1. Introduction

Since the seminal work of Jensen and Meckling (1976 ), the agency problem and the associated private and social costs have become one of the most important issues investigated in corporate finance. The classical agency problem stems from the separation between corporate ownership and management, while recent research has revealed that, in less-developed countries, the relevant agency problem lies between large and minority shareholders ( La Porta et al., 1999 ; Aminadav and Papaioannou, 2020 ). Extant empirical research has focused extensively on the consequences of the agency problem, that is, how agency costs affect financial and investment decisions and thus firm value, particularly in developed countries, while relatively less evidence exists from less-developed countries on the determinants of agency costs (1). Ang et al. (2000 ) were among the first to explore the determinants of agency costs. They compared variations in agency costs between firms with zero agency costs and those in which ownership and control were separated. Singh and Davidson (2003 ) extended the analysis of Ang et al. (2000 ) to the large USA public firms, while Fleming et al. (2005 ) replicated the work of Ang et al. (2000 )using Australian SMEs (2).

However, regardless of the form of the agency problem, it can entail significant costs that differ across developed and less-developed countries, depending on country-specific institutional structures ( Altuntas et al., 2015 ). Less-developed countries tend to have weaker investor protection laws and concentrated ownership structures, making it easier and less costly for large shareholders to divert firm's resources towards serving their self-interests in a way that expropriates minority shareholders' rights ( La Porta et al., 1999 ; Aminadav and Papaioannou, 2020 ). Therefore, understanding the determinants of agency costs in less-developed countries is a more relevant empirical question.

We investigated the determinants of agency costs in the insurance industry, a financial and supposedly regulated industry, in which agency costs are expected to be lower or nonexistent. Unlike in many other countries, the insurance industry in Jordan has recently become regulated, although insurance companies have been operating since 1951; thus, in such an industry, concerns regarding the existence of the agency problem (i.e. the potential expropriation by managers and large shareholders) remain. Although the insurance industry provides a rich environment for analyzing agency costs, as it is characterized by coexisting diverse ownership structures and various degrees of separation between ownership and management, empirical evidence is limited. For example, Miller (2011 ) provided evidence of the incremental effect of corporate governance in alleviating managerial discretionary costs. Cheng et al. (2017 ) found that CEO turnover varies significantly in different organizational forms and ownership structures and provided evidence that organizational form matters regarding agency costs.

This paper aims to examine the association between corporate ownership structure and agency costs in Jordan's insurance industry. This provides valuable insights into the role of ownership structure in mitigating agency problems in the financial sector, as insurance corporations generate and hold significant amounts of liquid assets that are less costly for managers to divert into private benefits ( Hsu et al., 2015 ). We found that managerial ownership does not mitigate agency costs but increases them instead, which supports the entrenchment hypothesis. Although the results provide weak evidence that the largest shareholders magnify agency costs, the wedge between the largest shareholders and managerial ownership reduces agency costs.

This study contributes to the existing literature on agency problems in several ways. First, it provides evidence from a small economy in the Middle East and North Africa (henceforth, MENA) region, where corporate ownership is highly concentrated in a few wealthy large shareholders. Second, unlike previous research that uses the ratio of cash flow rights to vote rights, we use the difference between large shareholders' ownership, which includes the ownership of all shareholders related to large shareholders, and managers' ownership as a proxy for the separation between ownership and control. This measure enables us to identify the de facto controller of the firm rather than examine deviations between the control and ownership of the same shareholder. Third, we provide evidence of agency costs from a financial industry (insurance industry) that would otherwise be regulated because it holds financial assets.

The remainder of this paper is organized as follows: Section 2 reviews the literature and develops the hypotheses. Section 3 describes the data and the methodology used. Section 4 presents the empirical results. Section 5 provides a brief discussion and Section 6 concludes the study.

2. Literature review

The essence of the agency problem theory is the separation between risk-bearers and management decisions ( Jensen and Meckling (1976 ; Fama and Jensen, 1983 ; Shleifer and Vishny, 1997 ). Agency problems arise due to conflicts of interest between corporate insiders, such as controlling shareholders and managers, or between large and minority shareholders. This is because large shareholders, who control the firm's management, may engage in activities that maximize their interests rather than those of corporate owners by diverting tangible and/or intangible firm's resources to their private benefits in the form of exaggerated salaries and private expenses, perquisites and value-destroying acquisitions (Jensen, 1986; Dyck and Zingales, 2004 ).

