Introduction

Female participation in the boardroom in the last two decades has witnessed increasing attention among policymakers and the academia (Abdelzaher and Abdelzaher, 2019; Ahmad, Rashid and Gow, 2018; Chiucchi, Giuliani, and Poli 2018; Moreno-Gómez, Lafuente and Vaillant, 2017; Mori, 2014), and to its credit, the volume of literature has grown significantly in the last one decade (Kilic and Kuzey, 2016; Moreno-Gómez, Lafuente and Vaillant, 2017; Singhatheep and Pholphirul, 2015). The growth is however not surprising because aside from the issues of gender discrimination and ethics, gender diversity is seen as having beneficial returns on firm performance (Maturo, Migliori and Paolone, 2019 Scholtz and Kievet, 2017). Findings further reveal that more female participation in the boardroom increases human capital development as a result of the level of experiences and exposures taken onboard during decision making (Mori, 2014).

The resource dependency theory of Pfeffer and Salancik (1978) noted that the opportunities available for the board members to harness and access resources is directly linked to the level of performance of the firm. The opportunities, however, could be fully explored if there are diverse avenues which could be exhibited through the mixture in the composition of the board (Abdulkarem, Al-Musali, and Ismail (2015). Female representation on the board increases the opportunities for making strategic decisions that could increase a firm’s competitive advantage (Ahmad, Rashid, and Gow 2018). The skills, experiences, and exposures attributed to the effective decision of the board members differ for men and women, hence gender equity in the boardroom improves the level of harnessing firm resources that are rare and imitable (Abdelzaher and Abdelzaher 2019).

Despite that the extant literature in developed nations attests to the increasing importance of gender mix (Kilic and Kuzey 2016), little attention is given to its significance in developing and emerging countries (Ciftcia et al., 2019). Also, the few studies on the impact of female boardroom participation on a firm’s performance exert mixed results. Scholtz and Kieviet (2017) revealed that female board participation enhances firms’ performance while on the contrary, Ahmad, Rashid and Gow (2018) and Manita et al., (2018) noted an insignificant impact. The reasons for the adduced negative impact of female board participation could be due to the limited number of female board members as well as inadequate utilization of the firm’s intellectual resources to drive competitive advantage of women to improve performance (Chiucchi, Giuliani, and Poli 2018).

On the other hand, intellectual resources are capital inputs for firms that have the capacity to increase competitive advantage, growth, and sustainability especially in a knowledge-transiting economy (Nadeem, Gan and Nguyen 2017). Intellectual capital due to its intangibility in utilization is acclaimed as a hidden source of wealth creation for firms (Anifowose, Abdulrashid, and Annuar, 2017; Isola, Odekunle and Akanni 2017;). This is because it encapsulates the human, structural and relational capital of firms and the efficient utilization of each of this capital has umpteen beneficial effects on performance (Chiucchi, Giuliani, and Poli 2018). Hence, the capital resources possess unique value additions to the firm due to their rare and imitable nature. The optimal utilization of these resources can be directly attributed to the competence, skills, experience and diversity of the board of directors (Isola, Odekunle and Akanni 2017; Shettima and Dzolkarnaini, 2018). This is because they tend to make strategic decisions on the creation, utilization, and management of intellectual resources (Nadeem, Gan and Nguyen, 2017). In particular terms, female boardroom participation tends to contribute to the efficient and effective decision-making process, which has a positive effect on the optimal utilization of intellectual capital and firm performance (Adams and Kirchmaier 2016). However, the extant literature notes that the impact of board diversity in terms of female participation on intellectual capital is undermined despite its significance to firm performance (Mori 2014).

