1. Introduction

Tax compliance is of paramount importance for the government to provide public goods and reallocate wealth (Jayawardane, 2016). For government to be able to provide public goods and reallocate wealth, there is a need for taxpayers to comply and pay the correct amount of taxes due and on time (Musimenta et al., 2017; Nkundabanyanga et al., 2017; Jayawardane, 2016). Because of the economic crises in several countries, for example, the Asian financial crisis in the late 1990s, there has been a marked increase in the importance of tax compliance in the global economic environment (Ritsatos, 2014). Tax revenue sustains economic development and finances both social programmes and infrastructure investment (Ibrahim et al., 2015). Osundina and Olanrewaju (2013) state that taxation (a process of levying and administering taxes) is a key player in every society of the world because it is a chance for the government to collect revenue needed in satisfying its pressing obligations. Tax revenues provide governments with the funds needed to invest in development, dismiss poverty, deliver public services and build the physical and social infrastructure for longterm growth (OECD, 2010). Therefore, mobilization of tax revenues through taxation of all the economic agents is the most important way through which the government can raise funds to provide public services (Ndekwa, 2014). Small business enterprises (SBEs) are one of such economic agents the government can raise revenue through taxation. In Uganda, small and medium enterprises employ approximately 2.5million, constitute approximately 90 per cent of the private sector generating over 80 per cent of the manufactured output that contributes 20 per cent of Uganda’s gross domestic product (Ojiambo, 2016; Hatega, 2007). With all their significance, studies have shown that the problem of non-tax compliance is still widespread among small businesses (Yusof et al., 2014; Kasipillai and Abdul-Jabbar, 2006). Most SBEs fall under the presumptive tax system yet during the financial year 2014/ 2015, a large number of businesses that fell under the presumptive tax bracket did not pay taxes to Uganda revenue authority (URA) (Auditor General report, 2015).

Despite the significance of taxation and several tax reforms such as tax education and online tax services, non-tax compliance is still a challenge (Nawawi and Salin, 2018; Nkundabanyanga et al., 2017; Musimenta et al., 2017; Terkper, 2003). This has led to an emergent interest by many researchers to find out why such tax compliance behaviours exist in business enterprises (Nawawi and Salin, 2018; Nkundabanyanga et al., 2017; Musimenta et al., 2017; Ndekwa, 2014; Merima et al., 2013; Nkwe, 2013; McCoon, 2011). Nawawi and Salin (2018)note that if there are no proper mechanisms put in place by the tax authorities to prevent tax evasion, there are higher chances that there will be non-tax compliance. (Nkundabanyanga et al., 2017)documented that, in the presence of tax collection mechanisms put in place, there are still cases of non-compliance in Uganda. Therefore, it remains unclear on which appropriate mechanism can governments in developing countries like Uganda use to achieve full tax compliance? One such mechanism is to have an electronic tax system where taxpayers are given an opportunity to assess themselves (Nawawi and Salin, 2018). Also, according to Nkwe (2013), tax payer’s attitude towards tax could be responsible for the compliance behaviours in Botswana. Attitude towards an electronic tax system is vital towards adoption or rejection of the e-tax system. Findings by Barati et al. (2014) suggest that positive evaluations such as convenience in terms of time and place and limited movements to the tax authority premises lead to the adoption of the e-tax system which improves tax compliance among taxpayers. To the researchers’ knowledge, no study has explored the mediating effect of adoption of an electronic tax system in the relationship between attitude towards electronic tax system and tax compliance using evidence from SBEs in a developing African country - Uganda. In this study, we try to bridge this gap by investigating the mediating role of the adoption of an electronic tax system in the relationship between attitude towards electronic tax system and tax compliance using evidence from Uganda. This study’s aim was achieved through a questionnaire survey of 214 owner managed small businesses in Uganda. Results suggest that adoption of electronictax system partially mediates the relationship between attitude towards electronic tax system and tax compliance.

