1. Introduction

The question of how income should be distributed, and what level of inequality is acceptable in society has been pondered upon by many economists. Some argue that income ought to be distributed according to the contribution provided by the income earner so that more productive people earn higher than less productive ones (Byrns and Stone, 1989, p. 591). Another argument that is put forward by Karl Marx (1818-1883) is that distribution should be done according to people’s needs although this view has received sharp criticism for its tendency to encourage laziness. Others yet believe that income should be distributed equally among all individuals, and this too has been criticized as being likely to reduce productivity in the society (Conrad, 2016). The Greek philosopher Plato argues that income distribution should ensure that the income of the richest person should not exceed four times the income of the poorest person in society (Byrns and Stone, 1989). This is however not the case with our societies today where some people are extremely wealthy while others cannot even afford the necessities of life like proper food and shelter.

Some form of inequality, whether in income or labour, exists in every economy. This may result from the ability of some people to perform some tasks better than others, work longer, take risks, warranting higher payments (Schmidt et al., 2015 and Checchi et al., 2017).

Differences in education and skills also qualify people into different job groups (van Damme, 2014), in addition, some people inherit wealth while others do not (Elinder et al., 2018). Economists have different views on how this existing inequality level should be handled (1).

According to theoretical views, one of the macroeconomic variables that explain income inequality is debt. This relationship, however, is not straightforward. Productive use of debt could lead to a reduction in inequality levels (You and Duttf, 1996) while high debt values could lead to volatility of income and as a result increase inequality (Azzimonti et al., 2014). The direction and impact of this relationship, therefore, varies from country to country depending on their macroeconomic policies (Anselmann and Kramer, 2016).

The redistributive theory states that an increase in internal debt will lead to an increase in inequality levels in an economy. Internal debts are held in the form of government securities, coupled with the fact that the government securities have relatively high prices, it is only the rich who can purchase the bonds. Consequently, when debt is serviced, it is the rich class of bondholders who again receive interest from the debt amounts. Being that debt servicing is achieved through taxation, resources end up being transferred from the poor to the rich bondholder class. The redistributive theory forms the main motivation of this study since there is little attention given to analysing the effect of debt on income inequality, a gap which this study seeks to fill. The main hypothesis of this study is to ascertain the impact of high values of debt on income inequality level as stated in the debt redistribution theory.

There are limited studies on this topic, but to the best of our knowledge, none of them examine the Kenyan economy. Debt-inequality nexus is a peculiar phenomenon for every country and the current study will be specific to Kenya. In this study, the effect of internal and public debt on income inequality is examined by using ARDL Method for the 1970-2018 period in Kenya. After determining the long-term relationships between variables, Toda Yamamoto Causality tests are also conducted to ascertain the existence of causality relationships between debt and inequality. The rest of the study will be divided as follows: the next section will provide theoretical and empirical background on the study, followed by the methodology and data section while the last section is where the results, conclusion and policy recommendations will be provided.

2. Literature review

2.1 Theoretical background

In a bid to finance expenditures, the government may resort to one or both of two options debt financing and/or an increase in taxes. The impacts of these forms of financing, most especially debt financing on the economy have been analysed by various economists. David Ricardo argues that there is no change in the national output of the overall economy when either form of financing is adopted, commonly known as Ricardian equivalence. This term was formally used by Barro (1989). The term has since been argued by economists as one of the theoretical views on public debt and inequality relationship. A decline in government budget deficit is offset by an increase in private savings implying no change in the national savings amount (Ricardo, 1817). This is because if there is an increase in government debt currently, the forward-looking consumer increases their savings as opposed to increasing their consumption to cater for possible future increases in taxes. The increase in savings can then be spent in the bonds market further increasing government debt. It is the rich in the society who often save as compared to the poor who are likely to channel the increase in disposable income to consumption. The implication is that government borrows from the rich but taxes both rich and poor to pay those debts. Therefore, government financing decisions may impact inequality position even though it may not impact output as postulated by Ricardo.

