Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Industrial Data

versión impresa ISSN 1560-9146versión On-line ISSN 1810-9993

Ind. data vol.26 no.1 Lima ene./jun. 2023

http://dx.doi.org/10.15381/idata.v26i1.24392

Production and Management

Analysis of the Negative Impact of Penalties Levied by the Peruvian Government on a Private Company in the Health Sector

1 Degree in International Business from Universidad Peruana de Ciencias Aplicadas. Currently working as bid manager at Tecnología Industrial y Nacional S.A. (Lima, Peru). E-mail: anny.obando@unmsm.edu.pe

In this paper, the negative impact of purchase orders with penalties for a private company in the health sector with contracts with the Peruvian government is analyzed. The research question focuses on how to reduce the number of penalties, and the objective is to reduce logistical issues. Vester’s methodology and Ishikawa and Pareto diagrams were applied to prioritize problems and determine their causes and effects. It was found that failure to meet deadlines is the primary reason for the penalties levied by the government. Therefore, it is necessary to implement process improvement methodology in the Supply Area to reduce penalties, in order to ensure compliance with all contracts and as a consequence, achieve greater organizational profitability.

Keywords: penalties; bidding; state contracting; delivery time; health.

INTRODUCTION

The Peruvian health sector consists of the Ministry of Health (MINSA), the Social Health Insurance (ESSALUD), the Armed Forces (FFAA) and Police Forces (FFPP) Health Services, and the private sector. The Peruvian government is the main purchaser nationwide, as it handles more transactions than private organizations, a fact that makes it a profitable business opportunity. During 2021, the Peruvian government made purchases for approximately 76 902 million soles, a figure that has been increasing over the last 3 years. A total of 677 418 companies worked as suppliers of the Peruvian government in 2021, a number that has been decreasing over the last three years (Ministerio de Economía y Finanzas, n.d.).

Most government contracts are publicized and are freely accessible to the public via the Sistema Electrónico de Contrataciones del Estado [Electronic Government Procurement System] (SEACE). Taking part in a bidding process demands careful attention to documentary aspects; all suppliers must be well-informed in order to increase their chances of making a sale, and they must also have the right products and prices to meet their bids (Estado Peruano, 2021). The Organismo Supervisor de las Contrataciones del Estado [State Contracting Supervisory Body] (OSCE) oversees contracting according to the regulations in force, while the Tribunal de Contrataciones del Estado [State Contracting Tribunal] (TCE) levies sanctions and fines on suppliers that violate the regulations; in December 2021 alone, 115 companies were fined a total of 8 086 577.59 soles (OSCE, n.d.).

All State contracts are subject to compliance with Technical Specifications (for goods) or Terms of Reference (for services) according to the final Administrative Bases of such procedure, as per the Unique Text of Law No. 30225, State Contracting Law - Supreme Decree No. 082-2019-EF. In the event of unjustified non-compliance with contractual obligations, the supplier is subject to penalties that amount to a maximum of 10% of the contract value and may be deducted from payments on account, valuations, payments, settlements or be executed from the guarantee (D. S. N.º 082-2019-EF, 2019).

Preventing penalties is important to maximize an organization’s profitability. The state of emergency due to the COVID-19 pandemic, however, increased the risk of penalties related to non-compliance with various contracts. There were only a few cases where the pandemic health crisis was considered a force majeure event, for which non-compliance did not result in the levying of penalties. However, in other cases, non-compliance was the result of a business decision, based on the advantages and disadvantages of complying with a contract, as some companies managed to survive this stage, but their revenues were affected or reduced to zero (Diario Gestión, 2020). Regardless, in the period from January to May 2022, the value of imports grew by 21.6% more compared to the same period in 2021 (Sociedad de Comercio Exterior del Perú, 2022). The Lima Chamber of Commerce stated that the global crisis in the supply chain has not yet been solved and could worsen. Peruvian imports were affected by logistics and maritime transportation problems in China. Such crisis began in early 2020 due to the COVID-19 pandemic and worsened in 2021, mainly due to the grounding of container ships, negatively affecting imports for several months (Cámara de Comercio de Lima, 2022).

The COVID-19 pandemic also affected the health sector to a great extent, as several institutions such as hospitals and private practices had problems in their logistics during the pandemic, ranging from the allocation of human resources to the management of all the elements necessary to handle the crisis. Because of this global situation, companies have understood the importance of having an appropriate supply chain and systems that contribute to an efficient performance (Conexión Esan, 2020). Procurement is the starting point of the supply chain, and it depends on the needs of raw materials, materials, spare parts, and packaging, among others. Purchasing management has two main functions: procurement and operations support (Conexión Esan, 2017). Internationally, there are organizations whose main competitive factor is in the procurement department, since they work with suppliers that other companies do not have, or they have exclusive distribution rights of a product, or their supplier offers a price or purchasing conditions that distinguish them and give them an advantage over their competitors (EAE Business School, n.d.).

