1. Introduction

The prime objective of any economic policy of developing country like Bangladesh is to attain sustainable economic growth with infrastructural development and poverty reduction. But when the government fails to meet their growth needs, they oblige to welcome financial assistance from the external sector, mostly in the form of debt. Bangladesh had to rely on debt and is still relying on external debt to manage the saving-investment gap and fiscal deficit since its independence.

External borrowing is not a negative issue for a country until it can generate higher returns than the cost of borrowing, but it becomes vicious if it is not used properly and prudently. External borrowing would be enhancing capacity and output growth hence, making the debt productive and justifiable (Poirson et al. (2002) and Pattillo et al. (2004)). On the contrary, this debt can create fiscal imbalances and excessive foreign borrowing that may make the country more vulnerable to different shocks and crises. It reduces the effectiveness of fiscal policies and limits the ability of the monetary authority to raise interest rates for monetary policy purposes, due to its effect on the budget deficit and debt (Beetsma & Bovenberg, 2003).

Although probable effects of large public debts on output growth are a major challenge for policymakers and public opinion in general, the empirical research addressing the debt-growth nexus in the context of Bangladesh is considerably scanty. Our study begins to highlight this issue through its investigation of the dynamic association between growth and external debt.

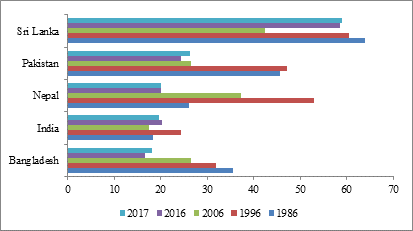

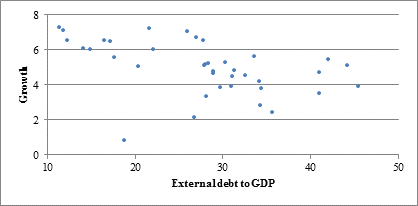

Given the fact, Bangladesh is still having a low debt-GDP ratio (Figure 1) and even the lowest per capita external debt in the South Asian region. So, it would be quite interesting to look into the debt–GDP nexus and how macroeconomic policy affects this nexus in the context of Bangladesh throughout 1980-2017.

The objective of this study is to explore the impact of external debt on growth and how the macroeconomic policy index can soothe to some extent or nullify the negative effect of external debt. Unlike any other studies on Bangladesh, this paper is significantly different as it analyses the external debt-growth relationship in a macroeconomic context taking the interactive term of external debt and policy in the model. Moreover, external debt is disaggregated to sketch their respective effects on growth independently. VAR impulse response function (IRF) has been employed to illustrate the dynamic effects of external debt shocks on growth as well as the shocks of the macro variable on economic growth.

This paper is organized into eight sections: starting with the introduction, Section 2 contains a review of the available empirical literature. Section 3 contains a brief discussion of the trends in external debt and growth in Bangladesh over the study period. Model specification and data are discussed in Section 4 while Section 5 contains the econometric methodology. Section 6 analyses the empirical results of the study and Section 7 presents the IRF. Conclusions with policy recommendations are described in Section 8.

2. Literature review

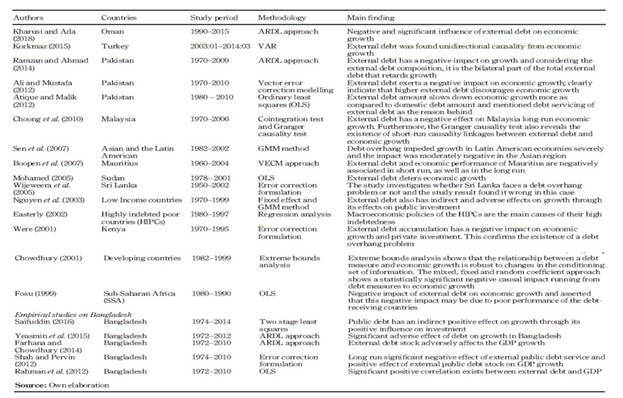

Overabundances of studies have examined the effect of public debt on economic growth, whereas most of them have focused on external debt issues of developing countries generally. The results of the empirical studies are mixed and inconclusive; differing upon the country or group of countries investigated, but also upon the study period, the model specification and estimation techniques, the set of control variables including the debt indicator variable. While the general conclusion of external debt studies is that external debt has an insignificant or negative relationship with economic growth. Though the studies on external debt issues across countries are innumerable, the studies that dwell on this topic relating to Bangladesh are scanty. For the reason of parsimony, we attempt to compile a brief summary of the recent contributions to the external debt perspective in Table 1.

