Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Journal of Economics, Finance and Administrative Science

versión impresa ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.18 no.35 Lima dic. 2013

ARTICLE

Adoption determinants of the International Accounting Standards IAS/IFRS by the developing countries

Determinantes de la adopción de las Normas Internacionales de Contabilidad IAS/IFRS por los países en desarrollo

Fatma Zehria, Jamel Chouaibib,*

a

University of Sfax, Sfax, Tunisiab Department of Accounting, College of Economics and Administrative Sciences, Al-Imam Muhammad Ibn Saud Islamic University, Riyadh, Saudi Arabi

ABSTRACT

This papers main objective is to identify certain explanatory factors that likely clarify the choice of applying IAS/IFRS adopted by developing countries (DCs) up until the year 2008. Based on a sample consisting of 74 DCs, the empirical results have indicated that the DCs most likely to adopt IAS/IFRS have a high level of economic growth, along with a legal system of common law and an advanced educational level.

Keywords: Developing countries, International financial reporting standards, Institutional environment.

RESUMEN

El principal objetivo de este documento es identificar ciertos factores que probablemente esclarezcan la opción de aplicar IAS/IFRS adoptadas por los países en desarrollo hasta el año 2008. Basados en una muestra de 74 países en desarrollo, los resultados empíricos han demostrado que la mayoría de ellos probablemente tienen un alto nivel de crecimiento económico, junto con un sistema jurídico de derecho consuetudinario y un nivel de educación avanzado.

Palabras clave: Países en desarrollo, Normas internacionales de información financiera, Ámbito institucional.

1. Introduction

Currently, more than 100 countries have adopted or expressed their intention to adopt or even to converge towards, the international accounting standards. On July 19, 2002, the European Parliament adopted the regulation imposing, starting for 2005, the IFRS to the consolidated accounts of listed companies, including banks and insurance companies. On February 27, 2006, the International Accounting Standards Board (IASB) with the Financial Accounting Standards Board (FASB) have jointly issued a memorandum confirming the shared objective of both boards to develop high quality common accounting standards to be applied by the international stock markets.

Although in its first version, the IAS/IFRS have mainly targeted and focused on the developed countries, above all, large corpo rations, a strong diffusion of these standards has been interested among the DCs.

The development of a country is measured with statistical indexes such as income per capita (GDP), life expectancy, the rate of literacy, et cetera. The UN has developed the HDI, a compound indicator of the above statistics, to gauge the level of human development for countries where data is available.

In this article, we focus in the voluntary not mandatory decision adoption of IFRS by the DCs.

Noteworthy, Tunisia has been a pioneering world country, to join the international accounting harmonization movement. Actually, the Tunisian experience dates back to 1996 following the adoption of the new business accounting system founded upon a quasi total compliance with the international standards. As for Algeria it has adopted an accounting scheme predominantly inspired by the IFRS. This scheme is abiding to the major IFRS principles and key concepts, while the more complex and inappropriate standards to the local economy have been modified.

On the academic level, however, most of the previous studies have been entirely concerned with costs and problems associated with the adoption of IFRS in the developed countries (Bradshaw & Miller, 2003; Delvaille, Ebbers & Saccon, 2005; Epstein & Mirza, 2006; Larson & Street, 2004; Nobes & Parker, 2004). Scarce are those studies dealing with the IFRS adoption by the developing countries, they have still remained limited as compared to the studies pertaining to the DCs. In this respect, Zeghal and Mhedhbi (2006) have conducted and focused their study on the IAS/IFRS adoption determinants by the developing countries. In fact, their study has examined a sample made up of 32 developing countries having adopted IAS and 32 other non adopting countries. Actually, they conclude that those developing countries having a capital market, advanced educational levels and high economic growth are more inclined to adopt IFRS.

This research constitutes an extension of the study conducted by Zeghal and Mhedhbi (2006) whose subject matter deals with the major factors that influence the adoption of IAS by the developing countries. Yet, the present papers contribution consists in testing the relevance of the findings achieved by Zeghal and Mhedhbi (2006) after five years of study while taking into account the passage from the IAS to the IFRS as well as other variables related to the type of legal system and political environment.

Seeing the considerable rising number of emerging countries having already applied or intending to apply the IFRS and with the accelerated processes over the years ranging between 2008 and 2011, we propose, through this study, to identify the determinants for adoption the IAS/IFRS via a panel of 74 developing countries. Thus, within a single logistic model of a countrys economic growth, we tend to integrate such factors as the stock markets, openness to the outside world, educational system, cultural aspect, legal system model and the political factor. Hence, the major objective of this study is to understand the fundamentals behind the decision of adoption of IFRS by the DCs.