Another explanation for the theoretical relationships between domestic debt and inequality is that domestic debt causes income redistribution. According to this theory, internal debt causes income redistribution in the economy since the people who purchase government bonds and treasury bills are the rich while during repayment, the burden of repayment lies on the entire tax base. This implies that during the debt repayment process, although rich people also pay tax, they receive interest rates from their treasury bills and bonds thus gaining more income. Through this process, the rich lenders become richer while the poor become poorer thereby increasing the inequality gap (Alesina and Tabellini, 1987; Elmendorf and Mankiw, 1998, p. 8; Mishkin, 2014, p. 438; Salti, 2015; Bohoslavsky, 2016, p. 189). This effect, however, may not be experienced in the short run because most rich people are highly dependent on capital income while the poor rely mostly on income from labour. When a debt crisis occurs due to a high amount of debt in the economy, a decline in output is likely to be experienced implying a reduction in both capital and labour incomes. In the long run, however, the capital income owners receive compensation for their capital making them richer while the poor are not compensated and tend to become poorer.

The direction of the relationship between debt and income inequality can also be from inequality to debt (Kumhof, 2015; Bohoslavsky, 2016, p. 183). With inequality, there is an existing possibility of reduced future consumption and so private investors seeking to maintain their present consumption into the future will purchase government securities when they are issued. The demand for government bonds thus increases. Through elections and exercising of democratic rights, the government is forced to issue more bonds implying higher public debts. Inequality thus triggers both the demand and supply of bonds. The rich vote for the bonds and treasury bills because it is a safe way of keeping money and ensuring continued consumption. The poor keep voting because of reduced international interest rates which are attractive to them.

2.2 Empirical literature review

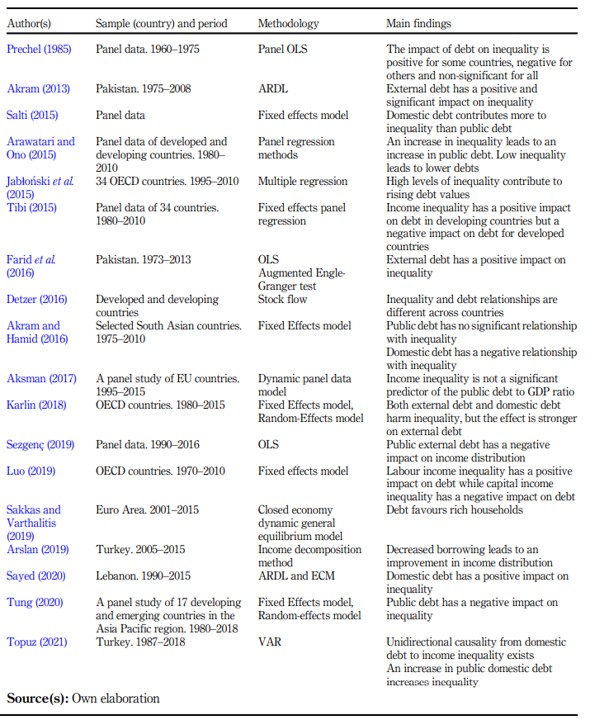

Much of the current literature on inequality pays particular attention to the relationship between inequality and economic growth. Similarly, a considerable number of empirical studies on debt and economic growth have been conducted. However, the studies on the relationship between debt, both public and internal, and income inequality are quite limited. These studies are summarized in Table 1.

Sakkas and Varthalitis (2019) and Tung (2020) ascertain that public debt harms inequality for countries in the Euro Area and Asia-pacific region respectively. These studies taken together suggest that governments may use public debt as a means of reducing inequality. However, Akram and Hamid (2016) analyse the impact of internal debt and external debt separately. The study concludes that only internal debt reduces inequality, whereas external debt has no impact on inequality. The study finds no statistically significant difference in the impact of external debt on the rich and the poor in South Asian economies.

