Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Journal of Economics, Finance and Administrative Science

Print version ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.22 no.42 Lima June 2017

ARTICLE

Capital structure management differences in Latin American and US firms after 2008 crisis

Santiago Valcacer Rodrigues1; Heber José de Moura2; David Ferreira Lopes Santos3; Vinicius Amorim Sobreiro4

1Department of Management, University of Fortaleza, Fortaleza, Brazil

2Department of Management, Universidade de Brasilia, Brasilia, Brazil

3Department of Economics, Administration and Education, São Paulo State University (UNESP), Jaboticabal, Brazil

4Department of Management, Universidade de Brasilia, Brasilia, Brazil

Abstract

Purpose – This paper aims to analyse the capital structure determining factors of Latin American and US corporations after the crisis of 2008, as a means of comparing theoretical assumptions and empirical results in markets of different efficiency levels.

Design/methodology/approach – The study sample comprises 1,091 companies belonging to the six largest economies in Latin America plus the USA, in the years 2009 to 2013. The authors performed a regression with data from a balanced overview, which were obtained by using the criterion of minimum weighted square.

Findings – The results demonstrated differences in determining factors of capital structure between companies from Latin America and from the USA. The pecking order theory was mostly observed in Latin American companies and the trade-off theory greater was closely aligned with US firms.

Originality/value – This research brings new contributions to the issue, once the differences and determinative of the debt profile in companies from different economic contexts are compared.

Keywords Information asymmetry, Trade-off, Indebtedness, Pecking order, Pooled regression

Resumen

Propósito – Este artículo analiza los factores determinantes de la estructura de capital de las corporaciones latinoamericanas y estadounidenses después de la crisis de 2008, para comparar los supuestos teóricos y los resultados empíricos en mercados de diferentes niveles de eficiencia.

Diseño/metodología/enfoque – La muestra del estudio comprende 1.091 empresas pertenecientes a las seismayores economías de América Latina y Estados Unidos, entre los años 2009 y 2013. Se realizó una regresión con datos de una visión general equilibrada, que se obtuvo utilizando el criterio de cuadrado mínimo ponderado.

Hallazgos – Los resultados muestran diferencias en los factores determinantes de la estructura de capital entre empresas de América Latina y de Estados Unidos. La Teoría de la selección jerárquica se observó principalmente en las empresas latinoamericanas y la Teoría del intercambio más cercana estaba estrechamente alineada con las firmas estadounidenses.

Originalidad/valor – Esta investigación aporta nuevas contribuciones al tema, una vez que comparamos las diferencias y determinantes del perfil de la deuda en empresas de diferentes contextos económicos.

Palabras clave – Endeudamiento, Intercambio, Asimetría de información, Selección jerárquica, Regresión agrupada

1. Introduction

From the studies by Durand (1952), Hirshleifer (1958), Lintner (1956), Markowitz (1952) and Modigliani and Miller (1958, 1963), several empirical studies have been performed in an attempt to understand the influence of capital structure on firm value since the 1950s (Ardalan, 2017; Milanesi, 2014; DeAngelo and Roll, 2015; Chakraborty, 2010). Choosing a capital structure is one of the most relevant topics in corporate finance (Drobetz et al., 2015; Chung et al., 2013; Barros et al., 2013; McMillan and Camara, 2012; Noulas and Genimakis, 2011). A trend-setting study developed by Modigliani and Miller (1958) (MM) is the cornerstone of the theoretical framework on capital structure and concluded that financial leverage has no effect on the company’s market value.

One of the study branches that arouses most interest in academia is studying factors that determine corporate indebtedness (Graham et al., 2015). In this line of thought, empirical contributions are controversial, so that the MM’s postulates were questioned and extended by a broader perspective on financial strategies, as reported by Ardalan (2017), Bradley et al. (1984), Chen (2004), Fama and French (2002), Frank and Goyal (2003), Hovakimian et al. (2004), Kayo and Kimura (2011), Moosa et al. (2011), Rajan and Zingales (1995), Shah (2012), Shyam-Sunder and Myers (1999), Titman and Wessels (1988) and Vo (2017).

In the past six years, the US subprime crisis triggered intense changes in various economies around the world (Dang et al., 2014). The financial crisis of 2008 led global economy into recession in 2009, the worst since the 1929 crisis (Carvalhal and Leal, 2013; Vidal et al., 2011). The crisis effects were transmitted from developed economies to emerging economies (Carvalhal and Leal, 2013; Singer, 2009). In Latin America, the crisis brought changes in external economic conditions, such as reducing foreign borrowing, significant capital flights as well as strong reduction in foreign direct investments and decline in commodities prices (Caprio et al., 2014; Dang et al., 2014). According to Singer (2009), medium and large size countries under a certain industrialization level, such as Argentina, Brazil, Chile, Colombia, Mexico and Peru, were affected by the crisis in a similar way with capital flight, foreign credit reduction and decrease in exports.

In this way, companies have their credit capacity impaired during a crisis period, when their financial statements and conditions may be deteriorated, besides credit availability restrictions, higher costs of outside financing and difficulty in granting or renewal of credit lines towards financial bodies (Vidal et al., 2011; Dang et al., 2014; Drobetz et al., 2015). Similarly, the US financial system contracted with the collapse and bankruptcy of several financial institutions in the country, which directly affected the credit for companies (Campello et al., 2010; Caprio et al., 2014; Graham et al., 2015).

It is here that researches on the connection between Latin American countries and the USA as well as their financial system composition, which directly influences the way companies raise funds to finance their operations, are particularly relevant to analyse capital structure in both markets (Bekiros, 2014; Tseng, 2010; Balli et al., 2015).

Some studies suggest that corporations tend to follow the capital-structure patterns their peers in other countries. Due to the dependence of the financial markets, it is possible for Latin American companies to follow North American standards (Francis et al., 2016). However, analysing the differences between the determinants of the capital structures between countries with different social structures is one of the conditions for the paradigm shift in this field proposed, which was proposed by Ardalan (2017). Given the above, this study aims at assessing the capital structure determining factors of corporations in Latin American and in the USA.

The knowledge on capital structure of developing markets is limited (Belkhir et al., 2016; Céspedes et al., 2010; Vo, 2017). For Al-Najjar (2011) and Chauhan (2016), theoretical explanations and empirical evidences on the issue are still inadequate for emerging markets. Decisions on such structure become even more complex when examined in an international context, particularly in developing economies, which are characterized by controls and institutional constraints (Belkhir et al., 2016; Francis et al., 2016; Haron, 2014).

Empirical studies have directed efforts towards an economic context of emerging Latin American countries in aggregated manner (Sobrinho et al., 2012; Céspedes et al., 2010) or through specific studies for each country (Vidal et al., 2011; Gómez et al., 2014).

Moreover, the period of analysis of this research contributes to the understanding of questions related to capital structure decisions in high volatility periods for both realities, in developed and developing markets (Dang et al., 2014; Duchin et al., 2010; Ivashina and Scharfstein, 2010).

Therefore, it is noteworthy to mention that there is a gap to understand empirically the factors that set corporate debt at this same time of crisis and economic recession. Therefore, the aim of this study is to analyse the difference in the management of the capital structure of the Latin American and US firms, after the post-crisis 2008. Furthermore, there is a need for literature foundation on capital structure of emerging markets with various credit lines fromdeveloped countries (Awartani et al., 2015).

This way, the economic background in which the companies are established and on which they have influence must be considered (Chauhan, 2016; Jõeveer, 2013; Jong et al., 2008). To reach the proposed goal, this article is organized in four sections after this introduction. The next section discusses the fundamentals of theoretical perspectives on capital structure that guide the analysis of the results. The methodology section presents the material which supported the research, as well as the empirical model used. The fourth section analyses the results of research from the theoretical and compares the results with other empirical evidence. Finally, the section with the conclusions indicates the implications of this study as well as the limitations and future research opportunities.

2. Theoretical foundation

The capital structure choice is one of the most relevant topics in corporate finance, despite the lack of consensus on what is the best or the most appropriate combination of debt for companies (Bradley et al., 1984; Myers, 1984; Myers and Majluf, 1984; Titman and Wessels, 1988; Rajan and Zingales, 1995; Shyam-Sunder and Myers, 1999; Moosa et al., 2011; Dang, 2013; Ebrahimet al., 2014; Graham et al., 2015; Ardalan, 2017).

A substantial number of empiric researches emerged fromMM’s postulates to test claims of authors (Drobetz et al., 2015; Ebrahim et al., 2014). Consequently, new theoretical approaches were revealed to elucidate questions on capital structure determinants, the most familiar are the static trade-off (Myers, 1984), the asymmetry information and the pecking order theory (Brealey et al., 1977; Myers, 1984; Myers and Majluf, 1984; Ross, 1977). It must be highlighted that despite the large number of empirical studies, available currently, the issue is far from being solved (Chauhan, 2016; Kayo and Kimura, 2011; Tucker and Stoja, 2011; Milanesi, 2014; DeAngelo and Roll, 2015; Vo, 2017).

