1. Introduction

Previous studies conclude that small and medium-sized enterprises (SMEs) present financing behaviour according to the predictions of pecking order theory (POT): firstly, they use retained earnings to fund their investments; secondly, when internal finance is exhausted, they rely on debt and as a last choice, they issue equity. Most SMEs aren't traded in the stock market, which may explain their strong dependence on financial debt, with long-term loans often implying the provision of collateral in the form of businesses’ fixed assets or the owner's assets ( Duppati et al., 2021 ). SMEs facing difficulties obtaining external finance may become financially restrained, negatively affecting their growth ( Nunes et al., 2013 b). Thus, profitability, allowing us to retain earnings, can have an essential role in growth in SMEs. Productivity may contribute to increasing internally generated funds, which SMEs can channelize for funding their needs associated with growth ( Czarnitzki and Hottenrott, 2011 ; Ferrando and Ruggieri, 2018 ; Caggese, 2019 ). Therefore, profitability and productivity, contributing to internal financing, may positively affect business growth.

The main objective of the current study was to analyse the importance of funding sources for SME growth. Firstly, we explored a non-linear relationship between profitability and business growth, while previous studies tended to examine a linear relationship between these two variables. Moreover, given that productivity contributes to increasing internally generated funds, we also analysed the relationship between that variable and growth. Considering that the insufficiency of internal funds may force SMEs to rely on debt, we also examined the role of this external funding source for growth.

The results of previous studies are not consensual about the relationships between firm size, age and growth. Size and age are associated with the intrinsic characteristics of SMEs, namely the concentration of ownership and management in the owner's hands, which can influence financing decisions. Therefore, as a secondary objective, this study analysed the size and age as determinants of SME growth.

Like other European Union countries, SMEs predominate in the business structure of Portugal. Moreover, Portugal has a bank-based financial system, and SMEs depend heavily on bank debt. Accordingly, Portugal is an appropriate setting for the paper's main goal, i.e., to investigate the relationships between the determinants of profitability, productivity, debt, size, age and growth in SMEs.

Data were collected for 3309 unquoted Portuguese SMEs using the System Analysis of Iberian Balance Sheets (SABI) database from 2010 to 2019. The econometric methods used to treat data are fixed, random and dynamic panel data models. Regarding the latter, we used the generalised method of the moments dynamic estimator of Blundell and Bond (1998 ) (hereafter, GMM-sys estimator).

Empirical evidence regarding the relationship between growth and profitability is sparse and heterogeneous, and the results of previous studies have not clarified the relationship between those variables in the SME context. This study contributes to the literature showing evidence of a non-linear relationship between profitability and growth. Initially, we identified a negative relationship between those two variables, contradicting most earlier studies ( Cowling, 2004 ; Honjo and Harada, 2006 ; Mateey and Anastasov, 2010 ; Nunes et al., 2013 a; Kachlami and Yazdanfar, 2016 ). After a certain level of profitability, the results showed that the relationship between profitability and growth becomes positive. These results suggest that after a certain level of profitability, SME owner-managers seem to channel the internally generated funds towards growth. This financing behaviour of SMEs follows the assumptions of POT, i.e., more profitable companies are more able to retain earnings to fund the needs generated by their growth.

This study also contributes to the literature on growth by showing a positive relationship between productivity and SME growth. This result is also in accordance with the predictions of POT, considering that productivity can contribute to increasing the internally generated funds that can fund the needs associated with growth. Additionally, this study shows a positive effect of debt on SME growth, which suggests that, the insufficiency of internal financing leads SMEs to use debt to fund their growth. This financing behaviour corroborates the predictions of POT, given the SMEs, after the exhaustion of internally generated funds, seem to rely on external debt.

Regarding the relationship between size and growth, the current study shows that Gibrat's Law does not hold, given that smaller businesses exhibit higher growth rates. Moreover, given that growth may be a prerequisite for SMEs to survive, growth is frequently related to age ( Honjo and Harada, 2006 ). This study revealed a non-linear relationship between age and growth. Young SMEs grow more than older ones, which may be explained by the former's objective to reach the minimum scale of efficiency. However, after a certain age, SMEs decrease their growth rates, probably because they no longer pursue the goal of growth.

After this Introduction, the study is structured as follows: Section 2 reviews the literature on relationships between determinants and growth in SMEs. Section 3 presents the method. The results are shown in Section 4 and the results obtained are discussed in Section 5; finally, Section 6 presents the conclusions.

