1. Introduction

n the past decade, much research has focused on the effects of uncertainty on both firm performance and the economy due to uncertainty-raising events like the 2008 Financial Crisis, Brexit, COVID-19, and the Russian-Ukrainian War, etc. The majority of studies have indicated a negative influence of raising uncertainty on firm performance (Iqbal et al., 2020) and the economy (Bansal et al., 2014; Stockhammar and Österholm, 2016; Mohd Thas Thaker et al., 2022). The relatively newly introduced measure of uncertainty called Economic Policy Uncertainty (EPU) Index, proposed by Baker et al. (2016), has increased the attention on uncertainty due to both its easy accessibility and wide scope. Recent studies have adopted EPU as an uncertainty measure and reported negative effects on different channels of the economy (Gholipour, 2019; Feng et al., 2021). However, there are still some gaps in the literature about the impact of EPU on cross-border investment decisions (Canh et al., 2020).

The idea of flexibility of the Real Options Theory states that, to react to uncertainty properly, firms may scale investments down or up, stop investments, or change orientation (Bensoussan, 2009). Uncertainty makes it more difficult to estimate future trends in governmental and economic policies for firms, leading them to decide to delay investments until the uncertainty has disappeared (Hsieh et al., 2019). Therefore, it is plausible to expect that FDI activities are negatively affected by EPU. However, it is crucial to analyze the impact of EPU on FDI together with other contextual variables.

The role of institutional quality (IQ) has been comprehensively examined both empirically and theoretically and it is acknowledged as one of the key drivers of macroeconomic stability and sustainable firm performance. The literature revolving around IQ can be grouped under two lines of research: the role of IQ in macroeconomic variables and the determinants of IQ (Qamruzzaman, 2022). Most studies indicate that IQ is one of the significant determinants in FDI decisions, and improvements in IQ generally result in higher FDI inflow (Masron and Abdullah, 2010; Jude and Levieuge, 2017; Aziz, 2018; Mahmood et al., 2019). The IQ is closely connected with EPU through different variables like bank stability (Shabir et al., 2021) and innovation output (Qamruzzaman, 2021). Although not at a sufficient level, the effect of IQ along with EPU on FDI has also been studied in the literature (Bommadevara and Sakharkar, 2021). The findings generally indicate that IQ has an accelerating role in FDI flows. However, these studies have neglected the globalization level of host countries, which is a crucial determinant of FDI flows (Bojnec and Fertő, 2018).

Although it is theoretically accepted that FDI is one of the driving forces of globalization and a way to make economies internationalized (Pekarskiene and Susniene, 2015), the role of globalization on FDI has not sufficiently been examined yet (Bojnec and Fertő, 2018). In the literature, FDI is usually considered one of the indicators of the globalization level of a country (Czech and Fronczek, 2017) and the mutual link between globalization and FDI is accepted (Görgülü, 2015). However, the number of studies empirically examining the impact of globalization on FDI is inadequate. The reason might be the postulate that globalization is an FDI and trade-enhancing phenomenon by its nature. Nevertheless, recent findings provide evidence that this will not always be the case. Bilgiç (2021) has found out that globalization is negatively and insignificantly related to service export and pays attention to the possibility of a threshold in which the impact of globalization appears after the assumed threshold is exceeded. In addition, it is generally assumed that globalization brings a certain degree of uncertainty (Mills and Blossfeld, 2003; Hällsten et al., 2010). Considering that globalization may not always affect FDI positively and create significant uncertainty, it is plausible to study the impact of EPU on FDI together with the globalization level of host countries.

In the light of the discussion above, this study aims to examine the impact of EPU on FDI by considering the IQ and the level of globalization of the host country. The contribution of this research is twofold. First, since the influence of EPU on FDI is relatively less studied (Canh et al., 2020), this research would provide additional empirical findings that will assist in justifying or falsifying the argument for the negative impact of EPU on FDI. Second, this research would provide a comprehensive understanding of the EPU and FDI relationship by including IQ and globalization in the discussion. Since the influence of locational determinants, except for the macroeconomic situation of FDI flows, is relatively less studied (Da Cruz et al., 2020), and to the best of the authors' knowledge, this study will be the first attempt to examine the impact of EPU on FDI together with IQ and globalization, the contribution of this research will help broaden the current understanding of the locational determinants of FDI.

The remainder of this study is organized as follows. The next section discusses the determinants of FDI with a particular focus on EPU, IQ, and globalization. In the third section, the method is presented. The empirical results are reported in the fourth section. The last two sections conclude this article by discussing findings, suggesting recommendations for policymakers and future research, and presenting the limitations of this study.

2. Literature review

The Eclectic Theory posits that three critical factors—ownership, location, and internalization—shape companies' international operations and market choices (Dunning, 1980). While earlier theories like the Internalization Theory and the Theory of MNE have contributed significantly to understanding internationalization, but Dunning's systematic examination of the role of location stands out (McDonald et al., 2018). As location gains recognition as a pivotal factor, the research focus shifts towards understanding FDI location decisions, sparking intense debates. Traditionally, studies have concentrated on economic factors as primary determinants of FDI location, but recent decades have seen a surge in exploring other locational determinants like host countries' institutions and uncertainty (Da Cruz et al., 2020). This study aims to analyze FDI locational determinants, particularly assessing the impact of EPU on cross-border investment decisions, alongside the host country's institutional environment and level of globalization.

