Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Journal of Economics, Finance and Administrative Science

Print version ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.21 no.40 Lima June 2016

Article

Does innovation strategy affect financial, social and environmental performance?

¿Afecta la estrategia de innovación al rendimiento financiero, social y ambiental?

Ferdaws Ezzia1; Anis Jarbouib2

1PHD, student in Financial and Accounting Methods: LARTIGE Sfax, University of Gabes, Gabes, Tunisia

2Doctor and HDR Financial and Accounting associate professor of Universities Higher Institute of Business Administration (ISAAS), University of Sfax, Tunisia

Abstract

In the very study, the emphasis lays on the specific problem of analyzing the impact of the innovation strategy (in particular investment in research and development) on the financial, social and environmental performance. After discussing this subject theoretically, we propose our research hypotheses which, in turn, will be corroborated by an empirical study of 96 Tunisian companies. Indeed, the results are noteworthy and important to the extent that one can say that the innovation strategy has a crucial impact on the performance of the companies.

Keywords: Innovation strategy. Social performance. Financial performance. Environmental performance.

Resumen

El énfasis de este estudio recae sobre el problema específico del análisis del impacto de la estrategia de innovación (en concreto, las inversiones en investigación y desarrollo) sobre el rendimiento financiero, social y ambiental. Después de analizar este asunto desde el punto de vista teórico, se propone una hipótesis de investigación que, a su vez, deberá ser corroborada por un estudio empírico de 96 empresas tunecinas. De hecho, los resultados son destacados e importantes, y permiten decir que la estrategia de innovación tiene un impacto crucial en el rendimiento de las empresas.

Palabras clave: Estrategia de innovación. Rendimiento social. Rendimiento financiero. Rendimiento ambiental.

1. Introduction

In recent years, there has been a shift from a single-criterionperformance model to a several-criteria performance model that incorporates the expectations of the different stakeholders; namely, the shareholders, the customers, the employees and so on. The performance indicators are a major tool of the management control system. Their importance resides in the performance measurement and in the control of the resource allocations. Accordingly, the company is usually expanded to maximize not only its financial performance but also its social and environmental performance. This concept is presented as a precautionary stakeholder model established by Freeman (1984) who highlights the problem of profitability. CSR was defined by Bowen (1953) as the prerequisite that business leaders must implement. CSR entails strategies, decisions and practices that go along with the goals and values of the community in general. In the 1990s, CSR became the crux of the matter of the long-lasting development within the company. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). F. Ezzi, A. Jarboui / Journal of Economics, Finance and Administrative Science 21 (2016) 14–24 15.

Thereafter, Hoffman and Bansal (2012) stated that companies must consider the environmental issues as a strategic problem by focusing on the relationship between the company and its environment. Caroll (1979) provided a conceptual model based on three dimensions: the principles, manner, and the values of social responsibility. Wartick and Cochran (1985) maintained CSR as the principles which incorporate the structure of this notion; the procedures that were implemented to develop the ability to be socially responsible and the policies resulting from this same ability. Equally important, Wood, George-Falvy, and Debowski (1991) proposed a model that incorporates the principles, the procedures, the organizational practices and responsibility as well as the results brought about by the actions and the choices carried out by the company.

Whereas, some researchers keep integrating the study of the relationships between business and environment (Business and Natural Environment) in the field of study of the relationship of the concept CSR. The relation between this concept and the financial performance builds the concept of total performance. Hence, the company grows so as to maximize not only its financial performance but also its social and environmental performance. So, the company chooses to be established in several projects, strategies and others which aim at growth, profitability and perennial. In this context, companies are seeking to be distinctive either by creating, renewing or maintaining by means of innovation and diversification through their divisions. Therefore, it resorts to set up in several projects, strategies and others which aim at growth, profitability and sustainability. Hence, the study of the effect of innovation on the corporate performance becomes a key issue. Meanwhile, we will try to find an answer to the question of the effect of the innovation strategy on the financial, social and environmental performance by referring to the theories that have shown the effect of the innovation strategy on the business performance.

Our objective is to study the effect of innovation strategy on the financial, social and environmental performance of the Tunisian companies; the main contribution of this work is to explain how the innovation strategy can affect not only financial performance but also social and environmental performance, thatweapplied the method of rating agency KLD to the Tunisian companies. The results are noteworthy and important to the extent that one can say that the innovation strategy has a crucial impact on the performance of the companies.

This article is structured as follows: Section 2 presents the related literature and the theories which motivate the empirical work; Section 3 presents the hypotheses will be tested, Section 4 discusses the empirical strategies that were adopted; and Section 5 presents the main results and discussion.

2. The theoretical grounds for the relationship between the innovation strategy and the performance companies

Many theories have addressed the relationship between the innovation strategy and the corporate performance in order to answer the question of the effect of the strategic choice on the business performance.

2.1. Industrial approach

This approach stems from the work of Mason (1939) and Bain (1951) in industrial economics. Such an approach considers the effect of the industrial structure on the types of the strategies adopted by the companies which explain the business performance. Again, the works of Caves and Porter (1977) affirm that the company can be successful only when it occupies a remarkable position in the product market and maintains it by setting barriers at the entry (according to the industrial approach).

2.2. The Chicago School

In this school, businesses are different and do not have the same skills to achieve the same performance. So, the skills of the individuals and theworkteams thatmakeupthe business play a significant role in the strategic choice within the companies. This role has an effect on the corporate performance when the company is more efficient than its competitors. (Demsetz, 1975; Stigler, 1964). In this context, the strategic choice affects the business performance since the differences in the efficiencies stemming from this choice have a direct impact on the corporate performance.

2.3. The resource-based view

This theory emerged in the mid 1980s in the work of Rumelt (1984) and Barney (1985). Durant (1997) says that "the development of the firm depends not only on its external position and the defensive game to which it is subject, but a part of its success also depends on the resources that it possesses and on the way it behaves to offer the services to its customers". In this theory, the company is a combination of natural productive resources, physical and human; they can be both tangible and intangible. With these resources, it can create a competitive advantage; that is to say, its performance is higher than its competitors’ (Penrose, 1959; Barney, 1991, 1985; Grant, 1991). According to Porter (1986), the competitive advantage "mainly lies in the value that a firm is able to create for its customers". The resource is "an appropriate and relevant theoretical framework to really understand the origin of the firms’ performance": Referring to this theory, recent researches are inclined to the relationship between innovation (in terms of product, market, labor, culture...) and organizational performance. In a complex innovative, unstable and turbulent environment, the companies can adapt thanks to their internal resources and skills. Wernerfelt (1984) shows that a company that is able enough to develop and use its skills and strategic resources is more efficient than one that is unable to manage its internal skills and resources. According to this theory, innovation may carry annuities due to the difference in efficiency between companies (if different from the Chicago School). The company resources can be the key of its success because they enable it to increase its production and to create values (Hunt, 2000, Hunt & Morgan, 1995). The companies with good resources and skills, in fact, choose the best strategies to produce effective and efficient products that meet the customer needs; that is how social performance can be fulfilled.

2.4. The agency theory

The agency theory highlights the conflicts of interest between the stakeholders in the firm. According to Albouy (2006), "to create value for the shareholders is to have the customers satisfied with the good products, developed by motivated employees and quality, together with the best suppliers and subcontractors by complying with the regulations imposed by the authorities". In this context, it is worth mentioning that the decision of innovation in an uncertain project may increase the conflicts of interest between the shareholders and the managers because they do not have the same degree of risk aversion. In other words, the shareholders are willing to endure a higher level of risk than the leaders since they have a diversified portfolio that assumes that diversification reduces the risk. In contrast, the leader chooses a less risky strategy to guarantee the employment security and the short-term profitability since his wealth depends to a great extent on the value of the company that he runs which would be in the interests of shareholders (Charreaux, 1993). This can lead to major investment issues (Porter, 1992): the efficient allocation problems of corporate resources (Jensen & Meckling, 1976) which are the agency costs.

