1. Introduction

During the decades of studies on the integrated marketing communications (IMC) concept, there has been a continuous interest in its possible implementation towards enhancing organizational performance (Einwiller and Boenigk, 2012; Kerr and Patti, 2013; Mulhern, 2009; Tafesse and Kitchen, 2017). The analysis from both customer and company perspectives underlines the strong positive effect of IMC on customer, market and financial performance, among others (Butkouskaya et al., 2020; Finne et al., 2017; Mulhern, 2009; Reid, 2005; Shinkle et al., 2013). Taken as a whole, the research confirms the positive impact of the IMC process on organizational outcomes at various strategic levels (Butkouskaya et al., 2021b; Porcu et al., 2017).

However, IMC is a customer-centric concept (Kliatchko, 2008; Kliatchko and Schultz, 2014; Nowak and Phelps, 1994; Reid, 2005). Customer evaluation of the company’s communications has a significant impact on the IMC effectiveness implementation. Recent research based on customer survey data by Butkouskaya et al. (2020) confirms the mediating role of customer satisfaction on the IMC effectiveness towards improving repurchase intention. The manager’s survey data study also confirms customer performance mediation in the relationships between IMC, market and financial performance (Butkouskaya et al., 2021b). In both cases, the customer performance neglects the direct effect of IMC on the firm’s performance. Moreover, some previous research has claimed that the IMC outcomes may have a hierarchical level (Butkouskaya et al., 2021b; Porcu et al., 2017; Reid, 2005; Tafesse and Kitchen, 2017; Luxton et al., 2015). Thus, to make more accurate conclusions about IMC consequences, a more complex model is needed. Following this, the study investigates the role of customer performance in IMC outcomes for market and financial performance.

Also, IMC outcomes may vary under the company size moderating conditions (Einwiller and Boenigk, 2012; Christensen et al., 2008; Nowak and Phelps, 1994; Reid, 2005). SMEs (Small and Medium-sized Enterprises) may be more effective in IMC implementation than larger companies (Low, 2000). Smaller companies have a higher level of flexibility and fewer marketing communications (Aragon-Sanchez and Sanchez-Marın, 2005; Evatt et al., 2005). SMEs build closer relationships with customers, facilitating customer value creation (Raju et al., 2011; Somohano-Rodrigues et al., 2020). By making more personalized offers, smaller companies can gain market share in the areas where bigger rivals are not specializing (Einwiller and Boenigk, 2012; Halimi et al., 2011). From another side, compared to larger rivals, SMEs may apply less technological innovations and have decentralized decision making (Aragon-Sanchez and Sanchez-Marın, 2005; Evatt et al., 2005; Ongori and Migiro, 2010). It may negatively impact the control function and neglect the IMC effectiveness. In SMEs, managers may see the IMC process implementation as a cost that exceeds the benefit (Schreyogg and Kliesch-Eberl, 2007; Pantouvakis et al., 2017). Thus, this study analyzes the possible variations in IMC outcomes and customer performance mediation role with the company size moderating effect.

Additionally, marketing research should consider the institutional context. Under the influence of an uncontrollable external environment, managerial decision-making may vary (Cadogan, 2010; Scott, 2008). For example, the availability of data is essential for successful IMC implementation. Due to less market activeness, the lack of available data can negatively influence IMC implementation in the developing economy compared to the developed one (Butkouskaya et al., 2021b; Li and Liu, 2014). In SMEs in a developing economy, fewer communications and smaller customer databases may limit their internal knowledge even more (Einwiller and Boenigk, 2012; Low, 2000; Reid, 2005). However, more market information and fewer control levels in the developed economy may negatively impact SME integration effectiveness (Evatt et al., 2005; Ongori and Migiro, 2010; Somohano-Rodrigues et al., 2020). Also, due to lower competitive intensity in developing economies, SMEs could gain market share easier. However, fewer network opportunities may hurt SMEs’ capacity (Butkouskaya et al., 2020; Raju et al., 2011; Shinkle et al., 2013). Thus, this study compares the IMC outcomes effectiveness and customer performance mediation in SMEs in an intercountry context.

