Introduction

Generally speaking, the banking credit risk is defined as the risk that loans are not repaid partially or totally (Liao et al., 2009; López et al., 2014), such risk can lead to the bank default. Since 2008 and the banks’ failure leading to the global financial crisis, the determinants of the banks default\credit risk became an important topic (Jaloudi Mutasem, 2019; Ngo Tra et al., 2019). There is a growing literature focusing on the determinants of credit risk and bank default risk including microeconomic factors such as bank liquidity, bank capital, bank size, bank competition, credit derivatives, internal rating systems, collateral, the relationship between lender and customer (Imbierowicz and Rauch, 2014; Agarwal et al., 2016; Mandala et al., 2012) and macroeconomic factors such as inflation, unemployment, house price, credit cycles, business cycle and economic growth (Hoque et al., 2015; Tajik et al., 2015).

The literature has pointed out that an analysis of macroeconomics factors contributing to the credit risk of the banking system is essential for policymakers to prevent a potential financial crisis (Agnello et al., 2011; Beltratti and Stulz, 2012). However, the existing literature dealing with macroeconomics determinants under-investigates the influence of the institutional quality on the credit risk and default risk of the banking system. Meanwhile, the literature on the impacts of macro institutional quality on credit risk in the banking system is scary. Notably, there are likely no studies on the association between institutional quality with other determinants of bank risk such as economic conditions or banking system characteristics. Roughly speaking, institutions refer to government effectiveness, regulatory quality and the rule of law. The literature has documented that better institutions can actually reduce asymmetric information and transaction cost, and therefore, they improve resource allocation (Williamson, 1981; Ho and Michaely, 1988). That is, the improvement in institutional quality may have important impacts on credit risk in the banking system. More importantly, the bank managers’ behaviours may be different under different contexts of their bank’s situation and economic conditions (Vo and Nguyen, 2014). Therefore, the impacts of institutional quality on bank risk may be heteroscedastic across economic conditions and bank conditions.

Our study finds that better institutions indexed by the mean of six institutional quality (including control of corruption, government effectiveness, regulatory quality, rule of law, political stability and voice and accountability) reduce the default risk, especially the credit risk of the banking systems. This is the major contribution of this research because the current literature does not offer yet an econometric analysis of the combined effect of institutional and economic factors on the risk in the national banking system. In doing so, this study is innovative because the impact of the institutional quality on the banking system’s risk is examined in association with the characteristics of the banking system (i.e. capitalization, liquidity, profitability, competition) and the economic conditions (i.e. economic growth, FDI flows, trade openness). Second, the study examines further the influence of institutions and their combination with some economic and banking system specific characteristics (i.e. liquidity, capitalization, profitability and concentration as the drivers of bank credit supply, economic growth and FDI inflow and trade openness) on the credit risk and default risk of the banking system. Our findings indicate that the influence of institutions in reducing the default risk is weaker in well-capitalized/profitable banking systems and high-growth economies. Our analysis suggests that institutional quality can act as a useful tool to reduce the default risk in highly liquid and concentrated banking systems, especially in high-growth economies with high economic integration. We explain our study in the following section.

The remaining of the paper is structured as follows. The second section provides the literature review and hypotheses development. In the third section, the methodology and data are introduced, while the fourth section presents and discusses our empirical findings, whereas the fifth section concludes the study with some policy implications\recommendations.

