Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Journal of Economics, Finance and Administrative Science

Print version ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.24 no.47 Lima June 2019

http://dx.doi.org/https://doi.org/10.1108/JEFAS-09-2018-0095

ARTICLE

Determinants of innovation: A multivariate analysis in Colombian micro, small and medium-sized enterprises

Jorge AnÃbal Restrepo-Morales1

Osmar Leandro Loaiza 2

Juan Gabriel Vanegas 1,*

1Ciencias Administrativas y Economicas, Tecnologico de Antioquia Institución Universitaria, Medellin Antioquia, Colombia

2Universidad de Antioquia, Medellin, Colombia

Corresponding author:* jvanegas1@tdea.edu.co

Abstract

Purpose: This paper aims to study the influence of innovation on micro, small and medium-sized enterprises (MSME) performance in Colombia through the 403 MSMES survey analysis. In particular, this paper measures the effect of participation in R&D alliances, product innovation and process innovation on it.

Design/methodology/approach: MSME performance is measured through a composite index, estimated through principal components analysis using polychoric correlations, which is based on eight self-reported assessments of MSME performance. Then, this measure of performance is related to MSME participation in R&D alliances and the product and process development stance of the MSME based on an adaptation of the Miles and Snow business classification scheme, by means of an ANOVA and a linear regression.

Findings: Colombian SMEs are not significantly benefitted from participation on R&D alliances. Instead, their performance appears to be dependent upon their internal innovation efforts directed to product development. Moreover, the results suggest that imitators get a performance almost as high as innovators.

Originality/value: Innovation activities in Colombian SMEs are carried out informally, as they are mostly uninterested to engage in R&D activities and to develop new products by own initiative. Moreover, few of them have an R&D department. In regard to technology, results suggest that almost half of SMEs are classified as followers, namely, they use the same technology as competitors.

Keywords: Innovation, MSME performance, Product and process innovation, Alliances, ANOVA

Introduction

Micro, small and medium-sized enterprises (hereafter we will use the terms SME and MSME interchangeably) are key players in Colombia's business field, as they make a big contribution to employment and output. Recent estimates show that SMEs provide 67 per cent jobs and 28 per cent output (GDP) in Colombia (Dinero, 2016). Similarly, Bell and Teima (2015) estimate that formal SMEs provide 45 per cent of jobs and produce 35 per cent of output (GDP) in emerging markets, figures that could be higher if informal sector SMEs were accounted for. The aforementioned facts together with SMEs fast adaptability to changing market conditions make them a key player in the production and distribution of wealth (Yoguel and Boscherini, 1996; Soto and Dolan, 2004).

Nonetheless, SMEs face big challenges, as several studies pinpoint SMEs' structural weaknesses, which undermine their innovation capabilities and competitiveness, thus compromising their survival (Restrepo et al., 2016; Vanegas et al., 2018). Increasing market openness, an accelerating rate of technological change, together with a loose management of knowledge assets and human capital, poor qualifications of firm owners and employees, localization and infrastructure disadvantages, all make it difficult for SMEs to prosper in highly competitive markets.

In such a complex market environment, it is believed that SMEs can earn a competitive edge through the added flexibility conferred by its small size. It is argued that this flexibility and fast decision-making create an environment conducive to innovation. Innovation can be either disruptive or incremental. Whatever the type of innovation, the whole point is that the SME needs to have a competitive edge that allows it to outperform competitors, especially bigger incumbents (Rosenbusch et al., 2011).

Hence, we intend to contribute to the debate about the relationship between innovation and performance in SMEs in emerging markets through the survey analysis carried out by FaedPyme (Foundation for the Strategic Analysis and Development of SMEs) in Colombia in 2012 (Gálvez et al., 2012). They comprise 403 formal SMEs. This paper analysed owners or managers' perceptions at SMEs about their innovation capabilities, and the relationship of these capabilities with financial and nonfinancial performance. Innovation capabilities are understood as the potential that a firm has to produce, to plan and to execute innovations with the available set of technological and organizational abilities available to the firm (Akehurst et al., 2011).

The paper is structured as follows. First, the literature review is presented. Second, the methodology is outlined. Third, the results are presented. Finally, the paper offers some concluding remarks.

Literature review

Innovation is the development of a new method, idea or product (Merriam-Webster, 2016). Generally speaking, innovation is beneficial for society as a whole because it either improves its productive potential, solves existing problems or needs or just because it makes the consumer better through the availability of new products and services. Hence, innovation is a key driver in the gradual improvement of the material well-being of societies. Indeed, since the seminal work of Solow (1956), it is well-known "that cross-country differences in technology may generate important cross-country differences in income per capita" (Comin, 2008, p. 2).

Thus, in economic growth theory, technological change is credited as a key determinant of the growth in total factor productivity (TFP). TFP refers to the combined contribution of all factors of production to output (Comin, 2008). But, obviously, technological change is driven by innovation. Hence, as innovation drives technological change, which in turn drives TFP growth, then it is considered that innovation is an important determinant of economic growth. This is precisely the view held by endogenous growth models (Romer, 1990).

For instance, Barro and Sala-i-Martin (2000) made a growth accounting exercise in which they decomposed the growth rate of a group of countries in three contributing elements: the contribution from capital, labour and from TFP growth. There, it is seen that in rich countries, TFP tends to make a high contribution to the growth rate of GDP. In Latin America, the case of Chile stands out (38 per cent). In OECD, the case of Japan is prominent example (47 per cent). Colombia, however, showcases a rather low contribution of TFP to the growth rate of GDP (19 per cent).

