Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Industrial Data

versión impresa ISSN 1560-9146versión On-line ISSN 1810-9993

Ind. data vol.24 no.2 Lima jul./dic. 2021 Epub 31-Dic-2021

http://dx.doi.org/10.15381/idata.v24i2.19215

Production and Management

Comparative Analysis of Mining Freight in the Central Region

2 Civil Engineer from Universidad Ricardo Palma with a specialization in Transportation Infrastructure Concession Regulation (Lima, Peru). Currently working as consultant for Janus Consulting (Cusco, Peru). E-mail: janusconsulting.gg@gmail.com

This study provides a comparative analysis of the land transportation infrastructure in Peru, where there is intermodal competition, specifically between road and rail in the Región Central (Central Region). Based on this analysis, which means of freight transport used to carry goods such as solid bulk, considering producers and consumers competing for mining logistic contracts to the Port of Callao, is established. The results show that transferring mining freight from road to rail reduces vehicular congestion caused by the intensive use of trucking.

Keywords: Transportation infrastructure; intermodal competition; freight transportation; solid bulks; mining logistics.

INTRODUCTION

The Carretera Central has collapsed due to the increase in traffic, principally due to the excessive presence of heavy trucks that make the highway dangerous and cause drivers to reduce their speed and assume higher economic impacts due to the time lost in said traffic caused by vehicle congestion, which averages 40 km/h according to Casapia (2014). One solution to this problem is to build a new road; however, this would require a highly engineered and highly financed process, necessitating the introduction of an alternative means of land transportation for goods such as minerals. As a result, this study addresses in depth the contribution of the railway, whose average speed is 25 km/h (with stops at stations and synchronization of locomotives and wagons), with the objective of meeting the requirements of the national productive activity and reduce road congestion produced by it.

Background

Since its arrival in the country, automotive road transportation has been in competition with the railway, which had been developed 50 years earlier. However, the railroad transportation system in the center and south of the country has been witnessing a slow decline, even as other countries are currently reaching a balanced situation in terms of volumes of cargo being transported.

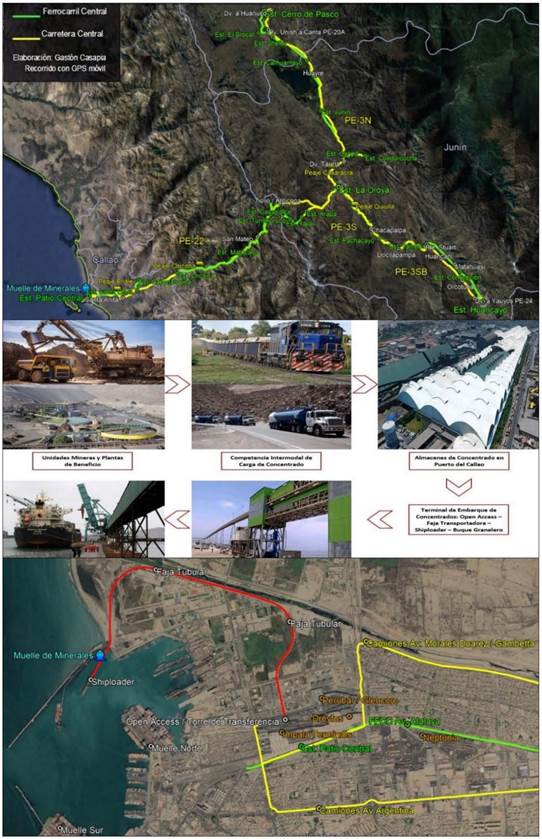

Peruvian national productivity is strengthened by mining, which is why there has been an expansion of the road network with primacy over rail transport; in this way the Ferrocarril Central (Central Railway) is in direct specific competition with the Carretera Central. According to Casapia (2014), these two modes of competitive transportation comprise the “central bimodal”, which connects the regions of Pasco, Junín and Lima with the Port of Callao; therefore, it is deduced that the transportation of freight by trucks is almost four times the freight transported by trains, leading to congestion of the highway (see Figure 1).