2.5. The transaction costs theory

Williamson (1994) analyzes the investment decision as a particular transaction in which the degree of the asset specificity plays an important role. The transaction costs are presented by Coase (1937) and, then, taken up and developed by Williamson (1975). These costs are many and include the information search costs and negotiation before signing a contract (ex ante transaction costs) and the costs of monitoring the implementation of this agreement after signing the contract (ex post transaction costs). Williamson (1985) thinks that a couple of behavioral concepts result from these costs: bounded rationality and opportunism. These two factors explain the failure of the markets to function efficiently. Simon (1957) argues that bounded rationality is the cognitive hypothesis on which the economy of transaction costs is based (Williamson, 1993). In fact, it is the inability of the agents to be fully informed and to treat all the reliable information available which leads to incomplete contracts and to the emergence of the phenomenon of opportunistic behavior. Indeed, Williamson (1993) developed the concept of opportunism which means that the agents seek to serve their own personal interests. According to Brousseau (1993) "the officers are sufficiently rational to try to benefit from the gaps and shortcomings of the contractual arrangements they establish". Indeed, Williamson (1994) distinguishestwo types of opportunism: the first is the ex ante opportunism which consists in the manipulation or the non-disclosure of information prior to the award of a contract to obtain a better deal. The second is the ex post opportunism that is the temptation of the contracting parties to change the terms of the contract. Hence, there comes the incompleteness of contracts between the agents (moral risk).

2.6. A strategic approach

Unlike the agency theory that does not effectively describe the managerial behavior, Lane, Kasian, Owens, and Marsh (1998) say that the leaders will not be selfish and opportunistic if their interests are not directly and clearly at stake. Consequently, the share-structure is slightly related to diversification. The explanation of the strategic decisions based on the shareholders’ control is not satisfactory because the outside shareholders, even the majority, do not have enough information to evaluate the strategic decisions. As part of the strategic theories of corporate governance, the board of directors is considered a cognitive tool helping to create skills (Charreaux, 2000). These theories also assign the board of directors a different role from that in the contractual theories (financial and partnership). Indeed, Charreaux (2000) believes that "the intangible nature of the new economy and the role played by innovation and knowledge make us reconsider the corporate governance and, therefore, the function of the Board of Directors". The Board of directors facilitates the development of skills and assists in the production of new opportunities; in short, it contributes to the innovation process.

2.7. The stewardship theory

There is a big difference between the agency theory and the stewardship theory. The first proposes a conception of man as an actor with a rational character seeking to maximize his interests; it is an economic approach based on the leaders’ opportunism. The second is based on a sociological and psychological approach in which the agent seeks to maximize his interest by respecting the interests of the organization to which he belongs (Donaldson, 1990; Donaldson & Davis, 1991; Davis, Schoorman & Donaldson, 1997); hence, the convergence is between the shareholders and the managers. In this theory, the board of directors can play its role (Charreaux, 2000) this approach proposes to go beyond the main limitations of the agency theory in which the managers behave as "good stewards" who are not necessarily motivated by individualistic goals. Their objectives can easily converge on those of the shareholders. Indeed, the manager may agree on a high value of cooperation. This theory is not limited to the issue of financial incentives, but it recognizes a number of non-financial reasons (R & D) of managerial behavior and gives an intrinsic motivation to act in favor of the interests of the organization without any need to an external control and supports the idea of the active school which enhances the strategic role of the board of directors (Hung, 1998; Stiles, 2001). This motivation leads to a long-term trust between the officer and the shareholder. According to Muth and Donaldson (1998) "the boards dominated by inside directors contribute to the depth of knowledge, expertise and the commitment of the firm; thus, this facilitates the board to play its active strategic role".

2.8. The cognitive theory

"The governance theories do not aim to study the way the leaders reign —which would lead to confuse governance and management— but the way they are governed". (Charreaux, 2004). The works of Berle and Means (1932) are the first to highlight the birth of the corporate governance concept by introducing the impact of property on the business performance. They deduce that the larger the leader’s capital in the company is, the higher the financial performance will be (financial governance) (Jensen & Meckling, 1976; Daily, Dalton, & Cannella, 2003). Like the stewardship theory, the cognitive theory is also characterized by the fact of improving the efficiency of the leaders in the company. This efficiency allows creating the value that requires research and development as well as managerial skills (Wirtz, 2006). The officer will be cautious of his decisions since they influence performance (Rindova, 1999; Charreaux, 2004). The cognitive theory is linked to the leader’s behavior. Therefore, a new theory is born; namely, the behavioral governance (Charreaux, 2011). The behavioral biases affect the agency costs (Charreaux, 2011). "Propose an integrating approach to the latitude that can offer a better understanding of the relationship between the characteristics of the leader, governance and the firm performance" (Charreaux, 2008a,b). In this, Charreaux combines the different theories (cognitive, behavioral, disciplinary, and strategic) in a model that characterizes the upper levels theory (Hambrick & Mason, 1984). It is based on the fact that the environment has a direct effect on the type of the leader who in turn affects the strategic choices and the performance of the firm. According to Charreaux (2011), the cognitive theory attaches importance to the capacity of the firm to innovate, to create the investment opportunities and to change the environment. "The firm is able to learn and to create knowledge. Thus, the notions of learning, competence and innovation have become increasingly crucial to understand the value creation process. Therefore, governance is apprehended by its ability to influence the creation of value through the cognitive lever; for example, by facilitating innovation. Such a concept is associated with the «cognitive" model of governance".

3. The hypotheses to be tested

When they studied the effects of the organizational characteristics on the ability of the firm to innovate, Hage and Aiken (1970) showed how it is complex to know the number of specialties within the firm is positively related to the innovation capacity. Equally important, Grabmeier (2002) stated that "diversified firms are more innovative than the specialized ones in the creation of new products and in the investment in research and development". Others argue that the diversified firms invest more than the specialized companies in R&D activities. In this section, we will try to verify the effect of the innovation strategy on the corporate performance.

3.1. The relation between research and development (R&D) and financial performance

Many studies have kept a waking eye on this topic to better understand the relationship thatmayexist between innovation and financial performance. Generally, such researches confirm the positive effect of investment in R&D on the corporate performance. This relationship has been considered by several researchers such as Schroll and Mild (2011), Van de Vrande, DeJong, Vanhaverbeke, and Rochemont (2009), Börjesson and Löfsten (2012), Colombo, Laursen, Magnusson, and Rossi-Lamastra (2012), and Parida, Westerberg, and Frishammar (2012).

The study of Del Monte and Papagni (2003) shows that the firms that are engaged in the R&D activities have a higher growth rate than the ones those are not. Additionally, Geroski, Machin, and Walters (1997) find a positive relationship between innovation and the competitiveness of the firm and, thus, its performance.

Johnson and Pazderka (1993) argue that there is a positive relationship between R&D and the market value of a firm. Berrone, Surroca, and Tribo (2007) think that investment in R&D has a significant effect on the company performance. Yet, Kothari, Laguerre, and Leone (1998) argue that the innovation based on R&D is more uncertain than investment in equipment. This may adversely affect the business performance.

O’Brien (2003), however, concludes that investment in R&D improves the competitiveness of the company. Griliches (1981), Hirschey and Weygett, 1985; Cockburn and Griliches (1988), and Hall (2000) argue that the company market value is a function of the market value of the company’s tangible and intangible assets. The R&D expenditures are positively and significantly correlated with the market value of the business.

Ben-Zion (1984), Connolly and Hirschey (1984) and Pakes (1985)comeup with the same result: a positive and significant relationship between the R&D expenditures and the market value of the firm. This result is also substantiated by the studies of Blundell, Griffith, and Van Reenen (1999) and Toivanen, Stonenman, and Bosworth (2002). Also, the study of Bae and Kim (2003) was conducted in three contexts: American, German and Japanese. It shows that the effect of the investment in R&D on the market value of a firm is positive and significant in all countries and is stronger in the case of the Japanese companies. In this context, several studies find a positive correlation between R&D and the market value (Hirschey & Weygett, 1985; Chung & Jo, 1996; Agrawal & Jayaraman, 1994; Bosworth & Rogers, 1998 and Cockburn & Griliches, 1988).

