Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Industrial Data

Print version ISSN 1560-9146On-line version ISSN 1810-9993

Ind. data vol.24 no.2 Lima July/Dec. 2021 Epub Dec 31, 2021

http://dx.doi.org/10.15381/idata.v24i2.20351

Production and Management

Digital Banking: Technological Innovation in Financial Inclusion in Peru

2 Master in Administration from Universidad del Pacífico. Currently working as professor at the School of Administrative Sciences of Universidad Nacional Mayor de San Marcos. (Lima, Peru). E-mail: avargasg@unmsm.edu.pe

Technology-driven digital transformation is impacting the financial sector with the entry of new business models such as fintech and bigtech that successfully compete by offering financial products with disruptive potential. Digital banking is the result of the sum of traditional banking and the internet that offers banking services through a website or mobile application. The integration of financial services into digital ecosystems represents a challenge for traditional banking that needs to evolve to face the changing environment. Digital banking plays an important role in financial inclusion, as it allows access to innovative services to more Peruvians and boosts economic growth. However, a high level of digital fraud also exists, aimed at misappropriating money or blackmailing financial users by means of phishing and the use of malware. Pearson’s correlation coefficient, useful for linear relationships, was used to evaluate the variables “digital banking” and “financial inclusion”, and SPSS-IBM software was used to tabulate the results.

Keywords: innovation; technology; inclusion; finance; banking.

INTRODUCTION

The significance of technologies used by digital banking is studied in this research, as they offer an excellent alternative for the integration of the socially-excluded population by providing access to and use of financial services (financial inclusion). Such technologies, starting from data traffic on cell phones, interbank transactions and digital accounts, can be used as tools to improve customer service efficiency.

Financial inclusion is a multidimensional concept related to the supply and demand aspects of financial products or services, whose dimensions are access, use, quality and impact on the financial wellbeing of families and companies. According to the Economic Commission for Latin America and the Caribbean (CEPAL), financial inclusion is a factor that drives 7 of the 17 sustainable development goals: “(SDG1) No poverty, (SDG2) Zero hunger, (SDG3) Good health and well-being, (SDG5) Gender equality, (SDG8) Decent work and economic growth, (SDG9) Industry, innovation and infrastructure, and (SDG10) Reduced inequalities” ((CEPAL, 2020, p.14), making this research particularly relevant. The objective of this study is to determine to what extent digital banking is related to financial inclusion during the period 2010-2019, while the general hypothesis seeks to verify that digital banking is significantly related to financial inclusion in Peru during the period 2010-2019.

This research contributes to expanding knowledge regarding the change that technological innovation is bringing about in the use of and access to financial services, which suggests that the future of banking and the development of financial inclusion is digital.

Digitalization in Latin America

In terms of digital development, Latin America ranks at a medium level with an index of 49.92 (on a scale of 0 to 100), higher than the African region (35.05) and Asia Pacific (49.16). However, it falls behind Eastern Europe (52.90), Western Europe (71.06) and North America (80.85). As part of the developing world, Latin America shows a moderate growth rate of digitalization compared to other regions of the developed world (Corporación Andina de Fomento [CAF], 2020a ).

The Frontier Technologies Readiness Index prepared by the Corporación United Nations [ONU] (2021) presented the results obtained by 158 countries based on a scale from 0 to 1, placing them within one of four 25-percentile score groups. The values considered were: low, lower-middle, upper-middle, and high. Table 1 shows the position obtained by the countries representing Latin America.

Table 1 Latin America’s Technologies Index.

| Country | World Ranking | Score | Score Group |

|---|---|---|---|

| Brazil | 41 | 0.65 | Upper-middle |

| Chile | 49 | 0.57 | Upper-middle |

| Mexico | 57 | 0.54 | Upper-middle |

| Argentina | 65 | 0.49 | Upper-middle |

| Uruguay | 68 | 0.47 | Upper-middle |

| Colombia | 78 | 0.44 | Upper-middle |

| Peru | 89 | 0.36 | Lower-middle |

| Ecuador | 90 | 0.34 | Lower-middle |

| Paraguay | 102 | 0.29 | Lower-middle |

| Bolivia | 116 | 0.24 | Lower-middle |

Source: Adapted from the United Nations, 2020.