The Carretera Central, with 377 km of track, has been under concession to Deviandes S.A.C. since 2010, which is charged of performing routine and periodic maintenance in order to postpone its rehabilitation. Its revenues are derived from the collection of tolls in Corcona, Casaracra and Quiulla, to which an additional toll would be added, covered by annual minimum income guaranteed by the Government -that for 2016 was USD 14 271 590, excluding I.G.V. (General Sales Tax) and for each toll station- as stipulated in the concession agreement of the Supervisory Board for Investment in Public Transport Infrastructure [ Ositrán] (2010)

The Ferrocarril Central was concessioned in 1999 to Ferrovías Central Andina S.A., whose infrastructure, tractive stock (locomotives) and rolling stock (coaches and wagons) came from Empresa Nacional de Ferrocarriles (Enafer). The railrway, with a standard gauge of 1.44 m and a length of 477 km, is being rehabilitated and its rail yard, renovated. Its tariffs are established based on the charge for use of the track per kilometer traveled, from which the Government receives 24.75% of gross revenues (not including revenues from tractive or rolling stock or I.G.V.) (Ositrán, 2006).

The importance of the storage and shipment of freight in the Central Region extends to the Port of Callao, as it is part of the logistics chain of minerals exported between the mine or concentrating plant and the ships to be loaded at the port. Thus, since the end of 2014, exports have been realized through the concession of the Terminal de Embarque de Concentrados de Minerales to the company Transportadora Callao S.A. which has a hermetic conveyor belt system that goes from a free or public access point (open access) or transfer tower to the dock (shiploader), designed to handle 2000 tonnes per hour and ships of up to 60 000 deadweight tonnes (DWT). According to Transportadora Callao (2018). the benefits of this shipping system are that it is 5 times faster than the previous one, it reduces 8 days of waiting time at anchor, it reduces 3 days of dock laytime, and it has replaced approximately 369 000 truck trips between warehouses and the port.

Source: Prepared by the author with the aid of geospatial tools.

Figure 1 Intermodal competition flow of the “bimodal central” and concentrate loading in Port of Callao.

The objective of this research is to analyze the adequate intermodal competition of mining freight transportation to reduce vehicular congestion in the mining logistics chain in the Central Region.

HYPOTHESIS

Adequate intermodal competition in rail freight transportation reduces vehicular congestion in the mining logistics chain in the Central Region.

JUSTIFICATION

The traditional mining sector is the main exporter in Peru. In 2017, this sector generated around 61% of the total value of FOB exports, which amounted to USD 26 809 000 000, representing an increase of 27.4% compared with the previous year, due to the increase in exports of copper (36%), iron (27%), zinc (32%), and other minerals (42%) (Superintendencia Nacional de Aduanas y de Administración Tributaria [SUNAT], 2018), which has contributed to the increase in GDP, which is the indicator that measures the capacity to generate wealth in the economy of the country.

Due to the absence of refineries in Peru, more than 95% of mining production, including ore concentrates such as copper, lead, silver, gold, zinc, and molybdenum, is sent to foreign markets. These concentrates have been traded internationally through private companies, which include domestic and foreign producers and traders, who are currently in charge of mobilizing the total exportable production of these concentrates using their logistics and means of transportation.

Due to the extensive use of cargo trucks, with the premise that it is the only means to meet commercial deadlines, year after year the vehicular congestion on the Carretera Central increases at rates for which its transportation infrastructure was not designed.

The Central Region has another much more efficient means of transportation for large volumes of freight and long distances: the Ferrocarril Central. However, it does not have the same equity conditions, even though the Plan Nacional de Desarrollo Ferroviario (National Railway Development Plan) indicates that its purpose is to contribute to the competitiveness of exports (Resolución Ministerial N.° 396-2016-MTC, 2016).