In conformity with previous studies (Al-Akra, Jahangir & Marashdeh, 2009; Larson, 1993; Zeghal & Mhedhbi, 2006), we have discovered that the economic growth level, constitutes a major determinant for adopting the international accounting standards. However, we find that such factors as culture, the political system and the existence of a capital market have not significantly affected the decision to adopt the IFRS.

Noteworthy, this paper is organized as follows. The second section summarizes the literature pertaining to the subject. The third outlines the research hypotheses. As for the fourth section, it describes the applied methodology. The fifth section presents the achieved results and their discussions. Finally, the sixth concluding section is consecrated to present the research findings along with its limitations.

2. Literature review

The purpose of this study is to identify the major determinants for adopting the IAS/IFRS by the developing countries. To note, studies on this subject are rare with respect to those dealing with the adoption of international standards by the developed countries.

Previous literature shows that two lines of research could be distinguished. While the first stream of research focuses on the macroeconomic factor related determinants for adopting international standards, the second investigates the microeconomic feature related determinants. Yet, one could well note the overwhelming dominance of microeconomic factor studies concerned with microeconomic factors related to firm characteristics while institutional influences specific to each country are being neglected.

Within the framework of this research, the major focus of this study is centered around examining the determinants for adopting international standards via country characteristics related factors.

Noteworthy, Leuz and Verrechia (2000) have examined the accounting choices of German companies listed on the DAX index for the year 1998. Using a logistic regression analysis, the authors show that factors such as firm size, financing needs and financial performance significantly explain the decision of adopting international standards.

As for Trembley (1989), has studied the characteristics of 53 U.S. software specialized firms among which 14 have opted for an anticipated adoption of SFAS No. 86 pertaining to the capitalization of software development fees. The author has reached finding that adoption choice is primarily determined by the company size along with the auditors opinion.

Similarly, Barbue (2004) has conducted a longitudinal study over the period ranging from1985 to 1999 to measure the French companies tendency to implement the international benchmark. He established the existence of a wandering accounting developed among the 100 reviewed French business groups subject of study.

In their turn, Affes and Callimaci (2007) have highlighted the motivations leading to an early adoption of IAS/IFRS by the German and Austrian listed groups. The logistic regression conducted on a sample of 106 German and Austrian firms reveals that the probability of early adoption of IAS/IFRS increases with respect to firm size. However, the relationship between debt and the anticipated adoption of IAS/IFRS appears to have little importance to highly indebted companies as their creditors might require compliance with debt covenants based on specific calculations. Besides, in a sample consisting of 28 firms listed on the Swiss stock market and applying local standards along with 51 companies applying IAS/IFRS, Dumontier and Raffournier (1998) have demonstrated the absence of a significant relationship between the voluntary adoption of IAS, the debt ratio and firm performance.

Recently, however, the question of studying the adoption determinants of the IAS/IFRS has been explored in the context of developing countries. Actually, the DCs continue to experience strong economic growth and have a weight in the international economy, are multiplied in their adherence numbers for to IAS/ IFRS. As a result, some research works have attempted to identify whether there are peculiarities related to DC regarding the decision to adopt international standards.

For instance, Omneya, Abd-Elsalam & Weetman (2003) have examined the language effect on the first introduction of IFRS in Egypt. Through a sample of 72 locally listed companies, the authors have shown that Egyptian companies continue to encounter difficulties in implementing IFRS, given the disparities between the IFRS spirit and philosophy in respect of the local accounting traditions and cultures. This study reports evidence that the IAS/ IFRS are of higher complexity with regards to the local standards.

Chamisa (2000) have examined the international standards role in improving the quality of financial information produced for a stock market in the developing countries. He noted that these standards are critically and crucially important for the developing countries with an active financial and capital market and are devoid of such importance regarding the other developing countries.

Actually, this observation has been confirmed through the study conducted by Zeghal and Mhedhbi (2006) dealing with a sample examination composed of 32 DCs having adopted the IAS and some other 32 countries which have not adopted them. They show that the developing countries enjoying capital markets, advanced education levels and high economic growth rates are most inclined to adopt the IFRS.

Moreover, on examining the development of accounting regula tions in Jordan, Al-Akra et al. (2009) have analyzed the impact of economic, political, legal and cultural factors on promoting the accounting practices. They came to conclude that the political and economic factors are the elements which most contribute to this development.