This paper contributes to the already existing literature on tax compliance by documenting that the adoption of an electronic tax system is a partial mediator in the relationship between attitude towards electronic tax system and tax compliance. Government through tax authorities may wish to improve tax compliance by sensitizing taxpayers about the benefits of electronic tax systems which may positively change taxpayers’ attitude towards electronic tax system and embrace the system and thus tax compliance. Tax authorities need to focus on increasing electronic tax system usage and ensure that there is further training of taxpayers on the importance of tax compliance as well. SBEs’ owners and managers may need to ensure that they comply with tax laws, and this is possible if the necessary infrastructures such as computers and qualified personnel are in place.

The rest of the paper is organized as follows. The next section is a literature review. In this section, the theories informing our study are discussed. A review of the existing literature is done to arrive at the hypotheses. The next section is methodology where the research design is outlined, and this is followed by the results section. Discussion of results then follows and finally summary and conclusion.

2. Literature review

2.1 Theoretical foundation

Tax compliance is fulfilling all the tax obligations as stated by the law willingly and fully (Marti, 2010). Singh (2003) also defines tax compliance as an act of lodging the income tax return form, stating all the taxable income truthfully and paying all the tax obligations within the specified period without having to wait for the authority for any follow-up actions. Theoretically, the views of the taxpayers and tax collectors are that tax compliance means observing the tax laws, which differ from one country to another (Chepkurui et al., 2014). Musimenta et al. (2017) state that in Uganda, an individual or company is considered compliant if that individual or company registers with URA, submits all the tax returns, settles the tax obligations fully and withholds all the required taxes as per the Income Tax Act. On the other hand, an individual or company is non-compliant if that individual or company fails to submit the tax returns within the specified period, understates its incomes, overstates the deductions and fails to pay the assessed taxes by the due date (Kasipillai and Abdul-Jabbar, 2006). The theory of reasoned action (TRA) as proposed by Ajzen and Fishbein (1980) is to the effect that attitude relates to one’s own personal views about a behaviour. Attitude may also be defined as positive or negative views of an “attitude object”; that is to say a person, behaviour or event. In relation to taxation, taxpayers’ attitudes are positive or negative views towards tax compliance behaviour. The outcomes of positive views are tax compliance, and negative views are tax non-compliance (Nkwe, 2013). Accordingly, some people may have a negative attitude towards electronic tax system and that they would prefer to stay with traditional methods, which for most is the paper-based way, and in this case, attitudes towards using electronic tax system represent one of the main barriers for tax compliance.

Technology acceptance model (TAM) was originally proposed by Davis in 1986 to help to explain and predict user behaviour on information technology (Legris et al., 2003). Davis (1989)and Davis et al. (1989) proposed TAM to explain why a user accepts to use or rejects to use information technology (IT) by adapting TRA. Carter and Belanger (2004) as cited in Shajari and Ismail (2010) highlighted that TAM is used by many researchers, especially in information systems, to achieve a better understanding of IT adoption and its success in organizations. However, TAM has proven to be a strong and robust framework to clarify the adoption pattern of users (Shajari and Ismail, 2010). Chuttur (2009) admitted that several studies found significant statistical results for the high influence of attitude on behavioural intention to use a specific system, and these studies provided strong evidence to support TAM as a model for predicting systems usage behaviour. TAM provides a basis with which belief or attitude to use an electronic tax system enhances adoption of an electronic tax system which affects tax compliance behaviours among SBEs.

2.2 Electronic tax system and tax compliance

According to Wasao (2014), an electronic tax system is an online platform that enables the taxpayer access tax services through the internet. Such services include registration for a tax identification number, filing of returns and registration of a payment and compliance certificate application. Electronic tax systems first started in the USA, where the Internal Revenue Services began offering tax return e-filing for tax refunds only (Muturi and Kiarie, 2015; Maisiba and Atambo (2016) argue that the e-tax system improves tax compliance, as it facilitates faster accessibility to tax services without a physical visit to the tax authority premises. Haryani et al. (2015) further state that a system that is easy to use, secure, dependable, provides easy payment mode, provides a variety of services and is user-friendly boosts voluntary tax compliance. Today, electronic tax system has been adopted in many countries such as Australia, Canada, Italy, the UK, Chile, Ireland, Germany, France, The Netherlands, Finland, Sweden, Switzerland, Norway, Singapore, Brazil, Mexico, India, China, Thailand, Malaysia and Turkey (Muturi and Kiarie, 2015). On the African scene, countries such as Uganda, Nigeria, Rwanda and Kenya have embraced electronic tax system (Muturi and Kiarie, 2015). Globally, the tax environment is changing rapidly, and an electronic tax system is a modern way of tax authorities interacting with taxpayers (Muturi and Kiarie, 2015).

