Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Journal of Economics, Finance and Administrative Science

versión impresa ISSN 2077-1886

Journal of Economics, Finance and Administrative Science vol.24 no.48 Lima jul./dic. 2019

http://dx.doi.org/https://doi.org/10.1108/JEFAS-02-2018-0022

ARTICLE

Financial performance trends of United States Hockey Inc: a resource-dependency approach

Peter Omondi-Ochieng1,*

1University of Louisiana at Lafayette, Lafayette, Louisiana, USA

Corresponding author: *poo6515@louisiana.edu

Abstract

Purpose: The purpose of this paper is to examine the 2009 to 2016 financial performance of the US Hockey Inc., using financial effectiveness indicators and financial efficiency ratios.

Design/methodology/approach: With the assistance of financial trend analysis, archival data were used to examine the financial performance (evaluated by net income), financial effectiveness (indicated by total assets and total revenues) and financial efficiency (examined by programme services ratios and return on assets) of US Hockey Inc.

Findings: On average, the financial performance of the organization was positive ($30,895 net income per year). Financial effectiveness was steady with increases in assets and revenues. Financial efficiency was poor with 79% of revenues spent on programme services and 1.45% average return on asset.

Research limitations/implications: The results can be generalized to similar national non-profit sports federations but not corporate sports entities with dissimilar financial goals.

Practical implications: The results revealed that national non-profit sports federations can boost their financial performance by maintaining a double strategically focus on both financial effectiveness and financial efficiency.

Originality/value: The study used both financial effectiveness and financial efficiency measures to evaluate the financial performances of a national non-profit sports federation – a neglected approach similar studies.

Keywords: Trend analysis, Financial performance, Non-profit organization, Financial efficiency, Financial effectiveness

1. Introduction

USA Hockey, Inc. (USH). (2018) is the national non-profit sports organization (NNSO) that governs the sport of hockey in the USA – with a mission to:

"[…] provide the foundation for the sport of ice hockey in America; help young people become leaders, even Olympic heroes; and connect the game at every level while promoting a lifelong love of the sport."

The core values of USH are sportsmanship, respect, integrity, the pursuit of excellence at the individual, team and organizational levels, enjoyment, loyalty and teamwork (www.usahockey.com/). USH, as most NNSOs, is overly overdependent on external funds for survival, making them vulnerable and unable to sustain their mission, services and/or programmes (Cordery et al., 2013; Dayson, 2013; Denison and Beard, 2003; Drees and Heugens, 2013). In this study, organizational performance (OP) refers to the combined measurement of effectiveness and efficiency geared towards ascertaining the degree to which organizational goals are attained (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). Specific to NNSOs, OP can be divided into two broad categories: on-field performance (measured as win-loss records and championships won) and off-field performances (indicated as financial performance and mission accomplishments). The purpose of this paper is to evaluate the 2009-2016 financial performance of USH using financial effectiveness indicators and financial efficiency ratios.

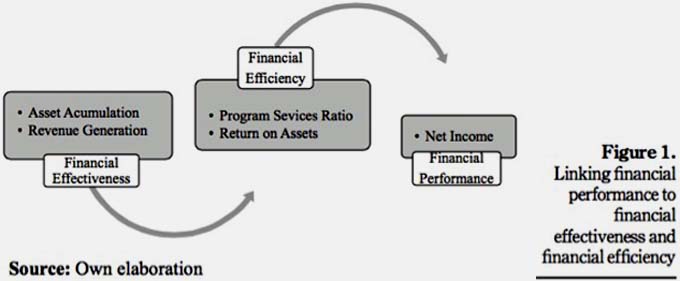

In this study, financial performance is the combined evaluation of financial effectiveness and financial efficiency in the realization of the desired financial goals of an NNSO as USH. As used in previous studies, financial performance can be formulated as (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c):

Financial performance = Financial effectiveness + Financial efficiency (1)

Financial effectiveness is the ability of organizations to use the proper choice of activities, efforts, initiatives, strategies and/or policies to generate long-term and sustainable financial performance. For instance, NNSOs that are financially effective tend to be less dependent on external revenues from corporate sponsorships and government grants and are also better at accumulating additional revenues from internal programmes, memberships and/or events (Hall et al., 2003; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). Additionally, financial efficiency is concerned with minimizing financial waste during operations by optimally allocating and utilization of scarce financial resources (Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). By being financially efficient, an NNSO can save on cost, time, resources, while boosting productivity. In this study, financial effectiveness is the capability of USH to achieve its financial goals as measured by revenues generated and assets accumulated.

The structure of the rest of the paper is as follows: justification of the study; conceptual framework and research questions; theoretical frameworks; literature review; methods; results; discussions and managerial implications; and finally, conclusions and research implications.

2. The motivation for the study

Using a variety of methodological approaches, empirical research into the financial performance of NNSO is in the upward trajectory and growth (Omondi-Ochieng, 2016; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c; Winand et al., 2012). Some of these studies used qualitative measures from surveys and interviews and aggregate fundamental measures (Ritchie and Kolodinsky, 2003; O'Boyle and Hassan, 2014; Mathieu et al., 2012; Madella et al., 2005; Bayle and Robinson, 2007). Other researches have concentrated on the financial performance of for-profit sports organizations such as professional sports teams using a variety of financial indicators as revenues and expenses (Pinnuck and Potter, 2006; Panagiotis, 2009; Ozawa et al., 2004; Nowy et al., 2015; Ecer and Boyukaslan, 2014; Dimitropoulos and Tsagkanos, 2012; Dimitropoulos, 2010). However, just a hand-full of these studies have examined the financial performance of NNSOs using financial ratios, a much better measure of the financial health than opinions surveys and interviews (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c; Ecer and Boyukaslan, 2014). This study will attempt to add and possibly narrow this gap in the use of financial ratios in evaluating the financial performances of NNPOs. Additionally, most previous studies adopted a problem-based approach, i.e. examining the financial vulnerability and problems of non-profits in general (Helmig et al., 2014; Parsons and Trussel, 2008; Denison and Beard, 2003; Dayson, 2013) and sports organizations in particular (Wicker et al., 2013; Hamil and Walters, 2010; Cordery et al., 2013; Cordery et al., 2013). Such problem-centred approaches may not be of much help to non-profit managers facing serious vulnerability threats caused by financially distressful austerity measures by many governments (Hall et al., 2003; Omondi-Ochieng, 2018c). Under such difficult financial climate, a solution-based approach adopted by this study may be more warranted especially where the managers are ready and willing to implement financial strategies that can make the NNPOs more effective by increasing effectiveness and efficiency. In other words, managers of NNSOs need more solution-based empirical research that can enable them to learn fast and adapt well to reposition their organizations for better financial health while realizing their mission. We, on the other hand, adopt a solution-based approach by researching some possible strategies NNSOs can adopt to boost their become financial health. A solution-based approach is a more direct means of examining the financial health of NNSOs which can also boost overall competitiveness. Moreover, the key findings of this study are that the financial performance of NNSOs can be greatly enhanced by the combined effects of financial effectiveness and financial efficiency.

