Introduction

The successive and continuous economic crises and the volatility of the international financial markets have had negative impacts on production, employment and income that may in turn have affected the finances of individuals

. The global COVID-19 pandemic negatively affected the financial well-being of millions of households around the world, specifically their capacity to have control over day-to-day finances (Consumer Financial Protection Bureau, 2017).

Referring to Garman and Joo (1998), Fadzli Sabri and Falahati (2013) state that financial wellness is a comprehensive concept that comprises financial satisfaction, financial objectivity, financial perception and financial behaviour that all cannot be assessed through one measure. Hence, the construct of “financial literacy” became a matter of public relevance after the sub-prime financial crisis of 2008 because of its potential role in the stability of the economy (Consumer Financial Protection Bureau, 2015; Lusardi, 2015; Cordero and Pedraja, 2018; Lusardi et al., 2020).

Financial literacy has become a main concern among financial educators in recent decades in such a way that the Consumer Financial Protection Bureau (2015) stated the following: “the ultimate goal of financial literacy is sustained financial well-being for individuals and families”. But attaining this goal is far from easy, as Chieffe and Rakes (1999) have observed, unplanned financial events are a problem that affects people with low incomes, but they can also affect those who have middle or high incomes. In other words, the lack of financial literacy may lead to financial fragility that makes households more vulnerable to negative external shocks and leads to a negative outlook on their finances.

Although Lusardi and Mitchell (2011) have identified that nearly half of Americans are financially fragile, Fisch et al. (2019) have shown that the financial crisis may have helped people to become less financially fragile. For instance, they identified that the percentage of working-age Americans considered as financially fragile decreased from 40% in 2012 to 36% in 2015. Later, Lusardi et al. (2020) found that 27% of respondents were financially fragile and had low confidence because so many families were under financial distress after losing their pay cheques and without a buffer stock of savings or access to funds, many Americans had a difficult time in the COVID-19 crisis.

Unsurprisingly, the situation is even worse in emerging countries. Ali et al. (2020) show that one-fifth of urban Malaysian households would not be able to survive for at least three months after their income was cut off, and 68.2% of Pakistani households have suffered financial distress (Caner and Wolff, 2004). Valerio and Villamonte Blas (2022) explain the impact of financial stress on economic activity and financial stability using a panel of advanced and emerging economies.

In Colombia, due to the effects of the pandemic, thousands of businesses went bankrupt or entered into financial restructuring agreements through the protection of the Bankruptcy Law. This liquidity crisis occurred as the country’s GDP showed negative growth of 6.8% (DANE, 2021). The foregoing produced the destruction of 5.5 million jobs in the first month after social isolation was decreed during the pandemic. This degree led to an unemployment rate in 13 main cities of 11-21.5% and was at 15.9% at the end of 2020 (DANE, 2021).

Furthermore, the government could make worse the negative effect of the crisis by generating households’ financial stress. According to the Interamerican Development Bank (2020), the pandemic has exerted high fiscal pressure on the economies of all countries worldwide and has had a negative effect that has generated liquidity and debt problems that have affected households, which are not financially prepared to deal with it.

Many studies have related financial literacy with financial fragility, but very few have addressed the relationship between the previous two constructs with financial preparedness and financial stress. Financial preparedness allows people to make the best consumption, savings, investment and financing decisions, and these in turn put them in better shape to manage financial stress during an exogenous crisis. Although some studies have addressed these issues, such as the ones of Lusardi and Mitchell (2011), OECD (Organisation for Economic Co-operation and Development) (2014) and Lusardi, 2015, it is important to design specific questions to measure financial preparedness and financial stress.

Thus, we aim to measure four constructs (financial literacy, financial fragility, financial preparedness and financial stress) and determine their relationship to a sample of Colombian households. Our contribution lies in the creation of the construct of financial stress and its relationship with the previous three constructs in an emerging country such as Colombia. To establish a relationship between the four constructs, we use two different methods: a linear regression model and a structural equation model.

We find a positive relationship between financial literacy and financial preparedness pre-COVID and between financial fragility and financial stress. We also find a negative relationship between financial preparedness and financial stress during the COVID crisis and between financial preparedness and financial fragility in Colombian households. We verify our results using a structural equation model and found that there is no significant relationship between financial literacy and financial fragility, nor between financial literacy and financial stress, so a better financial education will not lower financial fragility and stress unless it is being applied by households through better financial preparedness.

In the next section, we present our literature review, followed by our methods and the empirical results. In the final section, we conclude the article.