Turning the attention to the Colombian case, Loaiza and Franco (2012) estimate the main determinants of TFP growth. Globally, it is found that in Colombia technological change is the main contributor to TFP growth, followed by the increases in technical efficiency. However, if as the work of Barro and Sala-i-Martin (2000) shows, the contribution of TFP to the growth rate of GDP in Colombia is relatively low, this probably should stem from the fact that, being technological change the main determinant of TFP growth, technological change is not proceeding at a fast-enough pace in Colombia.

As innovation is a microeconomic phenomenon that occurs at the firm level, then it is important to analyse if innovation processes indeed have an impact on firm performance. So here we turn our attention to the empirical literature on the ties between innovation and performance in SMEs stemming from the realms of industrial organization and management.

According to the structure - conduct - performance (SCP) paradigm in industrial organization, the characteristics of the market structure determine the conduct of the firm, which in turn determine its results. However, this relationship is not unidirectional, as the firm's conduct may also influence the market structure and, hence, its own performance. From this perspective, the firm should adapt to the prevailing structural conditions in its industry or implement a strategic behaviour to be competitive. The uncertainty and intensity of changes faced by SMEs have accentuated the strategic role of innovation, so far as to be considered a key determinant of profitability.

In this vein, the works of Van de Vrande et al. (2009) find that SMEs pursue open innovation because of market-related causes, such as to keep up with clients demands or to keep up with competitors. So, according to the SCP paradigm, profitability differences among firms are explained by innovation-related factors and to the market structure in which firms compete. Therefore, this approach extends strategic management theories, which attribute profitability differences among firms mainly to internal factors, being innovation one of them(Williamson and Winter, 1993).

Innovation and SMEs are closely tied. First, the development of a new idea is the key reason why entrepreneurs establish a new business. Second, "the entrepreneur or small business manager needs to have an innovative edge to compete against bigger incumbents" (Rosenbusch et al., 2011, p. 442). Otherwise, it is likely they will be taken out of business by the Big Fish. Third, SMEs can adjust to environmental changes faster than bigger organization "due to their nimbleness, missing hierarchies, and quick decision-making" (Rosenbusch et al., 2011, p. 442).

However, innovation is a risky endeavour. On the one hand, it requires resources that may be hard to come by a SME. It is well-known that SMEs face tight financial resources restrictions due to credit constraints (Nixson and Cook, 2005; OECD, 2009; OECD, 2015); but they also may face other kinds of resource deficits, such as scarce management resources or limited access to human capital (OECD, 1998; Abdullah, 2000). On the other hand, the results Determinants of innovation 99 of those investments can be uncertain. So, it is no surprise that SMEs have a high mortality rate. For instance, in the USA "about half of all new establishments survive five years or more and about one-third survive, 10 years or more" (Bureau of Labour Statistics, 2016). In Colombia, just about 50 per cent of new businesses survive to the first year, and 20 per cent survive to the third year (Dinero, 2015).

Taking those facts into account, it is easy to see that big corporations have some advantages to innovate. First, large organizations usually have the "resource slack to absorb failure" and their accumulated experience may help them to better manage innovation projects (Rosenbusch et al., 2011). However, as Govindarajan (2016) points out, "Past success can trap [big] companies into believing what they have done is a blueprint for what they should do". Moreover, SMEs are very important. In Colombia, they represent well above 90 per cent formal businesses and create around 67 per cent jobs (Dinero, 2016). So, it is important to know if innovation indeed improves the performance or results of a SME in Colombia.

At the international level, there is a relatively wide body of empirical studies that try to assess the relationship between innovation and performance in SMEs. To innovate, the firm may use internal resources, external resources or a combination of both. In an empirical study directed specifically to analyse SMEs innovation capabilities, Sternberg and Arndt (2009) suggest that internal inputs are more important than external factors in determining the SME's innovation capability. In particular, they find that firms that participate in an innovation network are more likely to generate process innovations. However, participation in innovations networks does not have an impact on the probability to generate product innovations. Moreover, external regional spending on R&D has a positive impact on product innovation.

Now, the relationship between innovation and performance in SMEs, Rosenbusch et al. (2011) found that performance is not only assessed through objective measures of results but also through subjective ones. This fact could be related to the sensitiveness of SMEs' managers to disclose important business information, so that empirical studies must conform with indirect measures of results. The most relevant objective and subjective measures of performance considered in the literature go along three dimensions: accounting utility, growth and stock market performance. Firms can use internal inputs or external inputs, and the innovation process outputs refer to the results derived from the innovation endeavour, such as patents, new products and new industrial processes. This result could stem from the high uncertainty that surrounds innovation processes, as channelling huge resources to innovation activities is not guaranteeing to obtain successful innovation results. This is to say that the productivity of innovation resources is highly heterogeneous.

Opposing some of the results derived by Rosenbusch et al., (2011), Zeng et al., (2010) point that the increasing complexity of innovation processes has caused an important growth in the use of R&D networks by SMEs. They find that cooperation with other firms, cooperation with intermadiary institutions and cooperation with R&D organizations all have a positive impact on firm performance. Nonetheless, the strongest effect on firm performance is provided by inter firm cooperations.

Vermeulen et al. (2003) relate innovation inputs to innovations outputs and firm performance. As innovation inputs, the authors use variables such as the share of employees participating in R&D activites or in internal training activities, the participation of the SME in innovation cooperation networks, and the capacity of the firm to gather external information. Innovation outputs refer to the concrete products derived from the innovation products and are measured through a dummy variables that is positive if the SME has launched a new product. Finally, SME peformance is measured througth the return on sales (ROS). With this information in hand, Vermeulen et al. (2003) find that innovation inputs have a positive effect on innovation outputs, but evidence is not conclusive about the efect of innovation outputs on firm performance. In particular, they find that innovation outputs have a positive effect on firm performance but only for larger SMEs.

