | 21 % | 33 045 704 | 18 % |

| Total | 92 797 639 | 100 % | 183 280 072 | 100 % |

Note. Prepared with data taken from Información estadística de banca múltiple, by Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, 2023a (https://www.sbs.gob.pe/app/stats_net/stats/EstadisticaBoletinEstadistico.aspx?p=1#).

In Table 1, it is evident that the total public deposits in national currency in Multiple Banking in Peru experienced significant growth, nearly doubling. This increase reflects a strengthening in the perception of the banking system's solidity by the population and a greater willingness to deposit money in national currency in banks.

In the case of Banco de Crédito del Perú, an increase in its share of public deposits is observed. This growth suggests that the bank has managed to maintain its dominant position and has consistently expanded its market presence during that period. This phenomenon reflects the ongoing confidence of customers in the institution and its ability to attract deposits in national currency.

In the case of BBVA Perú, there is evidence of a slight decrease in its share of public deposits in national currency; although the institution remains one of the main players in the banking sector, the loss of this small percentage could indicate an adjustment in its market position. In contrast, Interbank experienced an increase in its contribution during the same period, highlighting its ability to expand its market share.

Similarly, Scotiabank Perú recorded an increase in its share of public deposits, indicating a positive trend in the institution's market share. Meanwhile, other banks within the Multiple Banking system observed a decrease in their contribution. This suggests that, although they grew in absolute terms, they lost ground compared to the leading banks.

Indeed, the evolution of consumer loans has undergone substantial transformations in recent years, as evidenced in Table 2, which reflects the expansion of the loan portfolios of the country's major financial institutions.

Table 2 Consumer loans in Multiple Banking (thousands of soles)

| Bank | 2015 | % | 2022 | % |

|---|---|---|---|---|

| Banco de Crédito del Perú | 10 276 068 | 26 % | 17 813 862 | 26 % |

| BBVA Perú | 4 072 869 | 10 % | 10 153 888 | 15 % |

| Interbank | 8 416 071 | 22 % | 14 977 744 | 22 % |

| Scotiabank Perú | 5 649 476 | 14 % | 10 303 695 | 15 % |

| Other banks | 10 723 921 | 27 % | 15 325 011 | 22 % |

| Total | 39 138 405 | 100 % | 68 574 199 | 100 % |

Note. Prepared with data taken from Información estadística de banca múltiple, by Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, 2023a (https://www.sbs.gob.pe/app/stats_net/stats/EstadisticaBoletinEstadistico.aspx?p=1#).

Table 2 presents data on outstanding, refinanced, restructured, and overdue loans for both revolving and non-revolving consumer loans. Analyzing these data reveals that some banks have maintained their position in the consumer loan segment, while others have experienced an increase in their market share. Overall, the market has witnessed an increase in the granting of consumer loans, associated with the changing financial needs of consumers.

Regarding Banco de Crédito del Perú, it maintained a consistent share in the consumer loan segment during this period, reflecting its strong position over the years. As for BBVA Perú, it underwent significant growth in its market share, successfully expanding its presence in this sector.

On its part, Interbank maintained its market share, demonstrating its ability to retain its position in the consumer loan market. Meanwhile, Scotiabank Perú experienced an increase in its market share, indicating growth in its market presence. However, the contribution of other banks in the consumer loan segment has notably decreased in market share. This decline indicates that smaller or less well-known banks have lost ground in this segment.

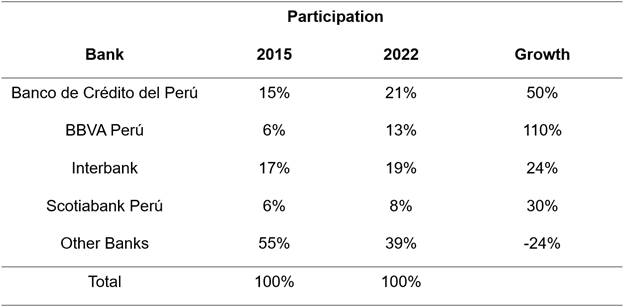

Similarly, exploring the percentage contribution and growth in the amount of debt per customer for consumer loans in Multiple Banking is crucial, serving as an indicator of access to this type of financing in the Peruvian population, as depicted in Table 3. A considerable growth in the amount of debt per customer for consumer loans in Multiple Banking in Peru is evident. Banco de Crédito del Perú registered an upswing in the amount of debt per customer, with a concurrent increase in the bank's proportion, signifying a noteworthy development in its market presence. Concerning BBVA Perú, the amount of debt per customer experienced a significant increase during the same period. Its market share also gained, reflecting a substantial expansion of its presence in the sector.