Previous scholars document a relationship between attitude towards electronic tax system and tax compliance (Simuyu and Jagongo, 2019; Ondara et al., 2016; Maisiba and Atambo, 2016; Al-Debei et al., 2015). Findings by Simuyu and Jagongo, 2019 indicate that there is a significant relationship between the perception towards online tax filing in terms of ease and simple to file and also the system being secure, and this improves tax compliance levels. Furthermore, Ondara et al.(2016) suggest that there is a strong relationship between attitude towards electronic tax system and tax compliance. Further, Maisiba and Atambo (2016) found that taxpayers in Kenya felt uncomfortable using an electronic tax system as compared to the old manual system. Taxpayers who evaluate electronic filing system as not easy to use do not adopt it which affect tax compliance (Maisiba and Atambo, 2016). Al-Debei et al.(2015) also propose that consumer attitudes towards online system are positively and directly affected by trust and perceived website reputation, and this implies that if taxpayers perceive or evaluate the e-tax system to be secure, they will trust it and adopt it. Similarly, Chan et al. (2000) found that Hong Kong taxpayers have a low promising attitude towards electronic tax system which results in a lower level of tax compliance.

The electronic tax system is one of the mechanism tax authorities can be proud of since it allows taxpayers to file returns and pay on time. Nkundabanyanga et al. (2017) castigate that, in the presence of tax collection mechanisms, countries such as Uganda will still face cases of non-tax compliance. Nkundabanyanga et al., (2017) attribute cases of non-tax compliance to lack of voice and accountability, government ineffectiveness and nontransparent tax systems. Accordingly, taxpayers are likely to comply in paying taxes voluntarily if there is a transparent tax system and if taxpayers expect the government to put the taxes to their intended use. Ibrahim et al. (2015) documented that if taxpayers have trust in government, they will pay the taxes, whereas Nkundabanyanga et al. (2017)are of the view that, for taxpayers to pay taxes, they should see government providing some sort of exchange. A government should be seen providing services to the citizens/tax payers to the extent that there is some level of equivalence in the amount of taxes paid to Government and the cost of services provided by Government to taxpayers. Whereas services are difficult to measure by virtual of their characteristics of intangibility, Bananuka et al. (2018) found that physical output or visibility of activities is one of the most important ways of ensuring accountability. So, taxpayers must see schools, roads and hospitals being constructed, and security must be provided to all citizens. Once, tax taxpayer is convinced that the government treats all her citizens equally, they are likely to comply with tax laws (Nkundabanyanga et al., 2017).

Other than voluntary tax compliance, there is a mandatory tax compliance, and the two must work together to achieve total compliance. Voluntary tax compliance is highly achieved if taxpayers have a positive attitude towards filing returns and subsequent payment of the taxes due. It is therefore important that the attitude of taxpayers towards self- assessment is improved to achieve a better tax compliance level (Nawawi and Salin, 2018). According to Khaddafi et al. (2018), the adoption of an electronic tax system will depend on the perceived ease of use of the tax system, intensity of behaviour and user satisfaction. This implies that taxpayers must be happy and motivated to use the electronic tax system, but the tax system should as well be easy to use. The user of the electronic tax system must find it pleasant interacting with the electronic tax system. Zaidi et al. (2017) found that taxpayers with computer skills will find it easy to adopt an electronic tax system than those without.