The existence of a negative relationship between external debt and growth is revealed by a good number of the studies. Even focusing on Bangladesh, we can state that majority of them exert a negative impact of external debt on growth. On the contrary, Saifuddin (2016) found an indirect positive effect on growth analysing public debt which is combined with external and domestic debt. So, the debate on the effect of external debt on economic growth, however, remains unresolved because of discrepancies in the results of extant studies.

Overview of an external debt scenario of BangladeshBank (2017)

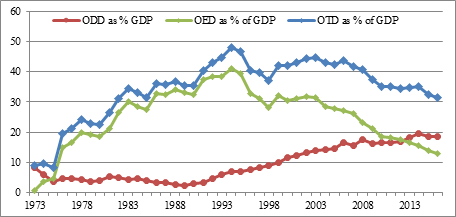

The inception of the debt demand is the inability to meet up the deficit financing of the budget. There is a clear indication in the ‘Public Money and Budget Management Act 2009’ to keep the budget deficit to a sustainable level. Therefore, the Bangladesh government is continuously trying to keep the fiscal deficit within 5 percent of GDP over the years. The Government borrows both from domestic and external sources to meet the budget deficit caused by the social welfare expenditure, unexpected expenditure in emergencies, development planning expenditure and increased investment. The budget of recent years shows a trend of the steady decline of dependence on external assistance. But the principal and interest repayment for received loans by Bangladesh are gradually increasing (Bangladesh Economic Review, 2017) (See Figure 2).

The sound management of public debt can be judged by looking at debt to GDP ratio and the per capita debt liability. And the next criterion is the status of servicing of the debt and the history of debt servicing. Bangladesh experiences success in the debt management policy. According to debt sustainability analysis (DSA) of IMF, Bangladesh’s risks of external debt distress and overall debt distress continue to be assessed as low. Until now Bangladesh never defaulted to service the debt nor ask for a rescheduling of debt. The debt-GDP ratio is the lowest in the South-Asian region which is below 30 percent from 2004 like our neighbouring countries India and Pakistan whereas; the external debt-GDP ratio of Sri Lanka is around 55 %.

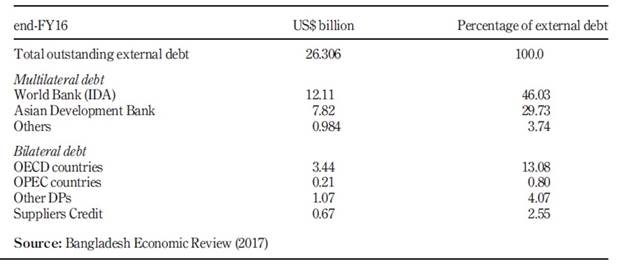

Also, Table 2 provides the detail of the external debt composition of Bangladesh. As of end-FY16, total outstanding external debt is estimated to be US$26.306 billion (11.88 percent of GDP). External debt consists of medium to long term loans from multilateral and bilateral creditors, short term debt and borrowings of the state-owned enterprises. Multilateral creditors account for a large share of the external debt, with the World Bank and the Asian Development Bank being the largest creditors while OECD countries are the largest bilateral creditors.

Bangladesh government is truly aware of institutional strengthening and capacity building to deal with this external debt issue. So, historically the fiscal policy should set in a way that it can keep the budget deficit low or below 5% of GDP.

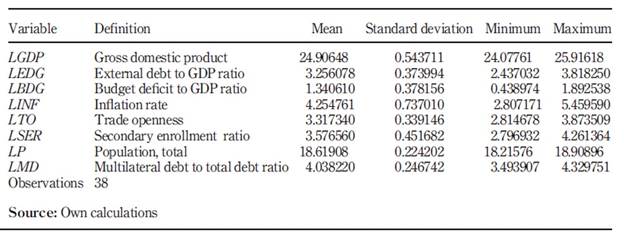

Model specification and data

To evaluate the impact of external debt on economic growth, our targeted main variables are GDP and external debt to GDP ratio. But few more variables are included as well in the model, namely budget deficit to GDP ratio, inflation, secondary enrolment ratio, and trade openness along with the above mentioned two variables. The population is taken as a control variable in order to avoid the variable specification bias.

Here are the justifications for using the above-discussed variables in the growth equation. Firstly, the fiscal management of government is a key determinant of growth. Studies of Fischer (1993) and Easterly & Rebelo (1993) examined the role of fiscal policy in determining the growth of output. They found that large and consistent budget deficits are negatively correlated with growth. Thus, a relatively low budget deficit (BDG) should have a positive effect on reflecting macroeconomic stability.