Literature review

The OECD (2014, 2016) recommends principles and good practices for financial education to help governments, financial entities and educational institutions implement it. The Jump Start Coalition for Personal Financial Literacy defines financial literacy as follows: “The ability to use knowledge and skills to manage one’s financial resources effectively for a lifetime of financial security” (rijumpstart.org).

The Programme for International Student Assessment (PISA) test for Colombia produced unfortunate results after evaluating the financial knowledge of 15-year-olds and ninth graders in 2015; in the test, Columbia ranked last among 18 countries from different continents (OECD (2014). This low performance is consistent with other studies which explained that financial education covered less than 1% of the country’s educated population in 2011 (García, 2012).

Furthermore, in 2012, a document of the World Bank carried out the first Survey of Financial Capabilities in Colombia by applying a survey questionnaire to 1,526 adults with terrible results. Of the participants, 66% showed poor knowledge and great weakness in the making of financial decisions. Further, only 11% reported to have recently received information through a financial literacy programme, and of these, parents were the most common source of information (Reddy et al., 2013).

At the national level, García Bohórquez and Castro (2010) have studied the financial capacities of Colombian children and youth, and the financial education in the central banks of Latin America and have found low financial capacities and less education. Studies have shown the importance of financial education in developing personal factors to strengthen their financial capacities (Lusardi et al., 2017; Cordero and Pedraja, 2018; White et al., 2019).

Cao Alvira et al. (2020) have identified important linkages between financial literacy and the indebtedness and wealth accumulation of households in Bogota (Colombia).

They also have found that households with good money management reduce the probability of acquiring debt, but if they have numerical skills, they can increase the probability of using debt sources. Giné et al. (2017) have found that customers with financial literacy do not easily accept the lending cost of their financial products. Some authors find a positive and significant correlation between knowledge and innovative performance (Leiva and Brenes-Sánchez, 2018). Also, Rasool and Ullah (2020) find that financial literacy is very important to make financial decisions.

Given the above, our first hypothesis is the following:

H1. We expect a positive relationship between financial literacy and financial preparedness.

Research on households’ financial fragility has normally been directed to variables such as education levels, income size, debt level, income, consumption, savings and sources of financing in the event of contingencies.

Poh Lee and Fadzli Sabri Lee(2017) have established the core definition of financial fragility as the personal feeling of being in a financially unstable situation; this feeling is one of the early indicators of financial stress for households. For this reason, they advise that households must always be concerned with an alert to their financial status and immediately take some corrective action when deficits occur. Thus, to lower financial stress, they must mitigate financial vulnerability first; our second hypothesis is the following:

H2.We expect a positive relationship between financial fragility and financial stress.

According to Anderloni et al. (2012) and Yusof et al. (2015), determining the nature of the external contingencies, such as the loss of a job, a reduction in wages or the arrival of various unforeseen events that demand considerable resources, is essential in assessing how they may affect household consumption. Furthermore, Ali et al. (2020) have determined a negative relationship between the financial education of family heads and their financial vulnerability. People who demonstrate healthy financial behaviours, such as conscious consumption, permanent savings, low levels of indebtedness and consolidated investments, should be less financially fragile. Therefore, our third hypothesis is the following:

H3. We expect a negative relationship between financial preparedness and financial stress.

Bilyk et al. (2020) have examined how people’s financial health was affected by COVID-19 in Canada. They analyze the slowdown and decline in economic activity caused by the pandemic and the negative implications of generalized income losses, especially for heavily indebted people.

White et al. (2019) have analyzed different research that shows the positive associations of objective financial knowledge, management, and self-efficacy on college students’ financial literacy; however, they point out that there is a need for a more detailed examination of the factors that are interrelated.

Additionally, Reddy et al. (2013) presented the following results: 94% of Colombians estimated their use of income, but less than 25% of them control their finances. Of the population under 60 years of age, 88% expressed concern about their ability to cover their expenses, 72% reported not having any savings of any type and 41% took some measures to be able to meet all their expenses at retirement.

Financial preparedness helped to protect households against different shocks to their revenues and employment. The households that were financially vulnerable prior to the COVID-19 pandemic suffered the most, in particular those with low income (Cantor et al., 2020; Fox and Bartholomae, 2020). Further, Fox and Bartholomae (2020) explain how households with savings or a job with the possibility of virtual flexibility had a lower deterioration of their conditions. Hence, our fourth hypothesis is the following:

H4. We expect that greater financial preparedness leads to less financial fragility.

Method

3.1 Sample and research design

We administered an online survey to people located in Colombia between July and December of 2020 after the end of the quarantine. Our initial dataset contained 904 responses, but we had to remove incomplete answers, which resulted in 856 complete and useful responses that we used to create 101 variables. The strength of this dataset is that it comprises the socio-demographic, economic, financial and behavioural characteristics of Colombian households, as well as a number of items to identify household financial characteristics before and during the COVID-19 crisis.

