Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Journal of Economics, Finance and Administrative Science

Print version ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.20 no.38 Lima June 2015

http://dx.doi.org/10.1016/j.jefas.2015.01.005

ARTICLE

Food price inflation in India: the growing economy with sluggish agriculture

Inflación de los precios de los alimentos en India: crecimiento económico y letargo agrícola

Joydeb Sasmal1

1 Department of Economics with Rural Development, Vidyasagar University, Midnapore (West)–721102, West Bengal, India.

ABSTRACT

India is experiencing high rate of economic growth in the last two decades but the growth has been coupled with high rate of food price inflation. The growth has been very uneven across sectors with agriculture remaining very sluggish. The increase in per capita income has significantly increased the demand for food but agricultural production has failed to keep pace with the growing demand. The theoretical explanations and time series econometric results establish that increase in per capita income and shortage in supply are responsible for price rise. There is no long run relationship between money supply and agricultural price. Increasing public expenditure and unfavorable foreign exchange rate have some effects on price although the results are not robust.

Keywords: Economic growth, Per capita income, Growing demand, Food grains production, Public expenditure, Shortage, Price rise.

RESUMEN

India está experimentando un elevado índice de crecimiento económico en las últimas dos décadas, aunque dicho crecimiento ha ido acompa˜nado de una elevada tasa de inflación de los precios de los alimentos. Este aumento se mostró bastante desigual entre los diferentes sectores, siendo muy lento en el sector agrícola. El incremento de la renta per cápita ha elevado considerablemente la demanda de alimentos, pero la producción agrícola no ha seguido el ritmo del crecimiento de la demanda. Las explicaciones teóricas y los resultados econométricos de las series de tiempo establecen que el incremento de la renta per cápita y la escasez de los suministros son los causantes del alza en los precios. No existe una relación a largo plazo entre el suministro dinerario y los precios agrícolas. El aumento del gasto público y las tasas poco favorables del cambio de divisas tienen ciertos efectos sobre los precios, aunque los resultados no son sólidos.

Palabras clave: Crecimiento económico, Renta per cápita, Crecimiento de la demanda, Producción de cereales para alimentación, Gasto público, Escasez, Incremento de los precios.

1. Introduction

India is experiencing high rate of GDP growth in the last two decades although the growth remains very uneven across sectors. The GDP is growing at a rate of 7-9% on an average per annum, but in agriculture the annual average growth rate is only 1.5% during this period. The share of agriculture in GDP has declined to less than 15%, although more than 50% of the population of the country is still dependent on agriculture for their livelihood. Like in many other developing countries the economic growth in India has been coupled with high rate of inflation. A major economic challenge the country is facing in the recent years is high food price inflation. From January 2008 to July 2010, the food price inflation rate year-on-year basis was recorded 10.20% (Nair & Eapen, 2012). From October 2009 to March 2010 food price inflation announced every week hovered around 20% (Basu, 2011). The researchers have tried to explain this price rise in terms of various factors including the effect of food crisis in the international market in the recent time (Gulati & Saini, 2013; Basu, 2011; Nair & Eapen, 2012). The Study of Robles (2011) shows that there is evidence of positive transmission effects of international prices on domestic agricultural markets in Asian and Latin American countries. Similar view has been expressed by Carrasco and Mukhopadhyay (2012). Baltzer (2013) however, notes that not all countries are equally hit by global food crisis. He states that in several countries, domestic prices are largely unrelated to international prices and reflect purely local shocks such as harvest failures, political turmoil etc. This study also finds that there is a close relationship between international and domestic prices in Brazil and South Africa, but the price passthrough from international to domestic market in China and India is almost nil. The level of transmission of international prices to domestic prices depends on a country’s dependence on imports of food items and the inputs used in agricultural production. But India’s dependence on the imports of agricultural products is not high except certain items like edible oils, sugar and pulses. In fact, India is a net exporter of food grains for the last thirty years although India’s dependence on the import of petroleum and petro products including fertilizers is really very high. The management food economy and government intervention into the market for food grains through procurement and public distribution to maintain stability of food prices is an important issue in the present context. A sizeable buffer stock of food grains is maintained in India through public procurement to iron out the price fluctuations arising out of seasonal and sudden supply shocks especially in the years of crop failure. But Basu (2011) has shown that, the release of food grains was inadequate in the time of price rise although the food reserve in the country was above normal limit. So, the management of food economy was not up to the mark.

Like the price of any other commodity, agricultural price is also a market outcome and demand and supply in the market play an important role in the determination of price. The market imperfection can create distortion in the functioning of the market and influence price by controlling supply. A typical agricultural marketing channel is: Farmer – Local assembler – Central wholesaler – Retailer – Consumer. The retail prices are determined nearly in a perfectly competitive market situation. However, a few traders dominate in the wholesale market both as buyers and sellers. They act as both oligopolists and oligopsonists at the bottleneck of the marketing process (Nicholls, 1955; Sasmal, 2003). In the study of Osborne (2005) in the context of Ethiopia it is found that there are general forms of imperfect competition among rural wholesale traders, although there is no conclusive evidence of imperfect competition among the traders in larger and more centrally located markets. Anyway, the market imperfection can influence the price temporarily but it cannot sustain price rise for a long period if there is no actual shortage. There may be seasonal variation also in the prices of agricultural commodities. According to Sarkar (1993), prices are low in harvest season and high in lean season. Therefore, it is finally the supply and demand which are the most important determinants of agricultural price. The supply is related to agricultural production. In sluggish agriculture in a country like India, the productivity is stagnant or increasing at a declining rate due to various reasons like resource degradation, decline in public investment and technological bottlenecks (Sasmal, 2012; Bhullar & Sidhu, 2006; Mani, Bhalachandran & Pandit, 2011). But the demand for food items is increasing at a very high rate following a steady increase in per capita income. Higher disposable income has not only significantly increased the overall demand for agricultural commodities but also changed the pattern of consumption. Gulati and Saini (2013) have shown that the pressure on prices is more on protein foods like pulses, milk and milk products, egg, fish and meat and vegetables indicating the shift in consumption pattern from cereal based diets to protein based diets due to rise in income. There has been nearly threefold increase of per capita income (at constant prices) in India in the last two decades and poverty has declined from 45% in 1993-94 to 22% in 2011- 12 (Source: Planning Commission Government of India, 2013). The overall demand has been further magnified by huge public expenditure of the government on a number of welfare schemes like rural employment, food security of the poor, subsidies, pension and various allowances. A lion’s share of this expenditure is spent on unproductive and less productive heads. This has increased demand significantly without making much contribution to supply. Naturally, there has been a mismatch between the growing demand and the actual production. The supply response studies in agriculture explain that just increase in price cannot raise production. Adequate infrastructure, proper technology and various supporting factors are necessary for higher production (Nerlove, 1958; Schultz, 1964; Mellor, 1966; Raj Krishna, 1963; Narain, 1965; Feder, 1980). Again, many of these facilities are of public good nature and they are provided by the government. But net public investment in agriculture has declined in India in the recent past (Mani et al., 2011). The Granger causality analysis in Gilbert (2010) has established the role of demand growth, monetary expansion and exchange rate movements in explaining price movements over time. The econometric results of Saghian, Reed and Merchant (2002), however, indicate that agricultural prices adjust faster than industrial prices to shocks in the supply of money affecting short run relative prices but long run neutrality of money does not hold.