Prices play a vital role in an economy to allocate resources efficiently, but high and rapidly increasing prices can distort economic stability. Thus, a high level of inflation may be inimical to growth by adversely affecting the decision-making effort of agents (see Barro (1996) and Khan & Ssnhadji (2001) for details). So, we expect inflation (INF) to adversely affect growth.

In the present growth theory, human capital is another core variable in explaining growth. Our growth model has taken the secondary school enrolment rate (SER) as a proxy of human capital. The positive impact of human capital on growth is expected because educated and skilled people tend to be more productive.

Trade openness (TO), measured by total trade as a ratio to GDP reflects what extent an economy is linked to the rest of the world. An economy with a more open trade can quickly adopt newly developed ideas and equipment and is particularly important for developing countries. Gallup et al. (1998) showed that open economies are generally in a better position to import new technologies and new ideas from the rest of the world as compared to closed economies. Therefore, and following Barro (1996), Easterly & Levine (1997), and Collier & Gunning (1999), thus we expect to have a positive effect of trade openness on growth.

Because of being a labour abundant economy, the population is a major component of economic growth which has a positive impact on growth.

The functional form of the model to satisfy the prime objective of the study is as follows:

GDPt =f(EDFt, BDGt, INFt, TOt, SERt, Pt) (1)

The endeavour of our study is to spot the external debt and growth association in Bangladesh within a broader macroeconomic set-up. According to Fischer (1993), economic growth positively responds to the influence of sound macroeconomic policy and causation runs from good macroeconomic policy towards economic growth. He argues that growth is negatively associated with high inflation, large budget deficits, and distorted foreign exchange market . Thus, following the above direction, we construct a macroeconomic policy variable incorporating the monetary, fiscal and trade variables to study the impact of this new macroeconomic policy variable on growth and external debt. The above equation can be modified as follows:

GDPt =f(EDGt, MEPt, MDt, SERt, Pt) (2)

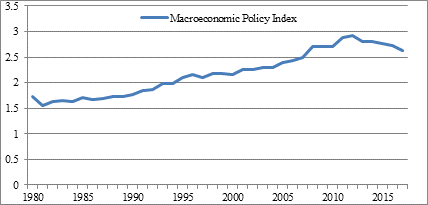

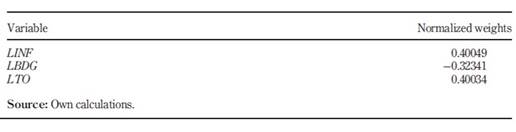

where, all the variables are discussed above, except MEP 𝑡 and 𝑀𝐷 𝑡 , where the first one is the newly formed macroeconomic policy variable and the second one is the external debt composition . Following Burnside & Dollar (1997, 2000, 2004), the macroeconomic policy index is constructed as a weighted average of three macroeconomic policies i.e. monetary policy, fiscal policy, and trade policy. The three policies are captured by the inflation rate , budget deficit and trade openness. For the obvious reasons, these variables are not included separately in the modified growth equation since they are already embedded in the macroeconomic policy variable (see Figure 3).

Source: Own computations

Annual data on studied variables are covering the time period of 1980-2017 and collected from the economic relations division (ERD) of Bangladesh, IMF world economic outlook and WDI indicators of World Bank. All data are in real and in natural logarithm form. The historical data of GDP and external debt to GDP ratio for Bangladesh are depicted below (see Figure 4 Table 3).

Source: World Bank (2018)

Various methodologies are available to construct the indices, such as the subjective method (weighted average), least-square regression model, and lastly, the principal component method. The principal component analysis method is adopted in this study. The OLS method was deliberately ignored because the determined weights of the policy index along with other variables will be somewhat redundant as well as weights may be unstable due to multicollinearities.

Principal Component Analysis (PCA) is a method that allows reducing of a system of highly correlated variables into a smaller number of dimensions; whose correlation is minimized. It is probably the most widely used and well-known of the standard multivariate methods. The main objective of a PCA is to reduce the number of dimensions in the data without losing too much information. Thus, the policy index is based on the formula:

where α 1 , α 2 , α 3 represents the normalized weights of the first principle component. Table 4 shows the estimated normalized weights that are used in constructing a policy variable.