Public transportation infrastructure should aim to reach more places and in faster ways, to be more economical, more comfortable and safer, and especially reduce the infrastructure gap and increase the competitiveness of the country. Consequently, this study analyzes the correlation between the problem of the excess of trucks with mining cargo on the Carretera Central, according to intermodal competition, and its mining logistics to ports; thus, the study proposes to reduce its circulation by using the railway, which is more efficient and affordable.

THEORETICAL BASIS

Intermodal Competition in Freight Transportation

Intermodal transportation occurs when different means of transportation work together, carrying out the shipment of materials and goods with a single load measure that could be in containers or other transport elements with cargo capacity.

Taking as a point of reference the modal split of freight transportation in different economies of the world -including 28 countries of the European Union, USA, Japan, China, and Russia-, maritime and road modes move the highest percentage of cargo with 33% each, while rail transportation is close with 22% of the total cargo in billion ton-kilometers, according to the European Commission (2018). However, this intermodal competition is far from our reality, where the studies of the Plan Intermodal de Transportes 2004-2023 (Intermodal Transport Plan 2004-2023) establish there is a “intercity cargo” transportation whose 74% is transported by road, 13% by rail, 12% by sea and 1% by river and air mode (Ministerio de Transportes y Comunicaciones [MTC], 2005).

According to Rodrigue, Comtois y Slack (2013) “Los modos pueden competir o complementarse entre sí en términos de costo, velocidad, accesibilidad, frecuencia, seguridad, comodidad, etc. [Modes can compete or complement each other in terms of cost, speed, accessibility, frequency, safety, comfort, etc.]” (p. 107) depending on the following conditions: 1. Different geographic markets, 2. Different transportation markets, and 3. Different levels of service.

While the existence of intermodal competition depends on geographic and transportation markets, there are other factors that affect these principles, such as infrastructure conditions, terrain conditions, and levels of service in collapse or with congestion, so intermodal competition in long-distance freight transportation must be optimized.

According to Thomson and Bull (2002), “la congestión es la condición que prevalece si la introducción de un vehículo en un flujo de tránsito aumenta el tiempo de circulación de los demás [congestion is the condition that prevails if the introduction of one vehicle into a traffic flow increases the circulation time of others]” (p. 110). On this matter, Ortúzar and Willumsen (2011) define that congestion arises when the intensity of demand approaches the capacity of the facility (road or rail infrastructure) and the time required to use it exceeds the established low-demand average.

Mining Marketing Logistics Chain

The value chain in the mining industry -from the extraction in mines, the processing and the commercialization of concentrates until its export in ports- determines the efficiency of its mining logistics, however, the readjustment of the logistics cost depends on the operators according to their ability to reduce their fixed costs and high rate of logistics specialization, so mining entrepreneurs must decide to select them by communication criteria, freight charge, service capacity, and delivery quality (Galo, Ribeiro, Mergulhão, & Vieira, 2018).

METHODOLOGY

This non-experimental study is based on a descriptive-comparative methodological framework. It is a comparative analysis of the demand of land mining cargo transportation on the Carretera Central and the Ferrocarril Central in service in order to know the modal alternative to the existing traffic in vehicular infrastructure.

The modes of land infrastructure for public use in the Central Region are unique, so the population and size of the study are the same; these are the Ferrocarril del Centro and the Carretera IIRSA Centro Tramo 2 (Central IIRSA Highway Section 2).

The mining logistics chain that includes the freight intermodal competition, that is, from the plants in the mining units to the Port of Callao, is evaluated by analyzing (1) the Average Daily Annual Rate (Índice Medio Diario Anual [IMDA]) of the vehicles passing through the counting stations of the Carretera Central and its alternate routes and (2) the demand of trains according to the shipment reports of the Ferrocarril Central. In this way, the number of units arriving to the warehouse at the port is calculated, which then proceed to dispatch the mining cargo by maritime means through the traffic movement of the del Terminal de Embarque de Concentrados de Minerales en el Puerto del Callao (Mineral Concentrate Shipping Terminal at the Port of Callao).