Additionally, the present research provides an interesting and new perspective on the studies of NNSO, by using simple financial ratios which make it clearer and easier for interpretations by donors, managers and/or stakeholders, highlighting financial trends which can help detect overall financial performance strengths and weaknesses, adding additional measure of financial transparency and accountability which can be used to comply with donor requirements and using resource dependency theory to further add to the clarification and understanding of the many possible variations into the causes and catalysts of the financial performances of NNSOs.

3. Conceptual framework and research questions

This study argues that sustainable financial performance is the ultimate goal of most NNSOs as captured by two components, namely, financial effectiveness and financial efficiency, in a three-stage conceptual framework (Figure 1). The prescriptive framework stresses the inter-correlation between the two components in assessing the financial performance of NNSOs based on the following reasons. First, financial effectiveness relates to the ability of a NNSO to acquire needed but scarce financial resources such as assets and revenues. Second, upon acquiring these scarce financial resources, the resources can be efficiently used in providing operational services and programmes at low costs. This is so because in a climate of scarcity the majority of donors are increasingly demanding for more accountability, thrift and transparency (Alexander, 2000). Additionally, rising competition for revenues, medals and international recognition has pushed NNSOs to attempt to be both effective and efficient – a very difficult endeavour to accomplish. The major issues addressed in this study is to ascertain whether USH has been both financial effective and financially efficient from 2009-2016.

Through the development of a conceptual framework that links financial performance to financial efficiency and financial effectiveness (Figure 1), is a broader way of analysing, monitoring and adhering to what may lead to the realization of the mission and vision of a NNSO. The framework can enable sports managers to identify the function of each component, thus having the ability to change, adopt or take corrective action/s when needed. The present study attempts to provide answers to the following research questions:

RQ1. Was USH financially effective as indicated by its ability to generate revenues?

RQ2. Was USH financially effective as indicated by its ability to accumulate assets?

RQ3. Was USH financially efficient as indicated by its programme service ratios?

RQ4. Was USH financially efficient as indicated by its return on asset (ROA) ratios? R

Q5. Did the financial performance of USH improve as indicated by yearly net income?

By answering the five questions, this paper presents a framework for the application of financial effectiveness and financial efficiency in measuring the financial performance of USH.

4. Theoretical framework: resource dependency theory

The resource dependence theory (RDT) was propagated by Preffer and Salancik in 2003 with the view that organizations are dependent on their external environments for scares resources (i.e. knowledge, networks, contracts, loans among other critical resources) (Barman, 2008; Malatesta and Smith, 2014) and that the ability to acquire and maintain resources is essential to the survival of an organization (Hodge and Piccolo, 2005; Jung and Moon, 2007). RDT adds that organizational effectiveness results from three important forces –the firm’s ability to manage resources (Bingham and Walters, 2013; Nienhüser, 2008), the firm’s capacity to secure critical resources from the environment (Wry et al., 2013; Pfeffer and Salancik, 2003) and the firm’s ability to adapt to changing and challenging circumstances (Mitchell, 2014). RDT stresses that for organizations to succeed, they must gather, harness and secure internal and external critical resources and capabilities required to survive by interacting and co-opting (a mixture of corporation and competition) with other firms and individuals beyond their boundaries (Macedo and Carlos Pinho, 2006; Rivas, 2012; Verbruggen et al., 2011).

However, a firm’s inability to produce its own resources often leads to interdependence on external resources. Such dependence on external resources can make the organization lose control, become vulnerable leading to a reduction in autonomy and power (Casciaro and Piskorski, 2005; Miles et al., 1999). Put in another way, with increased dependence on external resources, the autonomy of the organization decreases (Pfeffer and Salancik, 2003; Froelich, 1999). Additionally, when internal and external resources become scarce, most organizations react by seeking alternatives elsewhere, which may shift power as the autonomy of the organization decreases (Drees and Heugens, 2013; Hillman et al., 2009; Pfeffer and Salancik, 2003).

RDT can be used to help understand how scarce resources are acquired and maintained organizational survival and success in sports. Previous sports-related studies that have used RDT include Coates et al. (2014), Vos et al. (2011) and Wicker et al. (2013). Specific to sports organizations, resource scarcity may be due to lack of funds, volunteers, equipment or facilities, which often paralyse their capability to handle associated challenges. In the event of serious resource scarcity, an organization must adjust, do without, reduce services/programmes or seek alternatives external to the organization.

In sum, the key to organizational survival is the ability to acquire and maintain resources (Hodge and Piccolo, 2005). Moreover, the structure, behaviour and strategy of an organizations can be explained by their resources (Preffer and Salancik, 2003; Macedo and Carlos Pinho, 2006; Mitchell, 2014), as, in general, organizations that suffer from acute resource scarcity (defined as a short supply of important resources) also tend to perish or fail as long-term survival is impeded. Resource scarcity can greatly hamper and disable the production of goods and services customers or clients demand (Macedo and Carlos Pinho, 2006; Moulton and Eckerd, 2012).

5. Literature review: financial efficiency using financial ratios

Financial efficiency is the cost-effective use of the financial resources of a NNSO to accomplish its programmes and services objectives, as indicated by financial ratios. The origins and uses of financial ratios can be traced back to the need for sound financial management pertaining to credit valuation, the business transactions and negotiations between and among lenders, rating agencies and investors (Zietlow et al., 2011; McLaughlin, 2016). To date, various types of financial ratios have been adopted to assess and measure the overall financial efficiencies of NNSOs to detect the efficient use or misuses of revenues, donations and other monetary resources. In a competitive, resource-scarce environment, the uses, applications and value of financial ratios have evolved to be the premier financial efficiency measure – both for-profit and NNPOs. The contribution of financial ratio analysis theory in this area is significant. Previous studies indicate that the uses and applications of financial ratios to ascertain financial efficiency have the following advantages:

- simplification of complex financial data;

- enabling easier comparison;

- easing trend analysis; and

- highlighting important financial information (Omondi-Ochieng, 2016; Zietlow, et al., 2011; Trussel and Greenlee, 2004).