The incentives for controlling large shareholders vary depending on the effectiveness of the country's legal system. In countries characterized by an effective legal system, such as common-law countries, corporate ownership structures are relatively dispersed and most corporations are controlled by their owners. Therefore, agency problems may emerge due to conflicts of interest between managers and shareholders. In countries with ineffective legal systems, such as civil-law countries, ownership structures are concentrated and few shareholders control large stakes in the corporation's capital. Therefore, conflicts of interest may emerge between controlling or majority and minority shareholders. In this case, most corporate resources are concentrated in a few large shareholders whose interests may differ from those of minority shareholders ( La Porta et al., 1999 , 2002). Consequently, in the absence of legal deterrence, large shareholders can expropriate minority shareholders and extract private benefits by maximizing their utility ( Claessens and Yurtoglu, 2013 ).

2.1 Managerial ownership

Jensen and Meckling (1976) argued that zero agency costs exist in firms owned by a single owner-manager. However, according to their convergence of interest hypothesis, agency costs increase because of ownership-management separation (see, for example, Singh and Davidson, 2003 ). That is, when the equity ownership of the owner-manager drops below 100%, the manager's residual claim on the firm decreases. In this case, the manager not only has less incentive to exercise significant effort to make optimal investment and financing decisions but also has a greater incentive to practice management shirking and exaggerate expenditures on perquisites. Such suboptimal behaviour by the manager increases the need for monitoring and thus, incurs agency costs ( Ang et al., 2000 ; Mustapha and Che Ahmad, 2011 ). In contrast, an increase in managerial equity ownership leads to aligning the interests of managers and shareholders, where the former becomes more interested in firm's value creation ( Jelinek and Stuerke, 2009 ), thus reducing agency costs.

However, greater managerial ownership can encourage entrenched behaviour by managers, thereby increasing agency costs. According to the entrenchment hypothesis, a substantial proportion of managerial ownership enables managers to use their controlling power to entrench themselves, utilize firm resources, collect personal benefits, guarantee their employment with the firm and indulge themselves in non-value-maximizing behaviour, which increases agency costs ( Florackis and Ozkan, 2009 ; Allam, 2018 , among others). Several studies have reported that the managerial entrenchment effect is expected to be greater in less-developed markets (emerging and frontier markets). Such markets are characterized by poor legal systems, weak investor protection, weak corporate governance, the prevalence of pyramid ownership structure and loose separation between management and ownership, to the extent that controlling shareholders have power over firms through control rights rather than cash flow rights ( Morck et al., 2005 ; ( Claessens and Yurtoglu, 2013 ; Vergara Garavito and Chión, 2021 ). Given that corporate ownership is highly concentrated in less-developed civil-law countries such as Jordan and that large shareholders control the firm's board of directors, we hypothesize the following:

H1. There is a direct relationship between managerial ownership and agency costs.

2.2 Large shareholders

A growing body of empirical research shows that a concentrated ownership structure in which large shareholders control a firm is the dominant feature of firms in less-developed countries. In such countries, the legal system is weak and investors are not adequately protected. Controlling shareholders can gain power over firms by investing little real capital using a pyramid structure and/or cross holdings, participating in management or seeking protection by obtaining more control rights ( La Porta et al., 1999 ; Morck et al., 2005 ; ( Claessens and Yurtoglu, 2013 ). However, assuming that corporate ownership and management are separated, concentrated ownership involves benefits and costs. According to the monitoring hypothesis, large shareholders have an incentive to collect information and monitor managers' behaviour in a way that enables them to avoid the free-rider problem that exists when a firm's ownership is dispersed, thus reducing agency costs ( Fleming et al., 2005 ; San Martín Reyna, 2018 ).

In contrast, ownership concentration becomes costly when a few large shareholders control the firm, leading to an agency problem between large and minority shareholders. Therefore, the expropriation hypothesis argues that when large shareholders have nearly outright control, they have the power to expropriate minority shareholders' rights by pursuing their interests and extracting private benefits ( La Porta et al., 1999 ; La Porta et al., 2002; Allam, 2018 , among others). Thus, we hypothesize the following:

H2. Firms with more concentrated ownership structures have lower (higher) agency costs if large shareholders monitor the management (extract private benefits).