The objective of this paper is to analyze the nature and extent of food inflation in India in the last two decades and investigate into the factors behind the price rise. The main query of this study is to see to what extent the growing demand for agricultural commodities in a booming economy with sluggish agriculture can explain the food price inflation in a country like India. The paper has been arranged as follows: Section I introduces the matter, Section II presents a theoretical framework for explaining the price rise of food grains in a two-sector general equilibrium model. Section III provides empirical evidences and econometric results. Section IV gives the summary and policy implications.

2. Theoretical framework

2.1. Agricultural price in a two-sector general equilibrium model

One important feature of agricultural price is that it exhibits sharp fluctuations over time compared to non-agricultural prices. This is because in agricultural production supply can not immediately adjust itself with the changes in demand. Moreover, the elasticity of demand for most of the agricultural products is so low that a small change in supply with demand remaining constant or a small change in demand with supply remaining unchanged causes a large change in price.

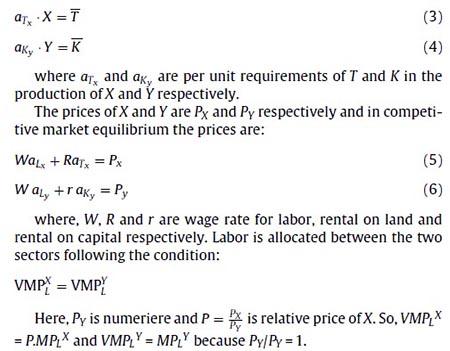

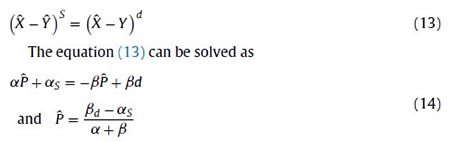

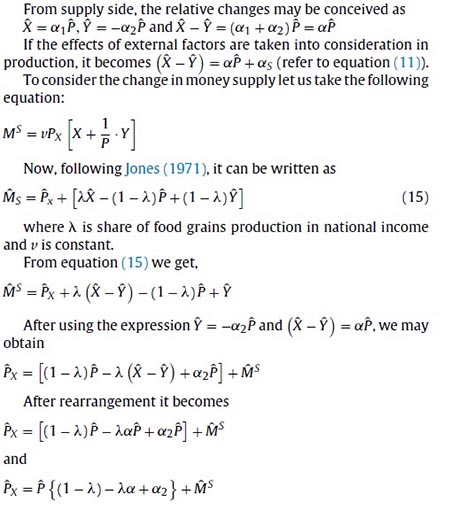

In this section, a theoretical framework of food price inflation has been constructed by using the framework of specific factor model of international trade developed by Jones (1971) and Jones and Marjit (2003) for explaining the price behavior in case of shortage in the agricultural market. Let us consider an economy with two production sectors —Agriculture and Non-Agriculture—. For simplicity, we may assume that agricultural sector produces only food grains and the production of food grains is denoted by X. The production of the Non-Agricultural sector is denoted by Y. The production of X depends on Land (T) and Labor (L) along with other factors like soil fertility, irrigation, public investment, technology and variable inputs which are treated as parameters. The supply of land is fixed and it is specific to agriculture. On the other hand, the production of Y depends on Capital (K), Labor (L) and a set of parameters consisting of technology, infrastructure, human skill and so on. K is fixed and specific to Y. L is mobile between sectors and it is used both in X and Y.

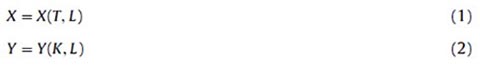

The production functions are:

The production functions follow constant returns to scale with diminishing returns. If more labor (L) is used with the fixed amount of land (T) there will be diminishing returns in the production of X. The same is true for Y. There is full employment of factors:

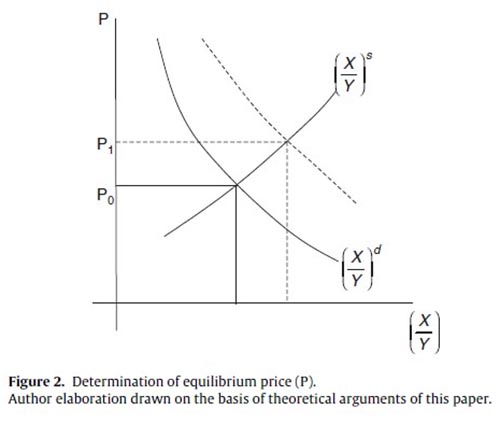

The optimal allocation of labor between the two sectors and equilibrium wage rate are determined in Figure 1.