Country-specific studies include Akram (2013) and Farid et al. (2016) who provide an analysis on how external debt impacts inequality levels in Pakistan. The former study uses the OLS method while the latter uses the ARDL method of analysis. Both studies find that external debt is not pro-poor as they prove the existence of a positive relationship between external debt and income inequality in Pakistan. Sayed (2020) and Topuz (2021) find a positive impact of domestic debt on income inequality in Lebanon and Turkey respectively. In a study conducted for Turkey, Arslan (2019) proves the applicability of the redistribution effect in Turkey. The results from this study indicate that there is an improvement in income inequality levels in the country when public borrowing reduces.

Some of the panel studies that have considered the inequality and debt relationship for both developing and developed economies belong to Prechel (1985), Arawatari and Ono (2015), Salti (2015), Tibi (2015), Detzer (2016) and Sezgenç (2019). Detzer (2016)uses financialization to explain the differences in debt and inequality for developed and developing economies while Prechel (1985) explains that the insignificant debt and inequality relationship in these economies is due to the differences in export and investment strategies. Sezgenç (2019)on the other hand attributes the differences in debt and inequality relationships to the political social setup of the countries and Tibi (2015) states that the initial level of income and development level of an economy highly influences the debt and inequality relationship. Arawatari and Ono (2015) find that countries with high inequality tend to have higher debt amounts compared to countries with lower inequality.The study emphasizes the role played by loose fiscal policies in causing high debt levels and high inequality. Salti (2015) concludes that internal debt is responsible for the increased inequality in different economies. Governments should adopt alternative sources of financing to help reduce inequality.

The relationship between debt and inequality for OECD countries is analysed by Jabłonski et al. (2015), Karlin (2018) and Luo (2019). The studies are conducted for different periods. While Jabłonski et al. (2015) claims that rising inequality contributes to an increase in public debt, Karlin (2018) states that there is a negative impact of external and internal debt on inequality for OECD countries. In this study, the impact of external debt is found to be stronger in reducing income inequality compared to internal debt. Unlike the other studies, Luo (2019) introduces labour and capital inequality. Inequality in labour contributes to higher debts in these economies while inequality in capital leads to a reduction of debt levels in these economies.

Finally, a remarkable study due to the results obtained belongs to Aksman (2017). The author analyses the impact of inequality and poverty on public debt to GDP ratio for European countries. This study finds out that inequality and poverty are not very significant in explaining changes in public debt. Looking at the studies in the literature, especially on the relationship between internal debt and income inequality, it can be said that they are quite limited. To the best of our knowledge, no study has examined the debt and income relationship for Kenya. The gap in the literature that arises due to an undefined relationship between these variables in Kenya forms the basis for this research.

3. Data and methodology

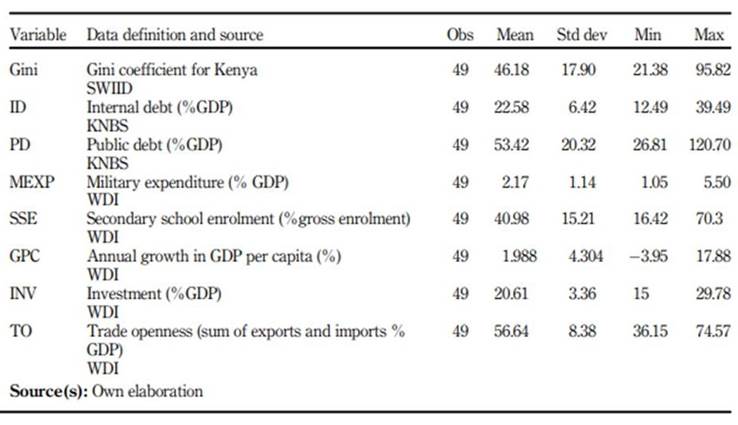

This study uses data for the period 1970-2018 for empirical analysis. The dependent variable is the Gini coefficient which represents income inequality. This data is obtained from the Standardized World Income Inequality Database (SWIID) published by Solt (2020). The internal and public debt data are sourced from the Kenya National Bureau of Statistics (KNBS) while the remaining data is from the World Development Indicator (WDI). Other control variables like military expenditure, human capital, per capita GDP, trade openness and investment are also included. The choice of the control variables is based on their consistent association with inequality as suggested in the studies by Akram (2013) and Salti (2015). Based on economic theory, a positive relationship between internal debt, public debt, military expenditure and investment on income inequality is expected. The variables expected to harm income inequality include GDP per capita, trade openness and secondary school enrolment. Table 2 shows the descriptive statistics and source of the variables.