Table 3 Participation and growth in the amount of debt per customer for consumer loans in Multiple Banking

Note. Prepared with data taken from Información estadística de banca múltiple, by Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, 2023a (https://www.sbs.gob.pe/app/stats_net/stats/EstadisticaBoletinEstadistico.aspx?p=1#).

The participation of Interbank in this market experienced moderate growth. In the case of Scotiabank Perú, the amount of debt per customer increased, and its market share also grew moderately. As a result, the four major banks increased their share in the amount of debt per customer from 45 % to 61 %, experiencing a 46 % increase in this period. In contrast, other banks faced a significant decrease in the amount of debt per customer. Consequently, their market share fell, indicating a decline in their position.

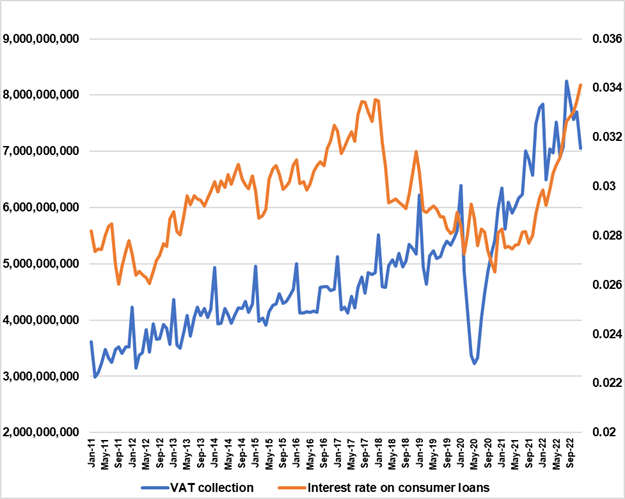

In the correlational analysis, the interaction between the interest rate on consumer loans and the collection of VAT plays an essential role in shaping the behavior of private consumption in the economic context. The fluctuation of the interest rate directly impacts consumers' financial decisions, influencing their propensity to apply for loans and, consequently, their spending patterns. In this context, a low-interest rate acts as an incentive, stimulating borrowing and encouraging increased spending. This phenomenon, in turn, can generate a positive effect on the collection of VAT, an indirect tax applied to most goods and services sold in the country.

As depicted in Figure 1, from 2011 to 2022, both the collection of VAT and the interest rates linked to consumer loans have experienced notable fluctuations, highlighting the intricacy of the relationship between these variables.

Note. Prepared with data taken from Tasas de interés promedio, by Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, 2023b (https://www.sbs.gob.pe/estadisticas/tasa-de-interes/tasas-de-interes-promedio); Ingresos del Gobierno central consolidado, by Superintendencia Nacional de Aduanas y de Administración Tributaria, 2023 (https://www.sunat.gob.pe/estadisticasestudios/ingresos-recaudados.html).

Figure 1 VAT collection and interest rate on consumer loans, January 2011 - December 2022

As indicated by Figure 1, the collection of VAT and the interest rate on consumer loans exhibited an upward trajectory over the years, marked by occasional seasonal fluctuations. The analysis involved examining 144 observations from January 2011 to December 2022. In this comprehensive examination, the interest rate on consumer loans displayed a rising trend, gradually increasing until approximately January 2018, after which it experienced a slight decline until 2020. In contrast, VAT collection continued to grow consistently, with a more pronounced increase observed from January 2021 onward.

In this same cycle, as per Table 4, the resulting p-value was 0,000, significantly lower than the conventional significance level of 0,05. This suggests robust statistical evidence to reject the null hypothesis of no correlation. Notably, the correlation value of 0,327 indicates a weak positive correlation between the interest rate on consumer loans and the collection of VAT. This positive correlation implies that an increase in the interest rate tends to correspond with an increase in VAT collection, and conversely, a decrease in the interest rate correlates with a decrease in VAT collection.

Table 4 Correlation Results

| Period | Number of Observations | p-value | Rho Value |

|---|---|---|---|

| January 2011-December 2022 | 144 | 0,000 | 0,327 |

| January 2011-December 2017 | 84 | 0,000 | 0,826 |

| January 2018-February 2020 | 26 | 0,450 | There is no correlation |

| March 2020-February 2021 | 12 | 0,198 | There is no correlation |

| March 2021-December 2022 | 22 | 0,000 | 0,774 |

Note. Prepared with data taken from Tasas de interés promedio, by Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, 2023b (https://www.sbs.gob.pe/estadisticas/tasa-de-interes/tasas-de-interes-promedio); Ingresos del Gobierno central consolidado, by Superintendencia Nacional de Aduanas y de Administración Tributaria, 2023 (https://www.sunat.gob.pe/estadisticasestudios/ingresos-recaudados.html).