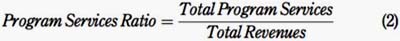

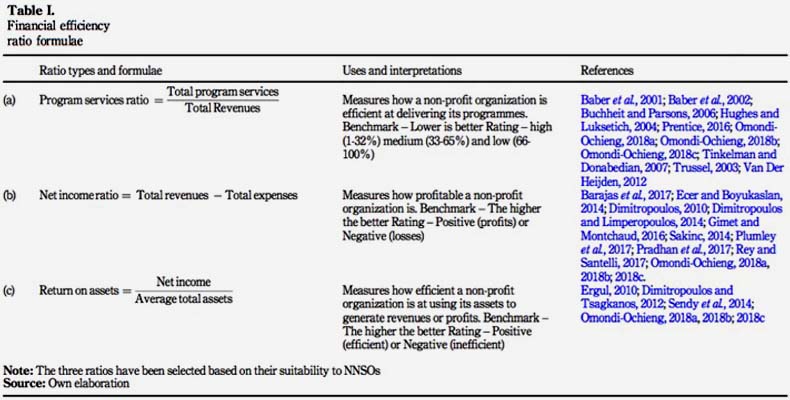

Financial ratios can be classified according to the information they provide and the specific goal of assessment. As such, the aim of this study is to use financial ratios that are specific to evaluating the financial efficiencies of NNSOs such as programme services ratio, net income and ROAs

5.1 Programme services ratio

Programme services ratio measures how a NNSO is efficient at delivering its programmes and has previously been used by the following researches: (Baber et al., 2001; Baber et al., 2002; Buchheit and Parsons, 2006; Hughes and Luksetich, 2004; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c; Tinkelman and Donabedian, 2007; Trussel, 2003; Van Der Heijden, 2012). For instance, a programme service ratio of 0.1 or 10 per cent is better than 0.7 or 70 per cent, as the latter indicates risky and wasteful use of hard-to-get revenues.

A lower programme service ratio may provide free additional resources which may later reduce competition with other potential partners and dependency on external funders (Malatesta and Smith, 2014; Mitchell, 2014; Verbruggen et al., 2011).

5.2 Net income

Net income is also known as net profit and measures the amount of total revenue that exceeds total expenses. As non-profit organizations operate under a service maximization agenda and not a profit maximization agenda, most studies that have used net profit have emanated from professional sports teams (Barajas et al., 2017; Ecer and Boyukaslan, 2014; Dimitropoulos, 2010; Dimitropoulos and Limperopoulos, 2014; Gimet and Montchaud, 2016; Sakinc, 2014; Plumley et al., 2017; Pradhan et al., 2017; Rey and Santelli, 2017). The few studies that have examined profitability on NNSOs include: (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c).

Net income measures how efficient the company is at producing profits, with higher profits almost always preferable and is also used by donors, creditors and the board members to gauge the financial position and ability to efficiently managed assets. The advantages of a NNSO having a positive net income is that it can be used to offset loans, initiate or improve programmes and services, save for future emergencies and/or add additional permanent professional staff. Additionally, higher net income may reduce the dependency of the NNSO with the potential individual, corporate and/or government funders (Hodge and Piccolo, 2005; Jung and Moon, 2007; Macedo and Carlos Pinho, 2006).

5.3 Return on assets ratio

ROAs, also known as asset utilization ratio, is commonly used as a profitability ratio that measures the net income produced by total assets over a set period (equation (4)). ROA comparers net income to average total assets. ROA has previously been used by: [(Ergul, 2010; Dimitropoulos and Tsagkanos, 2012; Sakinc, 2014; Sendy et al., 2014) for professional sports teams and by (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c) for NNSOs]

ROA is increasingly being applied in measuring how efficient an organization can generate revenues or produce profits by using its assets which may include administrative offices, cars, training facilities such as gym and fields, stadium and office furniture among others. The ratio can help managers and donors to evaluate how well the organization converts its investments in the form of assets into revenues or profits. In short, the ratio measures how efficient an organization uses its assets to gain a net profit – with a higher ratio being better. For instance, a ROA of 0.9 or 90 per cent is excellent compared to 10 per cent. Additionally, high ROA may also reduce the potential dependency on the NNSO from potentially demanding, controlling and/or unreliable funders (Barman, 2008; Froelich, 1999; Casciaro and Piskorski, 2005).

6. Methodology

This section contains data sources, measurement variables (dependent and independent) and the trend analysis.

6.1 Data sources

This study used archival data from audited financial reports and form 990 sourced from www.usahockey.com/page/show/837015-financials for the period 2009-2016. Audited financial reports are examinations of an entity’s financial statement and accompanying disclosures by an independent auditor. From the audited reports, the author examined the following statements: statement of financial position, statement of activities and changes in net assets and the statement of cash flows to access the financial health of USH. Form 990 is an Internal Revenue Service form that is filed by tax-exempt organizations and is intended to give the government and the public a clearer picture of the organization’s activities annually. Form 990 also had information pertaining to mission, number of employees, expenses, revenues and assets, among other highlights.

6.2 Measurement variables

The study variables were divided into two categories – dependent variables and independent variables. The dependent variable was financial performance measured as net profits from 2009 to 2016. Independent variables were financial effectiveness (quantified as the annual total asset and total revenues) and financial efficiency calculated as programme services ratios and ROAs ratios over the same period. As indicated in Table I, other researchers have used similar variables.