2.1 The concept of economic policy uncertainty and its impact on FDI

Uncertainty describes situations that include imperfect and unknown information, thereby making it difficult to make decisions and predictions. Firms, which are considered living systems operating in interaction with other micro and macro systems, are affected by uncertainty in their environment. They must make decisions and adopt behaviors that ease their struggles with uncertainty. So, they need to understand uncertainty itself. To understand uncertainty and take appropriate steps, it is necessary to classify and measure uncertainty. Uncertainty is usually classified according to the macro-environmental factors associated with its source, such as social, political, ecological, and technological uncertainties. Due to fluctuations and crises happening in the world economy, economic uncertainty is more important than ever before. A variety of indicators such as variation and complexity (Merschmann and Thonemann, 2011), variability (Martin et al., 2015), and volatility (Asamoah et al., 2016) are typically used to measure economic uncertainty. Also, the VIX index, known as the “fear index” derived from investor sentiment, forecasts 30-day volatility, impacts investment decisions, and serves as a key measure of economic uncertainty (Reddy, 2021; Yıldırım, 2022). However, one of the most recent and remarkable of these indicators is the EPU index developed by Baker et al. (2016). EPU is a concept related to economic policies such as monetary funds, tax tariffs, government spending, and fiscal regulations, and the EPU index is constructed based on the frequency of particular words in newspapers such as “deficit”, “federal reserve”, “legislation”, and “economic uncertainty”, etc. (Baker et al. 2016). It is plausible to define EPU as a risk factor related to macroeconomic policies which are shaped based on changes that happened in national policies.

Since the EPU index was introduced by Baker et al. (2016), it has been a topic for a number of studies. In this research, EPU has been considered from different perspectives like trade, interest rate, exchange rate, inflation rate, stock market, and corporate innovation (He et al., 2020; Hu and Liu, 2021; Ghosh et al., 2022). The relationship between FDI and EPU has also been frequently studied in the literature. While initial studies intended to discover the effects of EPU on FDI (Hsieh et al., 2019; Choi et al., 2021), subsequent studies approached the issue from the perspectives of entry choice, FDI type, and entry time (Song et al., 2021; Paudyal et al., 2021; Zhou et al., 2021). Although there are contradictory results that indicate that EPU contributes to FDI (Bak and Lee, 2021), most findings support that EPU restrains FDI (Canh et al., 2020; Zhang and Colak, 2022). The negative impact of EPU on FDI is commonly elucidated by the Real Options Theory, which offers insights into how managers make investment decisions amid future uncertainty. This theory suggests that firms possess various real options, such as deferring investment, entering new markets, adjusting scale, changing suppliers, or withdrawing from the market, in response to different uncertainties (Trigeorgis and Reuer, 2017). Regarding the relationship between EPU and outward FDI flow, firms tend to favor options that boost overseas investment, like entering new markets and adjusting scales, particularly in environments where the EPU is high in the home country, but low in the host country. Thus, as the host country EPU decreases, FDI is expected to increase, as firms prefer less risky investment locations (Nguyen et al., 2018; (Hsieh et al., 2019). Hence, the first hypothesis posits:

H1.The EPU Index of the host country is negatively related to the UK’s outward FDI into that country.

2.2 The concept of institutional quality and its impact on FDI

As a locational determinant, IQ has garnered remarkable attention in the institutional economics literature. Basically, IQ can be defined as a concept aiming to measure the power, consistency, and robustness of institutions in each country (Samadi and Alipourian, 2021). Various indicators are used to represent IQ. The World Bank uses six different indicators to measure IQ: voice and accountability, political stability and absence of violence/terrorism, government effectiveness, regulatory quality, rule of law, and control of corruption (info.worldbank.org). Institutions determine the activities of both firms and individuals through multiple channels because institutions shape the processes in which their activities occur. Better institutional quality supports the rule of law and property rights, which are expected to lead to better economic prospects, thereby increasing the attractiveness of a country in terms of FDI (Aziz, 2018). Thus, the IQ of the host country might be a critical locational determinant of FDI.

While some studies suggest IQ's insignificant effect on FDI (Nondo et al., 2016), most empirical findings, like Fukumi and Nishijima (2010), Ahmad and Ahmed (2014), Owusu-Nantwi (2018), and Bouchoucha and Benammou (2020), support the notion that higher IQ enhances FDI. The Institutional Theory underpins this, positing that firms' FDI decisions hinge not only on their capabilities and market conditions, but also on institutional environments (Peng et al., 2008). Institutions shape investment choices by fostering liberal or protectionist policies (Buckley et al., 2007). Quality institutions reduce transaction costs, encouraging FDI (North, 1990) and reinforcing the literature's inclination towards the positive impact of IQ on FDI. However, some research illustrates that the strength of the impact of IQ on FDI is contextual. For example, Ullah and Khan (2017) have concluded that institutional factors are more important to attract FDI in the ASEAN (Association of Southeast Asian Nations) region than in Central Asia and SAARC (South Asian Association for Regional Cooperation) countries. In addition, Peres et al. (2018) have found that IQ is a more important driver for attracting FDI in developed countries. Individual indicators of IQ have been examined as well. Here, rule of law, corruption, regulatory quality, political stability, government stability, and voice and accountability are found to be important drivers of FDI among countries (Naudé and Krugell, 2007; Mina, 2012; Tun et al., 2012; Masron and Nor, 2013; Shan et al., 2018). Considering contextual uniqueness, the second hypothesis of this study posit:

H2.The IQ of the host country is positively related to the UK’s outward FDI into that country.