Econometric methodology

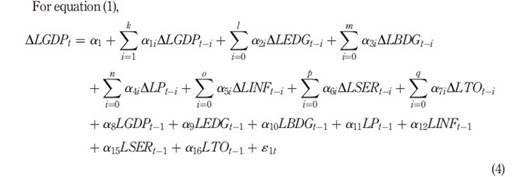

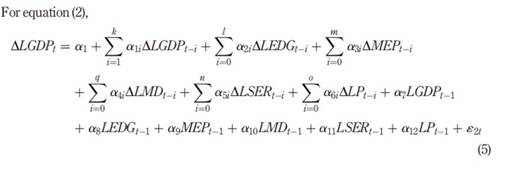

Autoregressive Distributed lag (ARDL) “Bound Test” approach introduced by Pesaran et al. (2001) is employed to analyse the long-run relationship between the external debt and growth in a multivariate framework . Appropriate modification of the orders of ARDL model is enough to simultaneously correct for residual serial correlation and problem of endogenous variables Pesaran, M. Hashem; Shin (1999). The econometric form of the first model relating to external debt and GDP, once stationarity or cointegration are verified:

LGDPt = α + β1LEDGt + β2LBDGt + β3LI NFt + β4LTOt + β5LSERt + β6LPt + ɛ t (3)

where, all the variables are discussed above, 𝛼 is the intercept, 𝛽 1 − 𝛽 8 are the coefficients of explanatory variables, and 𝜀 is the error term. Expected signs of the equation variables are: β1 < 0, β2 < 0, β3 < 0, β4 ≶ , 0, β5 > 0, and β6 > 0.

Although unit root pre-testing is not necessary to proceed with the ARDL bounds testing approach. Just to avoid the risk of invalid estimation , it is, therefore, essential to test the stationarity properties of each variable before proceeding to the econometric analyses. ADF and PP tests are used for testing unit root properties of the variables under study.

In the ARDL cointegration technique, the existence of cointegration or possession of long-run relationship among the variables is primarily determined. Then the short and long-run parameters extraction is done in the second step. The bound test approach is mainly based on an estimate of the unrestricted error-correction model (UECM) by using ordinary least squares (OLS) estimation procedure. The bound testing approach to cointegration involves investigating the presence of a long-run equilibrium relationship using the error-correction model (UECM) frameworks:

where, Δ is the difference operator, the existence of a long-run equilibrium relationship is tested by restricting the lagged level variables. Decisions of the bound test are made based on the F-statistic value that helps to draw conclusions about the long-run relationship of the variables.

In this study, the identification of the structural shocks of external debt and GDP is based on the identification scheme suggested by Blanchard & Perotti (2002). In this regard, the appropriate order of the variables to meet the assumption of the lack of a contemporaneous relationship is embedded in the estimated model. The targeted variables of our model were entered into the VAR model as follows: LGDP, MEP, LEDG, and LSER.

This ordering implies that GDP growth, macroeconomic policy, and primary enrolment ratio, respond contemporaneously to changes in external debt but debt responds to changes in these endogenous variables only with a lag. Similarly, output growth is assumed to be contemporaneously influenced by changes in external debt, macroeconomic policy, and primary enrolment ratio, but these variables respond to shocks to output growth only with a lag. Then we compute the impulse response functions (IRF) that are used to assess and trace out the time path of the effect of structural shocks on the variables under investigation.

Empirical results

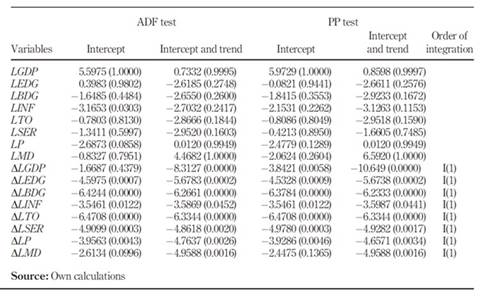

In this section, we present the empirical results from different methodologies. Table 5 shows that all the variables are non-stationary at levels but become stationary after first differencing and the results are summarized below:

It can be inferred that both ADF and PP (Table 5) test results reveal that the variables are non-stationary at a level at a 5% level of significance, but they became stationary at first difference level. Thus, all the variables are integrated of order one i.e. I(1) respectively where both possibilities with intercept as well as with intercept and trend are considered.

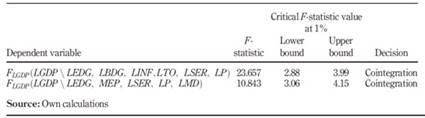

Since our variables are integrated of order one, so it’s needed to find whether the variables are cointegrated or not. To investigate the long-run relationship between external debt and GDP, the Autoregressive Distributed Lag model to cointegration and error correction is applied. The existence of a cointegration of our main model (Eq. 1) is confirmed by the bound test approach to cointegration (Table 6).