Erickson and Jacobson (1992) conclude that the R&D expenditure of a firm is positively related to financial performance. Yew, Mira, and Chee (2006) declare the existence of a positive relationship between the investment in R&D and the company growth opportunities. Nevertheless, the studies of Hung, Lee, and Lin (2006) come up with the fact that such a relationship is not significant. Merino, Srinivasan, and Srivastava (2006) think that the R&D expenditures have no significant effect on the share-value.

Jarrell, Lehn, and Marr (1985), Woolridge (1988) and Woolridge and Snow (1990) believe that the financial market reacts positively when the investment in research and development is announced. In fact, these results are confirmed by Lichtenberg and Siegel (1991) and John, John, and Sundaram (1996) and Bloch (2003) and Chan, Faff, Gharghori, and Ho (2007) show the existence of a significant and positive relationship between the stock returns and R&D.

The research of Chan et al. (1990), Zantout and Tsetskos (1994) and Szewczyk, Tsetsekos, and Zantout (1996), show that the announcement of the increase in R&D expenditures positively affects the returns of securities. According to Lantz and Sahut (2005), the investment in R&D has a significant effect on the financial performance in terms of profitability and risk. Sougiannis (1994) concludes that there is a correlation that implies the existence of a significant and positive relationship between R&D and the operating incomes. In contrast, the study of Casta et al. (2007) shows that the R&D costs have a negative impact on the operating income. To sum up, the previous studies tend to present conclusive results about the impact of R&D expenditures on the performance of a company. This impact can be either positive or negative.

It is in this sense our fourth assumption is made.

H1. Investment in R&D has a (positive or negative) effect on the financial performance of a company.

The companies have to face a new dimension of profit and performance. It is the social performance. Indeed, Quairel (2006) thinks that the company must show that it is "economically viable, socially responsible and environmentally sound". So, we must wonder about the impact of the innovation strategy on the social performance.

3.2. The impact of R&D on the corporate social performance

This new dimension requires the business enterprise to be part of the social change. The goal of innovation is to achieve a new kind of balance that not only takes into account the financial performance but also includes responsibilities related to the sustainable development. According to Oltra and Saint Jean (2011), the integration of innovation in the company is a response to the customer’s requests.

For Florida (1996), the customer’s demand helps carry out innovation within the company. The econometric results of Horbach (2008) confirm the assumption that the existing demand motivates the companies to innovate. So, the goal of every business is to meet the expectations of the customers; thus, innovation positively affects the social performance of the company. Lev and Sougiannis (1996) show the existence of a direct and positive correlation between investment in research and development and performance (in terms of the shareholders’ satisfaction).

Groff and Nguyen (2012) assert the high significance of the variable "actual or anticipated demand" for product innovations for all sectors (can be customer demand, customers or shareholders). It is the notion of stakeholders that comes here. According to the work of Gallaud, Martin, Reboud, and Tanguy (2012), "demand can integrate the incentive role of the group, shareholders, suppliers or even the employees".

According to the stakeholder theory (Freeman, 1984), the institutions "should take into account the conflicting expectations of the different interest groups". In contrast, Simpson, Siguaw, and Enz Cathy (2006) believe that innovation is costly and risky; it negatively affects the results and increases the costs and the employees’ dissatisfaction. Accordingly, one may say that there is a negative relationship between innovation and social performance.

These results denote that the relationship between innovation and social performance is complex and requires more research. But most empirical studies suggest a positive relationship between the innovation strategy and the social performance of the companies. Hence, our hypothesis will explore whether:

H2. The innovation strategy has a positive impact on the corporate social performance.

Besides the financial and social performance, today we talk about a new concept of performance that can have a relationship with the innovation strategy because the ways of thinking keep changing and the companies always seek to fulfill the satisfaction of the customers, the employees and so on. Therefore, the concept of environmental performance evolves.

3.3. The impact of R&D on the environmental performance of the companies

Kemp et al. (1994) argue that the "techniques, processes and products can eliminate or reduce the emission of pollutants and/or the use of raw materials, natural resources and energy". Oltra (2008) considers the impact of innovation on the environmental performance is based not only on research and development, but also on technology since the existence of new technologies urges the companies to innovate and to develop new environmental approaches.

Brouillat (2008) argues that the companies are more or less encouraged to engage in environmental trajectories that may require high internal research efforts (R&D). Freeman (1984) state that innovation by changing the "technological systems" upsets the technical and economic foundations of industry.

The works of Baker and Sinkula (2002), Balkin, Markaman, and Gómez-Mejía (2000); Darroch and McNaugton (2002), Lyon and Ferrier (2002), Scherer (1992), Utterback (1994) Vrakking (1990) and Wolfe (1994) show that innovation enables the company to cope with the environmental changes and, subsequently, research and development is very important to achieve environmental performance.

Therefore, one may proclaim that there is a positive relationship between innovation and environmental performance. Besides, Brown and Eisenhard (1995) and Miles and Snow (1978) have shown, after the environment turbulence, that the companies that are able to innovate can challenge environmental problems better than non-innovative ones. They can also take advantage of the market opportunities. Additionally, Wright, Palmer, and Perkings (2005) argue that the same type of environmental change can alter the effect of this strategy on the environmental performance.

According to these works about small businesses, innovation has no effect on the environmental performance of benign environments, but it has a positive effect on the environmental performance in hostile environments. Encaoua, Hall, Laisney, and Mairesse (1998) assume that investment in research and development is an uncertain strategy and negatively affects the business performance "the performance related to innovation actually depends on three types of uncertainties that innovative companies have to face: technological uncertainty, strategic uncertainty and market uncertainty. Technological uncertainty may be faced by a company when the latter decides to devote an effort to R&D in an attempt to implement a discovery".

Before hand, it is not sure that it will have the necessary expertise to turn the discovery into a technically viable industrial project. Strategic uncertainty means that when a company spends money on the development of an industrial project, it is not sure that it will be the first to bring the corresponding innovation to the market. Market uncertainty, finally, returns to the potential opportunities of innovation. Their existence is rarely achieved when the company chooses an industrial development project. For businesses, this uncertainty is often the most difficult to overcome. Also, the commercial performance of innovation depends on this uncertainty. With reference to these works, one can proclaim the next hypothesis:

H3. Research and development has a significant impact on environmental performance.

4. Methodology

Our study is aimed at investigating the effect of the innovation strategy on the performance companies. Thus, this research attempts to answer our central question: Howcan innovation affect the performance of Tunisian companies? Our methodology consists of two parts. The first is used to identify the data collection method and the second is devoted to the results interpretation.

4.1. Sample

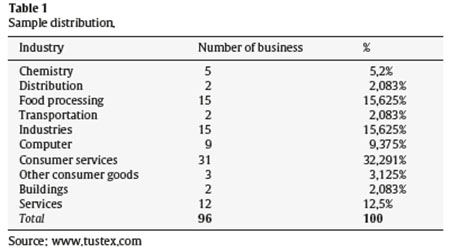

Our sample involves 96 Tunisian companies with high level on research and development divided into 10 industries which are: chemistry, distribution, food processing, transportation, industries, computer, other consumer goods, consumer services, buildings, and services. Companies belonging to the financial sector are excluded (banks, insurance company...) because they have a unique financial structure. Table 1 summarizes the distribution of the sample by industries.

4.2. Collection and the data sources

Our purpose is to verify the role of innovation strategy in performance. So, we need to know about the data concerning the innovation strategy, social performance, environmental performance and financial performance. Regarding innovation strategic, we gathered the needed data from the annual reports of the listed companies on the Tunisian tustex site, accessed the web-sites of the unlisted companies and contacted them by mail, fax and telephone to find out the necessary information to measure this variable. By using a questionnaire, we measured social performance and environmental performance (the questionnaire is sent to the leader of the companies which have a high level of investment in research and development). The data collection was carried out in 2013. We used several methods to gather information: personal investigation (by appointment: direct interview with the company leader of a duration of 45 minutes), telephone survey, fax inquiry and internet survey. The Ministry of Tunisian industry as well as several business centers, namely the business center of Sfax, helped us.