The adoption of e-tax systems has become fundamental, as many countries adopt information systems in tax management (Ondara et al., 2016). According to Davis (1989) TAM suggests that taxpayer adoption behaviour is determined by the intention to use a particular system, which in turn is determined by the attitudes towards the system. Accordingly, taxpayer adoption of any system may be determined by the intention to perform a certain behaviour. Adoption of an electronic tax system is important not only in terms of reducing costs and taxpayer convenience but also in terms of improving tax compliance (Guriting and Ndubisi, 2006). Much as the new e-tax system payment in Uganda has become easy and simple, it is still only used by the large companies, and small companies not connected electronically are still finding it difficult to pay taxes (Asianzu and Maiga, 2012). Findings by Motwani et al. (2015) suggest that adoption of e-tax systems is voluntary in India, and their findings suggest that voluntary adoption through taxpayers’ e-filing of tax returns and e-payment increases tax compliance. Similarly, the results of the study on tax compliance by Muturi and Kiarie (2015) indicate that there is a strong positive correlation between adoption of an e-tax system through online tax registration, online tax return filing, online tax remittance and tax compliance among small taxpayers in Meru County, Kenya. This implies that the government is able to raise more revenues if SBE taxpayers adopt the electronic tax system.

Previous scholars document that the relationship between attitude towards electronic tax system and adoption of the electronic tax system (Barati et al., 2014; Asianzu and Maiga, 2012; Ramlah, 2010; Jahangir and Begum, 2008). In developed countries, the evaluation by the taxpayers about the risk coming from breaking privacy and disclosure of information is the most significant factor in adopting the electronic tax system (Barati et al., 2014). Findings by Barati et al. (2014) indicate that the level of adapting to the electronic tax system is dependent on the attitudes of the taxpayer. Similarly, Asianzu and Maiga (2012) findings show that in Uganda negative attitudes towards electronic tax system limit their use. In another study, Kiring’a et al. (2017) found that there is a strong relationship between the perception towards online tax filing in terms of ease and simplicity to file and tax compliance. Ramlah(2010)discovered that the more the taxpayers believe in electronic tax system, the more committed they will become towards using the system. Additionally, Jahangir and Begum (2008)findings suggest that to attract more users towards electronic tax system, then there is need to work on the taxpayers’ belief on the usefulness of the tax system. From the foregoing review of the literature, it can be hypothesized that:

H1. There is a positive relationship between attitude towards an e-tax system and tax compliance.

H2. There is a positive relationship between adoption of an electronic tax system and tax compliance.

H3. Adoption of electronic tax system mediates the relationship between attitude towards an e-tax system and tax compliance.

3. Methodology

3.1 Research design, population and sample

This study’s research design is cross-sectional and correlational. This study’s population as extracted from the URA internal revenue report 2015/2016 Mbarara branch comprises 698 SBEs registered for tax purposes in Mbarara. Mbarara is the second largest commercial town in Uganda and with the highest number of small business establishments in western Uganda (UBOS, 2011). Uganda is divided into four regions, that is to say, western, northern, eastern and central. Western Uganda is second to central Uganda in terms of business establishments ((UBOS, 2011). Basing on the population of 698, a sample size of 242 SBEs was determined using the Krejcie and Morgan (1970) table of sample size determination. The simple random sampling method was used to select SBEs for the study. The rotary method of simple random sampling was used to select the 242 SBEs. The unit of analysis was the manager of the firm. Of the 242 SBEs, usable questionnaires were received from 214 respondents representing a response rate of 88 per cent. The higher response rate is as a result of the ample time given to respondents. Majority of the respondents were male 53 per cent, whereas 47 per cent were female. Further, the majority of the SBEs are owned and managed by age group that ranges from 30 to 40 years (about 39 per cent), followed by those who are below 30 years (about 38 per cent) and age group 52years and above (about 4 per cent). Diploma holders were the most respondents showing 30.3 per cent response rate followed by certificate holders with 25.9 per cent, 22 per cent were bachelor degree holders and the least level of education was the non-educated (2 per cent). Most of the respondents had owned or managed small businesses for a period between 6 and 10 years (46.6 per cent), and this was followed by 33.1 per cent of the respondents, and these had spent 1-5 years, and the least were businesses which had spent above 15 years.

