1. Introduction

The concept of retirement has evolved constantly, transforming societies and shaping both income and non-income dimensions of well-being. Pension entitlement turned gradually from political discourse to a human right discourse. Pension schemes have extended the scope of insurance coverage beyond labour markets and the lifecycle, supporting thebroader needs of the entire population. Furthermore, pension schemes are widely acknowledged as drivers of economic growth: they enhance labour productivity; foster smooth consumption; and create a stable economic environment for investment and innovation. Current expectations require pension schemes to adopt proactive and reactive policies to examine options for mitigation or modification of potential consequences in anticipation of exceptional events.

The heterogeneity and complexity in event dynamics are systemic in the sense that the impact is far from linear. The idiosyncratic nature of unexpected and unpredictable events is rather a result of multi-dimensionality based, among others, on magnitude, frequency, timing, intensity and impact. It is plausible to argue that crisis episodes can destabilize critical systems of economic activity, producing economic spill overs that can directly or indirectly affect the sustainability of pension schemes. If the calculation of direct economic impact is readily traceable, the estimation of indirect economic impact can be an onerous task.

Throughout their development, pension schemes have gradually accumulated scientific knowledge, both empirical and methodological nature. The use of different methodologies keeps a constant qualitative transformation in respect of content and form and quantitative transformation in respect of output. The empirical literature has identified pension adequacy and financial sustainability as the key evaluation criteria of pension schemes. The first criterion concerns of the ability of pension schemes to enable individuals to maintain their living standards at retirement (Biggs and Springstead, 2008; Blondell and Scarpetta, 1999; Borella and Fornero, 2009; Chybalski and Marcinkiewicz, 2016; Clingman et al., 2016; European Commission, 2006; Goodin et al., 1999; Holzmann and Guven, 2009; Hurd and Rohweder, 2008; Mandatory Provident Fund Schemes Authority, 2010; Mitchell and Phillips, 2006; and Pang and Warshawsky, 2013).

The second criterion refers to fund performance (Farrar, 1962; Grinblatt and Titman, 1989; Henricksson, 1984; Irwin et al., 1970; Irwin and Vickers, 1965; Jensen, 1968; Mains, 1977; Sharpe, 1966; Treynor, 1965). Notwithstanding, the existing evaluation methods are monotonic in principle, providing inadequate information about the scheme’s overall performance. Developing a performance measurement framework specific for pension schemes is a relatively new topic in the literature. It is anticipated given that most of the pension schemes in the developing countries are still in their development phase, whereas the well-established pension schemes in developed countries are experiencing administrative, regulatory and political issues.

The Gordian knot of pension scheme assessment requires the re-formulation of evaluation mechanism - a comprehensive evaluation tool that will link pension systems to socioeconomic activity and study the coverage and overall performance of pension schemes irrespective of their type and level of development. The socioeconomic landscape is subject to endogenous and exogenous uncertainties. In principle, these drivers of change may retain their basic properties; however, their impact on pension schemes has changed. The new complex environment emerged new systematic risks (flexicurity, labour mobility, climate change and technological advancements) and new needs (social protection). These conditions require a dynamic retirement assessment framework, a coordinated indicator that offers compatibility and interoperability evaluation in different pension schemes based merely on macro-economic analysis rather than micro-economic analysis.

This paper suggests a paradigm shift, a multi-disciplinary approach called pensionomics: this “multi-disciplinary” focus builds a new analytical framework to evaluate pension’s overall performance based on past work on pension evaluation, incorporating non-economic variables with significant impact on economic growth and social development. Pensions Consistency Index (PC-Index) introduces a comprehensive evaluation tool to study the overage, performance, efficiency, effectiveness, current trends and future possibilities of pension schemes. PC-Index investigates the uncertainty and behavioural change of pension schemes under a new perspective within the framework of a dynamic imbalanced state (Ruiz Estrada and Yap, 2013) and the Omnia Mobilis assumption (Ruiz Estrada (2011).

This paper is organized as follows. Section 2 places the development and differentiation of pension schemes through time. Section 3 introduces the concept of pensionomics. Section 4 defines PC-Index. Section 5 concludes this paper. The Appendix contains tables and figures.