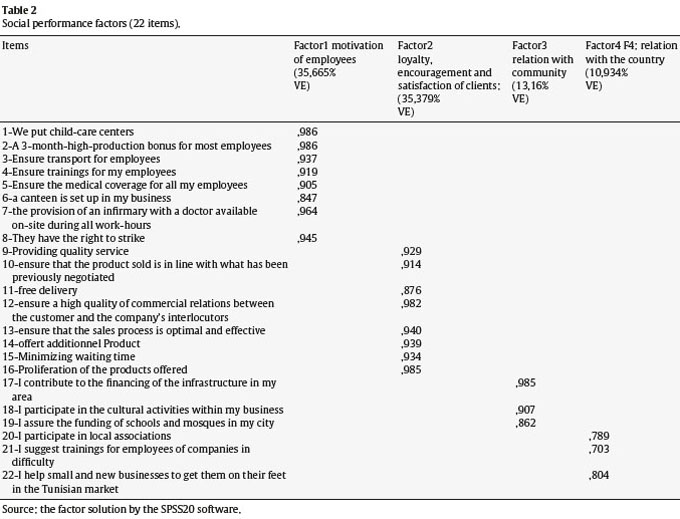

The questionnaire was based on the dimensions that seek to assess the company management with respect to its stakeholders (employees, customers, suppliers, shareholders, etc.). In the Tunisian context, the concept of social performance is limited and restricted. Therefore, we limited this performance to four main areas: employees, customers, community, country.

4.3. Variables

In this context, it is appropriate to separate the dependent variables from independent ones:

4.3.1. Measurement of the dependent variables

The dependent variables are the three forms of performance: financial performance, social performance and, finally, environmental performance.

4.3.1.1. Financial performance (FP). It is measured through several methods such as ROA, ROE (detailed in the first chapter). To measure financial performance, we used Return on Equity (ROE) which is used by many authors such as Brown and Caylor (2004).

The "return on equity" or "equity return rate" or the "equity return" is the ratio between the net income and the shareholders’ equity. It measures the ability of a business to generate profits from its net equity. The data is extracted from the income statements of the sample firms for the years from 2009 to 2013. According to these data, we calculated the ROE for each year. On this basis, we calculated the average ROE 2009-2013.

ROE = Net income/equity

4.3.1.2. Social and environmental performance. In the previous paragraph, we have shown that we have adopted a questionnaire to calculate the social and environmental performance. We have adopted the methodology of the KLD1 (Kinder, Lydenberg, Domini) rating agency to measure the dependent variables which are the social and environmental performance.

• Social performance: we have 4 axes:

- Customer relationships: we used 8 items to measure the firms’ social involvement regarding their relationships with their customers in terms of loyalty, satisfaction and encouragement. For each firm, we assigned a score ranging from 0 (no item is taken into account) to a maximum of 8 (all elements are taken into account). Then, we brought back the number to a value ranging from 0 to 1 by dividing the total by 8.

- The relationship with the employees: as we used 8 items for customers, we measured this variable in the same way; a score ranging from 0 (no item is taken into account) to a maximum of 8 (all elements are taken into account). Then, we brought back the number to a value ranging from 0 to 1 by dividing the total by 8.

- The relationship with the country and community: each axis took 3 items to check the social responsibility relationship, community and territory (with the same method of calculation).

- Finally, to calculate social performance, the sum of the four axes is divided by four. Social Performance(SP) = (clients’ aggregate score + employees’ aggregate score +community aggregate score + territory aggregate score)/4

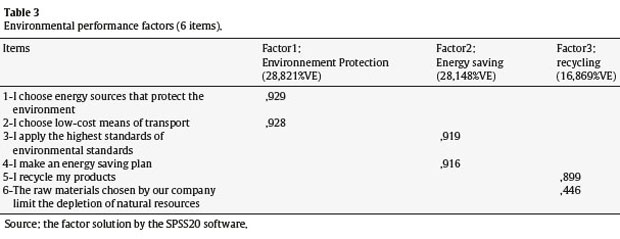

• Environmental performance: is calculated on the basis of 6 items which are defined to measure the firms’ environmental performance. For each firm, a score ranging from 0 (no item is taken into account) to a maximum of 6 (all items are considered). Then, we brought back the number to a value ranging from 0 to 1 by dividing the total by 6.

Environmental Performance(EP) = ( Σ items)/6

4.3.2. Measurement of independent variable

Here, we talk about the measurement of innovation strategy.

4.3.2.1. Innovation strategy (investment in research and development (R&D)). We use the research and development (R&D) intensity as a proxy for firm innovation strategy. As Francis and Smith (1995), Cho (1998), Abdullah, Weiyu, and Vivek (2002), Azouzi and Jarboui (2012), and Hamza and Jarboui (2012), is the ratio between R&D expense and total sales. This measurement is used also by Sumeonidis (1996), Klein and Rosenberg (1986), Gellatly and Peters (1999), Miller (2006) and Ghesbrough, Vanhaverbeke, and West (2006).

Research and development(R&D) = Research and development expenses/total sales

4.3.3. Measurement of the control variables

In our model, we included four control variables which explain the level of business performance. These variables are proxies of the firm size, debt, age and industry.

4.3.3.1. Debt. Hovakimian, Hovakimian, and Tehranian (2004) utilized the total debt ratio, but Myers (2001) used the long-term average debt ratio. Nevertheless, ION measured this variable by using the financial leverage which resides in the total debt divided by the total assets. This measurement is also used by Kochhar and David (1996), Barker and Mueller (2002), Lee and O’Neil (2003), Koh (2003), Demaria and Dufour (2007), Jarboui and Olivero (2008), Ben Kraiem (2008), and Sahut and Gharbi (2008).

Debt = (total debt/total assets) in percentage

4.3.3.2. Size. According to Hovakimian et al. (2004) and Dufour and Molay (2010), the size of the firm affects its financial policy. Indeed, larger companies have higher performance and are more investment in research and development than small and medium sized ones (Booth, Aivazian, Demirguc-Kunt, and Maksimovic, 2001). The company size, in fact, is calculated by several methods; namely, the log total assets, the workforce and turnover. According to Bahagat and Black (2001), Durnev andKim(2003), Andres, Azofra, and López (2005), and Hergli et al. (2007), the size is measured as follows: "log (sales)". Others, like Brown and Caylor (2004), Ben Cheikh and Zarai (2008), Bauer, Frijns, Otten, and Tourani-Rad (2008), and Adjaoud, Zeghal, and Andaleeb (2007) used the value "log (the total assets)".

We used the (Ln (CA)) as a size-measurement in this research. It is identified by the logarithm of the group turnover. This same measurement is used in several studies such as Bujadi and Richardson (1997), Barker and Mueller (2002) and Chen et al. (2008).

Size = Ln(CA)

4.3.3.3. Age. The company age has a very significant effect on performance. It is expressed by the logarithm of the number of working years (Brown & Caylor, 2004; Ben Cheikh & Zarai, 2008).

Age = Ln(number of years)

4.4. Questionnaire validation

Our objective is to test the validity of 22 items about social performance and 6 items about environmental performance. The internal consistency validity test of our questionnaire is achieved with Gronbach alpha (a measurement of the internal consistency between the different items of measurement (between social performance, and environmental performance) equals (= 0.623).

The internal consistency between the 22 items of social performance is very important, it equals 0, 781. For the 6 items of environmental performance, it is less important as it equals 0, 350. Thus, one can say that the scale generated for the measurement of the various items is reliable and includes the aspects of the theory. The Principal Component Analysis suggests a structure of 4 factors representing 95.138% of the total variance for the factors of social performance. For environmental performance, we have three factors representing 73.838% of the total variance. Thus, the index of Kaieser-Mayer-Olkin (KMO), which reflects the adequacy of the factor solution, is very important for the 3 variables. The factor solution of social performance is summarized in the following table: Table 2, Table 3.

4.5. Empirical validation of the research hypotheses

We will try to verify the effect of innovation companies on the performance of the firms:

4.5.1. Descriptive analysis

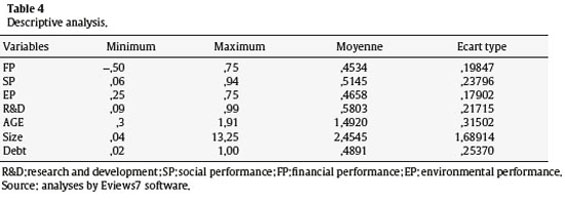

This part is dedicated to the presentation of the descriptive statistics related to: the average financial performance, innovation strategy, social performance, environmental performance, the company size, the company age and the debts Table 4.