Problems involving the levying of penalties affect various organizations working for the government. Consequently, it is important to have a thorough understanding of their negative impact on a company, the reasons why they are levied and how they can be prevented or reduced, since they are a consequence of logistical issues. Such issue is relevant, because it not only entails economic losses but also the disqualification for future State contracting. For that reason, a company that commercializes biomedical equipment and products in the health sector for the private and public sector (ISIC 4659, 4772) that has had penalties for breach of contract during the last 3 years will be studied in this research paper. The Vester methodology, Ishikawa and Pareto diagrams were used to identify the main causes for penalties and to prioritize the problems. It follows that penalties levied by the government negatively impact companies. Penalties are directly related to logistical issues, as failure to meet deadlines is the main cause of the problem. The aim is to reduce logistical issues in order to reduce the number of penalties levied by the State through the improvement of processes, mainly in the Supply Chain Area. The findings of this research paper can be useful in various sectors, particularly in the health sector that works with public hospitals and, in general, for any organization seeking to become a supplier to the public sector, for this research will provide detailed information on what it is like to enter into contract with the Peruvian government.

Sánchez and Sánchez (2021) conducted the research Propuesta de mejora en la gestión de compras para reducir penalidades por demora de entrega de la empresa Multiservicios Sánchez S. R. L. [A proposal to improve purchasing management to reduce penalties for late delivery of the company Multiservicios Sánchez S. R. L.] aimed at reducing penalties for late delivery of services using a procurement management improvement approach. Data were collected via surveys administered to the organization’s personnel. They found that the main cause was poor requirement planning, including lack of planning for spare parts purchases, lack of procurement procedures and policies, duplicate purchases, lack of training in the logistics process, personnel’s technical inexperience, lack of supervision, and duplication of activities. As a result of their improvement proposal, which included the implementation of an MRP system, a training plan and an information table, the company successfully reduced its penalties to zero soles, leading to a profit of S/ 18,784.14. In conclusion, the proposal did reduce penalties and increase the organization’s profitability.

In Estandarización de procesos para el mejor funcionamiento administrativo de la empresa Foto Estudio Proaño [Standardization of processes to improve the administrative operation of Foto Estudio Proaño company] by Castillo (2017), the author used field and bibliographic research to understand the organization’s needs, andconducted surveys and interviews to understand problems. He found that the company was growing, but processes were not being updated, as there was no guide to manage human capital and clearly assign roles; Management lacked policies, norms or activities to supervise work stations, which led to conflicts, miscommunication and delays. Based on these results, he analyzed the organization’s situation and concluded that it was necessary to implement process standardization models, create process maps, operational flowcharts and a process manual. A systematic approach to the implementation of process standardization for all the main areas through organizational manual made it possible to analyze and cross-reference the activities with those responsible for them from beginning to end. Administrative functioning was gradually improved, as was the management and control of operations.

In Las penalidades en el rubro de construcción y su impacto en la rentabilidad de la empresa LG Contratistas S.A.C. Año 2016 [Penalties in the construction industry and their impact on the profitability of the company LG Contratistas S.A.C. in 2016], Morales (2018) analyzes and assesses the performance of the organization’s processes in contrast with the penalties incurred, identifying that the organization has penalties that impact profitability. The author gathered information from key people to assess the processes performed by the company in an effort to determine which processes are responsible for causing the organization to incur penalties. Morales applied and calculated the company’s economic and financial profitability ratios and determined the monetary loss. As a result of the assessment and improvement of key processes, a favorable result was achieved for the company, which contributed to improve its processes and, consequently, increased its profitability in line with the budget.

The main purpose of this research is to implement process improvements in the Supply Area of a company in the health sector to reduce the amount of penalties levied by the government.

A general hypothesis has been formulated with 2 variables and their dimensions, as shown in Table 1.

Table 1 Independent and Dependent Variables by Hypothesis.

| Hypothesis | Independent Variable | Dependent Variable |

|---|---|---|

| Implementing process improvements in the Supply Area of a company in the health sector reduces the amount of penalties levied by the government. | (V1) Logistic issues Mapping of activities Improvement activities |

(V2) Penalties Profitability |

Source: Prepared by the author.

By analyzing the problems experienced by an organization that works with the Peruvian government, this study is theoretically justified, because it will serve as a useful tool to further the knowledge of workers on how to reduce or prevent penalties levied for various reasons, to obtain positive and profitable results for an organization.

It also has a practical rationale, because it will provide detailed knowledge of the main causes of the penalties levied by the State on a private company in the health sector in order to reduce the amount of penalties and to use this research paper as a practical support guide.

Present Situation of Logistics at a Global Level

According to SUNAT, the value of imports from January to May 2022 is the highest in recent years, as it increased to US$ 24 307 million, 21.6% more compared to the same period of 2021 (US$ 19 952 million). At present, one of Peru’s main suppliers of imported goods is China, valued at US$ 6 515 million, up 13.3% compared to the same period in 2021. The United States is in second place, followed by Brazil, Argentina and Mexico. It is important to note that China and the United States account for 49.9% of total imports (Sociedad de Comercio Exterior del Perú, 2022).

However, at the beginning of 2022, imports faced logistical and shipping problems in China, the largest trading partner. This crisis was triggered by the COVID-19 pandemic and worsened in 2021, mainly due to the grounding of the Ever Given container ship in the Suez Canal in March of that year. The negative impact of these events lasted for months. Furthermore, the spread of new variants of the coronavirus led to unexpected operational stoppages, such as the temporary closure of the Ningbo-Zhoushan port (the world’s busiest in terms of freight tonnage), the Yantian container terminal (Shenzhen) and the Shanghai airport. Such situation caused trip cancellations and long queues outside the ports and, consequently, carriers charged high rates for available space and surcharges for demurrage and detention, which dramatically increased international freight costs. The increase in the international price of fuel and the internal logistical problems of each country, such as the shortage of carriers in the United States and Europe, also contributed to the global crisis that increased the transport time of exported and imported goods (Cámara de Comercio de Lima, 2022).