RESULTS

Mining Productivity in the Central Region

The area of influence of this study covers the Central Region of the country, in which there has been metal mining production activity for many years, particularly in the Andean terrain of Lima, Junín and Pasco. Therefore, the research is directly circumscribed in 20 mining units, 15 of which have been exploited by underground mining; 4 by surface mining; and 1, Cajamarquilla, by refinery (Ministerio de Energía y Minas [MINEM], 2018) (see Table 1).

Table 1 Mining Units in the Central Region.

| ID | Expl. Method | Owner | Unit | Reg. | Prov. | Dist. | Prod. |

| 1 | Undergr. mining | Comp. Minera Argentum S.A. | Anticona | Junín | Yauli | Yauli | Zn, Ag, Cu, Pb |

| 2 | Undergr. mining | Comp. Minera Argentum S.A. | Manuelita | Junín | Yauli | Yauli | Pb, Zn, Ag, Cu |

| 3 | Undergr. mining | Comp. Minera Argentum S.A. | Morococha | Junín | Yauli | Morococha | Pb, Zn, Ag, Cu |

| 4 | Undergr. mining | Nexa Resources Atacocha S.A.A. | Atacocha | Pasco | Pasco | San Fco. Asís de Yarusyacán | Pb, Zn, Au, Ag, Cu, Bi |

| 5 | Undergr. mining | Comp. Minera Casapalca S.A. | Americana | Junín | Yauli | Yauli | Zn, Ag, Cu, Pb |

| 6 | Undergr. mining | Comp. Minera San Ignacio de Morococha S.A.A. | Palmapata | Junín | Chancha-mayo | San Ramón | Pb, Zn |

| 7 | Undergr. mining | Comp. Minera San Ignacio de Morococha S.A.A. | San Vicente | Junín | Chancha-mayo | Vitoc | Pb, Zn |

| 8 | Surface mining | Emp. Administradora Cerro S.A.C. | Cerro de Pasco | Pasco | Pasco | Simón Bolívar | Cu, Pb, Zn, Au, Ag |

| 9 | Undergr. mining | Emp. Minera Los Quenuales S.A. | Yauliyacu | Lima | Huarochirí | Chicla | Zn, Ag, Pb, Cu |

| 10 | Undergr. mining | Nexa Resources El Porvenir S.A.C. | Milpo Nº1 | Pasco | Pasco | Yanacancha | Cu, Pb, Zn, Au, Ag |

| 11 | Surface mining | Minera Chinalco Perú S.A. | Toromocho | Junín | Yauli | Morococha | Cu, Mo, Zn, Ag, As |

| 12 | Undergr. mining | Soc. Minera Austria Duvaz S.A.C. | Austria Duvaz | Junín | Yauli | Morococha | Pb, Zn, Ag, Cu |

| 13 | Surface mining | Soc. Minera El Brocal S.A.A. | Colquijirca Nº1 | Pasco | Pasco | Simón Bolívar | Cu, Au, Ag, As |

| 14 | Surface mining | Soc. Minera El Brocal S.A.A. | Colquijirca N°2 | Pasco | Pasco | Tinyahuarco | Zn, Ag, Pb, Cu |

| 15 | Undergr. mining | Volcan Comp. Minera S.A.A. | Andaychagua | Junín | Yauli | Huay-Huay | Zn, Ag, Pb, Cu |

| 16 | Undergr. mining | Volcan Comp. Minera S.A.A. | Carahuacra | Junín | Yauli | Yauli | Zn, Ag, Cu, Pb |

| 17 | Undergr. mining | Volcan Comp. Minera S.A.A. | Morada | Junín | Yauli | Yauli | Cu, Pb, Zn, Ag |

| 18 | Undergr. mining | Volcan Comp. Minera S.A.A. | San Cristóbal | Junín | Yauli | Yauli | Cu, Pb, Zn, Ag |

| 19 | Undergr. mining | Volcan Comp. Minera S.A.A. | Ticlio | Junín | Yauli | Morococha | Cu, Pb, Zn, Ag |

| 20 | Refinery | Nexa Resources Cajamarquilla S.A. | Refinería de Cajamarquilla | Lima | Lima | Lurigancho | Cd, Cu, Zn, Ag |

Source: Prepared by the author based on the Mapa de Principales Unidades Mineras en Producción (MINEM, 2018).