3.2 The questionnaire and variables measurement

We used the questionnaire because of its appropriateness in terms of data collection from a large group of respondents at a low cost, within little time and using less energy (Sekaran, 2003). A questionnaire may be an open-answer or closed-answer format. The openanswer system allows and encourages respondents to give their opinion fully and with as much nuance, as they are capable (Sudman and Bradburn, 1982; Bananuka et al., 2018). However, we considered this approach inapplicable in this research because of the intention to calculate the mean ratings of the extent of agreement with each statement; in the alternative, we considered a closed-answer format which is easier to analyse (Sudman and Bradburn, 1982; Bananuka et al., 2018). The questionnaire was designed according to the study hypotheses and variables used in this study (see Table 1). A six-point Likert scale was used because an even Likert scale enables the researcher to extract exact information from the respondents on situations they have already experienced. The questionnaire was developed after reviewing existing literature on attitude towards electronic tax system, adoption of an electronic tax system and tax compliance. The dependent variable for this study is tax compliance, whereas the independent variables are the attitude towards electronic tax (e-tax) system and adoption of electron tax (e-tax) system.

Table 1. Definitions and operationalization of variables| Global variable | Definition | Dimensions | Measurement | Sample items |

| Attitude towards | These are the positive | Evaluative | Respondents rank | I have positive |

| e-tax system | or negative views | judgement | eight items included | feelings for |

| that an individual | in the questionnaire | e-tax system | ||

| holds towards an | on a six-point Likert | |||

| e-tax system at a | scale | |||

| particular time | ||||

| Adoption of e-tax system | The ability to a tax payer to use an e-tax | Usage | Respondents rank eight items included | I use the e-tax system to file |

| system | in the questionnaire | returns | ||

| on a six-point Likert | ||||

| Tax compliance | Is the fulfilling of all | Payment | scale Respondents rank | We pay actual |

| the tax obligations as | compliance | seven items included | tax assessed | |

| stated by law willingly and fully | Regulatory compliance | in the questionnaire on a six-point Likert | to URA We file | |

| (Marti, 2010) | scale | returns on the | ||

| Respondents rank six | due date | |||

| items included in the | ||||

| questionnaire on a | ||||

| six-point Likert scale | ||||

| Source: Primary data |

3.3 Validity, reliability and factorability

We tested for validity and reliability using the content validity index and Cronbach alpha. Validity determines whether the research instrument truly measures that it was intended to measure or how truthful the research results are (Golafshani, 2003, p. 599). Field (2009) categorizes validity as criterion validity and content validity. The content validity index was used to test the relevance and clarity of the questions. The instrument was given to two academicians, two practitioners and any other knowledgeable person to ascertain the relevance and clarity of the questions. The overall content validity index was 0.857. Reliability is the ability of a measure to produce consistent results when the same entities are measured under different conditions (Field, 2009), and once the Cronbach’s alpha coefficient is above 0.70, the instrument is considered reliable (Cronbach, 1951). For this study, the Cronbach alpha coefficients of all the study variables were above 0.70 To further test for reliability and validity, we ran factor analysis. Factor analysis was run basically to find out how much of the variance present in the data is common variance. Exploratory factor analysis was used to have those factors that explain better the study constructs through data reduction. Exploratory factor analysis was done by running a rotated component matrix, thereby reducing the questions to those that are more relevant to the study variables. Before running factor analysis, we assessed the suitability of the data for factor analysis based on sample size adequacy, the Keiser-Meyer-Olkin (KMO) and Bartlett tests. The KMO and Bartlett’s (1954) test of sampling adequacy was computed to ensure that factor analysis yields different and reliable factors (Kaiser, 1974). Field (2009) explains that KMO and Bartlett tests values range from 0 to 1. The following criteria are used to assess and describe the sampling adequacy: Below 0.5 = unacceptable, 0.5 to 0.7 = Mediocre, 0.7 to 0.8 = Good, 0.8 to 0.9 = Great and above 0.9 = Superb (Field, 2009; Hutcheson and Sofroniou, 1999 and Kaiser 1974 ). The results show that the KMO values for the predictor and outcome variables are all above 0.5 which is acceptable (Field, 2009). Bartlett’s test of sphericity in all scales also reached statistical significance, that is to say significant value was 0.000 for each scale (Appendices 1-3)

4. Results

4.1 Descriptive statistics

We present descriptive statistics results in Table 2 . We generated means and standard deviations to summarize the observed data, as according to Field (2009), means represent a summary of the data, and standard deviations show how well the means represent the data. The mean score for the dependent variable (tax compliance) is 4.10, whereas the standard deviation is 0.98. This means that on average, Ugandans are tax compliant. However, given that the dependent variable is measured on a six-point Likert scale, the minimum score of 1.23 indicates that there are some Ugandans that do not tax compliant. The mean and standard deviation for attitude towards electronic tax system and adoption of an electronic tax system are 4.24 and 4.36 and 1.27 and 1.25, respectively.