State Contracting

Peru has an efficient and transparent procurement system that fosters competition, reduces costs, increases effectiveness and facilitates accountability. The Electronic Government Procurement System (SEACE) platform is designed for the exchange of information and promotion of government contracts, as well as electronic transactions, where information is freely available. Government suppliers are welcome to bid on this platform in accordance with the provisions of the Law, special regimes and other regulations in force. The State Contracting Supervisory Body (OSCE) is in charge of overseeing the government contracting processes undertaken by public entities. It is also responsible for encouraging the efficient use of regulations and promoting best practices for the optimal use of public resources (Estado Peruano, n.d.).

There are three stages of public procurement: planning and preparatory actions, selection, and execution of the contract. All the processes that the Entity will announce during the tax year are recorded in the Annual Procurement Plan (PAC), and published on the SEACE web page (SEACE, n.d.). The Procurement Body is responsible for conducting the market study to determine the evaluation requirement, i.e. the referential value, based on the Procurement Terms and Conditions. It takes into account the Technical Specifications or Terms of Reference, as well as the admission documents and qualification requirements, to encourage participation of a diversity of brands or bidders, generally through quotations issued by suppliers dealing with the contracting object.

Bids are public procurement contracts in which goods, services or works are awarded to the organization that complies with the bidding terms and conditions and has the best bid proposal. There are different types of bidding depending on the amount involved, such as public bidding and simplified bidding, which are the most common. Most of the acquisitions of goods are procurement contracts that require delivery services during the execution of the contract and post-contract technical service.

During the last three years, the number of government suppliers has been decreasing, and the contracted monetary capacity has been increasing, as shown in Table 2.

Table 2 Number of Suppliers Contracting with the Government.

| Year | Suppliers | Amount in Soles (S/) |

|---|---|---|

| 2019 | 718 432 | 60 495 355 228 |

| 2020 | 685 562 | 61 953 248 055 |

| 2021 | 677 418 | 76 902 164 541 |

Source: Ministerio de Economía y Finanzas (n.d.).

The TCE penalizes companies during the participation in each bidding process for various reasons, including presentation of inaccurate documentation, inducing the Entity to terminate the contract, presentation of false documentation, unjustified withdrawal of bid proposal, and unjustified noncompliance with the obligation to perfect the contract, among others. Such a penalty may include the temporary or definitive disqualification of the supplier or a fine. Each month, the OSCE publishes a historical listing of suppliers sanctioned with a fine by the TCE; as of December 2021 alone, 115 companies were fined for a total amount of 8 086 577.59 soles (OSCE, n.d.). On the other hand, after the award of a bid, during the execution of the contract, the government can also levy fines and penalties for various reasons of non-compliance or infringement. Each government contract is subject to compliance with Technical Specifications (for goods) or Terms of Reference (for services) according to the final Administrative Bases of such procedure.

State Contracting Law

According to the Unique Text of Law No. 30225, State Contracting Law according to Supreme Decree No. 082-2019-EF, in the event of unjustified non-compliance with contractual obligations, the supplier is subject to penalties for the following reasons:

Chapter 5 of Law No. 30225 provides details on the breach of contract; in Section 161 it is specified that penalties may be levied for late delivery, and other penalties may be added. The maximum amount assigned to these penalties is 10% of the amount of the contract in force. They are deducted from payments on account, valuations, final payments, and liquidations, or are charged from the performance bond (D. S. N.º 082-2019-EF, 2019).

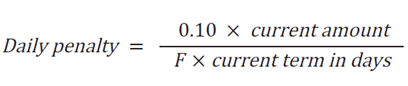

The penalties for delay in the performance of the services are detailed in Section 162 of Law No. 30225. It is stated that in the event of an unjustified delay in the performance of the services covered by the contract, the Entity automatically levies a penalty for each day of delay, according to the following formula:

Where F has the following values:

Term less than or equal to 60 days for goods, services in general, consultancies, and execution of works: F = 0.40

Term greater than 60 days

b.1) Goods, services in general, and consultancies: F = 0.25

b.2) Works: F = 0.15

Both the amount and the term must correspond to the current amount in the contract or item that should have been executed or, in the event that they involve periodic performance obligations or partial deliveries, to the individual service that was delayed.

Delays can be justified by requesting a duly approved extension of the deadline. If the contractor proves and objectively justifies that the delay is not attributable to him/her, such as in cases of force majeure or unforeseeable circumstances, the government deems the delay justified and, consequently, does not levy a penalty. Neither penalties nor costs of any kind are incurred in such cases.

Section 163 of Law No. 30225 states that additional penalty events may be included in the bidding conditions provided that they are objective, reasonable, congruent, and proportional to the subject of the contract. It also includes the method for calculating the penalty for each case and the procedure by which the case to be penalized is verified. Each penalty is calculated separately.