2. Literature review

2.1 SME growth and profitability

Previous studies show that SMEs rely on retained earnings to fund their operations and investments. Most SMEs are not traded in the stock market; therefore, when retained earnings are exhausted, these companies rely on external debt to fund their needs as a unique external funding source available for SMEs. This financing behaviour is according to the predictions of POT ( Cowling, 2004; Fagiolo and Luzzi, 2006 ; Serrasqueiro et al., 2010 ; Carvalho et al., 2013 ).

According to various authors ( Rahaman, 2011 ; Bottazzi et al., 2014 ; Bryson and Forth, 2016 ; Dowling et al., 2019 ; Ullah, 2020 ), high levels of profitability allow the generation of financial resources, which are used to fund its growth.

SMEs try to reach the minimum efficiency scale, and until this is achieved, profitability positively impacts their growth ( Nunes et al., 2013 b). However, after getting the minimum efficiency scale, SME owner-managers may wish to control of the firm and therefore no longer pursue the firm growth ( Ang et al., 2010 ). Cowling (2004) analysed a possible trade-off between profitability and growth but did not identify any relationship between these variables. Coad et al. (2011 ) found no relationship between profitability and growth in Italian manufacturing companies. Tong and Serrasqueiro (2020 ) found a negative relationship between profitability and growth in Portuguese medium and high-tech SMEs in the manufacturing industry. This relationship contradicts the expectations that favourable profitability levels can help accumulate retained profits to support firm growth. However, this negative relationship may be due to medium and high-tech sectors not pursuing growth. Various studies ( Goddard et al., 2004 ; Fagiolo and Luzzi, 2006 ; Jang and Park, 2011 ; Nakano and Kim, 2011 ) identified a positive effect of profitability on growth. Coad (2007 ) and Voulgaris et al. (2003 ) identified a positive relationship between growth and profitability in French manufacturing companies and Greek manufacturing SMEs, respectively. Those authors conclude that firms rely on internal finance to avoid high-interest rates in accessing external debt.

The results of the previous studies are not convergent, and considering the argument of Cowling (2004) and Soininen et al. (2012 ) about the trade-off between growth and profitability, the following research hypothesis is formulated:

H1. There is a non-linear relationship between growth and profitability in SMEs.

2.2 SME growth and productivity

Although SMEs contribute significantly to employment and value-added in most Organization for Economic Cooperation and Development (OECD) economies, Bakhtiari et al. (2020 ) argue that they present low productivity levels. This may result from financial constraints, which prevent them from investing in material and human resources.

In competitive markets, firm survival and productivity depend on investment in innovative technologies ( Foreman-Peck, 2013 ; Bryson and Forth, 2016; Okundaye et al., 2019 ). However, not all SMEs adopt new technologies due to insufficient internal financial resources and restrictions in accessing external finance (Okundaye et al., 2019). Accordingly, it is expected that SMEs with high levels of profitability can generate retained earnings, which may be channelized for funding investments in human resources and new technologies, contributing to increasing productivity. In turn, a higher level of productivity can improve SMEs' financial performance, which allows them to increase the financial resources needed to sustain their growth. This financing behaviour follows the predictions of POT.

Rogers (2004 ) argues that for small businesses, less rigid labour relationships contribute to greater success in investment opportunities and increased labour productivity. Nunes et al., 2013 a) concluded that labour productivity is important for SMEs' survival and growth. Yang (2019 ) found that labour productivity positively impacts firm growth. Voulgaris et al. (2003) and Carvalho et al., (2013) identified a positive relationship between labour productivity and growth in Greek manufacturing and Portuguese SMEs, respectively.

Based on the above, the following research hypothesis is formulated:

H2. There is a positive relationship between growth and productivity in SMEs.

2.3 SME growth and external debt

According to POT, SMEs use external debt to fund their operations and investments once retained earnings are exhausted. However, SMEs face asymmetric information problems with creditors who tend to increase interest rates and require collateral to protect themselves against default risk. Accordingly, SMEs prefer to fund their needs through internally generated financial resources, avoiding external finance ( Serrasqueiro et al., 2016 , 2018; Duppati et al., 2021). However, young, small businesses with low financial performance cannot retain earnings to fund their growth. Therefore, unquoted SMEs with insufficient internal financing must resort to external debt as the only external source of financing available.