Bimodal Central Competition in Mining Freight Transport

Approximately one century ago, mining freight from the Cerro de Pasco Copper Corporation to La Oroya and El Callao was transported by railway. However, the later appearance of heavy goods vehicles and the completion of the Carretera Central in 1936 showed that its logistics could be reduced, especially because there was neither at the time nor at the present day a fair price between the toll value per axle and the equivalent deterioration per axle caused by overloading the road.

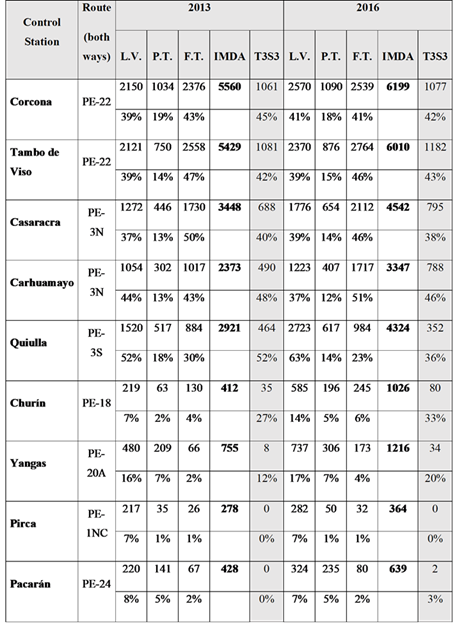

Since it is difficult to obtain information on the transportation of minerals through the country’s highways, a count of land transportation units is made when these vehicles cross checkpoints or stations. In this way the Ministry of Transportation and Communications obtains the IMDA by type of vehicle per road sections. In the case of the Central Region, data from the MTC (MTC, 2013 and MTC, 2016) are taken into account -considering that 2016 was the last year in which MTC published this information- and Table 2 and Figure 2 are analyzed.

Table 2 shows the number of vehicles using the Carretera Central (PE-22, PE-3N and PE-3S) and the alternate routes in both directions. According to the classification by demand of the Manual de Carreteras of the MTC (Resolución Directoral N° 03-2018-MTC, 2018), a road with an IMDA greater than 6000 veh/day, with two or more lanes of 3.60 m minimum width and a central separator of 6.00 m would be an autopista de primera clase (first class highway); that means that its typical section would measure a minimum width of 20.40 m. However, the Carretera Central still has a 6.60 m roadway, which is why it still presents inconveniences with its geometric design and, therefore, vehicular congestion problems.

It is worth noting that the flow of six-axle heavy goods vehicles, such as T3S3 trucks (three-axle tractor and three-axle semitrailer) and the box trucks used to transport concentrates to the port, has been increasing at an average annual rate of 1 to 5%. However, in Carhuamayo (between Cerro de Pasco and La Oroya) this increase was as high as 20%, while on other routes such as PE-18 in Churin (between Huaura and Ambo) the increase was 43% and on PE-20A in Yangas (between Lima and Unish) it was even 108% per year.

Table 2 IMDA 2013 - 2016 in the Central Region.

Note: L.V.: Light Vehicle (cars and vans).

P.T.: Public Transportation (rural vans, buses and omnibuses).

F.T.: Freight Transportation (articulated , 2 and 3 axles trucks).

Source: Prepared by the author based on IMDA by type of vehicle and road sections (MTC, 2013; MTC, 2016).

Source: Prepared by the author on Google Earth, based on IMDA, and road sections (MTC, 2013; MTC, 2016).