Zahra and Bogner (2000) study the incidence of the technology strategy on new venture performance (NVP) for the software industry in the USA. NVP performance is measured though the return on equity (ROE) and market share growth. The technology strategy is assessed through five diminensons: radicality, intensity, R&D spending, external tech resources and intelectual property rights. Moreover, they also assess the competitive environment through measures developed by Miller and Friesen (1982) based on entrepeunuers perceptions. The authors find that radicality, intensity and the use of external tech resources have a positive impact both on the ROE and the market share. Nonetheless, the results are not conclusive about the effect of R&D spending on firm perfomance.

In the case of emerging market economies, we highlight Mohd and Sidek (2013) and Ospina, Puche and Arango (2014). For instance, Mohd and Sidek (2013) study the effect of innovation on Malaysian SME performance, which is measured through a composite index based on managers' subjective perceptions on ROS, return on assets, market share, sales income and labour productivity. Moreover, the authors split innovation in three components: processes, products and markets. The study suggests that market innovation does not have a significant effect on firm performance, whereas process and product innovations do have a significant effect. Likewise, according to Ãvila (2015), manufacturing Mexican SMEs committed to innovation achieve better financial results. On the same vein, Ospina et al. (2014) make an analysis of innovation strategies and their impact on financial performance in Colombian SMEs, with the result that there is a direct relationship between R&D investments and profitability.

So, it is seen that there is no consensus in the literature about the effect of several innovation dimensions on firm performance. For instance, the effect of innovation inputs is called into question by some studies. Hence, some works claim that cooperation networks on R&D benefit SMEs (Zeng et al., 2010; Zahra and Bogner, 2000; Sternberg and Arndt, 2009; Restrepo et al., 2016), while others hold a different view (Edmondson and Nembhard, 2009; Rosenbusch et al., 2011). Also, some works find a strongly positive relationship between R&D spending and firm performance (Ospina et al., 2014), while others cast doubt about this relationship (Zahra and Bogner, 2000). It seems to be a wider agreement on the effect of product innovations on firm performance, as most studies find that innovation process outputs have a positive effect on SMEs performance (Mohd and Sidek, 2013; Rosenbusch et al., 2011; Zahra and Bogner, 2000), being the work of Vermeulen et al. (2003), the only one that casts some doubt on the issue.

Possibly, the mixed results on the relationship among several innovation dimensions and SMEs performance might be explained through different arguments (Bougrain and Haudeville, 2002; Cataño et al., 2008; Rosenbusch et al., 2011; Restrepo et al., 2016). As argued by Bougrain and Haudeville (2002), in SMEs, the manager takes responsibility for almost all the decisions, including those regarding technical changes. Given the resource constraints of a typical SME, then the manager's risk aversion could block innovation processes. However, these resource constraints are limited to not only financial capital but also human capital and organizational know how. Following Cataño et al. (2008), it could be argued that a key feature to understand SMEs limitations stems fromtheir isolation, as SMEs sparse networks pose them with increased barriers to access to technology, knowledge and financial resources. In the case of R&D cooperation networks, this isolation may be hard to break because "SMEs might lack the experience, needed to manage external collaborations" (Rosenbusch et al., 2011, p. 446), which are very complex endeavours as they involve coordination challenges, intellectual property and rent distribution issues.

Finally, it can be said that the disagreements fit into the wider debate about the nonlinearity on the relationship between innovation inputs and outputs. Some firms, with very few resources, could get successful and easily marketable products; whereas others, making huge investments, could fail in their pursuit. This could be the reason why generally product innovations are found to be more important to a SME performance, as product innovations refer to the concrete results of the innovation process. In contrast, innovation inputs refer to the resources brought into the innovation process, but whose final results are uncertain.

Methodology

Sample structure

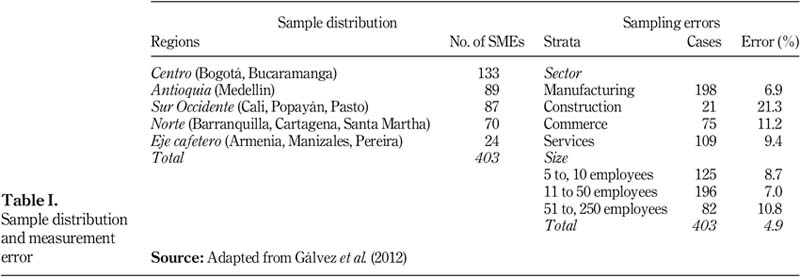

The FaedPyme-survey was implemented through a stratified sample design. Due to the difficulties to get to know the total SME population in Colombia because of unreliable and scattered public data, the sample size is determined through non-finite population sampling. The strata were as follows: industry sector, firm size and five Colombian regions. The sample consisted of Colombian 403 SMEs, with a sampling error of 4.9 and a confidence level of 95 per cent. Table I shows the sampling error for each strata.

Survey design

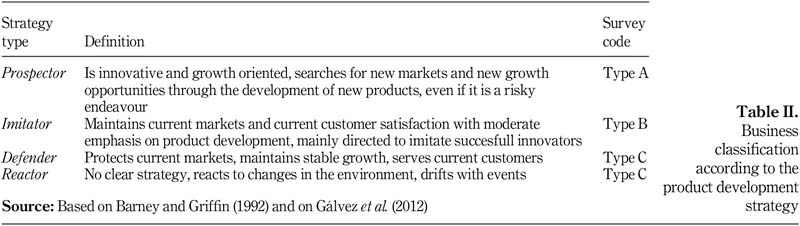

Respondents to the questionare were inquired by telephone. Survey-questions were closedended and were directed to the firm manager or CEO. The survey questioniare was designed by taking into account previous SMEs-empirical works. The final questionaire was, 25 questions long, gathered in five sections. The first section asks for generic information. The second section asks SMEs about their perception on the competitive environment and the business climate. The third block is about straetgy and organizational structure. Thus, it asks SMEs for the type of cooperation agreements they make, their planning time span, their human resources' management strategies, their interal departmantes and their business strategies. We are particularly interested in SMEs cooperations agreemnts and business strategies towards product and market development. First, this paper seeks to assess if cooperation agreements on R&D have an impact on SME performance. Second, regarding SMEs' strategies, we follow the (Miles and Snow, 1978) fourfold business classification according to their product development orientation and market strategy into prospector, analyser, defender and reactor organizations with a minor tweak: we will call the analyser as the imitator business instead. Thus, based on Barney and Griffin (1992), each strategy may be summed up as in Table II. We will use this classfication scheme to address the issue of product innovation in SMEs.