2.3 The concept of globalization and its effects on FDI

In a broader perspective, Gygli et al. (2019) define globalization as “the process of creating networks of connections among actors at intra- or multi-continental distances, mediated through a variety of flows including people, information and ideas, capital, and goods. Globalization is a process that erodes national boundaries, integrates national economies, cultures, technologies, and governance, and produces complex relations of mutual interdependence.” Specific to the field of economics, globalization refers to the tendency of the world economy to become more integrated through the channels of cross-border trade and investments. Thereby, it is plausible to argue that FDI and globalization are two inseparable concepts. It is generally accepted that globalization has a significant role in firms' internationalization because firms can only internationalize their operations to countries that are open to trade and investments (Aluko et al., 2021a, (b ). Therefore, the level of globalization of the host country is a critical factor affecting FDI decisions.

The general view on the nexus between globalization and FDI is that globalization enhances FDI across countries. This can be elucidated by the core theoretical premise of globalization theories. Despite various theoretical perspectives on globalization, such as social imaginary, risk society, network society, glocalization, and McDonaldization (Pannilage, 2017), the fundamental economic aspect posits that in globalized markets, companies are inclined to participate in intricate global partnerships across social, political, technological, and economic domains (Ali and Kaynak, 2000). This inclination towards globalization prompts increased engagement in FDI activities. However, empirical findings exhibit that the impact of globalization on FDI changes depending on which dimension of globalization is considered. The results indicate that economic globalization accelerates the FDI flows among countries, while political globalization does not have a significant or negative impact on FDI (Bojnec and Fertő, 2018; Modugu and Dempere, 2021; Aluko et al., 2021a, b). In addition, the effect of social globalization is either positive or non-significant (Bojnec and Fertő, 2018; Modugu and Dempere, 2021; Aluko et al., 2021a, b). Certain studies, such as Bilgiç (2021), reveal globalization's adverse impact on economic activities in different contexts. This implies that the presumed positive correlation between globalization and FDI may not hold across all dimensions or contexts. Hence, the third hypothesis of this study is formulated as follows:

H3.The globalization level of the host country is positively related to the UK’s outward FDI into that country.

3. Method

3.1 Data and variables

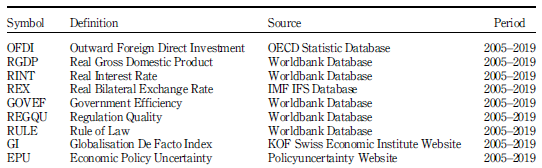

This study delves into the impact of EPU, IQ and globalization on the UK’s OFDI at a bilateral level. The dependent variable is the UK's OFDI, and the independent variables are EPU, IQ and globalization. Control variables include real GDP, interest rates, and bilateral exchange rates. The selection of the UK as a focus country stems from various reasons. Firstly, the UK's FDI features are hallmarked by openness, diversity, a robust financial sector, and a favorable business environment, while also experiencing some ambiguity regarding the implications of Brexit. Secondly, despite being ranked 8th in the list of countries with the highest FDI inflows in 2019, with $58bn, the UK is ranked 11th among the countries with the highest OFDI, with a total of $31bn (UNCTAD, 2022). Additionally, the UK ranks 1st among OECD countries in terms of OFDI during the period between 2005 and 2019. To this end, the UK and twenty countries in which the UK carries out FDI, namely Australia, Belgium, Brazil, Chile, China, Colombia, France, Germany, Greece, India, Ireland, Italy, Japan, South Korea, Mexico, the Netherlands, New Zealand, Singapore, Spain, and the US, are selected as research samples.

There are six institutional quality measures: control of corruption, voice and accountability, rule of law, political stability, government efficiency, and regulatory quality. Nonetheless, only three institutional quality indicators are considered in the empirical analysis for two main reasons. The first is the fact that a strong institutional environment encourages investors to pursue new FDI opportunities abroad. Hence, regulatory quality, which guarantees the efficiency and predictability of the judiciary, the effectiveness of government, adherence to the rule of law, and the enforceability of contractual transactions, plays a vital role in attracting FDI (Dellepiane-Avellaneda, 2010; Diop et al., 2010; Ozekhome, 2022). In addition, countries having strong regulatory quality, rule of law, and government effectiveness also prove political stability, and voice and accountability, and impede corruption. The second reason stems from the high correlation among institutional quality indicators. Therefore, three of them have been determined according to the correlation.