Section 164 of Law No. 30225 sets forth the grounds for rescission pursuant to Section 36 of the Law should the contractor fail to justify and comply with contractual, legal, or regulatory obligations; accumulate the maximum amount of the penalty for late delivery or for other penalties; or stop or restrict the performance of the service without justification, despite receiving notice for the correction.

Supply Chain Area

The Supply Chain Area is responsible for the management of all procurement, production, and distribution activities of an organization’s goods and is responsible for making the goods or services available to its end customers. The supply chain begins with the acquisition of raw materials and ends with the delivery of the final products to the customer. In other words, it is responsible for a series of additional processes that ensure the efficiency of the area.

The supply chain manager must be a person capable of integrating all operations at the level of material flows and information flows, encompassing the entire supplier network, the production site, logistics operators, points of sale, and end customers. Therefore, the supply chain manager must possess good communication, negotiation, and management skills.

The main responsibility of the supply chain manager is to secure the best competitive market prices for raw materials and to correctly determine the unit quantities of goods or services to be procured, to avoid misusing inventory resources. In addition, the manager must ensure an optimal amount of supplies available to the organization in order to meet planned production and sales. He or she must also oversee that customer demand is met each month, i.e., ensure that sufficient stock or production capacity is available to match product supply and demand. Among the manager’s main objectives are to optimize costs and increase efficiency in each process of the supply chain without reducing the quality or safety of the products or services.

Procurement Area

Most organizations have a Procurement Area (national and/or international) that plays an integral part in their daily operations, mainly in organizations whose core business is the sale of materials, products, or physical items. From an organizational structure, the Procurement Area is also known as or is part of the area of logistics, operations, and imports, among other related areas.

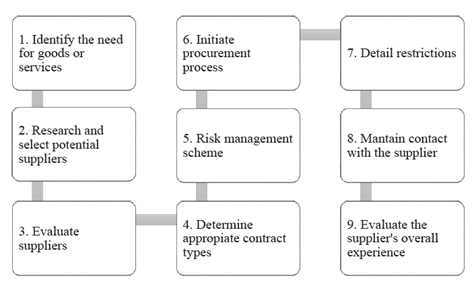

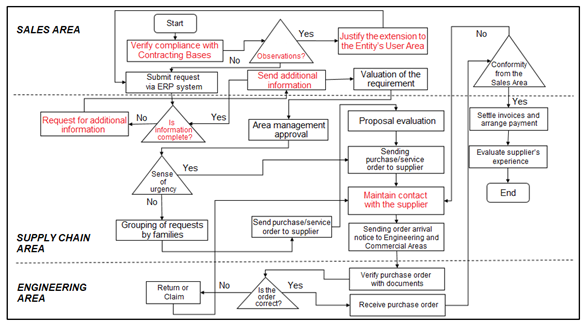

Companies should follow the steps shown in Figure 1 to implement a successful procurement system.

METHODOLOGY

This is an applied research study with a quantitative approach, as numerical data will be processed to test the hypotheses and the causes of the levying of penalties will be analyzed to identify the solution to the problem. It is explanatory because the processes will be identified to explain the main causes of the levying of penalties in order to suggest solutions. It follows a non-experimental design because the variables are not intentionally manipulated, rather the phenomena are observed in their natural context. The unit of analysis includes all sales to the government. The study population consists of all sales for the period 2019-2021, totaling 12 446 orders, 46 of which are sales with penalties. Data collection techniques used include brainstorming, Ishikawa diagram, Pareto diagram, and Vester matrix. The database had to be exported and all sales information was analyzed. Data analysis and interpretation were obtained by using the SAP B1 system and Microsoft Excel 2016 via pivot tables.

Estimates of the number of orders are based on the organization’s statistical data. This company supplies both the private and the public sector. It should be noted that private companies are exempted from the levying of penalties so only the public sector is affected. It follows that, during the 3-year period analyzed, a company in the health sector sold a total of 12 446 orders, of which 2130 were subject to penalties because they were sales made to the government. The number of purchase orders placed by public companies represents 17.11% of the total number of orders, of which 46 were penalized (2.16% of the total number of orders placed by public entities and 0.37% of the total number of orders), as shown in Table 3.

Table 3 Number of Accumulated Orders per Year by Type of Client.

| Year | Total Orders | Orders from Private Companies | Orders from Public Companies | ||

|---|---|---|---|---|---|

| No Penalties | With Penalties | Total Orders from Public Companies | |||

| 2019 | 4075 | 3395 | 665 | 15 | 680 |

| 2020 | 4410 | 3712 | 684 | 14 | 698 |

| 2021 | 3961 | 3209 | 735 | 17 | 752 |

| Total | 12 446 | 10 316 | 2084 | 46 | 2 130 |

Source: Prepared by the author.

In other words, 12 446 orders correspond to S/. 88,552,387.31 and S/. 46,269.27 is the monetary loss (0.05% of the total number of orders) due to penalties in the 3-year period analyzed, as shown in Table 4. There is a significant monetary loss that could be avoided if penalties on orders were prevented. Accordingly, the total amount of government orders expressed in monetary terms amounted to S/ 26 633 693.72, which represents 30.08% of the total number of orders. Also, the amount of S/ 46 269.27, which corresponds only to orders with penalties, represents 0.17% of all public sector orders.