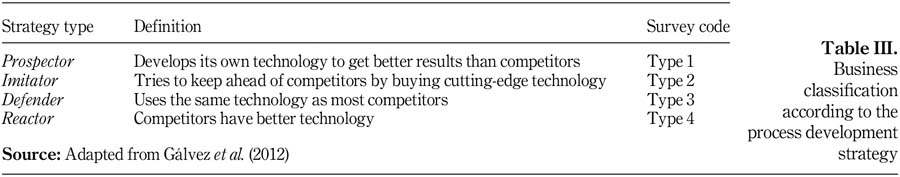

The fourth section deals with issues related to technology and business internal processes. From this section, we are particularly interested in assessing process innovations, namely, improvements in the production technology. Thus, by trying to keep a paralelism with the Miles and Snow (1978) classification scheme, the survey classifies SMEs in four types according to their stance regarding process innovations, as Table III shows:

Finally, the fith-survey-block asks the manager about hihe/sher perception on the SME financial and non-financial performance compared to competitors. The survey asks SMEs to rate eight statements in a fivefold qualitative scale ranging from strongly disagree (1) to strongly agree (5). The eight statements ask the manager to tell if, compared to competitors, the firm:

-

offers higher quality products;

-

has highly efficient internal processes;

-

has highly satisfied clients;

-

adapts faster to market changes;

-

grows faster;

-

is more profitable;

-

has highly satisfied and motivated employees; and

-

has a low employee absenteeism.

In this vein, those SMEs that strongly agree with each statement would regard themselves as high performers compered to competitors. Subjective assessments of firm performance are widely used in the literature, as a means to overcome managers' reluctance to disclose business information (Rosenbusch et al., 2011).

Data analysis techniques

We analyse if SMEs in Colombia are interested in innovation, and if this one has some impact on firm performance. Hence, the methodology is structured in three stages: first, it conducts a SMEs' descriptive analysis and innovation profiles. Second, it computes a summary measure of SME performance through principal components analysis (PCA). Third, it performs an ANOVA to determine if there are significant differences in SMEs' performance depending on their innovation profile. Finally, a regression model is estimated as an alternative tool to determine the influence of SMEs' innovation profiles on their performance.

Results

Small and medium-sized enterprises characteristics

Strategy and product innovation. According to survey data, strategic planning activities (57 per cent) are the most SMEs do perform. Nevertheless, within those that make strategic planning, the time horizon of their plans is fairly short, as just 19 per cent of SMEs consider time spans longer than one year.

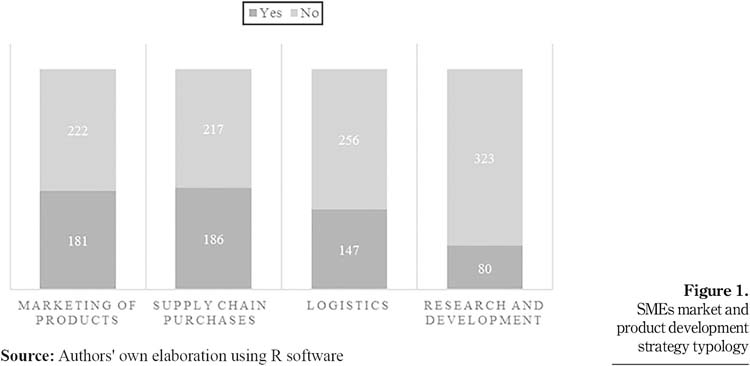

Furthermore, as can be observed in Figure 1, most SMEs do not implement alliances or cooperation agreements of any kind. Nonetheless, it can be seen the most common cooperation agreement is about provision activities, followed by alliances for distribution activities and logistics. Finally, it shows that just a minority of SMEs have struck a cooperation agreement to undertake R&D activities.

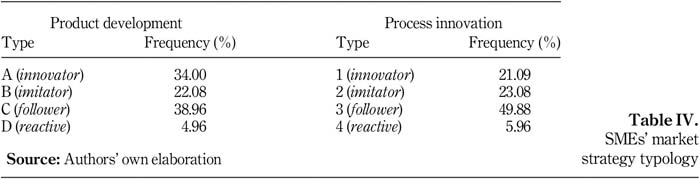

In the same vein, when classifying SMEs according to the (Miles and Snow, 1978) inspired strategy typologies (Table III), it is found that only 34 per cent are self-regarded as innovators, whereas the majority of SMEs are self-classified as imitators (22 per cent) or followers (38.96) - 22 and 38.96 per cent, respectively (Table IV). Finally, a tiny fraction selfclassifies as reactive. Hence, it follows that most SMEs are not involved in product innovation activities, reason why Colombian SMEs scarce interest on R&D cooperation should not come as a surprise.

Technology and process innovation. To assess SMEs' process innovation activities, the survey follows a classification scheme resembling that of Miles and Snow (1978). The results obtained show that just, 21.09 per cent of SMEs self-classify as innovators, whereas most SMEs self-classify as followers (49.88 per cent) and a tiny fraction as reactive (5.96 per cent) (Table IV). Thus, these results reaffirm Colombian SMEs low interest in innovation.

