Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Journal of Economics, Finance and Administrative Science

versión impresa ISSN 2077-1886

Journal of Economics, Finance and Administrative Science v.18 n.34 Lima jun. 2013

ARTICLES

Transactional capability: Innovation's missing link

Capacidad transaccional: el eslabón perdido de la innovación

Jorge Tello-Gamarraa,*, Paulo Antônio Zawislakb,*

a Ph.D. Candidate in Management, Management School, Federal University of Rio Grande do Sul (EA/UFRGS), Porto Alegre, Brazil

.b Ph.D. in Economics, University of Paris 7 (France). Associate Professor of the Management School, Federal University of Rio Grande do Sul (EA/UFRGS), Porto Alegre, Brazil.

Abstract

The topic of innovation as a source of competitive advantage for firms is consolidated in the literature. An innovation-based advantage is generally achieved by following a structured process, in which technological capability plays a key role. However, a question remains in studies into innovation, which is concerned with the reasons why not all firms that develop a technological capability are innovative. Where is the missing link? Great efforts have been made in attempts to answer to this question. However, the study of this link as a source of advantage for firms deserves further attention. This article aims to present a framework with two essential dimensions: (1) the technological capability and (2) the transactional capability. Technological capability is the ability of firms to make effective use of technical knowledge in order to improve production processes and develop new products and services. Transactional capability is defined as a repertoire of abilities, processes, experiences, skills, knowledge and routines that the firm uses to minimize its transaction costs (ex¿ante and ex¿post). Given that the present study is a theoretical paper, methodologically it is based on a literature review. The main finding of this study is the identification of transactional capability as the missing link in innovation. Accordingly, to be innovative, in addition to having a technological capability, a firm needs to develop its transactional capability.

Keywords: The firm, Technological capability, Transactional capability, Innovation.

Resumen

La innovación como fuente de ventaja competitiva de la firma es un tema consolidado en la literatura. Una ventaja basada en la innovación se alcanza, generalmente, a través de un proceso estructurado, donde la capacidad tecnológica tiene un papel crucial. No obstante, una cuestión que continúa pendiente en esta área de investigación es la de identificar por qué no todas las firmas que desarrollan su capacidad tecnológica son innovadoras. ¿Dónde está el eslabón perdido? Muchos esfuerzos ya fueron realizados para tratar de responder a esa pregunta. Sin embargo, el estudio de este eslabón perdido, como fuente de ventaja para la firma merece más atención. El presente artículo tiene por objeto presentar un framework con dos dimensiones esenciales: (1) la capacidad tecnológica y (2) la capacidad transaccional. La capacidad tecnológica es la habilidad que tiene la firma para hacer uso efectivo del conocimiento técnico para mejorar los procesos productivos y desarrollar nuevos productos y servicios. La capacidad transaccional es definida como un repertorio de habilidades, procesos, experiencias, destrezas, conocimiento y rutinas que la firma usa para minimizar sus costos de transacción (ex-ante y ex-post). Dado que este estudio se caracteriza como un artículo teórico, metodológicamente está basado en una revisión bibliográfica. El hallazgo principal de este estudio es la identificación de la capacidad transaccional como el eslabón perdido de la innovación. En este sentido, para que una firma sea innovadora debe, además de tener capacidad tecnológica, desarrollar su capacidad transaccional.

Palabras clave: Firma, Capacidad tecnológica, Capacidad transaccional, Innovación.

1.

IntroductionWhy some firms outperform others is a question which, despite appearing simple, remains valid. According to several authors, firms outperform their competitors because they have greater technological capability, which allows them to create new products and services that are recognized as such by the consumer to the point that they decide to purchase them.

A firm's technological capability is the result of learning processes (Jonker et al., 2006). It requires the intensive use of knowledge and the mobilization of scientific and technological resources that enable the creation of innovative products (Garcia-Muiña & Navas-Lopez, 2007). Thus, firms that have developed technological capabilities increase their chances of success in relation to those with weak technological capability.

A number of contributions have been made to the study of this capability (Acur et al., 2010; Afuah, 2002; Bell & Pavitt, 1995; Coombs & Bierly, 2006; Desai, 1984; Figueiredo, 2002; Garcia-Muiña & Navas-Lopez, 2007; Gomel & Sbragia, 2006; Gonzalez & Cunha, 2012; Jim & Von Zedtwitz, 2008; Jonker et al., 2006; Katz, 1984; Kim, 1999; Lall, 1992; Madanmohan et al., 2004; Nelson, 1991; Reichert et al., 2011; etc.), which have helped in its consolidation. However, although the relationship between technological capability and firm performance has been found, by some authors, to be positive (Acur et al., 2010; Calantone et al., 2002; Cooms & Bierly, 2006; Huang, 2011; Schoenecker & Swanson, 2002), other scholars (Patel & Pavitt, 1997; Teece, 1986) have noted that, for a firm to be innovative, technological capability is important but not sufficient. The fundamentals of this statement can be found at the very core of the process of innovation, since it is an extremely complex process which depends on activities and capabilities that often are dispersed throughout the firm, and need to be aligned with the strategic requirements of the company to meet the particular conditions of the competitive environment (Guan & Ma, 2003).