2. From the pension scheme to social security to welfare state

There is no country in the world without any form of a pension scheme. Some pension schemes are still in their infancy, others are well-established, but in the end, all are conditioned to economic, demographic and cultural characteristics of each country. In developed countries, pension schemes initiated to accomplish three objectives: fight poverty; provide social assistance and promote social cohesion. Despite certain commonalities, pension schemes exhibit substantial differences among developed countries regarding the objectives, scope, coverage, benefits and role of the public and private sectors in the welfare landscape.

The idea of social protection was driven by the need to protect the emerging working class during the industrial revolution. Bismarck’s work-based earnings model in the 1880s and Danish’s universal flat-rate model in 1891 instituted to provide limited coverage and meagre benefits to the disabled workforce. The German chancellor enacted sickness insurance bill in 1883, followed by the accident insurance bill in 1884 and old-age and disability insurance bill in 1889. There were three main features in the German social security scheme: compulsory insurance; self-financing autonomous pension institutions; and the accrued distributed benefits should be proportionate with the income levy. The Danish model, on the other hand, was based on the principle of universalism or citizenship rather than social insurance contributions. Based on the 1803 Poor Law, the 1891 law enacted to reform the current welfare state and to enhance it with the introduction of old-age assistant law and the sickness insurance law. The citizenship principle was given more emphasis to the individual rather to the family. Most social rights such as pension and insurance were directly linked to the individual, whereas social assistance and mutual aid subsidies were associated with the family level. These government subsidies were means-tested benefits available only to registered members, who met certain requirements. Following their footsteps, several European countries created analogous social pension schemes in the ensuing decades, for example, the British Old Pension Act in 1908, the Insurance Act of 1911, the Swedish compulsory old-age pension in 1925 and the Swiss Act of 1935 (Gordon, 1988).

During the Second World War, country after country conceptualized the need to develop a comprehensive pension scheme, moving towards a social security system. Britain represented its own variant of the welfare state as an alternative to the German model. In contrast with the German model, the Anglo-Saxon social security model maintained the flatrate distinctive feature (Veit-Wilson, 1992). The Beveridge Committee’s report envisioned a universal social security system that ensured full employment and runs through public institutions of social protection. All employees would be eligible for flat-rate insurance benefits independent from loss or reduction in income provided entirely by the state (flatrate contributions) and of flat-rate pensions that would ensure a minimum income and medical treatment (Gordon, 1988).

The social security aims to protect the population from situations that cause loss or reduction of sources of maintenance, preventative or remedial health protection to ensure employment and retention of capacity for work, to indemnify decent standards of living and to secure people’s active participation in economic and social life (International Labour Organization, 1999). United Nations Universal Declaration of Human Rights Act 1948 attested social security as a human right, and accordingly, the International Labor Organization set minimum standards for social security in the International Labor Convention of 1952.

Since then, welfare states are widely acknowledged as vehicles for sustainable and economic development. The vast majority of developed and developing societies around the world have used some level of welfare mechanisms to avert, administer and surmount situations that inimically affect people’s well-being. Although the concept of social security is generally associated with income maintenance and support programs, it refers to not only programs established by statute but also a broader meaning, including the concept of social protection and volunteerism. Furthermore, social security is seen as a driver of economic growth as: it enhances labour productivity; fosters smooth consumption; and creates a stable economic environment for investment and innovation.

Social security aims to also strengthen social cohesion, enhance growth and equity, redistribute income from the strong to impoverish segments of the population and pursue social justice to all (Pieters, 1998). Social welfare policy appears in the form of welfare programs - benefits and services - to meet individuals and groups’ basic needs. These needs include employment, income, health, education and housing, which are strong indicators of social progress. Social welfare transfer programs concern with the allocation of resources to those who identified poor or vulnerable with the objective of alleviation of social hardship, addressing social exclusion and reducing economic uncertainty. Income redistribution can take place through the processes of fundraising, insurance contributions or direct or indirect taxation and the allocation of benefits. The principles of fairness and equality, the access to appropriate health treatment and the equitable distribution of wealth are hallmarks of a stable and harmonious society with positive interactions, exchanges and the networks between individuals and communities.