The survey had four sections: In the first part, we captured general information about socio-economic and demographic characteristics such as age, gender, marital status, position in the household, and the highest level of education. The second section questioned the perceptions on financial knowledge and financial fragility.

The third section questioned the financial situation before and during social isolation, and in the fourth, we asked about the impact of the COVID-19 crisis on the finances of the households and the strategies they used to face them.

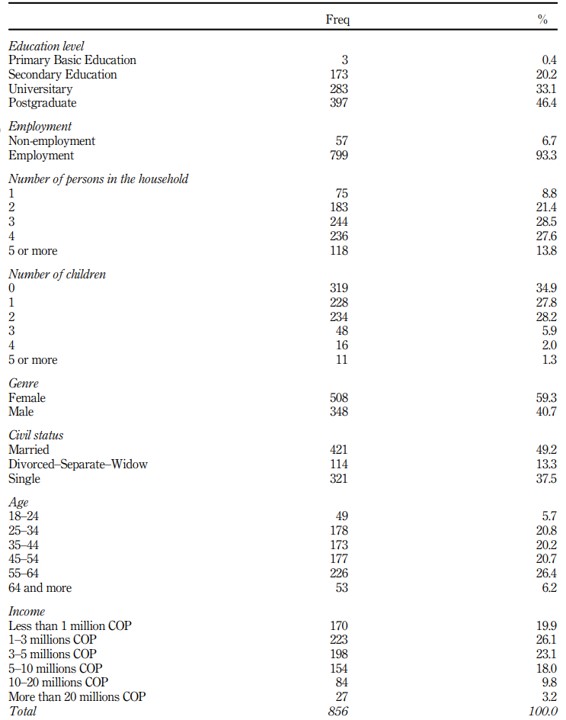

We also added control questions such as employment status, and household current gross monthly income to capture heterogeneity and control for household characteristics before the COVID-19 crisis. Table 1 shows the demographics of the sample group. The surveyed people were between 18 and 64 years old, with similar representation between females 59% and males 40%. The sample was 50% married people and 37% single. Notably, 27% of the sample had at least one child and 34% had no children.

3.2 Construction of the indexes

We construct four indexes to measure financial fragility, financial literacy, financial preparedness and financial stress. To construct our indexes, we use principal component analysis. This method synthesizes the information contained in many indicators into a few factors that reduce the dimensionality. The principal components are a linear combination of original independent variables. The scalars of the linear combination are a measure of the contribution of the individual indicator; therefore, they are not elasticities, and they are not analogous to regression coefficients.

The values of the explained variance are of great importance in determining the number of principal components to use. There is no specific number, so we must decide based on the number of variables and the proportion of accumulated explained variance while keeping in mind that the objective is to achieve the least possible number of components.

The principal components are the chosen number of factors that collect the largest possible proportion of the original variability. Then, after selecting the principal components, we represent them in the form of a matrix that has as many columns as there are principal components and rows according to the number of variables. We rotate the matrix producing an orthogonal factor with the objective of creating the indexes.