Table 4 Amount in Soles of Accumulated Orders per Year by Type of Client.

| Year | Total Orders | Orders from Private Companies | Orders from Public Companies | ||

|---|---|---|---|---|---|

| No Penalties | Penalty Amount | Total Orders from Public Companies | |||

| 2019 | S/31 151 442.08 | S/21 686 177.89 | S/9 481 011.14 | S/15 746.95 | S/9 465 264.19 |

| 2020 | S/31 516 862.72 | S/23 832 330.60 | S/7 703 783.72 | S/19 251.60 | S/7 684 532.12 |

| 2021 | S/25 884 082.51 | S/16 400 185.10 | S/9 495 168.13 | S/11 270.72 | S/9 483 897.41 |

| Total | S/88 552 387.31 | S/61 918 693.59 | S/26 679 962.99 | S/46 269.27 | S/26 633 693.72 |

Source: Prepared by the author.

RESULTS

Measures were taken aimed at achieving the research objectives in order to prove the hypotheses and formulate a solution. This research intends to demonstrate that, in order to reduce the levying of penalties, a company in the health sector should implement process improvements in the Supply Chain Area to reduce logistical issues and, as a consequence, improve its profitability. A detailed qualitative analysis of the causes of the penalties was carried out over a period of 3 years to identify the areas for improvement and corroborate the hypothesis. A qualitative and quantitative analysis of the data obtained from the organization was conducted for the hypothesis testing. The analysis proved that reducing logistical inconveniences in a health sector company does lower the amount applied for penalties. Improvement of processes in the areas in charge of the tasks where the main problems arise significantly reduces the monetary value of the loss and, as a consequence, the financial profitability of the organization increases by S/. 35 903.07.

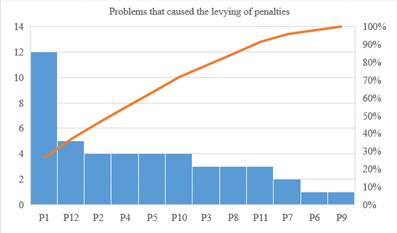

A total of 46 orders with penalties were processed. The problems that caused the levying of penalties in the 3-year period will be identified according to their frequency. The main problems will be identified using the Pareto diagram, and it will be demonstrated that by eliminating 20% of the causes, 80% of the company’s problems can be solved (Table 5).

Table 5 Causes that Led to the Levying of Penalties in the 3-Year Period.

| No. | Problems | Frequency | Cumulative Frequency | Unit Percentage (%) | Cumulative Percentage (%) |

|---|---|---|---|---|---|

| P1 | Failure to comply with delivery time as stated in the order | 12 | 12 | 26.09% | 26.09% |

| P2 | Misdelivery of wrong or defective products | 4 | 16 | 8.70% | 34.78% |

| P3 | Misdelivery of incomplete products or documents | 3 | 19 | 6.52% | 41.30% |

| P4 | Failure to rectify observations within the deadline established by the Entity | 4 | 23 | 8.70% | 50.00% |

| P5 | Failure to comply with the activities of the Preventive Maintenance Program | 4 | 27 | 8.70% | 58.70% |

| P6 | Failure to address unforeseen situations of downtime or malfunctioning | 1 | 28 | 2.17% | 60.87% |

| P7 | Failure to renew documents, permits, licenses and authorizations of the company pertaining to the object and product of the contract | 2 | 30 | 4.35% | 65.22% |

| P8 | Failure to renew permits and licenses of technical personnel for the execution of services | 3 | 33 | 6.52% | 71.74% |

| P9 | Failure to comply with the use of personal protective equipment and safety standards proposed to prevent COVID-19 | 1 | 34 | 2.17% | 73.91% |

| P10 | Failure to supply basic spare parts for maintenance work | 4 | 38 | 8.70% | 82.61% |

| P11 | Failure to renew performance bonds (letters of guarantee) | 3 | 41 | 6.52% | 89.13% |

| P12 | Request for rescission of contract due to price increase | 5 | 43 | 10.87% | 93.48% |

| 46 | 100.00% |

Source: Prepared by the author.

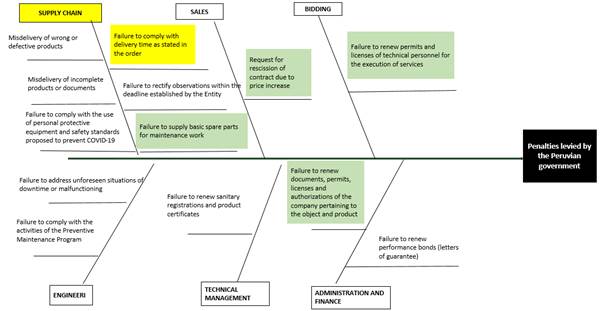

Using the Pareto diagram, the most frequent problems were identified: P1. Failure to comply with delivery time as stated in the order, and P12. Request for rescission of contract due to price increase (Figure 2). In other words, 80% of the problems can be solved by eliminating 20% of the causes.