The presence of social security also affects people’s economic behavior in the context of saving, productivity and retirement. The effect of social security on people’s saving behaviour is threefold. People tend to save less for retirement when they feel the presence of a “safety net” decreasing, thereby their expectations about how much they need to save (wealth substitution effect) (Aaron and Reischauer, 1998). Contrary, people tend to save more during their productivity period in an attempt to accumulate savings sufficient to lead to early retirement (retirement effect). Finally, people also tend to save more prone to higher social security taxes in consideration of encasing future expected costs of having children(bequest effect) (Rosen and Gayer, 2008).

Although social security benefits have a positive impact on saving and income distribution, it may have an adverse impact on labour supply. Unemployment benefits serve as one of the main economic stabilizers that tend by their design to offset fluctuations in economic activity. However, long-term unemployed individuals are often confronted with the unemployment trap dilemma - a situation in which the opportunity cost of returning to work is considerably significant - so benefits create a perverse incentive not to work. Individuals who drop out of the welfare system may become more detached from the labour market and put less effort into searching for a new job. Alongside with the labour market distortions, this may decrease the employment rate in the future, exactly the opposite effect of the one intended (Walker, 2005).

Pension arrangements provide a complex set of incentives for retirement. The provision of welfare benefits entices workers to retire before retirement age than they otherwise would have (Gruber and Wise, 1999). Payroll taxes, the level of benefits earned and the offsetting actuarial adjustment distort individuals’ labour supply incentives (Gordon, 1982). In addition, the tendency towards earlier retirement is also positively correlated with the impressive developments in health and life expectancy, the growth of income combined with an increasing demand for leisure, technological advancement and the expansion of social insurance programs, which imply that people tend to appreciate more leisure time (Boskin and Hurd, 1978).

3. Definition and classification of pensionomics

Pensionomics places the concept of retirement in a multi-disciplinary context. Pensionomics overcomes theoretical and empirical limitations encountered by the path-dependency perspective, developing a new research agenda to study pension schemes under the historical, cultural, social, economic, political and environmental prism. Integrating diversified data, techniques, perspectives and concepts, pensionomics’ objective is to connect natural and manmade events with social protection mechanisms for the development of a dynamic social protection framework, where individual, community and society needs are met effectively and efficiently by implementing tailored policies, closely related to their specific context.

A qualitative content analysis was conducted in the Journal of Pension Economic and Finance issued by Cambridge University Press (2017) (Table 1). The bibliometric analysis yielded 500 scholarly articles from 2002 to 2017. The publication record for pensions has grown gradually over the years. Pensionomics can be classified into the following ten categories:

(1) insurance;

(2) private plan retirement;

(3) public plan retirement;

(4) health-care programs;

(5) social welfare programs;

(6) unemployment protection;

(7) personal finances;

(8) formal transfers;

(9) informal transfers; and

(10) assurance.

Table 1 Papers classification according to different categories

| Categories | # of articles |

|---|---|

| Insurance | 75 |

| Private retirement plans | 120 |

| Public retirement plans | 150 |

| Health-care programs | 50 |

| Social welfare programs | 15 |

| Employment protection | 15 |

| Personal finances | 25 |

| Formal transfers | 5 |

| Informal transfers | 15 |

| Assurance | 10 |

| Source: Journal of Pension Economics and Finance (2017) |

Review in the past 15 years, numerous frameworks, conceptual models and vulnerability assessment techniques have been developed to advance both theoretical underpinnings and practical applications of social security using benefit/cost, risk, time series or forecasting analysis through the application of econometric methods and use of microeconomic- and macroeconomic-level secondary data. The vast majority of the scholarly articles is a result of mono-disciplinary collaborations, with 90% of them became a prevalent part of economic methodology. Only 10% of those papers followed a multi-disciplinary approach, drawing on knowledge and expertise outside of social security discipline.

4. Pensions Consistency Index

The PC-Index is a statistical measure of changes in pension performance. The PC-Index evaluates the consistency level of a pension system by pinpointing their deficiencies and mapping their patterns. The PC-Index involves 10 main variables, of which consist 50 subvariables. The PC-Index implementation involves the following steps:

the use of multi-input-output table;

the classification of variables and identification of parameters;

the measurement of the PC-Index; and

the construction of the PC-surface.