This study situates Nigeria, an emerging economy and one of the economic powerhouses in sub-Saharan Africa (SSA) with a large concentration of industries, banks, and corporate organizations. The observed identified gap in the industrial economics literature is the dearth of empirical evidence on the impact of female board participation on the efficient utilization of intellectual capital vis-à-vis firm performance on emerging economies and the Nigerian banking sector. Hence, this study fills this gap and attempts to establish the influence of female participation in the boardroom on the efficiency of intellectual capital as well as firm performance using 14 listed banks on the Nigerian Stock Exchange (NSE) from 2008 to 2017. The justifications for using the banking sector are diverse. (1) It is a very active component of the private sector and can proxy as being representative of corporate organisations (2) The sector employs an appreciable number of female staffs in different capacities and (3) it is one of the worst-hit sectors during the 2008 global financial crisis due to weak corporate governance which had since been improved upon. Given these, Nigeria’s banking sector is attractive to investigate the implications of female board participation in the efficient utilization of intellectual capital resources for firm performance. Added to the highlighted reasons, the sector is one of those that requires a critical assessment of its intellectual capital optimal utilization due to the intangibility of the products and services it offers.

Therefore, to realize the study’s objectives are as follows:

to evaluate the impact of female participation on firm performance,

to establish the link between intellectual capital and firm performance and

to investigate the interactive influence of female board participation and intellectual capital efficiency on firm performance, the econometric techniques of the random effects (RE) model are used.

Also, two measures of firm performance are used which are return on assets (ROA) and return on equity (ROE). Similarly, the study follows Pulic (2000) measure of value-added intellectual capital (VAIC) and Moreno-Gomez, Lafuente and Vaillant (2017) measure of female board participation. The policy relevance of this study is not far-fetched. For one, it will bring to light the issue of gender-biasedness and inequality in the corporate world and also highlight the need to give the female gender some proportionate representation in boardroom decision-making. The rest of the study is structured as follows: section 2 gives a brief literature review, section 3 details the data and empirical model, results are discussed in section 4 while section 5 concludes with policy implications.

2 Brief literature review

Several theories have established the connection between female participation in the boardroom and firm performance amongst which are the upper echelon theory (Abdulkarem, Al-Musali, and Ismail (2015), the critical mass theory (Moreno-Gomez, Lafuente and Vaillant 2017), the social identity agency theory (Mori, 2014) and the resource-based theory (Ahmad, Rashid and Gow, 2018). This study, however, adopts the resource-based theory because it takes cognizance of the need to develop and utilize internal resources (intellectual capital) through board decisions which could be more robust given equity in gender representation (Hsu, Lai and Yen, 2018).

The boardroom is noted to be an environment where the central activities of an organization are strategically decided upon, controlled and monitored for growth and survival (Agyei-Mensah, 2018; Moreno-Gomez, Lafuente and Vaillant 2017). The boardroom itself cannot judiciously perform without a league of highly diverse, innovative and strategic members, whose main function is to deliver outstanding performance to the shareholders (Hickman, 2014; Klettner, Clarke and Boersma 2016). Extant studies onboard performance as measured by its diversity in the developed regions exhibited strong and positive implications on firm value (Hsu, Lai and Yen, 2018). Most of these studies, however, find a significant relationship between female participation and firm performance (Klettner, Clarke and Boersma 2016). This could be attributed to the degree of skills and experience which the women on the board exhibited in the decision-making process.

However, not until recently, developing countries are now giving significant attention to the impact of female board participation on the growth and survival of firms (Mori, 2014). Given these, finding from developing countries are inconclusive as some studies (Joecks, Pull, and Vetter, 2013; Moreno-Gómez, Lafuente and Vaillant 2017;) depict positive implications of female board participation on the board. These affirm the assertions that quality corporate governance in terms of diverse utilization among board members is often reflected in firm improved performance. Contrarily, some scholars (Abdulkarem, Al-Musali, and Ismail (2015) and Shettima and Dzolkarnaini (2018) noted that the degree of diversity of board members can be directly ascribed to low firms’ performance due to the timeliness in resolving intellectual argument. More views and strands support the need for a high heterogeneity in board gender composition due to the dominance of diverse knowledge stock and enhanced qualitative decision making.