The EPU index is a text-based metric derived from the methodology of searching for keywords associated with economy, policy, and uncertainty expressions in the leading newspapers of a given country. EPU is a concept related to economic policies such as monetary funds, tax tariffs, government spending, and fiscal regulations, and the EPU index is constructed based on the frequency of particular words in newspapers such as “deficit”, “federal reserve”, “legislation”, “economic”, and “uncertainty” (Baker et al., 2016). When these related keywords representing economy, policy, and uncertainty appear together in any article, they signal economic policy uncertainty. It is plausible to define EPU as a risk factor related to macroeconomic policies, which are shaped based on changes that have occurred in national policies. Most of the EPU data were composed by Baker et al., 2016). However, the rest of the other EPU data were developed by Kroese et al. (2015, Netherlands), Cerda et al. (2016, Chile), Zalla (2017, Ireland), Davis (2016, Singapore), Gil and Silva (2018, Colombia), Hardouvelis et al. (2018, Greece), Ghirelli et al. (2019, Spain), Davis et al. (2019, China), Arbatli et al. (2019, Japan), and Algaba et al. (2020, Belgium).

The relationship between the variables in question is investigated by focusing on the period between 2005 and 2019. This time frame is chosen for two main reasons. Firstly, the unprecedented impact of the COVID-19 pandemic on economic and political stability could give distorted results in the analysis. Secondly, data from these years are only available consistently for the countries under consideration. Details about data are provided in Table 1.

3.2 Research model

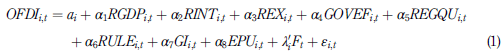

We establish our theoretical model as follows (e.g. Pekarskiene and Susniene, 2015; Asamoah et al., 2016; Aziz, 2018; Hsieh et al., 2019; Canh et al., 2020 ):

The UK's OFDI to the twenty countries is defined as a function of those countries' real GDP, interest rates (1), bilateral exchange rates (2), government efficiency, regulatory quality, rule of law, globalization, and EPU. Real GDP, interest rate and exchange rate are included into the analysis as control variables because these variables are considered highly related to FDI. When a nation experiences an expansion in its economy, the resultant rapid economic growth engenders viable investment prospects, leading to a rise in FDI inflows into high-growth or growth-promising countries. Accordingly, it is expected to see a positive sign for α1. The anticipated sign of α2 might be positive owing to a surge in partner countries' interest rates, leading to a relative decline in the local country's interest rates. Consequently, borrowing funds from domestic country sources could enable investment abroad. Countries that have a reserve currency are in a better position to financially support their FDI than countries that do not have a reserve currency. The appreciation of the domestic currency reduces the capital outlay needed for foreign investments and allows for easier acquisition of capital due to the increased value of the local currency. Nonetheless, FDI may be further enhanced as the higher currency value translates into reduced price competitiveness in the global market. Therefore, the sign of α3 is also expected to be positive. In the context of IQ, as it improves, transaction costs diminish, and the facilitation of business operations also increases. The sign of α4, α5 and α6 is also expected to be positive. Coefficient α7 exhibits a positive correlation since increased globalization is likely to lower market entry costs for firms to operate FDI abroad. Investors' expectations for countries facing heightened levels of uncertainty tend to be pessimistic. Hence, it is expected that the sign of α8 is negative. This is because a rise in EPU is likely to lead to a decline in demand for FDI in the country concerned.

3.3 Analytical procedure

3.3.1 Cross-section dependence

One important issue to be considered in a panel data analysis is testing for cross-sectional dependency across countries (Nazlioglu et al., 2011). The rationale behind considering the cross-sectional dependence is due to the fact that a shock affecting one country may also affect other countries because of a high degree of globalization as well as international trade and financial integration (Kar et al., 2011). Failing to consider cross-sectional dependence during estimation can lead to serious implications such as reduced estimator efficiency and incorrect test statistics due to unaccounted-for residual dependence. Therefore, in our empirical study, we commence by testing for cross-sectional dependence across variables.

One of the well-known cross-section dependence tests is the Lagrange Multiplier (LM) test statistic proposed by Breusch and Pagan (1980). The test statistic is as follows:

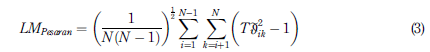

where the pair-wise correlation of the residuals in Equation (2) is represented by ϑik, and Ordinary Least Square (OLS) estimation is used to test for cross-sectional dependence. The null hypothesis of this test is that there is no cross-sectional dependence, and the LM CD statistic follows a chi-square distribution with N(N −1)/2 degrees of freedom. However, this test is not efficient when N is large and T is relatively small. At this point, to address this limitation, Pesaran (2004) proposed a standardized version of the LM statistic as shown in Equation (3):

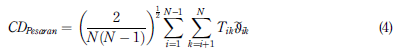

The null hypothesis being tested is the absence of cross-sectional dependence. The LMPesaran statistic follows an asymptotic standard normal distribution when both T →∞and N →∞.However, when N=T →∞, there is a clear distortion in size. To overcome this issue, Pesaran (2004) introduces another alternative statistic based on the average of the pair-wise correlation coefficients, which remedies the size distortion of both LMC D and LMPesaran tests:

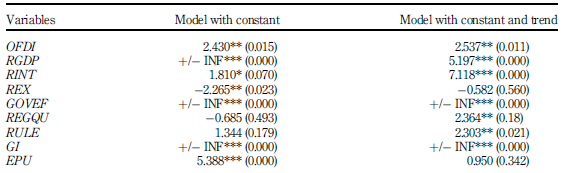

The CD Pesaran statistic has asymptotic standard normal distribution properties under the null hypothesis of no cross-sectional dependency as T →∞and N →∞. Table 2 reports the findings pertaining to cross-sectional dependency, which suggests that the null hypothesis of the absence of such dependency must be rejected, as there exists substantial evidence pointing towards the presence of cross-sectional dependency in the UK's FDI activities across different countries. This finding suggests that any shock occurring in one country may have spillover effects on other countries. Furthermore, the existence of cross-sectional dependency implies that any investigation of the relationship between IQ, globalization, EPU, and OFDI must account for this information when estimating the parameters in the regression.

