Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Journal of Economics, Finance and Administrative Science

versão impressa ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.23 no.46 Lima dez. 2018

The effect of ownership composition on earnings management: evidence for the Mexican stock exchange

Juan Manuel San Martín Reyna1

1 Department of Business Administration, Universidad de las Americas Puebla, Puebla, Mexico

Abstract

Purpose - This paper aims to examine the relationship between different types of shareholders that command share ownership, family, institutions or external blockholders and eamings management. In addition, it examines the effect of company size on eamings management.

Design/methodology/approach - The sample ineludes 67 companies listed in the Mexican Stock Exchange for the period 2005-2015. The sample composition is quite industry-balanced. A cross-sectional version of the Jones model (1991) is to measure the eamings management. The GMM (generalized method of moments) model is also estimated.

Findings - The results show that family and institutional ownership reduce the eamings management, but the impact is different depending on the company size.

Research limitations/implications - The results show that there is a elear relationship between increasing participation of family and institutional investors and a reduction in eamings management. This is consistent with the literature that establishes that ownership is an effective regulatory mechanism that limits eamings management through eloser supervision and involvement in management.

Practical/implications - For companies' corporate governance and regulatory authorities, the results of this study may serve to improve the decision-making.

Originality/value - This study shows that ownership structure can provide corporate governance in Mexican listed companies with different monitoring and control capacities to influence companies' strategies, particularly in relation to the discretion of earnings management.

Keywords: Corporate govemance, Eamings management, Ownership concentration

Introduction

The financial crisis in 2009 generated a vast body of research on the quality of financial information submitted by public companies and the critical role that corporate govemance plays as a control mechanism (Al-Fayoumi et al., 2010; Bar-Yosef and Annalisa, 2013; Castrillo and San Martin, 2008; Jin, 2013; San Martin-Reyna, 2012). The managers of public companies, given the crisis, have a greater need to attract investors as a way to strengthen their leverage structure and other financial measures. According to the cited research, this situation may tempt managers to show results of questionable quality to ensure company stability, as well as to ensure the necessary funds for the firms' investments. Earnings management is a key device for managers to influence investor perception as measured by the discretion that managers are able to have in their financial reporting (Macey, 1998). Therefore, there is a clear need for greater oversight of management practices in companies listed on the stock market because investors' perceptions are essential for the market value of public1y traded companies.

Previous research has focused on the infiuence of family ownership concentration on earnings management (Anderson et al., 2002; Bartholomeusz and Tanewski, 2006; López and Saona, 2005; San Martin-Reyna, 2012; Stiglitz, 1985; Warfield et al., 1994). This study extends previous research by inc1uding the relationship between other types of shareholders on earnings management. Specifically, this research will inc1ude the infiuence of institutional and other relevant blockholders on earnings management. It can be expected that in Mexico, given an emerging capital market where corporate government regulations are still in an evolving stage, the influence of sorne shareholders on the firm's decision-making processes is stil1 limited. In Mexico, the Best Corporate Practices Code carne into effect in 2006, with a reviewed version in 2010. The Consejo Coordinador Empresarial had been since 1999 a promoter of this code, based on the criteria of OECD. Moreover, there is an interest to examine how that infiuence is exercised in the Mexican context, where the level of family ownership in public companies is visibly high. Therefore, our main research question is as follows:

RQ. To what extent institutional or significant blockholders are able to reduce earnings management, and how the level of family ownership modera tes this infiuence?

This research found that the increasing ownership participation of family and institutional shareholders affects eamings management, and that the degree of influence changes with the level of ownership concentration. Additionally, the findings show that the impact of institutional and significant blockholders varies depending on the degree of family shareholding participation. The particular institutional Mexican context and the visibly high participation of families in shareholding explain to a large extent these results.

This study is divided into five sections, inc1uding the introduction. In the fol1owing sections a review of previous research is presented, fol1owed by the research methodology used in the study, presentation of the resu1ts with conc1usions and implications for further research.

Literature review

Ownership concentration and convergence

Agency theory suggests that a separation between ownership and control leads to a divergence between manager and owner interests Gens en and Meckling, 1976). However, the ownership structure has been suggested as a mechanism to reduce agency confiicts through the alignment of interests between management and shareholders, according to the convergence of interest theory (Demsetz and Lehn, 1985; Shleifer and Vishny, 1997). The concentration of shareholder ownership, especially within the family, can reduce managerial incentives to consume perquisites, expropriate shareholder wealth and engage in other non maximizing behavior (Demsetz and Lehn, 1985; Jensen and Meckling, 1976). Ownership concentration can be an effective regulatory mechanism for managers owing to closer supervision and/or direct shareholder involvement in management (Jensen, 1986; Jensen and Meckling, 1976; Shleifer and Vishny, 1997; Stiglitz, 1985). Moreover, Stein (1988, 1989) finds that family firms which have higher ownership concentration and higher investment horizons are more focused on maximizing long-term results.

Given that the separation of ownership and management is among the most important forces driving earnings management, a vast amount of research has examined the relationship between ownership structure and earnings management and the manipulation of accounting practice to create a more positive picture of a company's financial results (Al-Fayoumi et al., 2010; Amihud et al., 1983; DeFond and Jiambalvo, 1991; Dhaliwal et al., 1982; Koch, 1981; Salamon and Smith, 1979; San Martin-Reyna, 2012; Smith, 1976).

Earnings management

Although there is sorne consensus about the earnings management concept, researchers have seen their efforts limited by the difficulty to measure both the motivations of managers and their decision-making processes, given that accounting discretion cannot be directly observed (Garóa and Gill, 2005). Seminal work by Healy (1985) and DeAngelo (1986) represented a breakthrough in this field through the estimation of the non-discretionary part in total accrual adjustments which was calcu1ated as the difference between the accounting result and the operations cash flow. This identification provided a reference point from which the discretionary or abnormal part of accruals can be estimated, serving as a proxy for the measurement of earnings management (poveda, 2001).

Subsequently, Jones (1991) developed a model that established a linear relationship between non-discretionary accruals and the changes in the reporting of revenue and fixed assets and by controlling for the firrn's conditions introduced variability in discretionary adjustments. This was later modified by Dechow et al. (1995) by adjusting for changes in the reporting of account receivables, assuming this as part of discretionary adjustments. Guay, Kothari and Watts (1996) clarified that imprecision and poor specification of accruals reporting indicated measurement errors in the model.