Adler and Shenhar (1990) also noted that a common mistake made when analyzing innovation is to focus on a single dimension, in this case, the technological capability. In this sense, innovation would be the result of technological capability, though complemented by another capability.

The present paper argues that this complement is a new capability, referred to here as the 'transactional capability'. This capability is a set of skills, knowledge and routines that the firm develops in order to transact in the market (buy and sell) at the lowest possi ble cost. It also enables the firm to be linked to the external environment, both to buy inputs, and to sell its finished products.

Firms lacking transactional capability are incapable of understanding the demands of consumers and of providing goods and/ or services to the market at the lowest possible cost. Therefore, however much technological capability a firm may have to create new products and services it will still need a transactional capability to enhance its performance in the market. Accordingly, the transactional capability would be the missing link in innovation.

Following this introduction, the paper is organized into five sections. These include: (I) The capabilities of the firm; (II) the technological capability; (III) the transactional capability; (IV) A framework of the essential dimensions of the firm; and (V) Final remarks.

2. The capabilities of the firm

The firm is the economic agent which is capable of meeting the needs of another economic agent, the consumer. To accomplish this task, the firm needs a fundamental strategic input, knowledge. Based on this knowledge, transformed into capabilities, the firm arranges its technological and productive resources in order to generate new solutions of value (innovations).

The study of capabilities began with the work of a few scholars (Becker, 1962; Penrose, 1959; Selznick, 1957) who, in the mid-twentieth century, pointed out the importance of human resources. For these authors, firms, besides having physical resources, should be able to attract the best human resources within their boundaries. Human resources, after all, are being those that possess capabilities.

Capabilities are the "knowledge, experience and skills" (Richardson, 1972, p. 888) that firms develop in order to find the best arrangement of their resources to surpass their competitors (Barney, 1991; Grant, 1991).

The capabilities of a firm are multiple. They may include the absorptive capacity (Cohen & Levinthal, 1990); technological capabilities (Lall, 1992); organizational capabilities (Chandler, 1992); dynamic capabilities (Teece et al., 1997); marketing capabilities (Kotabe et al., 2002); Intercultural capability (Friedman & Antal, 2005; Gómez-Schlaikier, 2009) and operational capabilities (Wu et al., 2010), among others.

Given that the various capabilities take up such a large part of the research into why some firms are more successful than their peers, the current challenge is to identify which capabilities ensure superior performance.

For Prahalad and Hamel (1990), successful firms are those that have what they call key capabilities. According to these authors, few firms manage to build their leadership on more than five or six key capabilities. The authors argue that a firm that has a list of 20 or 30 capabilities probably does not have the key capabilities.

According to Patel and Pavitt (1997), among the multiple capabilities of a firm, technology is essential. It allows the firm to create new concepts, processes and solutions that are useful for the consumer, who will pay for them, thus allowing the firm to persist over time.

Firms with technological capability are more likely to increase their profits in relation to the competition. However, having technological capability is only one of the key capabilities of the firm. The present article argues that the transactional capability is also essential, since it allows the firm to transact in the market, giving it advantages over its competitors.

If a firm has the technological capability to create new concepts, processes and products, then transactional capability is required to ensure that its transaction costs are lower and thus complement the activities of the technological capability. Hence, the firm, besides concerning itself with accumulating technological capability, should also aim to develop its transactional capability.

In developing the concept of transactional capability, several initial insights have been gained from the interpretations of various authors. The suggestion made by Prahalad and Hamel (1990) - that firms that build their leadership in the world do so based on a small number of capabilities - guided the search for what these few core capabilities might be. The papers by Snow and Hrebiniak (1980) and Henderson and Cockburn (1994) were also of great use since they suggest that the search for a classification of these capabilities could be an ongoing task to better understand the nature of the firm.

Also of fundamental importance were the findings presented by Adler and Shenhar (1990), Christensen (1995) and Patel and Pavitt (1997) which emphasized that, though technological capability is important for enhancing a firm's performance, it should be complemented by other capabilities. Finally, the work of various authors (Argyres, 1996; Argyres, 2011; Argyres & Liebeskind, 1999; Argyres & Mayer, 2007; Jacobides & Winter, 2005; Langlois & Foss, 1999; Leiblein & Miller, 2003; Madhok, 1996; Mayer & Argyres, 2004; Mayer & Salomon, 2006; Nogueira & Bataglia, 2012; Poppo & Zenger, 2002; Williamson, 1999; Zawislak et al.; 2012) which highlight the need to combine studies into Transaction Costs Economics with those into the capabilities of the firm, served as insights to suggest that this marriage can be summed up in one element, transactional capability.

The following is a presentation of these two key capabilities of the firm: The technology and transactional capabilities. Following which, these two capabilities will be integrated into a framework that relates them to firm performance.