Several studies ( Serrasqueiro and Nunes, 2012 ; Robb and Robinson, 2014 ; Rostamkalaei and Freel, 2016 ; Yang (2019; Duppati et al., 2021 ) conclude that smaller and younger businesses, with insufficient retained earnings, depend on external finance, namely bank loans, to fund their growth. In this context, Honjo and Harada (2006) and Yang (2019) concluded that companies with a greater capacity to access debt present a higher growth rate.

Contrastingly, Honjo and Harada (2006) and Serrasqueiro et al. (2018 ) concluded that debt influences firm growth negatively. These authors argue that the negative effect of debt on SME growth may result from lenders raising the interest rates on loans due to the substantial risk of default. Yang (2019) concludes that a high level of debt in older firms harms financial performance, negatively affecting growth. Considering that SMEs depend on debt as the main external source to fund their growth, the following research hypothesis is formulated:

H3. There is a positive relationship between growth and debt in SMEs.

2.4 SME growth, firm size and age

Gibrat (1931 ) presents a model in which a firm growth is proportional to its initial size. Accordingly, growth rates are independent of the initial size. Various studies have tested Gibrat's Law in the literature on firm growth, which shows that firm growth does not depend on size. However, empirical results diverge regarding the relationship between firm growth and size, namely Oliveira and Fortunato (2006 ), Kachlami and Yazdanfar (2016 ) found a positive relationship, while Morone and Testa (2008 ), Haltiwanger et al. (2013 ), Arkolakis et al. (2018 ), Serrasqueiro et al. (2018 ) and Yang (2019) identified a negative relationship between size and growth.

Small businesses must grow to reach the minimum efficiency scale and may exhibit higher growth rates than larger, well-established companies. Considering that SME owners-managers may not pursue the goal of firm growth after achieving the minimum scale of efficiency, the following research hypothesis is formulated:

H4. A negative relationship exists between growth and size in SMEs.

The literature on growth often states that businesses fail at the beginning of their life cycle, suggesting that age is a variable to consider when researching growth. Mateey and Anastasov (2010 ), for SMEs in Central and Eastern Europe, conclude that age does not significantly impact growth. Concerning Portuguese SMEs, ; Serrasqueiro et al. (2010) conclude that after reaching the minimum efficiency scale, the youngest SMEs do not grow more than the older ones. In contrast, Fotopoulos and Giotopoulos (2010 ) find that smaller and younger Greek manufacturing companies have higher growth rates.

Considering the above, we formulate the following research hypothesis:

H5. There is a negative relationship between growth and age in SMEs.

3. Method

3.1 Data collection, sample and research variables

Similarly, to other countries in the European Union, in Portugal, micro, small and medium-sized firms predominate in the business structure. Portugal has a bank-based financial system implies companies' heavy dependence on bank loans. Most Portuguese SMEs are outside the stock market and have access to a restricted number of external financial sources. Consequently, SMEs rely on retained earnings and debt ( Serrasqueiro and Caetano, 2015 ), mainly bank debt.

Therefore, Portugal seems to be an appropriate setting for the paper's main goal, i.e., to investigate the relationships between profitability, productivity, external debt and growth in SMEs. Moreover, Portuguese SMEs present a high concentration of ownership and are often managed by their owners, who seek to control of the firm and preserve its independence ( Reis and Pinto, 2021 ). Consequently, size and age seem to be important determinants of SME growth.

This study used secondary data for Portuguese SMEs extracted from the SABI database. This database contains detailed economic-financial information about Portuguese SMEs. The definition of SMEs followed the European Union recommendation (L124/36-2003/261/CE) of 6 May 2003 regarding the definition of micro, small and medium-sized firms (2003): “the category of micro, small and medium-sized firms (SME) includes those with under 250 employees and with an annual turnover not exceeding 50 million euros and/or with an annual total balance sheet not exceeding 43 million euros”.

The initial sample comprised 4641 Portuguese SMEs, subjected to a fine-tuning process involving various stages. We removed businesses in the financial sector and those whose percentage of fixed assets over total assets exceeds 100% and/or when they present negative equity. To control for the possible influence of outliers, we also dropped the observations falling in the one per cent tail for each regression variable. Since this study uses dynamic panel data estimators, we eliminated companies that were not present in the database for at least four consecutive years. The research sample presents an unbalanced structure, with the number of years of observations for each firm varying between four and ten. The application of unbalanced panels, which allows companies to enter and exit the sample, partially mitigates the potential selection and survivor bias. The final sample is composed of 3309 Portuguese SMEs, with data for the period from 2010 to 2019.