Likewise, the significance of board diversity to the improvement of firm performance cannot be overemphasized and board diversity has been measured in diverse manners. Some studies used an index with the numerous measures of diversity such as age, tenure, nationality ethnicity and gender composition to represent the variable. Nonetheless, it is of utmost importance to evaluate the individual implications of these measures on firm performance. Studies by Moreno-Gómez, Lafuente, and Vaillant (2017) evaluated the significance of gender equity in the composition of the board and top executive management. The study revealed that there exists a positive relationship between female top management staff and corporate performance measured by the returns on equity. In a related manner, Abdelzaher, and Abdelzaher (2019) established a positive link between women represented onboard and the performances of the firms in Egypt while Abdulkarem, Al-Musali, and Ismail (2015)established the impact of gender diversity and the mediating influence of board effectiveness on firm performance. Their findings reveal that an intellectual capital efficiency increases as the mediating influence of board meeting increases.

3 Data and model

The study uses a panel data of 14 banks listed on the Nigerian Stock Exchange (NSE) from 2008 to 2017. The licenses of all listed banks are categorized into three based on the commercial banking licensing regulations enacted in 2010. Categories of licenses issued are international, regional and national. Thus, this study focuses on commercial banks with national and international licenses. Out of the 19 banks with national and international authorization, 14 are selected due to the adequacy and availability of financial information.

3.1 Data and sources

The variables employed in this study are sourced from the annual reports of the banks obtained from their respective websites, the NSE Portal and the African Markets website. The dependent variable is firm performance (proxied by ROA and ROE) while the independent variables are the female board participation and intellectual capital. This study follows similar studies in the measures used in defining these variables which are explained below:

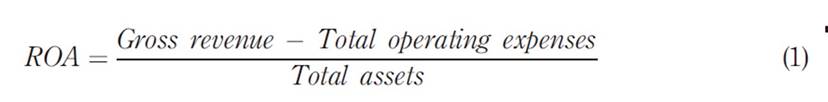

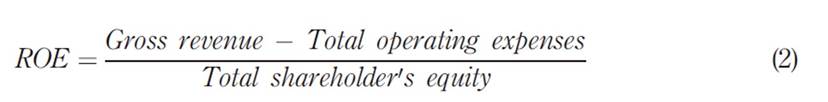

Firm performance: The first proxy used is the return on assets (ROA) which measures the economic performance of the firm. It is defined as the proportion of the net income to total assets and expressed as:

The second proxy is the return on equity (ROE) which measures financial performance. It is calculated as the proportion of net income to the total equity of the firm:

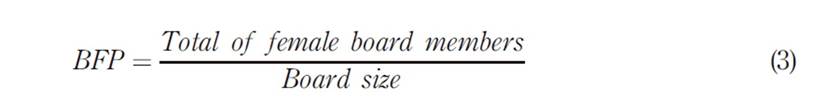

Boardroom Female Participation (BFP): Following Moreno-Gómez, Lafuente, and Vaillant (2017), this measures the proportion of female board members to the total board members derived thus:

Intellectual Capital Efficiency: This variable explains the variations between the book and market value of a firm (Isola, Odekunle and Akanni 2017). It depicts the source of competitive advantage and wealth creation of firms. The efficiency of intellectual capital is often measured in some ways but the most prominent and widely acceptable measure is the Pulic (2000) measure of intellectual capital. The Pulic value-added intellectual capital (VAIC) is noted by many scholars as to the most appropriate because of the utilization of data from the company’s performance rather than the subjective measurement approach (Isola, Odekunle and Akanni 2017). Hence, this measure is adopted due to its quantitative measurement approach. The VAIC is the composition of the human, structural and the capital employed of the firm expressed as:

VAIC = HCE + SCE + CCE(4)

The human capital efficiency (HCE) is measured as the proportion of the firm’s value addition attributable to the investment on human capital, efficiency in the firm’s structural capital (𝑆𝐶𝐸) measures as the variations between the company’s value-added and its investment on human capital and the firm’s value-added (𝐶𝐶𝐸) is the summation of the operating profit (𝑂𝑃), employee costs (𝐸𝐶), amortization (𝐴) and firm depreciation (𝐷). Hence, value-added (𝑉𝐴) is given by:

VA = OP + EC+ A+ D (5)

And by expansion, the value-added intellectual efficiency (VAIC) is expressed as:

where 𝐻𝐶 is the expenses on employee, 𝐸𝐶 is the stock of equity capital and 𝑆𝐶 is 𝑉𝐴−𝐻𝐶. This study adopts the 𝑉𝐴𝐼𝐶 measure of intellectual capital but focuses on the implications of its individual components on firm performance.