It is crucial to note that annual fluctuations have an impact on the analysis. To comprehend the correlation between the variables, as depicted in Figure 1, the analysis was segmented into specific time periods: January 2011-December 2017, marked by a steady increase in both variables; January 2018-February 2020, where it is apparent that both variables deviate from the same trend; March 2020-February 2021, influenced by the National State of Emergency due to COVID-19, spanning approximately 12 months; and March 2021-December 2022, during which both variables witnessed an increase. This approach facilitated a more detailed interpretation of the correlations over the analyzed period.

On the one hand, spanning from January 2011 to December 2017, 84 observations were assessed. The interest rate on consumer loans exhibited a gradual upward trend, indicative of increased spending associated with loans for customers. On the other hand, VAT collection demonstrated a consistent evolution over the last years, reflecting a growing economy with an upsurge in tax revenue.

In the same analyzed period, it is noted that the p-value is 0,000, which is less than the significance level of 0,05. This result implies strong statistical evidence against the null hypothesis, indicating a significant relationship between the variables: interest rate on consumer loans and VAT collection.

Similarly, the calculated correlation coefficient is 0,826, pointing to a positive and robust correlation within the analyzed variables. In this context, the positive correlation suggests that, in general terms, from January 2011 to December 2017, when the interest rate on consumer loans increases, the VAT collection tends to increase, and vice versa; it tends to decrease when the other does.

In the subsequent period from January 2018 to February 2020, 26 observations were scrutinized, revealing an increase in VAT collection. Conversely, the interest rate on consumer loans demonstrated a decrease during this timeframe. The obtained p-value of 0,450 exceeds the significance level of 0,05. Consequently, there is insufficient evidence to reject the null hypothesis, indicating no significant correlation between the interest rate on consumer loans and VAT collection in the analyzed period.

Between March 2020 to February 2021, 12 observations were examined, with the significant impact of the COVID-19 pandemic being notable during this time. The decrease in the interest rate on consumer loans reflects the implementation of lower interest rate policies by central banks in response to the economic crisis. In the early months of the pandemic, VAT collection experienced a decline; however, it recovered in the second half of 2020 and continued to grow in 2021. With a p-value of 0,198, surpassing the significance level set at 0,05, there is insufficient evidence to reject the null hypothesis. Thus, the null hypothesis is confirmed, suggesting no significant correlation between the interest rate on consumer loans and VAT collection during the analyzed period.

In the subsequent stage, spanning from March 2021 to December 2022, 22 observations were examined. There is an upward trend in the interest rate on consumer loans, translating into an increase in rates for borrowers. Simultaneously, VAT collection has experienced growth in these months, reflecting an economic recovery after the uncertainty generated by the COVID-19 pandemic.

The obtained p-value was 0,000, which is less than the typical significance level of 0,05. Hence, the data provide statistical evidence suggesting the rejection of the null hypothesis of no correlation. Furthermore, the correlation value is equal to 0,774; therefore, a moderate to strong positive correlation is observed linking the interest rate on consumer loans and VAT collection.

Hence, over the 144 months analyzed from January 2011 to December 2022, the results reveal a positive correlation of 0,327 between the interest rate on consumer loans and VAT collection. In the period from 2015 to 2022, the concentration of consumer loans by the four main banks increased from 73 % to 78 %. Additionally, public deposits in these banks rose from 79 % to 82 %. Furthermore, these banks increased their participation in the amount of debt per customer from 45 % to 61 %, indicating a growth of 46 %. These data reflect the consolidation and growing relevance of these banks in the financial landscape.

DISCUSSION

As a contribution, the results unveil a distinct banking concentration in various products offered by the four main banks, underscoring their growing significance. This phenomenon is interlinked with the establishment of interest rates on consumer loans, yielding a noticeable impact on the consumption of goods and services. The in-depth exploration of these findings lays a substantial foundation for economic and tax decisions, particularly in the formulation of fiscal policies aimed at fortifying VAT collection.

In this context, the increase in market share for the four banks represents a higher concentration, indicating operation in an environment with oligopolistic characteristics. In this scenario, a small number of players dominate the industry, giving them the ability to influence prices and market conditions.

In that regard, the expansion of public deposits signifies the confidence of depositors in the banks. Likewise, the upsurge in the amount of debt per customer substantiates this trend, aligning with Méndez-Heras et al. (2021b), who posit that there is an empirically supported and statistically favorable connection wherein, as bank credit expands, there is also an increase in the human development index. However, it should be noted that this effect is not significant in the rural sectors of Peru.