4.5.2. Verification of the absence of multicollinearity between the independents variables

Our goal is to verify the absence of multicollinearity between the explanatory variables, our first case is when our dependent variable is financial performance, our second case is if Y1 is equal to social performance and finally when the variable explained is equal to the environmental performance:

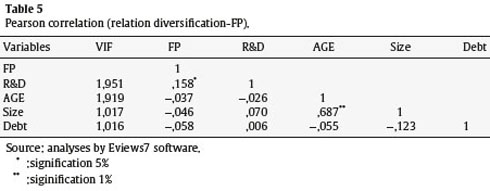

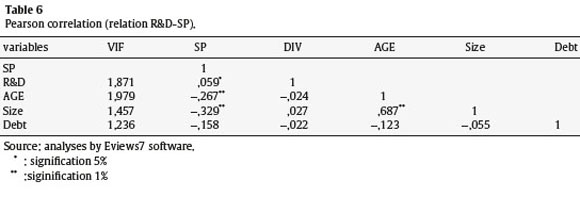

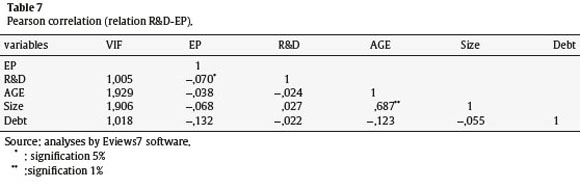

As the correlation matrix of Pearson (all correlation coefficients are below 0.7 which corresponds to the restricted from which it usually begins to have serious multicollinearity problems. In addition, from Table 5, Table 6 and Table 7, we can see that all our explanatory variables have a value of FIV which is much lower than 2. These results allow us to conclude that we do not have a serious problem of multicollinearity.

4.5.3. Tests of specification, heteroscedasticity and autocorrelation

Our study focuses on a sample of 96 Tunisian companies examined over a whole year. This leads to the estimation of time series rather than panel data. The estimation is done by Least Squared. In other words, we tested heteroscedasticity by performing the Breusch -Pagan test. In the context of a heteroscedasticity test, the null hypothesis is homoscedasticity and it will be the case when all the coefficients of regression of the squared residues are zero. To perform this test, we regressed the squared residues resulting from the fixed-effect model with the explanatory variables of the different regression equations. According to this test, the statistics F of Fisher is not significant for all equations. This leads to the rejection of the alternative hypothesis and the acceptance of the null hypothesis (they are all homogeneous and we do not have a problem of heteroscedasticity).

5. Results and interpretation

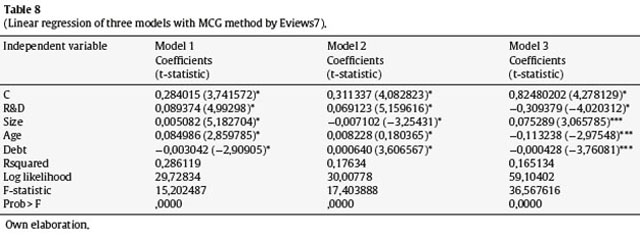

The models to be tested are:

Model 1 : FP = β0 + β1 * R&D + β2 * SIZE + β3 * AGE + β4 * DEBT + ξ→ H1

Model 2 : SP = β0 + β1 * R&D + β2 * SIZE + β3 * AGE + β4 * DEBT + ξ→ H2

Model 3 : EP = β0 + β1 * R&D + β2 * SIZE + β3 * AGE + β4 * DEBT + ξ→ H3

The results of the linear regression are presented in Table 8:

The regressions imply that R&D has a positive and significant impact of about 10% on the financial performance of the company. This concurs with the studies of Erickson and Jacobson (1992) who conclude that the R&D of a firm is positively related to financial performance. When Berroni et al. (2005) studied a sample of Spanish firms, they found that the effect of a significant level of investment in R&D (the amount is higher than the annual average for the sector) on the performance of the company is negative but insignificant if the control block holders are banks.

Thus, we assume the positive impact of the innovation strategy on the corporate social performance (H2). Our study leads to satisfactory results since we find a positive and significant relationship at about 5% and 10% between research and development and customers, research and development and employees, and a positive significance between research and development and community. The same results are found by Oltra and Saint Jean (2011) who show that the integration of innovation intervenes after the customers’ request; similarly, the work of Also, the work of Gallaud et al. (2012) deal with the relationship between innovation, employees and community. Thus, innovation enables the company to achieve not only financial performance but also social performance. In other words, the firm can satisfy and encourage, firstly and essentially, its customers; then, it strengthens its relationship with the employees; eventually, it can realize a regional satisfaction since it will help the region by financing the infrastructure. When we speak about the relationship between innovation and environmental performance, the validation of our hypothesis (H3) is used to identify the existence of a relationship (positive or negative) between research and development and environmental performance.

Our research drives us to conclude that research and development has a significantly negative effect of about 10% on environmental performance. This means that the Tunisian companies do not take the environment into consideration during their research. They seek only their financial and social performance. This result is in accordance with the studies of Oltra (2008) who believes that the effect of innovation on environmental performance does not rest only on research and development, but also on technology. In this, he means that the existence ofnewtechnologies would drive the firms to innovate and develop new environmental approaches.

In contrast, our results are inconsistent with the studies of Kemp et al. (1994) who state that "the techniques, process and products eliminate or reduce the emission of pollutants and/or the use of raw materials, natural resources and energy". When we talk about the control variable, we notice that size is not always as significant as the variables of age and indebtedness. So, we can say that performance is not related to the size of the company and, especially, the social and environmental performance. For instance, the Tunisian indebted companies have a positive financial, social and environmental performance.

6. Conclusion

Unlike many management topics in which we can perceive a rise of popularity and a decline of interest, the selection and implementation of the performance indicators have been an increasingly important matter in recent years. In the 1990’s, the companies sought to improve their performance by using new strategies. The article, therefore, is aimed to update the theoretical research dealing with the relationship between innovation and performance by studying a sample of Tunisian companies. The statistical tests clearly denote the existence of a significantly positive relationship between research and development and financial performance. Accordingly, this helps us deduce that the Tunisian companies have to improve their financial performance through new technologies and fresh ideas. Their vision must also be geared to a sound relationship between innovation and their customers, innovation and employees and communities. Thus, they build a strong relationship between innovation and their social performance. Throughout this study, we could come up with the fact that there is a positively significant relationship between the two concepts: research and development and social performance. When we point to environmental performance, we find that this variable is negatively significant. Thismeansthat despite the strong and positive relationship between the innovation strategy and the financial and social performance, the Tunisian companies turn a blind eye to the environment and its expectations; as such, the reduction of depleted natural sources.

References

Abdullah, F., Weiyu, G. & Vivek, M. (2002). The relation of managerial holdings with Tobin’s Q and R&D expenditures: Evidence from Japanese firms. Multinational Business Review, 10, 66–71.

Adjaoud, F., Zeghal, D. & Andaleeb, S. (2007). The effect of Board’s quality on performance: A study of Canadian firms. Journal compilation, 15(4, July).

Albouy, M. (2006). Théorie, applications et limites de la mesure de la création de valeur. Revue française de gestion, 1(160), 139–157. [ Links ]

Andres, P., Azofra, V. & López, F. (2005). Corporate boards in OECD countries: Size, composition, functioning and effectiveness. Blackwell Publishing Ltd., 13(2, March). [ Links ]

Azouzi, M. A. & Jarboui, A. (2012). CEO emotional bias and dividend policy Bayesian network method. Business and Economics Horizons, 7(1), 1–18. [ Links ]

Bae, S. & Kim, D. (2003). The effect of R&D investments on market value of firms: Evidence from the U.S., Germany, and Japan. Multinational Business Review, 11(3), 51–75. [ Links ]

Bahagat, S. & Black. (2001). The non-correlation between board independence and long term firm performance. Journal of Corporation Law, 231–274. [ Links ]

Bain, J. S. (1951). Relation of profit rate to industry concentration: American Manufacturing, 1963, 1940. Quarterly Journal of Economics, 65(August), 293–324. [ Links ]

Baker, W. E. & Sinkula, J. M. (2002). Market orientation, learning orientation and product innovation: Delving into the organization’s black box. Market Focus Manage, 5(1), 5–23.