4.2 Correlation analysis results

Pearson’s correlation analysis was conducted to measure the strength of linear associations between the study variables and is denoted by r. Results in Table 3 shows that there is a positive significant relationship between attitude towards electronic tax system and tax compliance (r = 0.531. **, p < 0.01). This means that any positive change in attitude towards e-tax system is associated with a positive change in tax compliance, thus providing support to H1 which states that there is a positive relationship between attitude towards an e-tax system and tax compliance of SBEs. Further, results indicate that there is a positive significant relationship between adoption of the e-tax system and tax compliance (r = 0.568, **, p < 0.01). This implies that for each unit increase in adoption of the e-tax system, there is up to 0.568 increases in tax compliance, and thus, H2 which states that there is a positive relationship between adoption of an electronic tax system and tax compliance is supported.

Table 2

.| Variable | N | Minimum | Maximum | Mean | SD |

| Attitude towards electronic tax system | 214 | 1.00 | 6.00 | 4.2430 | 1.27904 |

| Adoption of electronic tax system | 214 | 1.00 | 6.00 | 4.3692 | 1.25356 |

| Tax compliance | 214 | 1.23 | 5.77 | 4.1036 | 0.98328 |

| Source: Primary data |

5. Mediation test results

This study aimed to establish the mediation effect of adoption of the e-tax system on the relationship between attitude towards the e-tax system and tax compliance. Mediation tests were thus conducted to be sure that the conditions suggested by Baron and Kenny (1986) are met. According to Baron and Kenny (1986) and Kenny et al. (1998), mediation occurs if the following conditions are met:

variations in the independent variable significantly account for variance in the presumed mediator;

variations in the mediator significantly account for variance in the dependent variable;

variations in the independent variable significantly account for variance in the dependent variable; and

the effect of the independent variable on the dependent variable significantly reduces when the mediator is included in the equation.

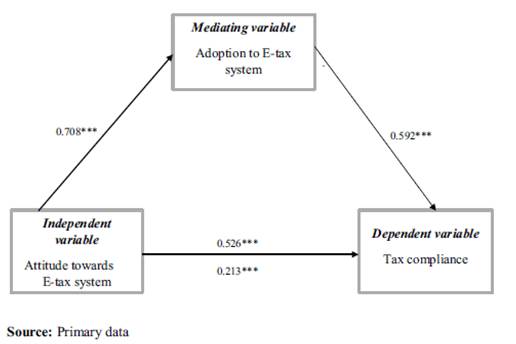

Baron and Kenny’s (1986) mediation path analysis as shown in Figure 1 revealed the following:

there was a significant direct effect of attitude towards electronic tax system and tax compliance (beta = 0.526; p < 0.05);

there was a significant direct effect of attitude towards electronic tax system and the adoption of an e-tax system (beta = 0.708; p < 0.05);

There was a significant direct effect of adoption of an e-tax system and tax compliance (beta = 0.592; p < 0.05); and

when controlling for the adoption of an e-tax system, the direct effect of the attitude on tax compliance reduced from beta = 0.526 to beta = 0.213 but remained significant. This is an indication that the relationship between attitude and tax compliance is partially mediated by the adoption of an e-tax system.