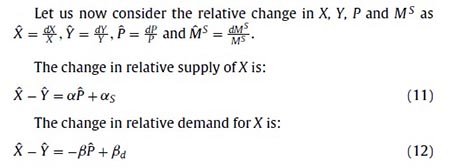

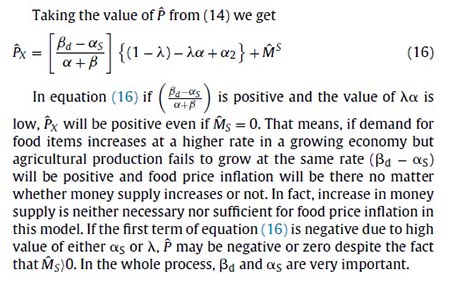

The production of X and Y are determined as

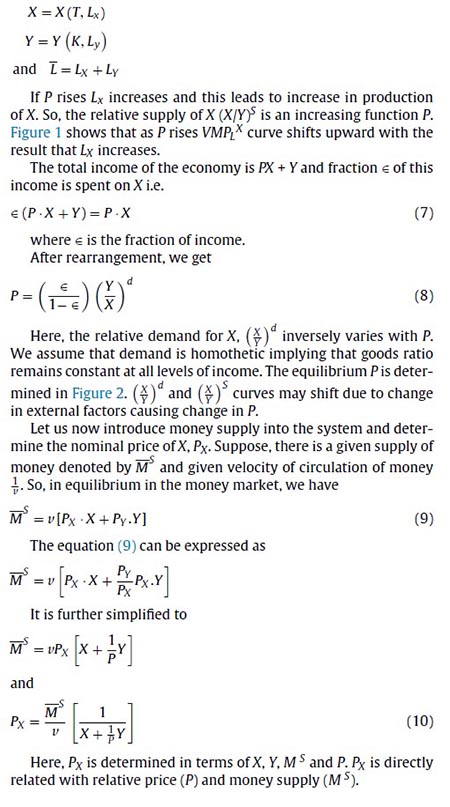

where α is elasticity of relative supply with respect to P and β is elasticity of relative demand with respect to P. αS and βd are elasticity of relative supply and elasticity of relative demand respectively with respect to external factors. αS and βd depend on the factors other than price. The factors may be technology, public investment, income, preference, crop failure, external effects which are taken as parameters in the model.

In equilibrium

The elasticities of supply and demand of food items w.r.t. price are low. So, the values of and are low. Now, if elasticity of food grains production w.r.t. external factors (αS) remains low and elasticity of demand for food grains w.r.t. external factors (βd) becomes high, Ρ will be positive and high. More clearly, if (α+β) is low and (βd− αS) is positive and high, P will be positive, implying that relative price of food grains will increase. α and β are low by nature. αS may be low due to lack of irrigation, decline of public investment, technological backwardness etc. On the other hand, βd may be high due to internal and external factors, higher purchasing power, change of preference, etc.

3. Empirical evidences and econometric results

3.1. Econometric results and discussion

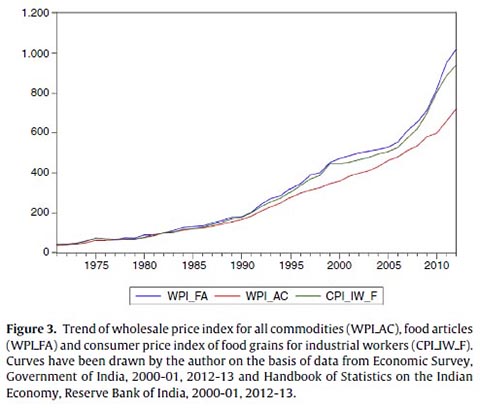

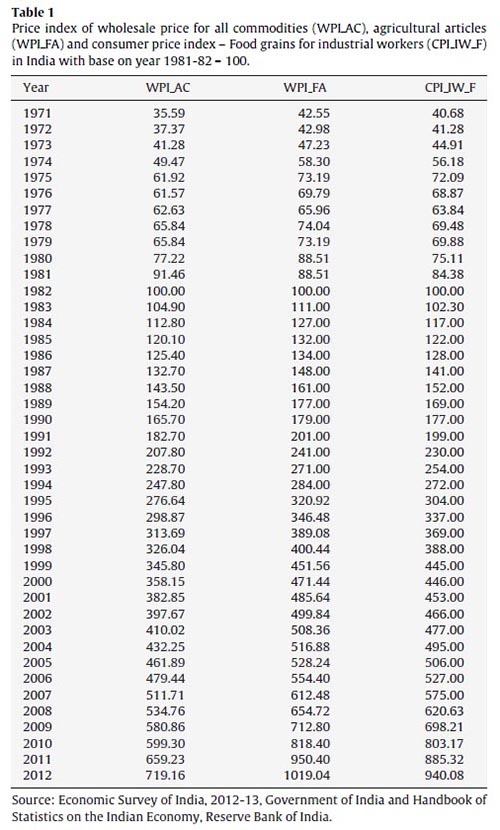

This section gives the nature, trend and magnitude of food price inflation in India and makes econometric analysis using Time Series annual data to provide explanations for the increase of prices of food articles in the country. Table 1 and Figure 3 show that food inflation was moderate in India up to 1990 and after that the price index for food articles started rising sharply and from 2005 onward price rise has remained alarmingly high. It is indicated in Figure 3 that increase of wholesale price index for food articles (WPI FA) was higher than the increase of consumer price index for food for industrial workers (CPI WI F). It is possibly because CPI IW F does not include many high value products like fruits, milk and meat, etc. that have shown tremendous price rise in recent years (see Nair & Eapen, 2012). It is interesting to note that food price inflation both in terms of WPI FA and CPI IW F is much higher than general inflation denoted by the wholesale price index of all commodities (WPI AC). While wholesale price index for all commodities (base 1981-82 = 100) has reached 719.16 in 2011-12, the index for food articles has risen to 1019.16 in the same period (see Table 1).