3. The technological capability

Among the repertoire of capabilities that all firms use to create differentiated products and services, technological capability has occupied a prominent place in the different studies on this subject.

The technological capability of the firm is defined by its ability to use technology (patents, skilled engineers, stock of knowledge in the form of databases, specialized units, licenses, etc.) and combine and recombine components, connections between components, methods, processes and techniques, as well as the fundamental concepts that support an innovative offer (Afuah, 2002).

Following a review of various studies that evaluate the technological capability of the firm (Acur et al., 2010; Afuah; 2002; Bell & Pavitt, 1995; Coombs & Bierly, 2006; Garcia-Muiña & Navas-Lopez, 2007; Ho et al., 2011; Jim & Von Zedtwitz, 2008; Jonker et al.; 2006; Kim, 1999; Lall, 1992; Madanmohan et al.; 2004; Nelson, 1991) it was possible to identify four aspects that characterize the debate on the subject, namely: (a) the learning processes, (b) the strategic focus (c) the difficulty of transferring the capability, and (d) the dynamic component of the capability.

-

The learning processes, according to Figueiredo (2002), influence the technological capability. Within the firm, these processes can be characterized by their variety, intensity and functionality (Figueiredo, 2002). According to this author, the way in which the firm coordinates its mechanisms and learning processes over time plays a central role in the accumulation of technological capability and in turn, on the performance of the firm. It is worth noting that the technological capability cannot be sold or bought, but only transferred. For Kim (1997), this transfer occurs in two ways: one, formal, and the other informal. Formal mechanisms for technology transfer include the acquisition of licenses and patents, as well as other forms of intellectual property (Kim, 1997). Informal mechanisms include reviewing the literature, observation tours, the use of products samples, employee mobility, etc. (Kim, 1997). Whatever form is used to enhance this capability, it is recognized that this does not happen by chance, because deliberate efforts to assimilate, adapt and modify existing technologies are necessary in order to develop new technologies (Madanmohan et al., 2004).

-

For Rush et al. (2007), the strategic focus, is the characteristic of technological capability that makes a firm choose and use technology to gain advantage over its competitors. Due the features present in the competitive environment, where there are increasing levels of competition in industry, the technological capability is seen increasingly as crucial for companies to maintain their long.term competitive advantage (Acur et al., 2010).

-

The difficulty of transferring this capability is another typical feature, because technological capability, as is the case with any other capability, is not marketable. According to Teece et al. (1997) and Winter (2000), capabilities should be established, and not necessarily purchased. There is no capabilities market. They are intangible and based on interaction, for which reason it is difficult to buy, imitate or duplicate them (Acur et al., 2010; Coombs & Bierly, 2006; Nelson, 1991). As previously shown (in (a) above), these can be developed through processes of transfer and learning, but not traded. As a consequence of this fact, developing a technological capability requires investments in terms of time and resources (Ho et al., 2011) in order to establish a structure capable of creating, developing and maintaining this capability.

-

The dynamic component of this capability is the factor responsible for driving technical change within the firm. In an environment where consumer tastes and preferences are constantly changing, firms need a repertoire of skills and routines that ensures they are always sufficiently agile to adapt. It is therefore necessary that these skills and routines are attuned to shifts in the competitive environment and, where possible, are ahead of them, with new concepts, solutions, processes, products and services. That is, the firm must be 'able to change its capabilities', skills and technological knowledge. When this happens, one can say that a firm has technological capability.

Following the above review of the literature, the concept of technological capability adopted in this paper is a body of knowledge, skills, routines and abilities that lead to technical change (innovation) in order that the firm exceeds its competitors.

4. The transactional capability

An inventory of the main capabilities studied in the literature shows them to be the following: absorptive capacity (Cohen & Levinthal, 1990); technological capabilities (Bell & Pavitt, 1995; Katz, 1984; Lall, 1992; Patel & Pavitt, 1997); operational capability (Miller & Roth 1994; Skinner, 1969; Ward et al., 1998); dynamic capabilities (Eisenhardt & Martin, 2000; Teece et al. 1997), managerial capability (Du Gay et al., 1996; Salomón, 2009; Stamp, 1981); organizational capabilities (Chandler, 1992; Zander & Kogut, 1995); marketing capabilities (Kotabe et al., 2002); core capabilities (Prahalad & Hamel, 1990), information technology capability (Bharadwaj, 2000; Santhanam & Artono, 2003).

From this inventory of capabilities, it can be seen that most of them (with the exception of marketing capability and absorptive capacity) focus primarily on issues relating to the internal organization of the firm, and so attribute less importance to the skills the firm needs both to maintain a constant link with its surroundings and to address the market and to carry out transactions.

The present article emphasizes the notion that the link with the market should be constantly maintained, since, as important as it is for the firm to continually organize innovation and production, the firm must also maintain a structure capable of aligning it offer with the needs of the consumer, while minimizing the costs of transacting the raw materials and finished products. That is, the firm will only be successful on the market after the transaction. Therefore, this transactional dimension, which guarantees the "real" status of the firm, should not be overlooked.