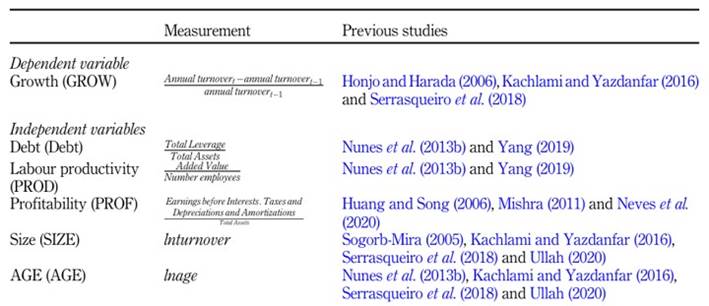

In this study, the dependent variable is growth, and as determinants of growth, we consider profitability, labour productivity and debt. Considering the empirical evidence showing the importance of size and age in the literature on firm growth, we also analyse these variables as determinants of SME growth. Table 1 summarises how the research variables considered in this study are calculated.

3.2 Estimation method

We use panel data models to estimate the effects of the independent variables on the dependent variable (growth) for the period 2010-2019.

Next, we point out the advantages of using dynamic panel data models in analysing the relationships between determinants and SME growth. Using Ordinary least square (OLS) regression implies that firms' non-observable individual effects are not controlled. This omission can give rise to heterogeneity, which may influence the parameter estimates. Static panel data models, i.e., fixed and random effect models, do not control the implications of non-observable individual effects on the parameter estimates. Moreover, static panel data models do not allow analysing the potential dynamics between determinants and firm growth. Consequently, we use dynamic panel data models, specifically the GMM-Sys estimator. This estimator can mitigate the problems of endogeneity associated with reverse causality, unobservable heterogeneity and simultaneity and use internal instruments ( Shao, 2019 ).

Below, we present the model to be estimated using static and dynamic panel data models:

where S s are the dummies referring to the industry; d t are the year dummies; v i are non-observable individual effects, and U it is the error term. In equation (I), we include size and age in the model, as they have been widely studied, and the results are not consensual regarding their relationship with firm growth.

3.3 Dynamic panel data estimators

Arellano and Bond (1991 ) proposed estimating equation (1) with the first difference variables and use the lagged growth variable and the other growth determinants as instrumental variables at levels. Estimating equation (1)in the first difference eliminates the non-observable individual effects. Using the lagged variables of the growth variable and the determinants as instruments creates orthogonal conditions between U it and GROW it-1 , eliminating the correlation. The estimations obtained using GMM-Sys will be accepted as valid on two conditions: 1) if the restrictions created using the instruments, are valid; 2) if there is no second-order autocorrelation. We used the Hansen test to validate the restrictions originating in GMM-Sys. The null hypothesis indicates that the restrictions imposed using the instruments are valid. Rejecting the null hypothesis, the restrictions are invalid, and the results are not open to discussion. We tested for the existence of first- and second-order autocorrelation. The null hypothesis refers to the non-existence of autocorrelation. If we reject the null hypothesis of the non-existence of second-order autocorrelation, we conclude that the estimator's results are not robust and not open to discussion.

4. Results

4.1 Descriptive statistics

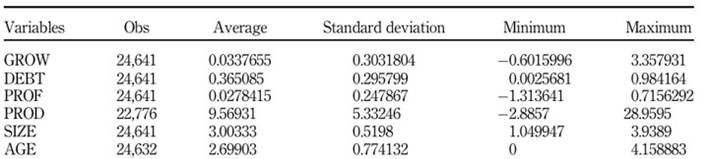

Table 2 presents the descriptive statistics of the dependent and independent variables considered in this study.

Table 2 reveals that the average growth of SMEs is around 3.37%. They have an average age of 14.3 years and an average size of 20 409 490€ (turnover). Concerning average profitability, this is low, around 2.61%. Average labour productivity is approximately 9.83. The average debt in the sample SMEs is around 37%.