Complications with the application of the model in situations of extreme levels of cash flow were recognized as well (Kang and Sivaramakrishnan, 1995; Jeter and Shivakumar, 1999; Peasnell, Pope and Young, 1998; Subramanyan, 1996), and the Jones model was modified with the use of instrumental variables and generalized method of moments (GMM). However, GarzaGómez, Okumura and Kunimura (1999) proved that in the case of random samples, the Jones model is well specified.

Earnings management and ownership

The presence of discretion in the management of eamings, within regulatory limits, may work to management advantage, promoting an opportunistic type of behavior that affects reporting of corporate profits (Delgado, 2003; Monterrey, 2004; Warfield et al., 1995), and as the separation between ownership and control expands, management discretion is expected to increase (Warfield et al., 1995). Family ownership concentration thus becomes a fundamental part of the control mechanism with which a company limits earning management (San Martin-Reyna, 2012).

Many empirical studies have concluded that both institutional investors and large equity blockholders can positively affect firm value (Barclay and Holdemess, 1989; Friend and Lang, 1988; Holdemess and Sheehan, 1988; Mehran, 1992; Mikkelson and Ruback, 1985), especially when monitoring is cost-efficient Gens en and Meckling, 1976), and there is the ability to lobby senior executives for corporate restructuring (Bethel and Liebeskind, 1993). Institutional shareholders, or intermediaries between lenders and borrowers, such as banks, for example, through the establishment of long-term business relationship with the firms, supervise the actions of management. As suggested by the empirical evidence, sorne benefits of institutional shareholders are reported in countries such as Germany (Cable, 1985), ]apan (prowse, 1990) and Spain (Zoido, 1998). For institutional investors, the size of their investment justifies the supervision of management, and the incentives to monitor increase with larger investments (Brailsford et al., 2002). Institutional investor power comes partly from the variety of control rights that institutions have when firms do not pay or violate the terms of debt contracts and partly because they tend to provide funds in the short term (Diaz, 2000). In situations in which a major lender extends its support over time, the threat of withdrawal of funds from the company, unless the management takes appropriate measures, becomes credible (prowse, 1994). Thus, institutional investors effectively monitor eamings management (Bar-Yosef and Prencipe, 2013; Dechow et al., 1996).

Blockholders are considered as those shareholders that possess a relevant ownership participation in the company but who do not form part of the dominant family (Al-Fayoumi et al., 2010). According to previous research, these blockholders also encourage managers to fully report financial information and hold a greater threat of intervention than minority shareholders (Barc1ay et al., 1991; Holdemess and Sheehan, 1988; McEachem, 1975; Shleifer and Vishny, 1986), thus creating incentives for managers to reduce earnings management, especially when the firm experiences dec1ining or poor performance (Zhong et al., 2007). Additionally, in a country characterized by high family ownership concentration, such as Mexico, the market relies on blockholders to monitor managers on issues such as eamings management, thus increasing company value (Earle et al., 2004), given their power as well as their separation from the controlling family that better enables them to supervise and reduce eamings management (Bar -Yosef and Prencipe, 2013).

Based on the review of the relevant literature, the following hypothesis is presented:

H1: The degree of eamings management tends to diminish as the level ownership concentration (family, institutional or blockholder) increases.

Family ownership as a moderating factor

It is likely that when there are high levels of family ownership, substantial risk from the pursuit of self-interest arises, that is, at sorne point, management entrenchment or expropriation may cause controlling shareholders to maximize their own benefits at the expense of other shareholders (Faccio and Lang, 2001; Fama and Jensen, 1983; Gómez-Mejia et al., 2001; Shleifer and Vishny, 1997). Paradoxically, at this point, controlling shareholders may find it convenient not to eliminate management discretion altogether, given that this discretion may work to their favor (Ball, 1989).

Castrillo and San Martin (2007), Claessens and Djankov (1999), DeAngelo and DeAngelo (2000), Faccio and Lang (2001), Friend and Lang (1988), ]ohnson et al. (1985), Singell (1997) and Wang (2006) argue that large shareholders can mitigate the managerial expropriation, or agency problems, in companies with concentrated ownership and control. Bar-Yosef and Prencipe (2013), Demsetz and Lehn (1985), Jin (2013), Morck et al. (1988), Pedersen and Thomsen (1997) and Shleifer and Vishny (1986) argue that the presence of blockholders limits earnings management. Blockholder supervision of managers potentially reduces eamings management by restricting management discretion in financial reporting, thus decreasing their incentive to manage earnings (Zhong et al., 2007). On the other hand, it is also argued that financial statements tend to be less important in detecting information asymmetry problems, resulting in less aversion towards eamings management, and the market relies on majority shareholders to monitor management behavior and thus may not consider earnings management risky (Bar-Yosef and Prencipe, 2013; Jin, 2013).

Therefore, it is important to study the degree to which institutional investors and blockholders mitigate the problem of earnings management, considering the level of family ownership concentration. Therefore, the following hypotheses are presented:

H2: Institutional investors moderate the effect of family ownership concentration on earnings management.

H3: Blockholder investors moderate the effect of family ownership concentration on earnings management.

Another important aspect of the study is the control variables. Financial leverage is included because managers are more likely to use earnings management techniques when companies are closer to default on debt contracts (Fernández, 1999; Press and Weintrop, 1990; Prowse, 1994). The size of the firms is also considered as its market visibility may pressure larger firms to incur in eamings management (Al-Fayoumi et al., 2010; Watts and Zimmerman, 1986). Profitability is also considered because listed firms with lower profitability tend to show higher earnings management (Al-Fayoumi et al., 2010; Chen et al., 2006). Final1y, growth opportunities are included as a control mechanism for demand conditions. (La Porta et al., 2000; McConnell and Servaes, 1990).