Financial Inclusion

Financial inclusion favors economic growth, focusing on the vulnerable population, as it provides the opportunity to save, invest, borrow and obtain credit and insurance through the use of and access to financial services. Use of and access to financial services is among the economic and social differences between high-income countries in Europe and low-income countries in Latin America (Orazi, Martínez, & Vigier, 2019).

Similarly,

Being able to have access to a transaction account is a first step toward broader financial inclusion since a transaction account allows people to store money, and send and receive payments. A transaction account serves as a gateway to other financial services, which is why ensuring that people worldwide can have access to a transaction account is the focus of the World Bank Group’s Universal Financial Access 2020 initiative. (Banco Mundial, 2018, para. 2)

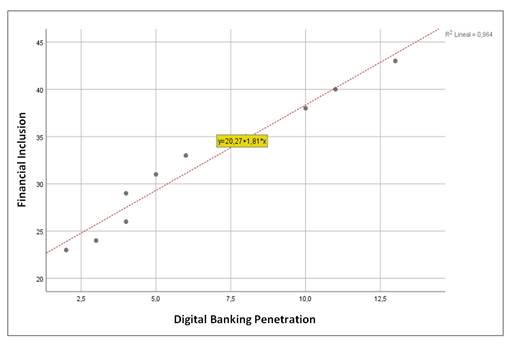

In 2019, regarding the number of deposit accounts in commercial banks, Mexico had 98 million 623 thousand, Colombia had 75 million 728 thousand; Argentina had 67 million 579 thousand; Chile had 44 million 994 thousand; Peru had 42 million 662 thousand; and finally Bolivia had 6 million 256 thousand (Figure 1).

Source: Adapted from International Monetary Fund, 2020.

Figure 1 Latin America: Number of deposit accounts in commercial bank branches from 2015-2019 (in thousands).

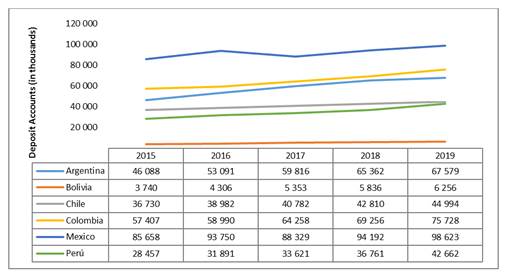

Concepts such as savings or access to credit are important aspects of financial inclusion. In 2019, regarding loan accounts in commercial banks, Colombia had 24 million 463 thousand; Argentina had 18 million 997 thousand; Chile had 15 million 675 thousand; Peru had 5 million 923 thousand; and finally Bolivia had 692 thousand (Figure 2).

Source: Adapted from International Monetary Fund, 2020.

Figure 2 Latin America: Number of loan accounts in commercial bank branches from 2015-2019 (in thousands).

Digital financial inclusion represents an opportunity for neglected low-income families to integrate into the banking sector and access digital financial services through the internet.

“Digital financial inclusion” can be defined as digital access to and use of formal financial services by excluded and underserved populations. Such services should be suited to the customers’ needs and delivered responsibly, at a cost both affordable to customers and sustainable for providers. (Grupo Consultivo de Ayuda a los Pobres [CGAP], 2015), p. 1

Digital Banking

New disruptive technologies have prompted traditional banking to be more competitive and a) be fast and accurate in risk assessment; b) ensure the security and protection of customer data; c) exploit big data intelligence to generate value from users; and d) offer products and services according to the reality and need of digital customers (Bueno, Longo, & Morcillo, 2017).

A definition of digital banking is presented below.

(…) el mundo digital ha cambiado la dinámica tradicional de la banca, ofreciendo productos enfocados en el consumidor y sus necesidades. Se trata de un consumidor que demanda transacciones en tiempo real, seguras y eficientes, y al que las nuevas tecnologías lo empoderan para: a) administrar sus productos a través de plataformas a las que pueden acceder desde cualquier lugar y en cualquier momento; b) conocer de primera mano la oferta de productos y servicios; c) comparar las opciones que le ofrece el mercado y d) emitir opiniones y defender sus derechos de manera más efectiva. Otra faceta de las nuevas tecnologías consiste en el impacto potencial que tienen para impulsar la inclusión financiera, particularmente en sectores de bajos ingresos [the digital world has changed the traditional dynamics of banking, offering products focused on the consumer and their needs. These consumers demand real-time, secure and efficient transactions, and new technologies empower them to: a) manage their products through platforms they can access from anywhere and at any time; b) learn first-hand about the range of products and services available; c) compare the options offered by the market; and d) express their opinions and defend their rights more effectively. A further feature of the new technologies is their potential to boost financial inclusion, particularly in low-income sectors]. (Asobancaria, 2017), p. 2

Digital Banking Technologies

Big data

Big data is the massive collection and management of information that makes possible the storage, processing and analysis of digital information. It allows banks to make more effective decisions, as, based on a better knowledge of their customers, they are able to offer financial products and services designed according to their needs. It improves credit approval, risk management, investment banking and cross-selling processes. It also erases the barriers of information asymmetry.