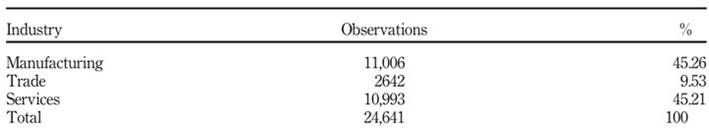

In most cases, the volatility of the variables is not significant, i.e., the standard deviation is below the mean, as is the case with age, labour productivity and debt. However, profitability shows volatility, presenting a standard deviation above the mean. Table 3 shows the sample composition according to the sectors of activity.

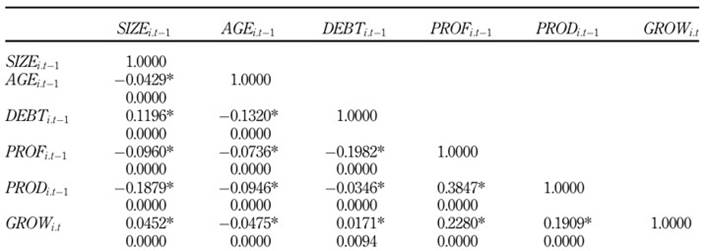

The matrix of correlations is presented in Table 4 , showing the correlations between the research variables.

Profitability, labour productivity, debt and size, are positively correlated with growth and statistically significant at 5%. However, age is negatively correlated with growth. Gujarati and Porter (2010 ) conclude that collinearity problems between the independent variables are not particularly relevant when their correlation coefficients are not above 50%. Based on Table 4 , finding no coefficients over 50%, we conclude that correlation problems between the variables seem not to be particularly relevant.

4.2 Panel data models estimations

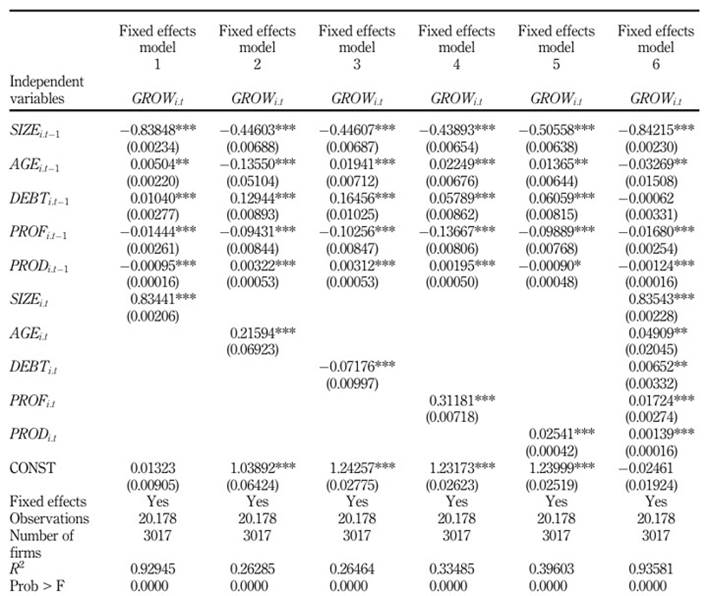

Seeking to check the suitability of the econometric methods to estimate the relationships between the determinants and SME growth, we need to check if the independent variables are strictly exogenous. The estimates obtained based on OLS regression and the fixed effects model is more efficient if the independent variables are exogenous. However, if this condition is not verified, it will be more appropriate to use the GMM-Sys estimator. Based on Wooldridge (2002 ), Table 5 presents the results obtained when testing the strict exogeneity of the independent variables, using a fixed effects model to estimate equation (1), in which we include the future values of the independent variables. Considering that the variables in equation (1) refer to the previous period, to assess strict exogeneity, we consider the following independent variables in the current period: PROF i;t ;PROD i;t ;DEBT i;t; AGE i;t ;SIZE i;t The relationships between these variables and the dependent variable GROW it are statistically significant, so we can reject the existence of strict exogeneity of the independent variables analysed. Accordingly, it is more appropriate to use the GMM-Sys estimator. In the dynamic panel data model, using the GMM-Sys estimator, we consider the annual dummies as exogenously determined variables ( Wintoki et al., 2012 ; Nguyen et al., 2014 ; Shao, 2019 ) and the other independent variables are considered as endogenous.