2.3 The separation between ownership and management

The separation between management and ownership may lead to agency conflicts between managers and owners. However, the impact of this separation on agency costs depends on the concentration of the firm's ownership structure and the identity of the large owners ( Blanco-Mazagatos et al., 2016 ). For example, Lins (2003 ) suggested that large non-management shareholders can reduce managers' private benefits and that their existence positively affects firm value, especially in countries with weak investor protection. Large shareholders can be families, states or institutions, but family firms are the most dominant worldwide. However, the impact of family ownership on agency costs remains unresolved. Family members are usually involved in the firm's management and may facilitate the takeover of minority rights. Several studies on emerging markets have reported that controlling families have a strong incentive to pursue private benefits at the expense of minority shareholders ( La Porta et al., 1999 ; Claessens et al., 2002 ; Morck et al., 2005). Blanco-Mazagatos et al. (2016 ).) argued that family relationships between managers and owners can reduce agency costs by aligning their objectives and reducing information asymmetry.

The institutional shareholder is another type of large shareholder that has implications for the agency problem. Cronqvist and Nilsson (2003 ) argued that firms owned by institutions are run by professional managers who are not entrenched. Consequently, this can align the interests of managers and shareholders and thus, reduce agency costs. As for Jordan, Bino et al. (2016 ) found that most of the Jordanian public firms are family-controlled and that the family is involved in the firm's management. Consequently, we expect that the existence of large shareholders unrelated to managers will reduce agency costs. However, the large shareholders' ability to act for the benefit of shareholders depends on their ownership stakes. Therefore, we hypothesize the following:

H3. The larger the ownership percentage of large shareholders relative to managerial ownership, the lower the agency costs.

3. Method

3.1 Data

As of the end 2019, 23 insurance corporations were listed on the Amman Stock Exchange (henceforth, ASE). The insurance industry has experienced several restructuring incidents, such as some companies' entry, exit, merger and liquidation. We limited the period to 2010-2019 to avoid survivorship bias in the data. Annual data over the sample period were hand-collected from yearly reports published on the ASE website, which compiles financial data items obtained from financial statements. The inclusion criteria for the sample were the following. The firm must have all data items required to calculate all variables. This resulted in 230 firm-year observations. In addition to investing in insurance operations, insurance corporations also invest in financial assets, mainly stocks and real estate. They also engage in reinsurance activities, reinsuring part of their insurance portfolio with other local and foreign insurance corporations and reinsuring other local insurance corporations' portfolios. The insurance corporation's premium revenue is approximately 28% of its total insurance premiums and 19% of its total assets. Thus, the average insurance corporation's portfolio seems to be diversified, locally and internationally.

3.2 Variables

3.2.1 Dependent variables

Two alternative proxies were used to measure a firm's agency costs: direct and indirect. The former is the selling, general and administrative expenses (SG&A) ratio to total sales. This measures how much a firm's managers effectively control operating costs. According to Jensen and Meckling (1976) and Jensen, 1986, managerial empire-building incentives imply that unmonitored managers may be motivated to maintain unutilized resources to increase personal benefits arising from status, power, excessive salary and prestige, which results in higher SG&A. Therefore, SG&A expenses reflect the extent to which managers exaggerate fees. Firms with more significant SG&A expenses are expected to have higher agency costs. The latter is the assets utilization ratio, measured as the ratio of total sales to total assets.

In contrast to the SG&A expense ratio, this is an inverse measure of agency costs. It measures a firm's manager's effectiveness in deploying assets. A high ratio indicates that managers use assets to generate more sales and thus more cash flow, which results in value creation. In contrast, a low ratio shows inefficient utilization of assets due to bad investment decisions, imperfect managerial effort and expenditures on personal unproductive perquisites. Therefore, firms with a lower assets turnover rate may have higher agency costs (see, for example, Ang et al., 2000 ; Florackis and Ozkan, 2009 , among others). The assets turnover of insurance corporations, however, will depend on the asset portfolio risk in addition to management's appetite to invest in risky assets. A close look at the asset portfolio in the Jordanian insurance industry shows insignificant variations in terms of exposure to risk and similar diversification procedures. Therefore, the assets turnover ratio can be used with less concern about firm-specific risk exposure.