The cointegration test in Table 6 ensured the presence of a long-run relationship between the variables and the results are presented in Table 7. The computed F-statistic of the above two models’ equations exceeded the upper bounds at a 1% level of significance. As per the rule, the higher F-statistic value supports the rejection of the null hypothesis that confirms the long-run relationship between the variables which implies that the variables will move together. And the cointegration results lead us to argue that external debt and GDP have a long-run association.

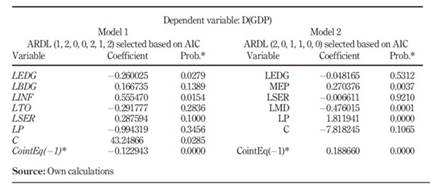

The AIC lag length criterion statistic indicates that ARDL (1, 2, 0, 0, 2, 1, 2) model and ARDL (2, 0, 1, 1, 0, 0) model are the best two lag orders combination and the estimation results are reported in Table 7. From the left panel of Table 7, it can be written that the coefficient of external debt is statistically significant and negative in the long run. A similar finding is also obtained by Yeasmin et al. (2015), Farhana & Chowdhury (2014) and Onafowora & Owoye (2017) which is External debt shocks have a negative impact on output growth.

Though inflation could have a negative impact in the short run, it may have a positive impact in the long run. It makes sense in the case of Bangladesh’s economy; because inflation harms growth by money devaluation, discouraging investment, savings and efficiency of productive factors but this tolerable level of inflation also contributes to creating employment opportunities in the long run. The trade openness has negative and budget deficit has a positive insignificant effect on economic growth in the long run. The secondary school enrolment ratio is revealing a positive significant effect on real GDP in the long run.

Whereas, from the right panel of Table 7, it is evident that the negative impact of the long-run coefficient of external debt becomes insignificant in the presence of macroeconomic policy. The macroeconomic policy variable has a positive sign and greater impact in terms of coefficient than external debt. The ratio of the multilateral debt to total external debt is significantly negative in the long run for the Bangladesh’s economy. Because the bilateral partners of Bangladesh sometimes exempt the debt amount of long-term debt.

The values of ECT coefficients in two model equations are -0.12 and 0.18 (negative and significant as expected in the case of the first model). This finding implies that the GDP growth adjusts towards its long-run about 12% and 18% of this adjustment taking place within around 9th year. It also can be said that holding other factors constant, the estimated error correction term indicates that if the GDP of Bangladesh is exposed to a shock, it will converge/diverge to the long-run equilibrium at a tolerable pace (e.g. approximately around 9th and 6th years respectively).

The possible justification for the neutralized effect of external debt on growth in the presence of good macroeconomic policy is that countries with stable macroeconomic policies are more attractive for investment in physical and human capital. High inflation, high budget deficit, and restricted trade may cause macroeconomic instability, which discourages investment. In case of a high budget deficit, external debt may be used to increase government consumption instead of increasing investment. This finding is in line with The World Bank (1990) and Burnside & Dollar (2004) .

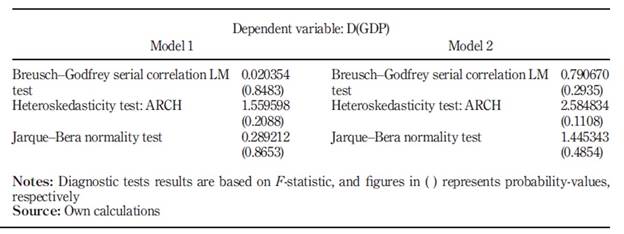

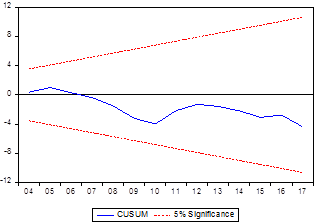

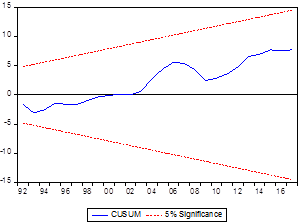

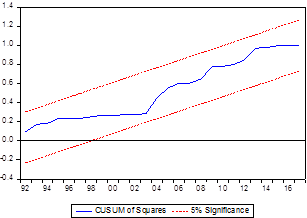

A series of diagnostic tests were conducted on the ARDL models (Table 8) and the models are found to be robust against residual correlation and the ARCH test confirms the homoskedasticity of the residuals. At the same time, the Jarque-Bera normality test ensured that estimated residuals are normal and the CUSUM and CUSUM of Sq. test also confirmed the correct functional form of the models (see Figures 5 6, 7 to 8).