Figure 2 IMDA 2013 - 2016 in the Central Region.

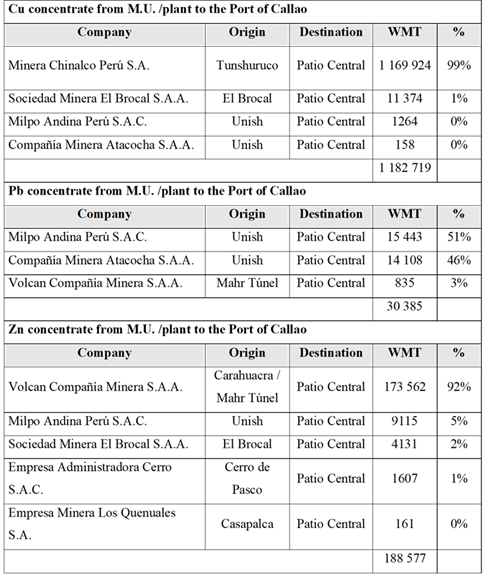

In addition to analyzing the transfer of mineral concentrates in heavy goods vehicles, it is also possible to compare the movement of trains (locomotives and wagons) and their respective loads through the Ferrocarril Central, whose information comes from the concessionaire Ferrovías Central Andina S.A. (FVCA), which is shown in Table 3, regarding the transport of mineral concentrates (Ferrovías Central Andina [FVCA], 2017).

Table 3 Freight Transport in Ferrocarril Central to Callao in 2017.

Source: Prepared by the author based on the Reporte Acumulado de Clientes por Carga (FVCA, 2017).

Once the zinc concentrate arrives in Callao, a total of 10 037 WMT were transferred to the Refinería de Cajamarquilla by Nexa Resources Cajamarquilla S.A. to obtain zinc bars.

In 2017, the transport of copper, lead and zinc concentrate through the railroad line to the Port of Callao (Central Yard) initiated in the beneficiation plants and/or mining units in production. The main customers of the railroad, according to concentrate, were Minera Chinalco with 99% of copper; Volcan with 92% of zinc; and, in the case of lead, Milpo with 51% and Atacocha with 46%; the latter two have now become part of the company Nexa Resources, which would consequently take 97% of the lead.

Mining Logistics at the Port of Callao

Regardless of the supply chain to the mines, the logistics chain organizes the transportation to deliver the products from the beneficiation plants to the final customer. Whether using the bimodal central or other alternative routes, the purpose of the mining companies is to complete the supply chain to a refinery or to the Port of Callao, depending on the commercialization contract they have signed.

Due to the requirements with respect to mineral deliveries, most mining companies subcontract the organization of transportation to logistics operators or traders, which offer mining logistics consulting services, which consist of contracting transportation companies, picking up and moving the goods, contracting warehouses for storage, dealing with customs procedures and maritime shipments, etc. Trafigura Perú S.A.C. (formerly Cormín) and Glencore Perú S.A.C. are two examples of these logistics operators.

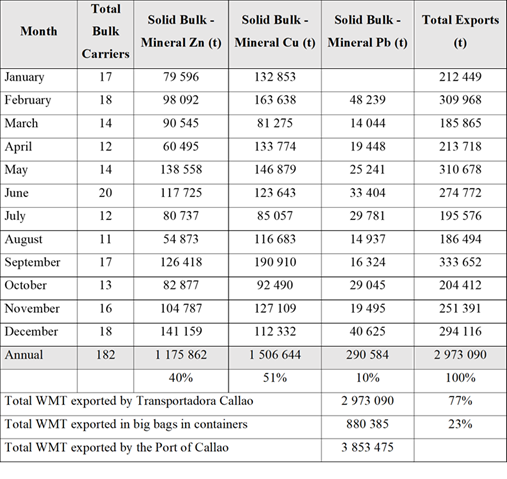

The Plan de Negocios del Terminal de Embarque de Concentrados (Transportadora Callao, 2018) details the 2017 traffic of the feeder warehouses used in port, such as Impala Terminals with 45%, Perubar with 33%, Chinalco with 15%, and Dreyfus with 7%. This is complemented by the information from the Resumen General de Naves y Tráfico de Carga en el Terminal de Embarque de Concentrados de Minerales (Ositrán, 2018), which is shown in Table 4.