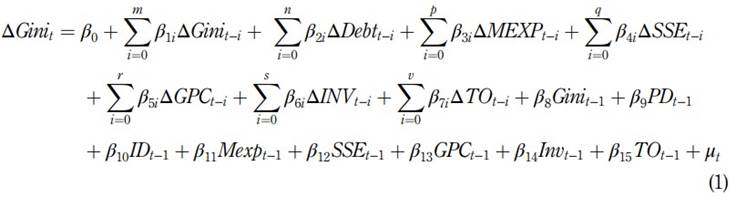

To demonstrate the effect of debt on income inequality in the long run, we used Autoregressive Distributed Lag (ARDL) based boundary test developed by Pesaran et al. (2001). To determine whether cointegration exists between the variables, the following equation is specified (2):

where β 0 is the constant term, Δ is a difference of variables, β 1i ... β 7i and β 8 ... β 15 are the variable coefficients, m, n, p, q,r,s, v, represent the optimal lag length and μ t is the error term.

The optimal lag is chosen based on the Akaike information criterion. To determine the existence of a long-run relationship, we derive the hypothesis below from equation (1):

Ho. β 9 = β 10 = β 11 = β 12 = β 13 = β 14 = β 15 = β 16 = 0 (no cointegration)

H1. β 9 ≠β 10 ≠β 11 ≠β 12 ≠β 13 ≠β 14 ≠β 15 ≠β 16 ≠0 (cointegration)

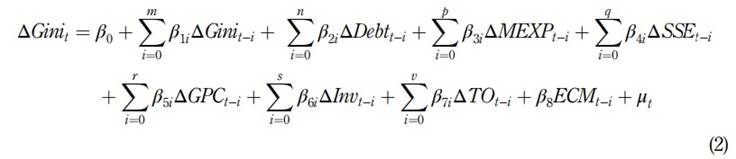

The test results are obtained by comparing the F statistic with the upper and lower bound critical values as suggested by Pesaran et al. (2001). The rejection of the null hypothesis is done when the calculated F statistic is greater than the upper bound value implying the presence of a cointegrating relationship between the variables. To represent the short-run equation, the error correction model used is as shown below:

where β8 is the speed of adjustment coefficient and shows the speed of adjustment in the long run.

After examining the long-term relationships between the variables using the ARDL method, the Toda Yamamoto causality test is applied. The conventional approach for testing the causality relationship was put forward by Granger (1969), however, it is limited as it may lead to spurious results if the variables are non-stationary or cointegrated (Wolde-Rufael, 2005). The Toda Yamamoto test is preferable as it produces reliable results as long as the order of integration does not exceed the lag length (Toda and Yamamoto, 1995). The Toda Yamamoto causality test is implemented in stages with the first step being fitting a VAR equation with k number of lags based on the different information criteria, AIC or SC, similarly, the maximum order of integration (d max ) is made known in this step. The second step is based on the two values (k and d max ) where a new VAR of order (k + d max ) is fitted.

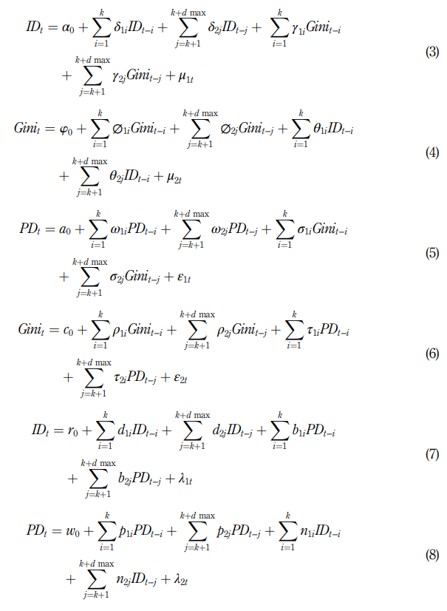

To understand the existence of a causality relationship, a modified Wald (MWALD) test is applied. The resulting parameter has asymptotic χ2 distribution which is important for inferencing. Equations (3-8) are used to test for the Toda Yamamoto causality relationship in the internal debt, public debt and income inequality models