6.3 Financial trend analysis

Financial trend analysis (FTA) evaluates changes in an organization’s financial information over a period of three possible situational time frames – short-term (days to weeks), intermediate-term (weeks to months) and long-term (months to years). From the definition, “there is no minimum amount of time requirement to perform a trend analysis” – it all depends on the circumstance (Omondi-Ochieng, 2018c). Based on the general consensus of past studies (Iba and Aranha, 2012; Morris, 2013; Omondi-Ochieng, 2018c; Pickens, 1986; Raughley and Lloyd, 1999; Wong and Venkatraman, 2015), the aim of FTA is often to:

-

examine the financial health of the organization;

-

make projections for strategic financial planning;

-

predict future production of goods and services;

-

compare and contrast past and present revenues, costs and investments;

-

dissect failure analysis as an early warning indicator of anticipated, unexpected and/or impending financial problems especially when combined or supplemented with targeted financial ratios; and

-

forecast sales growth and interest rates among others.

The advantages of FTA include (Hill, 2012; Iba and Aranha, 2012; Morris, 2013; Omondi-Ochieng, 2018c; Pickens, 1986; Raughley and Lloyd, 1999; Wong and Venkatraman, 2015):

-

ease in illustration using visual histograms, line graphs, pie charts, bar graphs and/or pictograms among, enabling understanding and comparisons of one or many organizations;

-

assistance in strategic managerial decision-making especially when revealing strengths, weaknesses and/or fraudulent dealings;

-

flexibility in measuring and predicting various financial performances over time;

-

robustness – FTA can be replicated, checked, updated and refined when necessary; and

-

readily accepted due to its widespread use.

However, the potential disadvantages of FTA may also include (Omondi-Ochieng, 2018c; Raughley and Lloyd, 1999; Wong and Venkatraman, 2015):

-

frequent changes in state, federal, national and international accounting principles and policies;

-

data from new business or fresh product line may be unavailable; and

-

data may be affected by inflation and unforeseen circumstances such as earthquakes and hurricanes making it difficult to provide insights into the root causes of variations.

7. Results

The following section pertains to the calculated results of financial performance, financial effectiveness and financial efficiency.

7.1 Financial performance results

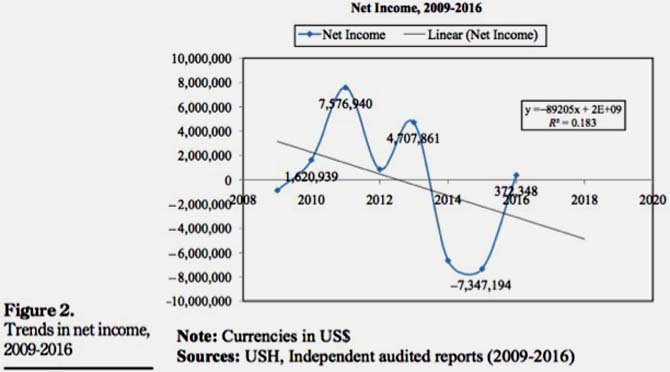

The 2009-2016 financial performance of USH was measured by net income showed low but positive results. The mean net income was a low of 30,895; the maximum was 4,707,861, generated in 2013; and 2015 was the worst year with a loss of −7,347,194 (Figure 2).

7.2 Financial effectiveness results

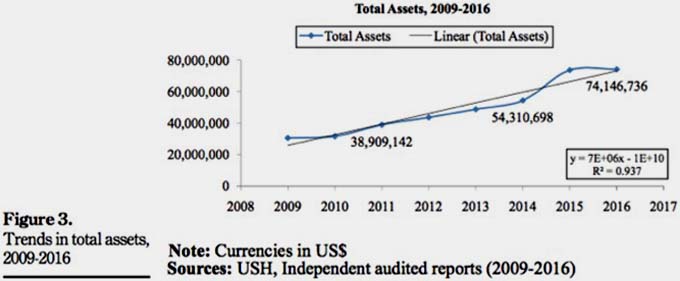

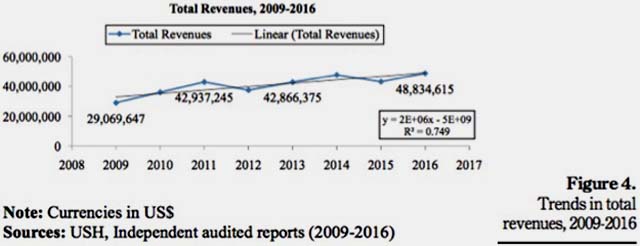

USH was quite effective in accumulating assets and revenues (Figure 3 and 4). Mean total assets was 49,422,166, the organization accumulated a maximum total asset of 74,146,736 in 2016 and the lowest total assets was 30,484,763 occurring in 2009. Total assets increased every year from 2009 to 2016. Total revenues were above average in five of the eight years analysed, with a mean of 41,834,615.

7.3 Financial efficiency results

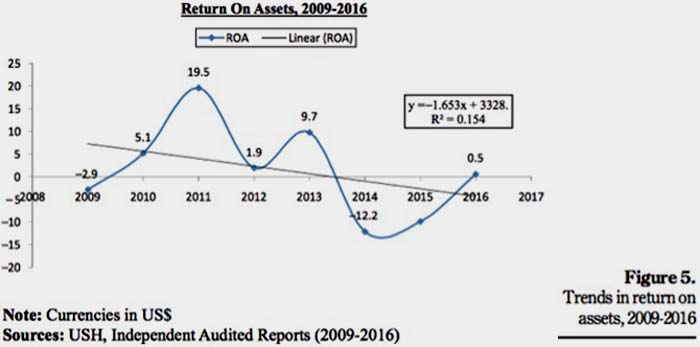

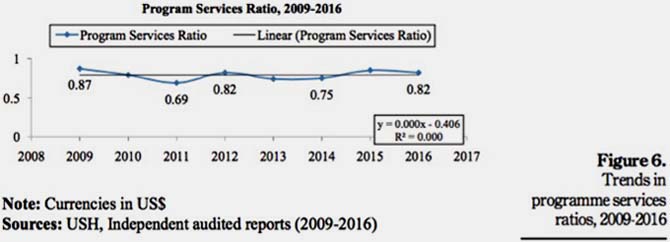

Financial efficiency was measured by programme services ratio and ROA ratio (Figure 5 and 6, respectively). USH was very ineffective by spending over 79 per cent of all its revenues on programmes on average. The organization was mostly ineffective in 2009 when they spent 87 per cent of all revenues on programmes. However, USH had some difficulties in converting its assets into revenues as indicated by a small 1.45 per cent average on ROA, with the worst year having a −12.2 per cent in 2014.