According to the trade-off theory, companies pursue an optimal point of indebtedness considering both the fiscal benefit and the costs of financial difficulties (Graham et al., 2015). Thus, by introducing financial difficulty and agency costs, companies seek a great point of indebtedness, based on a trade-off between tax benefit and cost of debt (Myers, 1984). This theory states that the value of the company consists of the value of the firm without leverage (financed completely by own capital), plus the present value of the tax savings from debt (interest of the debt that affords income tax deduction), minus the present value of financial distress costs (direct and indirect costs of bankruptcy and agency costs) (Myers, 1984).

When analysing the information asymmetry between management and shareholders, over the role of dividends, Ross (1977) noted that changes in capital structure and dividend distribution alter the market perception regarding future prospects, once debt increases indicate an optimistic future in relation to investment projects.

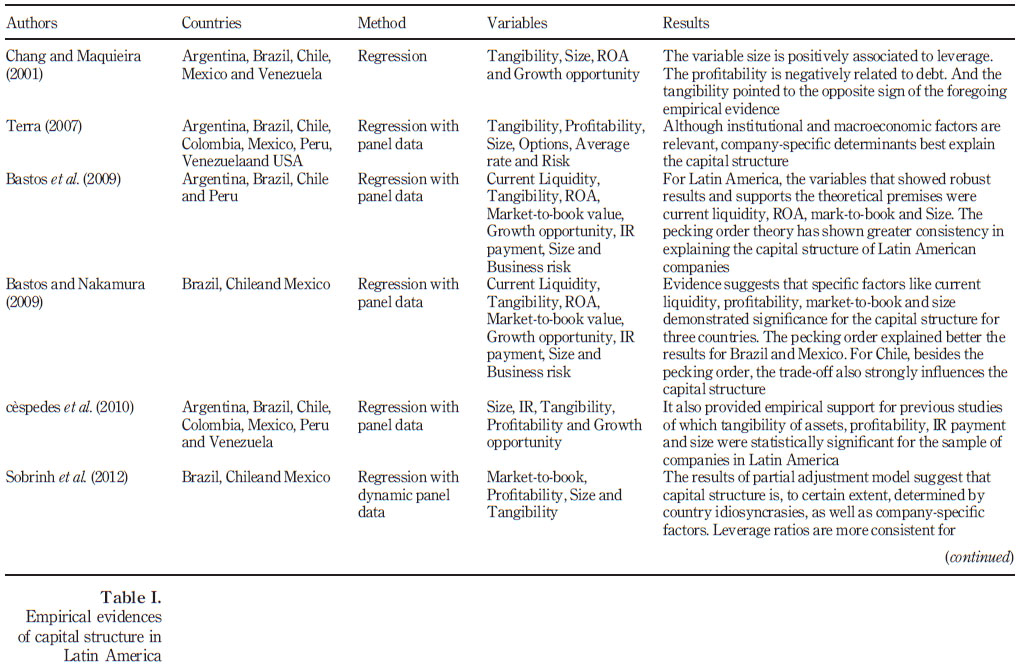

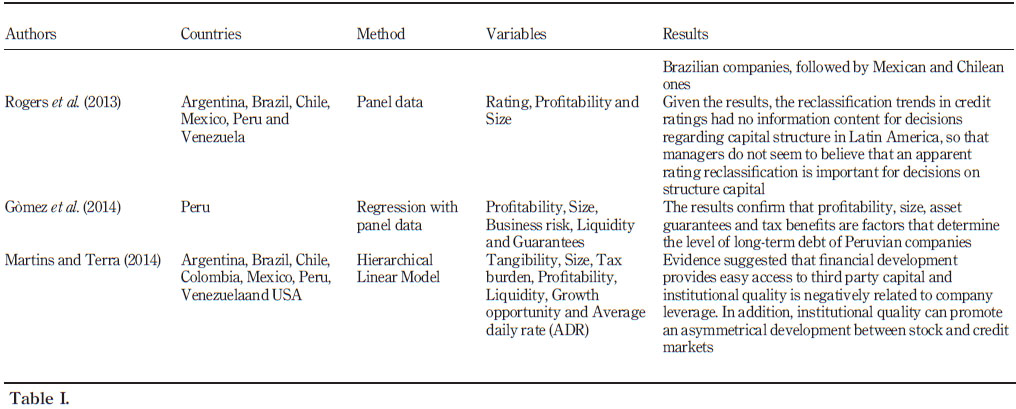

The pecking order background is the asymmetric information between managers and potential new shareholders. Such asymmetry induces the company to value destruction for current owners, in case they decide to issue new shares, as the implementation of new projects could not be evaluated properly by the market. Such fact would cause an underestimation of the new shares and consequently transferring wealth from current owners to new ones (Fama and French, 2002; Voutsinas and Werner, 2011). According to the theory, financing decisions mitigate issues associated with information asymmetry (Amess et al., 2015). Therefore, firms should prefer funds from internal to external sources, and, if funding with external resources were needed, companies should prefer to go into debt instead of issuing new shares; therefore, less vulnerable bonds are preferred rather than asymmetric information (Belkhir et al., 2016; Céspedes et al., 2010; Myers, 1984; Myers and Majluf, 1984). Table I outlines the empirical evidences on capital structure determinants for Latin American companies.

The studies highlight the importance of specific capital structure determinants for each company. The business profitability, earnings before interest and taxes (EBIT) margin, current liquidity, size, tangibility, and risk are considered company specific factors. As Bastos and Nakamura (2009) and Moosa et al. (2011), these factors have a stock and not flow nature. Most of the studies on capital structure were based on cross-section, which bounds results scope. Therefore, in this research, as well as other recent studies (Alves and Ferreira, 2011; Dang et al., 2014; Gómez et al., 2014; González and González, 2012; Martins and Terra, 2014; Zani et al., 2014; Rogers, Silva, Neder and Silva, 2013), panel data are used, seeking precisely to take into account the temporal behaviour of selected variables.

Economic analysis of the companies has gained proportions that takes into consideration not only an economic view but also geographic, political and social (Gwatidzo and Ojah, 2014). The environment, in particular, is one of those responsible for company performances (Ardalan, 2017). The performance is not restricted to originating country but extends to other realities. Thus, examinations of firms from developed or developing countries, in addition to the appreciation of companies belonging to an economic block, are of fundamental importance for understanding regional specificities (Zani et al., 2014; Awartani et al., 2015; Belkhir et al., 2016).

3. Methodology

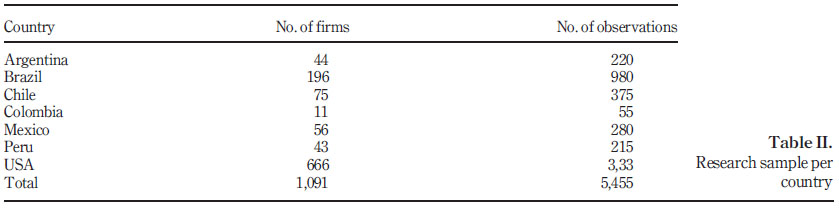

The sample comprises publicly companies traded in stock exchange in the six largest economies from Latin America (Argentina, Brazil, Chile, Colombia, Mexico and Peru). To compare the results, information of US firms was also gathered. Table II shows the sample by country from 2009 to 2013.

The analysis consisted of a regression using data from a balanced overview along five years’ evaluation. During this period, the selected firms were those that had good financial outcomes over the entire assessed period.

These nations have been selected given their importance for the Latin America economic bloc, in which Brazil and Mexico occupy the first and second largest share, respectively, and the others with relevant shareholding within the bloc. Yet, the choice of the USA can be attributed to the importance of this country in the world economy, which serves as a comparison whether decisions on firm’s capital structure in emerging economies are similar to those taken in mature markets, as the US credit and capital markets are reference for Latin America.

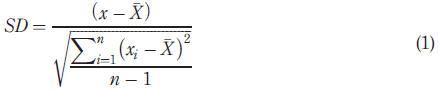

Data were collected directly from Economatica® System and updated by the main inflation index of each country for December 2014. After obtaining the original data, they were standardized to meet normality assumptions, as shown in equation (1):

In which SD is the standardized data, x original observation, X observation average and s the standard deviation. We opted for a regression with panel data because of its methodological rigour, which includes cross-section and time-series characteristics (Zhao et al., 2013). According to Fávero (2013), this technique shows a good explanatory power and its recurrent use in finance studies shows its solidity.