El término Big Data no sólo hace referencia al volumen de datos, sino a las tecnologías asociadas a la captación, administración y visibilidad de los mismos; y no sólo se tiene en cuenta el volumen sino la variedad de los mismos y la velocidad de acceso y procesamiento. [The term Big Data refers not only to the volume of data, but also to the technologies associated with the collection, management and visibility of the data; not only volume but also the variety of the data and the speed of access and processing are taken into account]. (Revuelta, 2018), p.312

Blockchain

A blockchain is a distributed database shared by a network that uses encrypted algorithms that makes information difficult to hack or steal. In banking, in the near future, blockchain will facilitate the secure transmission of data and capital using encrypted codes. It will also make it possible to provide customers with a secure identity on the web. Moreover, traditional contracts will be replaced by smart contracts, thus reducing the risk of transactions.

En cuanto al sector bancario y financiero, si bien es cierto que el uso de esta tecnología aún es incipiente, algunos bancos han venido trabajando de manera importante en la utilización del blockchain en el desarrollo de sus productos, viendo en su utilización enormes posibilidades para la reducción de costos, mayor eficiencia y agilidad en las transacciones. [As for the banking and financial sector, while the use of this technology is still incipient, certain banks have been actively using blockchain for product development, as they see in its use tremendous potential for cost reduction, greater efficiency and agility in transactions]. (Federación Latinoamericana de Bancos [FELABAN], 2018), p. 1

Cloud Computing

Cloud computing is the technology that, via the Internet, enables data storage and facilitates access to platforms, applications and services in a virtual space. Clouds (servers located in the network) are where workloads are executed. Data storage and services in the cloud ensure a high-speed processing of transactions resulting in cost savings for both the financial client and the bank, creating scalability and agility in the banking business. It is also friendly with other technologies such as artificial intelligence and big data.

Artificial Intelligence (AI)

AI is a branch of computer science that deals with the development of systems to perform complex tasks as human intelligence would. AI has an impact on banking activities such as risk management, credit scoring, credit card fraud, cash transactions and personalized customer support (app chatbot). “Un chatbot es un software que interactúa con el usuario mediante una interfaz de conversación, diseñado para simular una conversación inteligente sin un ser humano presente [A chatbot is a software that interacts with the user via a conversational interface and is designed to simulate a conversation intelligently performed without a human being present]” (Serrano-Cobos, 2016 ), p. 845.

AI technology has become an essential tool for financial investment markets, which is why it will be widely used in the short term. However, it will hardly replace the human being in its entirety but rather it will be an additional factor in decision making (Alonso & Carrio, 2019).

Internet of things (IoT)

It is the ability of physical and digital devices to interconnect through the Internet and share information with each other. The internet is no longer just a cloud, but together with the devices they form a whole. The IoT enables banks to use mobile devices, wristbands, smartwatches, among others, as communication channels to better know their customers. Thus, it allows banks to offer personalized financial services using the devices as a source of information.

Biometric Technology

Biometric technology systems are identity authentication systems that recognize people via physical means such as fingerprints, iris reading, voice or facial recognition, or other means. This technology enables automatic and unequivocal verification of the identity of financial customers. Identification is rendered more easily as it is unnecessary to memorize passwords to access platforms, it avoids the use of magnetic cards, and it prevents password theft.

La gran mayoría de los consumidores en el mundo (93%) prefiere la biométrica sobre las contraseñas para validar un pago. El uso de la huella dactilar para acceder a determinados servicios móviles ha calado entre los consumidores convirtiéndolo en el método más aceptado (80%) seguido por el reconocimiento facial (56%) o de Iris (50%) [Most consumers in the world (93%) prefer biometrics over passwords to validate a payment. The use of fingerprint to access certain mobile services gained traction among consumers making it the most accepted method (80%) followed by facial (56%) or iris (50%) recognition]. (Distrendia, 2019), p. 116

Use of Digital Channels

Mobile Banking

Mobile banking is a service provided through an application where customers can perform remote financial transactions via a cell phone 24 hours a day. Mobile banking reduces time and money costs for clients, as they no longer have to go to the bank.