Balkin, D. B., Markaman, G. D. & Gómez-Mejía, L. R. (2000). Is CEO pay in high-technology firms related to innovation? Academic Management, 43(6), 1118–1129. [ Links ]

Barker, V. L. & Mueller, G. C. (2002). CEO characteristic and firm R&D spending. Management Science, 48(1), 782–801. [ Links ] Barney, J. (1991). Firm resources and sustained competitive advantages. Journal of Management, 17, 99–120. [ Links ]

Barney, J. B. (1985). Strategic factor markets: Expectations, luck, and business strategy. Management Science, 32, 1231–1241. [ Links ]

Bauer, R., Frijns, B., Otten, R. & Tourani-Rad, A. (2008). The impact of corporate governance on corporate performance: evidence from Japan. Pacific-Basin. Finance Journal, 16, 236–251. [ Links ]

Ben Cheikh, S. and Zarai, M. A. (2008). Importance des facteurs organisationnels sur le pouvoir managérial et la performance de la firme. Colloque international fiscalité droit gestion, 8, 9 et 10 Mai 2008. [ Links ]

Ben Kraiem, R. (2008). The influence of institutional investors on opportunistic earnings management. International Journal of Accounting Auditing and Performance Evaluation, 5(1), 89–106. [ Links ]

Ben-Zion, U. (1984). The R&D and investment decision and its relationship to the firm’s market value:Somepreliminary results. In Griliches Zvi (Ed.), R&D, patents and productivity (pp. 299–312). University of Chicago Press.

Berle, A. A., & Means, G. C. (1932). The modern corporation and private property. New York: Macmillan Publishing Co. [ Links ]

Berrone, P., Surroca, J. & Tribo, J. A. (2007). Do the type and number of block holders influence R&D investments? New evidence from Spain. Corporate Governance: An international Review, 15(5), 828–842. [ Links ]

Bloch, C. (2003). The effect of R&D expenditures on stock market returns for Danish firms.. Working paper, 2003/6. (www.afsk.au.dk/ftp/Akti/WP2003 6.pdf) [ Links ]

Blundell, R., Griffith, R. & Van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. Review of Economic Studies, 66(3), 529–554. [ Links ]

Booth, L., Aivazian, V., Demirguc-Kunt, A. & Maksimovic, V. (2001). Capital structure in developing countries. Journal of Finance, 56, 87–130. [ Links ]

Börjesson, S. & Löfsten, H. (2012). Capabilities for innovation in small firms – A study of 131 high-tech firms and their relation to performance. International Journal of Business Innovation and Research, 6(2), 149–176. [ Links ]

Bosworth, D. & Rogers, M. (1998). Research and development, intangible assets and the performance of large Australian companies. Meulbourne Institute Working Paper, n◦ 2/98, janvier. [ Links ]

Bowen, H. R. (1953). Social responsibilities of the business man. pp. 25. New York: Harper & Row. [ Links ]

Brouillat, E., (2008). Firm strategy for innovation and end of life products: Towards a greening of product design. 1st DIME Scientific Conference: Knowledge in space and time: economic and policy implications of the Knowledge-based economy, 7-9 avril 2008, BETA, Université Louis Pasteur, Strasbourg, France. [ Links ]

Brousseau, E. (1993). L’économie des contrats. PUF. Brown, L. & Caylor, M. (2004). Corporate governance and firm performance Working paper. [ Links ]

Brown, S. L. & Eisenhard, K. M. (1995). Product development: Past research, present findings, and future directions. Acad Manage Rev, 20(2), 343–378. [ Links ]

Bujadi, M. L. & Richardson, A. J. (1997). Acitation trail review of the uses of firme size in Accounting Research. Journal of Accounting Literature, 16, 1–27. [ Links ]

Caroll, A. B. (1979). A three dimensional conceptual model of corporate social performance. Academy of Management Review, 4(4), 657–668. [ Links ]

Casta J. F., Escaffre, L. and Ramond, O. (2007). Investissement immatériel et utilité de l’information comptable: Etude empirique sur les marchés financiers européens. Actes du 28ème Congrès de l’Association Francophone de Comptabilité AFC (cédérom), 23-25 mai 2007, Poitiers.

Caves, R. E. & Porter, M. E. (1977). From entry barries to mobility barriers. Quarterly Journal of Economics, 91, 241–261. [ Links ]

Chan, H. W. H., Faff, R. W., Gharghori, P. & Ho, Y. K. (2007). The relation between R&D intensity and future market returns: Does expensing versus capitalization matter? Review of Quantitative Finance and Accounting, 29(1), 25–51. [ Links ]

Charreaux, G. (1993). Théorie financière et stratégie financière. Revue Franc¸ aise de Gestion, 46–63, janvier février. [ Links ]

Charreaux, G. (2000). Le conseil d’administration dans les théories de la gouvernance. Working paper. Université de Bourgogne.

Charreaux, G. (2004). Les théories de la gouvernance: de la gouvernance des entreprises à la gouvernance des systèmes nationaux. Cahier du FARGO 1040101. [ Links ]

Charreaux, G. (2008). À la recherche du lien perdu entre caractéristiques des dirigeants et performance de la firme: gouvernance et latitude managériale. Économie et Sociétés, (10), 1831–1868. Série Économie de l’entreprise.

Charreaux, G. (2008). La recherche du lien perdu entre caractéristiques des dirigeant performance de la firme: gouvernance et latitude managériale. Working Papers FARGO 1080502, Université de Bourgogne - Latec/Fargo.(Research center in Finance,organizational Architecture and Governance). [ Links ]

Charreaux, G. (2011). Quelle théorie pour la gouvernance? De la gouvernance actionnariale à la gouvernance cognitive et comportementale. Cahier du FARGO 1110402. [ Links ]

Chen, H. L., Hsu, W. T. and Huang, Y. S. (2008). Top management team characteristics, R&D investment and capital structure in the IT industry. Small Business Economics. Available at http://www.springerlink.com/index/k062471w88846740. pdf [ Links ]

Cho, M. H. (1998). Ownership structure, investment,and the corporate value: An empirical analysis. Journal of Financial Economics, 47, 103–121. [ Links ]

Chung, K. H. & Jo, H. (1996). The impact of security analysts’ monitoring and marketing functions on the market value of firms. Journal of Financial and Quantitative Analysis, 31(4), 493–512.

Coase, R. H. (1937). The nature of the firm. Economica. [ Links ]

Cockburn, I. & Griliches, Z. (1988). Industry effects and apropriability measures in the stock market’s valuation of R&D and patents. American Economic Association Papers and Proceedings, 78(2), 419–423.

Colombo, M. G., Laursen, K., Magnusson, M. & Rossi-Lamastra, C. (2012). Introduction: Small business and networked innovation: Organizational and managerial challenges. Journal of Small Business Management, 50(2), 181–190. [ Links ]

Connolly, R. A. & Hirschey, M. (1984). R&D, market structure and profits: A valuebased approach. Review of Economics and Statistics, 66(4), 682–686. [ Links ]

Daily, C., Dalton, D. & Cannella, A. (2003). Corporate governance: Decades of dialogue and data. The Academy of Management Review, 28(3), 371–382. [ Links ]

Darroch, J. & McNaugton, R. (2002). Examining the link between knowledge management practices and types of innovation. J. Intellect Cap, 3(3), 210–222. [ Links ]

Davis, J. H., Schoorman, D. F. & Donaldson, L. (1997). Toward a stewardship theory of management. The Academy of Management Review, 22(1), 20–47. [ Links ]

Del Monte, A. & Papagni, E. (2003). R&D and the growth of firms: Empirical analysis of a panel of Italian firms. Research Policy, 32(6), 1003–1014. [ Links ]

Demaria, S. & Dufour, D. (2007). Les choix d’options comptables lors de la transition aux normes AS/IFRS: quel rôle pour la prudence? Comptabilité-Contrôle-Audit, (195), 195–218.