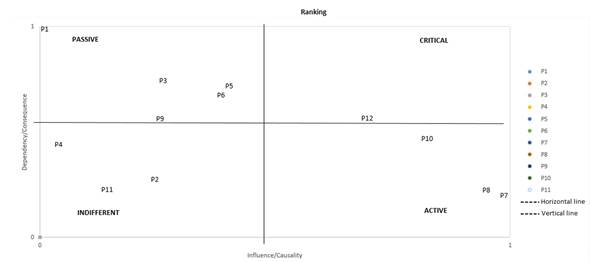

In addition, the Vester matrix was used to rank the problems with the greatest impact according to their influence and dependence. The data are shown in Table 6. This matrix will assist in the identification of the causes and consequences of the levying of penalties.

Table 6 Causes that Led to the Levying of Penalties in the 3-Year Period.

| P | P1 | P2 | P3 | P4 | P5 | P6 | P7 | P8 | P9 | P10 | P11 | P12 | Influence (x) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 3 |

| P2 | 1 | 0 | 2 | 0 | 2 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 6 |

| P3 | 1 | 0 | 0 | 0 | 1 | 2 | 0 | 0 | 1 | 1 | 0 | 0 | 6 |

| P4 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| P5 | 2 | 0 | 2 | 0 | 0 | 1 | 0 | 0 | 2 | 1 | 0 | 0 | 8 |

| P6 | 2 | 0 | 2 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 7 |

| P7 | 3 | 0 | 2 | 2 | 2 | 2 | 0 | 2 | 3 | 1 | 1 | 2 | 20 |

| P8 | 3 | 0 | 2 | 2 | 2 | 2 | 1 | 0 | 3 | 1 | 1 | 2 | 19 |

| P9 | 1 | 1 | 2 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 6 |

| P10 | 3 | 3 | 2 | 0 | 3 | 3 | 0 | 0 | 0 | 0 | 0 | 3 | 17 |

| P11 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 0 | 4 |

| P12 | 3 | 0 | 0 | 3 | 2 | 2 | 0 | 0 | 0 | 2 | 0 | 0 | 12 |

| 20 | 4 | 14 | 7 | 14 | 13 | 3 | 4 | 10 | 7 | 2 | 11 | 98 |

Source: Prepared by the author.

The Vester matrix shows that P1. Failure to comply with delivery time as stated in the order is considered passive based on its level of influence and dependence. Nevertheless, there are causes that should be given special attention because they are critical and active.

Critical

P12. Request for rescission of contract due to price increase

Active

P7. Failure to renew documents, permits, licenses and authorizations of the company pertaining to the object and product of the contract; P8. Failure to renew permits and licenses of technical personnel for the execution of services, and P10. Failure to supply basic spare parts for maintenance work.

Therefore, problems P12, P7, P8 and P9 are ranked higher than the other problems, as shown in Figure 3.

Figure 4 shows the Ishikawa diagram used to identify the area in charge of the tasks related to the most frequent causes of penalties, and to establish a hierarchy.

The Pareto diagram shows that the main causes are found in the Supply Chain Area (P1) and Sales Area (P12).

P1. Failure to comply with delivery time as stated in the order, and P12. Request for rescission of contract due to price increase.

According to the Vester Diagram, the most important causes are found in the Sales Area (P12), Administration and Finance Area (P7), Bidding Area (P8), and Supply Chain Area (P10).

P12. Request for rescission of contract due to price increase; P7. Failure to renew documents, permits, licenses and authorizations of the company pertaining to the object and product of the contract; P8. Failure to renew permits and licenses of technical personnel for the execution of services, and P10. Failure to supply basic spare parts for maintenance work.

In Table 7, the causes are classified according to the total amount of penalties in the 3-year period, in order to show which ones had the greatest monetary impact of loss.

Table 7 Causes that Led to the Levying of Penalties in the 3-Year Period Expressed in Soles.

| P | Variable | No. of Penalties | Sum of Penalty Amount (S/) |

|---|---|---|---|

| P1 | Failure to comply with delivery time as stated in the order | 12 | S/ 12 929.60 |

| P2 | Misdelivery of wrong or defective products | 4 | S/ 7287.00 |

| P3 | Misdelivery of incomplete products or documents | 3 | S/ 6685.75 |

| P10 | Failure to supply basic spare parts for maintenance work | 4 | S/ 4580.00 |

| P11 | Failure to renew performance bonds (letters of guarantee) | 3 | S/ 3117.20 |

| P5 | Failure to comply with the activities of the Preventive Maintenance Program | 4 | S/ 2780.00 |

| P8 | Failure to renew permits and licenses of technical personnel for the execution of services | 3 | S/ 2765.00 |

| P12 | Request for rescission of contract due to price increase | 5 | S/ 2400.00 |

| P4 | Failure to rectify observations within the deadline established by the Entity | 4 | S/ 1791.92 |

| P7 | Failure to renew documents, permits, licenses and authorizations of the company pertaining to the object and product of the contract | 2 | S/ 990.00 |

| P6 | Failure to address unforeseen situations of downtime or malfunctioning | 1 | S/ 714.00 |

| P9 | Failure to comply with the use of personal protective equipment and safety standards proposed to prevent COVID-19 | 1 | S/ 228.80 |

| Total | 46 | S/ 46 269.27 | |

Source: Prepared by the author.

It can be confirmed that the main causes of impact and monetary loss are P1. Failure to comply with delivery time as stated in the order, P2. Misdelivery of wrong or defective products, P3. Misdelivery of incomplete products or documents, and P10. Failure to supply basic spare parts for maintenance work.