Models with fixed and random effects were not fit satisfactorily and heteroscedasticity was detected, so that the technique was estimated by the method of weighted least squares (WLS). If the variation form is correctly specified, WLS estimation will be more efficient than the method of ordinary least squares (OLS), as the WLS produces new t and F-statistics with t- and F-distribution (Wooldridge, 2012; You and Zhou, 2013).

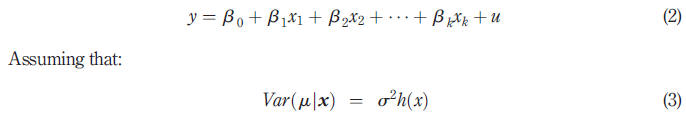

The heteroscedasticity is understood as a multiplicative constant, where the value of x represents all the explanatory variables as shown in equation (2). It is assumed that ujx1; x2; . . . ; xk ð Þ¼ 0, so that OLS is not biased and consistent:

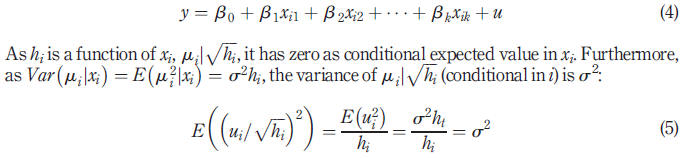

In which h(x) is a function of the explanatory variables that determines heteroscedasticity. For a random extraction of the population,Wooldridge (2012, p. 260) proposed "s 2 ¼ VarðmijxiÞ ¼ s 2hðxiÞ ¼ s 2hi, in which xi represents all the independent variables for i observations, while hi changes every observation once the independent variables change over observations". For b j estimation, we take into account the equation (4), which contains heteroscedastic errors, to transform it into an equation without such errors:

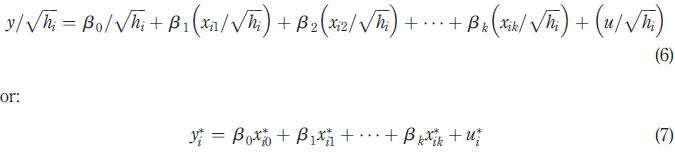

In which conditionality is suppressed in xi, by simplicity. In addition, we can divide the equation (4) by  obtaining:

obtaining:

In a way that  and the other variables overwritten with * are understood as the corresponding original variables divided by

and the other variables overwritten with * are understood as the corresponding original variables divided by That procedure is crucial for achieving estimators of efficiency properties better than OLS. For Wooldridge (2012), each slope parameter in

That procedure is crucial for achieving estimators of efficiency properties better than OLS. For Wooldridge (2012), each slope parameter in  multiplies a new variable that rarely has relevant interpretation.

multiplies a new variable that rarely has relevant interpretation.

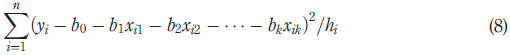

WLS focuses on the fact that  minimizes the weighted sum of squared residuals, in which each residue squared is weighted by

minimizes the weighted sum of squared residuals, in which each residue squared is weighted by  . The premise is to give less weight on observations of higher error variance. By contrast, the OLS method gives each observation equal weights, being most suitable when the error variance is identical for all population partitions (Wooldridge, 2012; You and Zhou, 2013). Mathematically, the WLS estimators are the values of

. The premise is to give less weight on observations of higher error variance. By contrast, the OLS method gives each observation equal weights, being most suitable when the error variance is identical for all population partitions (Wooldridge, 2012; You and Zhou, 2013). Mathematically, the WLS estimators are the values of  , that can be expressed as:

, that can be expressed as:

It is critical to note that the waste squared [equation (8)] are weighted by  . Finally, it is noteworthy that, in this study, the individuals (firms) were stratified by country (dummy variable). This resulted in one coefficient for each country, reproducing each country’s specific characteristics. According to Semykina and Wooldridge (2010), this procedure is to avoid perfect collinearity.

. Finally, it is noteworthy that, in this study, the individuals (firms) were stratified by country (dummy variable). This resulted in one coefficient for each country, reproducing each country’s specific characteristics. According to Semykina and Wooldridge (2010), this procedure is to avoid perfect collinearity.

The variables were organized to improve regression model with panel data and isolate the effects to be measured in a most efficient way. The dependent variables were selected to cover not only long-term debts, but also short-term ones, as this variable has proved to be significant in empirical studies for Brazilian firms, due to the limitations of those to longtermfunds (Barros et al., 2013).

The dependent variables used in the statistical procedures were defined with the background of previous empirical evidences on the subject. Such variables refer to the capital structure of companies and are represented by debt indicators which can be calculated from accounting data (Albanez et al., 2012; Céspedes et al., 2010; Chen, 2004; Gómez et al., 2014).

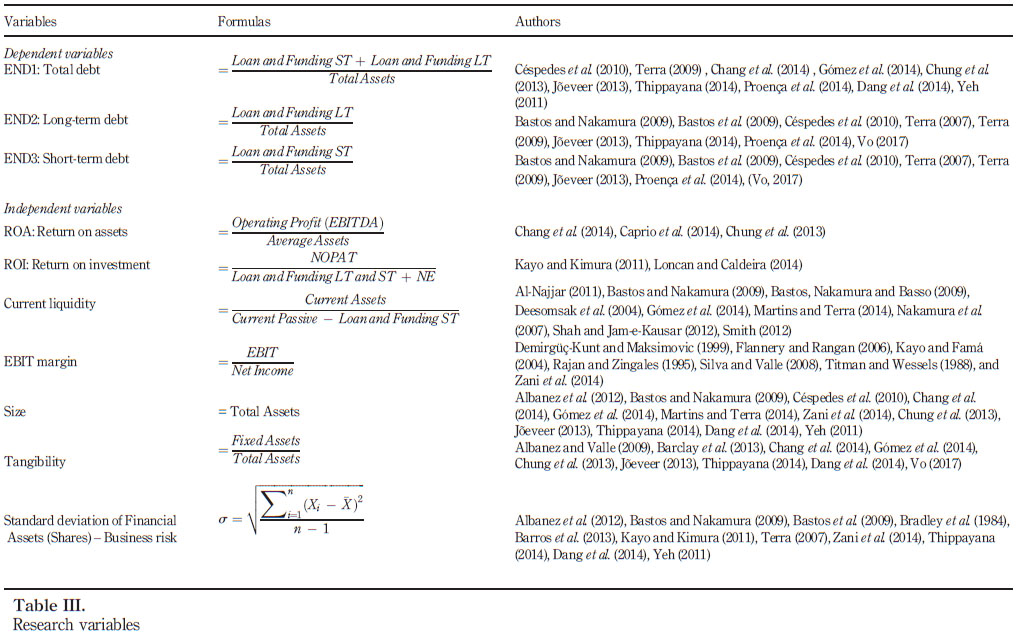

The independent variables represent the capital structure determinants of firms. These variables are widely used in empirical research with different calculation methods. Company-specific factors were chosen based on several empirical studies as seen in Table III.

4. Analysis of the results

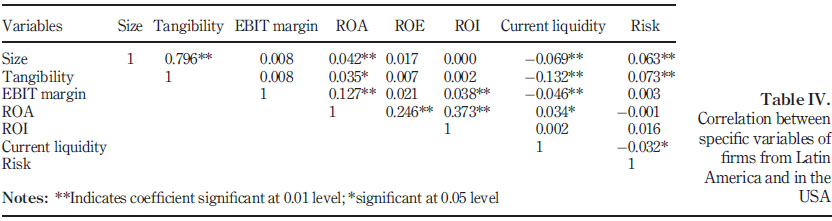

To verify the behaviour of independent variables and detect autocorrelation, we assessed Pearson’s correlation coefficient to measure the linear association between two variables. Table IV shows the value of Pearson’s correlation for each independent variable of the sample of LatinAmerica and USA.

The coefficient between size and tangibility displayed the highest degree of correlation (0.796); nevertheless, there is a theoretical reason for using these variables (Dang et al., 2014). In addition, the total assets represent how big the company is, suggesting a varied level of indebtedness for larger companies. These larger firms are most diversified and have more fixed assets, as for example, associated with guarantees that can provide higher levels of debt by reducing bankruptcy costs, according to the trade-off and the pecking order (Awartani et al., 2015). The remaining coefficients were below 0.40, and most of them were near zero, therefore, within a bearable limit according to Wooldridge (2012).