Methodology

Sample composition

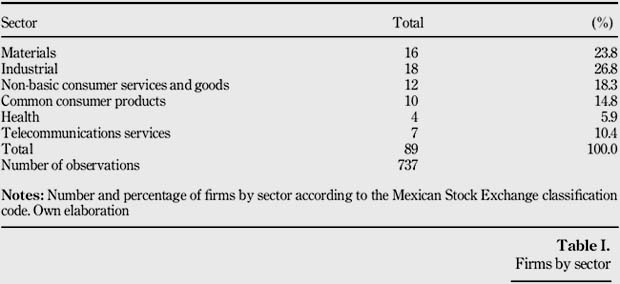

The sample includes companies listed in the Mexican Stock Exchange for the period 20052015. Out of 132 listed companies, non-profit companies, companies that do not inc1ude enough information in its financial statements and financial institutions were excluded, resulting in a total number of 67 firms. The final sample for the empirical analysis consists of 737 observations over a 10-year periodo The annual reports and financial indicators from Economatica and ISI Emerging Markets were obtained. Information on the industrial sector was obtained from company annual reports published by the Mexican Stock Exchange on its website. The firms selected are from the most important players in the different sectors of Mexican economy. Table 1 shows the companies that make up our sample according to the sectors to which they belong.

As can be seen in Table 1, the sample composition is quite industry-balanced, although there is a slight bias toward industrial and common consumer products firms at the expense of health or telecommunications companies that can be explained by the heavier concentration of the former in the Mexican market.

Discretionary accruals as measure of earnings management

As presented in the literature review, researchers have compared alternative accruals models to identify which ones provide more precise estimates of discretionary accruals. In general, the results of their research do not reveal the supremacy of any model over another, given that inclusion of "sophisticated" estimations as instrumental variables method or GMM, used, for example, in the Kang and Sivaramakrishnan (1995) model, even though theoretically justified, has not increased the quality of the estimates (Thomas and Zhang, 2000), and the original model of Jones still remains the most utilized.

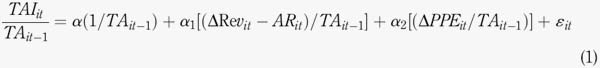

Therefore, a cross-sectional version of the jones model (1991) will be used which is detailed in equation (1). Importantly, it must be must be emphasized that each variable is defiated by total assets before a period of time, to avoid heteroskedasticity problems, according to Chung, Firth and Kim (2005):

Where:

TAIit = Total accrual information for firm i in the yearly period t [calculated in equation (2)].

TAit-1 = Total assets of firm i in the yearly period t - 1.

ΔReνit = Change in revenue of firm i in the year t compared to previous year.

ΔARit = Change in accounts receivable of firm i in the year t compared to previous year.

ΔPPEit = Change in property, plant and equipment gross of firm i in the year t compared to previous year.

εit = Other relevant information of firm i in the yearly period t, being orthogonal to independent variables.

Where Δ represents the change in year t - 1 to year t of each concept identified in the financial statements of the company i in the yearly period t. To identify the portion of the discretionary accrual information, the total accrued information (TAl) as the sum of the accrued discretionary information (DAI) and accrued nondiscretionary (NDA) was considered. That is, according to equation (2):

TAIit = DAIit + NDAit (2)

where:

DAI = is defined as the residual of equation (1), while

NDA = is defined as the set values of equation (1).

This approach is consistent with the literature, where DAI is considered as the result of the opportunities for decision -makers to select alternative accounting methods.

Variables

Family ownership (Famown) was defined as the percentage of shares held by family members. Institutional ownership (Inst) was measured as the percentage of shares held by institutions such as banks, insurance companies, pension funds and financial institutions. And blockholders ownership (Ebh) was defined as the percentage of shares held by individual blockholders who were not members of the dominant family. Following AI Fayoumi et al. (2010), this research considers institutional shareholders and blockholders only when their ownership represents 5 per cent or more of a firm's equity share capital.

The control variables used in the regression were: Debt, Size, ROE and Growth. Leverage (Debt) was measured by total liabilities divided by total assets, and was included because managers are more likely to use earnings management techniques when companies are closer to default on debt contracts (Fernández, 1999; Press and Weintrop, 1990; Prowse, 1994). For firm size (Size), the natural logarithm of total assets as a proxy for firm size was used. Profitability (ROE) was measured by retum on equity, and this variable was inc1uded because listed firms with lower profitability tend to show a higher earnings management behavior (Al-Fayoumi et al., 2010; Chen et al., 2006). Growth opportunities (Growth) was measured as annual rate of sales growth (La Porta et al., 2000; McConnell and Servaes, 1990), and this variable was included as a control mechanism for demand conditions; finally, Crisis is a dummy variable to control 2008 crisis effect.

To introduce family ownership as a moderating variable and prove H2 and H3, we create a dummy variable to interact with institutional and block holders' investors. For family firms the dummy variable takes the value of 1 if the family possesses 51 per cent or more of ownership and zero otherwise. For firms no family firms the dummy variable takes the value of 1 if family possesses is below that 51 per cent and zero otherwise. This level of family participation is evidently high as compared to thresholds used in other countries (Anderson and Reeb, 2003; Villalonga and Amit, 2006); however, given the presence of weak corporate govemment regulations in Mexico, this percentage may be used as a guarantee to maintain ultimate control of a firm (San Martin-Reyna and Durán-Encalada, 2012). Coincidentally, this percentage represents the median of family ownership in the sample.

Regression analysis

As stated before, the sample combines 67 firms, with ten cross-sections producing 737 panel data observations. Given that aim of the study as well as the number of observations, the panel data methodology seems to be the most accurate (Arellano and Bover, 1990; Arellano, 1993). However, this estimation as sumes that the variables are exogenous and incurs a certain heterogeneity bias. Therefore, a dynamic panel, the GMM, following the Arellano and Bond (1991) methodology, was added.

According to the authors, the GMM is appropriate when the sample is large and the time frame is smal!. In this study, the sample includes 67 firms over seven years, so it is appropriate to apply the GMM model. Applying the OLS model or panel with fixed or random effects can generate standards errors of parameters estimations that are inconsistent because, by construction, the unobservable effect is correlated with the lag of the dependent variable. To correct this problem, instrumental variables could be applied. Anderson and Hsiao (1981, 1992) propose using dependent lags. Arellano and Bond (1991) propose an estimator based on the GMM, which uses instrumental variables based on lags of all variables and especially for panels with many individuals and few periods. Under GMM, the consistency of the estimator depends on the validity of the instruments and the assumption that the difference in error terms does not exhibit second-order serial correlation. To test these assumptions, Arellano and Bond (1991) suggested a Sargan test of over-identifying restrictions, which tested the overall validity of the instruments by analyzing the sample along the moment conditions used in the estimation procedure (Liu and Hsu, 2006), and they also tested the assumption of no second-order serial correlation.