With respect to transaction costs, several scholars have pointed out that this approach has been critical for the shedding light on several aspects of the nature of the firm. However, it still needs to be complemented (Hodgson, 1998; Madhok, 1996).

According to Langlois and Foss (1999, p. 202):

"We argue that the last few years have witnessed the emergence of a perspective here generically called 'the capabilities perspective' that is much more conscious of the production side of the firm and represents the nature of production in a way that is potentially complementary to the transaction¿cost approach."

For Hodgson (1998, p. 181), "What is required in the future is the development of a research program in which the two approaches are conjointly evaluated and tested. By using compatible versions of both approaches, a hybrid theory may result".

On the possibility of having a new approach that combines the transactional perspective (external) and the capabilities perspective, Williamson (1999, p. 1087) perceptively underscores that "A lively research future for these two perspectives, individually and in combination, is projected". Hence, that hybrid approach, which identifies some compatible aspects (Hodgson, 1998) between the capabilities and the transactions of the firm, was identified as being pending.

Several efforts have been made to integrate these two areas in some way (Argyres, 1996; Argyres; 2011; Argyres & Liebeskind, 1999; Argyres & Mayer, 2007; Dyer & Singh, 1998; Hodgson, 1998; Hoetker, 2005; Jacobides & Winter, 2005; Langlois & Foss, 1999; Leiblein & Miller, 2003; Madhok, 1996; Mayer & Argyres, 2004; Mayer & Salomon, 2006; Nogueira & Bataglia, 2012; Poppo & Zenger, 2002; Williamson, 1999; Zawislak et al.; 2012). These efforts have sought to: a) emphasize that both approaches aim to answer the same questions about the existence of boundaries and the internal organization of the firm (Langlois & Foss, 1999); b) explain why organizational learning and cultural transmission could extend the answer about the existence of the firm/broaden the response regarding the existence of the firm (Hodgson, 1998); c) recognize that both the governance perspective and the contracts perspective are constructions of limited rationality and organizational support and, therefore, both share a common basis and, furthermore, that joint studies are a promising area of research (Williamson, 1999); d) understand how governance inf luences both the ability to generate income through assets such as the knowledge and capabilities (Dyer & Singh, 1998); e) note that the two fields of study are intertwined (Jacobides & Winter, 2005) and f) "Why Firms facing similar levels of contracting hazards their organize transactions differently" (Mayer & Salomon, 2006, p. 942).

As can be seen up to now, on the one hand, scholars of technological capability (Adler & Shenhar, 1990; Christensen, 1995; Patel & Pavitt, 1997) argue that this is insufficient to explain why some firms outperform their competitors. On the other hand, there is a need to find points of convergence between governance and the capabilities, which is also a subject of increasing interest among researchers of Transaction Cost Economics (TCE).

These two findings support the central hypothesis of this article. That is to say that there is a complementary capability to the techno logical capability, which could have been overlooked in the literature. Here, this capability has been dubbed the 'transactional capabilities'. Part of this capability is located in what has been called the complementary assets (Teece, 1986), organizational assets, external assets (Adler & Shenhar, 1990) and enabling proces ses (Chiesa et al., 1996). However, though these are important contributions in this area of research, their consolidation remains a pending task.

Throughout this article, transactional capability is defined as a repertoire of abilities, processes, experiences, skills, knowledge and routines that the firm uses to minimize its transaction costs. It also establishes that the transactional capability has two dimensions, one (a) customer-centered, and another, (b) supplier-centered. These guidelines emphasize that the firm, besides dedicating efforts that enable it to meet the needs of consumers, must also maintain an advanced level of coordination and relationship with its suppliers. It is in these two aspects of its business that a firm will be able to minimize its transaction costs.

We believe this is one of the key capabilities of the firm. Put another way, developing the technological capability to create innovative products and services is essential if the firm is to maintain an advantage over its competitors. However, this capability must be complemented with the transactional capability.

In a situation where two firms have "equivalent levels" of technological capability, develop similar products, and have similar production costs, which of the two firms would have greater success in their business environment? One answer to this question might be: "the firm that can minimize its transaction costs". Accordingly, the transactional capability is presented as an alternative that deserves to be explored.

Inspired by the efforts made by Lall (1992), by Bell and Pavitt (1995), by Ariffin and Figueiredo (2003) and Iammarino et al. (2008), who consolidated a typology for the study of the technological capability of the firm, the present article proposes a typology for analyzing the transactional capability.