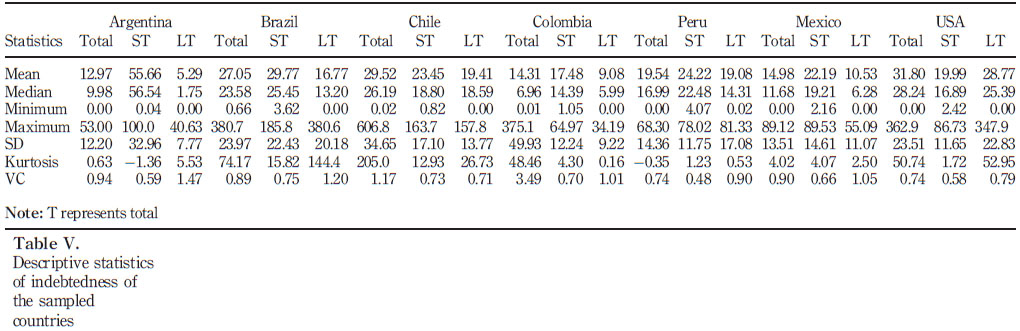

Table V shows the descriptive statistics for all three debt levels considered in this study, which are total debt (T), short-term debt (ST) and long-term debt (LT) for companies from Latin America and the USA.

First, it is noteworthy that the results were evaluated with and without outliers. There was no signal exchange or coefficient significance; thus, we decided to consider the results with outliers to preserve the original sample, as there was no further complication to discussions. Table V shows that Latin American companies finance their investments primarily with short-term funds. Chilean and Peruvian companies were those that used most long-term capital among the Latin countries, while Argentina used more short-term capital, which is probably due to internal crisis enhancement faced by this country.

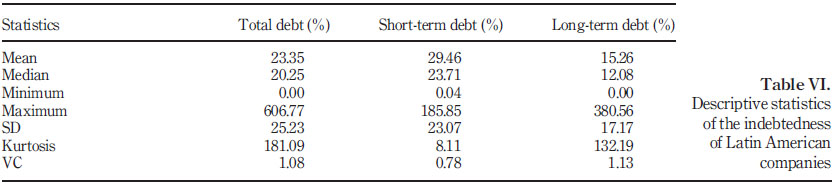

In contrast, US companies revealed a predominant use of long-term funds to finance investments. Moreover, North American companies have higher debt level compared to Latin American. This feature may be due to greater access to long-term capital and development of the capital markets of these firms. Table VI presents the descriptive statistics for the debt levels in Latin American companies considering aggregate results.

The average total debt of Latin American companies is 23.35 per cent, which is close to the total average debt of companies in Brazil (27.05 per cent) and Chile (29.52 per cent). Such indicator shows greater percentage change with regard to Argentinian (12.97 per cent), Colombian (14.31 per cent), Mexican (14.98 per cent) and Peruvian (19.54 per cent) companies. Differences between countries are important in the analysis.

Awartani et al. (2015) also identified differences in the average leverage of companies in Arab countries where the maturity of institutions, law and degree of development are several important exogenous variables. Belkhir et al. (2016) identified differences in the capital structure of companies established in North Africa and the Middle East. For otherwise, Gwatidzo and Ojah (2014) also identified differences in the debts of firms in different African countries.

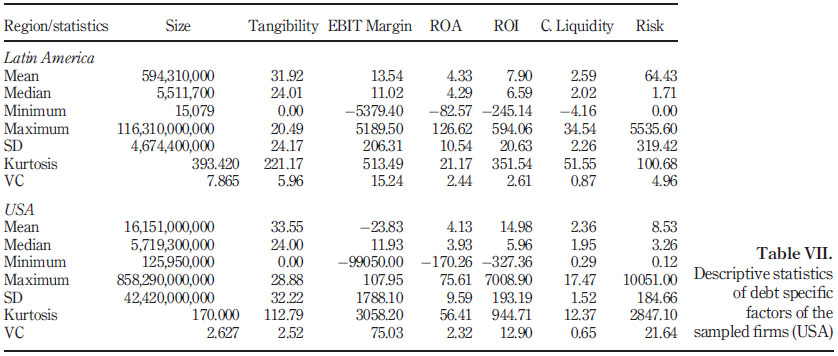

As for the ST, the average results for Latin America deviated more clearly for Argentinian companies (55.66 per cent), which since 2001 has difficulties to negotiate debt securities on account of event of default in that year, as well as economic difficulties consolidated. Similarly, the LT also showed greater difference for Argentinian companies, followed by Colombian ones. Table VII provides the descriptive statistics of some explanatory variables related to indebtedness of the sampled companies.

US companies, as well as the Latin American ones, show considerable dispersion for the variable size. The average tangibility was above one-third compared to total assets, a higher result compared to the Latin America business. The return on assets (ROA) of US companies is in line with that of Latin American companies. In contrast, the return on investment (ROI) of US companies is almost double the Latin American companies. As found for Latin American companies, the current liquidity reflects the concern of US companies with solvency, showing results above 2. The business risk of US companies showed lower dispersion and average than Latin America companies, which indicates a business and financial environment with a greater stability and liquity in the USA compared to that found in Latin countries.

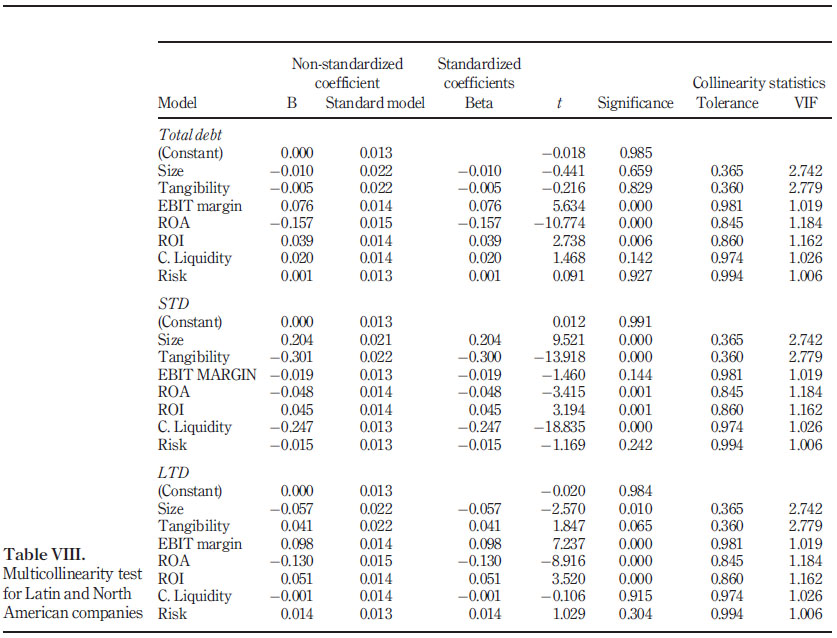

Capital structure determinants were analysed by country. We opted to present the results via regression estimated by WLS model, as it has better model fit. Shapiro–Wilk and Lilliefors tests were carried out to verify the normality of the variables, hence reporting the absence of normality for all of them. This result was expected based on the differences among companies and countries, restricting the use of the results for estimate purposes (Wooldridge, 2012). The multicollinearity test for Latin and North American companies is expressed in Table VIII.

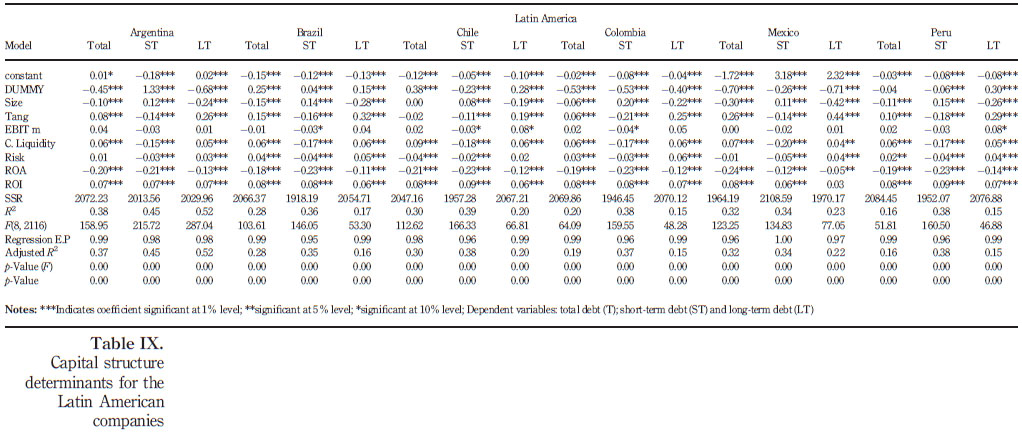

In view of the values pointed by the variance inflation factor (VIF), we may consider no restrictions related multicollinearity. Therefore, the capital structure determinants for companies in Latin America can be seen in Table IX.