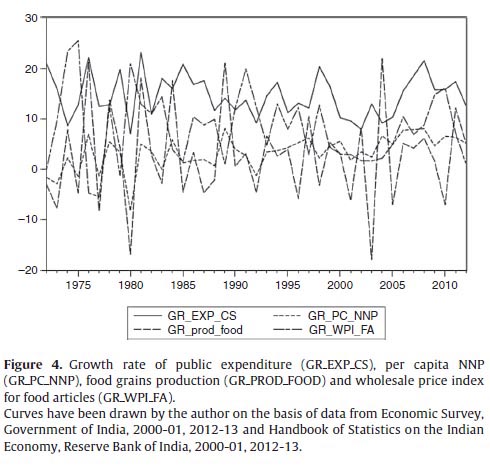

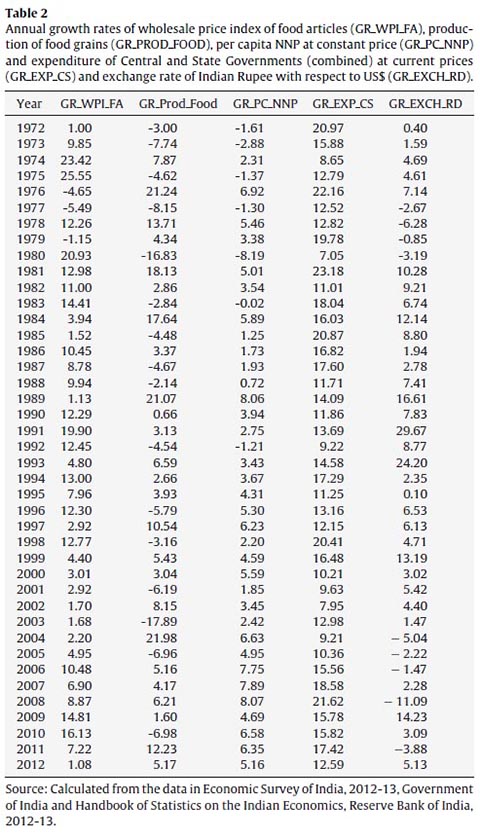

Table 2 shows annual growth rates of wholesale price index for food articles (GR WPI FA), production of food grains (GR Prod Food), per capita NNP at constant prices (GR PC NNP), public expenditure of the central and state governments (GR EXP CS) and Indian foreign-exchange rate with respect to US$ (GR EXCH RD). It indicates that annual price rise of food articles ranges from 6% to 16% for most of the time and prices remained continuously high over the period from 2005 to 2011. It is evident from Table 2 that the annual growth rate of food grains productions exhibits sharp fluctuations and in some years the growth rate has been found to be highly negative. In contrast, growth rate of per capita NNP (at constant prices) has remained consistently positive and high throughout the period since 1993. The growth rate of public expenditure of the central and state governments taken together is very high for the entire period. The growth rate of Indian foreign exchange rate (Indian Rupee per unit of US$) has shown fluctuations over the period although it shows positive trend for most of the time. It is interesting to note that during the period from 2004 to 2011, when agricultural price rise was very high, growth rate of exchange rate was negative. Figure 4 shows the growth rates of wholesale price index for food articles (GR WPI FA), per capita NNP at constant prices (GR PC NNP), production of food grains (GR PROD FOOD) and public expenditure of the Central and State governments (GR EXP CS).