Demsetz, H. (1975). Two systems of belief about monopoly. In H. Goldschmid, H. Goldschmid, et al. (Eds.), Industrial Concentration: The New Learing (pp. 164–184). Little Brown. [ Links ]

Donaldson, L. (1990). The ethereal hand: Organizational economics and management theory. Academy of Management Review, 15(3), 369–381. [ Links ]

Donaldson, L. & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49–56. [ Links ]

Dufour, D. and Molay, E. (2010). La structure financière des pme franc¸ aises: une analyse sectorielle sur données de panel, Manuscrit auteur, publié dans crises et nouvelles problématique de la valeur, Nice, hal-00479529, version 1. [ Links ]

Durant, T. (1997). Savoir, savoir-faire et savoir être. Repenser les compétences de l’entreprise. Actes de la conférence de Montréal.

Durnev, A. & Kim, E. H. (2003). To steal or not to steal: Firm attributes, legal environment, and valuation. Current Draft, (September 22), 2003. [ Links ]

Encaoua, D., Hall, B. H., Laisney, F. & Mairesse, J. (1998). Economie et économétrie de l’innovation. Un tour d’horizon. Annales d’Economie et de Statistique, (49/50).

Erickson, G. & Jacobson, R. (1992). Gaining comparative advantage through discretionary expenditures: The returns to R&D and advertising. Management Science, 38(9), 1264–1279. [ Links ]

Florida, R. (1996). The globalization of R&D: Results of a survey of foreign-affiliated R&D laboratories in the USA. Research Policy, 26, 85–103. [ Links ]

Francis, J.,& Smith, A. (1995). Agency costs and innovation:Someempirical evidence. Journal of Accounting and Economics, 19, 383–409. [ Links ]

Freeman, R. E. (1984). Strategic management: Astakeholder approach. Boston: Pitman. Développement, Croissance et Progrès, 36(1), 213–229. [ Links ]

Gallaud, D., Martin, M., Reboud, S. & Tanguy, C. (2012). La relation entre innovation environnementale et réglementation: une application au secteur agroalimentaire français. Innovations, 155–175. [ Links ]

Gellatly, G. & Peters, V. (1999). Understanding the innovation process: Innovation in dynamics service industries Working paper. pp. 2–3, http://www.ssrn.com/. [ Links ]

Geroski, P. A., Machin, J. & Walters, C. (1997). Corporate growth and profitability. Journal of Industrial Economics, 45(2), 171–189. [ Links ]

Ghesbrough, H., Vanhaverbeke, W. & West, J. (Eds.). (2006). Open innovation: Researching a new paradigm. New York: Oxford University Press. [ Links ]

Grabmeier, K. (2002). I don’t mind the critics: Diversified firms show innovative spirit. P:1. www.Google.com

Grant, R. M. (1991). The Resource-based theory of competitive advantage: Implications for strategy formulation. California Management Review. pp. 114–135. Spring. [ Links ]

Griliches, Z. (1981). Market value, R&D and patents. Economics Letters, 7(2), 183–187. [ Links ]

Groff, J. & Nguyen, T. T. U. (2012). Motivations à l’éco-innovation:une comparaison sectorielle sur les enterprises au Luxembourg. Working paper n◦ 2012-11.

Hage, J. & Aiken, M. (1970). Social change in complex organisations. Random House. [ Links ]

Hall, B. H. (2000). Innovation and market value. In R. Barrell, G. Mason, & M. O’Mahoney (Eds.), Productivity, innovation and economic performance (pp. 177–198). Cambridge, UK: Cambridge University, Press.

Hambrick, D. & Mason, P. (1984). Upper echelons: The organization as a reflection of its top managers. The Academy of Management Review, 9(2), 193–206. [ Links ]

Hamza, F. & Jarboui, A. (2012). Investor’s commitment bias and escalation of firm’s investment decision. Corporate Ownership and Controle, 9, 369–380.

Hergli, M., Bellalah, M. and Abdennadher, N. (2007). Gouvernance d’entreprise et valeurs de marché en Tunisie. 4th International Finance conference. 15-17 Mars, 2007, Hammamat, Tunis.

Hirschey, M. & Weygett, J. J. (1985). Amortization policy for advertising, research and development expenditures. Journal of Accounting Research, 23(1), 326–335. [ Links ]

Hoffman, A. J. & Bansal, P. (2012). Retrospective, perspective et prospective Introduction. pp. 28. The oxford Hetbook on Business et the Natural Environment (vol. 3) Oxford, UK: Oxford University Press. [ Links ]

Horbach, J. (2008). Determinants of environmental innovation – New evidence from Germanpanel data. Research Policy, 37, 163–173. [ Links ]

Hovakimian, A., Hovakimian, G. & Tehranian, H. (2004). Determinants of target capital structure: The case of dual debt and equity issues. Journal of Financial Economics, 71, 517–540. [ Links ]

Hung, S. C., Lee, Y. & Lin, B. W. (2006). R&D intensity and commercialization orientation effects on financial performance. Journal of Business Research, 59(6), 679–685. [ Links ]

Hung, H. (1998).Atypology of the theories of the roles of governing boards. Corporate Governance: An International Review, 6(2)101–111. [ Links ]

Hunt, S. D. (2000). A general theory of competition resources, competences, productivity 1’economic growth? Sage Publications.

Hunt, S. D. & Morgan, R. M. (1995). The comparative advantage theory of competition. Journal of Marketing, 59(2), 1–15. [ Links ]

Jarboui, A. & Olivero, B. (2008). Le couple risque/horizon temporel des investissements est il gouverné par les institutionnels et les actionnaires dominants? Banque et Marchés, (93, Mars–Avril), 20–34. [ Links ]

Jarrell, G., Lehn, K., & Marr, W. (1985). Investment horizon and the market for corporate control: The defensive role of long-term investments. Working paper. University of Michigan Business School. [ Links ]

Jensen, M. C. & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [ Links ]

John, K., John, T. A. & Sundaram, A. K. (1996). An empirical analysis of strategic competition and firm values: The case of R&D competition. Journal of Financial Economics, 40(3), 459–486. [ Links ]

Johnson, L. D. & Pazderka, B. (1993). Firm value and investment in R&D. Managerial and Decision Economics, 14(1), 15–24. [ Links ]

Kemp, R., Miles I. and Smith, K. (1994). Technology and the transition to environmental stability. Continuity and change in complex technology systems. Final report from project technological Paradigms and Energy Technologies.for SEER research programme of the CEC.(DG XII). [ Links ]

Klein, S. J. & Rosenberg, N. (1986). An overview of innovation. In R. Landau, & N. Rosenberg (Eds.), The positive sum strategy: Harnessing technology for economic growth. Washington, DC: National Academies Press. [ Links ]

Kochhar, R. & David, P. (1996). Institutional investors and firm innovation: A test of competing hypotheses. Strategic Management Journal, 17(1), 73–84. [ Links ]

Koh, P. S. (2003). On the association between institutional ownership and aggressive corporate earnings management in Australia. The British Accounting Review, 35, 105–128. [ Links ]

Kothari, S. P., Laguerre, T. E. & Leone, A. J. (1998). Capitalization versus expensing: Evidence on the uncertainty of future earnings from current investments in PP&E and R&D. Unpublished Working paper. University of Rochester. [ Links ]

Lane, J. D., Kasian, S. J., Owens, J. E. & Marsh, G. R. (1998). Binaural auditing beats affect vigilance performance and mood. Physiology of Behavior, 63(2), 245–252. [ Links ]

Lantz, J. S. & Sahut, J. M. (2005). R&D investment and the financial performance of technological firms. International Journal of Business, 10(3), 251–270. [ Links ]

Lee, P. G. & O’Neil, H. M. (2003). Ownership structures and R&D investments of U.S. and Japanese firms: Agency and stewardship perspectives. Academy of Management Journal, 46(2), 212–225.