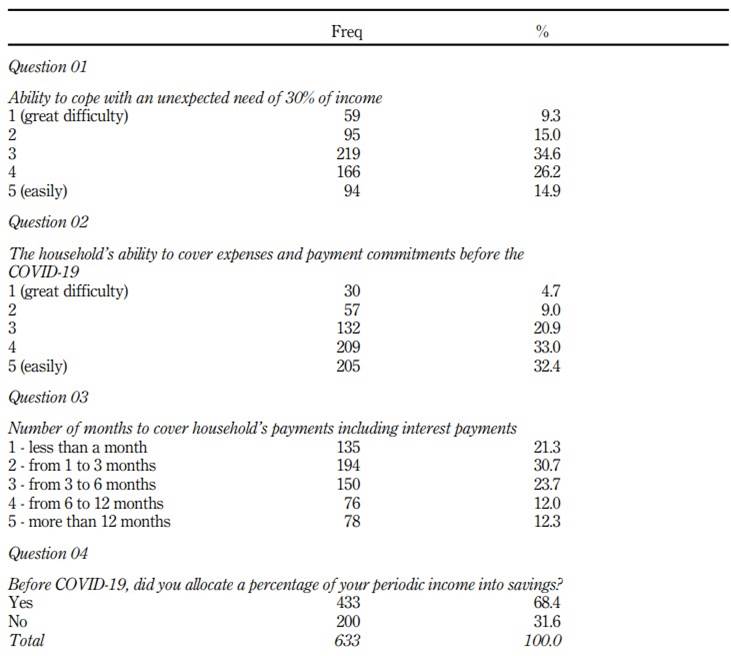

We construct the financial fragility index using four main questions shown in Table 2 (all questions use Likert scales of 1-5 points with 1 being the strongest). The index showed an adequate level of internal consistency (Cronbach’s alpha = 0.76). Following Lusardi and Mitchell (2011), we asked the following: “What is your ability to cope with an unexpected need for 30% more income?” We also asked about the household’s ability to cover expenses and payment commitments before COVID-19. This question measures asset poverty based on the approach by Haveman and Wolff (2005), Caner and Wolff (2004) and Yusof et al. (2015). This concept has been widely used in the literature to measure levels of fragility in households (Ali et al., 2020; Brunetti et al., 2020). We also asked for the number of months to cover the household’s payments including interest payments and the percentage of savings before COVID-19.

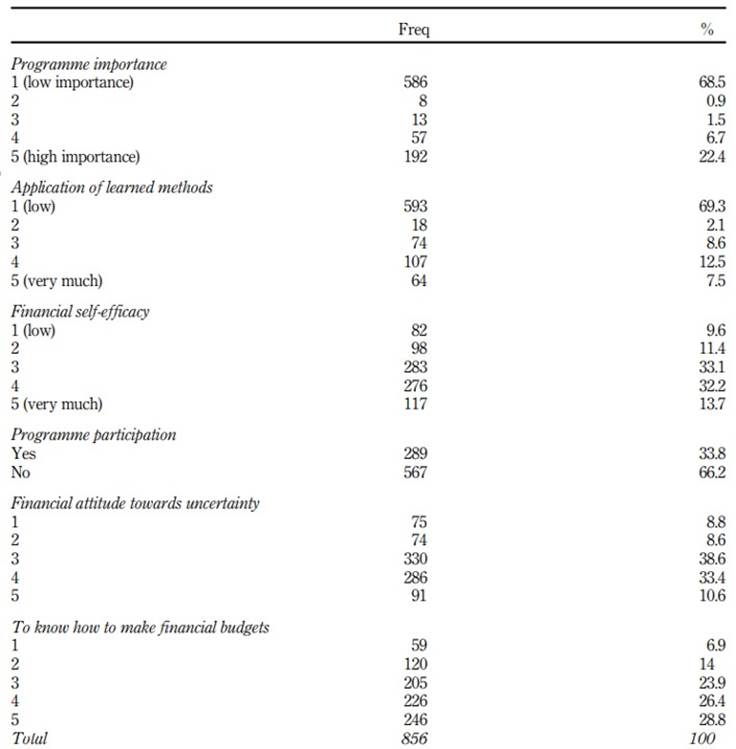

Financial literacy was measured by six questions and the index showed an adequate level of internal consistency (Cronbach’s alpha = 0.77). Table 3 shows the six questions: the appreciation of the importance of participating in programmes of financial literacy, whether they apply the learned financial methods, their perception of financial self-efficacy, their participation in previous financial literacy programmes, their attitude about financial uncertainty and they know how to make financial budgets for their personal finances.