Literature review

The literature on institutional quality usually claims that institutions facilitate the efficient allocation of resources contributing therefore to economic activities (Tran Nam and Dat Le, 2019) and economic growth (Nguyen et al., 2018). For instance, Beekman et al. (2014) find that corruption reduces incentives for individuals in both voluntary contributions and investments in Liberia creating therefore an impact on the economic growth. There are reasons to expect links between institutional quality and bank risk. First, a good institutional environment is also very important to reduce problems related to information asymmetry (Cohen et al., 1983; Ho and Michaely, 1988) and transaction cost (Jude and Levieuge, 2015). This issue directly affects credit activities (Qu et al., 2018) because the asymmetric information problem often presented as a major obstacle in channelling funds from savers to borrowers (Neyer, 2004; Lindset et al., 2014; Miller, 2015). For instance, Nguyen et al., 2018 documented that the better institutional quality induces higher credit level in the banking system in emerging economies over the period 2002-2013 as the reduction impacts of institutional quality on asymmetric information and transaction cost. In this context (low asymmetric information and the transaction cost), if the problem of asymmetric information including adverse selection and moral hazards becomes less serious, commercial banks will be less likely to supply loans to poor credit-worthiness borrowers and borrowers will also less likely to be involved in risky projects. Second, there is concrete literature pointing out that the better institutional quality induces a more effective macroeconomic policy (Nguyen, 2018; Nguyen et al., 2018; Su et al., 2019), which includes the banking regulations. As a result, the bank managers would be more careful in supplying credit to better credit-worthiness borrowers to meet the regulations. Third, better institutional quality is argued with less uncertainty in the macroeconomic systems as more prudential macroeconomic policies, while high uncertainty is argued to link with a higher risk in economic activities (Strobel et al., 2018). For instance, much evidence is showing that governments in advanced countries (mostly with high institutional quality) usually implement a counter-cyclical fiscal policy, while governments in developing countries are observed with pro-cyclical fiscal policy (Nguyen and Thong, 2016). That is, better institutional quality may be expected with lower macroeconomic uncertainty. In summary, we can expect that better institution quality will reduce the credit risk and the overall default risk of the banking system.

The originality of our research is to investigate this aspect through different characteristics, such as banking liquidity, capitalization, profitability and concentration. The association between institutions and economic growth is also examined as well as the influence of the association between institutions, and economic integration (including FDI inflow and trade openness) on the bank risk. This combined analysis has not been proposed by the existing literature that usually deals with classical statistical analysis by individual factors. Banking systems with a high level of diversification, high capital adequacy and high profitability are healthier and hence have a lower external cost to raise funds in response to financial distress (Kashyap and Stein, 1995; Kashyap and Stein, 2000; Gambacorta, 2005). The stability of a banking system might be directly related to the institutional environment. Park (2012) found that corruption distorts the bank fund allocation leading to poor project management in 76 countries. It has been well reported that information asymmetry in the form of moral hazard is one of the key roots of banks’ risk-taking behaviours, such as the search for yield (Rajan and Dhal, 2003) and too big to fail (O'hara and Shaw, 1990; Papachristos, 2011). We expect that a reduced information asymmetry thanks to the improvement in the institutional quality (Cohen et al., 1983; Ho and Michaely, 1988) can restrain moral hazards and reduce risky behaviours of commercial banks. In this context, one can expect a reduction of the credit risk in the banking systems and then a decrease in the overall bank default risk. Despite some theoretical works, the topic is still under-investigated. Our study aims at filling this gap. Larsson (2006), Cao and Birchenall (2013); Driffield et al. (2013); and Ghosh (2013) showed that institutional quality can have an important role in the stability of the banking system. However, highly concentrated banking systems (dominated by few large banks covering large market shares) create a situation in which banks can leverage their size in managing credit information. In other words, we might expect that any improvement in the institutional quality will have a marginal effect on the reduction of the credit and default risks. Meanwhile, many recent studies have found that banking systems with higher liquidity would have riskier activities in their activities (Nguyen and Boateng, 2013; Nguyen and Boateng, 2015; Nguyen et al., 2015). Related to that, we can expect that a higher institutional quality could limit such risky activities.

The default risk of the banking system can result from various activities. Higher liquidity and a well-capitalized banking system could invite banks to take more risks (Nguyen and Boateng, 2013; Nguyen and Boateng, 2015; Nguyen et al., 2015). In this article, we also investigate the demand side of the credit activities which is proxied by real gross domestic product (GDP) growth rate (Backé and Wójcik, 2008) - on this point, the existing literature has documented that high economic growth can efficiently reduce the information asymmetry (Bardhan, 1989; Bloom et al., 2008), and therefore the influence of institutions on the reduction of information asymmetry becomes marginal in fast-growing economies. In this context, we hypothesize that the impact of institutional quality on the credit risk will be weaker in economies with a high real GDP growth rate. Moreover, a banking system with a high economic growth would take more activities outside of their traditional core activities so that the effect of institutions on the default risk is expected to be smaller. Finally, we also take into consideration of the economic integration that refers to the level of exposure of domestic sectors (including the banking system) to exogenous shocks (Combes and Saadi-Sedik, 2006; Epifani and Gancia, 2009). Concerning that, we argue that better institutions could limit the negative effect of exogenous shocks owing to the higher economic integration on the credit risk and the default risk in the banking system. To sum up this section, our study combines several individual analyses offered by the existing literature to provide a more comprehensive\holistic understanding of the role played by the institutions in the risk of the national bank systems.