Granger causality from Gini to internal debt (ID), implies that γ1i ≠0 ∀i; granger causality from ID to Gini implies that θ1i ≠0∀i; granger causality from Gini to Public debt (PD) implies that σ1i ≠0∀i; while granger causality from public debt to Gini implies that τ1i ≠0∀i; similarly granger causality from public debt to internal debt implies that b1i ≠0∀i, and granger causality from internal debt to public debt implies that n1i ≠0∀i. The error terms μ1t , μ2t , ε1t, ε2t, λ1t and λ2t are normal (0, δ2 )

4. Empirical results and discussions

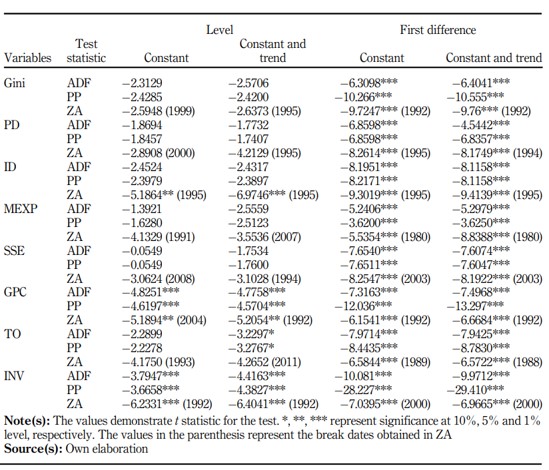

This section presents the results of the ARDL model estimation and Toda Yamamoto causality tests in Kenya for the period 1970-2018. The results of Augmented Dickey-Fuller (ADF), Phillips-Perron (PP) and Zivot-Andrews (ZA), unit root tests are shown in Table 3. After determining that the stationarity level of the variables are I(0) and I(1), the ARDL model can be estimated.

The results of the ADF and PP test above indicate that all the variables are non-stationary at levels except for per capita GDP, trade openness and investment. The remaining variables are stationary after the first difference. The two tests, ADF and PP, provide similar results. On the other hand, the ZA test indicates that internal debt, GDP per capita and investment are stationary at levels while Gini, public debt, trade openness, Secondary school enrolment and military expenditure are stationary after the first difference. Consequently, according to the results of these tests, the variables have different levels of stationarity, I(0) and I(1), the ARDL model suggested by Pesaran et al. (2001) is appropriate for estimating the long-run results.

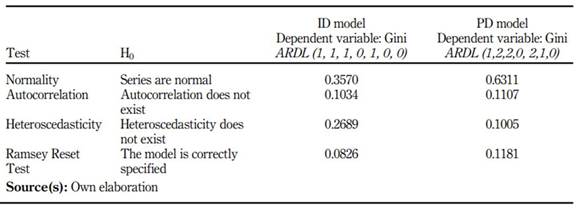

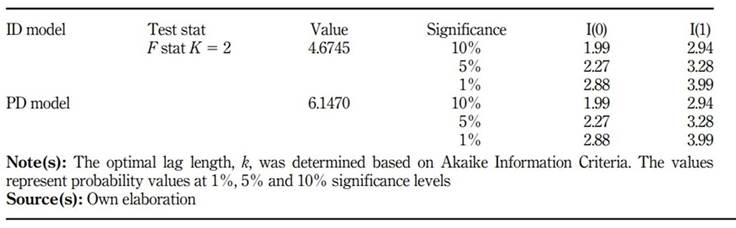

Table 4 presents the diagnostic test results of this model. The results indicate that there are no autocorrelation and heteroscedasticity. The model has normally distributed errors and the functional form is correctly specified.