From all that has been mentioned in the literature review, one can deduce that the research field the IAS/IFRS adoption determinants with respect with to the DCs remains limited with somewhat mixed results. In fact, most of the reviewed studies have highlighted the importance of institutional criteria factors (economic growth, education level, capital markets) along with some specific features regarding these countries operating companies (size, indebtedness levels, the quality of external audit) in deciding to adopt these standards.

3. Research hypotheses

The accounting literature, both theoretical and empirical, has persistently shown the effect of environmental factors on the development of accounting. In this respect, Belkaoui (1983) has noted that the accounting standards and policies are social products that can not escape the influences of the institutional environment.

In light of the IAS/IFRS literature adoption (Al-Akra et al., 2009; Chamisa, 2000; Hove, 1986; Standish, 2003; Street, 2002; Zeghal & Mhedhbi, 2006), we attempt to derive a set of hypotheses that pertain to study the effect of the developing countries on the decision of adopting of IAS/IFRS.

3.1. The culture factor

It is a well known fact that culture is a major critical factor in explaining the choice of relevant accounting systems of appropriate to each nation. Hofsted (1980) have stressed that cultures might differ according to four major cultural dimensions: the power extent distance, individualism, masculinity and uncertainty avoidance. Doupnik and Salter (1995) show that cultural norms and values vary in respect of the significant developments engendered by the external environment.

Indeed, several researchers have shown that countries influenced by the Anglo-Saxon culture enjoy a more developed and sophisticated accounting system. In this sense, Zeff (1998) found that culture is a major influencing factor for both social systems standards and values of social systems as well as the behavior of systems interacting groups. He has considered thatover the last two decades, the Anglo-Saxon culture has deeply influenced national cultures.

Nobes (1998) notes that countries affected by the same cultural values are likely to adopt the same accounting criteria. Chamisa (2000) and Hove (1986) have suggested that the adoption of IFRS will be easier for the developing countries with an Anglo-Saxon culture. This can be justified by the predominance of members with Anglo-Saxon origins in the work of the IASB.

In their turn, Zeghal and Mhedhbi (2006) have showed that the developed countries with an Anglo-Saxon culture are the most easily to adopt IAS. From this perspective, it is possible to anticipate that the adoption of IAS/IFRS criteria will be easier for countries with an Anglo-Saxon culture. The first hypothesis is as follows:

Hypothesis 1: A country with an Anglo-Saxon culture is more likely to adopt IFRS.

3.2. Economic growth

Since the IASB creation, countries have tried to improve their accounts by applying IAS criteria. Having been developed and prepared by an international standard setting accounting body, these standards are heavily dominated and inspired by certain facts by the developed countries. Indeed, on examining of the IASB composition and structure, it clearly appears that the developed countries are over predominantly with respect to the developing countries. This geographical discrepancy manifested itself in terms of topics treated and covered by these elaborated standards. In fact, the latter are generally advanced and proposed by the developed countries representatives and, thus, raise the problems that are most faced by firms operating in these countries. This confirms even more the fact once again that accounting development has never been dissociated from economic development. Arpan and Radebaugh (1985) have considered that economic development is indeed the fundamental variable that deeply influences the development of accounting seeing that it affects other functions in society.

On the academic level, the results highlighting the IFRS relationship with economic growth are controversial. Indeed, while the study of Zeghal and Mhedhbi (2006) has demonstrated that the IFRS adoption is more tolerable by the DCs with high economic growth. Woolly (1998) has observed that, in an Asian context, no significant differences could be noticed in terms of economic growth among IFRS adopting and those applying their local standards.

Hence, the following hypothesis appears to be more plausible to advance:

Hypothesis 2: A country with a higher level economic growth is more likely to adopt IFRS.

3.3. Capital market availability

The quality of financial information is a major ingredient in the development and efficiency of capital markets. Actually, the main challenge for adopting the IFRS lies in facilitating the stock markets functioning operations, hence protecting the investors interests on the various world exchange markets.

In this respect, Gray & Radebaugh (1997) have stated that investors constantly need sophisticated information to be able to analyze investment opportunities and optimize their choices. Such a pressure exerted by the institutional environment has prompted several countries to have recourse to a mere substitution of their local standards with the IFRS. In this way, Jemakowicz and Gornik-Tomaszewski (2006) have shown that countries with financial market that are open to foreign investors are more likely to adopt the IFRS. Thus, by enhancing information comparability, the IFRS constitute means of integrating the local financial market in the chain of global exchanges. Thus, our third hypothesis can be put forward, namely:

Hypothesis 3: A country with a capital market is more likely to adopt IFRS.