This paper investigates the specific role of customer performance in IMC outcomes in various size companies applying inter-country context. Taking the customer-centric nature of IMC, this research contributes to using marketing as an administrative discipline (Salcedo, 2021). The study analyzes IMC outcomes in the complex IMC-performance model. Considering the customer-central nature of the IMC concept, the customer performance mediating role is analyzed. Recognizing that SMEs more often apply focus strategies to gain market leadership, the article examines the moderating role of company size on IMC outcomes. Following the need to generalize the marketing models, this research contributes to the international marketing research by applying inter-country comparative analysis of IMC outcomes in SMEs in a developed and developing market. From the managerial perspective, the results may help explain the specific role of customer performance in IMC implementation effectiveness towards improving market and financial performance. It additionally reveals the value of the company’s flexibility and formalization level on IMC effectiveness. Moreover, the inter-country context provides a vision of possible obstacles for international companies.

2. Literature review

2.1 IMC outcomes and customer performance role

Both theoretical and practical-oriented studies support the customer-centric nature of the IMC concept (Kliatchko, 2008, Kerr and Patti, 2013; Porcu et al., 2017; Kliatchko and Schultz, 2014; Nowak and Phelps, 1994; Reid, 2005). Previous research demonstrated customer data importance in improving communications and transforming them into a competitive advantage (Butkouskaya et al., 2021b; Seric et al., 2015; Li and Liu, 2014). Expressly, the analysis from both customer and company perspectives underlines the strong positive effect of IMC on customer performance (CP), such as satisfaction, value creation, repurchase and intention to recommend (Finne et al., 2017; Mulhern, 2009; Reid, 2005). Message and channel consistency as the main component of the IMC concept facilitates customer perception of the communications, create more realistic expectations and reduces the possibility of cognitive dissonance when evaluating the purchase decision (Butkouskaya et al., 2021a). Crossfunctional coordination of the customer data within the company improves the decisionmaking process and the value creation process (Butkouskaya et al., 2021b).

Companies who apply the IMC concept keep in mind the customer-centric notion and integration of the processes, systems and mental models to link the organization to market and customer (Reid, 2005; Zahay et al., 2004). Research confirms the positive impact of the IMC process on organizational outcomes at various strategic levels (Butkouskaya et al., 2021b; Einwiller and Boenigk, 2012;Kerr and Patti, 2013; Mulhern, 2009;Tafesse and Kitchen, 2017). The message and channel consistency improve the results from marketing campaigns. The integration of market data provides more accurate information for the decision-making on customer value creation and facilitates reaching a more stable marketing position. Further integration of communications at the corporate level helps to attain the financial objectives. However, the studies explain that IMC performance outcomes may have a hierarchical level (Butkouskaya et al., 2021b; Porcu et al., 2017; Reid, 2005; Tafesse and Kitchen, 2017; Luxton et al., 2015). In other words, the existence of additional complex connections between different levels of outcomes may neglect the direct IMC effect while keeping the indirect one. For example, customer data integration would not directly affect the company’s market position. However, knowing customers better may help the company improve customer value (intermediate customer performance outcome). Higher customer satisfaction may cause more positive word-of-mouth (Butkouskaya et al., 2021a). It may help the company attract new customers and increase marketing outcomes (such as market share and growth). Moreover, the IMC process implementation would not improve the commercial ratios of the company. Even opposite integration may require additional investments. Also, managers may perceiv IMC as a negative for financial performance (Shinkle et al., 2013). However, through intermediate customer performance impact and improved customer retention, the company can improve financial stability. Thus, the research suggests the following:

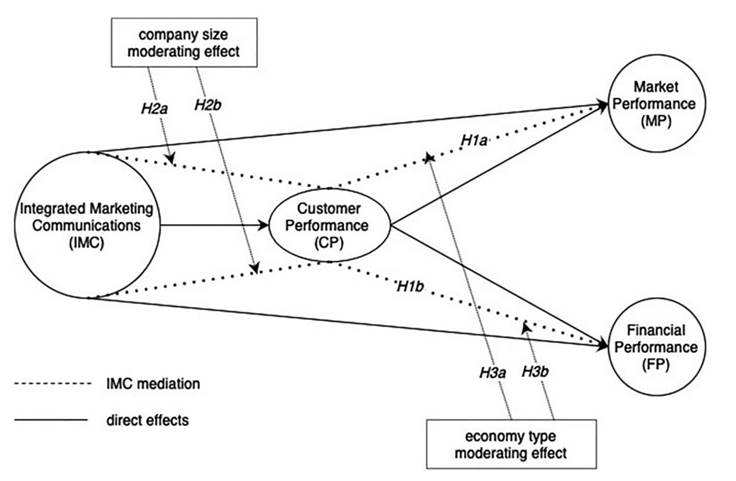

H1. Customer performance mediates the IMC effect on organizational performance.

H1a. Customer performance mediates the IMC effect on market performance.