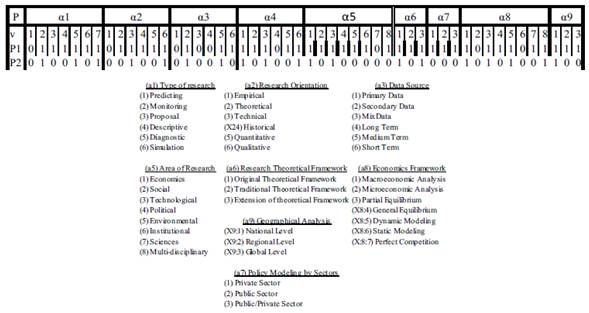

The multi-input-output table in Figure 1 analyses both direct and indirect effects on pension performance. It is a collection of large amounts of related data stored in a structured format within a database measured by a single variable. This single variable portrays the evolution of the pension scheme over time. The multi-input-output table output (m number of mainvariables n number of sub-variables) does not include any notion of a ranking of variables according to importance. All sub-variables are given the same importance (weight) expressed by a binary numeral system. The binary system is applied to every sub-variable because all sub-variables have the same level of importance and exert the same level of influence in the multi-input-output table.

Source:Ruiz Estrada (2011)

The construction of the PC-Index involves 9 main-variables and 50 sub-variables. The nine main variables are as follows: ( α1 ) type of research; ( α2 ) research orientation; ( α3 ) data sources; ( α4 ) econometrics methods applied; ( α5 ) areas of research; ( α6 ) research theoretical framework; ( α7 ) pensions by sectors; ( α8 ) economics frameworks; and ( α10 ) geographical analysis. The first main-variable ( α1 ) (“types of research”) is formed by seven sub-variables: predicting; monitoring; proposal; descriptive; diagnostic; simulation; and experimental. The second mainvariable ( α2 ) (“research orientation”) is formed by six sub-variables: empirical; theoretical; technical; historical; quantitative; and qualitative. The third main-variable ( α3 ) (“data sources”) consists of six sub-variables: primary data; secondary data; mixed data; long term; medium term; and short term. The fourth main-variable ( α4 ) (“econometric methods applied on policy modelling”) is made up of: linear regression analysis; multiple regression analysis; time series data; cross-sectional data; panel data; and multi-dimensional panel data. The fifth mainvariable ( α5 ) (“area of research”) comprises eight sub-variables: economics; social; technological; political; environment; institutional; sciences; and multi-disciplinary. The sixth main-variable (a6) (“research theoretical framework”) comprises three sub-variables: original theoretical framework; traditional theoretical framework; and extension theoretical framework. The seventh main-variable ( α7 ) (“pensions by sectors”) is made up of three sub-variables: private sector; public sector; and public/private sector. The eighth main-variable ( α8 ) (“economics frameworks applied on policy modelling”) comprises the following eight sub-variables: macroeconomics analysis; microeconomics analysis; partial equilibrium; general equilibrium; dynamic modelling; static modelling; perfect competition; and imperfect competition. The ninth main-variable (a9) (“geographical analysis”) is affected by three sub-variables: national level; regional level; and global level. It is without any sub-variable (Figure 2).

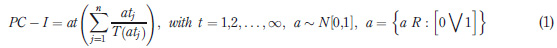

The PC-Index evaluates each main variable by its sub-variables. PC-Index is equal to the sum of all main-variables:

where i, j and t correspond to the main variables, sub-variables and total variables, respectively. The matrix for of equation (1) is given by equation (2):