The variable size has a distinct relationship within the sample, as this factor had a negative influence on because it was significant negatively influence on LT interpretation of companies from all Latin American countries, though positive on ST. This framework brings the importance of debt profile and dependence on third-party capital sources for corporate growth, which would approximate the Latin American reality to pecking order theory and information asymmetry predictions help to explain controversial results obtained from empirical research in these regions (Jong et al., 2008; Bastos and Nakamura, 2009) and other emerging countries (Belkhir et al., 2016; Vo, 2017).

In contrast, the tangibility had a significant positive effect on both T and LT, which corroborates findings by Martins and Terra (2014) e Vo (2017). However, this result was contrary by Bastos, Nakamura and Basso (2009), who studied the same geographical context. It may be associated with the post-crisis, when companies with high tangibility levels could provide more guarantees in a credit market more averse to risk.

The EBIT margin, as a source of cash-flow generation, was not statistically significant for Argentina and Mexico. Moreover, it exerted negative influence on ST in Brazil, Chile and Colombia and positive on LT for Chile and Peru. This evidence meets the pecking order theory predictions, which states that companies prioritize investments with self-financing (Céspedes et al., 2010).

Like firm size, current liquidity has specific impact on debt according to its profile and partly confirms the results of the EBIT margin, once companies with lower liquidity levels will have lower ST, as observed in similar studies (Jong et al., 2008; Bastos et al., 2009). Nevertheless, a positive and significant relationship between T and LT points to another aspect which is an increased availability of capital in restricted markets for companies with higher liquidity.

Profitability indicators registered mixed results. ROA showed a negative significant relationship for all levels of indebtedness, which strongly confirms the pecking order prediction, while ROI had a positive relation. Unlike our findings, previous studies for emerging countries reported a negative relationship for ROI according to the trade-off hypothesis (Booth et al., 2001; Kayo and Kimura, 2011).

A noteworthy aspect is that the business risk showed a positive relationship to both T and LT, contradiction theoretical assumptions on capital structure determinants. Nonetheless, the current liquidity index also showed a positive relationship to those variables. This way, it suggests that companies need greater liquidity to run up debts and withstand risk exposure.

Interestingly, results among the evaluated countries are similar, but not identical. This finding confirms the importance of a stratified analysis, as there is an influence of external factors that arise differently at companies in each country.

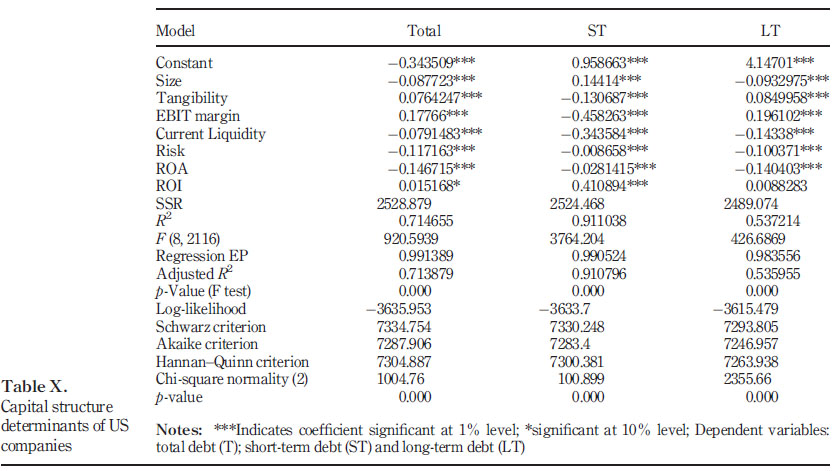

Aiming at comparing the capital structure determinants of the companies in Latin America with those in a developedmarket, Table X shows the indebtedness determinants for US companies.

The size of the US companies has negative and significant relationship with T and LT, disproving premises of trade-off. This result contrasts with those found by Frank and Goyal (2003). On the other hand, the North American tangibility was positively related to leverage levels, exerting a beneficial influence on LT financing decisions. Conversely, larger companies tend to be less in debt in a long term. In contrast, the logic is reversed in ST, in which we observed a positive relationship by size and a negative by tangibility. This result suggests that firms with a higher share of fixed assets on balance sheet tend to prefer LT.

When making a contrast to the Latin companies, US firms showed statistical significance in relation to EBIT margin, at all levels of indebtedness. For Americans, we observed a positive relationship of EBIT margin relative to the total leverage and LT, consistent with the assumptions of trade-off and information asymmetry. In contrast to this study, Jong et al. (2011) found an inverse relationship. For ST, it was an inverse relationship, which indicates that the greater the cash-flow generation, the lower should be the ST.

Current liquidity index had inverse relationship at all levels of indebtedness. This fact points that US firms with greater liquidity are less indebted, unlike the findings of Alves and Ferreira (2011). This evidence may be related to the negative relationship between the business risk with all debt levels, indicating that greater risks would incur less indebted companies, i.e. there is less pressure on the liquidity of a company. The Latin firms, in turn, showed a positive relationship between current liquidity and T, LT and risk, also positive for both debt levels. This result emphasizes that increased volatility in generating cash flows requires more liquidity.

Profitability indicators, measured by ROA and ROI, showed mixed results. ROA had negative relationship at all levels of indebtedness, as in the case of pecking order theory.

Conversely, the ROI showed positive relationship with all levels of leverage, unlike findings of Kayo and Kimura (2011), Jong et al. (2011) and Dudley (2012), who found an inverse relationship to US companies. This relationship of profitability indicators with debt levels was observed for companies of all countries analysed in this study. It is believed that this difference in the direction of profitability is related to the fact that ROI being the main indicator of return on investment and, in effect, working as parameter for capital costs for companies.

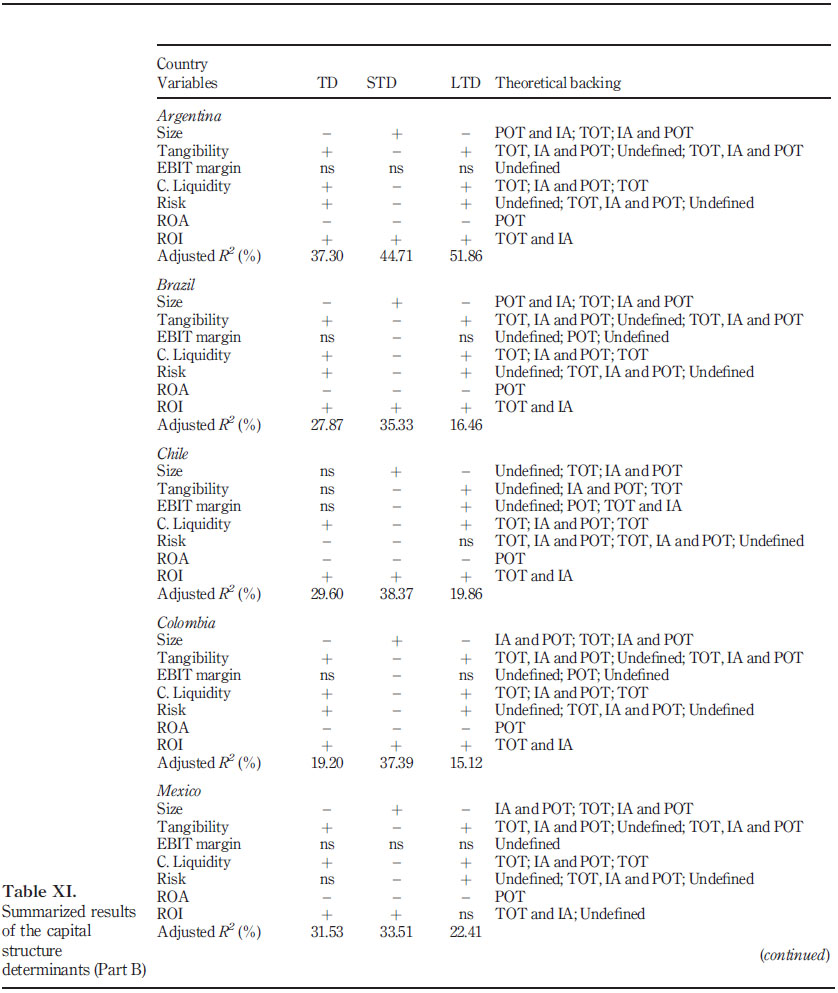

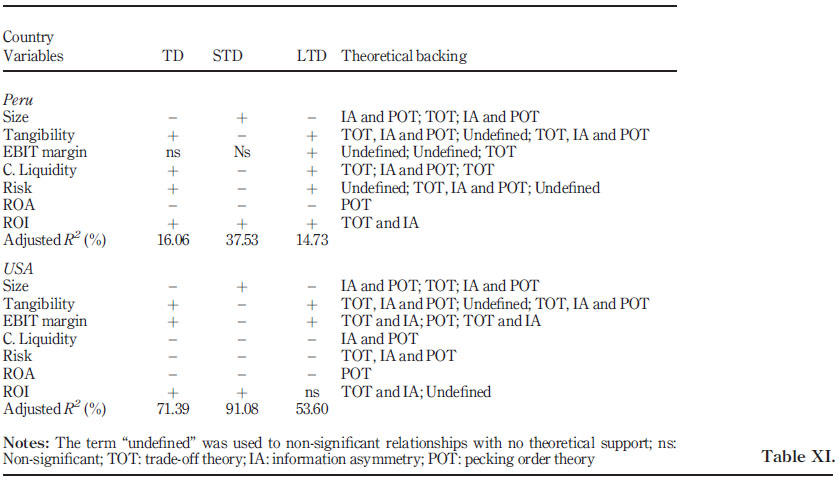

By means of the approached theoretical support, it was possible to identify that ST has been ignored in studies dealing with capital structure, in developed countries. Thus, verification and analysis of the ST determinants are our differential in relation to the previous studies. Table XI shows depicts a comparative summary of the capital structure determinants for each country.