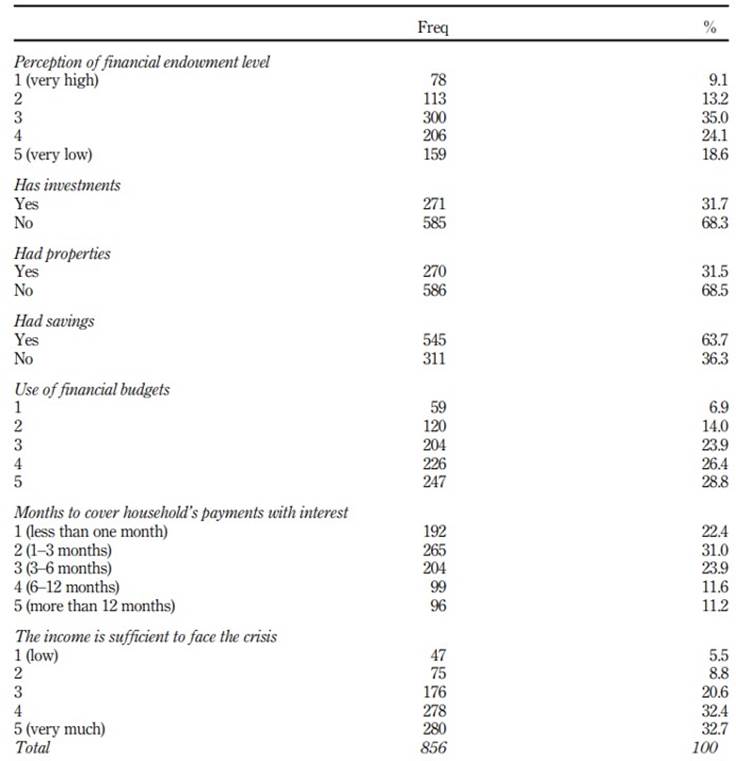

We construct the financial preparedness index using seven questions about the main levels of financial readiness and the index showed an adequate internal consistency (Cronbach’s alpha = 0.77). Table 4 shows the seven questions: the perception of their level of financial endowment, whether they have financial investments, real investments, if they have savings, if they make financial budgets for their personal finances, if they have financial slack to make payments with interests and if they perceive that their income is sufficient to cope with the crisis.

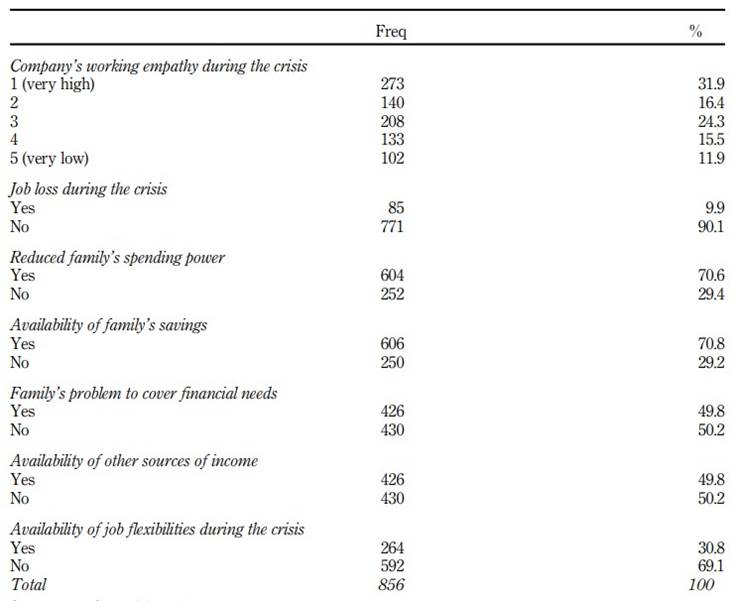

Finally, we construct the financial stress index, and the index showed an adequate level of internal consistency (Cronbach’s alpha = 0.70). Table 5 shows the seven questions: company’s working empathy during the crisis (reduced salary), job loss during the crisis (loss of the main source of family’s income), reduced family’s spending power (to lower their standard of living), availability of family’s savings to cope with the crisis, family’s problem to cover financial needs (minimum fixed costs), availability or creation of other sources of income and availability of job flexibilities during the crisis (less number of working hours, virtual job, among others).

3.3 Model

After constructing the four indexes, we estimate a set of linear cross-sectional regression models to test each one of our four hypotheses (see Tables 6-9). The first column of Tables 6 Tables 7 Tables 8 and Tables 9 tests our hypothesis without control variables (Equation (1)) and the second column with control variables (Equation (2)):

where

Id i is the dependent index value “d” for the household “i”

II i is the independent index value “I” for the household “i”

Xi is the vector of control variables for the household “i”

We used as control variables: the education level of the head of the family, employment of the head of the family, number of people living in the house, head of the family gender, if the head of the family is married or other (divorced, separated or widow) against being single, age of the head of the family against being younger than 25 years old and income of the head of the family in Colombian pesos.

Finally, in order to obtain robust results, we also estimate a structural equation model to verify the relationship between the constructed indexes using the procedure outlined by Jöreskog and Sorbom (1982) and Grace (2008).