Table 5 Stricty exogeneity tests

Note(s):***statistical significance at 1% level; **statistical significance at 5% level;*statistical significance at 10% level

Source(s):Own elaboration

We used the Durbin-Wu-Hausman test, which revealed statistical significance, implying a rejection of the null hypothesis, i.e., the absence of endogeneity of the regressors of equation (1). Therefore, there is a problem of endogeneity between growth and the determinants considered here. The OLS regression and fixed effects models may not allow unbiased estimates ( Shao, 2019 ); thus, we will consider the results obtained using the GMM-Sys estimator. Seeking to test the possible existence of autocorrelation at the levels, we use the second-order test, in the first differences of Arellano and Bond (1991 ) and the over-identification test of Hansen J (Hansen and Singleton, 1982 ), with a χ2 distribution under the hypothesis of instrument validity. Additionally, we performed the diff-in-Hansen test ( Wooldridge (2002 ) to test the exogeneity of the instruments. Furthermore, using the GMM-Sys estimator, the number of instruments tends to increase, which may negatively affect the results. Consequently, we use the Roodman (2009 ) routine to collapse the instrument matrix, as well as the dependent variable lagged one period.

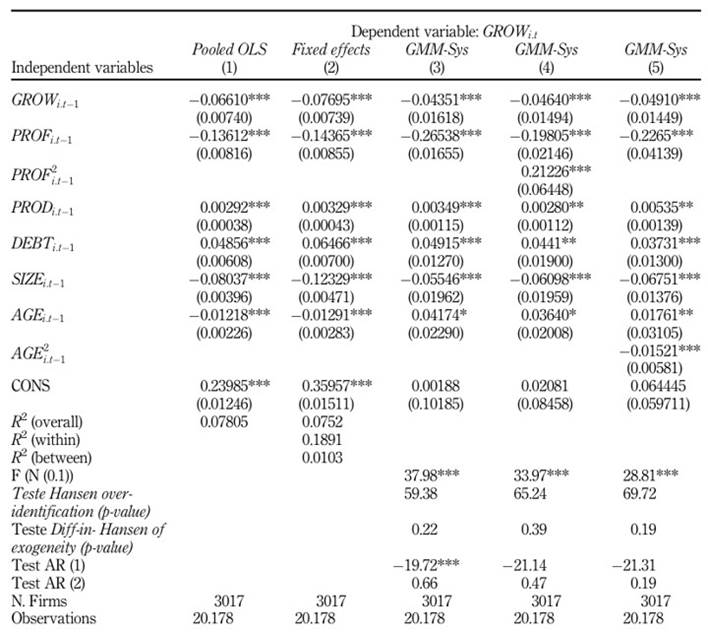

Table 6 exhibits the estimates for the relationships between determinants and growth obtained using the pooled OLS regression, the fixed effects models (introducing the dependent variable lagged one period as an independent variable), as well as the GMM-Sys estimator. The second-order autocorrelation test autocorrelation (AR) (2) indicates that we cannot reject the null hypothesis of the absence of second-order correlation. The Hansen test suggests that we cannot reject the null hypothesis of the validity of the instruments used. The diff-in-Hansen test of exogeneity allows us to conclude that we cannot reject the null hypothesis that the instruments in the equations at levels are exogenous. Thus, we can accept the estimates obtained using the GMM-Sys estimator.

Table 6. Growth determinants

Note(s): 1. CONS is the constant of the regressions. 2. Robust standard deviations in parenthesis. 3. ***Statistical significance at 1% level. **Statistical significance at 5% level. 4. The estimates include time dummy variables but are not shown. 5. The estimates include sector dummy variables but are not shown. 6. F is a test of the joint significance of the estimated firm-specific coefficients that are asymptotically distributed as N(0.1). Under the null hypothesis of no relationship. 7. Hansen test of over-identification is under the null hypothesis that all instruments are valid. 8. Diff-in-Hansen test of exogeneity is under the null hypothesis that the instruments in the equations in levels are exogeneous. 9. AR(1) test is a test of first-order autocorrelation in the first-differenced residuals and is distributed as N(0.1). under the null hypothesis of no first-order autocorrelation. 10. AR(2) test is a test of second-order autocorrelation in the first-differenced residuals and is distributed as N(0.1). under the null hypothesis of no second-order autocorrelation

Source(s): Own elaboration

4.3 Relationships between SME growth and profitability, productivity and debt

This sub-section analyses the estimates obtained using the GMM-Sys estimator regarding the relationships between SME growth and the determinants considered in this study. The results in Table 6 indicate that growth in the previous period is negatively related to growth in the current period. This negative relationship, statistically significant, between growth lag one period (GROW i;t 1 ) and growth in the current period (GROWi;t) suggests that growth is persistent, i.e., SMEs that grew in the past show present lower growth in the current period. The same relationship was found by Oliveira and Fortunato (2006), whereas other studies found a positive relationship between growth in the previous period and growth in the current period.