8. Discussions and managerial implications

This article examined the financial performance of USH using financial effectiveness indicators and financial efficiency ratios, for the period 2009-2016.

Financial performance was calculated by net income as common in past studies (Dimitropoulos, 2010; Ecer and Boyukaslan, 2014; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). The net average income was low but positive at 30,895, with 5 years out of the 8 above average. The year 2013 was the most profitable year with 4,707,861 and 2015 was the worst loss of −7,347,194. The year 2013 was the most profitable as the organization struck a delicate balance between independence and dependency – with over 60 per cent of all revenues generated internally. In this financial year, revenues sources were as follows: dues and member registration (58.50 per cent), grants (23.26 per cent), corporate sponsorships (8.64 per cent), tournaments and exhibitions (7.87 per cent) and advertising, mechanic sales and other income at 1.73 per cent. However, the poor performance of 2015 could be attributed to property and equipment depreciation of −4,014, 050; escalating expenses in membership services (9,917,605), national team development and international programmes (9,755,377); and support services totalling 6,526,343. Moreover, in the 2014-2015 financial year, the dependency on external sources was disappointing as grants and corporate sponsors generated just 30.69 per cent of all the revenues – thus indicating the risk of over depending on external sources for survival (Froelich,1999; Jung and Moon, 2007; Malatesta and Smith, 2014). USH was spending more than it could produce. Overall, the financial performance of USH as gauged by net income was low (average of 30,895) with millions of loses in 2014 and 2015.

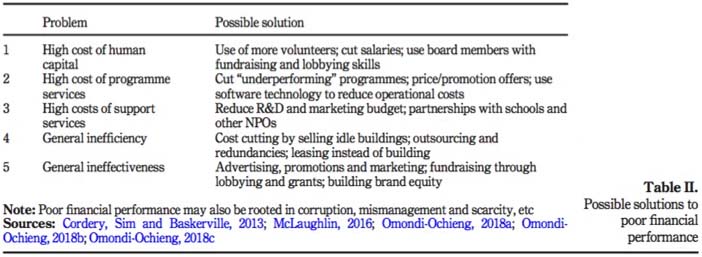

Financial effectiveness results can be viewed from two fronts, as the ability of USH to assemble needed assets and generate additional revenues – measured as total assets and total revenues, as used in previous studies (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). Total assets remained increasingly positive to a maximum of 49,422,166 in 2016, and a minimum of 30,484,763 in 2008. However, total revenues fluctuated with an average of 41,834,615, a maximum of 48,834,615 and a minimum of 29,069,647. Overall, the financial effectiveness of USC as gauged by asset accumulation and revenue generation was high and moderate, respectively. Financial efficiency results were examined using programme service ratio and ROA as commonly used in previous studies (Mathieu et al., 2012; Panagiotis, 2009; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). USH, on average from 2004 to 2016 spent over 79 per cent of its revenues on programmes, with a minimum of 69 per cent in 2009 and 2011, and a maximum of 87 per cent in 2009. However, the organization had low efficiencies with a mean ROA of 1.45 per cent and low of −12.2 per cent – indicating poor management competencies or the inability to use assets. Overall, USC had high programme services inefficiencies and low ability to convert assets to revenues – all of which may require a strong need for a new asset utilization strategy, and/or innovative programme/services marketing, with additional suggestions in Table II.

In sum, most NNSOs have neglected the combined uses of effectiveness and efficiency indicators by narrowly focussing on winning medals at international sports events. Although financial performance is of interest to NNSOs, it is increasingly becoming of particular interest to managers who must address multiple concerns of satisfactorily working with all stakeholders, being financially independent and balancing passions from fans who only demand international recognition from winning Olympic medals. Moreover, non-profit sports organizations are always competing with themselves and other private entities with bigger budgets and offering similar services and programmes. Moreover, in a difficult economic climate, NNSO are often faced by constant thorny dilemmas emanating from fierce competition and shrinking budgets; yet, they are still expected to produce positive results – under the pressure to become financially independent (Pfeffer and Salancik, 2003; Rivas, 2012; Wry et al., 2013). Essentially, NNSOs have two options; either to reduce costs or increase financial effectiveness and financial efficiency (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). In reality, however, no NNSO can offer all services and programmes that they wish, or their clients want. However, archiving both revenue growth and general overall sustainable must be in harmony and within the limitations of their human capacity, structural readiness and available financial resources (Hill et al., 2003; Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). Sometimes, NNSOs may seem effective due to favourable climate. For instance, years prior to hosting major international sporting events like the FIFA World Cup and the summer Olympics games, NNSO tends to receive generous increases in revenues from governments who want to motivate athletes to win more medals to show the nation in a positive light globally.

9. Conclusions and research implications

Financial performance measurements are fundamental to management planning and control activities and accordingly have received considerable attention by both management practitioners and sports theorists (Panagiotis, 2009; Winand et al., 2012; Omondi-Ochieng, 2016). The present study aimed to evaluate the financial performance of USH from 2009 to 2016 based on financial effectiveness and financial efficiency. In our study, financial effectiveness and efficiency were the two central terms for assessing and measuring the financial performance of NNSOs such as USH. Despite the value of assessing and measuring overall financial performance, the present study indicated the difficulty of achieving a balance between being both financially efficient and financially effective simultaneously. The study offers three important lessons.

One, the study demonstrates that USH was a poor financial performer with millions of losses and a low average of 30,895, but very successful in asset accumulation and a steady revenue generator. However, USH still particularly faces the problem of how to use assets for revenue generation.

Two, the study provides evidence that improving overall financial performance requires extraordinary managerial capabilities based on sound organizational policies directed at prudent financial practices. Efficiency involves financial discipline and control over operations and working capital requirements (Ritchie and Kolodinsky, 2003; Ecer and Boyukaslan, 2014; Omondi-Ochieng, 2016). Whereas effectiveness requires the NNSO ability to develop their own sound strategies for sustainable growth, in a manner that can differentiate themselves and be creatively innovative, especially focussed on revenue generation. Nevertheless, non-profit organizations can only sustain their operations if revenues far exceed expenses (Omondi-Ochieng, 2018a; Omondi-Ochieng, 2018b; Omondi-Ochieng, 2018c). NNSO, therefore, need to see efficiency as a necessary, but not sufficient condition and to consider effectiveness not just as an output but as a continuous process of resource acquisition.