3.4. The educational level

The subjects advanced by the IAS/IFRS are generally stem from the professional competences advice and opinions as well as the practical experiences of the IASB various members. As a matter of fact, these standards are quite complex and their understanding require deep and detailed knowledge not only of accounting but also of other disciplines (actuarial calculations, finance, etc). Thus, the degree of their acceptance requires a highly advanced level of expertise by countries adhering to such standards. In this respect, Doupnik and Salter (1995) and Street (2002) have stated qualified the adoption of IFRS as being socially strategic decision. Actually, understanding, interpreting and applying these standards need a certain level of education and university training. Thus our fourth hypothesis can be formulated as follows:

Hypothesis 4: A country with an advanced educational level is more likely to adopt IFRS.

3.5. Openness to the exterior world

Noteworthy, Cooke and Wallace (1990) have been pioneers in introducing the external environmental factors as necessary elements to understand the accounting systems of individual countries. One of these factors consists in the economys openness level to the outside world. According to these authors, the higher the countrys economy openness degree is, the higher the country is exposed to external pressures. Certainly, a countrys openness to the outside world does enhance economic growth, yet it engenders greater risks in terms of the security and scale of international pressure. These pressures are reflected in the volume of economic affairs. The application of internationally recognized standards relatively reduces some of the pressures faced by companies open to the outside world and could facilitate the access to other world markets for companies intending to do so. Hence, the fifth hypothesis:

Hypothesis 5: A country open to the exterior world is more likely to adopt IFRS.

3.6. The legal system

International accounting has notified the importance of the legal system as a predictor of differences in accounting standards between countries. In these regards, Nobes (1998) has made the distinction between written law countries belonging mainly to the continental Europe and the common law countries representing the Anglo-Saxon model.

Despite this prevailing international duality regarding the legal systems, history testifies to thestrong dominance of the Anglo-Saxon legal system, especially that of the U.S., in promoting the accounting culture. This seems to explain the several Anglo-Saxon impacts on the process of international accounting harmonization. Thus, for long years one can notice the prevalence of a remarkable American imprint on the works of the international standards body manifested by the rapprochement between the IASB and the FASB. This rapprochement or merger involves three aspects, namely, the change of name, headquarters and structure which shows mimicry between the U.S. standardization body and the international one. Moreover, the characteristics of IASB members characteristics clearly show the faithful Anglo-Saxon influence on the analyzed process. This has made Standish (2003) analyze the nationality, language, vocational training and activity in a standard-setting committee to demonstrate the Anglo-Saxon domination within the IASB. He states that in the IASB conducted process, the strong dominance of the American legal system highly predominates. Hence, the following hypothesis could be put forward:

Hypothesis 6: A country with a common legal system increases to adopt IFRS.

3.7. The political factor

Accounting standards are the product of a political action and reflect a state of temporary equilibrium anchored in some scientific logic and practice (Barbue, 2004).

Belkaoui (1983) suggests that the level of economic and civil freedom presents a key factor in the development of accounting practices. He justifies his view by the fact that if a country has a low level of political freedom, citizens will be unable to choose members of the government owing to the lack of democracy. Consequently, it is inconceivable that these people, being deprived of all forms of freedom, could act on accounting policies. Inversely, however, in the presence an equitably based democratic policy, should a better development of accounting standards is likely to prevail.

In addition, many researchers have admitted that both government and monetary stabilities can significantly affect the economic environment, which may consequently, affect the development of accounting (Hassab Elnaby, Epps & Said, 2003; Larson & Kenny, 1995). Given the weight of public authorities and of states in the governing most of the developing countries, the following hypothesis appears to be worth advancing:

Hypothesis 7: A country enjoying a favorable political environment is more likely to adopt IFRS.