H1b. Customer performance mediates the IMC effect on financial performance.

2.2 The firm size moderating effect

IMC implementation effectiveness may vary in firms of different sizes (Christensen et al., 2008; Low, 2000; Reid, 2005; Einwiller and Boenigk, 2012; Nowak and Phelps, 1994; Raju et al., 2011). SMEs have fewer customers and less complex brand hierarchies than larger firms (Reid, 2005). It may facilitate message consistency and channel integration. Smaller companies may be more effective in IMC implementation due to lower levels of formalization and simplified organizational structures (Einwiller and Boenigk, 2012; Christensen et al., 2008; Low, 2000). Being more flexible, SMEs might perform cross-functional coordination and share information within the company easier. As a result, smaller firms can respond to market changes faster than larger rivals. But, from another side, lower formalization may negatively influence integration due to lower level of control (Aragon-Sanchez and SanchezMarın, 2005; Evatt et al., 2005; Somohano-Rodrigues et al., 2020). It may happen due to the decentralized managerial approach typical of less formalized organizations. Also, a lower level of technology adoption in SMEs may harm IMC (Ongori and Migiro, 2010). Tracking and keeping customer data organized can be easier with the implementation of specialized software. Additionally, in the case of more simple marketing activeness, smaller companies may less likely adopt processes consistent with IMC (Low, 2000; Reid, 2005). Being specifically sensitive to resource availability, SMEs can see the IMC process implementation as a cost that exceeds the benefit (Schreyogg and Kliesch-Eberl, 2007; Pantouvakis et al., 2017). In other words, they might not be able to take full advantage of the IMC implementation due to the limited production and operating facilities. However, introducing unique products based on market information contributes to superior performance in SMEs (Avlonitis and Salavou, 2007; Raju et al., 2011).

SMEs can build closer relationships with customers, get more accurate information from communications and improve customer value through personalization (Halimi et al., 2011; Raju et al., 2011; Somohano-Rodrigues et al., 2020). They tend to compete in a narrow market niche, which could facilitate intelligence generation. As a result, SMEs can respond to changing demand and competitors’ actions faster than larger rivals (Aragon-Sanchez and Sanchez-Marın, 2005; Einwiller and Boenigk, 2012). Consequentially, the effect of IMC on the market and financial performance through customer performance could be higher in smaller companies than in larger rivals. Thus, the study can state the following:

H2. The customer performance mediation effect on the IMC and organizational performance relationships is stronger in SMEs than in larger companies.

H2a. The customer performance mediation effect on the IMC and market performance relationships is stronger in SMEs than in larger companies.

H2b. The customer performance mediation effect on the IMC and financial performance relationships is stronger in SMEs than in larger companies.

2.3 SMEs in inter-country context

The IMC implementation in SMEs may vary in different economic types (Butkouskaya et al., 2020). The research on IMC underlines the importance of market data for IMC implementation (Butkouskaya et al., 2021a; Seric et al., 2015). Access to information enhances the IMC as a capability. Companies operating in developed economies with a higher level of competition and more market activeness can implement IMC more successfully (Li and Liu, 2014). While developing economies lacking available customer and competitor data, neglect the IMC effectiveness (Butkouskaya et al., 2021b). In the case of SMEs, this may have even more negative consequences. Additionally, fewer communications and smaller customer databases limit the internal knowledge (Einwiller and Boenigk, 2012; Low, 2000; Reid, 2005). It may happen, for example, because the company gets less feedback from customers. Fewer communications result in a lower effectiveness of marketing communications (Einwiller and Boenigk, 2012; Trainor et al., 2011). More specifically, with little information available, less up-to-date information about customer needs appears in the market. It slows down organizational learning and gaining experience (Shinkle et al., 2013; Zhou and Li, 2010).

Specifically, the research shows lover impact of IMC on market performance in SMEs in developing compared to developed economies (Butkouskaya et al., 2020). Due to lower competitive intensity in developing economies, SMEs could gain market share easier. However, the lack of institutional development and, as a result, fewer networking opportunities probably hurts the SMEs’ ability (Butkouskaya et al., 2020; Raju et al., 2011; Shinkle et al., 2013). So, even having chances, it is not that easy for SMEs to enter new markets and grow. Also, in developing economies, managers often prefer less risky decisions and choose priority products rather than process optimization (Jayaram et al., 2015; Shinkle et al., 2013). It may additionally neglect the possible effect of IMC through customer performance on financial results. Following on the information mentioned above, we suggest the following:

H3. The customer performance mediation effect on the IMC and organizational performance relationships is stronger in developed than in developing economies.