Methodology and data

We combine several models from some existing studies (Ramos-Tallada, 2015; Yurdakul, 2014; Altunbas et al., 2010; Altunbas et al., 2012) to examine the impacts of institutions on the banking credit risk:

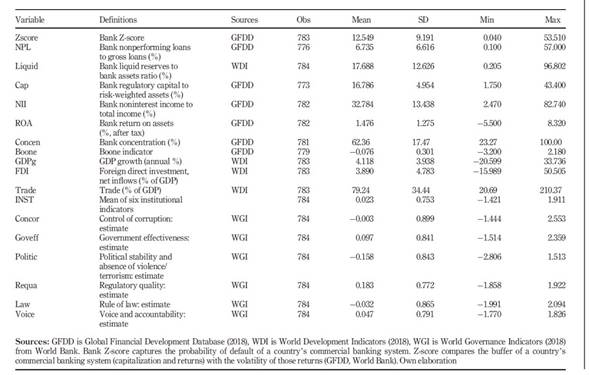

where i and t represent country and time (year), respectively. Bank risk (Bankrisk) is measured as the Bank Z-scores (1) (Zscore) for default risk and the ratio of non-performing loans to total outstanding loans (NPL) for credit risk of the banking system. In line with the previous studies as those by Park (2012); In’airat (2014); Herrera-Echeverri et al. (2014); and Zhang (2016), the institution quality (Inst) is measured by the mean of six institutional indicators (INST) coming from the World Governance Indicators including control of corruption (Concor), government effectiveness (Goveff), political stability (Politic), regulatory quality (Requa), rule of law (Law) and voice and accountability (Voice). In addition, each institutional quality indicator has been investigated individually as a check for robustness.

X is the vector of control variables that includes the economic and the banking system characteristics: banking liquidity (Liquid), banking capital (Cap), banking profitability (ROA), banking income diversification (NII) and banking concentration (Concen), credit demand, i.e. real GDP growth rate (GDPg), economic integration including FDI inflow (FDI) and trade openness (Trade). To measure the bank competition, we use the Boone indicator (Boone) from the Global Financial Development Database and the bank concentration indicator.

We collected yearly data for 56 countries for the period going from 2002 to 2015. The availability and some missing data issue explain the reason for why we selected the period 2002-2015 that appear to be a sample with clean data for analysis. The sources of our data are summarized in Table 1.

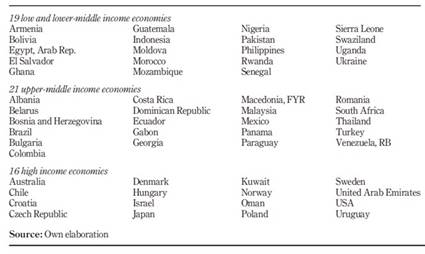

The three sub-samples including 19 low and lower-middle-income economies (LMEs), 21 upper-middle-income economies (UMEs) and 16 high-income economies are then examined. Table 2 lists the studied countries.

Econometrically speaking, our sample has a large number N (56 countries) in a short time T (14 years, 2002-2015), thus we first examine the cross-sectional dependence by using the Pesaran’s CD test (Pesaran, 2004). The results show that most of our variables have a cross-sectional dependence. Then we use the CIPS (Z(t-bar)) unit root test (Pesaran, 2007), Im-Pesaran-Shin unit root test (Im et al., 2003) and Fisher based on Phillips-Perron type Z (inverse normal) unit root test (Choi, 2001) are used to examine the stationarity of our variables. In a situation (like ours) characterized by the existence of a cross-sectional dependence for small panel data with a short time window and large sample, one can apply the panel corrected standard errors model (PCSE) to adjust the sample as PCSE helps in dealing with the cross-sectional dependence in a short time and large N panel data (Jönsson, 2005; Bailey and Katz, 2011; Marques and Fuinhas, 2012). In addition, we use the feasible generalized least squares (FGLS) model (as it deals with heteroscedasticity (Harvey, 1976)) and the pool ordinary least squares (OLS) for our robustness checks. Related to these robustness checks, a last technical point must be mentioned here: applying GMM with a small number of cross sections might be worrisome (in our sample) inviting us not to use this estimator in empirical estimation and to repeat our analysis with several alternative techniques as robustness check (pooled OLS, robust pooled OLS, pooled OLS with year effects). Importantly, all our estimations use a one-year lag for independent variables to avoid the feedback effects from the dependent variable that might cause an issue of endogeneity. We also add the control variables one by one into our estimations as another way of sensitivity check for the findings. All results indicate consistent results.