En general, la banca móvil brinda la posibilidad de derribar barreras importantes para la inclusión financiera de los pobres: asequibilidad y disponibilidad física. En comparación con los bancos tradicionales basados en sucursales, la banca móvil tiene la ventaja de que no incurre en el costo de implementación, maneja costos menores para las transacciones de bajo valor y proporciona un enlace con el nuevo nicho de mercado: las personas que no están bancarizadas [All in all, mobile banking has the potential to break down key barriers to financial inclusion for the disadvantaged: affordability and physical availability. Compared to traditional branch-based banks, mobile banking has the advantage no implementation cost, lowering fees for low-value transactions, and providing a bridge to the new niche market: the unbanked]. (Azabache, 2018, p. 71)

Internet Banking

Internet banking are financial transactions performed by customers via a computer or laptop, using an Internet connection on a virtual World Wide Web (www) space.

Los servicios de banca por Internet son un elemento de importancia estratégica para las entidades bancarias, considerando su potencial para la reducción de costes e incremento de ingresos; por ello, los bancos buscan redirigir a sus clientes hacia sus servicios en Internet [Internet banking services are a strategically important element for banking entities, considering their potential for cost reduction and revenue increase; therefore, banks seek to redirect their customers to their Internet services]. (Bourgault, Egea, Guerrero, González, & Mangin, 2013, p. 37)

It enables real-time customer service without the need to physically go to the bank, which makes it a fundamental tool for financial inclusion.

Telecommunications Infrastructure

Home internet

Peruvians’ marginalization regarding internet use (those who do not have access) represent a significant percentage: 47.46% (2018), 43.35% (2019) and 38.92% (2020), which is a major barrier preventing banking digitalization. Internet penetration in Latin America is 68.66% (2018), 73.52% (2019) and 78.78% (2020), which reflects progress in recent years (CAF, 2020b) (Table 2).

Table 2 Internet Penetration in Latin America (2018-2020).

| Country | 2018 | 2019 | 2020 |

|---|---|---|---|

| Argentina | 77.78% | 81.42% | 85.24% |

| Bolivia | 48.22% | 53.04% | 58.34% |

| Brazil | 74.22% | 81.64% | 89.80% |

| Chile | 82.33% | 82.33% | 82.33% |

| Colombia | 66.68% | 71.40% | 76.47% |

| Ecuador | 60.67% | 64.27% | 68.09% |

| Mexico | 65.77% | 67.75% | 69.79% |

| Paraguay | 64.99% | 69.16% | 73.60% |

| Peru | 52.54% | 56.65% | 61.08% |

| Uruguay | 70.21% | 72.20% | 74.24% |

| Latin America | 68.66% | 73.52% | 78.78% |

Source: Adapted from Banco de Desarrollo de América Latina - CAF, 2020b.

5G in Latin America

5G technology refers to the fifth generation mobile network that increases data transmission efficiency and allows multiple devices to be connected with minimal latency and high bandwidth. 5G allows browsing up to 10 GBps (gigabytes per second), much faster than the 4G technology. In addition, network response time (latency) will be reduced to 5 milliseconds, enabling real-time communication.

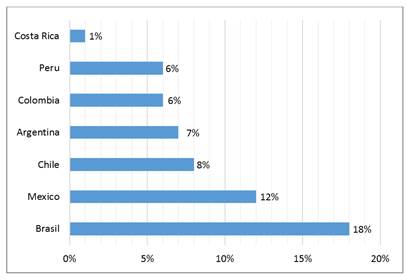

By 2025, 5G penetration in Latin America is expected to reach 9%, i.e. 62 million connections. The countries with the most encouraging forecasts in the region are Brazil with 18% and Mexico with 12% (Figure 3). 5G growth will be progressive and will coexist with 4G technology over the next few years (Global System for Mobile Communications [GSMA], 20202020b).

Source: Global System for Mobile Communications Association, 2020.

Figure 3 Latin America: Expected 5G penetration by county by 2025.