H3a. The customer performance mediation effect on the IMC and market performance relationships is stronger in developed than in developing economies.

H3b. The customer performance mediation effect on the IMC and financial performance relationships is stronger in developed than in developing economies.

Following the literature review mentioned above, Figure 1 groups all the hypotheses proposed for the graphical visualization and further testing.

3. Method

3.1 Research design

The sample consists of the primary data from managers’ surveys. To generalize the research results, it is based on the data from two data points: Belarus (developing economy) and Spain (developed economy) (Cadogan, 2010). The reasoning for the country selection was to make an inter-country comparison of the results between different economic types. The basis for the choice was the level of market activeness, competitive intensity and the national entrepreneurship context. For Spain as a developed economy, it is a more typical higher level of marketing activeness and competition. Belarus represents a developing economy with fewer marketing investments and a low-to-medium level of competition (Butkouskaya et al., 2021b). Also, the entrepreneurial context is more favorable in Spain than in Belarus (Bosma et al., 2019; Butkouskaya et al.(2021a).

3.2 Data collection

The data for the research were collected in the years, 2016 to 2017 . The original questionnaire in English was translated into the Russian language (for Belarus) and Spanish (for Spain).

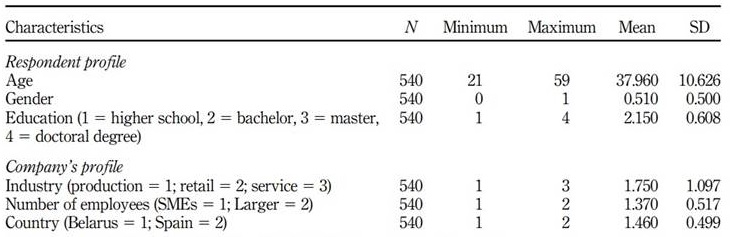

Before sending the survey, it has been pretested among theoretical and practical specialists. The questionnaire was distributed through email. A phone call to managers was made before sending the survey to obtain a higher response rate. All forms are guaranteed anonymously by the respondents. To avoid a bias in the sample, the respondents filled in the information on their age, gender, education. Also, the questionnaire included information about the company’s profile (such as industry and business type, number of employees). Finally, based on the number of employees, this study classifies companies as SMEs (with 250 and fewer employees) and larger companies (with more than 250 employees). The final Sample is presented in Table 1.

3.3 Measurement scales

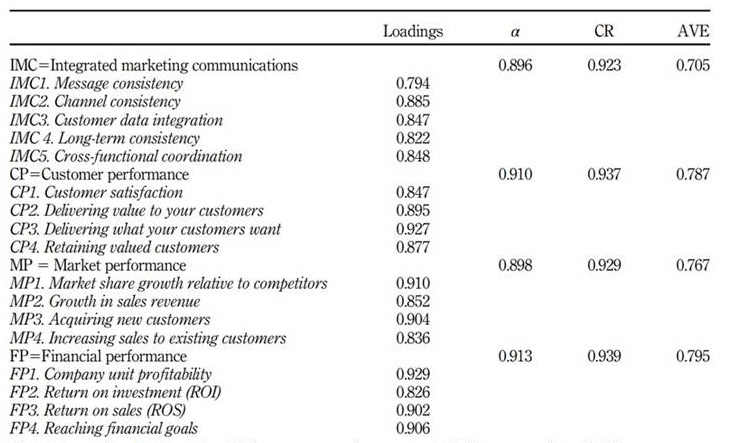

The study uses the measurement scales previously approbated in the literature (Appendix). The 5-Likert scales are applied. The IMC concept is measured as a second-order construct consisting of five components: message consistency, channel consistency, customer data integration, long-term consistency and cross-functional coordination (Butkouskaya et al., 2021b). The customer, market and financial performance are estimated as first-order constructs (Vorhies and Morgan, 2005). Regarding the formative constructs, the data obtained in the study has no multicollinearity problems (Table 2).

3.4 Analytical procedure

The research uses partial least squares structural equation modeling (PLS-SEM) for data analysis and hypothesis testing (Chin et al., 2003). PLS-SEM is appropriate in our case for several reasons: it is suitable for data samples with a small number of respondents (we have less than 250 for each subgroup); it shows fewer restrictions on data normality; it is also an accepted technique for international marketing studies (Chin, 2010; Fornell and Bookstein, 1982; Hair et al., 2019; Reinartz et al., 2009).