3.2.2 Independent variables

Our main independent variable, ownership structure, is measured using three alternative proxies. The first is managerial ownership, calculated as the percentage of a firm's capital held by the manager(s). Corporations listed on the ASE have ownership structures concentrated in the hands of a few related individuals via family ties. Additionally, controlling families are involved in a firm's management, which gives them great discretion over their assets and facilitates the expropriation of minority shareholders' rights ( La Porta et al., 1999 ; Bino et al. (2016). The second is the ownership of the largest shareholder(s), measured as the percentage of the firm's capital held by the largest shareholder(s). Like many other MENA countries, Jordan is a civil law country with weak legal protection and enforcement of investor rights (Altuntas et al., 2015 ), with corporate ownership concentrated in the hands of a few large shareholders. Several studies have reported that large shareholders may improve firm's corporate governance mechanisms and provide effective monitoring of management actions ( ; Shleifer and Vishny, 1997 ). However, the absence of legal protection enables large shareholders to expropriate minority shareholders' rights and extract private benefits in an attempt to maximize their utility rather than monitor the firm's management and maximize firm value ( Abu-Ghunmi et al., 2015 ; Bino et al. (2016). We argue that the impact of large shareholders on agency costs depends on the extent to which a firm's management and ownership are separate. Since the effect of large non-management shareholders differs from that of large management shareholders, the effect of large shareholders could differ based on large shareholder identity. This implies that family firms, where family members are heavily involved in management, are managed differently than non-family firms. Therefore, the third and last proxy for the ownership structure is the wedge between the percentage of capital owned by the largest shareholders and that of managers. This measure was proposed to control the separation of ownership from management. We argue that this measure is appropriate because it addresses the difference between ownership and management in absolute terms and implicitly addresses the identity of the large shareholder(s).

Following previous studies, we included several control variables. These include firm size, which is measured by the natural logarithm of total assets; sales growth, measured by the percentage change in sales revenues; financial leverage, measured by the sum of short-term and long-term debt divided by total assets; and firm's age, measured by the natural logarithm of the firm's age.

3.3 Empirical model

To test the impact of ownership structure on insurance companies' agency costs, the following specification was used:

where ACit is the agency costs for firm i at time t measured using sales, general and administrative expenses scaled by gross underwriting premiums (SG&A) and assets turnover (AT). OWNit is the ownership structure of the firm, measured using three alternative proxies: managerial ownership (MOSH), largest owner (LARG) and the wedge between the percentages of capital owned by the largest shareholders and the managerial stake in the firm's capital (LMW). The control variables included firm size (SIZEit), financial leverage (LEVit), sales growth (SGit) and firm age (AGEit). The impact of the unobservable firm- and time-specific variables is captured by including firm and year effects γi and δt,, respectively, and eit is a random error term. Typically, the error term is assumed to be normally distributed and uncorrelated with the independent variables, at which time the parameters of the pooled regression would be unbiased and efficient. However, this is unlikely to be the case in our data because the possibility of unobservable omitted variables cannot be ruled out. In addition, these unobservable variables might also change over time in a way that requires estimation methods that can account for the dynamic nature of both observable and unobservable variables and fix for possible heteroscedasticity concerns that are likely to cause endogeneity among variables.

Therefore, instead of relying on pooled regressions, we estimated the parameters of our model using fixed and random effects models to control for unobserved omitted variables. Furthermore, we recognize the endogeneity problem often noted in previous research that the ownership variables may introduce (see, for example, Hermalin and Weisbach, 1991 ; Himmelberg et al., 1999 ; Weir et al., 2002 ; Coles et al., 2012 , among others). This problem arises because of the simultaneity between ownership variables and agency cost measures, which renders the estimates of the static model inconsistent and biased. Although the fixed- and random-effects models control for the existence of unobserved omitted variables, they do not solve the endogeneity problem because of the possibility that the omitted variables may be time-varying. Therefore, we employed a dynamic panel data method using the generalized method of moments (GMM) estimators, which has several advantages over other methods. Specifically, we relied on a dynamic estimator of the GMM approach based on Blundell and Bond's (1998 ) system GMM, which uses the change in the lagged values of the dependent variable rather than external exogenous variables as instruments of the lagged values of the dependent variable. The fact that system-GMM estimation uses orthogonality conditions allows for controlling for heteroscedasticity of unknown form. Therefore, Blundell and Bond's (1998) state that the system GMM model is more efficient, as it is robust in capturing efficiency gains and reducing bias in finite samples.

4. Results

4.1 Descriptive statistics and correlation

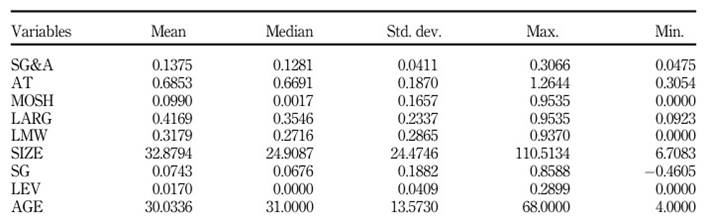

As shown in Table 1 , the average SG&A and assets turnover ratios were 13.75 and 68.53%, respectively. Managerial ownership ranged from 0.00 to 95.35%, with an average value of 9.90%. The average value of the large shareholders' ownership percentage was 41.69% and the mean value of the difference between the percentages of ownership of the largest shareholder and managerial ownership was 31.79%. The insurance firm's size ranged between 6.71 and 110.51 million JOD (9.45 and 155.65m USD), with an average value of 32.88m JOD (46.31m USD). On average, financial leverage accounted for 1.70% of the total assets. Finally, the age of the firms included in this analysis ranged from more than four years to nearly 68 years, with a mean value of more than three years.