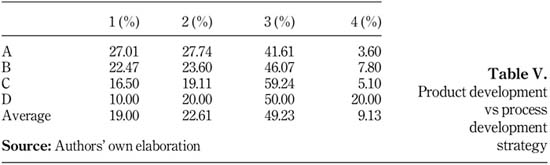

It could be expected, however, that SMEs that self-classify as innovators according to their product development strategy, should do the same according to their process development strategy. This is not the case. The cross-tabulation in Table V shows that within type A companies, the biggest share self-classifies as Type 3 companies (41.61 per cent). So, although they report to be product innovators, they self-regard as process followers. This is to say that although these SMEs' state to actively improve existing products or to develop new ones, they mostly use the prevailing technologies.

Performance indicator

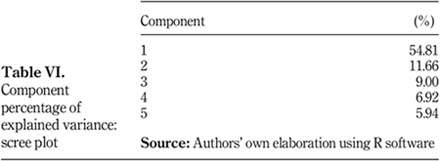

Cronbach's alpha (0.87) and Gutmman's lambda (0.88) for ordinal reliability (Gadermann et al., 2012) suggest a high degree of internal consistency among the item responses to the eight performance related questions. To compute a firm performance index, the answers are summed up in one composite index through a PCA, which is computed through the eigenvalue decomposition of the correlation matrix. In this regard, it should be noted that the measurement scale for each of these eight statements is an ordinal scale ranging from one (1) to five (5). Hence, to compute the PCA, it is necessary to rely on an alternative computation method to obtain the correlations among statements. In particular, we will not use the standard Pearson correlations but instead we will use polychorich correlations (Fox, 2010; Holgado et al., 2010). Using this matrix of polychoric correlations, it is found that the first component explains over half of data variability (54.81 per cent)(Table VI), whereas the second and subsequent components explain less than 12 per cent of data variability. Therefore, only the first component is retained, and the remaining ones are discarded.

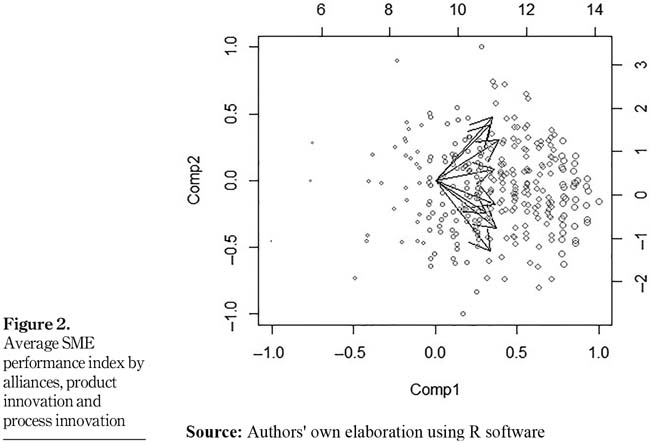

In Figure 2, the arrows represent the direction of variability of each one of the eight statements. As every arrow point rightwards, then it can be said that the first component - represented by the horizontal axis - in fact represents a composite index of firm performance. In what follows, we will relate this composite index of SME performance with its innovation strategies.

ANOVA

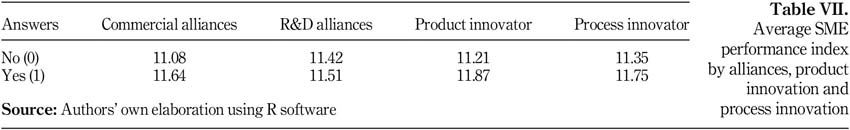

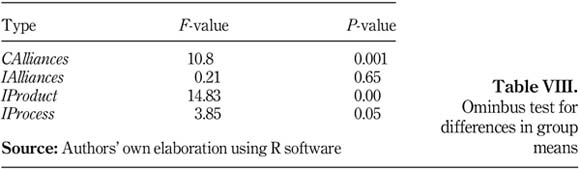

Performance vs alliances. The reader should remember that the survey considers for types of cooperation agreements. Those related to provision activities, to distribution activities and to logistics will be referred as commercial alliances (CAlliances). It can be seen in Table VII that SMEs with commercial alliances have a higher average performance (11.64) than those who do not (11.08). Moreover, those SMEs with R&D alliances (IAlliances) also have a higher average performance (11.51) compared to SMEs that do not participate in such alliances (11.42). Nonetheless, in this case, the difference appears to be very small.

Indeed, in Table VIII, it can be seen that the Omnibus test fails to reject the null hypothesis that there is no difference in the average performance between SMEs with R&D alliances and SMEs without such an alliance - see the high p-value in the second row (0.65). On the contrary, the Omnibus test suggests that there is a statistically significant difference in the average performance between SMEs with commercial alliances and those without these alliances - i.e. the p-value in the first row is almost zero (0.001).

Although at first glance, this result may appear surprising, it is not new in the literature. For instance, Rosenbusch et al. (2011, p. 446) find a similar result, arguing that "SMEs might lack the experience, needed to manage external collaborations", as they involve complex issues about coordination efforts, protection of intellectual property, appropriation of rents. Also, Sternberg and Arndt (2009) make a related finding, as their results suggest that probability of product innovations is unaffected by a SME participation in local or interregional innovation networks.

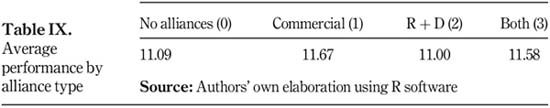

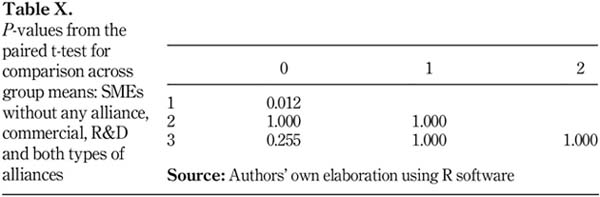

To confirm this result, we take an alternative approach. We group SMEs according to a variable that takes the value of 0 if the SME has no alliances, the value of, 1 if the company participates in commercial alliances only, 2 if the firm participates in R&D alliances only, and 3 if the SME has both commercial alliances and R&D alliances. Table IX shows that SMEs with commercial alliances and both types of alliances have a high average performance indicator compared to SMEs without any alliances. Nevertheless, the lowest average performance indicator is found to belong to SMEs that participate in R&D alliances only.