Failure to reject the null hypotheses of both tests gives support to the estimation pracedure. All regressors are treated as strictly exogenous except the lagged dependent variables. Previous research has praposed GMM as an instrument for the explanatory variables using lagged values of the original regressors and thus solving the endogeneity prablem (Arellano and Bond, 1991). The GMM model can control the correlation of errors over time, the heteraskedasticity among firms, simultaneity and measurement errors caused by the use of orthogonal conditions covariance matrix (Espinosa, 2009). With regard to the basic model to be estimated, a multivariate regression model has been built including the previously cited variables. This model can be expressed with the following equation, where i refers to the firms and t to the year (i = 1...0.89; t = 1...0.7):

DAIit = β1 + β2Famownit + β3Instit + β4Ebhit + β4Instfamit + β5Ebhfamit + β6Debtit + β7Sizeit + β8ROEit + β9Growthit + β10Crisisit + εit

Where:

Famown is the percentage of shares held by family members.

Instfam is interaction between family firms, the dummy variable (takes the value of 1 if family possesses 51 per cent or more of ownership and zero otherwise), and institutional investors.

Ebhfam is the interaction between family firms, the dummy variable (takes the value of 1 if family possesses 51 per cent or more of ownership and zero otherwise), and external blockholders investors.

Inst is the percentage of shares held by institutions such as banks, insurance companies, pension funds and financial institutions.

Ebh is the percentage of shares held by individual blockholders who were not members of the dominant family.

Debt is the total liabilities divided by total assets.

Size is the logarithm of total assets.

ROE is the return on equity.

Growth is the annual rate of sales growth.

Crisis is the dummy variable to control the crisis effect, which take the value of 1 if pre-crisis year (2005-2007) and zero otherwise.

Results

Descriptive data

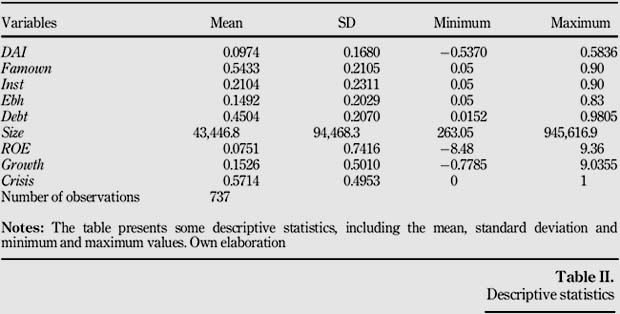

Table II shows the descriptive statistics of the variables. As can be seen, the mean of discretionary accruals is close to 0.1. On average, the sample firms have positive discretionary accruals. This result suggests that Mexican companies in the sample are managing their earnings upwardly, as in other studies (Garcia and Gill, 2005; San MartinReyna, 2012; Wang, 2006). For the regression analysis, the absolute value of discretionary accruals information (DAI) as a measure of the level of manipulation of eamings was used.

Table II shows the importance of family ownership (Famown) concentration in the Mexican market, as the value that varies from 0.5 to 90 per cent, with an average of 54 per cent. Institutional investors (Inst), on average, hold around of 21 per cent of ownership in the sampled firms, and external blockholders (Ebh) hold only an average of 15 per cent of shares. These results are not surprising owing to the nature of the Mexican market, where listed firms are owned and controlled by families and institutions rather than individual investors (Babatz, 1997; Barca and Becht, 2001; Castañeda, 2000; Castrillo and San Martín, 2007; Faccio and Lang, 2002; Husted and Serrano, 2001; Khanna and Palepu, 1999; La Porta et al., 1999; San Martín-Reyna and Durán-Enca!ada, 2012). The average debt (Debt) of companies in the period analyzed is 45 per cent of total funding. Firm size (Size) is quite heterogeneous and highly dispersed around the mean value, so the results are not believed to be biased by size issues. Profitability (ROE) shows that companies have obtained an average return on equity of 7.5 per cent, accompanied by an average annual sales growth (Growth) of 15.3 per cent during the 2005-2015 periodo The financial crisis dummy (crisis) is to control the pre- and post-2008 financial crisis periodo Table III shows the correlation matrix among the variables.

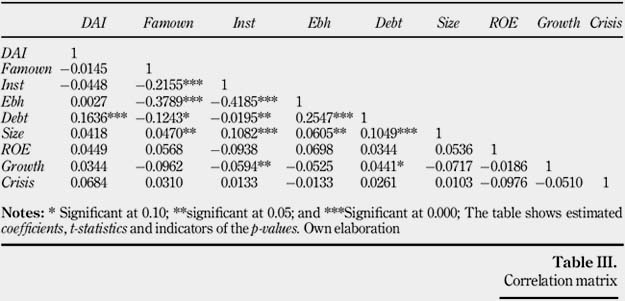

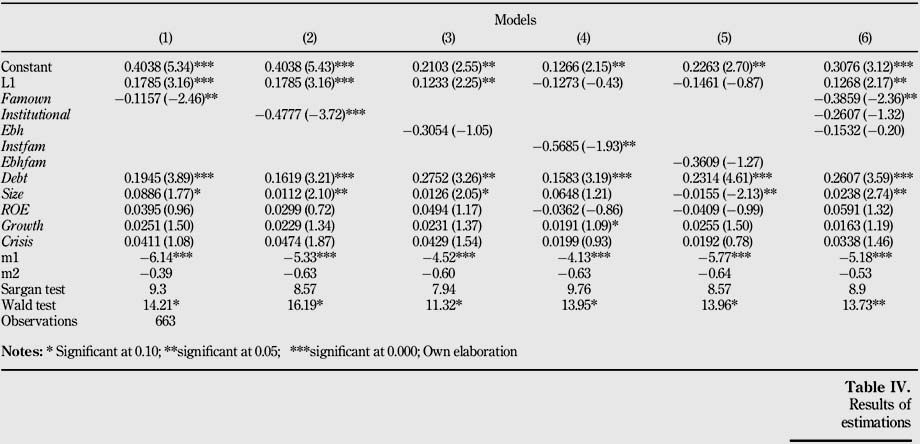

DAI has a negative correlation with family (Famown) and institutional (Inst) investors, which is consistent with the idea that managers seem to engage less in manipulating their accounting information when ownership of those investors increases. On the other hand, external blockholder (Ebh) investors, size, growth, leverage and profitability have a positive correlation with the earnings management behavior of managers. Size (Size) is positively associated with leverage (Debt), consistent with Cootter's (1998) finding that larger firms have higher leverage constraint levels. A positive correlation between profitability (ROE) and DAI indicates that more profitable firms are more likely to incur into earnings management. A positive correlation between Ebh and DAI signifies that the more concentrated the external blockholder ownership, the more is the discretionary accrual. However, larger firms seem to be more profitable firms (Positive and significant correlation between Size and ROE). The results of the panel data estimation are displayed in Table IV.