Results

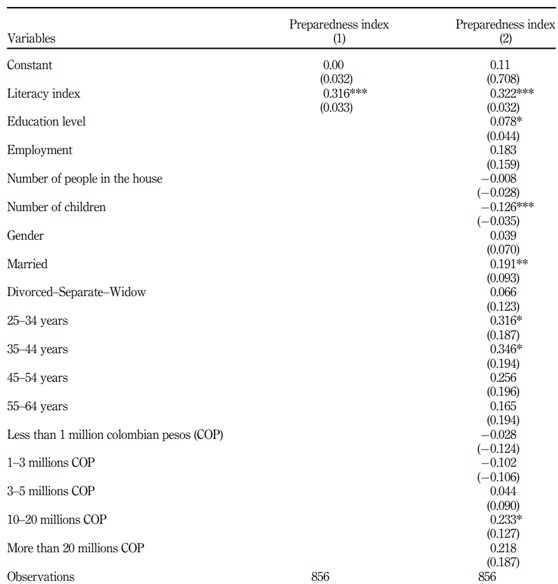

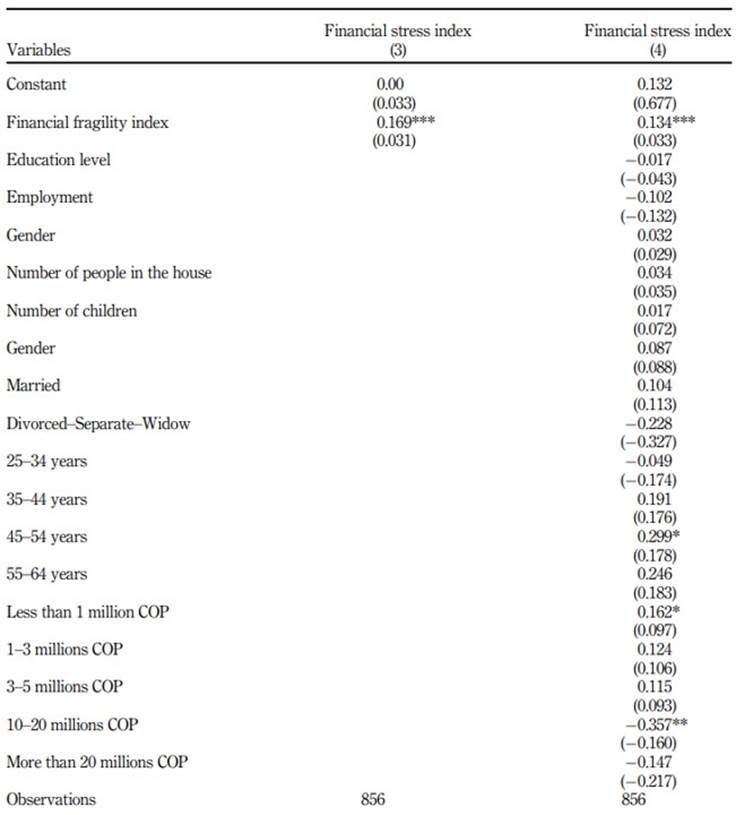

Table 6 shows a positive relationship between financial literacy and financial preparedness with and without control variables, so we find evidence for our first hypothesis. In addition,Table 7 shows a positive relationship between financial fragility and financial stress that supports our second hypothesis. The latter result holds with or without control variables.

Table 6 Relationship between financial literacy and financial preparedness indexes

Note(s): Column (1) shows the results of a robust linear regression between the financial literacy index and the preparedness index, while column (2) shows the same regression with control variables. Tables 3 and 4 display the components of the financial literacy and financial preparedness indexes, respectively Source(s): Own elaboration

Table 7 Relationship between financial fragility and financial stress indexes

Note(s): Standard errors in parentheses: ***p < 0.01, **p < 0.05 and *p < 0.1 Column (3) shows the results of a linear robust regression between the financial fragility index and the financial stress index, while column (4) shows the same regression with control variables. Tables 2 and 5 display the components of the financial fragility and financial stress indexes, respectively Source(s): Own elaboration