On April 21, 2021, the Peruvian Ministry of Transport and Communications authorized the implementation of 5G technology for mobile services, to be implemented under the NSA standard over existing networks awarded in public tenders. The government has just published legal norms for the reallocation of 500 MHz to the 1.7 GHz, 2.1 GHz and 3.5 GHz bands. Deployment of 5G in mobile services will start in the provinces of Ica, Trujillo, Arequipa, Cañete, Huarochirí, Callao and Lima. Subsequently, it will be progressively extended to other areas of the country during 2022 (Ministerio de Transportes y Comunicaciones [MTC], 2021).

Risks of Digitalization

In Latin America, organizations and users of digital technologies have experienced identity theft, loss of personal data and cybersecurity breaches in banking transactions. According to banking entities, the most frequently used types of attacks against financial services customers were email phishing (49.7%), text message phishing (24.2%), phone call phishing (24.8%) and infection with malicious software or malware (35.67%) (Organización de los Estados Americanos [OEA], 2018).

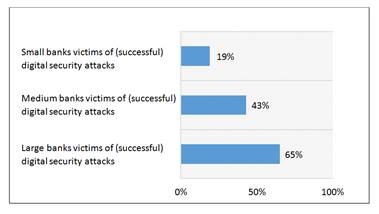

In relation to the materialization of digital security incidents (successful attacks) (including aspects of information security, cybersecurity and fraud prevention using digital media) in banking entities in the region during 2017, it is highlighted that 65% of the large banks state that they were victims of successful attacks, while among the medium banks the percentage is 43% and among the small banks, 19%. (OEA, 2018, p. 72) (Figure 4).

Source: Organización de los Estados Americanos, 2018.

Figure 4 Latin America: Banks victims of digital security attacks.

Users of financial services who stated that they did not use digital services to perform their banking operations provided the following reasons: distrust (59.26%), lack of interest in digital channels (27.78%), lack of knowledge of digital technology (11.11%) and lack of digital services (9.26%). From these results, it can be concluded that it is necessary to build trust and confidence in users to encourage the use of digital media (OEA, 2018).

METHODOLOGY

“Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs” (Banco Mundial, 2018, para. 1). Based on this definition, financial inclusion will only be addressed based on the Peruvian population in general, thus including all socioeconomic levels.

This research aims to demonstrate the significant relationship between the variables digital banking and financial inclusion in Peru. It has a quantitative approach, because statistical tools will be used to analyze and explain the results. It has a correlational and non-experimental design. Data for the period 2010-2019 will be obtained from the STATISTA database.

RESULTS

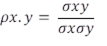

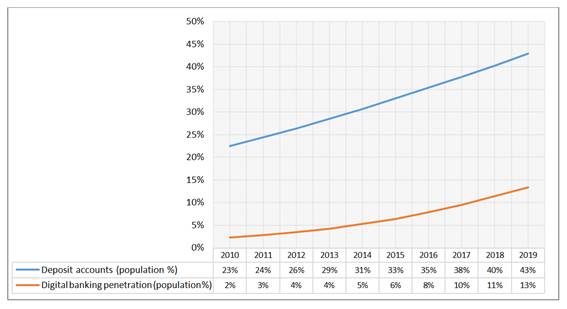

The independent variable (X) is represented by digital banking penetration and the dependent variable (Y) is represented by bank deposit accounts representing financial inclusion (Figure 5). The dependent variable is predicted or calculated, and the independent variable provides the basis for the calculation, i.e., it is the predictor variable.

Source: Adapted from STATISTA, 2021.

Figure 5 Peru: Commercial bank deposit accounts and digital banking penetration 2015-2019 based on population percentage.

Statistical Analysis

Table 3 Normality Test.

*. This is a lower bound of the true significance.

a. Lilliefors Significance Correction.

Source: Prepared by the author from SPSS-IBM.

As the data sample is (n < 30), normality will be analyzed with Shapiro-Wilk. Table 3 shows that the two quantitative variables have a significance level (Sig. > 0.05), thus, normality exists and Pearson’s correlation can be used.

The research hypotheses are:

H0 = Digital banking is not significantly related to financial inclusion.

H1 = Digital banking is significantly related to financial inclusion.

A regression and linear correlation analysis will be performed using SPSS-IBM software to interpret the data.

If the p-value is < 0.05 there is a linear relationship and the research hypothesis H1 is accepted.