The results of Models 1 and 2 in Table IV confirm H1 regarding the influence of family (Famown) and institutional (Inst) ownership on earnings management; as the levels of participation of family and institutional investors increase, there is a significant reduction in earnings management. However, in the case of blockholder ownership (Ebh), in Model3, the result is not significant. To prove if the impact on earnings management of institutional and blockholders is affected by the level of family ownership, Models 4 and 5 present the results achieved considering the interaction between family firms and institutional and external blockholders.

The results confirming our results indicate that institutional investors (Inst) are able to control or reduce earnings management in family firms. These results prove the moderating role that the level of family ownership plays, thus confirming H2. In the case of external blockholders (Ebh), the results show their not influence to reduce earnings management. Thus our results cannot confirm a moderating effect of family ownership in firms with blockholders' presence. Considering the control variables, indebtedness (Debt) and size (Size) are positively related to the level of earning management in both cases of family and non family firms. Regarding the control variables, it was found that leverage (Debt) and size (Size) are significant and have a positive effect on earnings management. The results on the relationship between debt and the use of discretionary accruals may be consistent with the argument that firms with high debt ratios have a greater likelihood of violating debt contracts and thus the association with greater earnings management. Finally, size is positively related to discretionary accruals, indicating that the larger the firm, the more pressure to incur in higher earnings management.

Conclusions

The results show that there is a clear relationship between an increasing participation of family and institutional investors, and a reduction in earnings management. This is consistent with the literature that establishes that ownership is an effective regulatory mechanism that limits earnings management through closer supervision and involvement in management. In congruence with the convergence hypothesis of agency theory, a reduction in earning management is the result of a greater commitment of these investors who have a longer-term orientation of the firm. The fact that indebtedness level and firms size positively relates to earnings management highlights the importance that the role of family and institutional shareholders can have in infiuencing discretionary management behavior regarding the presentation of financial information to the investor market. In the case of external blockholders, the research shows that this type of shareholder lacks the capacity and power to reduce earnings management. The lower participation of these shareholders in comparison to other countries with a more developed capital market helps explain to a large extent these findings. In addition, the 2008-2009 economic crisis may have motivated investors to diversify their portfolios among a larger number of options, thus affecting their ability to effectively supervise and control management teams.

A very well-known case in Mexico evidences the unfortunate consequences of this type of behavior as management had to finally recognize losses whose potential occurrence was concealed from investors in the financial reporting [1]. This example c1early justifies the need for research regarding the influence of institutional and blockholders on earnings management and the moderating effect of the level of family ownership. Our results confirm that family ownership moderates this relationship. In the case of institutional investors, it can be seen that in family firms, there is an association between their increasing participation and a reduction of discretionary management behavior. This means that the level of institutional involvement in this type of firms may exercise some counterbalance power to reduce expropriation by families through control1ing earnings management. According to the control variables, institutional investors would mitigate the temptation in these firms to manage earnings to support growth strategies by means of higher financialleverage. However, for non family firms, this infiuence disappears, refiecting that the impact on earnings management of these is more random. In the case of blockholders, the moderating effect works in the opposite direction. Whereas in family firms these shareholders do not infiuence earnings management, in the case of non-family firms, they are able to reduce it. The explanation for this is due to the low average participation of blockholders in Mexico. That is, only when the level of family ownership diminishes, being this the main ownership concentrator, this type of shareholder, given its relative low participation, is able to infiuence earnings management.

This research has examined the relationship of shareholders and earnings managements in Mexico and may have implications for government regulatory agencies in other emerging markets. Our findings have an important relevance toward new insights in the literature on emerging markets, suggesting the need for strengthening the application of the good corporate governance principIes and effectively monitoring earnings management that could be exercised by the executive team of Mexican companies, especially the biggest ones, because these could lead to significant management problems. Owing to the experience of other countries, such as Peru, where an index has been developed for corporate governance practices (Mongrut et al., 2013), we believe that Mexico should move forward in this aspect, to have a reference of the quality of corporate governance practices so as to reduce discretion on earnings management, given the high ownership concentration controlled by families or institutions, to the detriment of smal1er or minority shareholders (Centro de Excelencia en Gobierno Corporativo, 2009).

This line of research can be strengthened with two important analyzes, the explication power of discretional accrual information in the market performance, measured through the stock performance and the evaluation of the impact of the three types of ownership structure in dividends payment, as wel1 as in the market performance. We identify these future research lines, with the interest of making the link between signals of stock market perceives (or not), about the impact of the variables used in this paper (related to discretionary accrual information and ownership structure). Moreover, as we used only public financial data, we were not able to address control-enhancing structures, such as pyramids and their effect on shareholder infiuence. This would require a more focused case study that would examine exactly how these types of mechanisms operate. Further research could also address the effect of board composition on earnings management, as infiuenced by shareholder voting and cash-fiow rights. These and other questions relating to corporate governance may provide a better perspective on the role of ownership structure in an emerging market such as Mexico.

References

Al-Fayoumi, N., Abuzayed, B. and Alexander, D. (2010), "Ownership structure and earnings management in emerging markets: the case of Jordan", International Research Journal of Finance and Economics, Vol. 38, pp. 28-47. [ Links ]

Amihud, Y, Kamin, J.H. and Ronen, J. (1983), "Managerialism", 'ownerism', and risk", Journal of Banking and Finance, Vol. 7 No. 2, pp. 189-196. [ Links ]

Anderson, T.W. and Hsiao, C. (1981), "Estimation of dynamic models with error components", Journal of the American Statistical Association, Vol. 76 No. 375, pp. 598-606. [ Links ]

Anderson, T.W. and Hsiao, C. (1992), "Formulation and estimation of dynarnic models using panel data", Journal of Econometrics, Vol. 18 No. 1, pp.47-82. [ Links ]

Anderson, R, Mansi, S.A. and Reeb, D. (2002), "Founding family ownership and the agency cost of debt", Journal of Financial Economics, Vol. 68, pp. 263-285. [ Links ]

Anderson, R and Reeb, D. (2003), "Founding family ownership and firm performance: evidence from the S&P 500", Journal of Finance, Vol. 58 No. 3, pp. 1301-1328. [ Links ]

Arellano, M. (1993), "Introducción al análisis econométrico con datos de panel, la industria y el comportamiento de las empresas españolas", Ensayos en Homenaje a Gonzalo Mato, pp. 23-47. Alianza Editorial, Madrid. [ Links ]

Arellano, M. and Bond, R (1991), "Sorne test of specification for panel data: monte carlo evidence and an application to employrnent equations", Review of Economic Studies, Vol. 58 No. 2, pp. 277-297.