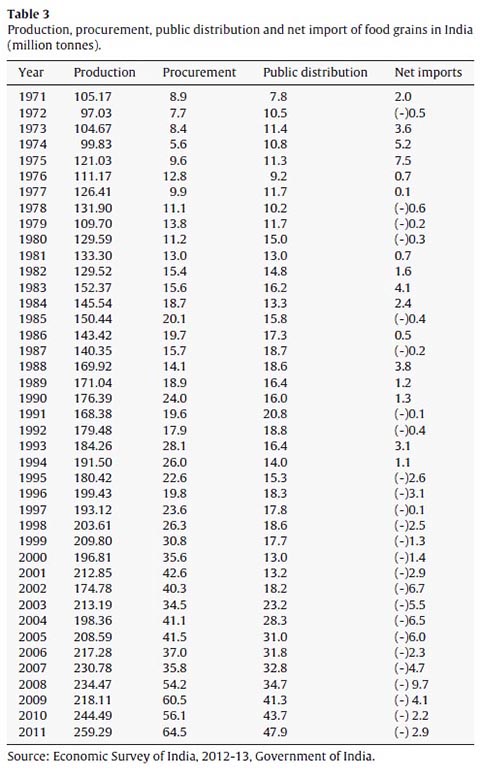

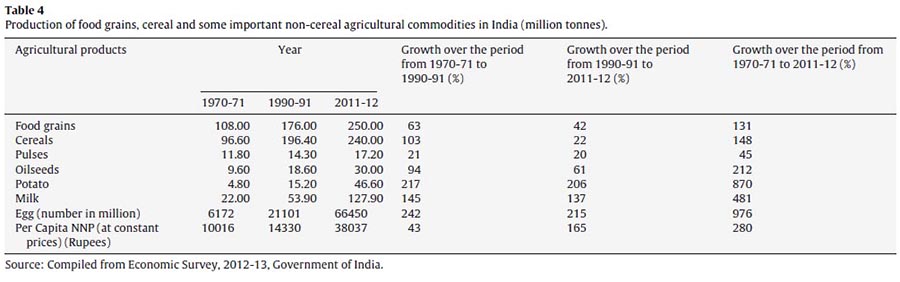

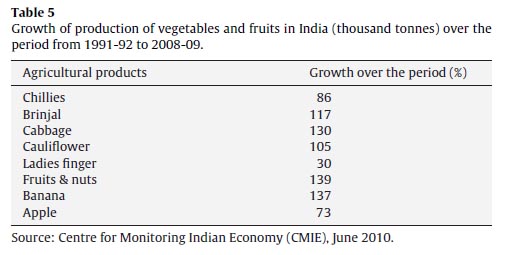

Table 3 shows total production, procurement, public distribution and net import of food grains in India during the period from 1971 to 2011. Both production and procurement have increased over time but the rate of procurement has remained higher than the rate of production. Again, the release of food grains through public distribution system remained lower than procurement. It indicates, government intervention could not be effective in stabilizing the prices of agricultural commodities. Table 3 also indicates that India is a net exporter of food grains for a long period. So, the argument that the effect of global food crisis has been transmitted into the Indian domestic market does not seem to be much convincing. The information in Tables 4 and 5 is very revealing. They show that the growth rates in production of cereal and non-cereal agricultural items are much lower than the growth rate of per capita income (at constant prices). While the per capita NNP has increased by 165% during the period from 1990-91 to 2011-12, the growth rates of food grains, cereal, pulses and oilseeds are found to be much lower than the growth rate of per capita NNP. The growth rates of vegetables and fruits were also less than the growth rate of per capita income.

3.2. Time series analysis

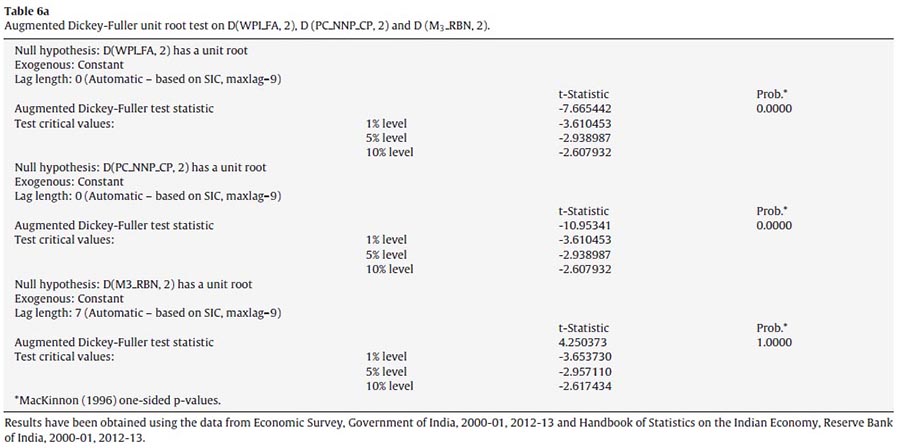

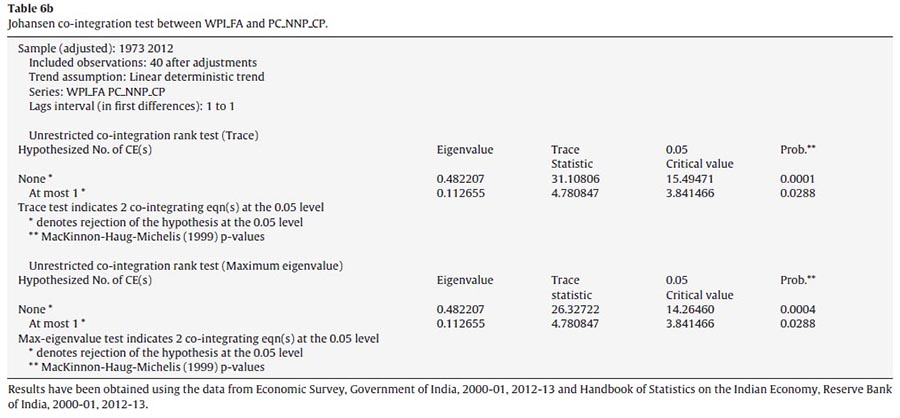

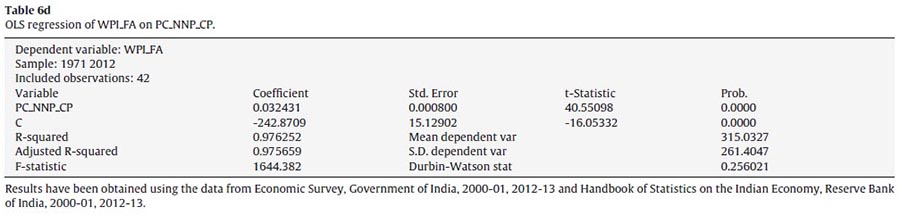

The stationarity of the series WPI FA, GR WPI FA, PC NNP CP, money supply (M3 RBN), growth rate of production of food grains (GR PROD FOOD), growth rate of public expenditure (GR EXP CS) and growth rate of foreign exchange rate (GR EXCH RD) have been checked by using Augmented Dickey-Fuller Test. The results show that WPI FA and PC NNP CP are stationary at 2nd difference. Money supply is non-stationary up to at 2nd difference (see Table 6a). In Johansen Co-integration Test WPI FA and PC NNP CP are found to be co-integrated C(2,2) and in Granger Causality Test, the result shows that PC NNP CP causes WPI FA (see Tables 6b and 6c). This is a very significant and strong result of this study. It establishes that there is meaningful long-run relationship between them and increase in per capita income is an important cause of price rise in the long-run. The regression results in Table 6d show that the adjusted R2 is very high (0.97) and the coefficient is positive and highly statistically significant.

On the other hand, money supply fails to explain the price rise. WPI FA and M3 RBN are not co-integrated implying that there is no meaningful long run relationship between them.