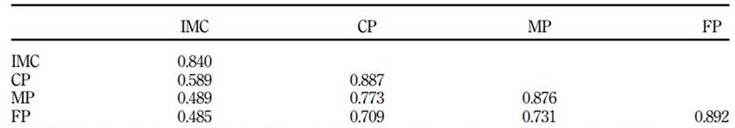

The data was processed using SmartPLS 3.0 software (Hair et al., 2017, 2021). The analysis confirms the global model fit based on the main recommended criterion such as the standardized root means squared residual (SRMR), the unweighted least squares discrepancy (duls) and the geodesic discrepancy (dg) (Dijkstra and Henseler, 2015). The PLS model examination consists of two main stages: first, the estimation of the measurement model and second, the evaluation of the structural model. The measurement model was estimated on the construct reliability and validity parameters and the discriminant validity (Henseler et al., 2016). The items in the measurement model fulfilled the required critical criteria: Cronbach’s alphas are above 0.7, composite reliability (CR) values are greater than 0.7, average extracted variance (AVE) values are above 0.5 and the outer loadings are higher than 0.7 (Table 3). Then, the theoretical model is evaluated using the bootstrapping procedure (2021). A three-step analysis of the measurement invariance of composite models (MICOM) by Henseler et al.(2016)was run as an essential procedure before multi-group analysis (MGA)

Table 1 Sample descriptive statistics

Note(s): MSD. Standard deviation N 5 it referred to the number of responses

Source(s): Own elaboration

Table 2 Estimation of the measurement mode

Note(s): Cronbach’s alpha, AVE 5 average variance extracted; CR 5 composite reliability

Source(s): Own elaboration

Further, using the SmartPLS3 algorithm, the indirect effects were calculated to check the mediation (Hair et al., 2017, 2021).

4. Results

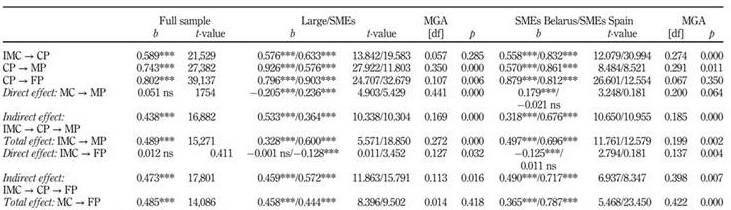

Table 4 presents the hypothesis testing results for the global data. The results confirm previous findings on the positive direct effect of IMC on customer performance (0.589; p < 0.01) and of customer performance on both markets (0.743; p < 0.01) and financial performance (0.802; p < 0.01). Also, IMC direct effects on market and financial performance are not significant (0.051; p > 0.1, and 0.012; p < 0.1). However, through customer performance, IMC has an indirect positive effect on both the market (0.438; p < 0.01) and financial performance (0.473; p < 0.01). Also, the total effects of IMC on the market and financial performance are significantly strong (0.489; p< 0.01, and 0.485; p < 0.01). It approves the existence of the full mediation effect of the customer performance on IMC outcomes. Thus, H1a and H1b are supported, and H1 is supported.

Opposite to the expectations, further MGA does not confirm any significant differences in IMC effect on the customer performance between SMEs and larger companies ((df) 5 0.057; p > 0.1). However, the customer performance effect on the market and financial performance varies significantly in smaller and larger companies. Interestingly, the customer performance effect on the market performance is stronger in larger firms than in SMEs ((df) 5 0.350; p < 0.01). While the impact of the customer performance on financial performance, on the opposite, is stronger in SMEs than in larger rivals ((df) 5 0.107; p < 0.01).

Also, the customer performance mediation effect on IMC outcomes is different between SMEs and larger companies. Specifically, the direct effect of IMC on market performance is significantly different in various size companies. It is negative in larger companies but positive in SMEs ((df) 5 0.481; p > 0.01). And even the indirect effect of IMC on market performance is stronger in larger compared to SMEs companies ((df) 5 0.169; p > 0.01). But the total effect is stronger in SMEs compared to larger rivals ((df) 5 0.272; p > 0.01). There are also some significant differences between smaller and larger firms in a customer performance impact on IMC and financial performance relationships. But in this case, the direct effect of IMC on financial performance is not significant in larger firms and negative in SMEs ((df) 5 0.127; p > 0.01). The indirect effect of IMC on financial performance through IMC is stronger in SMEs compared to larger companies ((df) 5 0.113; p > 0.05). However, there are no significant differences in the total effect of IMC on financial performance ((df) 5 0.014; p < 0.01). Thus, H2a and H2b are supported, but H2 is rejected.