Regression results and discussions

Full sample of 56 countries

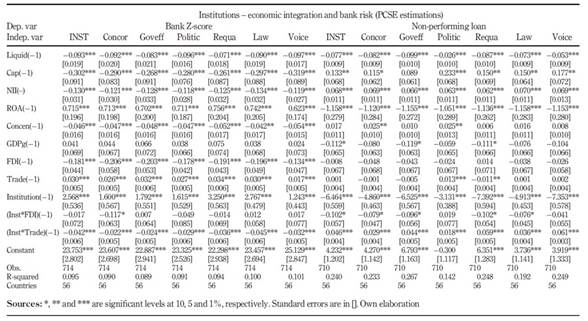

The major results of our analysis through the PCSE model are reported in Table 1.

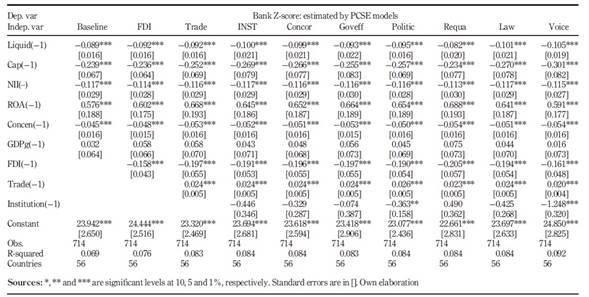

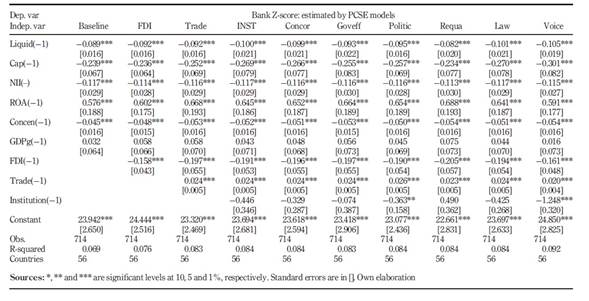

In line with our expectation and with the existing literature on the influence of institutions policy (Lindset et al., 2014; Miller, 2015; Nguyen, 2018; Nguyen et al., 2018; Su et al., 2019), Table 3 shows the influence of institutions on the bank default risk for the 56 countries. Regarding our control variables, more liquid, well-capitalized, income diversified and concentrated banking systems are found to have less default risk. Interestingly, the banking systems with high profitability also have a higher default risk - profitability being related to the level of risk such observation is quite understandable. The economic growth has an insignificant positive effect on the bank default risk while the economic integration exhibits two trends: a negative effect for the FDI inflow but a positive effect for the trade openness on the default risk. In other words, FDI brings stability to the banking system while trade openness might open the door for more risky activities. Also, in line with the works on the topic activities (Nguyen and Boateng, 2013; Nguyen and Boateng, 2015; Nguyen et al., 2015), a better institutional quality reduces the bank default risk, especially the political stability and voice and accountability. Table 4 reports the combined effect of the institutions and the banking system characteristics on the default risk.

A better institutional quality generates a stronger negative effect of liquidity and bank concentration on the default risk. In other terms, the institutional quality enhances the effect of these parameters on the banking system. Meanwhile, the influence of better institutions is weaker in banking systems with a high well-capitalization, high-income diversification, high profitability and in countries with higher economic growth. This can be explained by the fact that such banking systems have several ways of reducing their default risk. The results for the credit risk are shown in Tables 5 and 6.