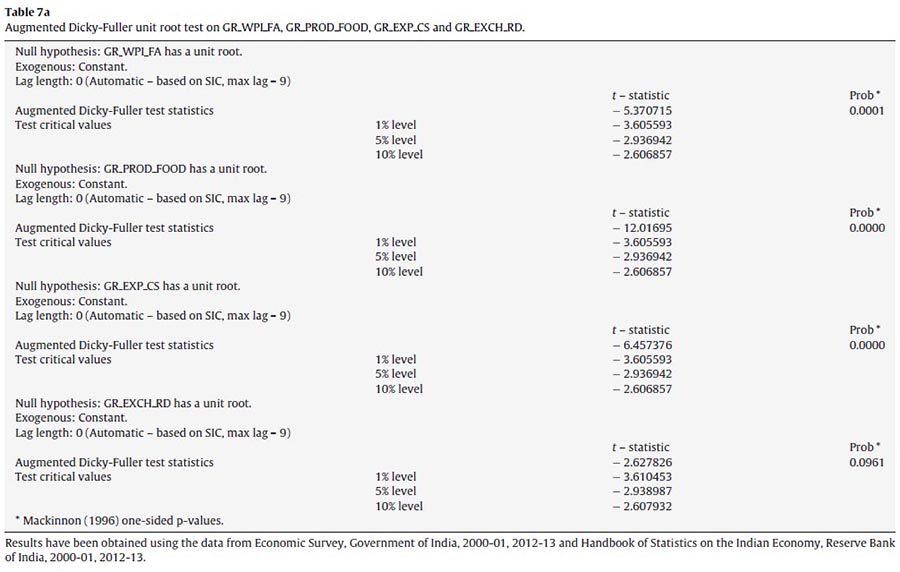

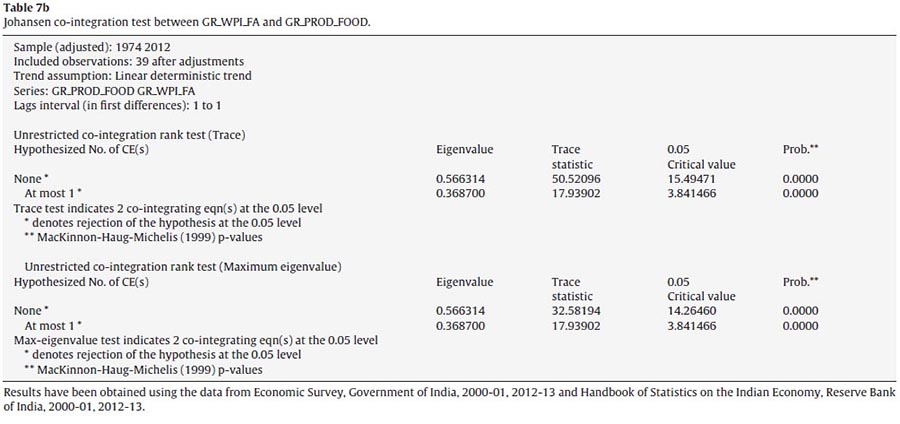

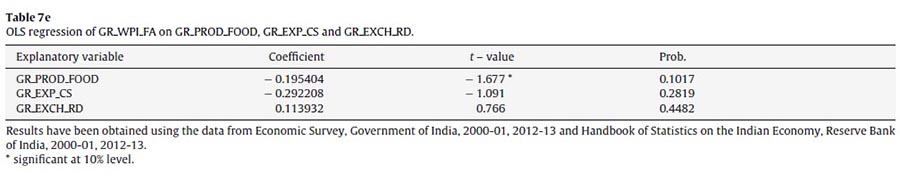

Since we are discussing food price inflation in a sluggish agriculture it is important to examine the relationship between growth rate of food grains production (GR PROD FOOD) and growth rate of prices of food articles (GR WPI FA). GR WPI FA and GR PROD FOOD are stationary at level and co-integrated in Johansen Test (see Tables 7a and 7b). The OLS estimation in Table 7e shows that there is statistically significant negative relationship between GR PROD FOOD and GR WPI FA. The significance of this result is that if supply of food grains declines due to crop failure or any other reasons, price rises. Figure 4 indicates that decline in the growth rate of food grains production is associated with sharp rise in the growth rate of food grains price.