Table 5 presents the ARDL bounds test results. The F values are larger than both I(0) and I(1) values indicating the existence of a long-run relationship between the variables for both the PD and ID model. While

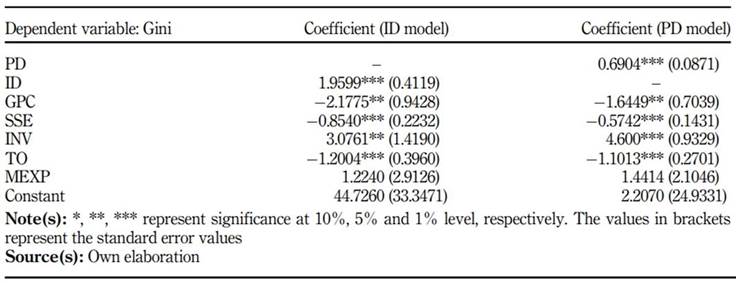

Table 6 presents ARDL model-based long-run coefficient estimations after identifying the existence of cointegrating relationships. Table 6 represents the long-run results test. The findings indicate that increasing public debt has a positive and significant impact on inequality. This is unlike the results obtained by Akram and Hamid (2016) who find that internal debt harms income inequality in South Asian countries. Internal debt also has a positive and significant impact on income inequality, and this is consistent with the redistribution theory which states that internal debt contributes to the redistribution of income from the poor to the rich. Similar results are obtained by Salti (2015), Sayed (2020), and Topuz (2021). The impact of internal debt on income inequality is found to be greater than that of public debt. Similarly, Salti (2015)finds that internal debt has a higher positive impact on inequality than public debt for the panel data study.

GDP per capita is found to have a negative and significant effect on inequality in both the public debt model and the internal debt model. This is because higher GDP per capita implies increased access to opportunities and higher incomes by individuals in the economy which leads to an increase in equality level. Akram (2013) also finds a negative impact of GDP per capita on income inequality. The impact of human capital as shown by secondary school enrolment on inequality is also found to be negative implying that the skills acquired in school are useful for better-paying jobs and that school is a great equalizer. Similar results are obtained by Abdullah et al. (2015) who find that education is particularly significant in reducing inequality levels in Africa.

The impact of investment on inequality for both the models is found to be positive and significant; this can be explained using the Kaldorian view where the impact of investment on inequality does not arise directly but rather indirectly. This indirect impact arises from the fact that it is mostly the rich who save. An increase in savings thus implies growth of the economy but at the expense of increased inequality. Similar results are obtained by Banerjee (2004). Trade openness also has a negative and significant impact on inequality. The negative impact implies that international trade contributes to a reduction of the existing level of inequality in the country. When a country’s level of trade openness increases, it implies that the country is trading more, and the effect of increased trade can indicate an increase in real wages of the workers thus leading to reduced inequality. This is consistent with Heckscher--Ohlin’s theory that inequality decreases with trade openness in developing countries. Similar results are obtained by Ravinthirakumaran and Ravinthirakumaran (2015) for the Asia-Pacific countries.

Military expenditure has a positive and non-significant impact on inequality. This can be because of the existing pay differentials between the military and the civilians, the military are paid a much higher salary as compared to civilians (Ali, 2007; Tongur, 2012 ). Similarly, fewer women are present in the military compared to men and therefore it can be said that this widens gender inequality which is one of the existing inequality types in Kenya.

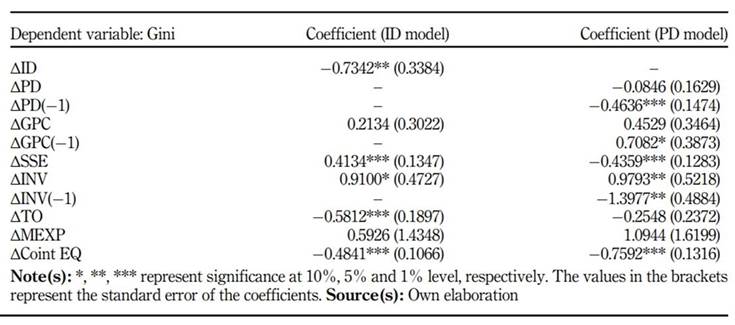

Table 7 shows the short-run coefficient estimates. The error correction terms, which are also the speed of adjustment term for both the internal debt and public debt model, are negative and significant as expected. It implies that the errors are corrected at an adjustment speed of 48% and 75% respectively.