Note(s): SG&A is the ratio of selling, general and administrative expenses scaled to sales. AT is the assets turnover. MOSH is the percentage of managerial ownership. LARG is the percentage of shares held by largest shareholders. LMW is the wedge between the percentages of capital owned by largest shareholders and managerial ownership in firm's capital. SIZE is firm's size measured in millions of Jordanian local currency (Dinar, JOD). SG is the annual growth rate in sales. LEV is firm's leverage. AGE is firm's life. Number of firm-year observations for all variables is 230

Source(s): Own elaboration

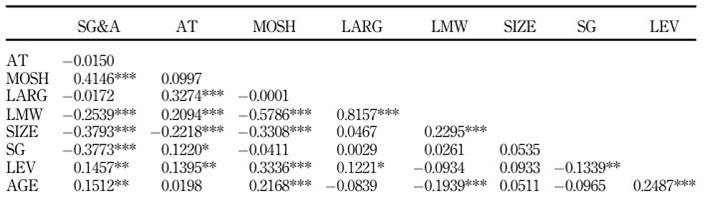

Table 2 shows that the SG&A ratio was positively correlated with managerial ownership, leverage and age but negatively correlated with large shareholders, indicating the wedge between the largest shareholders and managerial ownership, size, and sales growth. The results of assets turnover were qualitatively similar except for a few but with the opposite sign, given that assets turnover is an inverse measure for the agency cost, unlike the SG&A ratio. The correlation coefficient between the parentage of the largest shareholders' ownership and the wedge between the largest shareholders and managerial ownership was about 0.82, which is relatively high. This confirmed the existence of the largest shareholders who have more substantial equity stake than management equity stake. Apart from that, the results of correlation coefficients were relatively low and thus, multicollinearity among variables does not seem to exist.

Table 2 Pearson’s pair-wise correlations

Note(s): *, ** and *** denote significance at the 10%, 5% and 1% levels respectively. The variables are as defined in Table 1

Source(s): Own elaboration

4.2 Panel regression results

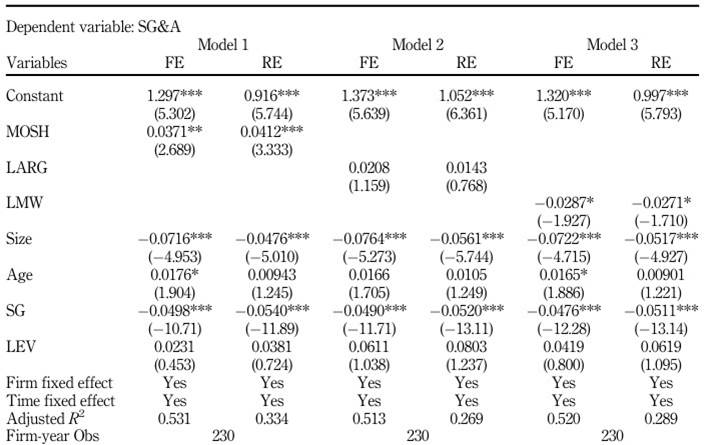

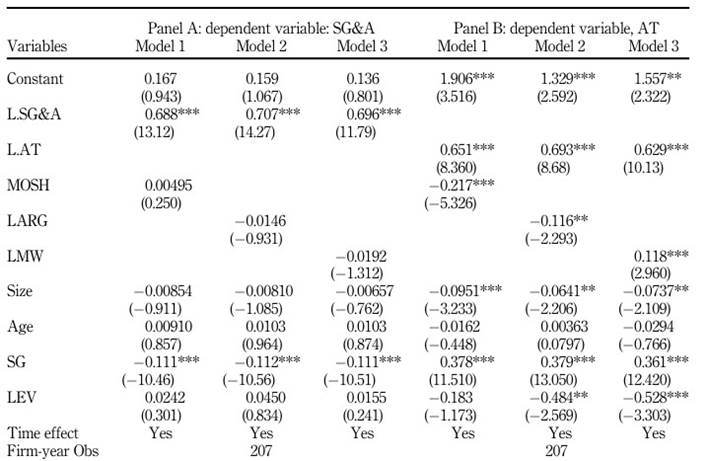

This section presents and discusses the empirical results of our panel regression models that tested the relationship between ownership structure and agency costs. Tables 3 and Table 4 report the results obtained by estimating three different specifications for each measure of agency cost, SG&A expenses and assets turnover ratio, respectively. Models 1-3 display the estimated coefficients with alternative ownership structure measures.