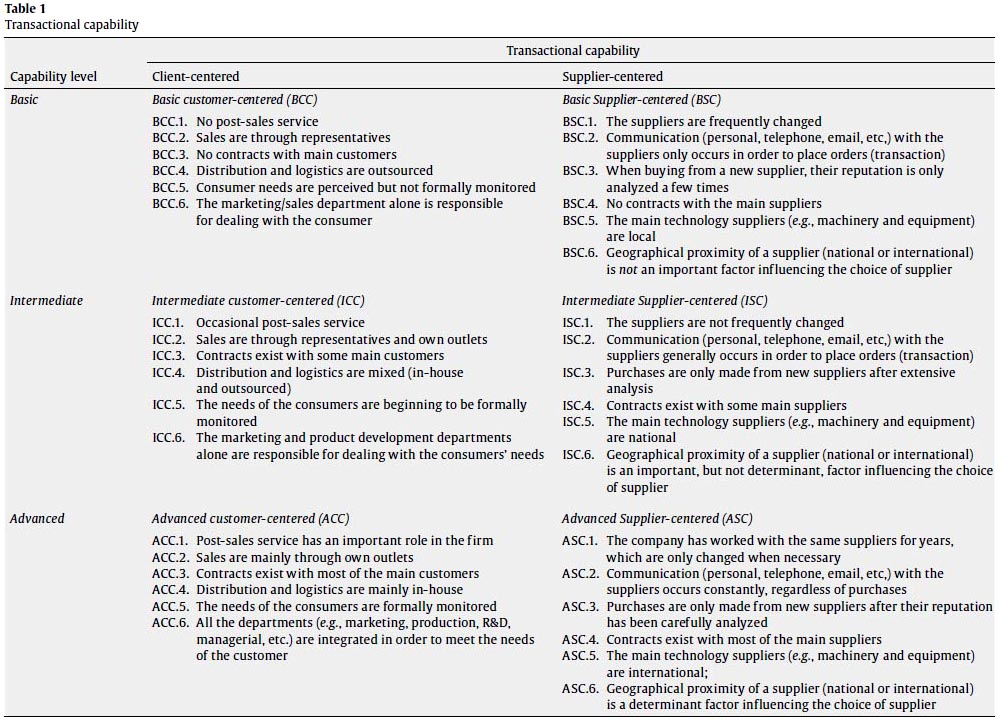

Similarly, this typology will also be composed of three levels, which are: basic, intermediate and advanced. Following a review of the literature aimed at studying the consolidation of this capability, the resulting typological description will consider aspects related to: the marketing capability (Kotabe et al., 2002; Ortega, 2010; Souitaris, 2002); the capability to relate to the market (Lukas & Ferrel, 2000; Madanmohan et al., 2004; Naver & Slater, 1990), the capability to relate with suppliers (Cannon & Homburg, 2001), and the capability to make contracts (Mayer & Argyres, 2004; Mayer & Salomon, 2006; Williamson, 1985, 2002, 1996, 1999). In Table 1 we describe a set of theoretical categories that form part of the proposed typology for the transactional capability.

As shown in Table 1, the transactional capability has two foci, one client-centered and another supplier-centered. The first refers to the skills the firm needs to develop in order to trade new products (created by the technological capability). These skills include aspects of customer relationships, management of distribution channels, and after-sales service, among others. The second point focuses on the firm's ability to deal with its suppliers, monitoring and communicating with them in order to reduce costs when buying raw materials, as well as the ability to enter into contracts.

One aspect that is emphasized throughout the article refers to the fact that the transactional capability is neither the marketing capability nor the degree of market orientation Transactional capability is a broader construct. While the marketing capability and the degree of market orientation analyze efforts that the firm makes to bring the best product to the consumer and to assess how the behavior of competitors, the transactional capability has a more complete view. Thus, besides analyzing the consumer side, the transactional capability is concerned with analyzing relations with suppliers and contractual aspects in existing transactions. Hence, it studies all aspects of the way the firm approaches the market, both to buy raw materials and to sell the products and services it produces. In the following section, a framework that integrates transactional capability and technological capability will be presented.

5. A framework for the essential dimensions of the firm

To summarize the preceding discussion, it can be said that different studies have indicated that firms with greater technological capability increase their performance (Acur et al., 2010; Calantone et al., 2002; Cooms & Bierly, 2006; Huang, 2011; Schoenecker & Swanson, 2002). However, a question that has remained unanswered is: "Why do many firms that manage to accumulate technological capability fail to achieve greater performance?"

According to a number of researchers (Adler & Shenhar, 1990; Christensen, 1995; Guan & Ma, 2003; Patel & Pavitt, 1997; Teece, 1986) examining the firm through a single dimension, in this case, its technological capability, is insufficient to ensure the success of firms.

It should be noted that the firm, besides being able to create value through technological capability, must also take possession of it. Therefore, firms need to develop another essential capability, here referred to as transactional capability.

This capability, is not only a decisive factor for firms to be able transact their finished products, but also important in reducing the costs of purchasing inputs, of monitoring and of distribution incurred by the firm when extending beyond its boundaries.

The proposal presented here can be summarized in the framework shown in Figure 1, in which the superior performance of firms stems from two key capabilities: technological and transactional.

This framework is translated into a central proposition, which is presented so that future research can be developed in this direction, it is:

P: There is a positive impact between the technological and transactional capabilities and firm performance. Firms with advanced technological and transactional capabilities outperform firms with basic technological and transactional capabilities.