4. Methodology

4.1. Sample

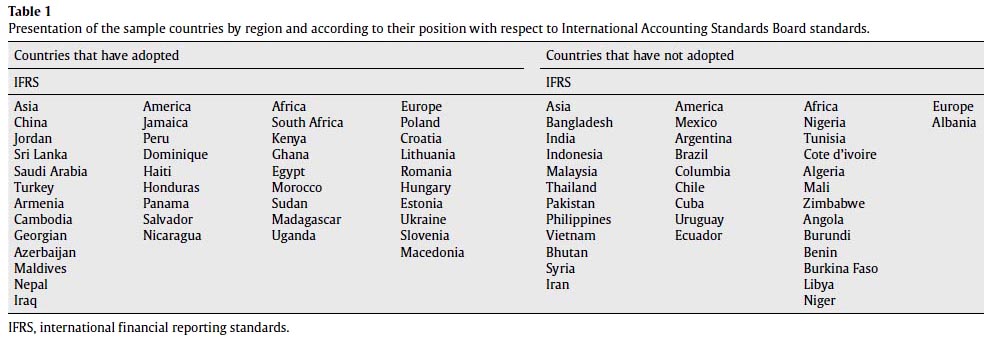

For the purpose of testing the relationship between macroeconomic factors and the developing countries adoption of the IFRS, we have relied on a sample consisting of some developing countries selected from the website of IAS (www.iasplus.com/country/country.htm) in a section labeled (use of IFRS by jurisdiction). This site has provided us with some detailed information pertaining to the position of several jurisdictions regarding the decision to adopt the IFRS. Actually, 74 developing countries have been selected and classified into two groups. The first group contains 37 developing countries that have adopted IFRS (with or without modification), while the second group also including 37 developing countries, but which, until 2008, have not yet adopted the IFRS. Both country groups list, spread over four continents, appears in the Table 1 below.

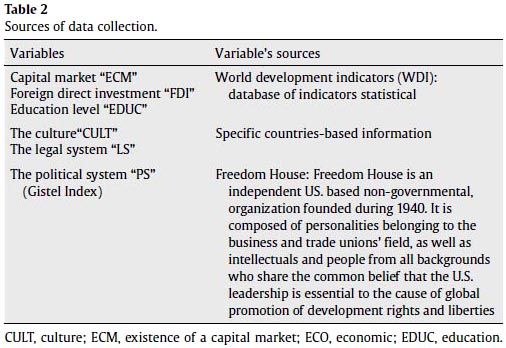

4.2. Data collection sources

To note, all information relevant to the studied factors has been gathered from various data sources. The following table (Table 2) shows the description of our studys sources of environmental variables.

4.3. Variables measurement and model presentation

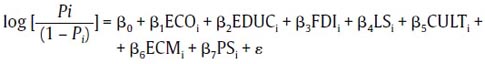

The above mentioned set concerning adoption decision IAS/IFRS are incorporated in the logistic model presented below:

Where:

-

Pi: is the probability of adopting IAS/IFRS in 2008.

-

ECOi: is the annual average growth rate of gross domestic product / person.

-

EDUCi: education level, measured by the general literacy rate in the country.

-

FDIi: Openness to the outside world, measured by foreign direct investment divided by the gross domestic product.

-

PSi: the political system measured by the Gistel index.

-

CULTi: culture is a dummy variable that takes the value 1 if the country has an Anglo-Saxon culture and 0 otherwise.

-

ECMi: the existence of a capital market is a dummy variable that takes the value 1 if the country has a capital market and 0 otherwise.

-

LSi: the legal system is a dummy variable that takes the value 1 if the country has a common law type of legal system and 0 otherwise.

-

ε : is the margin of error.

5. Results analysis

5.1. Descriptive analysis presentation

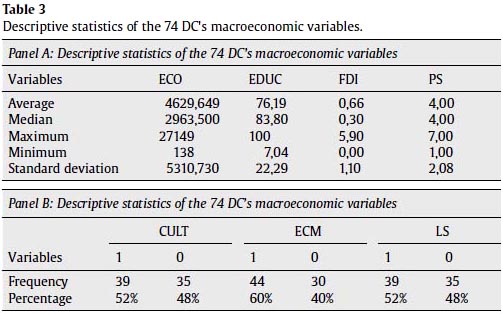

A description of the variables related to the 74 DCs subject of our study sample appears in Table 3 (panel A, B). On the basis of this table, it is worth noting that our samples GDP per capital average is 4629.649 dollars with a minimum of 138 and a maximum of 27149. To note, the developing countries under review have an average literacy rate of 76.19% average with a minimum rate of 7.04% and a maximum rate of 100%.

Besides, 52% of the studied DCs have an Anglo-Saxon culture, 52% have a "Common Law" legal system and 60% have a capital market. In general, our sample can be described as being equitably distributed as regards the cultural origins and legal system. As can be noted, the average index of Gastils political freedom is 4 which denote that the developing countries constituents of our sample are characterized by an average level of political freedom.

5.2. Univariate analysis: comparing the two developing country groups

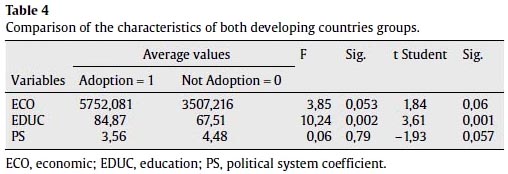

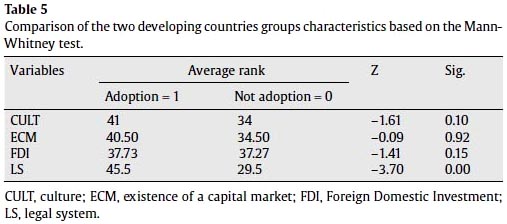

This analysis objective is to examine whether there exists, a priori, a difference between the set of developing countries having adopted the IAS/IFRS and the Group of Countries which have not yet adopted these standards. Hence, two types of statistical tests have been applied: the Student t test to compare some of the variables mean averages (see Table 4) as well as the Mann Whitney test for other variables in respect of the outcome of the Kolmogorov test result (see Table 5).