As now we have more than two groups, we turn to a paired t-test to compare group means, with p-values corrected by the Bonferroni adjustment method. Additionally, we test the results for the Wilcoxon signed rank test for paired samples that works even if the

population is not normally distributed. Table X reports the p-values obtained by applying the paired t-test. With a significance level of 5 per cent (or 0.05), we can conclude that there is a significant difference in average performance between SMEs with commercial alliances only versus those with no alliances at all, as the p-value is very small (0.012), rejecting the null hypothesis of equality in group means. On the contrary, we cannot find a significant difference in average performance between SMEs with R&D alliances only versus those with no alliances (0), as the p-value is large (1.00). But even those SMEs with both types of alliances (commercial and R&D, or Type 3 alliances) cannot be said to outperform those without any alliance, as the p-value is large (0.255). Hence, it can be said with less uncertainty that R&D alliances do not have significant effect on SME performance in Colombia.

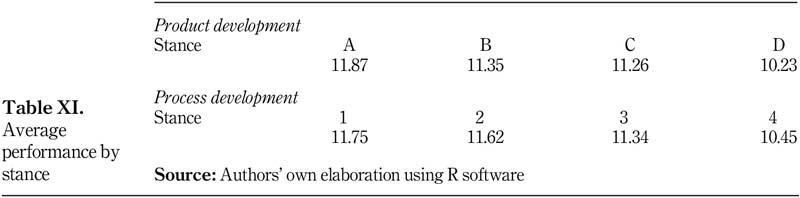

Performance vs product innovation. Here, we return to the Miles and Snow (1978)-based strategy classification, summarized in Table II, to identify product innovators. Consequently, SMEs are grouped according to a dichotomous variable (IProduct) which is one if SMEs are classified as type A firms, and zero otherwise (0). Now, considering the remaining three categories in the classification scheme, Table XI shows that innovators outperform the other three types of firms. However, the paired t-test shows that this difference is not significant when comparing imitators (type B) versus innovators (type A), as the reported p-value is fairly large (0.107), failing to reject the null hypothesis Consequently, it cannot be said that innovators in product development outperform imitators in product development. However, when comparing innovators with followers (type C) and reactive (type D) firms, the difference in means is found to be significant. Therefore, it can be said that innovators in product development outperform follower and reactive SMEs, but at the same time, they fail to gain a competitive edge compered to imitator SMEs. Hence, in Colombia imitators in product development get probably results nearly as good as innovators.

Performance vs process innovation. The SMEs are grouped according to a variable (IProcess) which is one (1) if the SME is classified as a type 1 (or a process innovator) firm, and zero (0) otherwise. Turning attention to the remaining three categories in the classification scheme (Table III), it is found that innovators in process development have an average performance higher than other type of firms, as can be seen in Table XI. Nevertheless, the paired t-test shows that this difference is not significant when comparing followers (Type 3) to innovators (Type 1) and imitators (Type 2) vs innovators (Type 1). So, innovators in process development only outperform reactive firms (Type 4), whereas followers and imitators in product development have a performance close to that of innovators. Therefore, it appears that in Colombia, SMEs that buy cutting-age technology (imitators) or use the same technology as the competitors (followers) get results so close to those of SMEs which develop their own technology, that innovators do not get a competitive edge against these other types of firms.

Linear regression model

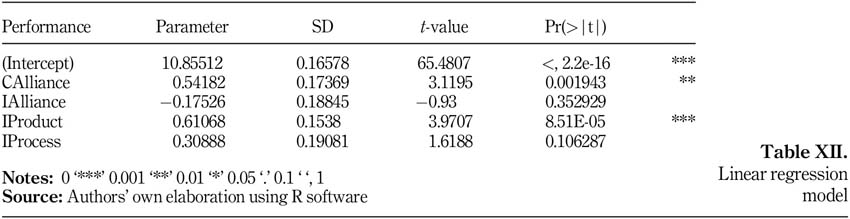

As a last step, and as a way to sum up the results so far obtained through the ANOVA, here we will estimate a regression model through the ordinary least squares method. In this model, we relate the performance index to a set of four dummy variables: CAlliance - whether the firm belongs to a commercial alliance, IAlliance - whether the firm belongs to a R&D alliance, IProduct- whether the firm makes product innovations, IProcess - whether the firm makes process innovations. The regression model reported in Table XII have no collinearity problems, as the squared root of the variance inflation factors is less than two. Nonetheless, due to the presence of heteroscedasticity, we report the robust sandwich estimator of White.

The regression model suggests that commercial alliances (CAlliances) and product innovations (IProduct) both have a positive and statistically significant effect on firm performance. However, alliances for R&D activities (IAlliances) and process innovations (IProcess) are not statistically significant. Hence, the model appears to confirm that there is no evidence, for the Colombian case, that cooperation in R&D and process innovations have a positive effect on SME performance.

Concluding remarks

Results suggest that innovation activities in Colombian SMEs are carried out informally, as they are mostly uninterested to engage in R&D activities and to develop new products by own initiative. Regarding technology, results suggest that almost half of SMEs are classified as followers, namely, they use the same technology as competitors. However, it is also found that a minority of SMEs are classified as imitators in product development. Finally, it is also found that SMEs oriented to product innovation have on average the highest performance indicator.