Table 4 Export of Concentrates from Transportadora Callao 2017.

Source: Prepared by the author based on the Resumen General de Naves y Tráfico de Carga en Terminal de Embarque de Concentrados de Minerales (Ositrán, 2018).

In 2017, 182 bulk carriers with an average cargo of 16 336 t per vehicle, that gave a total of 2 973 090 tonnes, were served. This represented 77% of the total ore concentrates exported in the Port of Callao and 26% of the total exported in Peru.

The main problem at the Port of Callao is that part of the concentrates is still exported in big bags inside containers, which is equivalent to 23% of total exports. For this reason, the concessionaire has been registering losses in its income statement, since the cargo handled by the Terminal is substantially less than projected.

Based on the information collected on the mining units in the Central Region and their concentrating plants, it is possible to estimate the number of heavy goods trucks that travel through this region, the number of wagons transporting ore concentrate and the exports that make use of the conveyor belt of the Terminal de Embarque de Concentrados de Minerales del Callao.

DISCUSSION

In 2017, Transportadora Callao mobilized a total of 2 973 090 WMT of copper, zinc and lead concentrates. If it is considered that in the same year the Ferrocarril Central transported to the port 1 391 644 WMT of concentrates with the same characteristics, we can deduce that the difference in these amounts are the tonnes that were sent by trucks to Callao, that is, 1 581 446 WMT. This means that 47% was mobilized by railway wagons and 53% by trucks.

Since there is no further research on this subject, except for the comparative of the bimodal central, and based on the above, it is argued that most mining companies subcontract to traders who prefer to use trucking companies.

Considering that a box truck of mining concentrate has an average payload of 30 WMT, the number of trucks per year that arrived at the port was 52 715, with a frequency of 144 trucks per day.

HYPOTHESIS TESTING

As it is shown in Table 2, the IMDA at Corcona control station was 6199 vehicles. If the cargo is transferred from road to rail, removing only an average of 288 trucks in both directions, the IMDA would be reduced by almost 5%. If the trucks transporting big bags, as shown in Table 4, are included in the cargo shifting, about 448 units would be replaced per day, that is, 42% of 6-axle trucks. As a result, a decongestion of heavy vehicles would occur not only on the highway but particularly in the access to Lima and the Port of Callao. Thus, the analysis shows that adequate intermodal competition of rail freight transportation reduces vehicle congestion in the mining logistics chain.

CONCLUSIONS AND RECOMENDATIONS

The development of the infrastructure of land transportation has been consolidating according to the technological prominence of the means of transportation. Thus, the average operating costs of a truck -fuel, maintenance, spare parts and insurance- are significantly lower than the tractive and rolling stock used by a train. Likewise, road transport infrastructure with a flexible pavement has a lower investment cost than railways (Casapia, 2014); however, road transport receives a higher subsidy, despite the fact that railroads have higher sunk costs, with an average use period of 80 years in operation before being rehabilitated.

After the discussion, it is clear that the railroad mode might guarantee the socioeconomic benefit of the country, reducing vehicle congestion, saving travel time and vehicle operation costs, decreasing traffic accidents, and above all reducing the costs derived from the intensive use of trucks. In other words, a policy of safety, environmental health and social responsibility should take precedence.

The improvement of transportation infrastructure is necessary to reduce logistics costs and to increase the sustainable growth of the region in order to close the infrastructure gap that in our country would be a good option to achieve the strength of the Plan Nacional de Infraestructura para la Competitividad (D. S. N.° 238-2019-EF, 2019), whose short-term gap in rail transport considers S/20 430 000 000, through multimodal connectivity, integrating productivity and its regions using road, rail and water transportation modes.