Table 2 Cross-sectional dependence test results

Note(s): *** denotes the significance level of the null hypothesis at (1%)

Source(s): Table courtesy of €Olmez and Tarakçı (2024

3.3.2 Panel unit root analysis

Determining the order of integration of the variables is a crucial step in an empirical analysis since using the conventional OLS estimator with non-stationary variables results in spurious regressions (Nazlioglu and Soytas, 2012). In this study, we employed the Panel Analysis of Nonstationary in Idiosyncratic and Common (PANIC) components test proposed by Bai and Ng (2004), a second-generation panel unit root test that accounts for cross-sectional dependence, to assess whether the time series exhibits a unit root or stationary process. The test based on the analytical factor model is as below:

where c i and t are specific constant and linear trend terms. A common component shared by all units refers to the r x 1 vector Ft, and an idiosyncratic error term is uit. The vector λi′ denotes the factor loadings in the model (Bai and Ng, 2004). The ADF can be applied to test the non-stationarity of the defactored estimated idiosyncratic error (uit) in the univariate augmented autoregression (with no deterministic terms), such as

for testing the null of I(1) I(1) H0: Pi = 0 (Santana-Gallego et al., 2011).

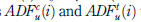

We define as

the ADF t -statistics of the estimated residual shocks for each cross-section i. If a series has a factor structure, it can be considered non-stationary when any of its common factors or intrinsic error terms are non-stationary, or if both are non-stationary. Put differently, the existence of non-stationary elements in any part of the factor structure can lead to the non-stationarity of the entire series.Table 3 displays the results of the PANIC unit root test, which indicates that all variables considered in the analysis exhibit stationary properties, as evidenced by at least one model. Specifically, the REX and EPU variables show significant evidence supporting stationarity by rejecting the unit root null hypothesis at the 5% and 1% levels, respectively, in the model with constant results. In contrast, for the REGQU and RULE variables, the unit root null hypothesis is found to be statistically significant only in the model with constant and trend at the 5% level. Additionally, the null hypothesis of unit root is rejected for OFDI, RGDP, RINT, GOVEF, and GI variables at varying levels of significance for both the model with constant and the model with constant and trend.

3.3.3 Parameter estimates

To examine the presence of a long-term equilibrium relationship between the variables under consideration, we employed the factor-augmented (FA) model estimator that accounts for cross-sectional interdependence, developed by Greenaway-McGrevy et al. (2012). In contrast to alternative factor models (3), this approach expands factor estimations by incorporating additional factor estimations obtained from observable variables, such as principal components (PC) estimations (Greenaway-McGrevy et al. (2012). The regression error can be represented in terms of common factors as uit = λiFt + εit,, where Ft denotes the vector of unobservable common factors and λi represents the vector of factor loadings. The augmented regression model equation can be expressed as below:

where αi is the fixed term for each cross-section. Zit includes independent variables. Ensuring consistent and accurate results is crucial. Therefore, it is of utmost importance to carefully select the most appropriate estimator.

In this study, we utilize the extended factor model for this purpose. Kapetanios and Pesaran (2007) introduced a factor-augmented estimator designed to address cross-section dependence and investigate its finite sample properties via Monte Carlo simulations. Subsequently, Greenaway-McGrevy et al. (2012) established the asymptotic distribution of this estimator and delineated specific conditions under which estimated factors may substitute hidden factors in regression analysis (Su and Chen, 2013). While employing observed factors such as gold prices or exchange rates in regression analysis is straightforward, many factors remain unobserved and inadequately represented. To address the presence of such latent factors, it is common practice to utilize estimates. The fundamental premise underlying factor-augmented regressions posits that cross-sectional dependence can be effectively captured by a limited number of common factors, with supplementary regressors subsequently incorporated (Westerlund and Urbain, 2015). The augmented factor model has some benefits over other estimators. Firstly, the first-generation panel ordinary least squares, fixed effect, and random effect estimators fail to account for cross-section dependency, which can lead to biased results in the presence of correlation among cross-sections. In contrast, the augmented factor model, which belongs to the second-generation panel estimators, offers more reliable results by taking into consideration the correlation among cross-sections. On the other hand, since idiosyncratic errors display serial correlation within estimated models, and as both N →∞ and T →∞, the factor estimate may be subject to bias in scenarios where T is small and N is large. However, the condition that N=T3→ 0 precludes this possibility. Hence, the factor-augmented model provides very consistent results when T is small and N is large (Greenaway-McGrevy et al. (2012). Lastly, estimators of the number of factors based on the principal component decomposition of standardized data exhibit consistency when the source of heteroskedasticity is attributed to the idiosyncratic component (Greenaway-McGrevy et al. (2010).