6. Final remarks

Studies into the subject of firms and how they outperform their competitors have taken different approaches. Particularly prominent among them in the literature, is the current that focuses on the capabilities of the firm. In this approach, the most successful firms will be those that achieve a repertoire of capabilities that allows them to create innovative products for consumers.

For Lall (1992), and for Bell and Pavitt (1995), f irms that accumulate technological capabilities can create innovative products and services and thus will be more successful. While these arguments have proven valid for several firms concerned with developing this capability, other studies have shown that technological capability alone is not enough to ensure a firm is innovative, since there is a missing link in studies into technological capability.

Accordingly, after an extensive literature review, transactional capability was found to be that missing link. The objective of this capability is to minimize costs the firm incurs when trading on the market. Thus, here, the transactional capability is defined as "a repertoire of abilities, processes, experiences, skills, knowledge and routines that the firm uses to minimize its transaction costs."

In this paper, we present a framework detailing the firm's two essential dimensions: the technological capability and transactional capability. It should be noted that firms more quickly surpass their competitors if they can combine these two dimensions in order to create new solutions of value, so that they can best negotiate with both suppliers and with customers at the lowest possible cost. Also, it is suggested that, in isolation, neither of these capabilities has superiority over the other, because the rate of use of each depends on the firm and the business sector in which it operates.

On the practical implications, it is suggested that managers prioritize the development of these two capabilities. Thus, the development of technological capability will be fundamental for the firm to be able to create new solutions. Having transactional capability will allow it, for example, to buy raw materials, monitor the market and transact the new solutions created by the technological capability.

Finally, it is recommended that the next step in this line of research, which is also conducted by other authors (Argyres, 1996; Argyres, 2011; Argyres & Liebeskind 1999; Argyres & Mayer, 2007; Hodgson, 1998; Hoetker, 2005; Jacobides & Winter 2005; Langlois & Foss, 1999; Madhok, 1996; Mayer & Argyres, 2004; Mayer & Salo mon, 2006; Nogueira & Bataglia, 2012; Poppo & Zenger, 2002; Williamson, 1999; Zawislak et al.; 2012), is to investigate its operationalization. For this, the two aforementioned dimensions (a customer-centered and supplier-centered) as well as their different levels (basic, intermediate and advanced) indicated here could be used as a first step towards the future consolidation of this approach.

Acknowledgements

The present study was carried out with the financial support of the Brazilian Government research funding agencies Research Foundation the State of Rio Grande do Sul (FAPERGS) and the Brazilian National Council for Scientific and Technological Development (CNPq).

References

Acur, N., Kandemir, D., Weerd-Nederhof, P., Song, M., 2010. Exploring the impact of technological competence development on speed and NPD program performance. Journal of Production Innovation of Management 27 (6), 915-929.

Adler, P.S., Shenbar, A., 1990. Adapting your technological base: the organizational challenge. Sloan Management Review 32 (1), 25-37.

Afuah, A.N., 2002. Mapping technological capabilities into product markets and competitive advantage'. Strategic Management Journal 23 (2), 171-179.

Argyres, N., 1996. Evidence on the role of firm capabilities in vertical integration decisions. Strategic Managerial Journal 17 (2), 129-150.

Argyres, N., 2011. Using organizational economics to study organizational capability development and strategy. Organization Science 22 (5), 2205-1138.

Argyres, N., Liebeskind, J., 1999. Contractual commitments, bargaining power, and governance inseparability: Incorporating history into transaction cost theory. Academy of Managerial Review 24 (1), 49-63.

Argyres, N., Mayer M., 2007. Contract design as a firm capability: an integration of learning and transaction cost perspectives. Academy of Managerial Review 32 (4), 1060-1077.

Ariffin, N., Figueiredo, P., 2003. Internationalization of innovative capabilities: Counter-evidence from the electronics industry in Malaysia and Brazil. In: Paper for DRUID Summer Conference, Copenhagen, June 12-14.

Barney, J., 1991. Firm resource and sustained competitive advantage. Journal of Management 17 (1), 99-120.

Becker, G., 1962. Irrational behavior and economic theory. Journal of Political Economy 70 (1), 1-13.

Bell, M., Pavitt, K., 1995. The development of technological capabilities. In: Trade, technology and international competitiveness. 1st ed. World Bank, Washington, DC.

Bharadwaj, A., 2000. A resource-based perspective on information technology and firm performance: An empirical investigation. MIS QUARTTERLY 24 (1), 169-196.

Calantone, R., Cavusgil, T., Zhao, Y., 2002. Learning orientation, firm innovation capability, and firm performance. Industrial Marketing Management 31 (6), 515-524.

Cannon, J., Homburg, C., 2001. Buyer-supplier relationships and customer firm costs. Journal of Marketing 65 (1), 29-43.

Chandler, A.D., 1992. Organizational capabilities and the economic history of the industrial enterprise. Journal of Economic Perspectives 6 (3), 79-100.

Chiesa, V., Coughlan, P., Voss, C., 1996. Development of a technical innovation audit. Journal of Product Innovation Management 13 (2), 105-136.