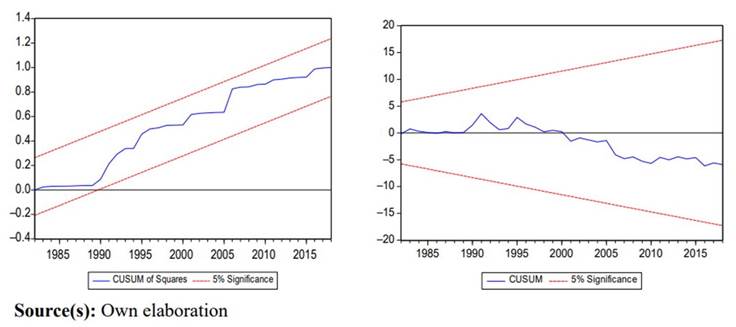

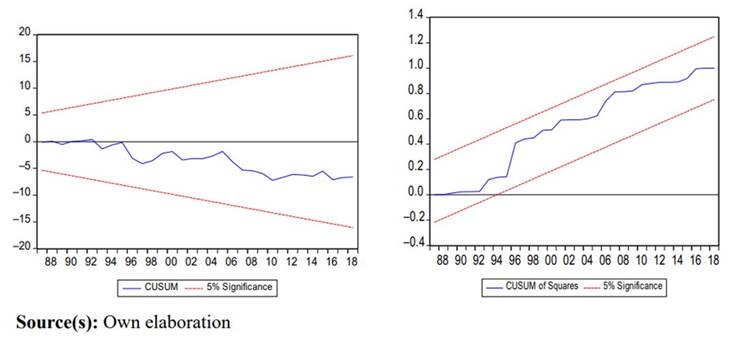

Finally, the results obtained from CUSUM and CUSUMSQ tests proposed by Brown et al. (1975) indicate that the estimated parameters are stable over the period 1970-2018 in Figures 1 and 2.

The Toda Yamamoto causality test is preferable over other causality tests because it can be used when the variables are cointegrated of random order, same order or not cointegrated at all (Ekeke, 2020). This is because the Toda Yamamoto causality test ignores the cointegration property of the variables and fits a vector autoregressive model for the variables at their levels (Wolde-Rufael, 2006).

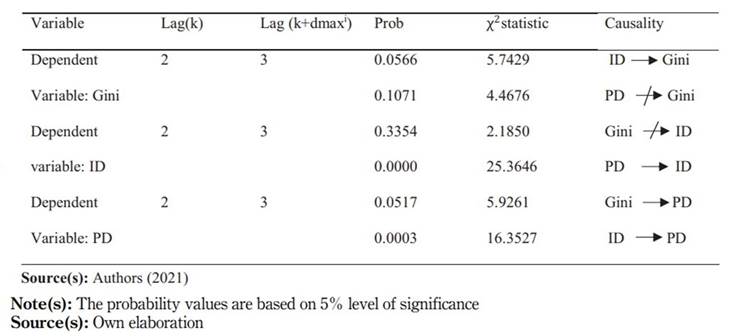

The unit root tests in Table 3 reveal that the maximum order of integration for Gini, internal debt and inequality is I (1).Table 8 represents the results of the Toda Yamamoto causality test(3).

The findings indicate that a unidirectional causality relationship exists from internal debt to income inequality but there is no evidence of an existing causality relationship from income inequality to internal debt in Kenya. Unlike Aksman (2017), we can say that we have found a relationship from internal debt to income inequality. This is consistent with expectations from macroeconomic theory. It implies that changes in inequality can be explained using internal debt values and for inequality to reduce, other sources of funds other than internal debt must be explored. These results further indicate that the redistributive effect of internal debt is applicable in Kenya for this period. These results are similar to the one by Topuz (2021) for Turkey.