The results obtained in this paper show that SMEs that make product innovations have a higher performance than those who do not. However, it is found that imitators in product development get a performance almost as high as innovators, as the ANOVA fails to reject the null hypothesis of equality of variances. Also, the ANOVA suggests that process innovations are not as critical to SMEs performance as product innovations, as even followers in process development appear to have an average performance so close to innovators, which the paired t-test (and the Wilcoxon test) fail to reject the null hypothesis of equality of variances for these two types of businesses. Moreover, R&D alliances do not appear to provide a competitive edge to Colombian SMEs.

The results are confirmed by a linear regression model. First, it is found that commercial alliances have a positive impact on firm performance, whereas R&D alliances appear not to have a significant effect on SME performance. In this respect, our results resemble the findings by Rosenbusch et al. (2011) and are in line with results obtained by Sternberg and Arndt (2009). Then, possibly there is a low interest in innovation, as the ANOVA suggests that imitators have a performance as high as innovators, or it can be the case that Colombian SMEs lack the capabilities or experience to manage cooperation efforts in R&D.

Second, the regression model suggests that process innovations are not as important to SME performance as product innovations. Indeed, the IProcess variable is not significant. This result is in line with that ofMohd and Sidek (2013), who found that product innovations have a greater effect on SME performance than process innovations. This finding could be understood from the lens of the non-linearity between innovation outputs and innovation inputs. Namely, it is far more important for the SME's success the concrete product derived from the innovation endeavour than the amount of resources involved in the innovation process. As process innovations are directly related to productive efficiency, but at most indirectly related to gains in marketability, it could be fruitless to increase productive efficiency if the market is not welcoming to an increased quantity of a previously existing, undifferentiated product. However, an improvement over an existing product could result in a heightened interest in the good or service provided by the SME. Moreover, an entirely new product opens up new markets. This could be the reason why product innovation is found to be more important to SMEs results than process innovation in this paper and the related literature (Mohd and Sidek, 2013; Rosenbusch et al., 2011; Zahra and Bogner, 2000).

References

Abdullah, M. (2000), Small and Medium Enterprises in Asian Pacific Countries: Roles and Issues, Nova Publishers, Huntington. [ Links ]

Akehurst, G., Rueda-Armengot, C., Vivas-Lopez, S. and Palacios-Marqués, D. (2011), "Ontological supports of knowledge: knowledge creation and analytical knowledge", Management Decision, Vol. 49 No. 2, pp. 183-194. [ Links ]

Ãvila, G. (2015), "How innovation in operations increases competitiveness in manufacturing SMES in the metropolitan area of guadalajara", Nova Scientia, Vol. 7 No. 15, pp. 597-615. [ Links ]

Barney, J. and Griffin, R. (1992), The Management of Organizations: Strategy, Structure, Behavior, Houghton Mifflin Co, Boston. [ Links ]

Barro, R. and Sala-i-Martin, X. (2000), Economic Growth, The MIT Press, Cambridge. [ Links ]

Bell, S. and Teima, G. (2015), "Small and medium enterprises (SMEs) finance", The World Bank available at: www.worldbank.org/en/topic/financialsector/brief/smes-finance (accessed 18 August 2016). [ Links ]

Bougrain, F. and Haudeville, B. (2002), "Innovation, collaboration and SMEs internal research capacities", Research Policy, Vol. 31 No. 5, pp. 735-747. [ Links ]

Bureau of Labor Statistcs (2016), "Entrepreneurship and the US economy", available at: www.bls.gov/ bdm/entrepreneurship/bdm_chart3.htm [ Links ]

Cataño, G., Botero, P., Vanegas, J., Castro, J. and Ibarra, A. (2008), Redes de Conocimiento en Sistemas Regionales de Innovacion. Un Estudio Comparado: el Caso de Las PYMES en Antioquia y el PaÃs Vasco, Instituto Tecnologico Metropolitano, MedellÃn. [ Links ]

Comin, D. (2008), "Total factor productivity", in Derlauf En, S. and Blume, L. (Eds), The New Palgrave Dictionary of Economics, PalgraveMacmillan, available at: www.people.hbs.edu/dcomin/def.pdf

Dinero (2015), (Feb. 19)"Por qué fracasan las pymes en Colombia?", Dinero, available at: www.dinero.com/economia/articulo/pymes-colombia/212958 [ Links ]

Dinero (2016), "Mipymes generan alrededor del 67% del empleo en Colombia", Dinero. Retrieved from: www.dinero.com/edicion-impresa/pymes/articulo/evolucion-y-situacion-actual-de-las-mipymes-encolombia/222395 [ Links ]

Edmondson, A. and Nembhard, I. (2009), "Product development and learning in project teams: the challenges are the benefits", Journal of Product Innovation Management, Vol. 26 No. 2, pp. 123-138. [ Links ]

Fox, J. (2010), "Polycor: polychoric and polyserial correlations. R package version 0.7-8", available at: https://CRAN.R-project.org/package=polycor [ Links ]

Gadermann, A., Guhn, M. and Zumbo, B. (2012), "Estimating ordinal reliability for likert-type and ordinal item response data: a conceptual, empirical, and practical guide", Practical Assessment, Research and Evaluation, Vol. 17 No. 3, pp. 1-13. [ Links ]

Gálvez, E. Riascos, S. and RodrÃguez, A. (2012), "Análisis estratégico Para el desarrollo de las MIPYMES en iberoamérica", Informe Colombia, 2011. Cali: Universidad del Valle, available at: www.gaedpyme.upct.es/documentos/Faedpyme_iberoamerica.pdf [ Links ]

Govindarajan, V. (2016), (June 6). "Stop saying big companies can't innovate", Harvard Business Review, available at: https://hbr.org/2016/06/stop-saying-big-companies-cant-innovate [ Links ]

Holgado, F., Chacon, S., Barbero, I. and Vila, E. (2010), "Polychoric versus pearson correlations in exploratory and confirmatory factor analysis of ordinal variables", Quality and Quantity, Vol. 44 No. 153, pp. 153-166. [ Links ]

Loaiza, O. and Franco, L. (2012), "Un estudio acerca de los determinantes de la productividad y la ineficiencia técnica en la industria colombiana, 1992-2007" [ Links ].