Lastly, the five most relevant causes will be ranked, based on all the analyses, in order to reduce the application of penalties, as shown in Table 8.

Table 8 Causes that Led to the Levying of the Most Significant Penalties in the 3-Year Period Expressed in Soles.

| P | Variable | Area | Frequency | Total Amount(S/) |

|---|---|---|---|---|

| P1 | Failure to comply with delivery time as stated in the order | Supply Chain | 12 | S/ 12 929.60 |

| P12 | Request for rescission of contract due to price increase | Commercial | 5 | S/ 2400.00 |

| P2 | Misdelivery of wrong or defective products | Supply Chain | 4 | S/ 7287.00 |

| P3 | Misdelivery of incomplete products or documents | Supply Chain | 3 | S/ 6685.75 |

| P10 | Failure to supply basic spare parts for maintenance work | Supply Chain | 4 | S/ 4580.00 |

| Total | S/ 33 882.35 | |||

Source: Prepared by the author.

Most of the causes of non-compliance with delivery deadlines in a health sector company arise from logistical issues in the Supply Chain Area for various reasons, such as shipment delays, lack of supplier stock, damaged or incomplete imported goods, high freight costs, and carrier stoppages, among others. Therefore, to minimize the amount of penalties, it is necessary to reduce logistical problems by implementing improvements, mainly in the Supply Chain and Sales Areas.

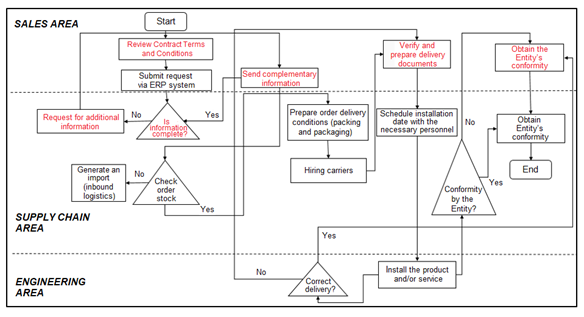

A flowchart will be drawn up for Supply Chain, Sales and Engineering areas, because they work in collaboration for each delivery. This flowchart will be prepared for inbound logistics (Figure 5) and outbound logistics (Figure 6). Activities highlighted in red will be implemented as improvements.

The Sales Area must verify from the outset whether the Bases of the contract will be complied with in terms of deadlines, quantities, accessories and average contract extension time, since contracts are often extended at the request of the Entity. In the event of non-compliance, the Sales Area, during the market study, must inform and explain to the Entity’s User Area the reasons why it is necessary to extend the Technical Specification or Terms of Reference and submit the request to the Supply Chain Area in advance.

In addition, the activity of maintaining contact with the supplier was implemented to address the need for real-time information on imports. Therefore, reasons for non-compliance, such as force majeure, can be timely notified and justified to the Entity via documentation to avoid penalties.

As for outbound logistics, once the contract is sent, the Sales Area must review it and convey in detail the conditions in terms of deadlines, technical specifications or terms of reference and required personnel to the Supply Chain Area. It must also verify all the required documentation, as per the Bases, for the corresponding delivery; the Bidding Area may assist in this activity to ensure the Entity’s conformity.

The improvements suggested would not be possible in the absence of adequate human capital for each specific function; thus, all personnel must be fully qualified and trained in the handling of government contracting, given the conditions, formats and, above all, the time frames that must be met. It is therefore important to conduct training on the State Contracting Law as needed or in the event of any modification; personnel’s knowledge should be periodically evaluated to refresh their memories.

Upon analysis and interpretation of the qualitative and quantitative information that allowed proposing process improvements through flowcharts and tasks established in the Supply Chain Area, a reduction of S/. 33 882.35 was achieved by implementing improvements in the specified supply chain activities. Furthermore, as a result of the improvements in the Supply Chain Area, the causes related to its operations were also reduced. These include P4. Failure to rectify observations within the deadline established by the Entity, and P9. Failure to comply with the use of personal protective equipment and safety standards proposed to prevent COVID-19, which add up to an additional S/ 2 020.72. Thus, a total of S/. 35 903.07 was saved by improving the flow of processes in the Supply Chain Area.

DISCUSSION

These findings are directly related to the background information provided in the research article, since they corroborate the following:

Penalties have a negative impact on the profitability of an organization and mainly affect sales for the government; however, it is possible to increase profitability as budgeted and projected by improving processes in the pertinent areas.

Procurement management, as part of the supply chain, consistently struggles with logistical issues; however, process improvement initiatives reduce them and, in turn, reduce penalties for late deliveries and increase profitability.

The improvement of processes in different areas of a company through process maps and flowcharts effectively provides greater clarity in terms of functions and, consequently, efficiency in the results and control of the area.

CONCLUSIONS

Process improvements in the Supply Area do reduce the penalties levied by the government, as they improve the company’s profitability. Initially, the penalties amounted to S/. 46 269.27, but after the improvements it was reduced by S/35 903.07. In other words, the amount of penalties levied by the government is considerably reduced.

Failure to comply with delivery times is a problem that originates in the Supply Chain Area; however, implementing process improvements in this area will gradually reduce the penalties by reducing logistical issues.