Control Variables: In line with similar studies (A. Abdelzaher and D. Abdelzaher, 2019; Hsu, Lai and Yen, 2018; Shettima and Dzolkarnaini, 2018;), variables that can influence firm performance are controlled for. These are bank size, bank age, board independence, and director shareholding structure. Bank size is measured by the natural logarithm of total assets, bank age is measured by the year of incorporation of the bank while board independence is measured by the proportion of the independent directors to board size while the proportion of directors’ shareholding to the total shares measures the director’s shareholding structure.

3.2 Empirical Model

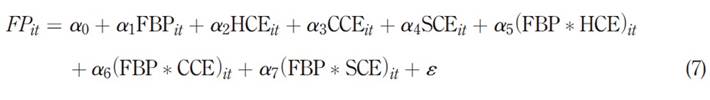

The use of a longitudinal panel data set is consistent with previous studies (Chiucchi, Giuliani, and Poli 2018) because it combines the characteristics of time series and cross-sectional data. Ciftcia, et al (2019) noted that the Hausman test is the most widely used panel data specification test to select the most appropriate estimation technique. The test compares the random effects (RE) estimator to the ‘within’ estimator (fixed effects). If the null hypothesis that the random effects are independent of explanatory variables is rejected, this favours the ‘within’ estimator’s treatment of the omitted effects. The use of the test, in this case, is to discriminate between a model where the omitted heterogeneity is treated as fixed and correlated with the explanatory variables, and a model where the omitted heterogeneity is treated as random and independent of the regressors. The significance of the p-value of the test statistic is used to justify the use of the fixed effects (FE) over the random effects (RE) estimator. In this study, however, the outcome of the Hausman test as given by the test statistic of 0.8743 supports the use of the RE model due to our inability to reject the null hypothesis. Following A. Abdelzaher and D. Abdelzaher (2019) the empirical model is modified as:

Where 𝐹𝑃 𝑖𝑡 the measure of firm performance is measured by ROE and ROA; α 0 is the constant term, α 1 𝑡𝑜 α 7 represent the parameters to be estimated; i and t are the number of firms and the time periods, respectively while ԑ stands for the disturbance term. Using ROA and ROE as alternating dependent variables, Equation (7) is estimated sequentially. First, the nexus of female participation and firm performance is analysed, followed by components of intellectual capital and firm performance and lastly the interactive influence of female board participation and intellectual capital efficiency on firm performance

4 Empirical results and discussions

4.1 Correlation analysis and summary statistics

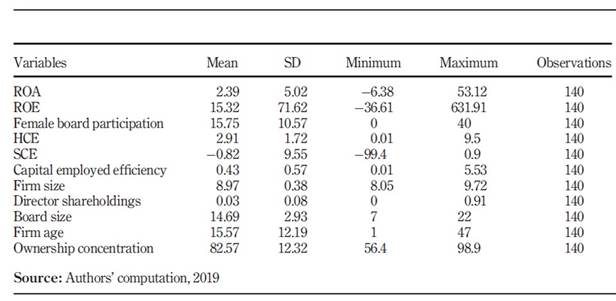

The summary statistics indicate that the average rate of return on assets is 2.39% with the least negative return of -6.38% and a wide variation of 5.02% from the mean value. This is indicative that the returns on assets have a wide differential across banks. The banking sector average returns on equity of 15.32% for the period under review while a wide variation in the returns on equity is observed. In terms of female participation in the boardroom, average female participation is 15%, the highest rate of female board members to the total board member is 40% while there are some firms zero female board members (see Table 1).