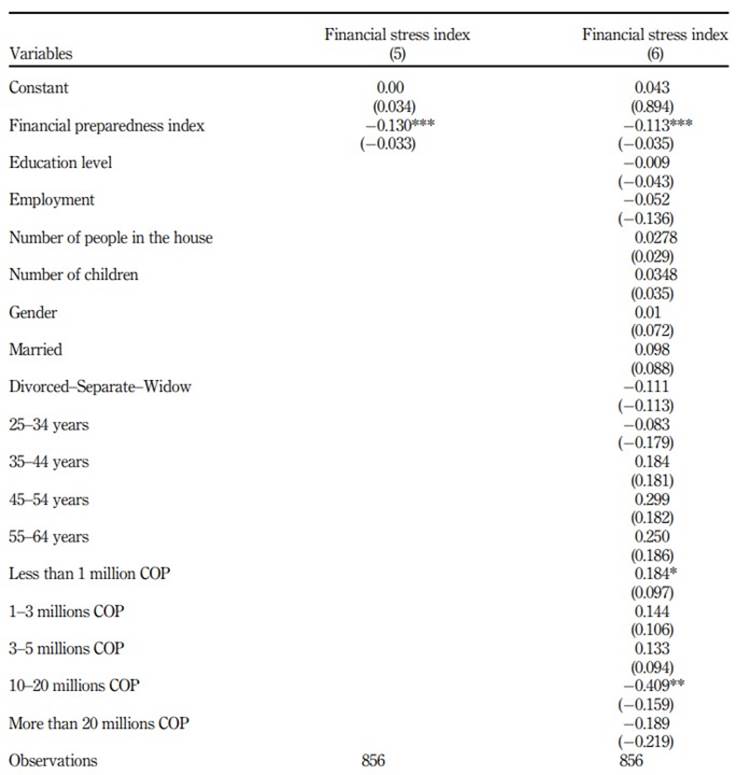

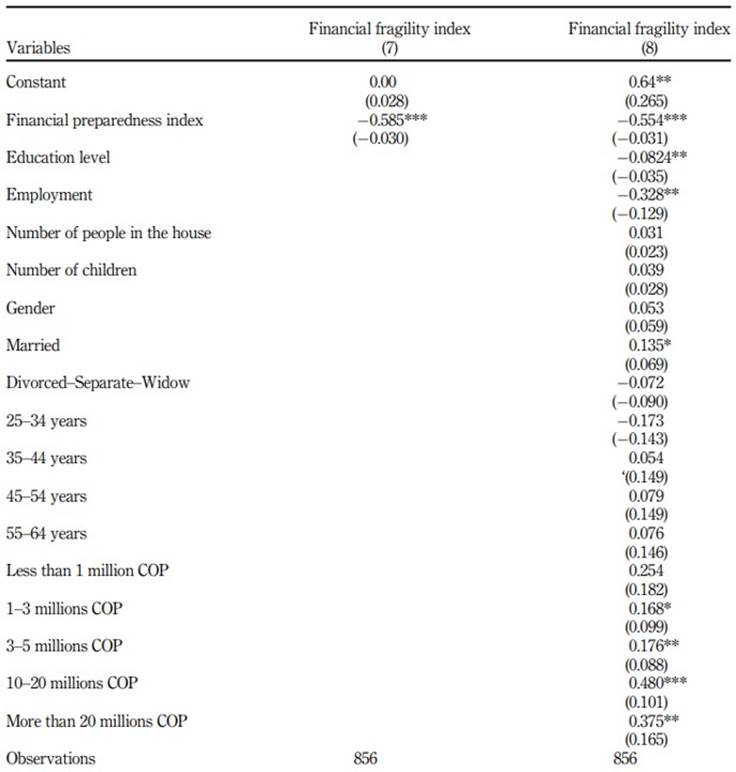

Table 8 shows the results between financial preparedness and financial stress. As expected, there is a negative relationship between both, which supports our third hypothesis. Finally, Table 9 shows a negative relationship between financial preparedness and financial fragility which supports our last hypothesis.

Table 8 Relationship between financial preparedness and financial stress indexes

Note(s): Standard errors in parentheses: ***p < 0.01, **p < 0.05 and *p < 0.1 Column (5) shows the results of a linear regression between the financial preparedness index and the financial stress index, while column (6) shows the same regression with control variables. Tables 4 and 5 display the components of the financial preparedness and financial stress indexes, respectively Source(s): Own elaboration

Table 9 Relationship between financial preparedness and financial fragility indexes

Note(s): Standard errors in parentheses: ***p < 0.01, **p < 0.05 and *p < 0.1 Column (7) shows the results of a linear regression between the financial preparedness index and the financial fragility index, while column (8) shows the same regression with control variables. Tables 2 and 4 display the components of the financial preparedness and financial fragility indexes, respectively Source(s): Own elaboration

Overall, our results indicate that the literacy index (β = 0.316, p-value ≤ 0.01) significantly explains positive financial preparedness; thus, households with greater financial knowledge are better prepared to face adverse events.

In addition, the fragility index (β = 0.169, p-value ≤ 0.01) significantly impacts a positive financial stress index, that is, the more financially fragile households are, the greater the effects they suffered during the COVID-19 crisis.

In addition, the financial preparedness index (β = −0.369, p-value ≤ 0.01) significantly explains the financial stress index because financially well-prepared households should experience less financial stress during the COVID-19 crisis. Finally, the financial preparedness index (β = −0.130, p-value ≤ 0.01) significantly explains the fragility index since greater financial preparation decreases the probability of households being financially fragile.

Furthermore, our fragility index has a large effect on the financial stress index; the positive coefficient indicates that when households are financially fragile, the impact of crises is greater, which indicates the need for preparedness on the part of households to face negative events and reduce their financial fragility.