As for Table 4, it shows that countries adopting the IFRS are characterized by a high level of education (EDUC = 84.87%) compa-red to other developing countries (67.51%). In addition, these same countries show strong economic growth (the variable ECO) contrary to those developing countries with a less democratic political system which have not adopted the international standard criteria.

Concerning Table 5, it is worth noting the existence of a significant difference between the two developing countries groups with respect to their legal system (the variable SL). In fact, countries having adopted the IFRS have been overwhelmingly dominated by a common law type legal system.

Regarding the other variables, neither culture (CULT), nor the existence of a capital market (ECM) and the openness to the outside (IDF) can depict any noticeable major difference between the two sets of countries.

As a summary of the univariate analysis, it is worth concluding that countries adopting thIFRS have reported the highest levels of both education and economic growth rates, dominated by an Anglo-Saxon culture along with a common law based legal system.

5.3. Presentation and discussion of the multivariate analysis results

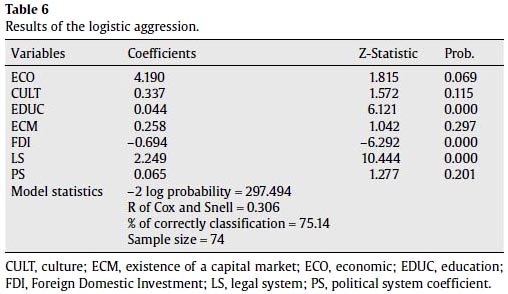

Firstly, it is worth noting that the Pearson correlations between independent variables have been analyzed. In fact, an examination of this matrix coefficient (see Appendix) does not reveal any major problems of multi-collinearity. At a second stage, the following logistic model is to be estimated.

In general, the logistic analysis results presented in Table 6 confirm the findings of the univariate analyzed. The model turns out to be globally significant and has accurately classified 75.14% of observation ranges adopt IFRS in the developing countries context. First, we find that such factors as culture, the political system and the existence of a capital market have not significantly affected the decision to adopt the IFRS.

In fact, cultures marginal effect on the IFRS adopting decision can be explained by the absence of traditions or even an accounting culture in the case of many emerging countries.

Actually, the decision to adopt IFRS could be a substitute for this cultural vacuum.

As regards the market, its non significant effect can be attributed to the relatively young age of most capital markets in the emerging countries, as these markets remain a subsidiary financing means in respect of the debt.

Although the positive sign of the political system coefficient (PS) has been consistent with our expectations (coefficient = 0.065, p value = 0.201). This variable does not seem to be significant in determining the developing countries adoption decision. It is quite possible in the emerging countries context, the political system is a priority factor in the socio-economic related fields rather than the accounting ones.

On the other hand, it clearly appears that the economic growth, level of education and legal system do significantly affect the developing countries choice of adopting international accounting standards. In conformity with previous studies (Al-Akra et al., 2009; Larson, 1993; Zeghal & Mhedhbi, 2006), we have discovered that the economic growth level (ECO) constitutes a major determinant for adopting the international accounting standards.

For instance, one can notice that Slovenia (a DCs which has adopted the IFRS) has a GDP per capita of 27,149 Dollars, while Burundi (a DCs which has not adopted the IFRS) is characterized by a very low GDP per person (138 Dollars). Actually, this result confirms not only the hypothesis H1 of this study but also the assertions of the strong association of economic growth and the accounting standards.

The education variable (EDU) reflecting the level of education has a positive and significant coefficient (coefficient = 0.044, p value = 0.000). This result confirms that the higher of the education level of a developing country is, the higher the countrys tendency to adopt IFRS will be. This result supports our hypothesis H4. The comparison between Georgia (a DC which adopted the IFRS with an education level equal to 100%) and Rwanda (a DC which has not adopted the IFRS with an education level of 7.04%) constitutes a perfect illustration. It seems obvious, then, that an advanced level of education is likely to facilitate the IFRS mplementation. As a matter of fact, these constantly changing standards, often recognized to be more complex, require a heavy training, competent professional accountants and a high level teaching staff.