The results in Table 6 exhibit a U-shaped relationship between profitability and growth since the estimated parameter referring to PROF i;t 1 is negative, and the parameter estimates for PROF 2 i;t 1 is positive. Therefore, the results suggest a non-linear relationship between profitability and growth, and hypothesis 1 cannot be rejected. Accordingly, a non-linear relationship indicates that initially, there is a negative relationship between profitability and growth, but from a certain level of profitability, that relationship becomes positive. Consequently, from a certain level of profitability, which may contribute to higher retained profits, this determinant positively impacts SME growth. This result is according to the predictions of POT, considering that high levels of profitability allow high levels of internally generated funds, which may contribute to funding the needs caused by business growth.

Coad (2007 ), Tong and Serrasqueiro (2020 ) and Lee (2014 ) found a negative relationship between profitability and business growth. However, Goddard et al., 2004 ) and Jang and Park (2011 ) found a positive impact of profitability on growth. In turn, Coad (2007 ) concluded that profitability is not a factor determining growth in French manufacturing companies.

Table 6 exhibits a positive relationship between productivity and growth; therefore, hypothesis 2 is not rejected. This result corroborates the results of previous studies ( Voulgaris et al. (2003) ; Mateey and Anastasov, 2010 ; Carvalho et al. (2013) ; Nunes et al., 2013 b; Yang (2019), showing that enterprises with high levels of productivity become more profitable, contributing to increasing the retained earnings that can fund their growth.

The result in Table 6 , showing a positive relationship between debt and growth in SMEs, implies that we cannot reject hypothesis 3 of this study. Therefore, the results suggest that when retained profits are insufficient, SMEs rely on external debt to fund their needs associated with growth. Cole and Sokolyk (2018 ) conclude that start-up firms depend on debt to fund their needs, and those using debt in the initial year of operations are more likely to survive and increase their turnover. Furthermore, Honjo and Harada (2006) and Yang (2019) concluded that companies with a greater capacity to access debt present a higher growth rate.

The results in Table 6 show a negative and statistically significant relationship between size and growth; thus, we cannot reject hypothesis 4. A similar relationship was identified in various studies ( Haltiwanger et al. (2013 ; Arkolakis et al. (2018 ) ; Serrasqueiro et al., 2018 ; Yang (2019).

The age determinant positively effects growth ( Table 6 ), allowing us to conclude that younger SMEs grow less, possibly a consequence of financial restrictions that affect growth negatively. This result contradicts the results of Morone and Testa (2008 ) and ; Serrasqueiro et al. (2010), who concluded that younger firms are more likely to show higher growth rates. However, Serrasqueiro et al. (2010) concluded that small businesses stop growing when they reach or come close to the minimum scale of efficiency. When we analyse a possible non-linear relationship between age and growth, we identify a negative relationship between the quadratic variable of age and growth. Therefore, from a certain age, SMEs grow less, which probably occurs after these firms have reached the minimum efficiency scale. Considering the results obtained, we can partially reject hypothesis 5, which forecasts a negative relationship between age and SME growth.

The results obtained in the current study seem to corroborate the argument of Cowling (2004) that younger businesses grow more, tending to channel their retained earnings towards funding their growth, seeking to ensure their survival. Additionally, the author found lower growth rates for small businesses in more advanced life cycle stages, where survival is less important.