Arellano, M. and Bover, O. (1990), "La econometria de datos de panel", Investigaciones Económicas (Segunda Época), Vol. 14 No. 1, pp. 345. [ Links ]

Babatz, G. (1997), "Agency problems, ownership structure, and voting structure under lax corporate govemance rules: the case of Mexico", PhD Thesis, Harvard University. [ Links ]

Ball, R (1989), "The Finn as a specialist contracting intermediary: application to accounting and auditing", Unpublished Working Paper, William E. Simon Graduate School of Business Administration, University of Rochester. [ Links ]

Barca, F. and Becht, M. (2001), The Control of Corporate Europe, Oxford University Press, Oxford. [ Links ]

Barclay, M.J., Clifford, G. and Holdemess, C.G. (1991), "Negotiated block trades and corporate control", Journal of Finance, Vol. 46 No. 3, pp. 861-878. [ Links ]

Barclay, M.J. and Holdemess, C.G. (1989), "Private benefits from control of public corporations", Journal of Financial Economics, Vol. 25 No. 2, pp. 371-395. [ Links ]

Bartholomeusz, S. and Tanewski, G.A. (2006), "The relationship between family firms and corporate governance", Journal of Small Business Management, Vol. 44 No. 2, pp. 245-267. [ Links ]

Bar-Yosef, S. and Annalisa, P. (2013), "The impact of corporate govemance and eamings management on stock market liquidity in a highly concentrated ownership capital market'', Journal of Accounting, Auditing, and Finance, Vol. 28 No. 3, pp. 292-316. [ Links ]

Bar-Yosef, S. and Prencipe, A. (2013), "The impact of corporate govemance and eamings management on stock market liquidity in a highly concentrated ownership capital market'', Journal of Accounting, Auditing, and Finance, Vol. 28 No. 3, pp. 292-316. [ Links ]

Bethel, J.E. and Liebeskind, J.P. (1993), "The effects of ownership structure on corporate restructuring", Strategic Management Journal, Vol. 14, pp. 15-31. [ Links ]

Brailsford, T.J., Oliver, B.R. and Pua, S.L.H. (2002), "On the relation between ownership structure and Capital structure", Accounting and Finance, Vol. 42 No. 1, pp. 1-26. [ Links ]

Cable, J. (1985), "Capital market information and industrial performance: the role of west German banks", The Economic Journal, Vol. 95 No. 377, pp. 118-132. [ Links ]

Castañeda, G. (2000), "Governance of large corporations in Mexico and productivity implications", Studies in Business Management, Vol. 3 No. 1, pp. 57-89. [ Links ]

Castrillo, L. and San Martin, J. (2007), "La propiedad familiar como mecanismo de gobierno disciplinador de la dirección en las empresas mexicanas, una evidencia empírica", Contaduría y Administración, Vol. 222, pp. 59-82. [ Links ]

Castrillo, L. and San Martin, J. (2008), "Los ajustes por devengo como medida de discrecionalidad directiva", Contaduría y Administración, Vol. 226, pp. 9-37. [ Links ]

Centro de Excelencia en Gobierno Corporativo (2009), "Gobierno corporativo en México, progresos recientes", Boletin Consilium, available at: www.uas.mx/cegc/consilium/doc/Progresosrecientes-Gobierno-Corporativo-México-U1009.doc.pdf (accessed 5 September 2013). [ Links ]

Chen, G., Firth, M., Gao, D. and Rui, O. (2006), "Ownership structure, corporate governance, and fraud: evidence from China" Journal of Corporate Finance, Vol. 12 No. 3, pp. 424-448. [ Links ]

Chung, R, Firth, M. and Kim, [B. (2005), "Earnings management, surplus free cash flow, and external monitoring" Journal of Business Research, Vol. 58 No. 6, pp. 766-776.

Claessens, S. and and Djankov, S. (1999), "Ownership concentration and corporate performance in the Czech Republic", CEPR Discussion Papers 2145. [ Links ]

Cootter, J. (1998), "Utilization and restrictiveness of covenants in Australian private debt contracts", Accounting and Finance, Vol. 38 No.2, pp.l81-196.

DeAngelo, L. (1986), "Accounting numbers as market valuation substitutes: a study of management buyouts of public stockholders", The Accounting Review, Vol. 61 No. 3, pp. 400-420. [ Links ]

DeAngelo, H. and DeAngelo, L. (2000), "Controlling stockholders and the disciplinary role of corporate payout policy: a study of the times mirror company", Journal of Financial Economics, Vol. 56 No. 2, pp. 153-207. [ Links ]

Dechow, PM., Sloan, RG. and Sweeney, A.P. (1995), "Detecting earnings managernent", The Accounting Review, Vol. 70 No. 2, pp. 193-225.

Dechow, P., Sloan, RG. and Sweeney, A.P. (1996), "Causes and consequences of earnings manipulation: an analysis of firms subject to enforcement actions by the SEC', Coniemporary Accounting Research, Vol. 13 No. 1, pp. 1-36.