6. Discussion of results

Based on the TRA, it can be argued that attitude towards electronic tax system improves tax compliance given that in Uganda; the filing of returns is done online. When a taxpayer evaluates the e-tax system as favourable, for instance as time-saving, improving performance in preparing tax returns, making work easier and being secure the person develops a positive attitude towards an e-tax system and end up adopting it, and this translates into tax compliance. This is supported by the findings of Ondara et al. (2016) who concluded that there is a strong relationship between attitude towards electronic tax system and tax compliance, though the author did not explore the mediation effect of adoption towards electronic tax system and tax compliance. Similarly, Kiring’a et al. (2017) found that there is a strong relationship between the perception towards online tax filing in terms of ease and simplicity to file and tax compliance. In Uganda, increased usage of the e-tax system by the taxpayers is associated with improvement in tax compliance. This is precise because when a taxpayer uses an e-tax system, for instance, to file returns, pay the tax dues, avoid penalties, comply with the law and register to get a tax identification number; this is likely to play a big role in tax compliance. According to TAM, one’s perception of the use of information technology is critical to its adoption. Once information technology is embraced by the owners of SBEs, it is likely that tax compliance will improve. This finding agrees with results of the study on tax compliance by Muturi and Kiarie (2015) which indicated that there is a strong positive correlation between adoption of an e-tax system through online tax registration, online tax return filing, online tax remittance and tax compliance among small taxpayers in Meru County, Kenya.

Table 3

.| Variable | 1 | 2 | 3 | 4 | 5 |

| Attitude towards electronic tax system (1) | 1 | ||||

| Adoption of electronic tax system (2) | 0.710** | 1 | |||

| Regulatory compliance (3) | 0.535** | 0.638** | 1 | ||

| Payment compliance (4) | 0.389** | 0.353** | 0.507** | 1 | |

| Tax compliance (5) | 0.531** | 0.568** | 0.863** | 0.873** | 1 |

| Note: **Correlation is significant at the 0.01 level (two-tailed) Source: Primary data |

Figure 1

.The mediation path analysis results indicate that the adoption of the e-tax system partially mediates the link between attitude towards an e-tax system and tax compliance. For example, attitude towards an e-tax system such as ease for completion of filing returns and payment, secure and time-saving significantly affect the usage of an e-tax system by a small business taxpayer in terms of filling returns, paying the tax dues and avoiding penalties which partially translate to filing compliance and payment compliance. These agree with the findings of Haryani et al. (2015) who suggested that adoption of e-tax systems is greatly influenced by perceived ease of use and perceived usefulness. Similarly, Muturi (2015) who investigated the effects of the online tax system on tax compliance among small taxpayers in Meru County, Kenya, established that when taxpayers remitted, filed and registered for tax online, this translated to tax compliance. Nonetheless, all the above studies have not studied the mediation effect of adoption of an e-tax system on the link of between attitude towards the e-tax system and tax compliance; the current study is intended to fill the gap.

7. Summary and conclusion

This study aimed to investigate the mediating effect of adoption of an electronic tax system in the relationship between attitude towards electronic tax system and tax compliance of SBEs in a developing country in a single study. This was achieved through a questionnaire survey of 214 owner managed SBEs through managers of these businesses. Results suggest that adoption of electronic tax system mediates the relationship between attitude towards electronic tax system and tax compliance. Overall, the findings of this study have important insinuations for academics as well as practitioners and regulators. This paper contributes to the already existing literature on tax compliance by documenting that the adoption of an electronic tax system is a partial mediator in the relationship between attitude towards electronic tax system and tax compliance. Government through tax authorities may wish to improve tax compliance by sensitizing taxpayers about the benefits of electronic tax systems which may positively change taxpayers’ attitude towards electronic tax system and embrace the system and thus tax compliance. Tax authorities need to focus on increasing electronic tax system usage and ensure that there is further training of taxpayers on the importance of tax compliance as well. SBEs’ owners and managers may need to ensure that they comply with tax laws, and this is possible if the necessary infrastructures such as computers and qualified personnel are in place.

Like any other study, this study is not without limitations. Given that this study was cross-sectional, monitoring changes in behaviour over time was not possible. The study used a quantitative research approach, and this limits respondents from expressing their feelings fully (Sudman and Bradburn, 1982). Future studies may also use a mixed-method design or qualitative research design. The study was conducted in Uganda, and it is possible that the results of this study can be generalized to developing countries with environments like that of Uganda. Further studies may be conducted in other national settings. However, the results of this study are useful and can be generalized to all small businesses in developing countries with environments similar to Uganda.