Failure to comply with delivery times is the most frequent cause of penalties, followed by the request for rescission of contract due to price increases, a critical problem according to Vester’s matrix. Therefore, to undertake the pertinent administrative actions to make the best decisions, it is essential to integrate both areas by consolidating the information as they are the main actors involved in the performance of the functions where the problematic causes originate.

Technical Specifications and Terms of Reference should be reviewed as soon as the public procurement market study is conducted, as that is the time to make observations on the delivery term established for the government to evaluate and consider granting an extension for such goods or services, in order to provide a term that is within the supplier’s capabilities.

ACKNOWLEDGMENT

My gratitude goes mainly to God, for allowing me to continue to grow professionally. To my professors, who played an important role in this learning process with their lessons and patience. To my parents, for their unconditional support, love and understanding at all times. And last but not least, to all my loved ones who offered me words of encouragement and support.

REFERENCES

Castillo Jarrin, M. R. (2017). Estandarización de procesos para el mejor funcionamiento administrativo de la empresa Foto Estudio Proaño. (Tesis de grado). Escuela de Administración de Empresas, Ambato. https://repositorio.pucesa.edu.ec/bitstream/123456789/1840/1/76343.pdf [ Links ]

Cámara de Comercio de Lima. (13 de enero de 2022). Importaciones peruanas se verían afectadas por continuidad de cuellos de botella globales. La Cámara. https://lacamara.pe/importaciones-peruanas-se-verian-afectadas-por-continuidad-de-cuellos-de-botella-globales/ [ Links ]

Conexión Esan. (21 de marzo de 2017). Las funciones de la gestión de compras. https://www.esan.edu.pe/conexion-esan/las-funciones-de-la-gestion-de-compras [ Links ]

Conexión Esan. (7 de mayo de 2020). Logística hospitalaria: claves para su funcionamiento. https://www.esan.edu.pe/conexion-esan/logistica-hospitalaria-claves-para-su-funcionamiento [ Links ]

Diario Gestión. (13 de julio de 2020). Las penalidades en tiempo de pandemia y el cuidado para su deducción. http://blogs.gestion.pe/agenda-legal/2020/07/las-penalidades-en-tiempo-de-pandemia-y-el-cuidado-para-su-deduccion.html [ Links ]

EAE Business School. (s.f.). EAE Business School. Retos en Supply Chain. https://retos-operaciones-logistica.eae.es/eae-business-school/ [ Links ]

Estado Peruano. (s.f.). Sistema Electrónico de Contrataciones del Estado (SEACE). https://www.gob.pe/7324-acceder-al-sistema-electronico-de-contrataciones-del-estado-seace [ Links ]

Estado Peruano. (13 de mayo de 2021). Perú Compras: Mypes representan el 88.6% de proveedores que le venden al Estado mediante Catálogos Electrónicos. https://www.gob.pe/institucion/perucompras/noticias/492780-peru-compras-mypes-representan-el-88-6-de-proveedores-que-le-venden-al-estado-mediante-catalogos-electronicos [ Links ]

Decreto Supremo N.º 082-2019-EF. Publican el Texto Único Ordenado de la Ley N.º 30225, Ley de Contrataciones del Estado. (2019, miércoles 13 de marzo). https://www.gob.pe/institucion/mef/normas-legales/266672-082-2019-ef [ Links ]

Ministerio de Economía y Finanzas. (s.f.). Consulta principal. https://apps5.mineco.gob.pe/proveedor/ [ Links ]

Morales Ruiz, G. L. (2018). Las penalidades en el rubro de construcción y su impacto en la rentabilidad de la empresa LG Contratistas S.A.C. año 2016. (Tesis de grado). Universidad Privada del Norte, Lima. https://repositorio.upn.edu.pe/bitstream/handle/11537/14296/S-Morales%20Ruiz%2C%20Loren%20Gianella.pdf?sequence=1&isAllowed=y [ Links ]

Organismo Supervisor de las Contrataciones del Estado. (s.f.). Listado Histórico de publicación mensual de proveedores sancionados con multa por el Tribunal de Contrataciones del Estado. http://www.osce.gob.pe/consultasenlinea/inhabilitados/Sancionadosmulta_publi_hist.asp [ Links ]

Sánchez Veneros, P. S., y Sánchez Novoa, W. R. (2021). Propuesta de mejora en la gestión de compras para reducir penalidades por demora de entrega de la empresa Multiservicios Sanchez S.R.L. (Tesis de grado). Universidad Privada del Norte, Lima. https://repositorio.upn.edu.pe/bitstream/handle/11537/29055/Sanchez%20Novoa%2c%20Walter%20Robert%20-%20Sanchez%20Veneros%2c%20Peregrina%20Soledad.pdf?sequence=1&isAllowed=y [ Links ]

Sistema Electrónico de Contrataciones del Estado. (s.f.). Buscador público. https://prodapp2.seace.gob.pe/seacebus-uiwd-pub/buscadorPublico/buscadorPublico.xhtml [ Links ]

Sociedad de Comercio Exterior del Perú. (2022). Importaciones en el periodo enero-mayo crecieron un 21.6%. https://www.comexperu.org.pe/articulo/importaciones-en-el-periodo-enero-mayo-crecieron-un-216 [ Links ]

Received: January 02, 2023; Accepted: March 23, 2023

texto en

texto en