DeFond, M. and Jiambalvo, J. (1991), "Incidence and circumstances of accounting errors", The Accounting Review, Vol. 66, pp. 643-655. [ Links ]

Delgado, M.M. (2003), "Factores determinantes de la discrecionalidad directiva en materia contable: una aplicación empirica a las empresas cotizadas españolas", Tesis Doctoral, Universidad de Burgos. [ Links ]

Demsetz, H. and Lehn, K. (1985), "The structure of corporate ownership: causes and consequences", Journal of Political Economy, Vol. 93 No. 6, pp. 1155-1177. [ Links ]

Dhaliwal, D.S., Salamon, GL. and Smith, ED. (1982), "The effect of owner versus management control on the choice of accounting methods" Journal of Accounting and Economics, Vol. 4 No. 1, pp. 41-53. [ Links ]

Diaz, E. (2000), "Comportamiento supervisor y beneficios privados de la propiedad accionarial: un análisis empirico para el caso español." Tesis Doctoral, Universidad de Cantabria. [ Links ]

Earle, J.S, Kucsera, C. and Telegdy, A. (2004), "Ownership concentration and corporate performance on the Budapest stock exchange: do too many cooks spoil the goulash?", Corporate Governance: an International Review, Vol. 13 No. 2, pp. 254-264. [ Links ]

Espinosa, C. (2009), "Estructura de propiedad y desempeño de la firma: el caso chileno", Revista Latinoamericana de Administración, Vol. 43, pp. 41-62. [ Links ]

Faccio, M. and Lang, L. (2001), "The separation of ownership and control: an analysis of ultimate ownership in Western European countries'', Journal of Financial Economics, Vol. 65 No. 3, pp. 365-395. [ Links ]

Faccio, M. and Lang, L. (2002), "The ultimate ownership ofWestern European corporations", Journal of Financial Economics, Vol. 65 No. 3, pp. 365-395. [ Links ]

Fama, E. and Jensen, M. (1983), "Separation of ownership and control", Journal of Law and Economics, Vol. 26 No. 2, pp. 301-325. [ Links ]

Fernández, P. (1999), Valoración de Empresas, Gestión 2000, Barcelona. [ Links ]

Friend, I. and Lang, L. (1988), "An empirical test of the impact of managerial self-interest on corporate Capital structure", Journal of Finance, Vol. 43 No. 2, pp. 271-28l.

Garcia, O. and and Gill, B. (2005), "El gobierno corporativo y las prácticas de earnings management: evidencia empirica en españa", Working Paper of Instituto Valenciano de Investigaciones Económicas (Ivie), WP-EC 11. [ Links ]

Garza-Gómez, X., Okumura, M. and and Kunimura, M. (1999), "Discretionary accrual models and the accounting process", Working Paper, Nagoya City University, p. 259. [ Links ]

Gómez-Mejia, L., Núñez-Nickel, M. and Gutiérrez, I. (2001), "The role of family ties in agency contracts", Academy of Management Journal, Vol. 44 No. 1, pp. 81-95. [ Links ]

Guay, W., Kothari, S. and Watts, R (1996), "A market-based evaluation of discretionary accrual models", Journal of Accounting Research, Vol. 34, pp. 83-105. [ Links ]

Healy, P. (1985), "The impact of bonus schemes on the selection of accounting principles", Journal of Accounting and Economics, Vol. 7 Nos 1/3, pp. 85-107. [ Links ]

Holderness, C. and Sheehan, D. (1988), "The role of majority shareholders in publicly held corporations: an exploratory analysis", Journal of Financial Economics, Vol. 20, pp. 317-346. [ Links ]

Husted, B. and and Serrano, C. (2001), Corporate governance in Mexico. Research Paper, ITESM, EGADE, Monterrey. [ Links ]

Jensen, M. (1986), "Agency cost of free cash fíow, corporate finance, and takeovers", The American Economic Review, Vol. 76 No. 2, pp. 323-329. [ Links ]

Jensen, M. and Meckling, W. (1976), "Theory of the firm: managerial behaviour, agency costs and ownership structure", Journal of Financial Economics, Vol. 3 No. 4, pp. 305-360. [ Links ]

Jeter, D.C. and Shivakumar, L. (1999), "Cross sectional estimation of abnormal accruals using quarterly and annual data: effectiveness in detecting event specific earnings management", Accounting and Business Research, Vol. 29 No. 4, pp. 299-319. [ Links ]

Jin, J.Y. (2013), "Investor attention and eamings management around the world", Accounting Perspectioes, Vol. 12 No. 2, pp. 165-187. [ Links ]

Johnson, B., Magee, R, Nagarajan, N. and Newman, H. (1985), "An analysis of the stock price reaction to sudden executive deaths: implications for the manageriallabor market", Journal of Accounting and Economics, Vol. 7 Nos 1/3, pp. 151-174. [ Links ]

Jones, J. (1991), "Earnings management during import relief investigations", Journal of Accounting Research, Vol. 29 No. 2, pp. 193-233. [ Links ]

Kang, S.H. and Sivaramakrishnan, K. (1995), "Issues in testing earnings management and an instrumental variable approach", Journal of Accounting Research, Vol. 33 No. 2, pp. 353-367. [ Links ]

Khanna, T. and Palepu, K. (1999), "Policy shocks, market intermediaries, and corporate strategy: evidence from Chile and India", Journal of Economics and Management Strategy, Vol. 8, pp. 271-310. [ Links ]

Koch, B.S. (1981), "Income smoothing: an experirnent", The Accounting Review, Vol. 56 No. 3, pp. 574-586. [ Links ]

La Porta, R, López-de-Silanes, F., Shleifer, A. and Vishny, R (1999), "Corporate ownership around the world" Journal of Finance, Vol. 54 No. 2, pp. 471-520. [ Links ]

La Porta, R, López-de-Silanes, F., Shleifer, A. and Vishny, R (2000), "Investors protection and corporate governance" Journal of Financial Economics, Vol. 58 Nos 1/2, pp. 3-27. [ Links ]

Liu, W. and Hsu, C. (2006), "Corporate finance and growth of Taiwan's manufacturing firms'', Review of Pacific Basin Financial Markets and Policies, Vol. 9 No. 1, pp. 67-95. [ Links ]

López, F.J. and Saona, P. (2005), "Earnings management and international mechanisms of corporate governance: empirical evidence from Chilean firms", Corporate Ownership and Control, Vol. 3 No. 1, pp. 17-29. [ Links ]

McConnell,J.J. and Servaes, H. (1990), "Additional evidence on equity ownership and corporate value", Journal of Financial Economics, Vol. 27 No. 2, pp. 595-612. [ Links ]

McEachern, W. (1975), Managerial Control and Performance, Lexington Books, Lexington, Mass. [ Links ]

McEvoy, J.F. and Govier, W.F. (2009), "Controladora comercial Mexicana: a premature case study?", ABI Journal, March: Vol. 85, pp. 46-47. [ Links ]

Macey, J. (1998), "Measuring the effectiveness of different corporate governance systems: toward", Journal of Applied Corporate Finance, Vol. 16 Nos 2/3, pp. 16-25. [ Links ]

Mehran, H. (1992), "Executive incentive plans, corporate control, and Capital structure", Journal of Financial and Quantitative Analysis, Vol. 27 No. 4, pp. 539-560. [ Links ]

Mikkelson, W.H. and Ruback, RS. (1985), "An empirical analysis of the interfirm equity investment process", Journal of Financial Economics, Vol. 14 No. 4, pp. 523-553. [ Links ]

Mongrut, S., Fuenzalida, D., Arteaga, J.R. and Erausquin, A. (2013), "Good corporate governance: does it pay in Peru?" Journal of Business Research, Vol. 66 No. 10, pp. 1759-1770. [ Links ]

Monterrey, J. (2004), "Información contable y gobierno corporativo", Revista de Contabilidad, Vol. 7, pp. 89-12l.