Additional MGA of the data from SMEs in inter-country context demonstrates significantly stronger impact of IMC on customer performance, and customer performance

Table 3 Correlation matrix and the discriminant validity

Note(s): IMC 5 integrated marketing communications, CP 5 customer performance, MP 5 market performance, FP 5 financial performance. Mean, the average score for all items included in this measure, SD5 standard deviation. Diagonal elements are the square root of the average variance extracted (AVE) between the constructs and their measures. Off-diagonal elements are correlations between constructs. For discriminant validity, diagonal elements should be larger than off-diagonal

Source(s): Own elaboration

Table 4 Evaluation of the structural model

Note(s): : IMC 5 integrated marketing communications, CP 5 customer performance, MP 5 market performance, FP 5 financial performance. b 5 path coefficients; df 5 path coefficient difference; ns 5 not significante; S 5 supported, R 5 rejected; SE 5 suppression effect, FM 5 full mediation, PM 5 partial mediation. 5 p-Value; * 5 p 0.01, ns 5 p 0

Source(s): Own elaboration

on market performance in Spain compared to Belarus ((df) 5 0.113; p > 0.01, and (df) 5 0.113; p > 0.01). However, there are no significant differences between developed and developing economies in the case of the customer performance effect on financial performance ((df) 5 0.067; p < 0.01).

The results of SMEs operating in developed and developing markets data analysis demonstrate the significant differences between Belarus and Spain. The direct effect of IMC on MP is positive in Belarus and not significant in Spain ((df) 5 0.200; p < 0.1). Meanwhile both indirect effect of IMC on MP through customer performance and total effect of IMC on MP is stronger in Spain compared to Belarus ((df) 5 0.185; p < 0.01, and (df) 5 0.199; p < 0.01). In this case, customer performance partially mediates IMC-MP relationships in Belarus and full mediation in Spain. Also, the IMC effect on financial performance is negative in Belarus and not significant in Spain ((df) 5 0.137; p < 0.01). In contrast, both the indirect effect of IMC on financial performance through customer performance and the total effect of IMC on financial performance is stronger in the developed economy compared to a developing one ((df) 5 0.398; p < 0.01, (df) 5 0.422; p < 0.01). In this case, customer performance has a suppression effect in developing economies and a full mediation effect in the developed ones. Thus, H3a and H3b are supported and H3 is supported.

5. Discussion

5.1 Theoretical implications

From the theoretical perspective, the results confirm previous findings on the positive effect of IMC on customer performance (Einwiller and Boenigk, 2012; Kerr and Patti, 2013; Mulhern, 2009; Tafesse and Kitchen, 2017). Also, the data analysis proves the positive effect of customer performance on the market and financial performance (Butkouskaya et al., 2021b; Porcu et al., 2017; Reid, 2005; Tafesse and Kitchen, 2017; Luxton et al., 2015). Moreover, as previously explained, this study supports the customer performance mediation effect of the IMC, market and financial performance relationships (Butkouskaya et al., 2021a). However, IMC’s indirect effect through customer performance confirms the hierarchical level of performance outcomes. Furthermore, the total IMC outcomes on the firm’s performance are significant (Butkouskaya et al., 2021b; Porcu et al., 2017; Reid, 2005; Tafesse and Kitchen, 2017; Luxton et al., 2015).

Additionally, the analysis of the company size moderation effect demonstrates the existence of significant differences in IMC outcomes between SMEs and larger firms (Butkouskaya et al., 2020; Christensen et al., 2008; Low, 2000; Reid, 2005; Einwiller and Boenigk, 2012; Nowak and Phelps, 1994; Raju et al., 2011). In particular, the research results reject the suggestion about the higher impact of IMC on customer performance in SMEs than in larger firms. So, contrary to the expectations, not SMEs but larger companies implement customer performance to enhance market performance more effectively. Nevertheless, in the case of the customer performance effect on financial performance, SMEs are more successful than larger firms. Moreover, there are significant differences in company size moderation effect on customer performance mediation. The mediating role of the customer performance in IMC and market performance relationships will be stronger in larger firms. In IMC and financial performance, relationships will be stronger in SMEs. Specifically, in SMEs, customer performance has a full mediation effect and eliminates the direct positive impact of IMC on market performance. In larger firms, customer performance has a suppression effect and compensates the direct negative influence of IMC on market performance, turning it positive (MacKinnon et al., 2019). Opposite, in the case of IMC and financial performance relationships, the customer performance has a full mediation effect and eliminates the IMC direct effect on financial performance in larger firms. In SMEs, customer performance has a suppression effect. Customer performance changes the negative impact of IMC on financial performance into a positive one. Interestingly, the total impact of IMC on market performance is significantly stronger in SMEs than larger rivals. Also, interestingly, there are no significant differences between SMEs and larger firms in the total IMC effect on financial performance.