A bidirectional causal relationship is found to exist between internal debt and public debt. Public debt does not granger cause income inequality, but income inequality granger causes public debt in Kenya. Internal debt is found to be more likely to have a higher redistributive impact on income inequality compared to public debt. This could be because a higher percentage of internal debt holders are likely to be the citizens of the country, therefore, their income levels are affected directly by the changes in internal debt amounts (Panizza, 2008).

5. Conclusion and policy implementation

One of the main goals in macroeconomic policies of developing and underdeveloped countries is to ensure fairness in income distribution. These countries also aim at a more productive use of their existing debt. However, there are limited studies that examine the relationship between debt and income inequality more so for these countries. This study investigates the impact of public and internal debt in Kenya using data for the period 1970-2018. Firstly, the ARDL model is used to explore the long-run relationship between the variables and then the Toda Yamamoto causality test to determine the existence of a causality relationship.

Kenya has resorted to public debt as a source of financing leading to rising debt in the recent decades. Although public debt as a source of finance is inclusive of both internal and external debt, the redistribution effect identifies internal debt as having a stronger redistributive impact on income inequality compared to public debt taken as a whole. The key findings of this empirical analysis suggest that the effect of both public and internal debt is positive and significant in the long run. Based on these results, it can be said that debt widens the income gap between the rich and the poor in Kenya. This positive relationship between internal debt and income inequality can be explained by the existing theoretical argument whereby internal debts increase when wealthy people are able to purchase government securities, however, during repayment everyone is taxed including the poor who cannot afford government securities. The owners of government bonds receive interests that can cushion them fromthe impacts of taxation. Therefore, the income gap gradually increases. The results obtained in this empirical analysis can be used to explain the increasing debt and income inequality in Kenya in recent years.

The causality relationship also showed the existence of a unidirectional relationship from internal debt to income inequality. This follows the theoretical expectations. The presence of a causality relationship implies that changes in inequality can be explained by internal debt while changes in internal debt cannot be explained by inequality at least for the period under consideration. A bidirectional causal relationship is found to exist between internal debt and public debt. Public debt does not granger cause income inequality, but income inequality granger causes public debt in Kenya. Also, the findings imply that debt financing is worse for the low-income earners compared to the high-income earners, thus debt financing should not be overly relied upon.

In place of short-term debts with high-interest rates, long-term term debts with low-interest rates could be preferred as a measure to reduce inequality albeit in the long run. In addition to debt financing, other sources of financing like progressive taxes and increased exports can be promoted. Further, part of the borrowed funds could be used to finance pro-poor policies such as “the beyond zero” initiative, the Give directly programs among others. This could help cushion the poor and the vulnerable in Kenya who fall out from the process of economic growth.

Although this is the first of a kind to be conducted on the relationship between debt and income inequality, it by no means covers the entire subject matter. For instance, a future study that disaggregates the impact of debt contraction into the various sectors on income inequality can guide the government on which sectors to commit borrowed funds to. Further, this study focuses on debt as the main factor that could influence inequality in Kenya, and therefore future research that expands this focus to include other potential factors could be critical for providing a comprehensive understanding of the main drivers of inequality in Kenya. Similarly, it is possible to investigate how debt affects the different income groups such as top, middle- and low-income groups and not the overall inequality as in this study.

Notes

1. Some schools of thought argue that it should be left to the market mechanism to work towards alleviating inequality (Dworczak et al., 2018), however, it is criticized on account that inequality will only be intensified because markets are in the hands of the rich and the decisions are made in their favour. On the other hand, interventionists believe that the government’s participation could contribute to a reduction of inequality through providing affordable education, a better healthcare system, and adoption of a progressive tax system (OECD, 2015 and Breunig and Rose, 2019).

2. The debt variable represents both internal debt and public debt variables.

3. We obtain the appropriate lag length. The result of the test indicates that the optimal lag length is 2. Furthermore, the inverse roots of the characteristic equation associated with the ARDL to ascertain the dynamic stability of the ARDL are applied. The characteristic roots all fall inside the unit root circle indicating stationarity of the process at the second lag.