Christensen, J.F., 1995. Asset profiles for technological innovation. Research Policy 24 (5), 727-745.

Cohen, W., Levinthal, D.A., 1990. Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly 35 (1), 128-152.

Coombs, J., Bierly, P., 2006. Measuring technological capability and performance. R&D Management 36(4), 421-438.

Desai, A.V., 1984. India technological capability - An analysis of its achievements and limits. Research Policy 13 (5), 303-310.

Du Gay. P., Salaman, G., Rees, B., 1996. The conduct of management and the management of conduct: contemporary managerial discourse and the constitution of the 'competent' manager. Journal of Management Studies 33 (3), 263-282.

Dyer J., Singh, H., 1998. The relational view: cooperative strategy and sources of interorganizational competitive advance. Academy of Manahement Review 23 (4), 660-679.

Eisenhardt, K., Martin J., 2000. Dynamic capabilities: What are they? Strategic Management Journal 21 (10/11), 1105-1121.

Figueiredo, P., 2002. Does technological learning pay off? Inter-firm differences in technological capability-accumulation paths and operational performance improvement. Research Policy 31 (1), 73-94.

Garcia-Muiña, F., Navas-Lopez, J., 2007. Explaining and measuring success in new business: The effect of technological capabilities on firm results. Technovation 27 (1-2), 30-46.

Gomel, M., Sbragia R., 2006. A capacitação tecnológica e o desempenho exportador da indústria brasileira de software: o papel dos investimentos em P&D. Journal of Technology Management & Innovation 1 (3), 60-73.

Gonzalez, R, Cunha, S.K., 2012. Internationalization process and technological capability trajectory of Iguaçu. Journal of Technology Management & Innovation 7 (2), 117-130.

Grant, R., 1991. The resource-based theory of competitive advance: implications for strategic formulation. California Management Review 33 (3), 114-135.

Guan, J., Ma, N., 2003. Innovative capability and export performance of Chinese firms. Technovation 23 (9), 737-747.

Henderson, R., Cockburn, I., 1994. Measuring competence? Exploring firm effects in pharmaceutical research. Strategic Management Journal 15 (winter especial issue), 63-84.

Ho, YC., Fang, HC., Lin, JF., 2011. Technological and design capabilities: is ambi-dexterity possible? Management Decision 49 (2), 208-225.

Hodgson, G., 1998. Competence and contract in the theory of the firm. Journal of Economic Behavior & Organization 35 (2), 179-210.

Hoetker, G., 2005. How much you know versus how well I know you: Selecting a supplier for a technically innovative component. Strategic Managerial Journal 26 (1), 75-96.

Huang, KF., 2011. Technology competencies in competitive environment. Journal of Business Research 64 (2), 172-179.

Iammarino, S., Padilla-Perez R., Von Tunzelmann, N., 2008. Technological capabilities and global-local interactions: The electronics industry in two Mexican regions. World Development 36 (10), 1980-2003.

Jacobides, M., Winter, S., 2005. The co-evolution of capabilities and transaction costs: explaining the institutional structure of production. Strategic Managerial Journal 26 (5), 395-413.

Jim, J., Von Zedtwitz M., 2008.Technological capability development in China's mobile phone industry. Technovation 28 (6), 327-334.

Jonker, M., Romijn, H., Szirmai, A., 2006. Technological effort, technological capabilities and economic performance: A case study of the paper manufacturing sector in West Java. Technovation 26 (1), 121-134.

Katz, J., 1984. Domestic technological innovations and dynamic comparative advantage. Journal of Development Economics 16 (1-2), 13-37.

Kim, L., 1997. The dynamics of Samsung's technological learning in semiconductors. California Management Review 39 (3), 87-100.

Kim, L., 1999. Building technological capability for industrialization: Analytical frameworks and Korea's experience, industrial and corporate change 8 (1), 111-136.

Kotabe, M., Srinivasan, S., Aulakh, P., 2002. Multinationality and firm performance: The moderating role of R&D and marketing capabilities. Journal of International Business Studies 33 (1), 79-97.

Lall, S., 1992. Technological capabilities and industrialization. World Development, v. 20, n. 2 , p. 165-186.

Langlois, R., Foss, N., 1999. Capabilities and governance: the rebirth production in the theory of economic organization. KYKLOS 52 (2), 201-218.

Leiblein, M., Miller, D., 2003. An empirical examination of transaction-and firm-level influences on the vertical boundaries of the firm. Strategic Managerial Journal 24 (9), 839-859.

Lukas, B., Ferrel, O., 2000. The effect of market orientation on product innovation. Journal of The Academy of Marketing Science 28 (2), 239-179.

Madanmohan, T., Kumar, U., Kumar, V., 2004. Import-led technological capability: a comparative analysis of Indian and Indonesian manufacturing firms. Technovation 24 (12), 979-993.

Madhok, A., 1996. The organization of economic activity: transaction costs, firm capabilities and the nature of governance. Organization Science 7 (5), 577-590.