It is noteworthy that the determinants with impact on financial leverage degree of the companies were size, tangibility, current liquidity, ROA and ROI. This conclusion is close to the evidence obtained by several authors, such as Bastos et al. (2009), Bastos and Nakamura (2009), Chang and Maquieira (2001), Daskalakis and Psillaki (2008), Jõeveer (2013), Kayo and Kimura (2011), Moosa et al. (2011), Rajan and Zingales (1995), Smith (2012), Terra (2009) and Thippayana (2014). However, the influence of these variables was distinct in Latin American countries and in the USA, which suggests the importance of distinct institutional structures between countries (Ardalan, 2017).

5. Conclusion

We analysed the capital structure determinants for firms fromsix countries in Latin America (Argentina, Brazil, Chile, Colombia, Mexico and Peru), as well as firms in the USA. The six Latin American countries have similar economic realities and institutional environments. In contrast, the US firms expressed different economic, political and social environments. The post-crisis period (2008) plus the differences on economic, political, social and institutional scenarios between Latin and North American companies provided an interesting backdrop for the comparison of determinants, as the same were found in unequal financial markets.

The relationship between company-specific factors in LatinAmerica and in theUSA, after 2008 crisis, was assessed based on three indebtedness measures. For this purpose, we used the following dependent variables: total debt (T), LT debt (LT) and ST debt (ST). A detailed analysis that led to conclusions that are more relevant was possible by considering indebtedness term. Furthermore, as ST has been neglected in developed economies’ researches, we also aimed to extend the understanding of specific factors in a ST for US firms.

By the capital structure determinants, we can infer that the indebtedness level of Argentinian, Brazilian, Colombian, Mexican and Peruvian companies are explained by the same exploratory variables, and the same theories (information asymmetry and pecking order). Yet, for the Chilean firms, the empirical results are different for T and business risk; however, it is also supported by the same theoretical currents. In addition, the risk of Chilean companies showed an inverse relationship, while the other Latin countries had positive relationship.

In the assessment of Latin America, the determinants that showed significant results and were supported by theoretical currents were size, current liquidity, ROA and ROI. The theoretical support that has shown improved robustness in explaining the relationship of the variables were information asymmetry and pecking order theory. For US companies, the variables that showed statistical significance and were supported by the theories were size, EBIT margin, current liquidity, business risk and ROA. Thus, theories of trade-off and asymmetry were the most robust to explain US companies’ indebtedness.

Evidences were identified that differentiate the determinants of firms in both Latin America and the USA. The results showed that, due to market restrictions relating to access to higher long-term funds faced by Latin American companies, such firms face stronger difficulties in deciding on the level of financial leverage. These results may indicate that the theoretical currents of capital structure developed and tested in developed countries may be, to some extent, applied in emerging countries, as assessed in this research, as they consider the major market imperfections presented in those developing countries.

Another important note is related to debt maturities. The evaluated periods have shown that there are differences related to the specific variables of firms, both for Latin American and for US firms. Thus, our study has contributed in two ways on the topic. One contribution was an increase in research, enriching literature of emerging countries. In the case of Latin America, there are still few conclusions about capital structure, particularly for Colombia, Peru and Mexico. A second contribution was by the flexibility of options among several corporate debt maturities, analysing different impacts of these determinants through a theoretical framework. Overall, the dependent variables were significantly different, which promulgates the importance of considering debt term. ST is neglected in researches of developed economies; thus, in this study, we considered such maturity to understand the impact of determinants on ST of US companies, filling this gap.

Limitations should not be neglected, as it is a complex issue without definitive answers. In an econometric order, the limitation is to use a static technique, which does not allow checking whether there is indeed a great goal of capital structure and how fast it would go.

Another limitation concerns on the sample taken, more specifically regarding Colombian firms, which accounted for only 1.01 per cent of the total sample (11 companies). Moreover, another limitation may be attributed to the normality test of variables, in which there was no evidence of normality, making it impossible to estimate results. However, this limitation did not compromise results and objectives of this research.

It is suggested, for further researches, to increase the number of companies sampled in Latin American countries, covering a higher number of companies and under different markets (heterogeneity), aiming to analyse the adherence of determining factors to the theoretical currents, consistently. In addition, it is suggested to use the data in dynamic panel model, which can present evidence on adjustment speed of indebtedness level for Latin American companies. Finally, it is suggested the combination of the theory of real options in capital structure, to develop a new approach to existing ones. Another study opportunity is to include the tangibility variable, checking its impact on the capital structure of Latin and US companies. Therefore, exhausting this theme seems, for now, somewhat distant. The progress of future researches depends, among other reasons, on challenges placed on this issue, the use of other econometric techniques and, undoubtedly, the emergence of newalternative theoretical currents.

References

Al-Najjar, B. (2011), "The inter-relationship between capital structure and dividend policy: empirical evidence from Jordanian data", International Review of Applied Economics, Vol. 25 No. 2, pp. 209-224. [ Links ]

Albanez, T., do Valle, M.R. and Corrar, L.J. (2012), "Fatores institucionais e assimetria informacional: influência na estrutura de capital de empresas brasileiras", RAM – Revista de Administração Mackenzie, Vol. 13 No. 2, pp. 76-105. [ Links ]

Albanez, T. and Valle, M.R. (2009), "Impactos da assimetria de informação na estrutura de capital de empresas brasileiras abertas", Revista Contabilidade& Finanças, Vol. 20 No. 51, pp. 6-27. [ Links ]

Alves, P.F.P. and Ferreira, M.A. (2011), "Capital structure and law around the world", Journal of Multinational Financial Management, Vol. 21 No. 3, pp. 119-150. [ Links ] Amess, K., Banerji, S. and Lampousis, A. (2015), "Corporate cash holdings: causes and consequences", International Review of Financial Analysis, Vol. 42 No. 1, pp. 421-433. [ Links ]

Ardalan, K. (2017), "Capital structure theory: reconsidered", Research in International Business and Finance, Vol. 39 No. B, pp. 696-710. [ Links ]

Awartani, B., Belkhir, M., Boubaker, S. and Maghyereh, A (2015), "Corporate debt maturity in the MENA region: does institutional qualitymatter?", International Review of Financial Analysis, Vol. 46 No. 1. [ Links ]

Balli, F., Balli, H.O., Louis, R.J. and Vo, T.K. (2015), "The transmission of market shocks and bilateral linkages: evidence from emerging economies", International Review of Financial Analysis, Vol. 42 No. 1, pp. 349-357. [ Links ]

Barclay, M.J., Heitzman, S.M. and Smith, C.W. (2013), "Debt and taxes: evidence from the real estate industry", Journal of Corporate Finance, Vol. 20 No. 1, pp. 74-93. [ Links ]

Barros, L.A., Nakamura, W.T. and Forte, D. (2013), "Determinants of the capital structure of small and mediumsized Brazilian enterprises, Brazilian", Administration Review, Vol. 10 No. 3, pp. 347-369. [ Links ]

Bastos, D.D. and Nakamura, W.T. (2009), "Determinantes da estrutura de capital das companhias abertas no Brasil, México e Chile no período 2001-2006", Revista Contabilidade & Finanças, Vol. 20 No. 50, pp. 75-94. [ Links ]

Bastos, D.D., Nakamura, W.T. and Basso, L.F.C. (2009), "Determinantes da estrutura de capital das companhias abertas na América Latina: um estudo empírico considerando fatores macroeconômicos e institucionais", Revista de Administração Mackenzie, Vol. 10 No. 6, pp. 47-77. [ Links ]

Bekiros, S.D. (2014), "Contagion, decoupling and the spillover effects of the US financial crisis: evidence fromthe BRIC markets", International Review of Financial Analysis, Vol. 33 No. 1, pp. 58-69. [ Links ]