Table 3 Panel regression results for SG&A and ownership structure

Note(s): Results of panel regression of the impact of ownership structure variables on agency costs proxied by SG&A. The ownership structure is proxied by MOSH, LARG or LMW. Control variables used are SIZE, SG, LEV and AGE. The variables are as defined in Table 1 . FE and RE refers to fixed effect and random effect respectively. Robust t-statistic (z-statistic) is in parentheses for FE (RE) regressions. *, ** and *** represent statistical significance at the 10%, 5%, and 1% level, respectively

Source(s): Own elaboration

The existence of unobservable firm-specific variables was tested using the Breusch-Pagan Lagrangian multiplier test for random effects. These results confirmed the need to control for firm-specific effects. Next, whether those unobservable variables are correlated with our regressors was tested using the Hausman test. The results revealed the rejection of the null hypothesis of no correlation (3). Although the results of the fixed effects regressions are considered in the discussion of the empirical results, the random-effects GLS estimators were also reported for robustness. The results are estimated with firm and time effects; the latter controls for time-varying exogenous variables such as inflation and other macroeconomic variables.

4.2.1 Agency costs as measured by the SG&A expenses

Table 3 reports the results when SG&A expenses measure the agency cost. The relationship between managerial ownership and agency costs was positive and statistically significant at 5%. This means that higher agency costs are reflected in higher managerial SG&A expenses, which supports H1 and thus, the entrenchment hypothesis, that is, managers engage in activities that maximize their interests and private benefits rather than shareholders' wealth, which is more likely to be the case in poorly governed firms. These findings were consistent with the results of Allam, 2018 ) but inconsistent with the results of Ang et al. (2000 ), Singh and Davidson, 2003 ), Fleming et al. (2005 ), Florackis and Ozkan (2009), Mustapha and Che Ahmad (2011 ) and Vijayakumaran (2019 ). Moreover, the results showed an insignificant impact of the largest shareholder's ownership on SG&A expenses, which is in line with the result of Singh and Davidson (2003 ), but inconsistent with the results of Ang et al. (2000 ), Fleming et al. (2005 ) and Allam (2018). Our result for the impact of the largest shareholder's ownership on agency costs does not support H2, which indicates that the largest shareholder's ownership is irrelevant regarding agency costs.

Regarding the last measure of ownership structure, the wedge between the percentage of the largest shareholder and managerial ownership, the results show that the estimated coefficient of the wedge is negative and statistically significant at the 10% significance level. Thus, the results showed that agency costs decrease when the largest shareholders own a larger percentage of firm's capital relative to managerial ownership. This implies that large shareholders can effectively monitor managers' actions and decisions; thus, as the wedge increases by 1%, agency costs decrease by 0.0287% because of the rise in largest shareholder ownership. This result supports H3.

As for the control variables, the results show that, in all models, the estimated coefficient of firm size is negative and statistically significant at the 1% level. This implies that larger firms have lower agency costs, meaning they have more resources to monitor managers' behaviour more effectively. This result is consistent with those of Ang et al. (2000 ), Singh and Davidson (2003 ), Florackis (2008 ), Allam (2018), and Vijayakumaran (2019 ) but inconsistent with that of Florackis and Ozkan, 2009) and Mustapha and Che Ahmad, 2011 ). In some regressions, the coefficient of a firm's age was positive and significant at the 10% level. This result does not support the argument of Ang et al. (2000 ) that older firms, because of learning and survival bias impact, are more efficient than younger firms. The positive impact of age on agency costs implies that older firms are more likely to have higher agency costs as they may become less efficient in managing their resources and controlling their expenses. In other words, investment opportunities in mature firms may have been exhausted; thus, excess cash flows allow for greater abuse of resources. This result was consistent with the findings of Vijayakumaran (2019) but inconsistent with Ang et al. (2000 ), who found no effect of firm age on agency costs. The sales growth rate has a negative impact on agency costs, as the estimated coefficient is negative and significant at the 1% level. According to Fleming et al. (2005 ), this implies that firms with more growth opportunities suffer from a shortage of cash, which results in lower discretionary expenses. This result contradicts that of Florackis (2008), who found that growth opportunities measured by the book-to-market ratio are positively related to the SG&A ratio. Our results show that the estimated leverage coefficient is not statistically significant. This indicates that insurance firms maintain large amounts of cash received from operations (i.e. underwriting premiums) rather than debt. The insignificant impact of leverage does not support the argument that leverage could be considered an effective mechanism in corporate governance to restrict managers' behaviour towards spending corporate resources on suboptimal investments and consuming excessive perks (see Vijayakumaran, 2019, among others).