Mayer, K., Argyres, N., 2004. Learning to contract: Evidence from the personal compu ter industry. Organization Science 15 (4), 394-410.

Mayer, K., Salomon, R., 2006. Contract design as a firm capability: an integration of learning and transaction cost perspectives. Academy of Managerial Review 49 (5), 942-959.

McEvily S., Eisenhardt, K., Prescott, J.E., 2004. The Global Acquisition, leverage, and protection of technological competencies. Strategic Management Journal 25 (8-9), 713-722.

Miller, J., Roth, A., 1994. A taxonomy of manufacturing strategies. Management Science 40 (3), 285-304.

Naver, J., Slater, S., 1990. The effect of market orientation of business profitability. Journal of Marketing 54 (4), 20-35.

Nelson, R., 1991. Why do firms differ, and how does it matter? Strategic Management Journal 12 (8), 61-74.

Nogueira A.C., Bataglia, W., 2012. Transaction costs and organizational competences: Explaining the governance structure for manufacturing stage. Journal of Technology Management & Innovation 7 (1), 159-174.

Ortega, M., 2010. Competitive strategies and firm performance technological capabilities moderating roles. Journal of Business Research 63 (12), 1273-1228.

Patel, P., Pavitt, K., 1997. The technological competencies of the world's largest firms: complex and path-dependent, but not much variety. Research Policy 26 (2), 141-156.

Penrose, E., 1959. The theory of the growth of the firm. Oxford University Press, New York. 272 p. Reprinted in 1995.

Poppo, L., Zenger, T., 2002. Do formal contracts and relational governance function as substitutes or complements? Strategic Managerial Journal 23 (8), 707-725.

Prahalad, C., Hamel G., 1990. The core competence of the corporation. Harvard Business Review 68 (3),79-91.

Reichert, F., Beltrame, R., Corso, K., Trevisan, M., Zawislak, P.A., 2011. Technological capability's predictor variables. Journal of Technology Management & Innovation 6 (1), 14-25.

Richardson, G., 1972. The organization of industry. Economic Journal 82 (327), 883-896.

Rush, H., Bessant, J., Hobday, M., 2007. Assessing the technological capabilities of firms: developing a policy tool. R&D Management 37 (3), 41-50.

Salomón, J., 2009. Managerial capabilities in Peruvian family companies: An exploratory study. Journal of CENTRUM Cathedra 2 (1), 108-135.

Snow, C., Hrebiniak, L., 1980. Strategy, distinctive competence, and organizational performance. Administrative Science Quarterly 25 (2), 317-336.

Santhanam, R., Artono, E., 2003. Issue in link information technology capability to firm performance. MIS QUARTTERLY 27 (1), 125-153.

Schoenecker, T., Swanson, L., 2002. Indicators of firm technological capability: Validity and performance implications. IEEE Transactions on Engineering Management 49 (1), 36-44.

Selznick, P., 1957. Leadership in administration: a sociological interpretation. University of Califonia Press, Berkeley and Los Angeles, Ca. Reprinted in 1984.

Skinner, W., 1969. Manufacturing: missing link in corporate strategy. Harvard Business Review 47 (3), 136-145.

Souitaris, V., 2002. Firm-specific competencies determining technological innovation: a survey in Greece. R&D Management 32 (1), 61-77.

Stamp, G., 1981. Levels and types of managerial capability. Journal of Managerial Studies 18 (3), 277-298.

Teece, D., 1986. Profiting from technological innovation. Research Policy 15 (6), 285-305.

Teece, D., Pisano, G., Shuen, A., 1997. Dynamic capabilities and strategic management. Strategic Management Journal 18 (7), 509-533.

Ward, P., McCreery, J., Ritzman, L., Sharma, D., 1998. Competitive priorities in operations managerial. Decisions Science 29 (4), 1035-1046.

Williamson, O., 1985. The economic institutions of capitalism. Free Press, New York. 450 p.

Williamson, O., 1996. Economics and organization: A primer. California Management Review 38 (2), 131-146.

Williamson, O., 1999. Strategic research: governance and competence. Strategic Management Journal 20 (12), 1087-1108.

Williamson, O., 2002. The theory of the firm as governance structure: From choice to contract. The Journal of Economic Perspectives 16(3), 171-195.

Winter, S., 2000. The satisficing principle in capability learning. Strategic Management Journal 21 (10-11), 981-996.

Wu, S., Melnyk, S., Flyn, B., 2010. Operational capabilities: The secret ingredient. Decision Sciences 41 (4), 721-754.

Zander, U., Kogut, B., 1995. Knowledge and speed of the transfer and imitation of organizational capabilities: And empirical test. Organization Science 6 (1), 76-92.

Zawislak, P., Alves, A., Tello-Gamarra, J., Barbieux, D., Reichert, F., 2012. Innovation capability: From technology development to transaction capability. Journal of Technology Management & Innovation 7 (2), 14-27.

Article history:

Received January 4, 2013

Accepted February 15, 2013

* Corresponding author.

E-mail address: jorgetellogamarra@gmail.com