Impulse response functions

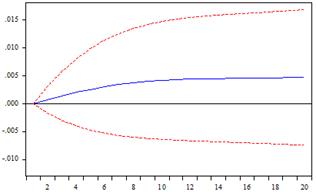

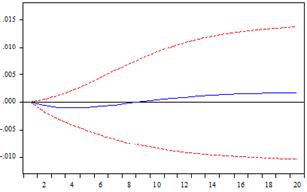

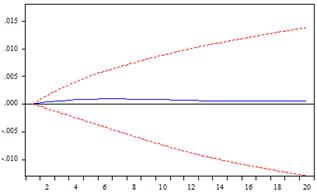

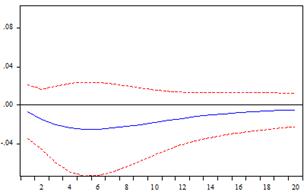

The impulse response functions (IRF) help us to know how a variable responds to a shock in the other variable initially and whether the effect of the shocks persists or dies out rapidly. Our IRF of the four endogenous variables to their own-shock and to the other variables’ shock is depicted in Figures 9, 10, 11 and 12. In the graphs, the solid lines represent the function, while the dashed lines represent the confidence bands. They are two standard errors wide, in other words, they are approximately 95% confidence bands.

The impulse response function of LGDP following a positive shock to MEP increases after the impact and rises continuously upward. Whereas, a positive shock to MEP has a lasting and negative impact on external debt over the forecast horizon. Similarly, LGDP in response to secondary school enrolment ratio shocks increase onwards in a consistent manner. On the other hand, the impulse response function of LGDP following a positive shock of LEDG falls to zero after the first six periods, it then rises upward.

So, it appears that external debt has unfavourable consequences on economic growth as a large share of a country’s revenue is used to repay foreign loans. Though the methodologies are different, our study result also is consistent with studies as Ajayi & Oke (2012) for Nigeria, Were (2001) for Kenya, Hameed et al. (2008) for Pakistan, who find that an increase in external debt stocks has a negative effect on output growth. Lastly, due to the positive shock of MEP on external debt, the external debt decreases after the impact and then falling constantly downward.

Conclusions

The foremost focus of this study is to analyse the impact of external debt on the economic growth of Bangladesh, within the purview of macroeconomic policy. Earlier different studies have explored the impact of external debt on growth in Bangladesh in different directions. However, there is barely any study that concentrates on the role of macroeconomic policy in the context of debt–growth relationships. The ARDL approach to cointegration is used for the empirical estimation of external debt growth for Bangladesh over the period of 1980-2017. The composition of external debt is taken into account to investigate the debt growth nexus as well.

Like some other studies on a similar issue including Bangladesh’s perspective, we find a negative relationship between external debt and economic growth as well. The negative relationship between external debt and growth is consistent with the findings of E Borensztein, n.d. and Eduardo Borensztein (1990) who studied the case of the Philippines as well as Farhana & Chowdhury (2014) and Yeasmin et al. (2015) for Bangladesh. The results also support the finding of Iqbal & Zahid (1998) and Ramzan & Ahmad (2014) for Pakistan.

The key aspect of the study is that it permits us to see the impact of external debt on growth considering the economic policy which is approximated by a macroeconomic policy index. Our constructed macroeconomic policy index helps us to analyse the effectiveness of economic policies in utilizing external debts. External debt has a negative relationship both in the short run and positive in the long run when this policy index is incorporated in the growth equation.

However, the estimated macroeconomic policy variable has a positive and significant effect on economic growth. Even the variance decomposition analysis shows that macro policy Granger-causes GDP both in the long run. So, these results indicate that stable macroeconomic policy leads to higher economic growth. The impulse response function (IRF) under the VAR framework is also consistent with our findings from the estimated ARDL equations.

In the context of Bangladesh, the overall good macroeconomic policy (with the aberration for two or three years) over the study period has softened and to some extent might have nullified the negative impact of debt and created a positive impact on growth. So, sound macroeconomic policy and right human resource policy is the key to offset the adverse impact of debt and to propel the growth dynamics of Bangladesh on a higher trajectory of growth plane.