As for the legal system, it significantly and positively influences the IFRS adoption by the developing countries. This result supports the prediction stipulating that the developing countries with a common legal system are more likely to adopt the IFRS. As has been stated, the work of the IASB and its ambitious project of international accounting harmonization are heavily dominated by Anglo-Saxon common law countries. Hence, the IFRS implementation would be more feasible for the developing countries with a legal system of common law. The legal systems influence on IFRS adoption reveals the existence of a coercive type of isomorphism reflecting legal pressure.

Regarding the countrys openness level to the outside world, the FDI variable has shown a negative and significant coefficient pertaining to the decision to adopt IFRS by the developing countries. Consequently, this result invalidates the hypothesis stating that the more a developing country is open to the outside world, the more likely it is to adopt the IFRS.

Hence, one might well think that adopting the IFRS, the developing countries are primarily aiming at local financial communication.

6. Conclusion

Following the financial scandals of the early 2000s occurring in Europe and the U.S. (Enron, WorldCom), the regulatory authorities have sought to improve the quality of financial disclosure and communication in a wide context of economic globalization. This reaction resulted in the introduction of a set of reforms, governance practices and financial communication, among which is the adoption of IFRS. If in 2005 the main user of this international standards criterion remained the European Union through CE1606/2002 regulation, the recent years have witnessed a widespread diffusion of the IFRS among the developing countries. Hence, the present works objective, which consists in identifying the key factors associated with the decision to adopt the IFRS by developing countries.

The empirical analysis results have shown that the developing countries most favorable to the adoption of IFRS are those having a high economic growth rate, a high level of education and common law based a legal system. As for the other variables, relevant to our model: culture, the existence of a capital market, the political system and internationality, they have turned out to no significant impact on the decision to adopt IFRS. Collectively considered, these results lead us to conceive that the decision to adopt the international standard is closely related to the developing countries institutional environment (above all the legal system) as well as to their macroeconomic data (i.e. these countries economic and educational growth level). This allows us to identify the existence of a coercive isomorphism in the developing countries trend vis-à-vis the international accounting standards. Actually, this finding highlights the difference distinguishing the results achieved by similar studies relevant to the developed countries and our study reached results concerning the developing countries context. As a matter of fact, the developing countries transition modalities to the IFRS would probably differ from those of developed countries. Our results may provide some valuable classification to the developing countries standardization organisms wishing to join the international accounting standards.

Nevertheless, the present research has left some space for certain limits. In particular, the models explanatory power remains quite modest. This connotes the impact left by some existence of omitted variables that might be explored in future studies.

Eventually, various prospective ways of further research through investigation seem to be worth examining, namely: what are the new IFRS effects on the developing countries accounting practice? Does the adoption of IAS/IFRS have an effect on these countries economies? Finally, does the content of some IFRS really enable to improve accounting information?

References

Affes, H. & Callimaci, A. (2007). Les déterminants de ladoption anticipée des normes comptables internationales: choix financier ou opportunisme. Comptabilité Contrôle Audit, 13(2), 149-166. [ Links ]

Al-Akra, M., Jahangir, A. M. & Marashdeh, O. (2009). Development of accounting regulation in Jordan. The International Journal of Accounting, 44, 163-186. [ Links ]

Arpan, J. S. & Radebaugh, L. H. (1985). International Accounting and Multinational Enterprising. New York: Wiley. [ Links ]

Barbue, E. (2004). Lharmonisation comptable internationale: dun vagabondage comptable à lautre. Comptabilité Contrôle Audit, 10, 1, 37-61. [ Links ]

Belkaoui A. (1983). Economic, Political and Civil Indicators and Reporting and Disclosure Adequacy: E mpirical Investigation. Journal of Accounting and Public Policy, 2, 356-412. [ Links ]

Bradshaw, M. & Miller, G. (2003). Will harmonizing accounting standards really harmonize accounting? Evidence from non-US firms. Working paper. Harvard University. [ Links ]

Chamisa, E. (2000). The relevance and observance of the IASC standards in developing countries and the particular case of Zimbabwe. The International Journal of Accounting, 35(2), 267-286. [ Links ]

Cooke, T. E. & Wallace, R. S. O. (1990). Financial disclosure regulation and its environment: A review and further analysis. Journal of Accounting and Public Policy, 9, 79-110. [ Links ]

Cooke, T. & Wallace, O. (1990). Financial disclosure regulation and its environment: A review and further analysis. Journal of Accounting and Public Policy, 9(2), 79-110. [ Links ]