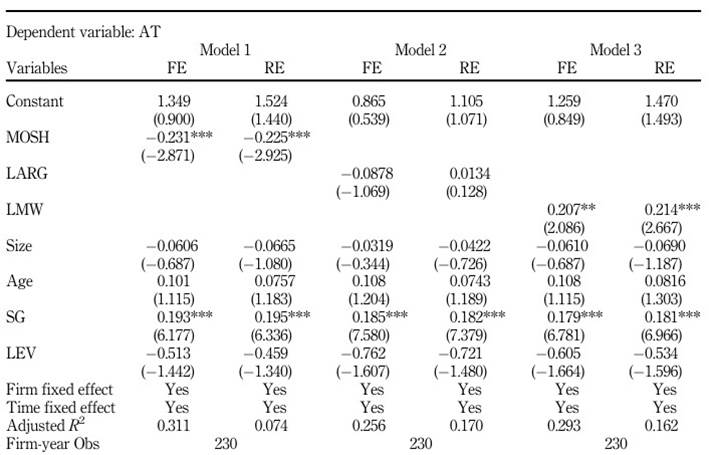

4.2.2 Agency costs as measured by assets turnover

Table 4 reports the results when the agency cost is measured by assets turnover, an inverse measure of agency costs. As shown in all the models, the results of the estimated coefficients of the ownership structure variables are consistent with our findings in Table 3 . The estimated coefficient of managerial ownership is negative and significant at the 1% level. This finding supports H1 and the entrenchment hypothesis. This implies that agency costs are associated with lower assets turnover, meaning that managers who hold larger stakes in the firm's capital report a lower assets turnover rates due to bad investment decisions and inefficient or insufficient efforts. In addition, the largest shareholder ownership percentage was irrelevant to assets utilization, as the estimated coefficient was statistically insignificant. Finally, consistent with the results in Table 3 , the estimated coefficient for the last proxy for the ownership structure, namely, the largest shareholders and managerial equity wedge, was positive and significant at the 5% level. This implies that agency costs decrease as the separation between ownership and management increases, leading to improved managerial efficiency as measured by asset turnover. In summary, the results obtained using assets turnover as a measure of agency costs are consistent with those obtained using SG&A expenses.

The estimated coefficients were statistically insignificant when considering the impact of the control variables. One notable exception is the negative impact of growth opportunities on agency costs. The estimated coefficient is statistically positively related to assets turnover.

Table 4 Panel regression results for assets turnover and ownership structur

Note(s): Results of panel regression of the impact of ownership structure variables on agency costs proxied by AT. The ownership structure is proxied by MOSH, LARG or LMW. Control variables used are SIZE, SG, LEV and AGE. The variables are as defined in Table 1 . FE and RE refers to fixed effect and random effect respectively. Robust t-statistic (z-statistic) is in parentheses for FE (RE) regressions. *, ** and *** represent statistical significance at the 10%, 5%, and 1% level, respectively

Source(s): Own elaboration

4.3 GMM estimation results

The results in Tables 3 and Table 4 may be driven by the possibility that managers decide to own a larger percentage of firm's capital that can offer better remuneration packages to their executives. Managers may also be incentivized to invest in their employer firms when they already have larger-scale assets and therefore, can satisfy their empire-building incentives. Similar arguments may also apply regarding large shareholders' ownership, at least to the extent that large shareholders or individuals related to them hold executive positions in the firm. These concerns about endogeneity introduced by ownership variables have been noted in previous research. To account for these endogeneity concerns, we repeat our analysis in Table 5 , Panels A and B, by estimating a dynamic setting in which both measures of agency costs are allowed to be functions of their lagged values. This is done using Blundell and Bond's (1998) system GMM estimators, which use changes in the lagged values of the agency costs measure as instruments for their lagged values.