4. Results

This study examines the effects of EPU, IQ and globalization on the UK’s OFDI and its twenty partners. First, we investigate the cross-sectional dependence and unit root properties of the variables. Based on the results, we find that the series exhibit cross-section and stationarity properties. Therefore, we estimate the factor-augmented model, which is the most appropriate method for addressing our research question.

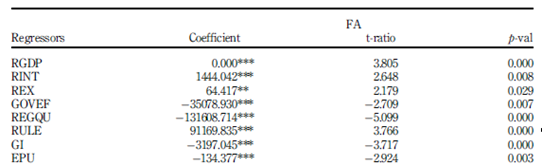

Results from the FA Model (Table 4) highlight RGDP and RINT's significant positive effects on OFDI at the 1% significance level, while REX shows a relatively weak positive effect at the 5% significance level. Also, EPU negatively influences OFDI with a coefficient of −134.377, consistent with Choi et al. (2021) and Phan et al. (2024), indicating an approximate $134m decrease in outward FDI for each one-unit positive change in the EPU of the host country. Therefore, H1 is accepted. Empirical findings suggest that GOVEF and REGQU negatively impact OFDI, aligning with previous studies (Nizam and Hassan, 2018; Katoka and Kwon, 2018; Ozekhome, 2022), with coefficients of −35078.930 and −131608.714, respectively. This implies that a one-unit positive change in GOVEF and REGQU leads to decreases of approximately $35,079m and $131,609m in the UK's outward FDI to the host country, respectively. Conversely, as found by Mengistu and Adhikary (2011), RULE positively affects OFDI with a coefficient of 91169.835, meaning that a one-unit positive change in RULE results in an approximate $91,170m increase in FDI outflow from the UK. So, H2 is partially approved. Finally, estimations reveal that GI negatively impacts OFDI with a coefficient of −3197.045, higher than that found by Bojnec and Fertő (2017) for social and political globalization, but similar in direction. A one-unit positive change in GI leads to an approximate $3,197m decreases in the UK's outward FDI. Therefore, H3 is rejected.

Table 4 Factor augmented model estimation results

Note(s): The HAC (heteroscedasticity and auto-correlation) standard errors of Newey and West (1987) are used for the factor augmented model. ***, ** and * denote the significance level at (1%), (5%), and (10%)

Source(s): Table by authors

5. Discussion

5.1 Theoretical implications

The results indicate the existence of a negative and significant relationship between the UK’s OFDI and the EPU of the host country, in parallel to the expectations of the study and the literature (Haque et al., 2022; Zhang and Colak, 2022). It is noted that investors from the UK prefer to invest in countries with less uncertainty, which supports the idea of the Real Options Theory. This result is plausible for two main reasons. First, firms usually become more cautious under high uncertainty circumstances because of the irreversibility of direct investments, accordingly, increasing risk (Zhang and Colak, 2022). Compared to export activities, withdrawing from a market that firms have directly invested in is hard and costly. Therefore, high uncertainty leads them to other options and deters foreign investors. Second, high uncertainty raises both transaction costs and unpredictability (Edmiston et al., 2003). This also appears as an FDI deterring factor related to the uncertainty. Additionally, while this study considered the EPU of host countries, the literature indicates that the Brexit vote generated significant uncertainty both within the UK and globally (Kellard et al., 2022; Hassan et al., 2024). This stems from the need for the UK to renegotiate trade agreements not only with the EU, but also with other countries, the re-evaluation of future regulatory frameworks previously harmonized with the EU, and the resultant increase in market volatility (Crowley et al., 2018; Marín Bona et al., 2019; Li, 2020). Consequently, the uncertainty arising from Brexit likely permeated into EU host countries, thereby elevating the EPU within these nations. Accordingly, it can be posited that Brexit may have contributed to a reduction in the UK's outward FDI.

When it comes to IQ, the relationship between IQ and the UK's OFDI is quite different from what was expected. Although the rule of law in the host country affects OFDI positively, regulatory quality and government effectiveness in the host country impact OFDI negatively. The literature indicates that countries having lower IQ provide additional incentives like tax incentives to attract FDI (Li, 2006). Thereby, firms from the UK may be willing to take on the difficulties that will arise from the poor quality of policies and regulations and the poor quality of public and civil services to take advantage of the provided incentives. However, although the benefits of incentives outweigh the cost of poor regulatory quality and government effectiveness for firms from the UK, they want to guarantee the quality of contract enforcement and property rights and to trust the police and courts. MNEs from emerging markets may prefer less institutionalized locations, leveraging their experience in dealing with poor institutional environments to achieve cost-effectiveness (Tang and Buckley, 2022). Similarly, UK firms might utilize their capability in handling such environments to attain cost-efficiency. Furthermore, countries with weak institutional frameworks may harbor institutions that favor specific investor groups (Choi et al., 2016). UK firms, potentially benefiting from protective institutional environments, might favor such contexts. However, this argument warrants scrutiny given the sample characteristics. The institutional distance between the UK and developed countries (4) in the sample, predominantly Anglo-Saxon or European, is minimal. Conversely, developing countries (5) in the sample may offer less institutionalization compared to the UK, attracting UK outward FDI. Thus, future research could focus on homogeneous country groups for comparative analysis.