Table 4 Institutions and bank system risk: the associations with bank system characteristics and economic growth

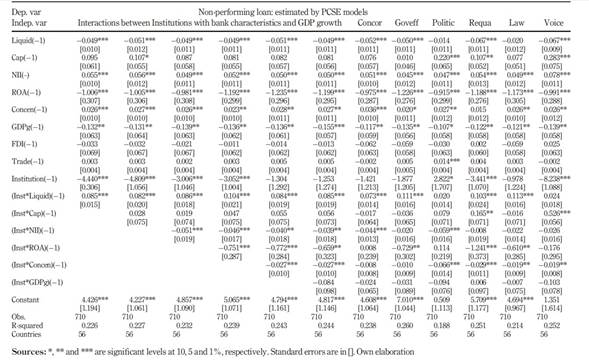

Table 6 Institutions and bank credit risk: the associations with bank system characteristics and economic growth

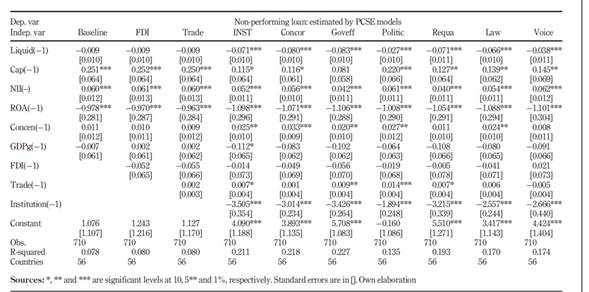

The banking systems with higher liquidity and profitability have a lower credit risk. Meanwhile, the well-capitalized, well income diversified and highly concentrated banking systems have a greater credit risk simply because banks have more opportunities to be exposed. A higher economic growth reduces the credit risk while the trade openness increases the credit risk significantly. The finding related to the banking profitability also supports the literature claiming that banks may take the higher risk owing to the motivation for high yield (Rajan, 2006). Also, well-capitalized, diversified and highly concentrated banking systems are found to take greater credit risk - this finding supports the idea that large banks with highly concentrated power may commit to-big-too-fail moral hazards (O'hara and Shaw, 1990; Papachristos, 2011), whereas well-capitalized banks can better anticipate and buffer distressed assets (and therefore absorb greater credit risk (Bliss and Kaufman, 2002)). As expected, a high GDP growth rate is associated with a smaller credit risk as economic expansion reduces the likelihood of asset distress (Marcucci and Quagliariello, 2009).

A better institutional quality consistently decreases the banking credit risk owing to a reduction of information asymmetry that directly improves credit quality. Interestingly, we find evidence that the reducing effect of institutions on credit risk is weaker in liquid and well-capitalized banking systems. Even though this particular aspect has not been investigated specifically in the existing literature, it confirms the hypothesis according to which these banking systems usually take more (credit) riskier activities. Having said that, we found a consistent and strong negative effect of institutions on the credit risk for banking systems with different characterization (diversification, profitability and concentration levels). The influence of institutions across economies with different GDP growth rates is not significant, suggesting that institutions do not affect the credit risk through the credit demand factors. The results for our analysis using the Boone indicator for banking system competition show inconsistent coefficients suggesting that it is suitable to use the bank concentration to proxy for banking competition.

The originality of our study refers to the investigation of the combined effect of the institution and economic\banking characteristics on the banking system’s risk. The associations between institutions and economic integration are reported in Table 7.

The negative effect of FDI inflow on both default risk and credit risk is enhanced by the institutions. In other words, the combination of institutions and FDI inflow contributes to the banking system’s risk stabilization. Meanwhile, the positive effect of trade openness on default risk is limited by institutions but the trade openness effect on the credit risk is reinforced by the institutions. This last observation is quite surprising and never suggested in the existing literature - it is mainly because that trade openness combined with better institutions creates more economic activities leading to an increase of economic agents’ loans and, therefore, exposing the banking system to higher credit risk. This finding is our first contribution. More generally, our results show the important roles of institutions in limiting the effects of exogenous factors in banking system risk. All results have been double-checked through robustness checks with FGLS models (our robustness check is available on request).