The research variables are:

X: Digital banking penetration based on percentage of population (independent variable).

Y: Deposit accounts in banks based on the percentage of the population - representing financial inclusion (dependent variable).

A statistical technique of linear regression will be used to predict the dependent variables based on the behavior of the independent variables.

General form of the regression equation (mathematical expression that defines the relationship between two variables).

Pearson’s correlation analysis will be used as a measure of dependence that provides information on the degree of linear association between two quantitative variables (X, Y).

ρx.y |

= Pearson’s correlation coefficient |

σxy |

= Covariance of (X, Y) |

σx |

= Standard deviation of X |

σy |

= Standard deviation of Y |

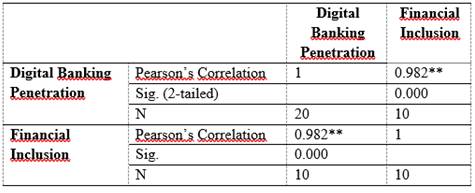

Digital banking penetration and financial inclusion variables present the positive Pearson’s correlation value of 0.982, very close to 1. The p-value is 0.000 < 0.05 (Table 4).

Table 4 Pearson’s Correlation.

**. Correlation is significant at the 0.01 level (2-tailed).

Source: Prepared by the author from SPSS-IBM.

The scatter plot depicts a cloud of points in the coordinates X, Y. A linear relationship is apparent, as the X variable increases so does the Y variable (Figure 6).

The resulting model is: Y = 20.27 + 1.81 X

DISCUSSION

Pearson’s correlation coefficient describes the intensity of the relationship of the variables, it can take any value from -1.00 to +1.00, as long as the result obtained is close to these values it can be said that the correlation is perfect.

Statistically, there is a correlation of 0.982, indicating that there is a strong positive correlation close to +1.00. The p-value is 0.000 < 0.05, therefore, H1: Digital banking is significantly related to financial inclusion is accepted, because the variables are highly correlated. The statistical test was performed at 5% error or 95% confidence. The plot indicates that, for each percentage point increase in digital banking, financial inclusion increases by 1.81 percentage points.

The scatter plot indicates that, as digital banking transactions increase, financial inclusion also increases, a straight line with a positive slope.

CONCLUSIONS

As the study hypothesis has been proven, it can be stated that digital banking is significantly related to financial inclusion because both variables are highly correlated. Digital banking becomes a strategic alternative for financial inclusion in Peru, by using innovative technologies and software to optimize financial services and reach the most remote populations in the country in a cost-effective and inclusive manner.

Digital banking enables for the financial system to expand its services through internet platforms or cell phones, as it allows to open savings accounts, purchase insurance, apply for loans or credit cards, make investments in mutual funds, and conduct other transactions. However, as noted by the OAS (2018), the digital security incidents experienced by users of the banking system in Latin America are phishing by email (49.7%), phishing by text message (24.2%), phishing by phone call (24.8%) and infection with malicious software or malware (35.67%)

In Peru, internet penetration was 53% in 2018, 57% in 2019 and 61% in 2020, due to connectivity limitations. As a consequence, the handling of cash and its disadvantages such as: risk of theft, inappropriate data use, counterfeiting, fraud, money laundering, among others, are intensifying.

Traditional banking is facing great challenges such as digital transformation that requires investment in technology, change of culture, new business models, human resources, among others, in order to adapt to the current demands of the sector and market context.

REFERENCIAS BIBLIOGRÁFICAS

Alonso, I., y Carrio, A. (2019). La gestión de la información en banca: de las finanzas del comportamiento a la inteligencia artificial. Papeles de Economía Española (162), 148-161. Recuperado de https://www.funcas.es/revista/la-gestion-de-la-informacion-en-banca-de-las-finanzas-del-comportamiento-a-la-inteligencia-artificial-febrero-2020/ [ Links ]

Asobancaria (2017). La banca digital: estrategia clave para impulsar la inclusión financiera. Semana Económica. Recuperado de http://www.asobancaria.com/semanseconomicas/1074-a.pdf [ Links ]

Azabache, C. (2018). La banca móvil como alternativa para la inclusión social en áreas rurales. Review of Global Management, 3(2), 67-81. Recuperado de https://dx.doi.org/10.19083/rgm.v3i2.779 [ Links ]