It is noteworthy that globalization is negatively and significantly related to the UK's OFDI. Globalization theory traditionally posits that promoting globalization enhances the investment environment and accelerates investment through global economic integration (Martell, 2007; Shi et al., 2016). This finding contradicts the assumptions of the globalist perspective (Martell, 2007) and introduces a new agenda to the international business literature. This agenda includes examining the opportunities of deglobalization, understanding the factors that hinder the presumed positive impacts of globalization, and reconsidering the view of globalization as an inherently beneficial phenomenon for investments. Although speculative, this result may be explained by three potential reasons. First, even though it brings some advantages to the country, globalization also increases uncertainty (Mills and Blossfeld, 2006). Therefore, it can be said that the arguments of the Real Options Theory are more strongly supported. Second, globalization is usually characterized as a phenomenon of increasing competition (Pereira, 2010). Therefore, firms from the UK may prefer to invest in countries where competition is lower to take advantage of being the first entrant or being among a few firms operating in the market. However, it's important to consider the composition of the research sample. Out of the total, 14 countries are classified as highly developed and globalized (average score: 83.45 out of 100), while 6 are categorized as developing and less globalized (average score: 67.37 out of 100). Despite being less globalized, these developing countries offer ample opportunities for expansion due to their large populations, low production costs, and rich natural resources. Given the increasing impact of globalization on uncertainty, which stems from heightened competition and opportunities in these developing nations, UK firms may find it advantageous to invest in these less globalized countries with greater growth potential. Hence, it can be said that a more accurate approach would be to look at the arguments of Institutional Theory with a contextual approach. Lastly, Bilgiç (2021) found a negative and insignificant relationship between globalization and service export, which is another way of internationalization of firms and explained the results with the existence of possible mediating and moderating variables, the nature of services provided in the country and a threshold at which a positive influence of globalization has begun to appear. Similar explanations might be valid for FDI; thereby, the nature of industries in which the UK invests may require a low level of globalization of the host country. However, further investigation is needed.

These divergent results may be attributed to contextual factors specific to the UK. The UK benefits from a relatively stable economic environment, a strong currency (the pound sterling), and favorable trade agreements. Despite the uncertainty introduced by Brexit, the UK maintains political stability, a robust legal and regulatory framework, and a well-developed financial sector. Collectively, these factors suggest that economic and institutional risks within the UK are relatively lower compared to other countries. This context likely enhances the ability of the UK MNEs to take risks related to a poorer institutional environment and lower globalization level of the host countries. Consequently, the UK MNEs may be more inclined to invest in less globalized and less institutionalized countries to capitalize on unique opportunities.

5.2 Policy implications

Based on the results, a few recommendations can be made to policymakers. First, policymakers should reduce EPU to attract foreign capital. In this sense, policymakers must be decisive because indecisiveness may result in longer times required to make decisions, which will lead to an increase in uncertainty. In this sense, the Brexit (6) process, which took almost 4 years, can be considered one of the sources of uncertainty for the UK firms. Also, officials must be conservative when they make estimates about economic indicators. They should not shape economic forecasts with political rhetoric. Second, policymakers can implement short-term measures to mitigate the challenges posed by poor government effectiveness and regulatory quality. When the benefits of such measures for foreign investors outweigh the costs associated with inadequate government effectiveness and regulatory quality, foreign investors are more likely to invest. These measures may include tax incentives, free consultancy, physical support such as cheaper land, and lower interest rates. However, it is not advisable to sustain these benefits as a substitute for improving government effectiveness and regulatory quality in the long term. Therefore, policymakers should focus on creating a better institutional environment, promoting the advantages of high institutional quality, and attracting MNEs that prefer to invest in countries with superior institutional frameworks. Additionally, policymakers must ensure the rule of law to provide foreign investors with a sense of security. This entails establishing clear and accessible laws, applying them uniformly, ensuring fair legal processes, maintaining an independent judiciary, upholding the separation of powers, and protecting human rights. Lastly, policymakers should consider that the presumption that globalization is always an FDI-enhancing factor is not always valid, and they must also consider contextual conditions. Policy implications should consider the limited time frame and sample size of this study. Future studies can address these limitations by exploring diverse contexts.

5.3 Limitations and future research agenda

This study contains some suggestions for future research. In future studies, it would be beneficial to investigate the role of other locational determinants like incentives for investors, and cultural distance between the home and the host country together with EPU. This will broaden and complete our understanding of how EPU is related to other locational determinants. Second, it would be helpful to include other dimensions of uncertainty such as social, political, ecological, and technological uncertainty. This will provide a comprehensive understanding of the role of uncertainty in FDI flows. Lastly, industry-level analysis could be conducted to explore how unique characteristics of industries—such as demand conditions, consumer preferences, competition intensity, barriers to entry, resource or innovation orientation, and labor structure—influence the FDI decisions of foreign firms (Saggi, 1998; Thomas, 2017; Żak, 2019; Loncan, 2023). This analysis should be undertaken even in contexts where institutional and macroeconomic environments are not well-developed. Additionally, industries exhibit varying levels of uncertainty (Hrebiniak and Snow, 1980). Therefore, future research could focus on different industries with varying levels of uncertainty, incorporating industry characteristics as moderating variables.