Merriam-Webster (2016), "Innovation", in Merriam-Webster Dictionary. available at: www.merriamwebster.com/dictionary/innovation [ Links ]

Miles, R. and Snow, C. (1978), Organizational Strategy, Structure, and Process,McGraw-Hill, New York, NY. [ Links ]

Miller, D. and Friesen, P. (1982), "Innovation in conservative and entrepreneurial firms: two models of strategic momentum", Strategic Management Journal, Vol. 3 No. 1, pp. 1-25. [ Links ]

Mohd, M. and Sidek, S. (2013), "The impact of innovation on the performance of small and medium manufacturing enterprises: evidence from Malaysia", Journal of Innovation Management in Small and MediumEnterprise, Vol. 2013, pp. 1-16. [ Links ]

Nixson, F. and Cook, P. (2005), "Small and medium sized enterprises in developing economies", in Green, C.J., Kirkpatrick, C. and Murinde, V. (Eds), Finance and Development: Surveys of Theory, Evidence and Policy, Edward Elgar Publishing. [ Links ]

OECD (1998), "Small businesses, job creation and growth: facts, obstacles and best practices. OECD", available at: www.oecd.org/industry/smes/2090740.pdf [ Links ]

OECD (2009), "Top barriers and drivers to sme inernationalisation. OECD working party on SMEs and entrepreneurship", available at: www.oecd.org/cfe/smes/43357832.pdf [ Links ]

OECD (2015), "New approaches to sme and entrepreneurship financing: broadening the range of instruments. OECD Centre for entrepreneurship", available at: www.oecd.org/cfe/smes/New-Approaches-SME-full-report.pdf [ Links ]

Ospina, M., Puche, M. and Arango, B. (2014), "Gestion de la innovacion en pequeñas y medianas empresas: generando ventajas competitivas y posicionamiento en el mercado", Revista Gestion de Las Personas y TecnologÃa, Vol. 7 No. 19, pp. 34-39. [ Links ]

Restrepo, J., Loaiza, O. and AlbarracÃn, E. (2016), "Innovacion y desempeño de las micro, pequeñas y medianas empresas en Colombia", Revista de Ciencias Sociales, Vol. 22 No. 4, pp. 24-40. [ Links ]

Romer, P. (1990), "Endogenous technological change", The Journal of Political Economy, Vol. 98 No. 5, pp. 71-102. [ Links ]

Rosenbusch, N., Brinckmann, J. and Bausch, A. (2011), "Is innovation always beneficial? A metaanalysis of the relationship between innovation and performance in SMEs", Journal of Business Venturing, Vol. 26 No. 4, pp. 441-457. [ Links ]

Solow, R. (1956), "A contribution to the theory of economic growth", Quarterly Journal of Economics, Vol. 70 No. 1, pp. 65-94. [ Links ]

Soto, E. and Dolan, S. (2004), Las PYMES Ante el DesafÃo Del Siglo XXI: los Nuevos Mercados Globales, Thompson Editores, México. [ Links ]

Sternberg, R. and Arndt, O. (2009), "The firm or the region: what determines the innovation behavior of european firms?", Economic Geography, Vol. 77 No. 4, pp. 364-382. [ Links ]

Van de Vrande, V., De Jong, J., Vanhaverbeke, W. and De Rochemont, M. (2009), "Open innovation in SMEs: trends, motives and management challenges", Technovation, Vol. 29 Nos 6/7, pp. 423-437. [ Links ]

Vanegas, J., Pérez, L., Y. and Restrepo, J. (2018), "Permanencia de firmas en el mercado: perspectivas desde Colombia y méxico. CapÃtulo 13", in Rincon En Y., Rincon, J., Y. and J., Vanegas J. (Eds), Competitividad y Capacidad de Exportacion en un Contexto Global, Sello Editorial Tecnologico de Antioquia, I.U, MedellÃn, Colombia, pp. 361-376, p. 378.

Vermeulen, P. Shaughnessy, K. and de Jong, J. (2003), "Innovation in SMEs: an empirical investigation of the inputthrougput-output-performance model", SCALES-paper N200302. Scientific Analysis of Entrepreneurship and SMEs. [ Links ]

Williamson, O. and Winter, S. (1993), The Nature of the Firm: Origins, Evolution, and Development, Oxford University Press, New York, NY. [ Links ]

Yoguel, G. and Boscherini, F. (1996), "Algunas reflexiones sobre la medicion de los procesos de innovacion: la relevancia de los elementos informales e incrementales", Redes, Vol. 3 No. 8, pp. 95-116. [ Links ]

Zahra, S. and Bogner, W. (2000), "Technology strategy and software new ventures' performance: exploring the moderating effect of the competitive environment", Journal of Business Venturing, Vol. 15 No. 2, pp. 135-173. [ Links ]

Zeng, S., Xie, X. and Tam, C. (2010), "Relationship between cooperation networks and innovation performance of SMEs", Technovation, Vol. 30 No. 3, pp. 181-194. [ Links ]

Citation:

Restrepo-Morales, J., Loaiza, O. and Vanegas, J. (2019), "Determinants of innovation", Journal of Economics, Finance and Administrative Science, Vol. 24 No. 47, pp. 97-112. https://doi.org/10.1108/JEFAS-09-2018-0095

Received: 28 September 2018

Accepted: 30 October 2018