Finally, the inter-country analysis of the SMEs’ data confirms previous findings on the stronger IMC effect on the customer performance in SMEs operating in developed than developing economies (Butkouskaya et al., 2020; Einwiller and Boenigk, 2012; Li and Liu, 2014; Trainor et al., 2011). Also, as suggested, in SMEs, the customer performance effect on market performance is stronger in developed than in developing economies ((Butkouskaya et al., 2020). However, there is no significant difference in customer performance effect on financial performance between developed and developing markets. Also, as suggested, variations exist in SMEs’ customer performance mediation effects in an inter-country context (Cadogan, 2010; Scott, 2008). The customer performance mediation of the relationships between IMC and organizational performance (market and financial) is stronger in developed compared to developing economies. Specifically, in SMEs in developed markets, customer performance partially reduces the direct positive effect of IMC on market performance, while in developing economies, customer performance reduces it entirely. While, in SMEs in developing economies, customer performance has a suppression effect and compensates for the direct negative influence of IMC on financial performance. The positive customer evaluation turns a negative IMC effect into a positive one (MacKinnon et al., 2019). Also, the total impact of IMC on the market and financial performance is positive and significantly stronger in developed economies.

5.2 Managerial implications

This research supports the practical perspective that message consistency, customer data integration and cross-functional coordination positively influence customer satisfaction and value creation. Also, companies that pay more attention to customer satisfaction may increase their market share, growth and financial ratios. Nevertheless, customer evaluation of the company’s activities may neglect the positive impact of IMC on the market and financial performance. Even though, by integration of market communications, firms may gain better market position and financial results. However, this effect will have a hierarchical nature and only be possible through customer performance. It additionally demonstrates the importance of customer performance in IMC implementation.

However, the IMC implementation effectiveness towards performance outcomes varies in firms of various sizes. Probably, there is a different nature of these variations. In the case of the IMC impact on customer performance, SMEs may gain over larger rivals because of higher flexibility, lower formalization and more simple integration due to fewer number communications (Einwiller and Boenigk, 2012; Christensen et al., 2008; Low, 2000; Reid, 2005). However, larger firms are compensating in IMC effectiveness towards gaining customer satisfaction due to higher-level resource availability, greater technology adoption, more control and centralized decisions (Aragon-Sanchez and Sanchez-Marın, 2005; Evatt et al., 2005; Ongori and Migiro, 2010; Somohano-Rodrigues et al., 2020; Schreyogg and Kliesch-Eberl, 2007; Pantouvakis et al., 2017). As a result, neither smaller nor bigger firms gain a distinctive advantage. Interestingly, SMEs lose over larger rivals to transfer customer satisfaction into higher market share and growth. Even being aware of the opportunities, SMEs do not have enough resources to react to market changes quickly. Also, when implementing a new market idea, SMEs are more vulnerable to imitation from larger rivals who dispose of more resources (Avlonitis and Salavou, 2007; Raju et al., 2011). Furthermore, curiously, opposite, SMEs are gaining the ability to transfer customer satisfaction towards improving financial outcomes. It may happen since, in smaller companies, the cost of IMC process implementation can be lower than in larger ones. Also, in SMEs, any minor change in financial outcomes would be more visible in overall numbers than in larger companies.

Additionally, the results confirm that customer performance plays a significant role in IMC outcomes both in SMEs and larger companies. Specifically, the IMC process implementation, together with the ability to build closer relationships with customers through unique and personalized offers, can be a distinct competitive advantage for smaller firms aiming to gain market position (Aragon-Sanchez and Sanchez-Marın, 2005; Einwiller and Boenigk, 2012). Nevertheless, SMEs cannot gain over larger rivals in IMC towards enhancing financial results. Communication integration and cross-functional coordination require extra resources that are limited in SMEs. Thus, IMC implementation may hurt the company’s financial results (Schreyogg and Kliesch-Eberl, 2007; Pantouvakis et al., 2017). However, by improving customer satisfaction and value through personalization and unique offer, smaller companies can compensate for the investments needed and even see a good financial outcome. In other words, even not being able to gain in financial outcomes, the final benefit of IMC may exceed the implementation costs.