Banco Mundial. (2018). Inclusión financiera. Recuperado de https://www.bancomundial.org/es/topic/financialinclusion/overview [ Links ]

Bourgault, N., Egea, J., Guerrero, M., González, M., y Mangin, J. (2013). Modelización de la confianza y seguridad en la adopción de la banca por internet. Revista Portuguesa de Marketing, 16(30), 35-54. Recuperado de https://search.proquest.com/scholarly-journals/modelización-de-la-confianza-y-seguridad-en/docview/1462485767/se-2?accountid=12268 [ Links ]

Bueno, E., Longo, M., y Morcillo, P. (2017). La innovación del modelo de negocio bancario: El reto de la banca digital. Revista de la Asociación Española de Contabilidad y Administración de Empresas, 5-8. Recuperado de https://aeca.es/wp-content/uploads/2019/10/120.pdf [ Links ]

Comisión Económica para América Latina y el Caribe. (2020). Fortalecimiento de la inclusión y capacidades financieras en el ámbito rural. Recuperado de https://repositorio.cepal.org/bitstream/handle/11362/45115/4/S2000323_es.pdf [ Links ]

Corporacion Andina de Fomento. (2020a). Las oportunidades de la digitalización en América Latina frente al Covid-19. Recuperado de https://scioteca.caf.com/handle/123456789/1541 [ Links ]

Corporacion Andina de Fomento. (2020b). El estado de la digitalización de América Latina frente a la pandemia del COVID-19. Recuperado de https://scioteca.caf.com/handle/123456789/1540 [ Links ]

Ditrendia. (2019). Mobile en España y en el Mundo 2019. Recuperado de https://ditrendia.es/informe-mobile-espana-mundo-2019/ [ Links ]

Federación Latinoamericana de Bancos. (2018). El blockchain y los smart contracts en la banca y el sector financiero. Recuperado de https://felaban.s3-us-west-2.amazonaws.com/noticias/Noticia-2018-07-18.pdf [ Links ]

Fondo Monetario Internacional. (2020). Financial Access Survey. Recuperado de https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C [ Links ]

Global System for Mobile Communications. (2020). The mobile economy Latin America 2020. Recuperado de https://www.gsma.com/mobileeconomy/wp-content/uploads/2020/12/GSMA_MobileEconomy2020_LATAM_Eng.pdf [ Links ]

Grupo Consultivo de Ayuda a los Pobres. (2015). Inclusión financiera digital: Implicancias para clientes, reguladores, supervisores y organismos normativos. Recuperado de https://www.cgap.org/sites/default/files/Brief-Digital-Financial-Inclusion-Feb-2015-Spanish.pdf [ Links ]

Ministerio de Transportes y Comunicaciones. (2021). MTC autoriza el despliegue de tecnología 5G para servicios móviles. Recuperado de https://www.gob.pe/institucion/mtc/noticias/482361-mtc-autoriza-el-despliegue-de-tecnologia-5g-para-servicios-moviles [ Links ]

Orazi, S., Martinez, L., y Vigier, H. (2019). La inclusión financiera en América Latina y Europa. Ensayos de Economía, 29(55), 181-204. Recuperado de https://doi.org/10.15446/ede.v29n55.79425 [ Links ]

Organización de Estados Americanos. (2018). Estado de la Ciberseguridad en el Sector Bancario en América Latina y el Caribe. Recuperado de https://www.oas.org/es/sms/cicte/sectorbancariospa.pdf [ Links ]

Organización de las Naciones Unidas. (2021). Technology and Innovation Report 2021. Recuperado de https://unctad.org/es/node/32191 [ Links ]

Revuelta, M. (2018). "Big Data": crisis y nuevos plantaeamientos en los flujos de comunicación de la cuarta revolución industrial. Área Abierta, 18(2), 309-324. Recuperado de: http://dx.doi.org/10.5209/ARAB.59521 [ Links ]

Serrano-Cobos, J. (2016). Tendencias tecnológicas en internet: Hacia un cambio de paradigma. El Profesional de la Información, 25(6), 843-850. Recuperado de http://dx.doi.org/10.3145/epi.2016.nov.01 [ Links ]

STATISTA. (2021). Digital Payments. Recuperado de https://www.statista.com/outlook/dmo/fintech/digital-payments/south-america [ Links ]

Received: May 17, 2021; Accepted: August 11, 2021

text in

text in