Compared with the results reported in Table 3 , the results in Panel A of Table 5 provide no evidence of agency costs proxied by the SG&A ratio. The estimated coefficients for all ownership measures are statistically insignificant. This finding is inconsistent with our prediction of the impact of ownership structure on agency costs in the Jordanian insurance industry. However, the results of the system GMM estimator reported in Panel B of Table 5 are qualitatively like our previous results reported in Table 4 on the relationship between ownership measures and assets turnover. The estimated coefficients of ownership measures are statistically significant at the 5% or 1% level. The results show that managerial ownership and the largest shareholders lead to agency costs, which supports the entrenchment and expropriation hypotheses. However, the wedge between the largest shareholders and managers reduces agency costs.

Table 5 Results of GMM estimation for the relationship between agency costs and ownership structure

Note(s): Results of system GMM estimation for the impact of ownership structure variables on agency costs proxied by SG&A expenses in panel A and by AT in panel B. L.SG&A and L.AT are the lagged values of the dependent variable. The ownership structure is proxied by MOSH, LARG or LMW. Control variables used are SIZE, SG, LEV and AGE. The variables are as defined in Table 1 . Robustz-statistic is in parentheses. *, ** and *** represent statistical significance at the 10%, 5%, and 1% level, respectively

Source(s): Own elaboration

5. Discussion

5.1 Theoretical implications

From a theoretical viewpoint, the results of this study support the entrenchment hypothesis, as ownership variables adversely affect agency costs. This implies that managers engage in suboptimal behaviour that maximizes their interests and private benefits rather than shareholders' wealth, which typically characterizes poorly governed firms. Therefore, this study provides a better understanding of the link between ownership structure and agency costs in the insurance sector in a weak investor protection environment, where ownership is concentrated in the hands of a few large shareholders.

5.2 Policy implications

The results of this study have several policy implications. The relationship between managerial ownership and agency costs suggests that boards of directors should design a compensation mechanism that provides sufficient incentives to prevent management from exaggerating expenditures on perquisites. Furthermore, as the insurance industry has recently become regulated by the Central Bank of Jordan, insurance companies in Jordan must comply with governance codes similar to those applied to the banking industry. Based on our findings, this mitigates managerial entrenchment observed in our data. Additionally, it is expected that as the effectiveness of a firm's governance improves, it is expected to have a higher market value, less expropriation by managers and shareholders of policyholder rights and enhanced productivity and growth in the sector.

5.3 Future research agenda

Future research may extend this research further by including the identity of large shareholders, the composition of the board of directors as another dimension of corporate governance and alternative measures of agency costs. In addition, investigating this issue in the insurance industry in other countries with different institutional frameworks would provide comparable evidence. Furthermore, the results of this study could be used later to compare the determinants of agency costs for the insurance industry after it has become subject to due regulations.

6. Conclusions

This study investigated the relationship between ownership structure and agency costs for insurance corporations in Jordan. The following two alternative proxies for agency costs were used: the ratio of SG&A and the assets turnover ratio. Regarding ownership structure, three alternative measures were employed: managerial ownership, the largest shareholders and the wedge between the percentages of capital owned by the largest shareholders and the managerial stake in the firm's capital. To account for the endogeneity introduced by the ownership variables, we used the system GMM estimator. The results show that managerial ownership and the largest shareholders negatively affect the assets turnover ratio, implying that unmonitored managers and large shareholders in such markets indulge themselves in non-value-maximizing behaviour and engage in activities that serve their interests and extract private benefits. As for the wedge between the percentage of capital owned by the largest shareholders and managerial ownership in a firm's capital, we found that the efficiency ratio increases as the wedge increases, which indicates that non-controlling managers reduce agency costs in terms of private benefits and managers' efforts.

Notes

1. See, for example, Ben Mohamed (2021 ) and Jones et al. (2021 ), among others.

2. Other studies provided evidence from developed markets such as the UK ( McKnight and Weir, 2009 ; Allam, 2018), Germany ( Schäuble, 2019 ) and Italy ( Rossi et al., 2018 ), which examined the impact of ownership structure on agency costs. Studies also examined emerging markets, such as Taiwan ( Lin and Chang, 2008 ), Malaysia ( Mustapha and Che Ahmad, 2011 ), Latin America ( Muñoz Mendoza et al., 2021 ) and China ( Vijayakumaran, 2019 ; An et al., 2022 ).

3. The authors do not include the results of the Lagrangian multiplier and the Hausam test, but they are available upon request.