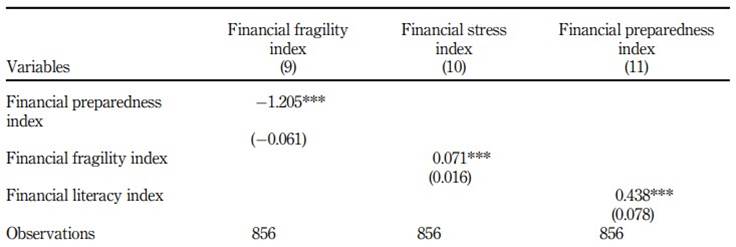

As a robustness test, we estimate the relationship between the four indexes through a structural equation model and obtain again a significant and positive relationship between financial literacy and financial preparedness (Hypothesis 1, Table 6). We also obtain a positive and significant relationship between financial fragility and financial stress (Hypothesis 2, Table 7) and a negative and significant relationship between financial preparedness and financial fragility (Hypothesis 4, Table 9).

We do not find a significant relationship between financial preparedness and financial stress (Hypothesis 3, Table 8), but it may work through the following channel: higher financial preparedness leads to lower financial fragility and this, in turn, to lower financial stress. This channel seems robust because we can validate it through both methodologies (see Table 10).

Table 10 Results of the structural equation model

Note(s): Standard errors in parentheses: ***p < 0.01, **p < 0.05 and *p < 0.1 Columns (9), (10) and (11) show the results of a structural equation model. It only displays the significant relationship between the indexes. There is no significant relationship between financial literacy and financial fragility, neither between financial literacy and financial stress, but we obtain again a significant and positive relationship between financial literacy and financial preparedness (see Table 6). We also obtain a positive and significant relationship between financial fragility and financial stress (Table 7) and a negative and significant relationship between financial preparedness and financial fragility (Table 9) Source(s): Own elaboration

We found that there is no significant relationship between financial literacy and financial fragility, nor between financial literacy and financial stress. Hence, financial preparedness is an important mediator variable.

Discussion

5.1 Theoretical implication

Our main findings indicate that low financial literacy led to poor financial preparedness for Colombian households during the COVID crisis and poor financial preparedness lead to high financial fragility. This deficiency in turn caused higher financial stress that may have led to the heavy protests that occurred at the end of 2020 in Colombia.

We also found that there is no significant relationship between financial literacy and financial fragility, nor between financial literacy and financial stress, so a better financial education will not lower financial fragility and stress unless it is being applied by households through better financial preparedness. Financial preparedness is one step further than financial literacy because it requires the achievement of certain financial goals and this in turn requires practice, discipline, organization and strategy.

5.2 Managerial implication

In the long term, it is cheaper for any government to have financially well-educated and prepared people rather than those who do not know how to face the crisis and who are looking for help from an absent government. It is important to highlight that the pandemic not only taught us to improve biosecurity measures but also that financial strength, ability to work remotely and income diversification were key factors in facing this adverse shock.

Although Kurowski (2021) has shown that high levels of financial education have positively affected the ability of individuals to manage their resources (financial preparedness) and, therefore, to comply with the payments of their debts to the market during the COVID crisis, it is clearly not enough.

Public education programmes fall short because they are concerned more with knowledge and less with daily financial applications and financial accomplishments. Why is it so? Governments in emerging markets are still striving to improve their basic and tertiary education levels without a particular focus on personal finances. Hence, if they worry about personal finances, they do not go one step further because they consider it far beyond their scope. Indeed, financial accomplishment requires certain values, habits and attitudes that are hardly learned within financial education programmes.

5.3 Future research agenda

Future research must be directed towards assessing what values, habits and attitudes are learned within a family and whether these are consistent with good financial practices. Furthermore, it is important to study the efficacy of private and public institutions in promoting better financial education, but this assessment must involve a longitudinal study of households’ financial preparedness, fragility and stress.

Conclusions

Most financial education programmes end up with financial education, but this is clearly not enough, what is needed is financial preparedness. We may say that financial education is the necessary knowledge and financial tool, while financial preparedness is the financial accomplishment at a certain point in time due to good financial practices. The more financial goals we accomplish, the less financially fragile we become (financial fragility is our financial diagnosis at a certain point in time).

If we are financially solid (not financially fragile), we may start thinking about strategies to avoid financial stress, such as job flexibility, income diversification, saving more money and so on. Hence, we will not suffer from financial stress. In the limit, a situation of financial stress means that we are financially trapped in the sense that we are either jobless or have a low salary with no flexibility, we cannot repay our debts and we cannot cope with our basic needs. The fact that we do not even have other sources of income leads us to desperation and to take legal (such as public protests) or illegal actions.