The human capital efficiency in terms of the sector’s value-added output has a maximum ratio of 9.5, the least ratio was 0.01 and the mean value stood at 2.91. This indicated that more of the banks exhibit lesser efficiency level in terms of human capital utilization. Similarly, the capital employed efficiency exhibited the same minimum returns to the value-added while the maximum efficiency ratio was 5.53, the mean efficiency capital employed ratio was 0.43. This indicated that human capital is better utilized than capital employed. Structural capital efficiency in a different vein recorded the least efficiency ratio. This reflected that the processes of the banks need to be improved for better and optimal utilization.

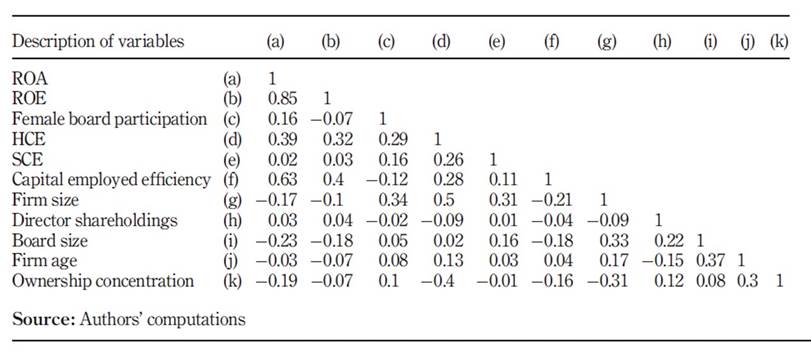

Table 2 presents the correlation analysis of the variables used in the model. The table shows the degree of association among the variables. The result provides evidence of a very high degree of correlation (0.85) between the returns on assets (ROA) and returns on equity (ROE). However, this outcome poses no econometric problem since both serve as alternating dependent variables. All other variables exhibit mild correlations, hence the problem of multicollinearity is circumvented.

4.2 Empirical results

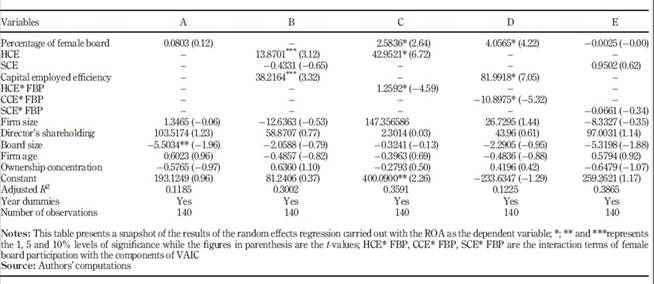

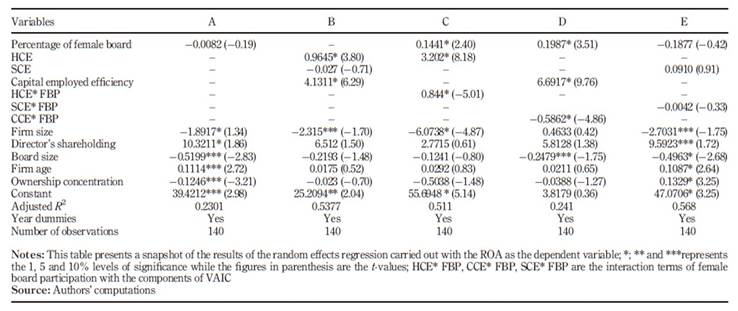

Tables 3 and 4 show the results of the regression analysis when ROE and ROA are used interchangeably as dependent variables. In both Tables, Columns A to E relate to the five systematic estimations of equation (7). Column A details the findings of the female board and firm performance nexus which reveal that female board participation does not have any statistically significant impact on firm performance. This suggests that there is no evidence to support the hypothesis that increasing the number of female boardroom participants enhances firm performance. This outcome can be attributed to the minority composition of female board members and as such their influence will largely be unfelt on the performances of the firm. These findings contradict the works of Scholtz and Kieviet (2017) but align with those of Ahmad, Rashid, and Gow, (2018), Shettima and Dzolkarnaini, (2018) and Manita, et al., (2018). Ahmad, Rashid, and Gow (2018) show that the presence of female board members is not significant to boost firm performance in terms of corporate social responsibilities (CSR) while Manita, et al., (2018) posit the same findings in terms of the link between gender diversity and environmental, social and governance disclosures. Similar arguments for Column A in Table 4.