Low and lower-middle-income economies

We use the same econometric technique for estimating the case of 19 low and LMEs. The results show that better institutions induce higher default and credit risks in low and LMEs. This is a surprising result that can be explained as follows: better institutions generate a higher economic activity in various sectors which then create a higher exposure for the banking system to new risk. Because the banking system in LMEs is not mature in terms of processes, regulations and diversification, the default and credit risks increased as a part of the financial development. However, the negative combined effect of institutions with other variables (bank liquidity, bank capitalization, bank diversification, bank profitability, economic growth, FDI inflow and trade openness) on the bank default risk indicates the important role of institutions in financial development progress in low and LMEs. These findings have been double-checked and confirmed with an FGLS model.

Upper-middle-income economies

In line with our previous section, we use the PCSE model as the major econometric technique for our analysis of the 21 UMEs. Our findings show a different trend than the one documented for the low and LMEs because, for this sub-sample, better institutions induce a higher default risk, but it decreases the credit risk. This result that is in line with our observation for the global sample, can be explained as we explained earlier: better institutions generate a higher economic activity as the case of low and LMEs which then causes riskier in banking activities so that the default risk is increased - however, the negative effect of institutions on the credit risk suggests that the institutional quality can reduce the credit risk. This situation results from the fact that this category of a country can generate more profitable outputs explaining why the generated economic activity has a higher probability to pay back (partly or totally) loans. It is also worth mentioning that the negative influence of the association between institutions and the other variables (bank liquidity, bank diversification, bank concentration, FDI inflow and trade openness) on the default and credit risks suggests that an improvement in institutional quality can contribute to better control of the risk in the banking system.

High-income economies

We repeated our econometric analysis for the 16 high-income economies, and the results indicate that institutions have a negative effect on the default risk and especially on the credit risk. In other words, institutions clearly contribute to the reduction of these two risks, but their effect seems to be more marginal than for the previous categories of countries. The negative influence of the association between institutions and other characteristics (bank liquidity, bank profitability, bank concentration, economic growth, FDI inflow and trade openness) on the default risk and the credit risk also show the important roles of institutions in the banking risk control for high-income economies. These findings also show that the institutional influence on the default and credit risk of the banking system directly depends on the income level of the country.

Conclusion

We contribute to the existing literature dealing with the impact of institutions on financial stability by reducing credit risk. Applying several econometric techniques for a panel of 56 countries over the period 2002-2015, our results show several notable findings. In line with the existing literature, we found that institutions generally contribute to the stability of the banking system. Better institutional quality has a negative impact on bank risk improving therefore the banking system’s stability. Interestingly, this effect is less important in well-capitalized, highly profitable and high economic growth countries, but it is stronger in highly liquid banking systems and high concentrated banking systems.

Beyond this empirical confirmation, a contribution of our paper refers to the identification of specific patterns in the influence of institutional quality on the default\credit risk of system banking. Precisely, the effectiveness of institutions on the credit risk varies across banking contexts and becomes marginal in large, liquid and well-capitalized banking systems. The economies with small, less liquid and under-capitalized banking systems will benefit the most from institutional quality improvement in pursuing financial stability.

Our major contribution consists of identifying different institutional effects on the credit and default risk for different categories of income. Precisely, our results also show that institutional quality has a significant negative relationship with the banking credit risk, especially in high-growth countries. Institutions have a different impact depending on the income of the countries. In LMEs, institutions increase the default and credit risk of the banking system - this observation has never been suggested in the existing literature and suggests that a particular policy should be taken for these countries: they need to improve their banking system before using institutions as enablers. The UMEs exhibit a different story because institutions in these countries contribute partly to the banking system’s stability through the reduction of the default risk - but they increase the credit risk by easing economic activities to agents who might therefore borrow more money. Finally, institutions contribute to reducing the credit and the default risk of HIEs banking systems. When institutions are combined with other factors, we observe that they reduce the positive effect of trade openness while enhances the negative effect of FDI inflow on both banking system risk and credit risk. In other words, the combination of institutions and trade openness increases the banking risk through the creation of new economic activities where it helps in stabilizing the banking system through an FDI inflow-oriented policy.

Note: All our robustness checks, results statistically consistent and the analysis carried out for this work can be provided on request.

Note 1. As defined in Global Financial Development Database, the Bank Z-score captures the probability of default of a country's commercial banking system. The higher value of the bank Z-score indicator is in line with higher default risk.