Also, the inter-country context changes the ability of SMEs to implement IMC effectively. In the developing economy, the IMC-related decision-making process is more complicated due to lower market activeness and less market information available (Butkouskaya et al., 2020; Li and Liu, 2014; Seric et al., 2015). It negatively affects the IMC’s effectiveness towards improving customer satisfaction and creating value for customers. Moreover, SMEs in developing markets are less effective in gaining market share. However, SMEs in both developed and developing economies would have the same effect on financial ratio outcomes. The possible reason might be the lack of institutional development and networking opportunities in developing markets (Raju et al., 2011; Shinkle et al., 2013). Partnership with other SMEs in similar or supporting industries helps smaller firms add more uniqueness in their personalized offer and target a higher number of new customers. Also, the role of customer performance for IMC outcomes varies in inter-context. It additionally confirms that market information and networking are essential for the SME’s success. Also, SMEs in developing economies with lower access to financial resources are more vulnerable than SMEs in developing markets (Bosma et al., 2019; Butkouskaya et al., 2021a; Jayaram et al., 2015). Finally, less entrepreneurship support in developing markets creates barriers for the SME’s success and survival.

5.3 Future research agenda

As with any research, this article has some limitations which may stimulate further research lines. It just focuses on the analysis of three performance outcomes (customer, market and financial). Further, studies can create a more complex model of IMC-performance relationships. The study only checks on the customer performance mediating role. However, Butkouskaya et al. (2021b) also suggested the possible mediating effect of market performance in IMC outcomes. The sample data includes respondents from different industries. A separate analysis could be applied, for example, for the service industry where customer evaluation plays a vital role. Also, the company size effect can be evaluated and compared between micro, small, medium and large companies. Other external moderators can be added to the analysis, such as entrepreneurship policies and networking opportunities. Finally, for further results’ generalization, the data from more countries can be compared.

6. Conclusions

This article provides both theoretical contributions and practical implementations. Following the research objective, this paper empirically confirms the vital role of customer performance in IMC effectiveness for market and financial performance. The lack of direct IMC outcomes proves the customer-centric nature of the IMC concept. Meanwhile, the IMC indirect effect on firms’ results through customer performance confirms the hierarchical nature of IMC outcomes.

Also, it is pioneering research that applies the firm’s size moderating effect in IMC outcomes analysis. The results close the gap on possible variations in IMC implementation effectiveness in firms of various sizes. It confirms the variation of the customer performance effect on IMC outcomes. The role of customer satisfaction is more vital in larger than in smaller companies in case of IMC impact on market performance. However, on the opposite, the customer performance effect is more potent in SMEs in the case of IMC and financial performance relationships. However, in the total IMC effect, SMEs can still gain an advantage over larger rivals. Applying IMC with a strong customer focus, SMEs can gain over larger rivals in market position and financial outcomes.

Moreover, the study contributes to the entrepreneurship and international marketing literature by investigating the variations of IMC outcomes in SMEs in an inter-country context. The results underline that SMEs in the developed economy are more effective in IMC than in developing ones. However, interestingly, the customer performance role in IMCmarket performance relationships is more potent in developing economies. Meanwhile, the customer performance mediation effect on IMC-financial performance is more substantial in developing economies.

From the practical perspective, the study underlines that IMC implementation should be applied with a strong emphasis on customer performance management. Customer satisfaction may neglect the IMC effect in enhancing market position and financial results. Also, IMC effectiveness has a hierarchical nature, and through customer performance, the IMC has an indirect impact on firms’ outcomes such as market share, growth and financial ratios. Also, the benefits of IMC implementations for the firms’ outcomes vary in SMEs and larger companies. Larger companies having more resources can react faster to the increase in demand. Thus, from IMC implementations, larger companies would grow in the market share more than smaller ones. However, smaller companies would have more visible results from IMC implementation for the financial outcomes as the cost of IMC implementation for SMEs would be lower. Overall, SMEs with a strong focus on customer satisfaction, value and relationships can implement IMC as a distinctive advantage over larger rivals. However, the SMEs’ capability to implement IMC will vary depending on the institutional environment. In developing markets, SMEs are less effective in channel and message integration due to less market information available, lacking resources and networking opportunities. It can be a point of reference for government organizations in developing markets. Facilitating networking and providing SMEs with extra information resources may help their decisionmaking and market position growth. Also, additional financial support may reduce the level of risk-avoidance. More support for SMEs may help their sustainable development. It is an important issue considering the critical role of SMEs in the overall economy and social wellbeing