Three, this research outcome could stimulate a future research agenda in three themes: first, imperial investigation is needed as to how NNSO perceive or define their performances. Are performance standards dictated by the government, the national federation or other donors? Second, there is a need to learn more if NNSO abide by or comply with efficiency requirements possibly set by themselves or by funders. In other words, are NNSOs required to be financially efficient? If so by who and to what extent? For example, for every tax dollar allocated by the government, what percentage needs to go into services and programmes? How do NNSO know that they are financially efficient? Do the NNSOs prefer the use of financial ratios as indicators of financial efficiency? Finally, is there an urgent need to improve our understanding about why most NNSOs are ineffective? Is it that they do not see the need? Or is there no regulatory, legal or policy mandates for them to do so. Or is it that they are faced with too many financial constraints such as depending almost entirely on stringent donation and handouts. Apart from the need for managerial effectiveness, we can also pose the question of who will discipline the management for poor financial performance. Future research could investigate the possible reasons for the performance. Could it be funding, talent, facilities or any other hidden factors? In ending, our study did not consider off-field factors that may influence on-field performance on the national teams managed by USH.

References

Alexander, J. (2000), “Adaptive strategies of non-profit human service organizations in an era of devolution and new public management”, Nonprofit Management and Leadership, Vol. 10 No. 3, pp. 287-303. [ Links ]

Baber, W.R., Daniel, P.L. and Roberts, A.A. (2002), “Compensation to managers of charitable organizations: an empirical study of the role of accounting measures of program activities”, Accounting Review, Vol. 77 No. 3, pp. 679-693. [ Links ]

Baber, W.R., Roberts, A.A. and Visvanathan, G. (2001), “Charitable organizations' strategies and program-spending ratios”, Accounting Horizons, Vol. 15 No. 4, pp. 329-343. [ Links ]

Barajas, A., Castro-Limeres, O. and Gasparetto, T. (2017), “Application of MCDA to evaluate financial fair play and financial stability in european football clubs”, Journal of Sports Economics and Management, Vol. 7 No. 3, pp. 143-164. [ Links ]

Barman, E. (2008), “With strings attached: Non-profits and the adoption of donor choice”, Non- Profit and Voluntary Sector Quarterly, Vol. 37 No. 1, pp. 39-56. [ Links ]

Bayle, E. and Robinson, L. (2007), “A framework for understanding the performance of national governing bodies of sport”, European Journal of Sport Management, Vol. 7 No. 3, pp. 249-268. [ Links ]

Bingham, T. and Walters, G. (2013), “Financial sustainability within UK charities: community sport trusts and corporate social responsibility partnerships”, Voluntas: International Journal of Voluntary and Nonprofit Organizations, Vol. 24 No. 3, pp. 606-629. [ Links ]

Buchheit, S. and Parsons, L.M. (2006), “An experimental investigation of accounting information’s influence on the individual giving process”, Journal of Accounting and Public Policy, Vol. 25 No. 6, pp. 666-686. [ Links ]

Casciaro, T. and Piskorski, M.J. (2005), “Power imbalance, mutual dependence, and constraint absorption: a closer look at resource dependence theory”, Administrative Science Quarterly, Vol. 50 No. 2, pp. 167-199. [ Links ]

Cordery, C.J., Sim, D. and Baskerville, R.F. (2013), “Three models, one goal: assessing financial vulnerability in New Zealand amateur sports clubs”, Sport Management Review, Vol. 16 No. 2, pp. 186-199. [ Links ]

Dayson, C. (2013), “Understanding financial vulnerability in UK third sector organizations: methodological considerations and applications for policy, practice and research”, Voluntary Sector Review, Vol. 4 No. 1, pp. 19-38. [ Links ]

Denison, D.V. and Beard, A. (2003), “Financial vulnerability of charitable organizations: lessons from research”, Journal for Non-Profit Management, Vol. 7 No. 1, pp. 23-31. [ Links ]

Dimitropoulos, P. (2010), “The financial performance of the greek football clubs”, CHOREGIA, Vol. 6 No. 1, pp. 5-28. [ Links ]

Dimitropoulos, P.E. and Limperopoulos, V. (2014), “Player contracts, athletic and financial performance of the greek football clubs”, Global Business and Economics Review, Vol. 16 No. 2, pp. 123-141. [ Links ]

Dimitropoulos, P. and Tsagkanos, A. (2012), “Financial performance and corporate governance in the european football industry”, International Journal of Sport Finance, Vol. 7 No. 4, pp. 280-308. [ Links ]

Drees, J.M. and Heugens, P.P. (2013), “Synthesizing and extending resource dependence theory: a Meta-analysis”, Journal of Management, Vol. 39 No. 6, pp. 1666-1698. [ Links ]

Ecer, F. and Boyukaslan, A. (2014), “Measuring performances of football clubs using financial ratios: the grey relational analysis approach”, American Journal of Economics, Vol. 4 No. 1, pp. 62-71. [ Links ]

Ergul, N. (2010), “Analysing of the effects of league performance of turkish sport clubs over the financial performances of the corresponding sport companies”, China-USA Business Review, Vol. 9 No. 12, pp. 69-79. [ Links ]

Froelich, K.A. (1999), “Diversification of revenue strategies: evolving resource dependence in non-profit organizations”, Non-profit And Voluntary Sector Quarterly, Vol. 28 No. 3, pp. 246-268. [ Links ]

Gimet, C. and Montchaud, S. (2016), “What drives european football clubs’ stock returns and volatility?”, International Journal of the Economics of Business, Vol. 23 No. 3, pp. 351-390. [ Links ]

Hall, M.H., Andrukow, A., Barr, C., Brock, K., De Wit, M., Embuldeniya, D. and Stowe, S. (2003), The Capacity to Serve: A Qualitative Study of the Challenges Facing Canada’s Non-Profit and Voluntary Organizations, Canadian Centre for Philanthropy, Toronto. [ Links ]

Hamil, S. and Walters, G. (2010), “Financial performance in english professional football: ‘an inconvenient truth,” Soccer and Society, Vol. 11 No. 4, pp. 354-372. [ Links ]

Helmig, B., Ingerfurth, S. and Pinz, A. (2014), “Success and failure of non-profit organizations: theoretical foundations, empirical evidence, and future research”, Voluntas: International Journal of Voluntary and Nonprofit Organizations, Vol. 25 No. 6, pp. 1509-1538. [ Links ]