The increase in the participation of consumer loans and its continuous growth suggests broader access to credit, even among low-income families. This pattern aligns with the observations of Ceballos Mina and Santiago Ayala (2019), who point out that financial services, especially high-cost credit cards, impact low-income families, threatening their long-term well-being. In the event that these families struggle to repay high-interest loans, they could be adversely affected in the long run.

The results indicate the presence of an oligopolistic structure, conferring substantial influence to banks in the financial market. Their policies regarding credit limits and risk tolerance can exert a significant impact on market conditions and competition. This finding is consistent with the research of Trejo Garcia et al. (2017), who contend that banks encounter pivotal decisions concerning credit limits and their readiness to assume risks in pursuit of desired profitability levels.

The findings indicate a rise in market share and an increase in the amount of debt per customer for the four banks. This suggests that these banks are extending credit to an equal or larger number of individuals, heightening the risk of default and impacting the profitability of the companies. This observation aligns with the proposal by Crespi Junior et al. (2017), supporting the inclusion of the operating margin as a criterion to define the cutoff point in granting credit. By considering the operating margin, companies can alleviate the risk associated with extending credit to individuals who cannot afford it, thereby reducing default rates and improving overall profitability.

The correlation and banking concentration values emerge as key elements in understanding why, despite the implementation of an expansive monetary policy aimed at reducing interest rates and facilitating access to loans to boost spending, interest rates and VAT collection show a positive trend in the analyzed dataset.

In this context, the results for the Peruvian case do not align with the suggestions of Levy Orlik (2012), who advocates for the implementation of expansive monetary policies through the credit channel with a focus on the production sector. They also do not align with the proposals of Rodríguez Nava and Venegas Martínez (2015), who argue that expansive monetary policy motivates households to seek more credit to cover their expenses.

As demonstrated by the results, within a context of positive correlation and concentration of consumer loans, consumers might feel compelled to seek loans even if interest rates are relatively high.

Moreover, the lack of financial knowledge and low financial literacy may lead to debt-related decision-making without a comprehensive understanding of the associated risks. This observation aligns with Saiag's (2020) assertion that financial illiteracy leads to indebtedness. Additionally, this argument finds support in the work of Braun Santos et al. (2018), who emphasize that low financial literacy poses a risk for overindebtedness. This phenomenon is reflected in the results: the four banks have increased their market share, experience consistent growth in loan placements, and observe an escalation in the amount of debt per customer. These factors indicate a high level of indebtedness among individuals.

In this manner, the absence of financial knowledge during periods without correlation can lead to unpredictable financial behaviors, impacting the relationship between interest rates and VAT collection. Although there is observed growth in the demand for consumer goods, not all of that spending proportionally translates into an increase in VAT collection.

The presence of a limited number of dominant banks conditions the financial system and makes it more vulnerable in an adverse economic environment. This scenario aligns with the conclusions of Perera and Wickramanayake (2016), who argue that retail interest rates are linked to a series of macroeconomic controls, as well as factors in the financial and banking sector. When analyzing banking concentration and consumer loans, it is revealed that the financial system is more susceptible to macroeconomic changes. These aspects underscore the importance of understanding the interconnection between the financial structure and macroeconomic factors, influencing the vulnerability and stability of the Peruvian financial system.

The positive correlation indicates an increase in people taking out loans. Periods with variable correlations may signify moments when the intention to obtain credit, beyond the actual repayment capacity, becomes less predictable. The lack of a constant correlation reflects that the connection between these variables does not always align with consumer intentions, supporting the notion of active over-indebtedness, as proposed by Goldenberg Serrano (2020), implying the intention to seek credit beyond the real repayment capacity. In this context, active over-indebtedness can increase the risk of financial crises, and authorities should consider this possibility when designing policies and regulations.

It is crucial to highlight that the positive correlation found does not imply causation and could be the result of various factors. Logic suggests that higher interest rates might discourage spending. In general, one would expect the VAT collection to increase as the interest rate on consumer loans decreases. This is because, with lower interest rates, individuals and businesses are more inclined to take out loans, leading to an increase in consumption and investment.

However, the results show the opposite, suggesting the possibility that banks may be using interest rates to their advantage. This situation could indicate that banks possess significant market power, making efficient competition in the sector challenging. It is essential to consider these dynamics for a more comprehensive understanding of the observed relationships and their potential economic implications.