REFERENCIAS BIBLIOGRÁFICAS

Casapia, G. (2014). Carretera o Ferrocarril ¿Qué modo de transporte usar? Lima, Perú: Universidad Ricardo Palma. [ Links ]

D. S. N.° 238-2019-EF. Plan Nacional de Infraestructura para la Competitividad. Diario Oficial El Peruano (28 de julio del 2019). [ Links ]

European Commission. (2018). EU Transport Statistical Pocketbook. Luxembourg, Publications Office of the European Union. Recuperado de https://doi.org/10.2832/491038 [ Links ]

Ferrovías Central Andina - FVCA (2017). Reporte Acumulado de Clientes por Carga. Lima, Perú. [ Links ]

Galo, N., Ribeiro, P., Mergulhão, R., y Vieira, J. (2018). Selección de proveedor de servicios logísticos: alineación entre criterios e indicadores. Innovar, 28(69), 55-67. Recuperado de https://doi.org/10.15446/innovar.v28n69.71696 [ Links ]

Ministerio de Energía y Minas. (2018). Mapa de las Principales Unidades Mineras en Producción 2018. Lima, Perú. [ Links ]

Ministerio de Transportes y Comunicaciones. (2005). Plan Intermodal de Transportes PIT 2004-2023. Lima, Perú. [ Links ]

Ministerio de Transportes y Comunicaciones. (2013). Índice Medio Diario Anual - IMDA. Lima, Perú. [ Links ]

Ministerio de Transportes y Comunicaciones (2016). Índice Medio Diario Anual - IMDA. Lima, Perú. [ Links ]

Organismo Supervisor de la Inversión en Infraestructura de Transporte de Uso Público. (2006). Contrato de Concesión del Ferrocarril del Centro. Lima, Perú. [ Links ]

Organismo Supervisor de la Inversión en Infraestructura de Transporte de Uso Público. (2010). Contrato de Concesión del IIRSA Centro Tramo 2: Puente Ricardo Palma - La Oroya - Huancayo y La Oroya - Dv. Cerro de Pasco. Lima, Perú. [ Links ]

Organismo Supervisor de la Inversión en Infraestructura de Transporte de Uso Público. (2018). Resumen General de Naves y Tráfico de Carga en el Terminal de Embarque de Concentrados de Minerales 2017. Lima, Perú. [ Links ]

Ortúzar, J., y Willumsen, L. (2011). Modelling Transport. Chichester, UK: Wiley Publication. Recuperado de https://doi.org/10.1002/9781119993308 [ Links ]

Resolución Ministerial N.° 396-2016-MTC. Aprueban el "Plan Nacional de Desarrollo Ferroviario". Diario Oficial El Peruano (16 de junio del 2016). [ Links ]

Resolución Directoral N° 03-2018-MTC, Aprueban Manual de Carreteras: Diseño Geométrico DG 2018. Diario Oficial El Peruano (07 de febrero del 2018). [ Links ]

Rodrigue, J., Comtois, C., y Slack, B. (2013). The Geography of Transport Systems. Abingdon, UK: Routledge, Taylor & Francis Group. Recuperado de https://doi.org/10.4324/9780203371183 [ Links ]

Superintendencia Nacional de Aduanas y de Administración Tributaria (2018). Anuario Estadístico de Comercio Exterior 2017. Lima, Perú. [ Links ]

Thomson, I., y Bull, A. (2002). La Congestión del Tránsito Urbano: Causas y Consecuencias Económicas y Sociales. Revista de la CEPAL, (76), 109-121. Recuperado de http://hdl.handle.net/11362/10804 [ Links ]

Transportadora Callao (2018). Plan de Negocios del Terminal de Embarque de Concentrados de Minerales. Lima, Perú. [ Links ]

Received: December 10, 2020; Accepted: July 09, 2021

texto en

texto en