Column B details the outcome of the relationship between the returns on equity and value-added intellectual capital components (human capital, structural capital and capital employed). The results reveal that a significant and positive relationship exists between human capital, capital employed and the returns on equity. These outcomes lend support to those obtained by Anifowose, Abdulrashid, and Annuar (2017) which confirm that human capital efficiencies have positive and significant contributions towards firm performance. The structural capital, on the contrary, exhibits an insignificant connection with the returns on equity and this conforms with the study conducted by Nadeem, Gan, and Nguyen (2017). The insignificance may be connected with the mode of measurement and likely measurement errors. It could also be that the banks are not exploring enough innovative ideas on product development as well as not having sufficient skills or processes to drive innovative ideas. A similar outcome is noted when the return on assets (ROA) is used as a dependent variable in column B of Table 4.

Likewise, column C of Table 3 expresses the outcome of the functional relationship between the interactions of female board participation and human capital efficiency on performances of the listed banks. The results reveal that upon interaction, both human capital and female boardroom participation reflect a positive and significant effect on performance. This indicates that female participation has an indirect significant effect on the performances of the firms when human capital efficiencies are fully explored. In fact, the significance level improved from the initial 10% to 1%. Also, column C of Table 4 shows an exact comparable outcome when the return on assets is adopted as a proxy for firm performance. Examining the outcome of the interactions of capital employed and female boardroom participation results in Column D of Table 3 show a significant influence of female participation and capital employed on the returns on equity. A similar outcome is noted on the returns on capital as indicated in Column D of Table 4.

On contrary, column E of Table 3 details an insignificant effect of the interactions of structural capital and female participation on board. This outcome is like the result of Abdulkarem, Al-Musali, and Ismail (2015) who examine the interactions of intellectual capital efficiencies and board effectiveness on firm performance. The results suggest that the female participation on board needs to be strengthened and the female on board should possess relevant skills, educational background and professional certifications that relate to the activities in the banking sector.

Controlling for other factors that influence the performance of the firm, director shareholding and firm age as a year of the listing has significant influences on the performances of listed commercial banks in Nigeria. This depicts that the stake of directors on board mounts pressures on them on their performance to improve the firm’s performance, however, this might likely impose a greater risk and volatility especially upon retirement, when directors seek to withdraw their funds. The age of banks at incorporation, on the other hand, improves its performance because that is the period most of its reports become public and is influenced by the investor’s decision. Ownership concentration reveals a negative but significant relationship with firm performance. This result conforms to those of Chiucchi, Giuliani, and Poli (2018) and Ciftcia, et al., (2019). It is indicative that a high ownership concentration influences the decisions on the board and may hamper firm performance.

5 Policy implications and conclusion

This study examines the nexus of female board participation, intellectual capital and firm performance in Nigeria using a panel data set of 14 listed banks on the Nigerian Stock Exchange from 2008 to 2017 analysed using the random effects estimation technique. Notable contributions made to the industrial economics literature that intellectual capital significantly contributes to firm performance. Optimal intellectual capital utilization brings about competitive advantages, creates value addition as well as attracts domestic and foreign investment. In retrospect, even though the impact of female participation is not statistically significant, our findings tilt towards the encouragement of female participation in the boardroom as it has been revealed that women are better drivers on intellectual capital efficiencies of firms which were revealed when the intellectual capital components interact with female participation inboard. Furthermore, adequate female representation in the board increases the impact of human and capital employed efficiencies in the value addition process of the firms. Policy recommendations to corporate organizations suggest that a more attentive culture needs to be developed on the potential benefits accrued to having more females on their boards. The outcomes of this research have relevant policy implications for gender equity experts, policymakers and academia. Gender equity and diversity having been acknowledged as an important driver of the company’s intellectual resources which in turn drives its corporate performance. This paper contributes to the better comprehension of the impact of female participation in the boardroom on the performances of the banks in Nigeria. Policymakers should encourage more female participation in order to maximize the likely economic gains that will accrue as a result of such participation on the board.