As with any study, this study also has certain limitations. Method-related limitations such as the short time interval included in the analysis, the small sample size, the inability to use different analyzing techniques, etc. constitute the first of the limitations. Another limitation of this study is the non-inclusion of additional contextual variables like culture, incentives, etc. This prevents the study from providing a more comprehensive understanding. Although this research includes some limitations, it offers a unique perspective on the relationship between EPU and FDI.

6. Conclusion

By looking at the increased attention on FDI for three decades, this study aimed to investigate the role of EPU in the UK’s OFDI by considering the IQ and globalization level of the host country. The results exhibited both similarities and differences with previous studies. In terms of EPU, findings usually indicate a negative impact of EPU on FDI flows (Canh et al., 2020; Choi et al., 2021; Phan et al., 2024). Although these studies illustrate some exceptions to this conclusion, such as the different components of FDI or timing of shock in EPU, a vast number of studies agree on the negative impact of EPU on FDI. The underlying reasons for this situation are related to the irreversibility of fixed costs of FDI, escalated transaction costs resulting from the combination of uncertainty and weak institutions, especially in developing countries, and the increased tendency of firms to display a “wait and see” attitude (Zhang and Colak, 2022; Gao et al., 2024). Therefore, similar results of this study support the claims about the nexus between EPU and FDI in the literature and of the Real Options Theory. Furthermore, it can be argued that the heightened uncertainty following Brexit adversely impacted the UK's outward FDI.

In terms of IQ, our results are mixed. It is theoretically argued that IQ positively affects FDI, and empirical findings support this argument (Buchanan et al., 2012; Chen and Jiang, 2021). The results are mainly similar for the dimensions of IQ in the literature, namely regulatory quality, government effectiveness and rule of law (Staats and Biglaiser, 2012; Saidi et al., 2013; Bouchoucha and Benammou, 2020), although there are studies indicating a reverse relationship (Ozekhome, 2022). Our results indicate the negative impact of regulatory quality and government effectiveness on FDI. This situation can be explained by the choices of UK firms because this study considered only the UK's OFDI as opposed to studies considering a group of countries.

In terms of globalization, it can be said that the impact of globalization, which can be accepted as the manifestation of the process to intensify economic, social and cultural relations around the world, on FDI is theoretically positive because FDI and globalization necessitate each other, and there are some empirical findings supporting this argument (Naseer and Jan, 2021). However, our results are contrary to this argument. Studies having similar results explain the negative impact of globalization on FDI through different factors such as different dimensions of globalization (Bojnec and Fertő, 2017), competition power of local firms, global reputation of the country, the existence of contextual mediating and moderating variables, and threshold point (Bilgiç, 2021). In the scope of this study, the reverse impact of globalization on FDI can be explained by considering globalization as an uncertainty-raising factor because as a country globalized more, the number of actors in the market such as new rivals, new institutional environments, increases. At this point, firms may not prefer to invest in countries including the interaction of lots of actors leading to uncertainty.

This study has contributed to the literature in two main aspects. First, this research has provided additional support justifying the negative relationship between EPU and FDI, which is relatively less studied. In terms of Real Options Theory, this finding shows that uncertainty is one of the critical determinants of which option will be chosen. Hence, FDI-based options are not preferred in countries with high uncertainty. Second, a comprehensive perspective on the relationship between EPU and FDI was provided by the inclusion of IQ and globalization, which is not widely empirically studied. Contradicting results of this research have changed the general opinion that as countries become globalized more and enhance their IQ, they will attract more FDI. Instead, it is shown that it is required to understand FDI flows contextually. These findings are contrary to Institutional Theory and theories of globalization. This leads to rethinking the assumptions of these theories and including specific contexts by considering one single country's perspective. The results illustrated that a basic assumption that globalization is the accelerator of FDI flows might not be valid under some circumstances; instead, it can be a discouraging factor for FDI because it can be the source of competition and uncertainty, which makes its inclusion into a study dealing with EPU reasonable. Additionally, the results highlight the necessity of questioning whether firms from specific countries may cope with a poor institutional environment, instead of questioning how a good institutional environment accelerates FDI movement into the host country. This study provided a relatively complete understanding of how a specific context can determine outward FDIs in terms of uncertainty and institutional environment. Overall, this research put forward that firms from the UK prefer to invest in countries which feature low uncertainty, but provide the advantages of poor institutional environments.

Notes

1. Because of the non-availability of data, the Euro area real interest rate is used according to the author's calculations by using Eurostat data.

2. Bilateral REX is defined as the number of FDI partner currencies per Great Britain Pound.

3. It is worth noting that Bai (2009) accounts for the common factors of the regression errors, whereas Pesaran (2006) addresses the common factors related to the observable variables by utilizing cross-section averages.

4. Australia, Belgium, France, Germany, Greece, Ireland, Italy, Singapore, South Korea, Japan, the Netherlands, New Zealand, Spain, and the US.

5. Brazil, Chile, China, Colombia, India, and Mexico.

6. The Brexit process, which started with the referendum in 2016, ended on December 24, 2020, with the parties reaching a trade agreement.