Belkhir, M., Maghyereh, A. and Awartani, B. (2016), "Institutions and corporate capital structure in the MENA region", Emerging Markets Review, Vol. 26, pp. 99-129. [ Links ]

Booth, L., Aivazian, V., Demirguc-Kunt, A. and Maksimovic, V. (2001), "Capital structures in developing countries", The Journal of Finance, Vol. 56 No. 1, pp. 87-130. [ Links ]

Bradley, M., Jarrell, G.A. and Kim, E.H. (1984), "On the existence of an optimal capital structure: theory and evidence", The Journal of Finance, Vol. 39 No. 3, pp. 857-878. [ Links ]

Brealey, R., Leland, H.E. and Pyle, D.H. (1977), "Informational asymmetries, financial structure, and financial intermediation", The Journal of Finance, Vol. 32 No. 2, pp. 371-387. [ Links ]

Chauhan, G.S. (2016), "Reconciling theory and evidences for corporate financing in India", Journal of Emerging Market Finance, Vol. 15 No. 3, pp. 295-309. [ Links ]

Carvalhal, A. and Leal, R.P.C. (2013), "The world financial crisis and the international financing of Brazilian companies", BAR Brazilian Administration Review, Vol. 10 No. 1, pp. 18-39. [ Links ]

Campello, M., Graham, J.R. and Harvey, C.R. (2010), "The real effects of financial constraints: evidence froma financial crisis", Journal of Financial Economics, Vol. 97 No. 3, pp. 470-487. [ Links ]

Caprio, G., Jr., D’Apice, V., Ferri, G. and Puopolo, G.W. (2014), "Macro-financial determinants of the great financial crisis: implications for financial regulation", Journal of Banking & Finance, Vol. 44 No. 1, pp. 114-129.

Céspedes, J., González, M. and Molina, C.A. (2010), "Ownership and capital structure in latin america", Journal of Business Research, Vol. 63 No. 3, pp. 248-254. [ Links ]

Chakraborty, I. (2010), "Capital structure in an emerging stock market: the case of india", Research in International Business and Finance, Vol. 24 No. 3, pp. 295-314. [ Links ]

Chang, R. and Maquieira, V.C. (2001), "Determinantes de la estructura de endeudamiento de empresas latinoamericanas emisoras de adrs", Estudios de Administración, Vol. 8No. 1, pp. 55-87. [ Links ]

Chang, C., Chen, X. and Liao, G. (2014), "What are the reliably important determinants of capital structure in China?", Pacific-Basin Finance Journal, Vol. 30 No. 1, pp. 87-113. [ Links ]

Chen, J.J. (2004), "Determinants of capital structure of chinese-listed companies", Journal of Business Research, Vol. 57 No. 12, pp. 1341-1351. [ Links ]

Chung, Y.P., Na, H.S. and Smith, R. (2013), "How important is capital structure policy to firm survival?", Journal of Corporate Finance, Vol. 22, pp. 83-103. [ Links ]

Dang, V.A. (2013), "An empirical analysis of zero-leverage firms: new evidence from the UK", International Review of Financial Analysis, Vol. 30 No. 1, pp. 189-202. [ Links ]

Dang, V.A., Kim, M. and Shin, Y. (2014), "Asymmetric adjustment toward optimal capital structure: Evidence from a crisis", International Review of Financial Analysis, Vol. 33 No. 1, pp. 226-242. [ Links ]

Daskalakis, N. and Psillaki, M. (2008), "Do country or firm factors explain capital structure? evidence fromSMEs in France and Greece", Applied Financial Economics, Vol. 18 No. 2, pp. 87-97. [ Links ]

DeAngelo, H. and Roll, R. (2015), "How stable are corporate capital structures?", Journal of Finance, Vol. 70 No. 1, pp. 373-418. [ Links ]

Deesomsak, R., Paudyal, K. and Pescetto, G. (2004), "The determinants of capital structure: evidence from the Asia Pacific region", Journal of Multinational Financial Management, Vol. 14 Nos. 4/5, pp. 387-405. [ Links ]

Demirgüç-Kunt, A. and Maksimovic, V. (1999), "Institutions, financial markets, and firm debt maturity", Journal of Financial Economics, Vol. 54 No. 3, pp. 295-336. [ Links ]

Duchin, R., Ozbas, O. and Sensoy, B.A. (2010), "Costly external finance, corporate investment, and the subprime mortgage credit crisis", Journal of Financial Economics, Vol. 97 No. 3, pp. 418-435. [ Links ]

Dudley, E. (2012), "Capital structure and large investment projects", Journal of Corporate Finance, Vol. 18 No. 5, pp. 1168-1192. [ Links ]

Durand, D. (1952), "Costs of Debt and Equity Funds for Business: Trends and Problems of Measurement", Technical report, National Bureau of Economic Research, conference on Research in Business Finance of National Bureau of Economic Research. [ Links ]

Drobetz, W., Schiling, D.C. and Schröder, H. (2015), "Heterogeneity in the speed of capital structure adjustment across countries and over the business cycle", European Financial Management, Vol. 21 No. 5, pp. 936-973. [ Links ]

Ebrahim, M.S., Girma, S., Shah, M.E. and Williams, J. (2014), "Dynamic capital structure and political patronage: the case of Malaysia", International Review of Financial Analysis, Vol. 31 No. 1, pp. 117-128. [ Links ]

Fama, E.F. and French, K.R. (2002), "Testing trade-off and pecking order predictions about dividends and debt", Review of Financial Studies, Vol. 15 No. 1, pp. 1-33. [ Links ]

Fávero, L.P.L. (2013), "Panel data in accounting and finance: theory and application", Brazilian Business Review, Vol. 10 No. 1, pp. 127-149. [ Links ] Flannery, M.J. and Rangan, K.P. (2006), "Partial adjustment toward target capital structures", Journal of Financial Economics, Vol. 79 No. 3, pp. 469-506. [ Links ]

Francis, B.B., Hasan, I. and Kostova, G.L. (2016), "When do peers matter?: A cross-country perspective", Journal of International Money and Finance, Vol. 69, pp. 364-389. [ Links ]

Frank, M.Z. and Goyal, V.K. (2003), "Testing the pecking order theory of capital structure", Journal of Financial Economics, Vol. 67 No. 2, pp. 217-248. [ Links ]

Gómez, G.M., Rivas, A. and Bolaños, E.R.L. (2014), "The determinants of capital structure in Peru", Academia Revista Latinoamericana de Administración, Vol. 27 No. 3, pp. 341-354. [ Links ]

González, V.M. and González, F. (2012), "Firm size and capital structure: evidence using dynamic panel data", Applied Economics, Vol. 44 No. 36, pp. 4745-4754. [ Links ]

Graham, J.R., Leary, M.T. and Roberts, M.R. (2015), "A century of capital structure: the leveraging of corporate America", Journal of Financial Economics, Vol. 118 No. 3, pp. 658-683. [ Links ]

Gwatidzo, T. and Ojah, K. (2014), "Firms’ debt choice in Africa: are institutional infrastructure and non-traditional determinants important?", International Review of Financial Analysis, Vol. 31 No. 1.

Haron, R. (2014), "Capital structure inconclusiveness: evidence from Malaysia, Thailand and Singapore", International Journal of Managerial Finance, Vol. 10 No. 1, pp. 23-38. [ Links ]

Hirshleifer, J. (1958), "On the theory of optimal investment decision", Journal of Political Economy, Vol. 66 No. 4, pp. 329-352. [ Links ]

Hovakimian, A., Hovakimian, G. and Tehranian, H. (2004), "Determinants of target capital structure: the case of dual debt and equity issues", Journal of Financial Economics, Vol. 71 No. 3, pp. 517-540. [ Links ]

Ivashina, V. and Scharfstein, D. (2010), "Bank lending during the financial crisis of 2008", Journal of Financial Economics, Vol. 97 No. 3, pp. 319-338. [ Links ]

Jõeveer, K. (2013), "Firm, country and macroeconomic determinants of capital structure: evidence from transition economies", Journal of Comparative Economics, Vol. 41 No. 1, pp. 294-308. [ Links ]

Jong, A.D., Kabir, R. and Nguyen, T.T. (2008), "Capital structure around the world: the roles of firm-and country-specific determinants", Journal of Banking & Finance, Vol. 32 No. 9, pp. 1954-1969. [ Links ]

Jong, A.D., Verbeek, M. and Verwijmeren, P. (2011), "Firms’ debt-equity decisions when the static tradeoff theory and the pecking order theory disagree", Journal of Banking & Finance, Vol. 35 No. 5, pp. 1303-1314.