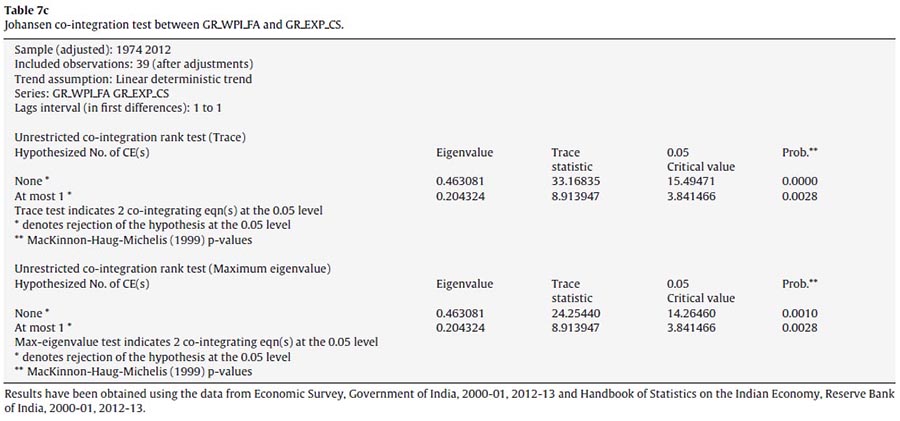

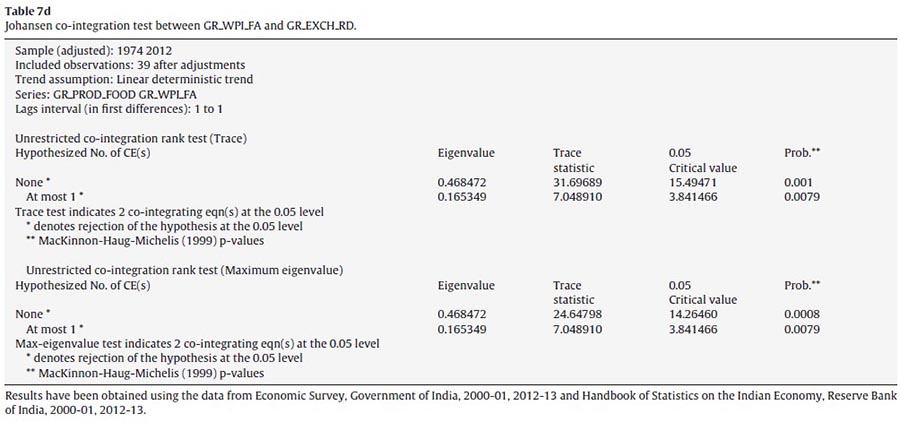

The other two important variables are growth rates of public expenditure of the Central and State governments (GR EXP CS) and Foreign exchange rate of Indian Rupee with respect to US$ (GR EXCH RD). It is theoretically argued that if public expenditure increases it will boost up demand leading to price rise. On the other hand, if the exchange rate (Rupees per unit of US$) rises it will increase the cost of imports putting an upward pressure on price. GR EXP CS, GR EXCH RD and GR WPI FA are stationary at level and they are co-integrated in Johansen Test although the results are not robust (see Tables 7a–7e). That means, public expenditure and foreign exchange rate have effects on agricultural prices but they are not very significant because there is no causality between them. The regression coefficients are also not significant (see Table 7e).

What finally comes out of this study is that it is the growth of per capita NNP that significantly explains the food price inflation in India. The sluggishness of agricultural production also accounts for the price rise. The market imperfection, government intervention and external trade do not seem to have any significant effect on food prices in the long run. Similarly, the effects of growing public expenditure and unfavorable foreign exchange rate are found to have some effects on agricultural price in the long run although the results are not very robust.

4. Political implications

4.1. Food price and the poor

Food price inflation has significant political implications. It reduces purchasing power and consumption level of the poor. Pinstrup-Anderson (1985) has found that low income consumers in developing countries typically spend 60-80% of their incomes on food and due to increase of food prices, real income decreases by 5.5% to 9% at the lowest decile. He has also shown that price elasticity of demand for rice for low income groups ranges from 1.23 to 4.31. Therefore, increasing food prices have serious welfare implications for the poor. Among the measures adopted by the government to give some relief and food security to the poor subsidy on food is an important one. The subsidy on food provides social safety net to the poor. The government of India allocates a hefty amount from the annual budget for procurement and distribution of food grains for this purpose. But the policy has now come under serious criticism because of its large contribution to budget deficit, economic inefficiency and poor targeting (Sharma, 2012). The subsidy on food in India has significantly increased in the post-reform period. In the years 2011-12, the amount of subsidy was Rupees 72,283 crore (Sharma, 2012) and in the annual budget of 2014-15, this amount has been raised to Rupees 1,15,000 crore (Reserve Bank of India Bulletin, 2014). But the problem is that a sizeable portion of this huge subsidy does not reach the target groups due to corrup- tion, and lack of good governance and proper delivery mechanism. So, more effective policy measures are needed in this respect.

4.2. Public expenditure and food price inflation

The increase of public expenditure of the Central and State governments, though not very robust, has been found to be a cause of food price inflation in this study. The expenditure has increased at a rate of 10-20% per annum. But nearly 50% of this expenditure is spent on non-developmental purposes. More than 80% of the total expenditure of the Central government is spent on the heads of revenue expenditure that include salaries and wages, subsidies, pension and interest payment on loan. This huge expenditure increases demand in the market without contributing much to production. Sasmal (2011) demonstrates that if political gain from distributive expenses is higher, the government will have a tendency to spend more on such heads at the cost of long term growth. In fact, the government has a political compulsion in this matter. In India, National Rural Employment Guarantee Act (NREGA) has been passed and implemented to ensure employment to the jobless poor rural workers at statutory minimum wage rate and huge budgetary provisions are there for carrying out this scheme. In 2012-13 annual budget of the Central government financial allocation for NREGA is Rupees 90 000 crore which is more than 6% of the total budget. The problem with this scheme is that it does not help asset creation and production of the country to any significant extent although it boosts up demand in the market and puts huge financial burden on the government. As a result, the scheme has been brought under political controversy.

4.3. Agricultural growth and the role of the Government

The sectoral imbalance in GDP growth has serious consequences on the whole economy. Ray (2010) provides a framework for research in development economics in the context of uneven growth. India has achieved high rate of overall growth in the post-liberalization period largely banking on the expansion of the service sector which is growing at the rate of 10-12% per annum against less than 2% growth of the agricultural sector. The government has remained complacent with overall GDP growth and less attention has been given to the production sector. Especially agricultural has been grossly neglected by the government in the recent past. Overall growth and private investment in agriculture are conditional on public investment. Mani et al. (2011) have shown that real public investment in agriculture in India (in billion Rupees) has declined from 104.96 in the period 1979-80 to 1981-82 to 37.15 in 1999-2000. As a result, rate of annual investment in agriculture has gone down to 0.93% from 2.43% during this period. Now it has become imperative for the government to take appropriate measures to keep pace with the growing demand. Instead of dolling out money in the name of social security and welfare of the poor the government needs to allocate more funds for irrigation, agricultural research, technological innovations and resource management keeping in mind that government has a big role for agricultural growth in developing countries.

5. Summary and policy implications

India is experiencing high rate of GDP growth in the last two decades. But the growth has remained uneven across sectors and it has been associated with high rate of food price inflation. The demand for food articles has increased significantly with increase in per capita income over the years. But agricultural production has remained sluggish and failed to keep pace with the growing demand. The huge public expenditure of the government every year, mostly on unproductive or less productive heads has further magnified the demand. On the other hand, resource degradation, technological stagnation, lack of infrastructure and fall in public investment have created bottlenecks for increasing agricultural production. This paper has tried to analyze the trend and causes of food price inflation in India theoretically and with the help of econometric exercises.