In this regard, the concentration results in both consumer loans and public deposits align with the observations of Méndez-Heras et al. (2021a), who suggest that central banks should include efficient competition as one of its objectives. In this context, it would help ensure that consumers have access to financial products at competitive prices, thereby reducing pressure on banks to increase interest rates.

So, high concentration enables financial institutions to apply higher rates, affecting consumers with lower incomes and reducing their well-being. This scenario aligns with Estrada González (2016), whose proposition suggests that these banks can impose higher rates on consumers with fewer resources, resulting in a lower quality of life for the latter. Additionally, the results highlight the connection between banking concentration and interest rates, impacting the economic well-being of consumers. In this context, financial authorities could benefit from implementing measures that mitigate the negative effects of high banking concentration on interest rates, thus promoting a more equitable and sustainable financial environment.

Likewise, the results of correlation, concentration, and the amount of debt per customer suggest patterns that could indicate that banks are using their market power to take risks that could harm consumers or the financial system. This finding aligns with the perspective presented by Batu Tunay et al. (2020), who emphasize the importance of monitoring and strengthening the financial structures of banks, as supervision contributes to mitigating risk.

Similarly, these results indicate that banks may be acting to the detriment of consumer interests, suggesting that voluntary self-regulation in Peru might not be sufficient to ensure fair practices. Therefore, regulatory intervention is necessary to protect consumers, aligning with the perspective put forward by Renke and Steennot (2020b), who suggest that self-regulation alone is rarely sufficient.

These findings propose that regulators could consider intervening to ensure fair and reasonable rates, especially if the lack of competition facilitates the imposition of higher rates. This perspective is supported by the work of Nugroho et al. (2022), who argue that regulators should take steps to compel banks to reduce interest rate variations.

This information provides evidence supporting the need for regulatory intervention in the consumer credit market in Peru. Such intervention could take the form of measures to promote competition, such as reducing entry barriers to the market, or measures to directly regulate interest rates.

The correlation results, both for the overall period and the subperiods, suggest that loans can have a positive impact on the economy, even if this impact is not necessarily direct. This finding is in line with the proposal of Cisneros Zepeda (2022), who points out that loans granted by banking institutions are favorably associated with sustainable economic expansion. In this scenario, increased consumption can lead to increased production and employment, contributing to sustained economic development.

In the analysis, the data reveals substantial participation values in consumer credit by the four banks, accompanied by an increase in their market share. Additionally, the positive correlations between the interest rate on consumer loans and the VAT collection underscore the oligopolistic nature of the Peruvian financial system. Consequently, banks can anticipate increased demand for goods and services during periods of economic growth. This aligns with the perspective presented by de la Oliva de Con and Aguilar Cabezas (2019), who emphasize that speculation is intrinsically linked to the capitalist credit system, as it alone does not have the capacity to trigger economic crises.

In this context, when banks identify an increase in economic activity, they anticipate higher demand for goods and services. This anticipation, in turn, leads to a projection of an increase in consumer credit demand. Given the control that banks exert over the financial system due to banking oligopoly, banks can strategically adjust interest rates in response to the anticipation of an increase in credit demand. This interest rate adjustment becomes a speculative tactic to maximize profits, demonstrating how speculation integrates into the system as a direct consequence of the dominant position of banks in the oligopolistic market.

In conclusion, there is a positive correlation between the interest rate on consumer loans and the collection of the Value Added Tax in the analyzed period, from January 2011 to December 2022. This means that when the variable of interest rates on consumer loans increases, the variable of VAT collection also tends to increase, and vice versa.

However, when analyzing subperiods, variations in these correlations are observed, with predominant moments where the relationship is not significant. The variability across subperiods indicates that the connection between both factors may change in different economic contexts. The absence of correlation in some subperiods shows the influence of external factors, such as economic events or changes in financial policies that affect the relationship between these variables.

The concentration of the financial system controlled by four banks can impact interest rates and the availability of credit in the Peruvian banking system. It may also influence rate strategies adopted by dominant banking entities. If these banks implement similar policies regarding interest rates, they could affect correlations more uniformly. It is important to emphasize that the presence of a correlation does not inherently establish a direct cause-and-effect relationship between the variables. Other factors may influence this association.

This study has determined the correlation between the interest rates on consumer loans and the value added tax revenue in the Peruvian financial context during the period 2011-2022. However, it is advisable to conduct further research to address specific questions: What are the specific motivations that lead consumers to assume consumer loans at relatively high interest rates? What are the specific interactions between interest rates, private consumption, and VAT revenue? How could regulatory intervention address the issue of banking concentration and better protect consumers?