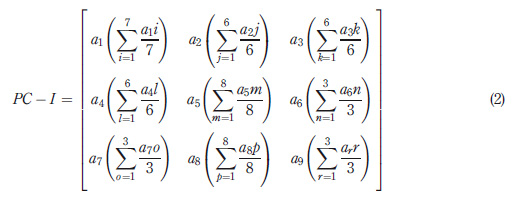

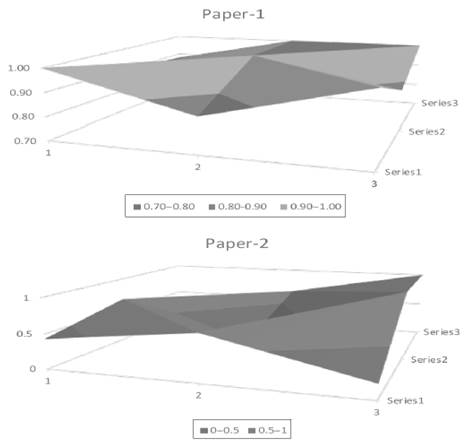

The above matrix formulation reflects the nine main variables. Intuitively, PC-Index evaluates the level of consistency of pension scheme. PC-Index classifies pension scheme consistency into four levels: perfect consistency (9 < PC-I < 10); good consistency (7 < PC-I < 8.99); acceptable consistency (5 < PC-I < 6.99); and low consistency (0 < PC-I < 4.99). Figure 3 graphically represents the PC-Index.

Source: Ruiz Estrada (2013)

The symmetric 3-D surface reveals pension scheme strengths and weaknesses. The construction of the graph is based on the concept of the mega-surface coordinate space, multidimensional manifolds to visualize multi-variable economic data behaviour (Ruiz Estrada, 2007).

4.1 Application of Pensions Consistency Index and Pension Consistency Surface: an example

We apply the aforementioned methodology to two different pensions model cases featuredin two papers of the Journal of Pension Economics and Finance, Cambridge University Press. The first is the paper entitled “Financial literacy and retirement planning in the United States” (Paper 1) authored by Lusardi and Mitchell (2011). The second paper is “A model for the pension system in Mexico: diagnosis and recommendations” (Paper 2) authored by Alonzo et al. (2015)

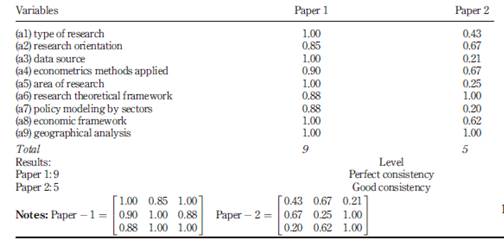

Analysis findings are presented in Table 2 Paper 1 demonstrates perfect consistency and Paper 2 demonstrates acceptable consistency which reflect to 9 and 5 index points, respectively. Paper 2’s relatively poor performance lies on the following four weak main-variables: main-variable X3 (0.21 = poor performance); main-variable X5 (0.25 = poor performance); main-variable X7 (0.20 = poor performance).

The four weak variables are multi-dimensionally graphically depicted in Figure 4 Possible recommendations: use of secondary data in its specific model to improve the mainvariable (X1); the inclusion of non-economic variables in its model to improve the mainvariable (X5); identify the sector that is relevant to improve the main-variable (X7); andimprove the main-variable (X9) by applying its model to different regions and countries.

Source: Authors’s elaboration

5. Concluding remarks

The consideration of pensionomics concept as an evaluation tool for pension schemes provides insights that are helpful to explain performance differentials. Taking definition, classification and evaluation as a guiding principle, the new conceptual framework can be a useful point of reference for the overall evaluation of pension schemes revealing deficiencies that traditional evaluation methods cannot detect. The multi-disciplinary approach focuses on building inter-sectoral and holistic policies able to respond to the multi-dimensional uncertainties of the new dynamic environment.

The PC-Index suggests an alternative methodological evaluation directly linking pension performance with historical, cultural, social, political, economic, political and environmental activity. Rephrasing Pierson (1999), there is not a single assessment indicator of pension performance, but different evaluation methodologies with different configurations involve important trade-offs to meet certain objectives. In the context of a constant change, the performance of pension schemes should be based on a clear understanding of what outcomes the current design influences and how it allocates costs and risks. Policymakers should seek ways of reforming their pension systems in anticipation of financial burdens in the future (Holzmann, 1988). Pension funds can restore their actuarial balance if policymakers undertake funding-oriented reform initiatives. Notwithstanding, the need for system consistency constitutes an opportunity to re-evaluate existing methodologies, considering more fundamental changes.

The concept of pensionomics presented in this study needs to be explored further to realize its full potential. Multi-disciplinary considers new approaches for pension scheme performance, especially from the social security theory point of view. It is, therefore, necessary to continue the empirical validation by considering non-economic variables, designing new indicators with different assessment tools and running case studies with real data from the non-economic environment to ensure conclusion validity. This paper is also available in the SSRN working papers series, available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2981461