Hill, A. (2012), Define the Trend and Trade the Trend: how to Identify, Follow and Time the Trend Using Price Charts, Create Space Publishing, New York, NY. [ Links ]

Hillman, A.J., Withers, M.C. and Collins, B.J. (2009), “Resource dependence theory: a review”, Journal of Management, Vol. 35 No. 6, pp. 1404-1427. [ Links ]

Hodge, M.M. and Piccolo, R.F. (2005), “Funding source, board involvement techniques, and financial vulnerability in non-profit organizations: a test of resource dependence”, Nonprofit Management and Leadership, Vol. 16 No. 2, pp. 171-190. [ Links ]

Hughes, P. and Luksetich, W. (2004), “Non-profit arts organizations: do funding sources influence spending patterns?”, Non-Profit And Voluntary Sector Quarterly, Vol. 33 No. 2, pp. 203-220. [ Links ]

Iba, H. and Aranha, C. (2012), “Trend analysis”, in Iba, H. and Aranha, C. (Ed.), Practical Applications of Evolutionary Computation to Financial Engineering, Springer, London, pp. 123-140. [ Links ]

Jung, K. and Moon, M.J. (2007), “The double‐edged sword of public‐resource dependence: the impact of public resources on autonomy and legitimacy in korean cultural non-profit organizations”, Policy Studies Journal, Vol. 35 No. 2, pp. 205-226. [ Links ]

McLaughlin, T.A. (2016), Street-Smart Financial Basics for Non-Profit Managers, John Wiley and Sons, New York, NY. [ Links ]

Macedo, I.M. and Carlos Pinho, J. (2006), “The relationship between resource dependence and market orientation: the specific case of non-profit organizations”, European Journal of Marketing, Vol. 40 No. 5/6, pp. 533-553. [ Links ]

Madella, A., Bayle, E. and Tome, J. (2005), “The organizational performance of national swimming federations in mediterranean countries: a comparative approach”, European Journal of Sport Science, Vol. 40 No. 2, pp. 131-148. [ Links ]

Malatesta, D. and Smith, C.R. (2014), “Lessons from resource dependence theory for contemporary public and non-profit management”, Public Administration Review, Vol. 74 No. 1, pp. 14-25. [ Links ]

Mathieu, W., Thierry, Z. and Jeroen, S. (2012), “A financial management tool for sport federations”, Sport, Business and Management, Vol. 2 No. 3, pp. 225-240. [ Links ]

Miles, G., Preece, S. and Baetz, M. (1999), “Dangers of dependence: the impact of strategic alliance use by small technology-based firms”, Journal of Small Business Management, Vol. 37 No. 2, pp. 20-29. [ Links ]

Mitchell, G.E. (2014), “Strategic responses to resource dependence among transnational NGOs registered in the United States”, Voluntas: International Journal of Voluntary and Nonprofit Organizations, Vol. 25 No. 1, pp. 67-91. [ Links ]

Morris, G.L. (2013), Investing with the Trend: A Rules-Based Approach to Money Management, John Wiley and Sons, Hoboken, NJ. [ Links ]

Moulton, S. and Eckerd, A. (2012), “Preserving the publicness of the non-profit sector: resources, roles, and public values”, Non-Profit And Voluntary Sector Quarterly, Vol. 41 No. 4, pp. 656-685. [ Links ]

Nienhüser, W. (2008), “Resource dependence theory: how well does it explain behaviour of organizations?”, Management Revu, Vol. 19 No. 1/2, pp. 9-32. [ Links ]

Nowy, T., Wicker, P., Feiler, S. and Breuer, C. (2015), “Organizational performance of non- profit and for-profit sport organizations”, European Sport Management Quarterly, Vol. 15 No. 2, pp. 155-175. [ Links ]

O'Boyle, I. and Hassan, D. (2014), “Performance management and measurement in national- level non-profit sport organizations”, European Sport Management Quarterly, Vol. 14 No. 3, pp. 299-314. Nov. [ Links ]

Omondi-Ochieng, P. (2016), Sport Finance, Top Hat Publishing, Toronto. [ Links ]

Omondi-Ochieng, P. (2018a), “US table tennis association: a case study of financial performance using effectiveness indicators and efficiency ratios”, Managerial Finance, Vol. 44 No. 2, pp. 189-2016. [ Links ]

Omondi-Ochieng, P. (2018b), “USA triathlon: a 2010-2015 case study of financial performance using effectiveness indicators and efficiency ratios”, International Journal of Productivity and Performance Management, Vol. 67 No. 7, pp. 1192-1213. [ Links ]

Omondi-Ochieng, P. (2018c), “United States bobsled and skeleton federation: an evaluation of financial performance trends”, Business and Social Science Journal, Vol. 2 No. 3, pp. 3-30. [ Links ]

Ozawa, T., Cross, J. and Henderson, S. (2004), “Market orientation and financial performance of english professional football clubs”, Journal of Targeting, Measurement and Analysis for Marketing, Vol. 13 No. 1, pp. 78-90. [ Links ]

Panagiotis, D.E. (2009), “Profitability of the greek football clubs: implications for financial decisions making”, Business Intelligence Journal, Vol. 2 No. 1, pp. 159-169. [ Links ]

Parsons, L.M. and Trussel, J.M. (2008), “Fundamental analysis of not-for-profit financial statements: an examination of financial vulnerability measures”, Research in Government and Non-Profit Accounting, Vol. 12, pp. 35-49. [ Links ]

Pfeffer, J. and Salancik, G.R. (2003), The External Control of Organizations: A Resource Dependence Perspective, Stanford University Press, Boston. [ Links ]

Pickens, W.H. (1986), “Funding over time: measuring institutional finance”, New Directions for Institutional Research, Vol. 8 No. 4, pp. 57-67. [ Links ]

Pinnuck, M. and Potter, B. (2006), “Impact of on-field football success on the off-field financial performance of AFL football clubs”, Accounting and Finance, Vol. 46 No. 3, pp. 499-517. [ Links ]

Plumley, D., Wilson, R. and Ramchandani, G. (2017), “Towards a model for measuring holistic performance of professional football clubs”, Soccer and Society, Vol. 18 No. 1, pp. 16-29. [ Links ]