A two-sector general equilibrium model has been constructed in the framework of specific factors trade model to demonstrate theoretically that if demand for agricultural commodities increases significantly due to increase of income and other external factors but supply fails to increase proportionately, agricultural prices will increase. In econometric exercise time series analyses have been done to verify the long run relationship between wholesale price index for agricultural commodities, per capita NNP and growth rate of food grains production. The effect of public expenditure, money supply and foreign exchange rate on agricultural prices has also been examined.

Empirical evidences suggest that food crisis in the global market in the recent years does not have much impact on India’s domestic food price. The government intervention into the food grains market also fails to explain the phenomenon of price rise in the country. The time series analyses strongly establish that per capita income and wholesale price index for food articles are co-integrated and increase in per capita income has significant positive impact on food prices. The growth rate of food grains production is co-integrated with agricultural price index and a negative relationship between them has been obtained in the long run. This study finds no meaningful long run relationship between money supply and agricultural price. On the other hand, growing public expenditure and unfavorable foreign exchange rate are found to have impact on price although the results are not very robust.

Acknowledgement

The author expresses his thanks and gratitude to the anonymous Reviewer and the Editor of the Journal for the valuable comments on this paper. He also expresses his indebtedness to Professor Sugata Marjit for his help in writing this article. The help of Ritwik Sasmal is acknowledged. The usual disclaimer applies.

References

Baltzer, K. (2013). International to domestic price transmission in fourteen developing countries during the 2007-08 food crisis. WIDER Working Paper No. 2013/031, World Institute for Development Economic Research. [ Links ]

Bhullar, A. S., & Sidhu, R. S. (2006). Integrated land and water use–A case study of Punjab. Economic and Political Weekly, Dec. 30. [ Links ]

Basu, K. (2011). India’s food grain policy: An economic theory perspective. Economic and Political Weekly, Jan. 29.

Carrasco, B., & Mukhopadhyay, H. (2012). Food price escalation in South Asia. Economic and Political Weekly, Nov. 17. [ Links ]

Feder, G. (1980). Farm size, risk aversion and the adoption of new technology under uncertainty. Oxford Economic Papers, 32(2), 263–283. [ Links ] Gilbert, C. L. (2010). How to understand high food prices. Journal of Agricultural Economics, 61(2), 398–425. [ Links ]

Gulati, A., & Saini, S. (2013). Taming food inflation in India. Discussion Paper No. 4, Commission for Agricultural Costs and Prices, Ministry of Agriculture, Government of India. [ Links ]

Jones, R. W. (1971). A three-factor model in theory, trade and history. In J. Bhagawati, R. Jones, R. Mundell, & J. Vanek (Eds.), Trade, balance of payments and growth. North-Holland: Amsterdam. [ Links ]

Jones, R. W., & Marjit, S. (2003). Economic development, trade and wages. German Economic Review, 4(1), 1–17. [ Links ]

Krishna, R. (1963). Farm supply response in India–Pakistan: A case study of the Punjab region. Economic Journal, September. [ Links ]

Mani, H., Bhalachandran, G., & Pandit, V. N. (2011). Public investment in agriculture and GDP growth: Another look at the inter sectoral linkages and policy implications. Working Paper No. 201, Centre for Development Economics, Delhi School of Economics. [ Links ]

Mellor, J. W. (1966). The economics of agricultural development. Cornell University Press. [ Links ]

Nair, S. R., & Eapen, L. M. (2012). Food price inflation in India (2008-2010). Economic and Political Weekly, May 19. [ Links ]

Narain, D. (1965). Impact of price movement on area under selected crops in India: 1900-39. Cambridge University Press. [ Links ]

Nerlove, M. (1958). The dynamics of supply: Estimation of farmers’ response to price. John Hopkins University Press.

Nicholls, W. H. (1955). Imperfect competition in agricultural industries, in H. G. Halcrow (ed.) Contemporary Readings in Agricultural Economics. [ Links ]

Osborne, T. (2005). Imperfect competition in agricultural markets: Evidence from Ethiopia. Journal of Development Economics, 76(2), 405–428. [ Links ]

Pinstrup-Anderson, P. (1985). Food prices and the poor in developing countries. European Review of Agricultural Economics, 12(1-2), 69–81. [ Links ]

Planning Commission, Government of India (2013). Press note on poverty estimates, 2011-12. [ Links ]

Ray, D. (2010). Uneven growth: A framework for research in development economics. Journal of Economic Perspective, 24(3), 45–60. [ Links ]

Reserve Bank of India Bulletin. (2014). September 10. [ Links ]

Robles, M. (2011). Price transmission from international agricultural commodity markets to domestic food prices: Case studies in Asia and Latin America. Washington, DC: IFPRI. [ Links ]

Saghian, S. H., Rein, M. R., & Merchant, M. A. (2002). Monetary impacts and over shooting of agricultural prices in an open economy. American Journal of Agricultural Economics, 84(1), 90–103. [ Links ]

Sarkar, A. (1993). On the formation of agricultural prices. Journal of Development Economics, 41(1), 1–17. [ Links ]

Sasmal, J. (2003). Agricultural price and price policy and agricultural trade liberalization in India. Artha Beekshan, 12(1), 25–37. [ Links ]

Sasmal, J. (2011). Distributive politics, nature of Government spending and economic growth in a low income democracy. Journal of Economics, Finance and Administrative Science, 16(30), 31–49. [ Links ]

Sasmal, J. (2012). Resource and technology as constraints to growth in agriculture: The Indian experience. Conference proceedings in International Journal of Arts & Sciences, Paris, France, 5(3), 57–70. [ Links ]

Schultz, T. W. (1964). Transforming traditional agriculture. Yale University Press. [ Links ]

Sharma, V. P. (2012). Food subsidy in India: Trends, causes and policy reform options. Working Paper No. 2012-08-02, Indian Institute of Management, Ahmedabad, India. [ Links ]

Corresponding author:

E-mail address: joydebsasmal@yahoo.co.in

Received 21 February 2014

Accepted 30 January 2015