Delvaille, P., Ebbers, G. & Saccon, C. (2005). International financial reporting convergence: Evidence from three continental European countries. Accounting in Europe, 2, 137-164. [ Links ]

Doupnik, T. & Salter, S. (1995). External environment, culture, and accounting practice: A preliminary test of a general model of international accounting deve lopment. The International Journal of Accounting, 30(3), 189-202. [ Links ]

Dumontier, P. & Raffournier, B. (1998). Why firms comply voluntarily with IAS: an empirical analysis with Swiss data. Journal of International Financial Management and Accounting, 9(3), 216-245. [ Links ]

Epstein, B. J. & Mirza, A. A. (2006). IFRS. Interpretation and application of International Financial Reporting Standards. John Wiley & Sons, Inc. [ Links ]

Gray, S. J. & Radebaugh, L. H. (1997). International Accounting and Multinational Enterprises. New York: John Wiley & Sons. [ Links ]

Hassab Elnaby, H. R., Epps, R. W. & Said, A. A. (2003). The impact of environmental factors on accounting development: An egyptian longitudinal study. Critical Perspectives on Accounting, 14, 273-292. [ Links ]

Hove, M. (1986). The Anglo-American influence on international accounting standards: The case of the Disclosure standards of the international accounting standards committee. Research in Third World Accounting, 1, 55-66. [ Links ]

Jermakowicz, E. K. & Gornik-Tomaszewski, S. (2006). Implementing IFRS from the perspective of EU publicly traded companies. Journal of International Accounting, Auditing and Taxation, 15, 170-196. [ Links ]

Jermakowicz, K. (2006). Implanting IFRS from the perspective of UE publicly traded company. Journal of International Accounting Auditing and Taxation, 15, 170-196. [ Links ]

Joshi, P. L. & Ramadhan, S. (2002). The adoption of international accounting standards by small and closely held companies: Evidence from Bahrain. The International Journal of Accounting, 37, 429-440. [ Links ]

Larson, R. K. & Kenny, S. Y. (1995). An empirical analysis of international accounting standards, equity markets, and economic growth in developing countries. Journal of International Financial Management and Accounting, 6(2), 130-157. [ Links ]

Larson, R. K. & Street, D. L. (2004). Convergence with IFRS in an expanding Europe: Progress and obstacles identified by large accounting firms survey. Journal of International Accounting, Auditing & Taxation, 13, 89-119. [ Links ]

Larson, R. K. (1993). International accounting standards and economic growth: an empirical investigation of their relationship in Africa. Research in third world Accounting, 24, 165-179. [ Links ]

Leuz, C. & Verrecchia, R. (2000). The economic consequences of increased disclosure. Journal of Accounting Research, 38, 91-124. [ Links ]

Nobes, C. (1998). Towards a general model of the reasons for international differences in financial reporting. Abacus, 34, 2, 162-185. [ Links ]

Nobes, C. W. & Parker, R. (2004). Comparative international accounting (8th ed). London: Prentice Hall. [ Links ]

Omneya, A. & Weetman, P. (2003). Introducing International Accounting Standards to an emerging capital market: relative familiarity and language effect in Egypt. Journal of International Accounting, Auditing & Taxation, 12, 63-84. [ Links ]

Standish, P. (2003). Evaluating capacity for direct participation in international accounting harmonisation: France as a test case. Abacus, 39(2), 186-210. [ Links ]

Street, D. (2002). GAAP 2001 benchmarking national accounting standards against IAS: Summary of results. Journal of International Accounting, Auditing & Taxation, 11, 77-90, 1-29. [ Links ]

Street, D. L. & Larson, R. K. (2004). Large accounting firms survey reveals emergence of "Two Standard" system in the European Union. Advances in International Accounting, 17. [ Links ]

Trembley, M. A. (1989). Accounting method choice in the software industry: characteristics of firms electing early adoption of SFAS No. 86. The Accounting Review, 64(3), 529-538. [ Links ]

Wooly, R. (1998). International accounting standards and economic growth, an empirical investigation of their relationship in Asia. Working Paper series Australia: School of Accounting and Law, RMIT. [ Links ]

Zeff, S. A. (1998). The IASC core standards: what will the SEC DO? The Journal of Financial Statement Analysis, 67-78. [ Links ]

Zeghal, D. & Mhedhbi, K. (2006). An analysis of the factors affecting the adoption of international accounting standards by developing countries. The International Journal of Accounting, 41, 373-386. [ Links ]

* Corresponding author.

E-mail address: chouaibi_jamel@yahoo.fr (J. Chouaibi).

Article history:

Received 21 July 2013

Accepted 23 September 2013