Morck, R, Shleifer, A. and Vishny, R (1988), "Management ownership and market valuation", an Empirical Analysis. Journal of Financial Economics, Vol. 20, pp. 293-315. [ Links ]

Peasnell, K.V., Pope, P.F. and and Young, S. (1998), "Detecting earnings management using cross sectional abnormal accrual models", Working Paper, Lancaster University. [ Links ]

Pedersen, T. and Thomsen, S. (1997), "European patterns of corporate ownership", Journal of International Business Studies, Vol. 28 No. 4, pp. 759-778. [ Links ]

Poveda, F. (2001), "Cuestiones estadisticas sobre modelos y contrastes de ajustes por devengo anormales", Working Paper, Instituto Valenciano de Investigaciones Económicas, pp. 1-52. [ Links ]

Press, E.G. and Weintrop, J.B. (1990), "Accounting-based constraints in public and private debt agreements: their association with leverage and impact on accounting choice", Journal of Accounting and Economics, Vol. 12 Nos 1/3, pp. 65-95. [ Links ]

Prowse, S.D. (1990), "Institutional investment patterns and corporate financial behavior in the United States and Japan" Journal of Financial Economics, Vol. 27 No. 1, pp. 43-66. [ Links ]

Prowse, S.D. (1994), Corporate Governance in an International Perspective; a Survey of Corporate Control Mechanisms among Large Firms in the United States, the United Kingdom, Japan and Cermany. Economic Paper, Vol. 41, pp. 7-79. [ Links ]

Salamon, G. and Smith, E. (1979), "Corporate control and managerial misrepresentation of firm performance", The Bell Journal of Economics, Vol. 10 No. 1, pp. 319-328. [ Links ]

San Martín-Reyna, J.M. (2012), "An empirical examination of ownership structure, eamings management and growth opportunities in mexican market", Internationaljournal 01 Business and Social Research, Vol. 2 No. 7, pp. 103-123.

San Martín-Reyna, J.M. and Durán-Encalada, J.A. (2012), "Relationship among family business, corporate governance and firm performance: evidence from the Mexican stock exchange", Journal of Family Business Strategy, Vol. 3 No. 2, pp. 106-117. [ Links ]

Shleifer, A. and Vishny, R (1986), "Large shareholders and corporate control", Journal of Political Economy, Vol. 94 No. 3, pp.461-488. [ Links ]

Shleifer, A. and Vishny, R (1997), "A survey of corporate governance", Journal of Finance, LII, Vol. 52 No. 2, pp. 737-783. [ Links ]

Singell, L. (1997), "Nepotism, discrimination, and the persistence of utility-maximizing, owner operated firms", Southern Economics Journal, Vol. 63 No. 4, pp. 904-920. [ Links ]

Smith, E.D. (1976), "The effect of separation of ownership and control on accounting policy decisions", The Accounting Review, Vol. 51, pp. 707-723. [ Links ]

Stein, J (1988), "Takeover threats and managerial myopia", Journal of Political Economy, Vol. 96 No. 1, pp. 61-80. [ Links ]

Stein, J (1989), "Efficient Capital markets, inefficient firms: a model of myopic corporate behavior", Quarterly Journal of Economics, Vol. 104 No. 4, pp. 655-669. [ Links ]

Stiglitz, JE. (1985), "Credit markets and the control of capital", Journal of Money Credit and Banking, Vol. 17 No. 2, pp.133-152. [ Links ]

Subramanyan, KR (1996), "The pricing of discretionary accruals", Journal of Accounting and Economics, Vol. 22 Nos 1/3, pp. 249-28l.

Thomas, J and and Zhang, X. (2000), "Identifying unexpected accruals: a comparison of current approaches", Working Paper, Columbia Business School and University of Califomia-Berkeley. [ Links ]

Villalonga, B. and Amit, R (2006), "How do family ownership, control, and management affect firm value?" Journal of Financial Economics, Vol. 80 No. 2, pp. 385417. [ Links ]

Wang, D. (2006), "Founding family ownership and eamings quality", Journal of Accounting Research, Vol. 44 No. 3, p. 619. [ Links ]

Warfield, T.D., Wild, ].J. and Wild, K1. (1995), "Managerial ownership, accounting choices, and informativeness of earnings" Journal of Accounting and Economics, Vol. 20 No. 1, pp. 61-9l.

Watts, R.L. and Zirnmerman, J (1986), Positive Accounting Theory, Prentice Hall, 1986. [ Links ]

Zhong, K, Donald, W. and Zheng, X. (2007), "The effect of monitoring by outside blockholders on earnings managernent", Quarterly Journal of Business and Economics, Vol. 46, pp. 38-60. [ Links ]

Zoido, E. (1998), "Un estudio de las participaciones accionariales de los bancos en las empresas españolas", Investigaciones Económicas, Vol. 22, pp. 427-468. [ Links ]

Corresponding author

Juan Manuel San Martin Reyna can be contacted at: juanm.sanmartin@udlap.mx

Received 23 January 2017

Revised 6 April 2018

Accepted 4 May 2018

Note

1. Controladora Comercial Mexicana SAB, Mexico's third-largest operator of food retailers, filed for Chapter 15 bankruptcy to aid its main restructuring in Mexico. The company defau1ted on debt in 2008 after derivative transactions meant to protect it against fiuctuations in the Mexican peso went awry. Arguably this situation had been concealed to public investors by the dominant family coalition that owns close to 70 per cent of total assets (McEvoy and Govier, 2009).