5. Discussion

5.1 Theoretical implications

This study analyses the determinants of SME growth. Previous studies ( Nunes et al., 2013 b; Lee (2014 )) have analysed internal finance, external finance, productivity, size and age as potential determinants of small firm growth. The current study also analyses these determinants, extending the analysis of the relationship between profitability and SME growth, considering a potential non-linear relationship between these two variables. Firstly, we identify a negative relationship between profitability and growth, contradicting most earlier studies ( Cowling, 2004 ; Honjo and Harada, 2006 ; Mateey and Anastasov, 2010 ; Nunes et al., 2013b; Kachlami and Yazdanfar, 2016 ). Therefore, our study does not corroborate Nunes et al. (2013b) argument that until reaching the minimum efficiency scale, small companies reveal a positive relationship between profitability and growth. However, the results of the current study show that after a certain level of profitability, the relationship between profitability and SME growth becomes positive. These results, corroborating the argument of Lee (2014 ), suggest that SME owner-managers may prioritise the maximisation of profits until a certain level of profitability, thus inhibiting firm growth. However, beyond a certain level of profitability, owner-managers seem to channel internally generated funds towards growth, contributing to SMEs achieving the minimum efficiency scale. This result follows the predictions of POT, considering that profitability contributes to retained earnings that SMEs may channel towards growth. Cowling (2004) and Honjo and Harada (2006 ) identified a positive relationship between profitability and growth for SMEs in the United Kingdom and Japan, respectively. Furthermore, productivity is a positive determinant of SME growth, corroborating the study by Nunes et al. (2013 b), showing that productivity can contribute to increasing internally generated funds, which may fund SME growth.

The debt determinant has a positive role in funding SME growth, which the insufficiency of internally generated funds can explain to support growth. A negative relationship exists between size and SME growth ( Table 6 ), contradicting Gibrat's Law, whereby growth does not depend on size. Nevertheless, the negative relationship between size and growth corroborates the results of various studies ( Haltiwanger et al. (2013 ; Arkolakis et al. (2018 ); Serrasqueiro et al., 2018 ; Yang, 2019 ).

We investigate a potential non-linear relationship between age and SME growth. Initially, we identify a positive relationship between age and growth but contradict the results of various previous studies. The results show that after a certain age, the relationship between age and growth becomes negative ( Morone and Testa, 2008 ; Serrasqueiro et al., 2018 ). Thus, the results suggest that SMEs grow less after a certain age, corroborating the results of previous studies indicating that SMEs grow less after reaching the minimum scale of efficiency.

5.2 Managerial implications

Lee (2014 )) argues that the companies' owner-managers who focus on profit maximisation do not exploit investment opportunities and seek to preserve high levels of firm profitability. This may occur in SMEs managed by owners who adopt a short-term perspective of the business and pursue maximum profitability. We suggest that SME owner-managers should invest in physical and human capital to increase productivity. These investments can contribute to internally generated funds that are important for SMEs to fund their growth needs. Internally generated funds may be particularly important for younger and smaller firms that have not yet reached the minimum efficiency scale and face problems of asymmetric information with creditors, which negatively affects the terms of external debt.

For policymakers, the results of this study underline the importance of promoting favourable terms for SMEs accessing external debt. This can be guaranteed schemes and/or more favourable interest rates to promote access to external debt by growing SMEs. Moreover, policymakers could implement measures to encourage growing SMEs to be listed on the stock market, allowing them to obtain less expensive funds.

5.3 Limitations and future research agenda

This study involves a sample of Portuguese SMEs, so the results obtained cannot be generalised for SMEs in other contexts. Future research could analyse the determinants of SME growth in the context of European countries and make a comparative analysis. Moreover, we suggest examining the determinants of SME growth in less developed economies to deepen our understanding of the importance of financial resources and the size and age of SME growth in those economies. Qualitative research could deepen our understanding of how SME owner-managers select finance sources to fund growth.

6. Conclusions

This study analysed the determinants of SME growth, focussing on the sources that can fund that growth. We identify a non-linear relationship between profitability and growth. Initially, there is a negative relationship but beyond a certain level of profitability; this variable positively affects growth. Productivity positively affects SME growth, probably due to a high level of internally generated financial resources, which can be used to fund growth needs. When internal funds are exhausted, SMEs rely on external debt to fund their growth. The financing behaviour of SMEs in satisfying their growth needs seems to follow the predictions of the POT.

The results do not agree with Gibrat's Law, given that larger SMEs grow less than their smaller counterparts. Moreover, age has a non-linear relationship with growth, initially impacting positively, but beyond a certain age, that relationship becomes negative. Therefore, we may conclude that larger and older SMEs reduce their growth rates, probably because they have achieved the minimum efficiency scale. Moreover, this study allows us to conclude that firm growth is persistent and that, SMEs that grew in the past show less growth in the current period.