Lev, B. & Sougiannis, T. (1996). The capitalization, amortization, and value-relevance of R&D. Journal of Accounting and Economics, 21(1), 107–138. [ Links ]

Lichtenberg, F. & Siegel, D. (1991). The Impact of R&D investment on productivity: New evidence using linked R&D-LRD data. Economic Inquiry, 29(2), 203–228. [ Links ]

Lyon, D. & Ferrier, W. (2002). Enhancing performance with product–market innovation: The influence of the top management team. J. Manage Issues, 14(14), 452–469. [ Links ]

Mason, E. S. (1939). Price and production policies of large scale enterprise. American Economic Review, 29, 61–74. [ Links ]

Merino, M., Srinivasan, R. & Srivastava, R. K. (2006). Advertising, research and development and variability of cash flow and shareholder value Working paper. Zips technical report, Zyman Institute of Brand Science. [ Links ]

Miles, R. E. & Snow, C. (1978). Organizational strategy, structure and process. New York: McGraw Hill. [ Links ]

Miller, D. J. (2006). Technological diversity, related diversification, and firm performance. Strategic Management Journal, 27, 601–619. [ Links ]

Muth, M. & Donaldson, L. (1998). Stewardship theory and board structure: A contingency approach. Corporate Governance: An International Review, 6(1), 5–28. [ Links ]

Myers, S. C. (2001). Capital structure. Journal of Economic Perspectives, 15, 81–102. [ Links ]

O’Brien, J. P. (2003). The capital structure implications of pursuing a strategy of innovation. Strategy Management Journal, 24(5)415–431. [ Links ]

Oltra, V. & Saint Jean, M. (2011). Sectoral systems of environmental innovation: An application to the French automotive industry. Technological Forecasting and Social Change, 76(4), 567–583. [ Links ]

Oltra, V. (2008). Variety of technological trajectories in low emission vehicles (LEVs): Apatent data analysis. Journal of Cleaner Production, 3, 534. [ Links ]

Pakes, A. (1985). On patents, R&D and stock market rate of return. Journal of Political Economy, 93(2), 390-409. [ Links ]

Parida, V., Westerberg, M. & Frishammar, J. (2012). Inbound open innovation activities in high-tech SMEs: The impact on innovation performance. Journal of Small Business Management, 50(2), 283–309. [ Links ]

Penrose, E. (1959). The theory of the growth of the firm (3ème édition). Oxford: Oxford University Press. [ Links ] Porter, M. (1986). L’avantage concurrentiel. pp. 7–200. InterEditions.

Porter, M. E. (1992). Capital disadvantage: American’s failing capital investment system. Harvard Business Review, 70(5), 65–85.

Quairel, F. (2006). Contrôle de la performance globale et RSE. Actes du congrès de l’association Francopohone de comptabilité.

Rindova, V. (1999). What corporate boards have to do with strategy: A cognitive perspective? Journal of management studies, 36, 953–977. [ Links ]

Rumelt, R. (1984). Strategy, structure, and economic performance. Cambridge: M. Harvard University Press. [ Links ]

Sahut, J. M. & Gharbi, O. (2008). Investisseurs institutionnels et valeur de la firme. pp. 1–28. Papier de travail, Université de Poitiers et Université Paul Cézanne hal-00645361. [ Links ]

Scherer, E. M. (1992). Schumpeter and plausible capitalism. Econ Lit, 30, 1416–1433. [ Links ]

Schroll, A. & Mild, A. (2011). Open innovation modes and the role of internal R&D. An empirical study on open innovation adoption in Europe. European Journal of Innovation Management, 14(4), 475–495. [ Links ]

Simon, H. A. (1957). Models of man: Social and rational. New York: John Wiley and Sons. [ Links ]

Simpson, P. M., Siguaw, J. A. & Enz Cathy, A. (2006). Innovation orientation outcomes: The good and the bad. J. Bus Res, 59, 1133–1141. [ Links ]

Sougiannis, T. (1994). The accounting based valuation of corporate R&D. The Accounting Review, 69(1), 44–68. [ Links ]

Stigler, G. J. (1964). A theory of oligopoly. Journal of Political Economy, 72(1), 44–61. [ Links ]

Stiles, P. (2001). The impact of the board on strategy: An empirical examination. Journal of Management Studies, 38(5), 627–650. [ Links ]

Sumeonidis, G. (1996). Innovation, firm size and market structure: Schumpeterian hypotheses and some new themes. Journal of Financial Economics, 37, 69-65. [ Links ]

Szewczyk, S. H., Tsetsekos, G. P. & Zantout, Z. (1996). The valuation of corporate R&D expenditures: Evidence from investment opportunities and free cash flow. Financial Management, 25(1), 105–110. [ Links ]

Toivanen, O., Stonenman, P. & Bosworth, D. (2002). Innovation and market value of UK firms, 1989-1995. Oxford Bulletin of Economics and Statistics, 64(1), 39–61. [ Links ]

Utterback, J. M. (1994). Mastering the dynamics of innovation: How companies can seize opportunities in the face of technological change. Boston: Harvard Business School Press. [ Links ]

Van de Vrande, V., DeJong, J. P. J., Vanhaverbeke, W. & Rochemont, M. (2009). Open innovation in SME’s: Trends, motives and management challenges. Technovation, 29, 423–437.

Vrakking, W. J. (1990). The innovative organization. Long Range Plann, 23(2), 94–102. [ Links ]

Wartick, S. L. & Cochran, P. L. (1985). The evolution of the corporate social performance model. Academy of Management Review, 10(4), 758–769. [ Links ]

Wernerfelt, B. (1984). A Resource-based view of the firm. Strategic Management Journal, 5(2), 171–180. [ Links ]

Williamson, O. E. (1975). Markets and hierarchies: Analysis and antitrust implications. New York: Free Press. [ Links ]

Williamson, O. E. (1985). The economics of institutions of capitalism: Firms, markets and relational contracting. New York: MacMillan Free Press. [ Links ]

Williamson, O. E. (1994). Transaction cost economics and organization theory. In N. J. Smelser, & R. Swedberg (Eds.), The Handbook of Economic Sociology. (pp. 77–107). Princeton, NJ: Princeon University Press. [ Links ]

Williamson, O. E. (1993). Calculativeness, trust and economic organization. Journal of Law and Economics, 36(1), 453–562. [ Links ]

Wirtz, P. (2006). Compétences, conflits et création de valeur: vers une approche intégrée de la gouvernance. Revue Finance, Contrôle, Stratégie, 9(2), 187–201. [ Links ]

Wolfe, R. A. (1994). Organizational innovation: review, critique and suggested research directions. Manage Stud, 31(3), 405–431. [ Links ]

Wood, R. E., J. George-Falvy and S. Debowski (1991). Motivation and information search on complex tasks. In Work motivation in the global context of a 56 Globalizing Economy, sous la direction de M. Erez, U. Klienbeck et H. Thierry, Mahwah, NJ: Erlbaum, p. 27-48. [ Links ]

Woolridge, J. R. & Snow, C. C. (1990). Stock market reaction to strategic investment decisions. Strategic Management Journal, 11(5), 353–363. [ Links ]

Woolridge, J. R. (1988). Competitive decline: Is a myopic stock exchange. Review of financial studies, 1. [ Links ]

Wright, R. E., Palmer, J. C. & Perkings, D. (2005). Types of product innovations and small business performance in hostile and benign environments. Small Bus Strat, 15(2), 33–44. [ Links ]

Yew, K. H., Mira, T. & Chee, M. Y. (2006). Size, leverage, concentration and R&D investment in generating growth opportunities. The Journal of Business, 79(2), 851–876. [ Links ]

Zantout, Z. Z. & Tsetskos, G. P. (1994). The wealth effect of announcements of R&D expenditures increases. The Journal of Financial Research, 17(2), 205–216. [ Links ]

Corresponding author.

ISAAS, BP 1013 - 3018 Sfax-Tunisia, 680 450, University of Sfax, Sfax, Tunisia, Tel.: +00216 74 680 460; fax: +00216 74.

E-mail address: ferdawsezzi@yahoo.fr (F. Ezzi).

Received 28 April 2015

Accepted 16 March 2016

NOTAS AL PIE

1 Rating agency which estimates large companies quoted Americans (together of the indication (index) Russel 3000) according to a series of criteria of exclusion (example: alcohol, tobaccos. . .) and of criteria of evaluation (Human resources, environment, sponsorship, customers. . .).