Kayo, E.K. and Famá, R. (2004), "A estrutura de capital e o risco das empresas tangíveisintensivas e intangíveis-intensivas", RAUSP Revista de Administração da USP, Vol. 39 No. 2, pp. 164-176. [ Links ]

Kayo, E.K. and Kimura, H. (2011), "Hierarchical determinants of capital structure", Journal of Banking & Finance, Vol. 35 No. 2, pp. 358-371. [ Links ]

Lintner, J. (1956), "Distribution of incomes of corporations among dividends, retained earnings, and taxes", The American Economic Review, Vol. 46 No. 2, pp. 97-113. [ Links ]

Loncan, T.R. and Caldeira, J.F. (2014), "Capital structure, cash holdings and firm value: a study of Brazilian listed firms", Revista Contabilidade & Finanças, Vol. 25 No. 64, pp. 46-60, available at: http://dx.doi.org/10.1590/S1519-70772014000100005 [ Links ]

McMillan, D.G. and Camara, O. (2012), "Dynamic capital structure adjustment: US MNCs & DCs", Journal of Multinational Financial Management, Vol. 22 No. 5, pp. 278-301. [ Links ]

Markowitz, H. (1952), "Portfolio selection", The Journal of Finance, Vol. 7 No. 1, pp. 77-91. [ Links ]

Martins, H.C. and Terra, P.R.S. (2014), "Determinantes Nacionais e Setoriais da Estrutura de Capital na América Latina", RAC Revista de Administração Contemporânea, Vol. 18 No. 5, pp. 577-597. [ Links ]

Milanesi, G.S. (2014), "Binomialmodel for company valuation and the effects of debt: tax shield and company insolvency", Journal of Economics, Finance and Administrative Science, Vol. 19 No. 36, pp. 2-10. [ Links ]

Modigliani, F. and Miller, M.H. (1958), "The cost of capital, corporation finance and the theory of investment", The American Economic Review, Vol. 48 No. 3, pp. 261-297. [ Links ]

Modigliani, F. and Miller, M.H. (1963), "Corporate income taxes and the cost of capital: a correction", The American Economic Review, Vol. 53 No. 3, pp. 433-443. [ Links ]

Moosa, I., Li, L. and Naughton, T. (2011), "Robust and fragile firm-specific determinants of the capital structure of Chinese firms", Applied Financial Economics, Vol. 21 No. 18, pp. 1331-1343. [ Links ]

Myers, S.C. (1984), "The capital structure puzzle", The Journal of Finance, Vol. 39 No. 3, pp. 574-592. [ Links ]

Myers, S.C. and Majluf, N.S. (1984), "Corporate financing and investment decisions when firms have information that investors do not have", Journal of Financial Economics, Vol. 13 No. 2, pp. 187-221. [ Links ]

Nakamura, W.T., Martin, D.M.L., Forte, D., Carvalho Filho, A.F., Costa, A.C.F. and Amaral, A.C. (2007), "Determinant factors of capital structure in the brazilian market - an analysis of the regression with data covering the period from 1999 to 2003", Revista Contabilidade & Finanças, Vol. 18 No. 44, pp. 72-85. [ Links ]

Noulas, A. and Genimakis, G. (2011), "The determinants of capital structure choice: evidence from greek listed companies", Applied Financial Economics, Vol. 21 No. 6, pp. 379-387. [ Links ]

Proença, P., Laureano, R.M. and Laureano, L.M. (2014), "Determinants of capital structure and the 2008 financial crisis: evidence from Portuguese SMEs", Procedia – Social and Behavioral Sciences, Vol. 150 No. 1, pp. 182-191. [ Links ]

Rajan, R.G. and Zingales, L. (1995), "What do we know about capital structure? Some evidence from international data", The Journal of Finance, Vol. 50 No. 5, pp. 1421-1460. [ Links ]

Rogers, D., Silva, W.M., Neder, H.D. and Silva, P.R. (2013), "Credit rating and capital structure: evidence fromLatin America", RBFin – Brazilian Review of Finance, Vol. 11 No. 3, pp. 311-341. [ Links ]

Ross, S.A. (1977), "The determination of financial structure: the incentive-signalling approach", The Bell Journal of Economics, Vol. 8 No. 1, p. 23. [ Links ]

Semykina, A. and Wooldridge, J.M. (2010), "Estimating panel data models in the presence of endogeneity and selection", Journal of Econometrics, Vol. 157 No. 2, pp. 375-380. [ Links ]

Shah, S.Z.A. (2012), "Determinants of capital structure of leasing companies in Pakistan", Applied Financial Economics, Vol. 22 No. 22, pp. 1841-1853. [ Links ]

Shah, S.Z.A. and Jam-e-Kausar (2012), "Determinants of capital structure of leasing companies in Pakistan", Applied Financial Economics, Vol. 22 No. 22, pp. 1841-1853, available at: http://dx.doi. org/10.1080/09603107.2012.678978 [ Links ]

Shyam-Sunder, L. and Myers, C.S. (1999), "Testing static tradeoff against pecking order models of capital structure", Journal of Financial Economics, Vol. 51 No. 2, pp. 219-244. [ Links ]

Silva, A.F. and Valle, M.R. (2008), "Análise da estrutura de endividamento: um estudo comparativo entre empresas brasileiras e americanas", Revista de Administração Contemporânea, Vol. 12 No. 1, pp. 201-229. [ Links ]

Singer, P. (2009), "A América Latina na crisemundial", Estudos Avançados, Vol. 23 No. 66, pp. 91-102. [ Links ]

Smith, G.P. (2012), "Capital structure determinants for tax-exempt organisations: evidence from the UK", Financial Accountability& Management, Vol. 28 No. 2, pp. 143-163. [ Links ]

Sobrinho, L.R.B., Sheng, H.H. and Lora, M.I. (2012), "Country factors and dynamic capital structure in latin american firms", Brazilian Review of Finance, Vol. 10 No. 2, pp. 267-284. [ Links ]

Terra, P.R.S. (2007), "Estrutura de capital e fatores macroeconômicos na américa latina", RAUSP - Revista de Administração da USP, Vol. 42 No. 2, pp. 192-204. [ Links ]

Terra, P.R.S. (2009), "Are leverage and debt maturity complements or substitutes? evidence from Latin America", Revista de Administração Mackenzie, Vol. 10 No. 6, pp. 4-24. [ Links ]

Thippayana, P. (2014), "Determinants of capital structure in Thailand", Procedia - Social and Behavioral Sciences, Vol. 143 No. 1, pp. 1074-1077. [ Links ]

Titman, S. and Wessels, R. (1988), "The determinants of capital structure choice", The Journal of Finance, Vol. 43 No. 1, pp. 1-19. [ Links ]

Tseng, H.-Y. (2010), "How does the removal of the United States short-sale rules impact three Latin American markets?", International Review of Financial Analysis, Vol. 19 No. 2, pp. 127-133. [ Links ]

Tucker, J. and Stoja, E. (2011), "Industry membership and capital structure dynamics in the UK", International Review of Financial Analysis, Vol. 20 No. 4, pp. 207-214. [ Links ]

Vidal, G., Marshal, W.C. and Correa, E. (2011), "Differing effects of the global financial crisis: why mexico has been harder hit than other large Latin American countries", Bulletin of Latin American Research, Vol. 30 No. 4, pp. 419-435. [ Links ]

Vo, X.V. (2017), "Determinants of capital structure in emerging markets: evidence from vietnam", Research in International Business and Finance, Vol. 40, pp. 105-113. [ Links ]

Voutsinas, K. and Werner, R.A. (2011), "Credit supply and corporate capital structure: evidence from Japan", International Review of Financial Analysis, Vol. 20 No. 5, pp. 320-334. [ Links ]

Wooldridge, J.M. (2012), Introductory Econometrics: A Modern Approach, 5th ed., No. 978-1111531041, South-Western College, Mason. [ Links ]

Yeh, T.-L. (2011), "Capital structure and cost efficiency in the Taiwanese banking industry", The Service Industries Journal, Vol. 31 No. 2, pp. 237-249. [ Links ]

You, J. and Zhou, X. (2013), "Asymptotic theory in fixed effects panel data seemingly unrelated partially linear regression models", Econometric Theory, Vol. 30 No. 2, pp. 407-435. [ Links ]

Zani, J., Leites, E.T., Macagnan, C.B. and Portal, M.T. (2014), "Interest on equity and capital structure in the Brazilian context", International Journal of Managerial Finance, Vol. 10 No. 1, pp. 39-53. [ Links ]

Zhao, X., Tong, X. and Sun, J. (2013), "Robust estimation for panel count data with informative observation times", Computational Statistics& Data Analysis, Vol. 57 No. 1, pp. 33-40. [ Links ]

Corresponding author

Vinicius Amorim Sobreiro can be contacted at: sobreiro@unb.br

Received 1 May 2016

Revised 3 June 2016

Accepted 3 March 2017