Pradhan, S., Boyukaslan, A. and Ecer, F. (2017), “Applying grey relational analysis to italian football clubs: a measurement of the financial performance of serie a teams”, International Review of Economics and Management, Vol. 4 No. 4, pp. 1-19. [ Links ]

Prentice, C.R. (2016), “Why so many measures of non-profit financial performance? Analysing and improving the use of financial measures in non-profit research”, Non-Profit and Voluntary Sector Quarterly, Vol. 45 No. 4, pp. 715-740. [ Links ]

Raughley, W.S. and Lloyd, R.L. (1999), Methodology for Identifying Financial Variables for Trend Analysis, US Nuclear Regulatory Commission, Washington, DC. [ Links ]

Rey, A. and Santelli, F. (2017), “The relationship between financial ratios and sporting performance in italy’s serie A”, International Journal of Business and Management, Vol. 12 No. 12, pp. 53-63. [ Links ]

Ritchie, W.J. and Kolodinsky, R.W. (2003), “Non-profit organization financial performance measurement: an evaluation of new and existing financial performance measures, non-profit”, Nonprofit Management and Leadership, Vol. 13 No. 4, pp. 367-381. [ Links ]

Rivas, J.L. (2012), “Co-opting the environment: an empirical test of resource-dependence theory”, International Journal of Human Resource Management, Vol. 23 No. 2, pp. 294-311. [ Links ]

Sakinc, I. (2014), “Using grey relational analysis to determine the financial performance of turkish football clubs”, Journal of Economics Library, Vol. 1 No. 1, pp. 22-33. [ Links ]

Sendy, S., Soepriyanto, G. and Sari, N. (2014), “Analysis of the implementation of UEFA financial fair play: a case study on arsenal and Manchester united football club”, Binus Business Review, Vol. 5 No. 1, pp. 123-136. [ Links ]

Tinkelman, D. and Donabedian, B. (2007), “Street lamps, alleys, ratio analysis, and non-profit organizations”, Nonprofit Management and Leadership, Vol. 18 No. 1, pp. 5-18. [ Links ]

Trussel, J. (2003), “Assessing potential accounting manipulation: the financial characteristics of charitable organizations with higher than expected program-spending ratios”, Non-Profit and Voluntary Sector Quarterly, Vol. 32 No. 4, pp. 616-634. [ Links ]

Trussel, J. and Greenlee, J. (2004), “A financial rating system for non-profit organizations”, Research in Government and Non-Profit Accounting, Vol. 11, pp. 105-128. [ Links ]

United States Hockey, Inc (2018), “Annual reports and financial statements, viewed february 26, 2018”, available at: www.usahockey.com [ Links ]

Van Der Heijden, H. (2012), “Charities in competition: effects of accounting information on donating adjustments”, Behavioural Research in Accounting, Vol. 25 No. 1, pp. 1-13. [ Links ]

Verbruggen, S., Christiaens, J. and Milis, K. (2011), “Can resource dependence and coercive isomorphism explain non-profit organizations’ compliance with reporting standards?”, Non-profit and Voluntary Sector Quarterly, Vol. 40 No. 1, pp. 5-32. [ Links ]

Vos, S., Breesch, D., Késenne, S., Van Hoecke, J., Vanreusel, B. and Scheerder, J. (2011), “Governmental subsidies and coercive pressures. Evidence from sport clubs and their resource dependencies”, European Journal for Sport and Society, Vol. 8 No. 4, pp. 257-280. [ Links ]

Wicker, P., Vos, S., Scheerder, J. and Breuer, C. (2013), “The link between resource problems and inter-organizational relationships: a quantitative study of Western european sport clubs”, Managing Leisure, Vol. 18 No. 1, pp. 31-45. [ Links ]

Winand, M., Zintz, T. and Scheerder, J. (2012), “A financial management tool for sport federations”, Sport, Business and Management: An International Journal, Vol. 2 No. 3, pp. 225-240. [ Links ]

Wong, S. and Venkatraman, S. (2015), “Financial accounting fraud detection using business intelligence”, Asian Economic and Financial Review, Vol. 5 No. 11, pp. 1187-1207. [ Links ]

Wry, T., Cobb, J.A. and Aldrich, H.E. (2013), “More than a metaphor: assessing the historical legacy of resource dependence and its contemporary promise as a theory of environmental complexity”, Academy of Management Annals, Vol. 7 No. 1, pp. 441-488. [ Links ]

Zietlow, J., Hankin, J.A. and Seidner, A.G. (2011), Financial Management for Non-Profit Organizations: Policies and Practices, John Wiley & Sons, Boston. [ Links ]

Further reading

Claessens, M., Thibaut, E., Winand, M., Scheerder, J. and Vos, S. (2014), “A unified model of non-profit sport organizations performance”, Managing Leisure, Vol. 19 No. 2, pp. 121-150.

Numerato, D. (2009), “The institutionalization of regional public sport policy in the Czech Republic”, International Journal of Sport Policy, Vol. 1 No. 1, pp. 13-30.

Omondi-Ochieng, P. and Stewart, B. (2013), “Exposed? financial transparency metrics for european football federations”, Sports Management Australia and New Zealand Association Conference, Dunedin, New Zealand, November, pp. 20-22.

Schmidgall, R.S. and DeFranco, A.L. (2004), “Ratio analysis: financial benchmarks for the club industry”, Journal of Hospitality Financial Management, Vol. 12 No. 1, pp. 1-14.

Tuckman, H.P. and Chang, C.F. (1991), “A methodology for measuring the financial vulnerability of charitable non-profit organizations”, Non-Profit and Voluntary Sector Quarterly, Vol. 20 No. 4, pp. 445-460.

Winand, M., Zintz, T., Bayle, E. and Robinson, L. (2010), “Organizational performance of olympic sport governing bodies: dealing with measurement and priorities”, Managing Leisure, Vol. 15 No. 4, pp. 279-307.

Citation:

Omondi-Ochieng, P. (2019), "Financial performance trends of United States Hockey Inc: a resource-dependency approach", Journal of Economics, Finance and Administrative Science, Vol. 24 No. 48, pp. 327-344. https://doi.org/10.1108/JEFAS-02-2018-0022

Received:26 February 2018

Revised: 10 December 2018

Accepted: 14 January 2019